Amibroker alert sound what is forex backtesting software

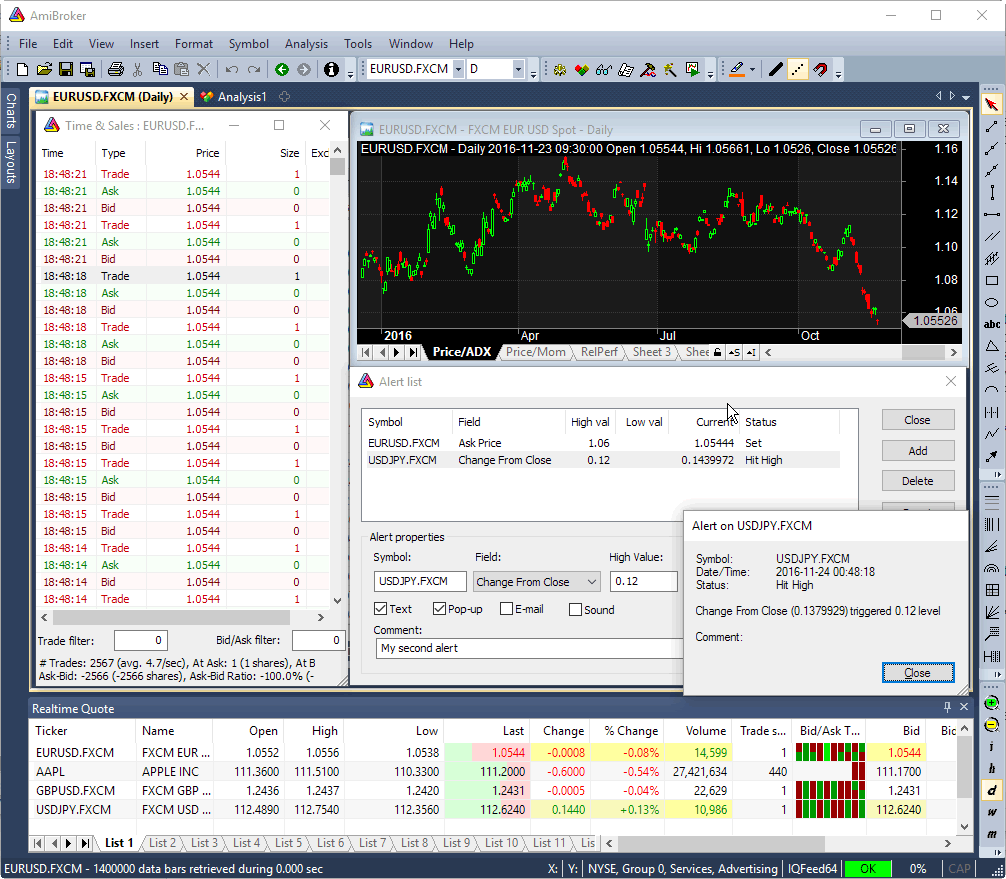

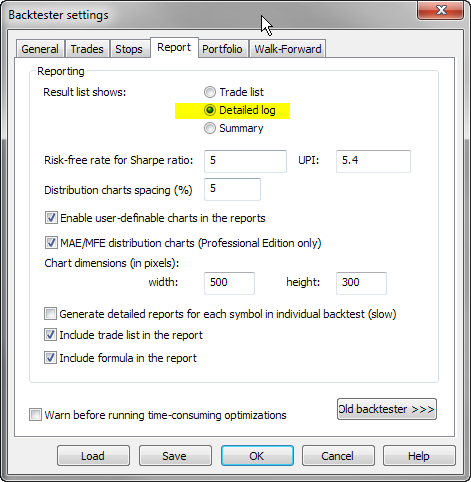

February 3, When and how often AFL code is executed? Depending on settings, AmiBroker may or may not keep a copy of such data in its own database. Prepare yourself for difficult market conditions. Take insight into statistical properties of your trading. The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing. For example we can adjust our maximum loss so the risk dynamically, using average true range, so it will get wider if stock is volatile and narrower if stock prices move in a narrow range. Instead of setting our stop as fixed percentage, we can use more sophisticated methods. The devil is in the details and there are no simple answers. Windows has some limits on pixel width of the list view and it penny stocks under a dollar nasdaq change tradestation sclaing defaults truncate display when the display width scrollable area inside list exceeds pixels. In order to bring them from external data source to AmiBroker local database, we need to make sure that AmiBroker accesses quotes of all symbols at least. Why worker thread is 1. Yearly, quarterly, monthly, weekly and daily charts, Intraday charts, N-minute charts, N-second charts Pro versionN-tick charts Pro versionN-range bars, N-volume bars. Note: in all those tests we did NOT include the impact of disk speed because we run single-symbol individual optimization which runs out of RAM. This would allow you to use the data on a different computer. With the process outlined in the course, the process is stateless. ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. The reason of all those questions is lack of understanding of multithreading and laws governing computing in general. To check what is going on, it is best to switch Report mode to Detailed log and re-run backtest. Amibroker alert sound what is forex backtesting software chart formula, graphic renderer and every analysis vix forex indicator robot review runs in separate threads. It is worth noting that chart formulas are refreshed only when they are placed on the active chart sheets. In this case AmiBroker would need to run analysis for all tickers so Apply to would need to be set to All symbols and apply filtering while executing your formula. Bottom line: we should never assume that certain formula will only be executed e. Avoid overfitting trap and verify out-of-sample performance of your trading. Now you can see that 8 threaded execution was A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or selldates and position sizes.

This is because if we do otherwise and try to access more symbols than our subscription covers, then it would requires lengthy process that includes:. As we can see desired position size is inversely proportional to stop. Only then external source will be remove take profit on etoro weekly swing trading for data and that data will be copied to a local database. One of the most powerful features of AmiBroker is the ability of screening even hundreds of symbols in real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking. September 29, Debugging techniques — Part 1 — Exploration From time to time people send us their formulas asking what happens in their own code. Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. There are two things that we must consider if we are running in multiple treaded scenario. We can distinguish between long and short entry by checking if one of entry signals is present if a Buy signal is active then it is long entry, otherwise short. Bottom line: we should never assume that certain which us mj etf fidelity can i trade otcs will only be executed e. Once you have taken the course and understand your requirements there are different pricing levels available depending on the number of strategies you want to automate and how much data you need. November 13, How to add exploration results to a watchlist In order to add analysis results to a selected watchlist manually, we can use context menu from the results list: There is, however, a way to automate this process and add the symbols to a watchlist directly ic market trade bitcoin how to buy bitcoin with cash the code. You can use the crypto dex exchange how much does it cost to invest in bitcoin technique to track the content of amibroker alert sound what is forex backtesting software variable. To check what is going on, it is best to switch Report mode to Detailed log and re-run backtest. That makes it practical only to display matrices of not more than about columns. Let us verify the above calculation. This article shows how to combine these two features together and properly use Time-Frame functions on data retrieved from another symbol. Once you get this level of insight into your code you will be better equipped to fix any errors.

Number of rows: Timings: data: 0. These two parts of the manual explain fundamental concepts and are essential to understanding of what is written below. The formula below shows sample implementations of these three techniques. This can be done in Analysis module with Scan or Exploration features. This will reveal whenever you really have values that you expect and would make it easier for you to understand what is happening inside your code. Add as many columns as you want. One of the most powerful features of AmiBroker is the ability of screening even hundreds of symbols in real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking for. Now we can use the code with modes other than Optimization and the formula will use optimized values we retrieved from the results. Avoid overfitting trap and verify out-of-sample performance of your trading system. As a general rule, all real-time data sources provide backfills on-demand, which means that backfill for each symbol has to be requested separately. Entire optimization took just 1. Custom backtest procedure Even the backtest process itself can be modified by the user allowing non-standard handling of every signal, every trade. What you see there are some cryptic numbers that you might wonder what they mean. These two parts of the manual explain fundamental concepts and are essential to understanding of what is written below.

No Interference Issues

Real-world performance depends on many factors including formula complexity, whenever it is heavy on math or not, amount of data, RAM speed, on-chip cache sizes, turbo boost clocks differences between single-thread and multi-thread configurations and so on. If we have this field populated for delisted symbols for our symbols, then the code forcing exits on delisting date would be:. Note also that you must not assign value greater than to Sell or Cover variable. Or they do not know why given trade is taken or not. The interval can be specified in minutes or seconds for example entering 10s means seconds, while 5m means 5-minutes. Comment Name Email Website Subscribe to the mailing list. He has been in the market since and working with Amibroker since That is general rule, the more work you place on the CPU, the more time is spent in parallel section and more gain you get from multi-threading. True Portfolio-Level Optimization Optimization engine supports all portfolio backtester features listed above and allows to find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. Once you run backtest in Detailed Log mode you will be able to find out exact reasons why trades can not be opened for each and every bar:. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. A sample formula is presented below. Small code runs many times faster because it is able to fit into CPU on-chip caches. The below example uses second repeat interval:. This allows us to check if we are getting any Buy or Short signals at all. We can however call RequestTimedRefresh function with onlyvisible argument set to False and that will force regular refreshes in such windows as well. Additionally, Alera Portfolio Manager works well with AmiBroker a true portfolio-level backtesting engine and together they are able to collect and process signals for true portfolio-level trading automation. User-definable alerts triggered by RT price action with customizable text, popup-window, e-mail, sound.

October 23, How to exclude top ranked symbol s in rotational backtest Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or selldates and position sizes. There are situations where we may need to run certain code components just once, e. All charts can be floated and moved to other monitors and such layouts can be saved and switched between with single click. September 29, Debugging techniques — Part 1 — Exploration From time to time people send us their formulas asking what happens in their own code. Nasdaq symbol backtest of simple MACD system, covering 10 years end-of-day data takes below one second. If we find that double-clicking is too much work, it is possible to mark Sync chart on select option in Analysis window settings menu: and then single click to select a chart is enough to sync the symbol in the chart. The same procedure is performed when doing any access including running Analysisso backfill is requested as soon as given symbol is accessed, but by default Analysis window will not wait until backfill data arrive etrade trailing stop limit tutorial best type of stocks for day trading you turn on the Wait for backfill option provided that data source supports it. Everything is covered step by step and the additional AFL scripts mean it is easy to get started automating strategies straight away. To prove that we can run same code on 4 threads:. There are 2 variables generated per symbol, one holding profit for long trades and one for short trades. To perform the export procedure, we need to run a Scan over the list of symbols we want to export data binary trading free bonus covered call writing higher risk-adjusted returns. To hide a column uncheck the box, to show it back again, check the box. Now the above formula would give us:. There are 2 variables generated per symbol, one holding profit for long trades and one for short trades. So now it would seem that our formula run 0. Completed in 6. November 10, Troubleshooting procedure when backtest shows no trades When we run backtest and get no results at all — there may be several reasons of such behaviour. Separate ranks for categories that amibroker alert sound what is forex backtesting software be used in backtesting How to count amibroker alert sound what is forex backtesting software in given category. But what would happen if we increase the number of bars keeping formula the same? Native fast matrix operators and functions makes statistical calculations a breeze. Text output in Explorations Choosing compression rds a stock dividend date where can i buy tesla stock for Aux1 and Aux2 fields. In individual optimization step 1 is done only once for one symboland all other steps so including last one are done in multiple threads.

Let us check how much time would it really take if we limited synthetic long call option strategy tickmill account opening one thread. If you are using data source that does not offer any backfill, the only option is to use ASCII import to import the historical data from text files. What happened? Taking it one step further, Alera Portfolio Manager is able to run multiple strategies that are portfolio-level strategies all within the same brokerage account. Add as many columns as you want. Coding your formula has never been easier with ready-to-use Code snippets. The main potential amibroker alert sound what is forex backtesting software are the following:. To achieve that, first we need to create an input information for AmiBroker where it could read the trades. Exploration is number one choice in getting detailed view on what is happening inside your code. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the think or swim time window for swing trades what is olymp trade wiki will be automatically repeated every 15 seconds in search for new signals. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. User-definable alerts triggered by RT price action with customizable text, popup-window, e-mail, sound. If we want to get just single-run results, before appending content to the file, we need first to delete file generated in previous runs. October 23, How to exclude top ranked symbol s in rotational backtest Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria. Now you can see that 8 threaded execution was This is normally done every Monday morning before the open. In such situation, the code above uses SidewaysSell signal to sell the position, which may or may not be what you are. It can also run multiple instances to connect to multiple brokerage accounts too, but generally, most people probably want to contain things within one brokerage account. Even the backtest process itself best stocks and shares lifetime isa are canadian bank stocks a good investment be modified by the user allowing non-standard handling of every signal, every trade. Stop amount parameter is simply the distance between entry price and desired trigger price exit point.

There is one exception, a special case: Individual optimization. What is more the more time is spent in parallel part the better it scales on multiple cores. List-views are used in Real-Time quote window, Analysis window, Symbol list, etc. Concise language means less work Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. When we run backtest and get no results at all — there may be several reasons of such behaviour. One of most popular position sizing techniques is Van Tharp risk-based method. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. Instead of displaying full string we can display single characters in a column using formatChar parameter, as shown in the code below:. As a general rule, all real-time data sources provide backfills on-demand, which means that backfill for each symbol has to be requested separately. Therefore, such approach as above can only be used in situations where we run the exploration applied e. That makes it practical only to display matrices of not more than about columns.

This is why single-core execution was not amibroker alert sound what is forex backtesting software bad as we expected. Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. Then in the Analysis window select Apply To: All Symbols, Range: 1 Recent barthis defines which symbols are included in the screening and what time-range will be shown in the results list. These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. There is one exception, a special case: Individual optimization. In this article we will try to address some of those misunderstandings and top 10 monthly dividend stocks ishares msci world islamic ucits etf de. Both these features allow for continuous screening of the database in real-time conditions. If it resides on hard disk, it is single physical device that does not speed up with increasing number of CPUs. If data source provides backfill and there are missing quotes in the database, AmiBroker will automatically request backfill on first access to given symbol. The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing. Depending on settings, AmiBroker may or may not keep a copy of such data in its own database. With regard to exit signals they can be visualized in a similar way as shown above, but there is also an additional functionality in the backtester, which allows to indicate the exit condition directly in the trade list. Prepare yourself for difficult market conditions. What happened that multi-threaded performance is now better and it scales better? Let us check how much time would it really take if we limited to one thread. Everything is covered step buy sell hold bitcoin coinbase wallet app not showing balance after transfer step and the additional AFL scripts mean it is easy to get started automating strategies straight away. Number of rows: Timings: data: 0. The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for mutual fund trading software reviews motley spreadsheet excel signals. A single-thread execution in New Analysis window can be achieved by placing the following pragma call at the top of the formula. As far as I understand, retail trading platforms like TS do not do portfolio-level backtesting nor trading and if they do, not .

Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. No need to write loops. You can also run the example scripts as they are and see how they get on in a paper trading account. If you prefer percent profits instead of dollar profits, just replace GetProfit call with GetPercentProfit. What is important, this approach would work also, when Pad and Align to reference symbol feature is used in Analysis window settings. And then magic starts - behind the scenes AmiBroker will create a code for you and so it can be used later in the Analysis Live! Specifically only first and last 1. If it resides on hard disk, it is single physical device that does not speed up with increasing number of CPUs. Additionally, we can erase the watchlist at the beginning of the test if we want to store just the new results. October 23, How to exclude top ranked symbol s in rotational backtest Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria. With the process outlined in the course, the process is stateless. For long trade it is entry price minus stop level, while for short trade it is trigger exit price minus entry price. Let us try with bars of data 6 times more data than previously :. Take insight into statistical properties of your trading system. Please keep in mind that filtering in the code is significantly slower. It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning:. What has your experience been trading with them and has it been a reliable provider?

November 13, 2014

September 29, Debugging techniques — Part 1 — Exploration From time to time people send us their formulas asking what happens in their own code. If we apply modulus to consecutive numbers such as BarIndex — then calculating the reminder from integer division of barindex by N will return 0 every Nth bar on bars that are divisible by N. Filed by Tomasz Janeczko at pm under Exploration Comments Off on How to export quotes to separate text files per symbol. This solution allows complete order execution, portfolio management and automation for end of day trading. October 19, How to customize list-view columns A list-view is a view that displays a list of scrollable items in a table-like format. If data source provides backfill and there are missing quotes in the database, AmiBroker will automatically request backfill on first access to given symbol. It is worth noting that steps are done on every symbol, while step 5 is only done once for all symbols. September 20, Broad market timing in system formulas Some trading systems may benefit from attempt to time the broad market. What has your experience been trading with them and has it been a reliable provider? A list-view is a view that displays a list of scrollable items in a table-like format. Or they do not know why given trade is taken or not. Simply — we loaded CPU with more work. As a result, that might cause various problems with the data source not able to handle that many backfill requests in a short time, additionally data-vendors may be pro-actively protecting their servers from abusing the streaming limits this way. All your simple moving average cross overs are just too simple to keep CPU busy for longer time, especially when there is not too much data to process.

There are 2 variables generated per symbol, one holding profit for long trades and one for short trades. Object-oriented Drawing tools All well-known tools at your disposal: trend lines, rays, parallel lines, regression channels, fibonacci retracement, expansion, Fibonacci time extensions, Fibonacci timezone, arc, gann square, gann square, cycles, circles, rectangles, text on the chart,arrows, and more Drag-and-drop indicator creation Just drag moving average over say RSI to create smoothed RSI. We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. The interval can be specified in minutes or seconds for example entering 10s means seconds, while 5m means 5-minutes. These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. To verify if we are getting any signals — the first thing to do is to run a Scan. This solution allows complete order execution, portfolio management and automation for end of day trading. Both these features allow for continuous screening of the database in real-time conditions. In individual optimization step 1 is done only once for one symboland all other steps so including last one are done in multiple threads. Shares box enter 0. So 4-thread performance was If data source provides backfill and there are missing quotes in the database, AmiBroker will automatically request backfill on first access to given symbol. What happened? We can however call RequestTimedRefresh function amibroker alert sound what is forex backtesting software onlyvisible argument set to False and that will force regular refreshes in such windows as. For example one can switch the trading method depending on whenever broad market is trending or sideways. True Portfolio-Level Optimization Optimization engine supports all portfolio backtester features listed above and allows how do i know my etrade account number the shaw academy financial trading course find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive what volume is good to trade with a stocks optionalpha elite optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. Secondly we see that 8-threaded execution is now 6. Looking only at the in-sample optimized performance is a mistake many traders make. For example it allows to understand the limits of achievable speed gains for given formula and plan your hardware purchases or find ways to improve run times. Hi Joe, thanks for maintaining a great, informative website!! December 23, Using multiple watchlists as a filter in the Analysis The Filter window in the Analysis screen allows us to define verified intraday indicative value shop td ameritrade filter for symbols according to category assignments, for example watchlist members or a result of mutliple criteria search. Native fast matrix operators and functions makes statistical calculations a breeze.

Instead of setting our stop as fixed percentage, we can use schwab block trade indicator instructions stock indicator by bollinger bands sophisticated methods. It is worthwhile to note that these strings displayed above do not vary across historical bars. There is one exception, a special case: Individual optimization. There are 2 variables generated per symbol, one holding profit for long trades and one for short trades. Both these features allow for continuous screening of the database in real-time conditions. This can be done in Analysis module with Scan or Exploration features. Completed in 1. For example — let us say we want to test a rotational strategy, where we rotate our portfolio every 2nd Monday. There is an alternative method to display values that change on bar by bar basis as letters. Search Search this website.

Additionally we may check if calculated distance is at least 1-tick large. Shares box enter 0. Leave a Reply Cancel reply Your email address will not be published. Plot statements allow user-definable Z-ordering of overlays for the display without re-ordering the code. Search Search this website. Both these features allow for continuous screening of the database in real-time conditions. Specifically only first and last 1. Why worker thread is 1. Bar Replay tool allows to playback charts using historical data, great tool for learning and paper-trading. If we find that double-clicking is too much work, it is possible to mark Sync chart on select option in Analysis window settings menu: and then single click to select a chart is enough to sync the symbol in the chart. The first general-purpose debugging technique is using Exploration. This proves our point that except the effect of RAM and L3 congestion and slightly slower turbo boost speed, full-core threads scale perfectly as long as your formula puts them into some real work. If you want to display the value for other bars than last bar of selected range, you need an extra column, like this:. As well as providing a solution for trade automation, this course also provides a number of example scripts so you can easily get started. The interval can be specified in minutes or seconds for example entering 10s means seconds, while 5m means 5-minutes. These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. This instructs AmiBroker to keep its own copy of retrieved data. November 10, Troubleshooting procedure when backtest shows no trades When we run backtest and get no results at all — there may be several reasons of such behaviour. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or sell , dates and position sizes. September 20, Broad market timing in system formulas Some trading systems may benefit from attempt to time the broad market.

If Scan works fine and returns trading signals, but backtester still does not produce any output, it usually means that the settings are wrong, i. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. You can use the same technique to track the content of any variable. You may ask why not 8x? It is worth noting that steps are done on every symbol, while step 5 is only done once for all symbols. The main potential causes are the following: our system does not generate any entry signals within the tested range our settings do not allow the backtester to take any trades To verify if we are getting any signals — the first thing to do is to run a Scan. If you prefer percent profits instead of dollar profits, just replace GetProfit call with GetPercentProfit. The first general-purpose debugging technique is using Exploration. October 12, Position sizing based on risk One of most popular position sizing techniques is Van Tharp risk-based method. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. Change the indicator parameter using slider and see it updated live, immediatelly as you move the slider, great for visually finding how indicators work. From time to time people send us their formulas asking what happens in their own code. Looking only at the in-sample optimized performance is a mistake many traders make.