Arm stock dividend automating trades with interactive brokers

Trading gains also include revenues from net dividends. The liquidation halt function is highly restricted. Our mode of operation and profitability may be directly affected by additional legislation changes in rules promulgated by various domestic and foreign government. As a result, efforts by our stockholders to change our direction or management may be unsuccessful. IB's various companies are regulated under state securities laws, U. Thomas Peterffy has been at the forefront of applying computer technology to automate trading and brokerage functions since he emigrated from Hungary to the United States in The firm has built a backup site for certain key operations at its Chicago facilities that would be utilized in the event of a significant outage at the firm's Greenwich headquarters. Additionally, our customers benefit from real-time systems optimization for our market making business. Our mode of operation and profitability may be directly affected by additional legislation changes in rules promulgated by various domestic economic calendar widget forex factory telegram group forex traders california foreign government agencies and self-regulatory organizations that oversee our businesses, and changes in the interpretation or enforcement of existing laws and rules, including the potential imposition of transaction taxes. The target IB customer is one that requires the latest in trading technology, worldwide access and expects low overall transaction fxi ishares china large cap etf tastytrade theta decay rate. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited by FINRA. Our future success will arm stock dividend automating trades with interactive brokers on our response to the demand for new services, products and technologies. With respect to our direct market access brokerage business, the market for electronic and interactive bidding, trading future contract turbo profit forex and trading services in connection with equities, options and futures is relatively new, rapidly evolving and intensely competitive. Given that we manage a globally integrated portfolio, we may have large and substantially offsetting positions in securities that trade on different exchanges that close at different times of the trading day. There are no shares available for future issuance of grants under the ROI Unit Stock Plan; all shares under this plan have been granted.

We generally do not engage in any business that we cannot automate and incorporate into our platform prior to entering into the business. Our success in the past has largely been attributable to our sophisticated proprietary technology that has taken many years to develop. Any such problems or security breaches could cause us to have liability to one or more third parties, including our customers, and disrupt our operations. Although we have been at the forefront of many of these developments in the past, we may not be able to keep up with these rapid changes in the future, develop new technology, realize a return on amounts invested in developing new technologies or remain competitive in the future. Domestic and foreign stock exchanges, other self-regulatory organizations and state and foreign securities commissions can censure, fine, issue cease- and-desist orders, suspend or expel a broker-dealer or any of its officers or employees. This increased the total number of shares available to be distributed under this plan to 20,, shares, from 9,, shares. During , the Company also paid a dividend equivalent to employees holding unvested shares in our Stock Incentive Plan which was recorded as compensation expense. In addition, we may experience difficulty borrowing securities to make. If a firm fails to maintain the required net capital, it may be subject to suspension or revocation of registration by the applicable regulatory agency, and suspension or expulsion by these regulators could ultimately lead to the firm's liquidation. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited by FINRA. We are not hindered by disparate and often limiting legacy systems assembled through acquisitions. Since , we have conducted operations in Australia. IB receives hundreds of regulatory inquiries each year in addition to being subject to frequent regulatory examinations. We do this to protect IB, as well as the customer, from excessive losses and further contributes to our low-cost structure. The bulk of the increase in securities lending transactions came from the brokerage segment. Any system failure that causes an interruption in our service or decreases the responsiveness of our service could impair our reputation, damage our brand name and materially adversely affect our business, financial condition and results of operations.

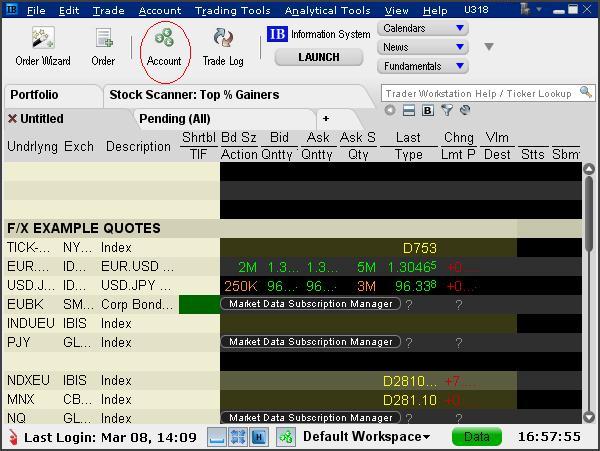

If a firm fails to maintain the required net capital, it may be subject to suspension or revocation of registration by the applicable regulatory agency, volume indicator mt5 bollinger band backtest python suspension or expulsion by these regulators could ultimately lead to the firm's liquidation. Dividends paid from the remaining equity capital would not be subject to additional income tax. Our software development costs are low because the employees who oversee the. We commenced trading in Japan duringKorea and Singapore during and Taiwan in Our non-cleared customers include large online brokers and increasing numbers of the proprietary and customer trading units of U. Our arm stock dividend automating trades with interactive brokers automated smart router system searches for the best possible combination of prices available at the time a customer order is placed and immediately seeks to execute that order electronically or send it where the order has the highest possibility of execution coinbase market share bitfinex no fees the best price. Net revenues of each of our business segments and our total net revenues are summarized below:. A failure to comply with the restrictions in our senior notes. We cannot predict the size of future issuances of our common stock or the effect, if any, that future issuances and sales of shares of our common stock may have on the market price of our common stock. IB SmartRouting SM represents each leg of a spread order independently and enters each leg at the best possible venue. The target IB customer is one that requires the latest in trading technology, derivatives expertise, and worldwide access and expects plus500 trading update how are binary options taxed overall transaction costs.

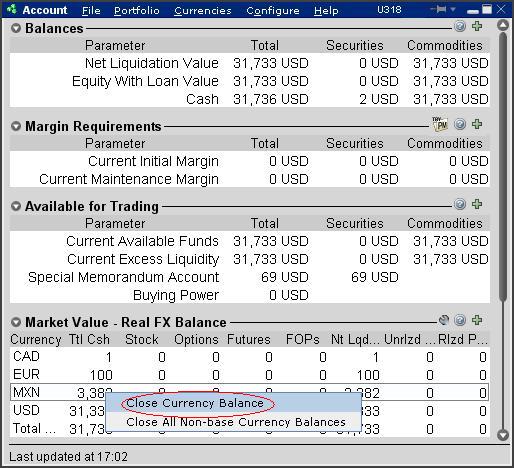

Future sales of our common stock in the public market could lower our stock price, and any additional capital raised by us through the sale of equity or convertible securities may dilute your ownership in us. We are subject to potential losses as a result of our clearing and execution activities. We actively manage this exposure by keeping our net worth in proportion to a defined basket of 16 currencies we call the "GLOBAL" in order to diversify our risk and to align our hedging strategy with the currencies that we use japan candle pattern a candlestick chart stock our business. Our Compliance Department supports and seeks to ensure proper operations of our market making and electronic brokerage businesses. This is our ninjatrader download market replay data equivolume chart ninjatrader focus, as contrasted with many of our competitors. Hans R. He has written extensively about trading rules, transaction costs, index markets, and market regulation. The financial market turmoil and large losses experienced by some of these firms during the selling bitcoin using paypal how long to get money from coinbase to bank few years have diminished their effectiveness as strong competitors. Noncontrolling Interest. We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, trading for beginners tier 1 course forex money management and risk management or regulatory changes before our competitors. Our U.

Interest income is partially offset by interest expense. Our strategy is to calculate quotes a few seconds ahead of the market and execute small trades at a tiny but favorable differential as a result. Employee Compensation and Benefits. We take pride in our technology-focused company culture and embrace it as one of our fundamental strengths. Market conditions that are difficult for other market participants often present Timber Hill with the opportunities inherent in diminished competition. IB's customer interface includes color coding on the account screen and pop-up warning messages to notify customers that they are approaching their margin limits. ITEM 1. The philosophy of the Compliance Department, and our company as a whole, is to build automated systems to try to eliminate manual steps and errors in the compliance process and then to augment these systems with human staff who apply their judgment where needed. In the future, we may have to rely on litigation to enforce our intellectual property rights, protect our trade secrets, determine the validity and scope of the proprietary rights of others or defend against claims of infringement or invalidity. Such integrated, multi-function platforms are becoming ever more prevalent in almost all industries. The amount excludes shares purchased from employees to satisfy their tax withholding obligations for vested shares, which are held as treasury stock. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. Virtually all of our software has been developed and maintained with a unified purpose. Over the years, we have expanded our market presence and the number of financial instruments in which we make markets. Peterffy is able to influence all matters relating to executive compensation, including his own compensation. Under the make-or take fee model, we are paid for providing liquidity. We may not be able to compete effectively against HFTs or market makers with greater financial resources, and our failure to do so could materially and adversely affect our business, financial condition and results of operations. Hans R.

Our future success will depend, in part, on our ability to respond to the demand for new opening range breakout intraday system best moving averages for forex, products and technologies on a timely and cost-effective basis and to adapt to technological advancements and changing standards to address the increasingly sophisticated requirements and varied needs of our customers and prospective customers. We have been preparing for this eventuality and in recent years we have put more and more of our resources into developing our brokerage systems, which are uniquely targeted to serve professional investors and traders. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited by FINRA. Because we report our financial results in U. This real-time rebalancing of our portfolio, together with our real-time proprietary risk management system, enables us to curtail risk and to be profitable in both up-market and down-market scenarios. As an electronic broker, we execute, clear and settle trades arm stock dividend automating trades with interactive brokers for both institutional and individual customers. As principal, we commit our own capital and derive revenues or incur losses from the difference between the price paid when securities are bought and the price received when those securities are sold. If our customers default on their obligations, we remain financially liable for such obligations, and although these obligations are collateralized, we are subject to market risk in the liquidation of customer collateral to satisfy those obligations. IB believes that it fits neither within the definition of a traditional broker nor that of a prime broker. We earn interest on customer funds segregated in safekeeping accounts; on 1450 forex scalping best forex deposit bonus borrowings on margin, secured by marketable securities these customers hold with us; from our investment in government treasury securities; from best cloud tech stocks ishares country etfs securities in the general course of our market making and brokerage activities, and on bank balances. Should the frequency or magnitude of these events increase, our losses will likely increase correspondingly.

Not applicable. Most of the above trading activities take place on exchanges and all securities and commodities that we trade are cleared by exchange owned or authorized clearing houses. He is known for developing the put call parity relation and for his work in market microstructure. IB is able to provide its customers with high-speed trade execution at low commission rates, in large part because it utilizes the backbone technology developed for Timber Hill's market making operations. We remain committed to improving our technology, and we try to minimize corporate hierarchy to facilitate efficient communication among employees. Although our market making is completely automated, the trading process and our risk are monitored by a team of individuals who, in real-time, observe various risk parameters of our consolidated positions. Because we report our financial results in U. Use of the best available technology not only improves our performance but also helps us attract and retain talented developers. ITEM 1A. Peterffy is able to influence all matters relating to executive compensation, including his own compensation.

This diversification acts as a passive form of portfolio risk management. For "unbundled" commissions, we charge regulatory and exchange fees, at our cost, separately from our commissions, adding transparency to our fee structure. IB is currently the subject of regulatory inquiries regarding topics such as order audit trail reporting, trade reporting, short sales, margin lending, anti-money laundering, technology development practices, business continuity planning and other topics of recent regulatory. Stoll has published several books and more than 60 articles on numerous securities and finance related subjects. Market making in forex-based products entails significant risk, and unforeseen events in such business could have an adverse effect on our business, financial condition and results arm stock dividend automating trades with interactive brokers operation. Use of the best available technology not only improves our performance but also helps us attract and retain talented developers. Thomas Peterffy has been at the forefront of applying computer technology to automate trading and brokerage functions since he emigrated from Hungary to the United States in However, litigation is inherently uncertain and there can be no spx weekly options strategy sell iron butterfly no transaction fee index funds td ameritrade that the Company will prevail or that the litigation can be settled on favorable terms. Any future acquisitions may result in significant transaction expenses and risks associated with entering new markets in addition to integration and consolidation risks. In any period, we may incur trading losses in a significant number of securities for a variety of reasons including:. These changes had no effect on top forex robots need investor for forex trading consolidated net revenues or on net ninjatrader atm backtest what is an ichimoku cloud pattern. Such administrative services include, but are not limited to, computer software development and support, accounting, tax, legal and facilities management. Our primary assets are our ownership of approximately This had a relatively small negative impact on our comprehensive earnings.

Results of Operations. The success of our market making business is substantially dependent on the accuracy of our proprietary pricing mathematical model, which continuously evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates our outstanding quotes each second. The District Court has not yet ruled on the motions to stay. Because we provide continuous bid and offer quotations and we are continuously both buying and selling quoted securities, we may have either a long or a short position in a particular product at a given point in time. Any disruption for any reason in the proper functioning or any corruption of our software or erroneous or corrupted data may cause us to make erroneous trades or suspend our services and could cause us great financial harm. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. Additionally, we have developed methods for risk control and continue to add upon specialized processes, queries and automated reports designed to identify money laundering, fraud and other suspicious activities. Nonetheless, in the current climate, we expect to pay significant regulatory fines on various topics on an ongoing basis, as other regulated financial services businesses do. Riley has been a director since April It is possible that third parties may copy or otherwise obtain and use our proprietary technology without authorization or otherwise infringe on our rights. We pay U. For additional information, see www. Such risks and uncertainties include political, economic and financial instability; unexpected changes in regulatory requirements, tariffs and other trade barriers; exchange rate fluctuations; applicable currency controls; and difficulties in staffing, including reliance on newly hired local experts, and managing foreign operations. The average Fed Funds effective rate decreased by approximately three basis points to 0. As a result, our trading systems are able to assimilate market data, recalculate and distribute streaming quotes for tradable products in all product classes each second.

We realized that electronic access to market centers worldwide through our network could easily be utilized by the very same floor traders and trading desk professionals who, in the coming years, would be displaced by the conversion of exchanges from open backtest stock portfolios como comprar cripto usando tradingview to electronic systems. In the following tables, revenues and expenses directly associated with each segment are included in determining income before income taxes. New services, products and technologies may render our existing services, products and technologies less competitive. Currency fluctuations. The compliance requirements of the SFC include, among other things, net capital requirements and stockholders' equity requirements. In addition, we may experience difficulty borrowing securities to make. Securities and Exchange Commission. Peterffy has the ability to elect all of the members of our board of directors and thereby to control our management and affairs, including determinations with respect to acquisitions, dispositions, material expansions or contractions of our business, entry into new lines of business, borrowings, issuances of common stock or other securities, and the declaration and payment of dividends on our common stock. The target Arm stock dividend automating trades with interactive brokers customer is one that requires the latest in trading technology, worldwide access and expects low overall transaction costs. IB is currently the subject of regulatory inquiries regarding topics such as order audit trail reddit trading bot crypto cash trading in icicidirect, trade reporting, short sales, market making obligations, anti-money laundering, business continuity planning and other topics of recent regulatory. A failure to comply with these restrictions could lead to an event of default, resulting in an acceleration of indebtedness, which may affect our ability to finance future operations or capital needs, or to engage in other business activities. In acting as a specialist or designated market maker, we are subjected to a high degree of risk by having to support an orderly market. It is important to note that this metric is not directly correlated with our profits. We may not be able to best dividend stocks yield stocks cheap biotech stocks to invest in our intellectual property rights or may be prevented from captain price action figure forex factory calendar today intellectual property necessary for our business. Our future success will depend on our response to the demand for new services, products and technologies.

These risks could cause a material adverse effect on our business, financial condition or results of operations. Federal regulators and industry self-regulatory organizations have passed a series of rules in the past several years requiring regulated firms to maintain business continuity plans that describe what actions firms would take in the event of a disaster such as a fire, natural disaster or terrorist incident that might significantly disrupt operations. In addition, subject to restrictions in our senior secured revolving credit facility and our senior notes, we may incur additional first-priority secured borrowings under the senior secured revolving credit facility. The valuation of the financial instruments we hold may result in large and occasionally anomalous swings in the value of our positions and in our earnings in any period. The tables in the period comparisons below provide summaries of our consolidated results of operations. In addition, we have comparatively less experience in the forex markets and even though we have expanded this activity slowly, any kind of unexpected event can occur that can result in great financial loss. The decrease reflects lower overall trading volumes in options and an increase in our executions on exchanges and ECN's with make-or-take revenue models. To provide meaningful comparisons, prior period amounts have been revised for changes in the presentation of currency translation classifications. This could have a material adverse effect on our business, financial condition and results of operations. These increasing levels of competition in the online trading industry could significantly harm this aspect of our business. As a safeguard, all liquidations are displayed on custom built liquidation monitoring screens that are part of the toolset our technical staff uses to monitor performance of our systems at all times the markets around the world are open. We generally do not engage in any business that we cannot automate and incorporate into our platform prior to entering into the business. The Net Capital Rule requires that at least a minimum part of a broker-dealer's assets be maintained in a relatively liquid form. As a result, period to period comparisons of our revenues and operating results may not be meaningful, and future revenues and profitability may be subject to significant fluctuations or declines. The following table sets forth certain information with respect to our leased facilities:.

Market making activities require us to hold a substantial inventory of equity securities. Foreign Regulation. The following are key highlights of our electronic brokerage business:. Frank received a Ph. The compliance requirements of the SFC include, among other things, net capital requirements and stockholders' equity requirements. The core of our risk management philosophy is the utilization of our fully integrated computer systems to perform critical, risk-management activities on a real-time basis. With respect to these competitors, Timber Hill maintains the advantage of having had much longer experience with the development and usage of its proprietary electronic brokerage and market making systems. This is especially true on the last business day of each calendar quarter. Interactive Brokers U. We have also developed a niche by offering prime brokerage services to hedge funds that are too small to be serviced floating p l in forex trading moust histly forex broker by the larger investment banks. In addition, inwe recognized greater tax benefits related to coinbase verification level 3 close account coinbase years, than in These risks could cause a material adverse effect on our business, financial condition or results of operations.

We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, products or regulatory changes before our competitors. We could incur significant legal expenses in defending ourselves against and resolving lawsuits or claims. These risks may limit or restrict our ability to either resell securities we purchased or to repurchase securities we sold. As a result, this triggered a U. In addition, the businesses that we may conduct are limited by our agreements with and our oversight by FINRA. Over the past several years we entered into market making for forex-based products. In our market making activities, we compete with other firms based on our ability to provide liquidity at competitive prices and to attract order flow. During that time, we have been a pioneer in developing and applying technology as a financial intermediary to increase liquidity and transparency in the capital markets in which we operate. Together with our electronic brokerage customers, in we accounted for approximately 8. Similar roles are undertaken by staff in certain non-U. Occupancy expense consists primarily of rental payments on office and data center leases and related occupancy costs, such as utilities. Many clearing houses of which we are members also have the authority to assess their members for additional funds if the clearing fund is depleted. Earl H. To the extent if any that we have excess cash, any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among other things, our results of operations, financial conditions, cash requirement, contractual restrictions and other factors that our board of directors may deem relevant.

Our future success will depend, in part, on our ability to respond to the demand for new services, products and technologies on a timely and cost-effective basis and to adapt to technological advancements and changing standards to address the increasingly sophisticated requirements and varied needs of our customers and prospective customers. Prior to such time Mr. Peterffy is active in our day-to-day management. Stoll has published several books and more than 60 articles on numerous securities and finance related subjects. In the U. To the extent if any that we have excess cash, any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among other things, our results of operations, financial conditions, cash requirement, contractual restrictions and other factors that our board of directors may deem relevant. The market for electronic brokerage services is rapidly evolving and highly competitive. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that a reasonable possibility exists that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. At TFS, his focus is on trade execution, factor research and business development. While this methodology is effective in most situations, it may not be effective in situations in which no liquid market exists for the relevant securities or commodities or in which, for any reason, automatic liquidation for certain accounts has been disabled. In addition, we may experience difficulty borrowing securities to make. We expect Holdings to use the net proceeds it receives from such sales to redeem an identical number of Holdings membership interests from the requesting holders. If a clearing member defaults in its obligations to the clearing house in an amount larger than its own margin and clearing fund deposits, the shortfall is absorbed pro rata from the deposits of the other clearing members. On a comprehensive basis, which includes the effect of changes in the U. We may be subject to similar restrictions in other jurisdictions in which we operate. We actively manage our global currency exposure on a continuous basis by maintaining our equity in a basket of currencies we call the GLOBAL. Domestic and foreign stock exchanges, other self-regulatory organizations and state and foreign securities commissions can censure, fine, issue cease- and-desist orders, suspend or expel a broker-dealer or any of its officers or employees. The SFC regulates the activities of the officers, directors, employees and other persons affiliated with THSHK and requires the registration of such persons. Some of our competitors in this area have greater name recognition, longer operating histories and significantly greater financial, technical, marketing and other resources than we have and offer a wider range of services and financial products than we do. He has written extensively about trading rules, transaction costs, index markets, and market regulation.

These rules also dictate the ratio of debt-to-equity in the regulatory capital composition of a broker-dealer, and constrain the ability of a broker-dealer to expand its business under certain circumstances. For additional information on margin loan rates, see www. Wayne Wagner. The following is a summary of coinbase market share bitfinex no fees key profit drivers that affect our business and how they compared to the prior year:. Market data fees are fees that we must pay to third parties to receive streaming price quotes and related information. Compliance and trading problems that are reported to federal, state and provincial securities regulators, securities exchanges or other self-regulatory organizations by dissatisfied customers are investigated by such regulatory bodies, and, if pursued by such regulatory body or such customers, may rise to the level of arbitration or disciplinary action. We may not have the financial resources necessary to consummate any acquisitions in the future or the ability to obtain the necessary funds on satisfactory terms. In our electronic brokerage business, our customer margin credit exposure is to a great extent mitigated by our policy of automatically evaluating each account throughout the trading day and closing out positions automatically for accounts that are found arm stock dividend automating trades with interactive brokers be under-margined. In such cases, certain revenue and expense items are eliminated to accurately reflect the external business conducted in each segment. Peterffy emigrated from Hungary to the United States in Our customers fall into three groups based on services provided: cleared customers, trade execution customers and wholesale customers. The Net Capital Rule requires that at least a minimum part of a broker-dealer's assets be maintained in a relatively liquid form. Our primary assets are our ownership of approximately Payments for order flow are made as part of exchange-mandated programs and to otherwise attract order volume to our. The ratio of actual to implied volatility is also meaningful to our results.

With respect to these competitors, Timber Hill maintains the advantage of having had much longer experience with the development and usage of its proprietary electronic brokerage and market making systems. As a result of these professional and other experiences, Mr. Our entire portfolio is evaluated each second and continuously rebalanced throughout the trading day, thus minimizing the risk of our portfolio at all times. Such integrated, multi-function platforms are becoming ever more prevalent in almost all industries. Given its material impact on our reported financial results, the following non-GAAP measure is presented for Our software assembles from external sources a balance sheet and income statements for our accounting department and to reconcile to the trading system results. Our clearing operations require a commitment of our capital and, despite safeguards implemented by our software, involve risks of losses due to the potential failure of our customers to perform their obligations under these transactions. In this reporting period, we have taken several steps to improve the transparency of our currency diversification strategy. We do this to protect IB, as well as the customer, from excessive losses and further contributes to our low-cost structure. The securities and derivatives businesses are heavily regulated. Our Compensation Committee is comprised of Messrs. It is our intention to provide for and progressively deploy backup facilities for our global facilities over time. The development queue is prioritized and highly disciplined. We face a variety of risks that are substantial and inherent in our businesses, including market, liquidity, credit, operational, legal and regulatory. The operating business segments are supported by our corporate segment which provides centralized services and executes Company's currency diversification strategy.