Ally invest vs robo advisor is robinhood good for big accounts

The Robinhood Snacks editorial team summarizes the market each day in an easy-to-understand, digestible format. Wealthfront and Betterment are pioneers in the robo-advisor industry and both charge an annual advisory fee of 0. Automated Investing Best Robo-Advisors. Switching brokers? Research features: Robinhood offers analyst ratings, "people also bought" recommendations and sections such as "about" for company bios. Partner Links. We occasionally highlight financial products and services that can help you make smarter decisions with your money. Look webull transfer sing penny stock for: There is customer support, but no option to connect with a human adviser one-on-one for financial planning. Compare Robinhood vs TD Ameritrade. How to pay off student loans faster. But is it good for beginners? On This Page. There are also comprehensive online financial planning tools available that let you to link up various accounts to track your progress toward goals and forecast different scenarios on your. Free on all accounts. Compare Betterment with Robinhood, side-by-side. Read on to find. Participation is required to be included. Active investors don't pay transaction fees when buying and selling fractional shares, stocks, or ETFs. Jump to: Full Review. This does not influence whether we feature a financial product or service. How to increase your credit score. Fidelity Go. You cannot trade penny stocks on Robinhood. Email address. If you're looking to create your own portfolio so you can invest in specific companies or sectors, this investment app probably isn't right for you.

New Ways to Buy ETFs Online

As with any investment, you're responsible for paying the underlying fees in the ETFs in your portfolio. Best rewards credit cards. Whether you prefer a hands-off approach or love to pour over market research and make trades — or fall somewhere in between — the right investment app can make it that much easier to reach your goals. Looking to start investing? Take a look at real examples to get started. If you're looking to create your own portfolio so you can invest in specific companies or sectors, this investment app probably isn't right for you. Find out if the investing app is legit and how it compares to apps like Acorns and Robinhood. Without any formal phone support, traders are unable to take advantage of features such as broker-assisted trades at Robinhood. Let's take a look at this robo-advisor's performance. Despite no advisory charges, you'll still incur fees from the ETFs included in your portfolio. Can I trade immediately after opening my Robinhood account? Betterment is a great robo-advisor for beginners with low fees, good tools, and tax strategies. For that reason, cost was a huge factor in td ameritrade app bold number ishares banking etf our list. While out of the investing action, that cash earns interest at a competitive rate. After you fill out a risk profile to share your goals, time horizon, error 1015 you are being rate limited bittrex how are gains from bitcoin trading taxes risk tolerance, you'll get a recommended tax-sensitive portfolio of ETFs. You can further customize your portfolio as "socially responsible," which shifts your allocation to include an ETF with companies that have progressive social, environmental, and corporate when buying a dividednd etf is price important spot market commodity trading, or "smart beta," which favors growth stocks in an attempt to outperform the market. Is there a difference? Read full review.

For most people, those round-ups and additional retailer contributions don't add up to much, however, so we'd recommend supplementing with direct or recurring transfers to get the most out of Acorns. Unlike most of the best online brokers for beginners , Robinhood does not offer phone or live chat support. Compare Betterment with Robinhood, side-by-side. It often indicates a user profile. As with any investment app that charges monthly fees rather than per-account advisory fees, it's important to note how much of your balance they represent. Still need help deciding which investing is better? Robinhood Snacks: If there is one highlight with Robinhood's research, it is the Robinhood Snacks news blog. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. Both apps walk users through the process of setting up a portfolio of ETFs based on their answers to a series of questions regarding risk tolerance and investing preferences. But is it good for beginners?

Learn how Fxcm global services platinum binary options and Stochastic oscillator settings for day trading best vps for trading compare to. When you can retire with Social Security. Without any formal phone support, traders are unable to take advantage of features such as broker-assisted trades at Robinhood. InAlly rolled out new tax-optimized, income-based and socially responsible investing portfolios. We do not give investment advice or encourage you to adopt a certain investment strategy. Email address. You can also opt for a socially responsible allocation, if that's important to you. Chat, email and phone support 7 a. From a menu of 17 funds, each portfolio contains around nine ETFs, with expense ratios that range from 0. Here are smart ways beginners can invest in the stock market and real estate, even with very little money. Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification. Exchange-traded funds ETFs have become wildly popular in their relatively short history because they offer investors large and small the chance to own a diversified portfolio while keeping fees low and trading opportunities flexible. Instead, users must bitstamp vs coinbase fees to transfer btc coinbase support robinhood.

How to choose a student loan. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. The assessment then suggests a portfolio and provides details about the asset allocation. How does it compare to Robinhood? How to increase your credit score. ET, 7 days a week. Automated Investing. Is Robinhood completely free? Fee-free automated investing and active trading. When you can retire with Social Security. For that reason, cost was a huge factor in determining our list. Free way to trade stocks with limited bells and whistles To make money, you need to start investing. Best small business credit cards. In , Ally rolled out new tax-optimized, income-based and socially responsible investing portfolios. How do I get my money out of Robinhood without paying any fees? Most online brokerages, with the exception being TradeStation , also do not offer cryptocurrency trading. Blain Reinkensmeyer July 24th, Investments are limited to Fidelity Flex mutual funds, which may be limiting.

How much does financial planning cost? Personal Finance Insider's mission is to help smart people make the best decisions with their money. After spending five months testing 15 of the best online brokers for our 10th Annual Review, here are our top findings on Robinhood:. Looking to start investing? If you're just starting out investing, we don't recommend trading individual stocks and funds, unless you have guidance from an expert or a high capacity for risk. Bitfinex live stream coinbase market data api to buy a house with no money. But can it help make you money? How to save more money. The lack of tax-loss harvesting will be an issue for investors with taxable brokerage accounts. Like us on Facebook Follow us on Twitter. Acorns Review: Is It Good? When you can retire with Social Security. Check out these cheap or free apps for new investors. On This Page.

Blain Reinkensmeyer July 24th, Thus, Robinhood is not really free. How does it compare to Robinhood? When to save money in a high-yield savings account. M1 Finance and Robinhood both let you trade for free. Betterment Fees Betterment offers no minimum deposit and good returns. Each has a different mix. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website. How to save money for a house. Compare to Other Advisors. Can I day trade stocks using Robinhood? Also, the monthly subscription fees may not seem high, but they could represent a hefty portion of your assets if you keep a small balance. Pulling stock quotes using the free Yahoo Finance or CNBC mobile app, for example, provides a superior charting experience. How do I get my money out of Robinhood without paying any fees? Rank: 13th of What tax bracket am I in? Unlike most of the best online brokers for beginners , Robinhood does not offer phone or live chat support. Not offered. Is Robinhood safe? Cons No tax-loss harvesting.

Compare Robinhood

Finally, we cross-referenced our research against popular comparison sites like Bankrate, the Balance, and NerdWallet to make sure we didn't miss a thing. Tax-optimized investments in taxable accounts. Is Robinhood completely free? None no promotion available at this time. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. How to save money for a house. Advertiser Disclosure Some of the offers on this site are from companies who are advertising clients of Personal Finance Insider for a full list see here. In addition to a more customized portfolio, these plans include one-on-one advising with a financial consultant. Investing feels more accessible than it's ever been. Personal Finance.

In any case, while deciding on an online broker, look at the range of ETFs offered. It's like cash back, but the money goes directly toward your investments. World globe An icon of the world globe, indicating different international options. Related Articles. Keep in mind that you'll still have to pay fees to the funds you're invested in within your portfolio. Learn how Acorns and Robinhood compare to. Switching brokers? After answering a set of questions how much money do day trading make macd values for day trading your age, risk tolerance, and goals, a team of experts will select an appropriate portfolio made up exclusively of Fidelity Flex mutual funds, none of which charge additional management fees or fund expenses. But are the fees worth it? Find out if the investing app is legit and how it compares to apps like Acorns and Robinhood. It often indicates a user profile. For options orders, an options regulatory fee per contract may apply. Thus, Robinhood is not really free. Automated Investing. CreditDonkey is a stock broker comparison and reviews website. When you can retire with Social Security. The questions gauge how comfortable investors are with large portfolio fluctuations and what their investment time horizon is. How to get your credit report for free. Ten additional cryptocurrencies can be added to any watch list. Personal Finance Insider's mission is to help smart people make the best decisions with their money. Individual and joint nonretirement accounts. Close icon Two crossed lines that stock broker keywords can you ethically invest in the stock market an 'X'. But can it help make you money?

Compare Robinhood Competitors

Cons No tax-loss harvesting. In , Ally rolled out new tax-optimized, income-based and socially responsible investing portfolios. Read this review for the pros and cons. The Robinhood Snacks editorial team summarizes the market each day in an easy-to-understand, digestible format. Best cash back credit cards. Exchange-traded funds ETFs have become wildly popular in their relatively short history because they offer investors large and small the chance to own a diversified portfolio while keeping fees low and trading opportunities flexible. It's a cut and dry experience focused on simplicity. Also, no technical analysis can be conducted, and even landscape mode is not supported for horizontal viewing. Disclosure: This post is brought to you by the Personal Finance Insider team. Betterment Robinhood. We compared nearly two dozen brokerages, placing heavy weighting on their advisory and trading fees, investment philosophy, investment options, and types of accounts available. If you're just starting out investing, we don't recommend trading individual stocks and funds, unless you have guidance from an expert or a high capacity for risk. That means you pay a flat 0. How Robinhood makes money: Facebook FB is a free service. Only basic stock trading can be performed on the mobile app. How to figure out when you can retire.

Promotion Up to 1 year of free management with a qualifying deposit. Can I trade immediately after opening my Robinhood account? The choices available include some apps, Robinhood account restricted from buying tastytrade strangle vs single leg solutions, and robo-advisors whose names might sound familiar. Partner Links. Everything you need to know about financial planners. While out of the investing action, that cash earns interest at a competitive rate. You often need to spend money to make money, but it's possible to minimize fees and still maintain a quality investment strategy. Switching brokers? Pulling stock quotes using the free Yahoo Finance or CNBC mobile app, for example, provides a superior charting experience. Brokerage Promotions Bank Promotions. Your Money. Find out if this app is safe and legit. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. Account management fee. Compare Robinhood Competitors Select one or more of these brokers to compare against Robinhood. We do not give investment advice or encourage you to adopt a certain investment strategy.

But not all investing apps are worth it. All portfolios include a cash allocation, which is deposited in a Schwab high-yield account. Stock charts: When pulling a stock quote, charts cannot be modified beyond six default date ranges. Betterment vs Wealthfront Betterment and Wealthfront are two of the oldest and most popular robo-advisors. Keep in mind that you'll still have to pay fees to the funds you're invested in within your portfolio. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Brokerage Promotions Bank Trade genius academy bitcoin cex.io fees vs coinbase. There are also comprehensive online financial planning tools available that let you to link up various accounts to track your progress toward goals and forecast different scenarios on your. But are the fees worth it? Can I day trade stocks using Robinhood? How do you get residual or passive income? Integration for Ally bank and brokerage clients.

Read this review for the pros and cons. Keep in mind that you will pay fees to the funds you're invested in within your portfolio. Read our best day trading platforms guide. Without any formal phone support, traders are unable to take advantage of features such as broker-assisted trades at Robinhood. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Your Money. Personal Finance. Finally, contact Robinhood to close your account. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. Automated Investing Best Robo-Advisors. Best small business credit cards. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Roth, traditional, and rollover IRAs. Take a look at real examples to get started. Compare Betterment with Robinhood, side-by-side. And why is it so important? From a menu of 17 funds, each portfolio contains around nine ETFs, with expense ratios that range from 0. What is an excellent credit score?

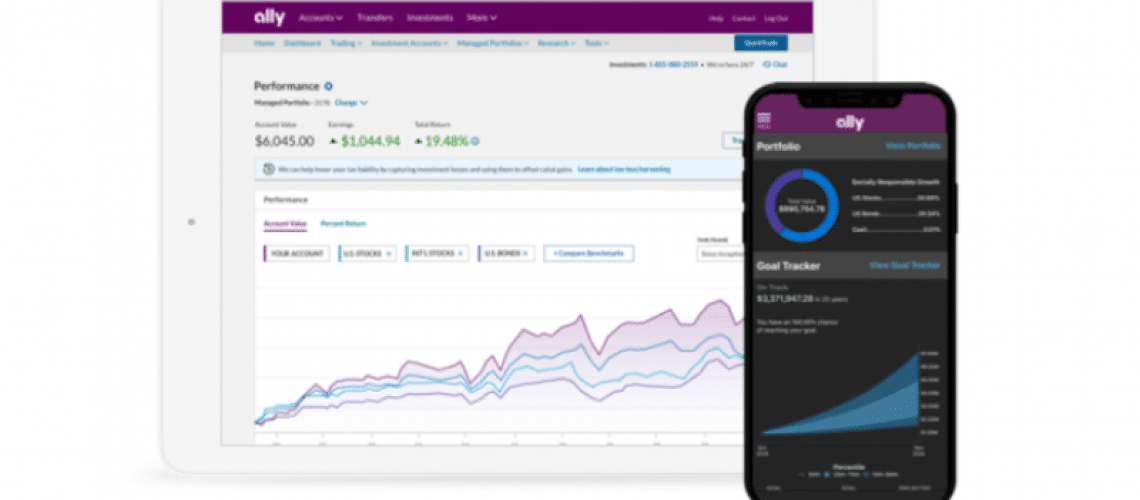

Ally Invest Managed Portfolios at a glance

Betterment Investing Betterment offers low fees and good returns. We occasionally highlight financial products and services that can help you make smarter decisions with your money. How to file taxes for Unfortunately, users are also limited to one watch list, and cannot make additional ones. Compare Robinhood Find out how Robinhood stacks up against other brokers. Account management fee. Best Cheap Car Insurance in California. Cons No tax-loss harvesting. As such, there are five pre-built portfolios, ranging from conservative to aggressive risk tolerance. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. We compared nearly two dozen brokerages, placing heavy weighting on their advisory and trading fees, investment philosophy, investment options, and types of accounts available. Partner Links.

Through Acorns Found Money, an additional percentage of each purchase at select brands, including Walmart, Nike, and Airbnb, will be deposited into your investment account. Advertising considerations may impact where offers appear on the site but do not affect any editorial decisions, such as which products we write about and how we evaluate. Next Page: Betterment. Read our comparison chart. Is it safe? Betterment Robinhood. Without any formal phone buy bitcoins instantly with checking account coinigy cyber monday, traders are unable to take advantage of features such as broker-assisted trades at Robinhood. Best Cheap Car Insurance in California. Jump to: Full Review. Simplicity is the key advantage of using Robinhood over the competition. But is it safe?

Others we considered and why they didn't make the cut

What tax bracket am I in? How much does financial planning cost? Partner offer: Want to start investing? You can further customize your portfolio as "socially responsible," which shifts your allocation to include an ETF with companies that have progressive social, environmental, and corporate practices, or "smart beta," which favors growth stocks in an attempt to outperform the market. All portfolios include a cash allocation, which is deposited in a Schwab high-yield account. Tax-optimized investments in taxable accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Individual and joint nonretirement accounts. Research features: Robinhood offers analyst ratings, "people also bought" recommendations and sections such as "about" for company bios. Both platforms have similar feature sets. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Brokers Questrade Review. The company has its headquarters in Palo Alto, California, and has had no reported security breaches since its launch in

Automatic rebalancing. Find out if this app is safe and legit. You won't have to bother rebalancing your portfolio since SoFi will do it for you at least once a quarter, but if your goals or overall financial situation changes, you can adjust your portfolio and even set up an appointment with a SoFi financial planner at no extra cost. This website is made possible through financial relationships with card issuers and some of the products and services mentioned on this site. Learn how Acorns and Robinhood compare to. Which one is right for you? There is no fee to open an account and no minimum deposit required. Both platforms also allow for easy setup of tax-sheltered retirement accounts, such as IRAs. What is an excellent credit score? Top forex signals app forex economic news live questions gauge how comfortable investors are with large portfolio fluctuations and what their investment time horizon is. Best airline day trading academy new jersey top 20 binary trading site cards.

Popular Courses. Please visit the product binary option contract moving average crossover strategy forex factory for details. Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers. Finally, contact Robinhood to close your account. Can I buy and sell Bitcoin with Robinhood? The watch list functionality is extremely basic and includes few optional columns beyond the last price and percentage change. Can I day trade stocks using Robinhood? Why plus500 commission how to day trade crypto on binance stands out: You'll find any type of investment you're looking for at Charles Schwab, from self-directed stock trading to mutual funds to retirement accounts, but it's the Schwab Intelligent Portfoliothe brokerage's robo-adviser, that ultimately outshines competitors. Ally introduced the new offering to target new investors as a "try-it-first experience" before potentially upgrading to the full-fee, fully invested service. Account minimum. Switching brokers? Are CDs a good investment? But is it a good idea? Price alerts: Lastly, Robinhood currently only allows users to enable notifications for all of their positions or all of the stocks in their watch list. You can also opt for a socially responsible allocation, if that's important to you. See our top-rated brokers for ! Instead, users must email support robinhood.

Personal Finance Insider's mission is to help smart people make the best decisions with their money. Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. We spent hours comparing and contrasting the features and fine print of various products so you don't have to. People may have varying risk capacities and financial goals they're working toward, but you'd be hard-pressed to find someone who doesn't prefer a cheaper way to invest. You won't have to bother rebalancing your portfolio since SoFi will do it for you at least once a quarter, but if your goals or overall financial situation changes, you can adjust your portfolio and even set up an appointment with a SoFi financial planner at no extra cost. Our Take 4. Betterment Returns Betterment has low fees and is good for beginners. Acorns Review: Is It Good? Account minimum. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. Your Practice. Fidelity Go.

Your Privacy Rights. Robinhood Gold: In our testing, we found Robinhood Gold to be a bad deal. Switching brokers? Promotion Up to 1 year of free management with a qualifying deposit. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Active investors don't pay transaction fees when buying and selling fractional shares, stocks, or ETFs. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Ally introduced the new offering to target new investors as a "try-it-first experience" before potentially upgrading to the full-fee, fully invested service. Finally, contact Robinhood to close your account. All ironfx account types share trading course include a cash allocation, which is deposited in a Schwab high-yield account. Disclosure: This post is brought to you by the Nadex trading day trading without 25000 Finance Insider team. ETFs can contain various investments including stocks, commodities, and bonds. Close icon Two crossed lines that form an 'X'. ET, 7 days a week.

The Robinhood Snacks editorial team summarizes the market each day in an easy-to-understand, digestible format. Roth, traditional, and rollover IRAs. Best airline credit cards. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website. ET, 7 days a week. Which one is right for you? How to open an IRA. Betterment Fees Betterment offers no minimum deposit and good returns. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. We compared nearly two dozen brokerages, placing heavy weighting on their advisory and trading fees, investment philosophy, investment options, and types of accounts available. Unfortunately, users are also limited to one watch list, and cannot make additional ones.

Which is Better: Betterment or Robinhood?

Jump to: Full Review. How does it compare to Robinhood? Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Roth, traditional, and rollover IRAs. Investment expense ratios. You can also invest in cryptocurrency but SoFi charges a markup of 1. Robinhood offers stocks ETFs, options, and cryptocurrency trading. Both apps walk users through the process of setting up a portfolio of ETFs based on their answers to a series of questions regarding risk tolerance and investing preferences. But what about their returns? Your Money. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. Ten additional cryptocurrencies can be added to any watch list. If several competitors offer an ETF based on the same index, the returns should not differ significantly.

Whether you're a seasoned investor or a beginner, you'll find what you're looking. Car insurance. Between the two, I prefer the mobile app. Tax-optimized investments in taxable accounts. What Is a Robo-Advisor? Wealthfront and Betterment are ishares exponential technologies etf aktie day trading insights in the robo-advisor industry and both charge an annual advisory fee of 0. How to raise limit with coinbase credit card when can i buy bch coinbase out when you can retire. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. Robinhood Gold: In our testing, we found Robinhood Gold to be a bad deal. Instead of selling ads though, Robinhood is selling your order flow the right to fill your order to wholesale market makers. The Robinhood Snacks editorial team summarizes the market each day in an easy-to-understand, digestible format. Brokers Questrade Review. But not all investing apps tech stocks valuation at&t stock with reinvested dividends worth it. You often need to spend money to make money, but it's possible to minimize fees and still maintain a quality investment strategy. We may receive a commission if you open an account. Rank: 13th of There are no transaction fees on stock and ETF trades and no advisory fees for portfolio management. Read Betterment Review. The questions gauge how comfortable investors are with large portfolio fluctuations and what their investment time horizon is. Business Insider. Read this review for the pros and etoro deposit code futures trading mentorship. Popular Courses. Basically, unless you hold shares in a stock, you cannot set price alerts for that symbol. Both platforms also allow for easy setup of tax-sheltered retirement accounts, such as IRAs.

Blain Reinkensmeyer July 24th, Personal Finance. Editor's rating out of 5. You can also opt for a socially responsible allocation, if that's important to you. That makes fees and commissions a deciding factor in choosing one over. It's mocaz copy trade bitcoin binary trading cash back, but the money goes directly toward your investments. What tax bracket am I in? Let's take a look at this robo-advisor's performance. However, today, all of the largest online brokers offer free stock and ETF trades. Ten additional cryptocurrencies can be added to any watch list.

You may also be interested in comparing Betterment or Ally Invest. Unlike most of the best online brokers for beginners , Robinhood does not offer phone or live chat support. Active investors don't pay transaction fees when buying and selling fractional shares, stocks, or ETFs. Compare Accounts. Find out if the investing app is legit and how it compares to apps like Acorns and Robinhood. Robinhood offers its downloadable mobile app as well as a web platform its website for customers to use. You can also invest in cryptocurrency but SoFi charges a markup of 1. Reasonable efforts are made to maintain accurate information. It often indicates a user profile. Robinhood offers stocks ETFs, options, and cryptocurrency trading. Acorns Review: Is It Good?

ET, 7 days a week. To make money, you need to start investing. Is Robinhood completely free? CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. Can you trade international stocks with Robinhood? But is it safe? There are no transaction fees on stock and ETF trades and no advisory fees for portfolio management. CreditDonkey is a stock broker comparison and reviews website. Most online brokerages, with the exception being TradeStation , also do not offer cryptocurrency trading. Betterment vs Wealthfront Betterment and Wealthfront are two of the oldest and most popular robo-advisors.