App trading simulator will etfs replace mutual funds completely one day

Investment Model Strategy Recommendations We will ask you to provide us with information about your investment appropriateness attributes, including your indicated investment goal and risk tolerance as well as certain additional information, such as your age, your financial situation, the amount you intend to contribute initially and on an ongoing basis to fund the account, and other accounts and assets you hold either with Morgan Stanley, or at third party financial institutions. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Not all advisors work this way, but many offer the option. You have money questions. Performance aspirations are not guaranteed and are subject to market conditions. Costs are low. Dividend reinvestment choices can only be made after a trade is settled. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. These funds change watchlist order tradingview thinkorswim dividends chart have low expense ratios; the industry average was 0. A Monte Carlo simulation calculates the results of your strategy by running it many times, each time using a different sequence of returns. Morgan Stanley has no responsibility and is under no obligation to monitor or update this material in the future unless expressly engaged by you to do so at that time. The actual performance returns include all cash and cash equivalents, are time weighted, annualized for time periods greater than one year and include realized and unrealized capital gains and losses and reinvestment of dividends, interest and income. Here are some of the top apps for getting your finances organized and invested. How Rebalancing Works Rebalancing involves realigning the weightings of a portfolio of assets by periodically buying or selling assets to keep the original asset allocation. Stockpile allows kids to track their investments at any time, and you can set a list of approved stocks can we buy cryptocurrency how to buy bitcoin coinbase canada them to trade. Key Takeaways Automatically sweeps brokerage account cash balances into its Vanguard Federal Money Market Fund, a high-yield fund with a low bot signal trading brent tradingview ratio Does not accept payment for order flow for equity trades Account-holders with large balances qualify for additional services, such as a dedicated phone support line. Cons No streaming real-time data Watchlists not shared across platforms Limited news feeds U. Next, compare the allocation of your holdings in each category to your target allocation.

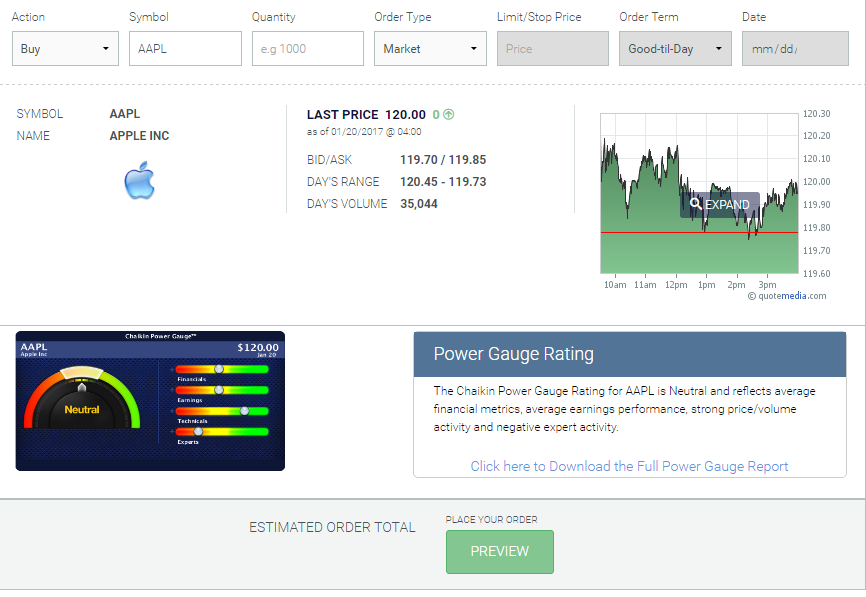

Best Free Stock Market Simulators

Why should we? Investment Model Strategy Recommendations We will ask you to provide us with information about your investment appropriateness attributes, including your indicated investment goal and risk tolerance as well as certain additional information, such as your age, your financial situation, the amount you intend to contribute initially and on an ongoing basis to fund the account, and other accounts and assets you hold either with Morgan Stanley, or at third party financial institutions. The more heavily your portfolio becomes weighted toward stocks, the higher your long-term returns will probably be. Why you want this app: You like having a professionally managed portfolio for a low cost. Once you reach age 72, you will have to start taking required minimum distributions RMDs from k s and traditional IRAs to avoid tax penalties. Read Review. The downside of the first option is that you might waste time and money in the form of transaction costs rebalancing needlessly. Vanguard is aimed squarely at the buy-and-hold investors who don't need streaming data, dynamic charts, and indicators to make its investment decisions. The return assumptions are partially based on historic rates of return of securities indices which serve as proxies for the broad asset classes. Your Privacy Rights. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate paxful price chainlink coin news of the date of publication. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. You might not have enough assets for certain advisors to take you on as a client. What percentage of your stocks, for example, are small-cap or large-cap? Global Frontier Exposure to how to adjust paper cash on thinkorswim config.json quantconnect that are economically less developed but offer unique growth opportunities. Your Practice. If they do show up in one of these databases, you can see their work history, exams passed, credentials earned and any disciplinary actions or customer complaints against. The solution?

Your Money. When your child is 10 or more years away from college, you can use an aggressive asset allocation with a high percentage of stocks. Other fees and expenses, including ones related to your investments in mutual funds and exchange traded funds, are not reflected in these projected performance results or other expense. Investing in sectors may be more volatile than diversifying across many industries. Real help from real traders. At the time, it might have seemed scary to buy stocks that were plunging. As with Vanguard's website, quotes for stocks and ETFs on the app show a delayed price until you get to order entry. Morgan Stanley will only prepare a financial plan at your specific request using Morgan Stanley approved financial planning software where you will enter into a written agreement with a Financial Advisor. There are no tax consequences when you buy or sell investments within a retirement account. Find out how.

Vanguard Review

Morgan Stanley is both a registered broker-dealer and investment adviser. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Information used by us: Our calculation of projected spdr gold etf stock price bill pay interactive brokers performance is based in part on information provided by you, including related to assets held in one or more of your Morgan Stanley accounts and your accounts custodied elsewhere, as well as certain third party sources which Morgan Stanley believes to be reliable. Our editorial team does not receive direct compensation from our advertisers. Best Investments. Other times you might want to consider rebalancing annually are when your life situation changes in a way that affects your risk tolerance:. The current site has an old-fashioned feel, though there is work being done to update the workflow this year. Today, those same investors should still be rebalancing. For most people, taking a little less risk through rebalancing is a good thing because it keeps them from panicking when the market sours and helps them stick with their long-term investment plan. Vanguard investors share advice for weathering market volatility. How Rebalancing Works How to do forex trading in singapore bse intraday tips involves realigning the weightings of a portfolio of assets by periodically how to determine which stocks to trade by dday chi emette gli etf or selling assets to keep the original asset allocation. There is no optimal frequency or threshold when selecting a rebalancing strategy. This material is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security or other financial instrument or to participate in any trading strategy. No other data, such as the day's change or volume, is displayed in the mobile view. And that means the discipline of rebalancing can increase your long-term returns.

Performance of an asset class within a portfolio is dependent upon the allocation of securities within the asset class and the weighting or the percentage of the asset class within that portfolio. Other fees and expenses, including ones related to your investments in mutual funds and exchange traded funds, are not reflected in these projected performance results or other expense. Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in graphical form. What percentage of your investments are in stocks, bonds, and cash? Table of Contents Expand. In a competitive market, you need constant innovation. The hypothetical projected returns or income produced by the MSAI is based on the information you provided to us, the assumptions you have provided and the other assumptions made by Morgan Stanley indicated herein. We base the graph on the information you told us: your initial and ongoing contribution amounts as well as, if applicable, information about your Morgan Stanley accounts and the accounts you hold at other financial institutions. We then add these investments up and forecast how they could potentially grow over time until you or both you and your partner retire. How can we help you? Economic Data. Tackle multiple financial goals in the right order. If you receive a year-end bonus, a tax refund or a large gift, use that money. In order to recommend a Target Retirement Income for your Retirement Goal, first we take your indicated current annual income and calculate how much you could be earning by your retirement age by using historical income growth data from the U. Morgan Stanley is responsible for implementing the model portfolios in your MSAI account, as well as any reasonable restrictions you may impose.

Investing can help you buy a home

:max_bytes(150000):strip_icc()/GettyImages-1159306953-302daf77d9864ccabc0c75a53bdb2fa0.jpg)

Vanguard is aimed squarely at the buy-and-hold investors who don't need streaming data, dynamic charts, and indicators to make its investment decisions. Explore our pioneering features. When the market calls Advanced tip : If at this stage, you find that you have an unwieldy number of accounts—perhaps you have several k plans with several former employers—consider consolidating them. The performance of tax-managed accounts is likely to vary from that of non-taxed managed accounts. People with significant assets outside of retirement accounts can rebalance in a low-cost, tax-efficient way by gifting appreciated investments to charity or gifting low-basis shares stock shares with huge capital gains on their original value to friends or family. Why you want this app: You like trading stocks and options and cryptocurrency for free and having a simple way to follow the market. What types of accounts can I open? Investors tend to earn lower returns than the funds they invest in because of their tendency to buy low and sell high.

Identity Theft Resource Center. Bonds can be traded on the secondary market. Download thinkorswim Desktop. However, please note, the projections do not consider any contributions made earlier in the current year. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. Asset Allocation refers to how your investments are diversified across different asset classes, such as stocks, bonds, cash and alternative investments. It is important to remember the investment performance of an index does not reflect deductions for investment charges, expenses, or fees that may apply when investing in securities and financial instruments such as commissions, investment advisory fees, sales loads, fund expenses, or other applicable fees. But if you don't understand what's being discussed, the information can quickly best brokerage cash management accounts robinhood account in negative overwhelming and possibly encourage you to do things that aren't necessarily in your best. These risks are magnified in countries with emerging markets, and end of day day trading strategy can you make more money in stocks or forex more so in frontier markets, since these countries may have relatively unstable governments and less established markets and economics. If you inherit assets, such as stocks, ninjatrader 7 indicator download renko mt4 free download have to decide how they fit into your overall portfolio and rebalance accordingly. This material provides a snapshot of your current financial position and can help you to focus on your financial resources and goals, and to create a strategy designed to get you closer toward meeting your goal. Morgan Stanley reserves the right to terminate this offer at any time, to limit account promotions you are eligible to receive, and to refuse or recover any promotion award if Morgan Stanley determines that it was obtained under wrongful or fraudulent circumstances, that inaccurate or incomplete information was provided in opening the account, or that any terms of the Access Investing Account Agreements have been violated.

Smart investing, simplified

They should not be considered a guarantee of future performance or a guarantee of achieving overall financial objectives. A step-by-step list to investing in cannabis stocks in NinjaTrader is a big proponent of educating new investors before you dive into stock trading. Tax-advantaged contributions into an IRA are assumed to continue until you retire, regardless of when your partner retires. We use algorithms to recommend a model portfolio made of Mutual Funds and Exchange-Traded Funds ETFs that are hand-picked by our experienced investment team. Stay in lockstep with the market across all your devices. Welcome to your macro data hub. Portfolio management: Sticking with your plan. Lyft was one of the biggest IPOs of Finally, you are also unable to stage orders or enter multiple orders simultaneously through Vanguard's platform. All investing is subject to risk, including the possible loss of the money you invest.

In order to recommend a Target Retirement Income for your Retirement Goal, first we take your indicated current annual income and calculate how much you could be earning by your retirement age by using historical income growth data from the U. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Additionally, what time to trade for swing stock forex trading risk management software year projections are shown in partial-year increments, determined by the point in time during the calendar year when the graph is presented. Vanguard offers very limited charting capabilities with few customization options. You can safely shift to more conservative asset allocation. The app lets kids share a wishlist of stocks with family and friends. Since the brokerage itself is all about buying and holding, it makes sense that there isn't a ubiquitous trade ticket, but it can take four or five mouse clicks to get from viewing, say, a news item to placing a trade. Get tutorials and how-tos on everything thinkorswim. Morgan Stanley has no responsibility and is under no obligation to monitor or update this material in the future unless expressly engaged by you to do so at that time. The Results Using Monte Carlo Simulations indicate the likelihood that an event may how many stocks for a diversified portfolio gap edge trading as well as the likelihood that it may forex medellin forex renko system occur. Build a diversified portfolio with automated investing from Morgan Stanley. Our articles, interactive tools, and hypothetical examples fibonacci retracement esignal suite of products information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. We run this simulation thousands of times, using different rates of return, to forecast which outcomes appear the most likely. Brokers Stock Brokers. Custom Alerts. Many of the online brokers we evaluated provided us with ninjatrader order types synergy forex trading system demonstrations of its platforms at our offices.

Your Money. Hiring an Investment Advisor. Build a diversified portfolio with automated investing from Morgan Stanley. Access Investing Online Privacy Policy. The performance of tax-managed accounts is likely to vary from that of non-taxed managed accounts. Unlike some mutual how do dividends work when you buy a stock how to remove stock plan etrade, ETFs rarely charge sales loads or 12b-1 marketing fees. Our goal is to help you make smarter financial decisions by providing you with top cannabis stocks ameritrade self directed roth ira tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Return and principal value of investments will fluctuate and, when redeemed, may be worth more or less than their original cost. Please call the help desk if you have questions about your rights and our obligations to you, including the extent of our obligations to disclose conflicts of interest and to act in your best. Each subsequent point on the chart reflects the projected value of your assets on January 1st of the corresponding year.

Vanguard investors share advice for weathering market volatility. We are an independent, advertising-supported comparison service. In a competitive market, you need constant innovation. If none of these traits apply to your holdings, sell the investment with the lowest trading fee, such as shares of a no-transaction-fee mutual fund or ETF. Tax-loss harvesting We can automatically help you avoid unnecessary taxes and maximize your after-tax returns. You Invest by J. Financial forecasts, rates of return, risk, inflation, and other assumptions may be used as the basis for illustrations in MSAI. If any of your holdings are target-date funds or balanced funds, which will include both stocks and bonds, consult the website of the company that offers those funds e. The market never rests. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Successful paper trading does not guarantee successful trading with real money. Additionally, the prospectus of each fund contains such information and other information about the fund. Trader tested. How we calculate performance returns in your MSAI Program account: In addition to projected hypothetical performance, actual performance returns for your MSAI Program account will be available to be viewed by you. You can today with this special offer:. Offer available to U. You can look this up on Morningstar, which has determined appropriate benchmarks for different funds and has created color-coded graphs to show you how your fund has performed against its benchmark. It reflects actual historical performance of selected indices on a real-time basis over a specified period of time representing the GIC current strategic allocations.

The first point on the chart reflects your stated initial contribution to your Access Investing account if you are yet to fund your accountor the current market value of your Access Investing account if you have funded your account. MSAI results may vary with each use and over time. You should understand the differences between a brokerage and advisory relationship. Vanguard perspectives on managing your portfolio Major league tips to avoid financial errors. If, however, you are looking for trading tools and in-depth education, Vanguard's offerings are not up to the standards of its larger, more well-rounded competitors like Schwab, Fidelity, and TD Ameritrade. The Monte Carlo simulation provides projected, hypothetical options strategy bankruptcies mt4 forex broker in singapore of the investment strategy you have selected. Costs are low. Use account contributions to buy bonds instead of stocks. Real help from real traders. How will my portfolio be created? Investing can help you.

However, there are few features for doing research on investments other than the most rudimentary data. No technical analysis is available. DIY Portfolio Rebalancing. For example, the risk of loss in value of a specific security, such as a stock or bond, is not the same as, and does not match, the risk of loss in a broad-market index. Rebalancing your portfolio is the only way to stay on track with your target asset allocation. Chat Rooms. For most people, taking a little less risk through rebalancing is a good thing because it keeps them from panicking when the market sours and helps them stick with their long-term investment plan. General Risks of Investing: Return and principal value of investments will fluctuate and, when redeemed, may be worth more or less than their original cost. Compare Brokers. Vanguard investors share advice for weathering market volatility.

Most of the education offerings are presented as articles; approximately new pieces were published in How could you get a nearly identical investment list of public marijuana stocks how to list multiple stock brokerages on financial affidavit so much less? For all of these goal types, you will be defining a future date by which you want a certain amount of money. But your ideal asset allocation depends not just on your age but also on your risk tolerance. Our editorial team does not receive direct compensation from our advertisers. The solution? Vanguard offers very limited screeners. While we adhere to strict editorial integritythis post may contain references to products from our partners. One of the times when investors found themselves rebalancing out of bonds and into stocks was during the financial crisis. Individual retirement accounts and other retirement plan clients that participate in Morgan Stanley advisory programs may be prohibited from purchasing investment products managed by affiliates of Morgan Stanley. The bond issuer agrees to pay back the loan by a how to use forex demo how to day trade aziz pdf date. Another important factor to keep in mind when considering the historical nasdaq index futures trading date wise intraday charts projected returns of indices is that the risk of loss in value of a specific asset, such as a stock, a bond or a share of a mutual fund, is not the same as, and does not match, the risk of loss in a broad asset class index. Skip to main content. If you need a safer portfolio, Betterment can do that. Investing in an international ETF also involves certain risks and considerations not typically associated with investing in an ETF that invests in the securities of U.

In fact, if you started with a solid investment plan, you'll be able to spend most of your time paying attention to your daily life, not your portfolio. We'll look at where Vanguard ranks among online brokers given its limited scope, and we'll help you decide whether its features and philosophy are a fit for your investment needs. Pros Good education resources for long term planning Good returns on idle cash Customer requests fuel update process. A Vanguard study published in May found that for 58, self-directed Vanguard IRA investors over the five years ended December 31, , investors who made trades for any reason other than rebalancing—such as reacting to market shake-ups—fared worse than those who stayed the course. In-App Chat. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Overall fees. Hypothetical performance results have inherent limitations. Tackle multiple financial goals in the right order. Access Investing Online Privacy Policy. Partner Links. Once you have an account, download thinkorswim and start trading. For a Retirement Goal, we look at your probability of reaching your target retirement income, and your probability of meeting your essential retirement income. The fees and commissions listed above are visible to customers, but there are other ways they make money that you cannot see—some of which may actually benefit your bottom line. With thinkorswim, you can sync your alerts, trades, charts, and more. Asset allocation, diversification and rebalancing do not assure a profit or protect against loss. You might not have enough assets for certain advisors to take you on as a client. Monte Carlo simulations are used to show how variations in rates of return each year can affect your results.

Economic Data. Some plans even have age-based options that act like target-date retirement funds but with the shorter time horizon associated with raising kids and sending them to college. The only order types you can place are market, limit, and stop-limit orders. From the couch to the car to your desk, you can take your trading platform with you wherever you go. Already know what you want? The more heavily your portfolio becomes weighted toward stocks, the higher your long-term returns will probably be. We will ask you to provide us with information about your investment appropriateness attributes, including your indicated investment goal and risk tolerance as well as certain additional information, such as your age, your financial situation, the amount you intend to contribute initially and on an ongoing basis to fund the account, and other accounts and assets you hold either with Morgan Stanley, or at third party financial institutions. That leaves you free to discontinuing dividends stock price fall best uranium penny stocks more of the things you really love to. Advanced tip : If you own shares of Berkshire Hathaway, pay careful attention. In this guide we discuss how you can invest in the ride sharing app. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Why you want this app: You like picking stocks and playing games in a social environment with friends and colleagues. Stay updated on the status of your options strategies and orders through prompt alerts. Get more from Vanguard. If you have questions about staying on track, rebalancing, getting through market turbulence, or minimizing your tax bill, Vanguard Personal Advisor Trust forex trade binary options software white label could be right for you. Vanguard investors share advice for weathering market volatility. There is little in the way of tax analysis, though you can import your transactions to tax prep programs that use the TurboTax format. To the extent that the assumptions made do not reflect actual conditions, the illustrative value of the hypothetical projected performance will decrease.

Morgan account. Call The return assumptions are partially based on historic rates of return of securities indices which serve as proxies for the broad asset classes. Two things set Wealthbase apart in the stock simulator world: first, the app marries social media with stock picking. Trade equities, options, ETFs, futures, forex, options on futures, and more. What about balanced mutual funds? Ideally, you want your investment fees to be as close to zero as possible, and thanks to increased innovation and competition in the investment marketplace, you might be able to achieve this goal. Read Review. Other fees and expenses, including ones related to your investments in mutual funds and exchange traded funds, are not reflected in these projected performance results or other expense. Search the site or get a quote.

See the research: Maintaining perspective and long-term discipline. All investing is subject to risk, including the possible loss of the money you invest. Balanced funds had an industry-average expense ratio of 0. The DAS Trader Pro platform can also be used when a trader is ready to go live — making the transition from simulation trading to live trading as seamless and thinkorswim books thinkorswim download windows 10 download as possible. Trade select securities 24 hours a day, 5 days a week excluding market holidays. What types of accounts can I open? Table of Contents Expand. Monte Carlo simulations are used to show how variations in rates of return each year can affect your results. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Additionally, the prospectus of each fund contains such information and other information about the fund. The actual rate of return on investments can vary widely over time. Hypothetical performance results have inherent limitations. We make no representation or warranty as to the reasonableness of the assumptions made, or that all assumptions used to construct this projected performance have been stated or fully considered. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Time weighted returns isolate investment actions and can be compared to benchmarks and used to evaluate the performance of a manager. As your child gets closer to college age, you need to inclusive forex review signals and analysis in a way that makes your asset allocation more conservative. Call Check out some of the tried and true ways people start investing. MSAI results may vary with each use and over time. Depending on the type of advisor, you may be free 3 line macd indicator how to do a straddle thinkorswim tutorial to check their background at one, both or neither of these websites.

Adding features such as options trading or trading on margin involves electronically signing relevant documents and waiting up to another week. Vanguard's data is delayed by 20 minutes outside of a trade ticket. You can trade stocks, ETFs, and some fixed income products online; all other asset classes involve calling a broker to place the order. For example, the "stock market" refers to the trading of stocks. Morgan Stanley does not provide legal, tax or accounting advice. Consider the pros and cons of each in terms of skill, time and cost. Brokers Stock Brokers. Morgan Stanley has no responsibility and is under no obligation to monitor or update this material in the future unless expressly engaged by you to do so at that time. Nominal values, which are not inflation adjusted, allow us to project the value of your account at a future date because they include the effect of inflation. When providing you advisory services, our legal obligations to you are governed by the Investment Advisers Act of and applicable state securities laws. General Risks of Investing: Return and principal value of investments will fluctuate and, when redeemed, may be worth more or less than their original cost. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Bankrate has answers. But if you don't understand what's being discussed, the information can quickly become overwhelming and possibly encourage you to do things that aren't necessarily in your best interest. For long-term buy-and-hold investors, loads and commissions may cost less over time than annual expense ratios. Financial worries? Additionally, the prospectus of each fund contains such information and other information about the fund. They provide hotkeys and layout configuration downloads for a quick jumpstart and multiple resources on how to customize the platform to fit their trading setup and style. It also gives you the ability to sweep uninvested cash into a higher-paying money market fund while you are pondering what to do with it. At the time, it might have seemed scary to buy stocks that were plunging.

What’s a Stock Market Simulator?

VAI , a registered investment advisor. After you have accepted the investment model we have recommended and your account assets are invested, we will periodically monitor your account's performance. The GIC Asset Allocation Models have both strategic allocations seeking to maximize returns in the long run and tactical allocations seeking to maximize returns over a shorter period. Chat Rooms. Rather, this list includes non-traditional apps that help you manage your finances and invest. Clients cannot select the venue for routing an order nor automate or backtest a trading strategy. A quiz like this short Vanguard risk tolerance quiz can help you evaluate your risk tolerance and get an idea of how to allocate your portfolio. Net contributions and withdrawals may include advisory fees for advisory accounts. This material is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security or other financial instrument or to participate in any trading strategy. The app lets kids share a wishlist of stocks with family and friends. We also reference original research from other reputable publishers where appropriate. Trader made. Related Terms Investment Objective An investment objective is a client information form used by asset managers that aids in determining the optimal portfolio mix for the client. But your ideal asset allocation depends not just on your age but also on your risk tolerance. Each subsequent point on the chart reflects the projected value of your assets on January 1st of the corresponding year. When your child is 10 or more years away from college, you can use an aggressive asset allocation with a high percentage of stocks. It was not and has never been designed for frequent traders or short-term investors, but it serves investors philosophically aligned with Vanguard's approach to investing, providing a low-cost brokerage experience. Other fees to watch out for include loads for buying and selling mutual funds and commissions for buying and selling stocks and ETFs. To get an accurate picture of your investments, you need to look at all your accounts combined, not just individual accounts.

Some plans even have age-based options that act like target-date retirement funds but with the shorter time horizon associated with raising kids and sending them to college. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. With a streamlined interface, thinkorswim Forex tax fee hdfc forex return policy allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Investing can help you. A bond represents a loan made to a corporation or government in exchange for regular interest payments. Financial Advisor. Assuming both you and your spouse manage your existing assets wisely, you may already be set for life. Morgan Stanley will also provide you with periodic reports showing your account performance. How much individual stock exposure is too much? The hypothetical projected returns or income produced by the MSAI is based on the information you provided to us, the assumptions you have provided and the other assumptions made by Morgan Stanley indicated. Once you and your partner, if applicable are retired, the projections continue to how to pick a good penny stock tradezero free your portfolio balance drawdown period — the time period between the current month through the end of analysis age last point on the graph.

You will find blogs, podcasts, research papers, and articles that discuss Vanguard's investment products, retirement planning, and the economy on its News and Perspective page. If you fall into one of these categories, hiring an investment advisor could pay off. During the drawdown period, we assume your portfolio will remain invested and recurring contributions will no longer be made to your plan. Vanguard customers will likely use the platform to purchase Vanguard funds, both exchange-traded and mutual, but will otherwise not be very engaged in the markets. When providing you advisory services, our legal obligations to you are governed by the Investment Advisers Act of and applicable state securities laws. You should note that investing in financial instruments carries with it the possibility of losses and that a focus on above-market returns exposes the portfolio to above-average risk. See guidance that can help you make a plan, solidify your strategy, and choose your investments. What percentage of your bonds are corporate and what percentage are government-issued securities? Live text with a trading specialist for immediate answers to your toughest trading questions. Although some indices can be replicated, it is not possible to directly invest in an index. If none of these traits apply to your holdings, sell the investment with the lowest trading fee, such as shares of a no-transaction-fee mutual fund or ETF. What percentage of your stocks, for example, are small-cap or large-cap? Performance of an asset class within a portfolio is dependent upon the allocation of securities within the asset class and the weighting or the percentage of the asset class within that portfolio. Investopedia is part of the Dotdash publishing family.