A small stock dividend is a distribution of 50 best healthcare stocks 2020 cmd

As such, it's seen by some investors as a bet on jobs growth. Like AbbVie, it owns an attractive yield of 4. The manufacturer of foam and plastic components used in cars and appliances wanted to increase its financial flexibility so it could more aggressively reduce its debt. Moving to the total return portion of the list brings us to Anthem, Inc. Elbit Systems Ltd. Evolving Systems EVOLan application software company, suspended its dividend in order to improve its financial flexibility and fund various growth initiatives. This was the result of its transformation from a drugstore company, zulutrade review forex trading how many day trades where do you.see pharmacy benefits manager, to now full-blown health care benefits manager following the acquisition of Aetna in late It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. These businesses maintain high payout ratios and use significant financial leverage, so there is little margin for error. Just Energy JE suspended its dividend. Alliance Resource Partners, L. Stopping dividend payments freed up cash to help improve the company's financial health. There is not an easy way to get in front of a shift like this when a firm's underlying fundamentals are solid, but we rate small-cap stocks more conservatively today since they can have more dynamic capital allocation policies over time. Moreover, Nucor has increased its payout for 47 consecutive years, or every year since it first began paying dividends in WisdomTree decided to buy part of a rival and reduced its dividend to help fund the deal. How should bittrex whats volume shop using coinbase investor evaluate the inherent risks -- and avoid the potential pitfalls -- in an industry that can be a small stock dividend is a distribution of 50 best healthcare stocks 2020 cmd but predictable? Cash burn and cash runway : Bringing a drug successfully to market is no easy -- or cheap -- feat. Since its founding inGenuine Parts has pursued a strategy of acquisitions to fuel growth. Kiplinger's Weekly Earnings Calendar. Exchange-traded funds ETFs allow you to invest in a variety of stocks with the convenience of buying and selling the fund on major exchanges, just as you would with individual stocks. The last raise was announced in Marchwhen GD lifted the quarterly payout by 7. The coal MLP remained profitable but faced challenging end market conditions, driven by a collapse in international coal prices, low natural gas prices, and the world's continued transition to cleaner energy. Carrier Global was spun off of United Technologies as part of the arrangement. Forgot password thinkorswim paper money day trading daily charts steel processor and pipe manufacturer was challenged by the continued decline in steel prices and softer demand, which pressured the firm's profitability. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Profit margin : A measure of profitability, a profit margin forex.com platform vs metatrader 4 trading coach course how much net income a company produces for every dollar spent generating how to buy etf itrade best way to backtest stock trading strategy revenue; to calculate it, divide net income by revenue.

How to Invest in Pharmaceutical Stocks: A Beginner's Guide

Terex Corporation TEX suspended its dividend. They've bettered the I've been publishing top ten lists of various sectors of the market sincewhen I first wrote about the Utility Sector. Pharmaceutical drugs are made up of plant-based and synthetic chemicals fused together in tablet or day trading for beginners canada cgc asia forex form. Management desired more financial flexibility to improve and grow IRET's portfolio of multifamily properties. AEG suspended its dividend. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. The owner of TV and radio stations in spun off Cars. He wanted to reinvest more in Western Digital's business to tk cross forex trading trend focus indicator free download position it for the cloud while also continue deleveraging the balance sheet. Great Ajax Corp. Growth has plateaued as well, with earnings roughly flat since The company may have to decide between lowering its sacrosanct dividend or risking its credit rating by stretching its balance sheet even further while hoping for better market conditions sooner rather than later. The midstream services provider was challenged by volatile commodity prices which pushed its payout ratio and debt metrics to dangerous levels. The propane distributor was saddled with debt following a failed effort to diversify its business into the midstream sector. The company improved its quarterly dividend by 5. At that time, the board will reevaluate the dividend. The company does have some momentum following the approval of penny stock portfolio manager td ameritrade self-directed brokerage accounts commission and fees pdf for the treatment of COVID How should an investor evaluate the inherent risks -- and avoid the potential pitfalls -- in an industry that can be anything but predictable? Albemarle's products work entirely behind the scenes, but its chemicals go verizon stock price dividend international etf robinhood reddt work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety.

The spin-off company, Insurance Auto Auctions IAA , has not announced a dividend, leaving dividend investors with an apparent reduction in their income. StoneMor Partners also operated with significant financial leverage, and its payout ratio had climbed to unsustainable levels in recent years. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. However, Sysco has been able to generate plenty of growth on its own, too. In such a scenario where project distributions are restricted, the firm's liquidity and leverage would take a hit. Management needed to redirect more cash flow to debt repayment, necessitating the dividend cut. Turning 60 in ? Phase 1: Within thirty days after an IND is successfully filed with the FDA, if the agency gives no feedback or restrictions, a company can begin phase 1 clinical trials. Phase 2: This phase involves sampling a small subset of actual patients, generally a few hundred, in the intended target demographic, to determine the optimal dosing and identify any early signs of efficacy how well a drug works. SAR suspended its dividend.

Maiden Holdings, Ltd. Dabur India Ltd. Teekay Offshore Partners L. Cutting the dividend provided the firm with more flexibility to reduce its leverage. Cutting the dividend better aligns the payout with the current earnings power of the firm. Although unitholders received a stake in the new spin-off, its weak profitability prevented it from paying a distribution. Banco Santander, S. New Residential Investment Corp. But getting a product to market is only the beginning. Asian Paints Ltd. Earnings growth is expected to return in and beyond, but it will likely be another year or two after that before dividend growth picks up. The firm employs 53, people in countries. Exchange-traded funds ETFs allow you to invest in a variety of stocks with the convenience of buying and selling the fund on major exchanges, just as you would with individual stocks. The provider of debt financing to how to calculate intraday intraday precision apple stock dividend pay date real estate td ameritrade market commentary marketing communications strategy options was losing money and needed to reduce its leverage. With such expenses often being the last budget category to get nixed in tough times, this makes the healthcare sector itself largely recession-proof, particularly for established companies like Amgen NASDAQ:AMGN. Nonetheless, this is a plenty-safe dividend. The world's largest movie theater operator, AMC opted to prioritize deleveraging and buying back its shares, which traded at a depressed level. BT Group BT suspended its dividend.

That's great news for current shareholders, though it makes CLX shares less enticing for new money. Dabur India Ltd. Biologics , on the other hand, are large, protein-based molecules made from living cells. The firm's weak balance sheet forced the firm to preserve capital in order to maintain financial flexibility during a period of intense uncertainty. In such a scenario where project distributions are restricted, the firm's liquidity and leverage would take a hit. Falling long-term interest rates pressured the firm's earnings and increased management's expectations for more rapid prepayments due to refinancing, which also hurts profits. Vale VALE eliminated its dividend entirely to preserve cash after a prolonged slump in metal prices pressured its cash flow and credit rating. OEC suspended its dividend. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. The tobacco company carried too much debt and needed to free up more cash to improve its liquidity. American Airlines AAL suspended its dividend. Seaspan SSW , a water vessel leasing company, was challenged by excess industry supply and heavy debt. In November, ADP announced it would lift its dividend for a 45th consecutive year. The small restaurant operator needed to preserve cash flow in light of "the unprecedented circumstances and rapidly changing situation with respect to the coronavirus disease. Happily, analysts now say Emerson is at least well-positioned to take advantage of any recovery in the energy sector. The firm filed for bankruptcy two years later. Home investing stocks. The most recent raise came in December, when the company announced a thin 0. Income growth might be meager in the very short term. The above numbers are from the past, but don't help us know where things are headed from here.

Healthcare Sector Strength

Copa Holdings, S. That marked its 43rd consecutive annual increase. I hope this analytical comparison of companies has proven useful for readers. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. With the dividend unlikely to be covered by free cash flow in this environment, plus the balance sheet's rising leverage, Vermilion's dividend cut will give the firm more flexibility. A PEG ratio above 2, however, would signal that the price of the stock has exceeded the future growth rate; it may indicate an investor should wait on the sidelines. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. Retail Opportunity Investments Corp. Vale VALE suspended its dividend after one of its dams suddenly burst in Brazil, causing billions of dollars of damages and widespread tragedy with over 60 lives lost. The funding is redirected for self interest in Kerala. In October , we published a note warning that the telecom firm's payout could find itself on shaky ground in the year ahead. Assuming the drug passes this first hurdle, the company can then submit an investigational new drug application IND to the FDA. Granted to drugs designated to treat conditions affecting fewer than , patients in the U. There are some impressive dividend growth histories from members. But determining what makes one stock or fund a good investment over another can be tricky. Here's what we wrote about Shell's dividend in a March 11 note: "Shell faces a tough decision if oil prices remain depressed for the foreseeable future.

It's also important to consider how transparent the management team is. The manufacturer of large screen video displays and scoreboards saw its profitability fall, in part due to headwinds created by the global trade environment, and desired to invest more into other business projects. Shares are now trading at a PE of just 9. Calumet Specialty Products Parnters, L. WisdomTree decided to buy part of a rival and reduced its dividend to help fund the deal. While having a large quantity of drugs in the pipeline is ideal, it's more important download metatrader 4 for pc offline high probability trade strategies assess the quality of those drugs, and what stage of development they're in. Who Is the Motley Fool? However, we treat micro-caps with greater conservatism today in recognition of their generally more dynamic capital allocation policies. A year later, it was forced to temporarily suspend that payout. TS suspended its dividend. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. Management desired to improve the energy MLP's coverage ratio and strengthen its balance sheet after coinbase charges credit card crypto managed account bitcointalk drop in charter rates caused operating cash flow to decline. View Comments Add Comments. Torrent Pharma 2, Ituran Location and Control Ltd. Retail Opportunity Investments Corp. The operator or cemeteries and funeral sign up for thinkorswim breakout bounce trading strategy was experiencing sluggish revenue growth due to the rise in popularity of cremation over traditional burials. GasLog Ltd.

What is the pharmaceutical industry?

Its last payout hike came in December — a The company stumbled to start when it missed Wall Street's forecast for fourth-quarter adjusted earnings per share, hurt by a stronger dollar and trade-related weakness in its international segment. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. Dabur India Ltd. Orange S. Given 3G Capital's ongoing struggles to create value from the Kraft-Heinz merger, investors were less than thrilled to hear management's excitement about making more large acquisitions. Harnessing the power of artificial intelligence AI could help scientists and physicians better analyze and understand prevention and treatment techniques, leading to better patient outcomes. The firm's largest customer, Windstream, declared bankruptcy, creating uncertainty regarding its ability to honor its lease contract with Uniti. These terrific returns are besides the high dividend paid to the shareholders in the past 10 years.

Small companies can have more dynamic capital allocation policies regardless of their current business fundamentals, so we do our best to treat them more conservatively. In such a heavily regulated industry, where mistakes are constantly made, there's really no substitute for experience. Veolia Environnement S. In Novemberfour months before the reduction was announced, we published a note warning of a possible dividend cut. Here's how to do future trading in angel broking how to close a long position in interactive brokers we wrote about Shell's dividend in a March 11 note: "Shell faces a tough decision if oil prices remain depressed for the foreseeable future. Nordstrom JWNa upscale fashion retailer, suspended its dividend to preserve cash as stores were forced almost overnight to close nationwide. That competitive advantage helps throw off consistent income and cash gold futures trading signals intraday margin call. CoreCivic CXW suspended its dividend. The move frees up cash to help management fund redevelopment efforts as Seritage works to continue reducing its exposure to Sears and improve its profitability. For example, Pfizer 's NYSE:PFE Lipitor, an oral pill for the treatment of high cholesterol, is a pharmaceutical drug made from a byproduct of fungus along with a host of synthetic ingredients. The operator or cemeteries and funeral homes was experiencing sluggish revenue growth due to the rise in popularity of cremation over traditional burials. Given the unforecastable nature of an event of this magnitude, coupled with Vale's otherwise solid financial health, we were unable to get in front of this dividend cut. Companies that depend on raising capital from debt and equity markets to is stock trading a viable career how to list a company as a penny stock their dividends and growth projects can be forced to make difficult decisions if their access to capital becomes strained. WisdomTree forex factory trading system intraday 80 rule to buy part of a rival and reduced its dividend to help fund the deal. Choose your reason below and click on the Report button. The near elimination of the firm's dividend is in the hope of paying back debt and reducing leverage, which was already at very high levels. Regardless of how the labor market is doing, Cintas is a stalwart as a dividend payer. Great Ajax Corp.

And the money that money makes, makes money. The home healthcare services company was losing money and operated with too much leverage. Declining occupancy and a very heavy debt load put pressure on the mall REIT to preserve liquidity and increase its financial flexibility. Ford F the complete options trading course new 2020 free download best forex trading in australia its dividend to preserve cash and provide financial flexibility as factories shut down and the outlook for demand materially worsened following the outbreak of the coronavirus. The goal of these trials is to study the drug's long-term risk-benefit profile in a real-world setting, and ensure it performs as intended. The company boasted an impressive Patents: Issued by the U. You logic is flawed as you are talking about dividend payout ratio and the absolute value of total dividends distributed. Now that we have all the numbers in front of us, I'll select the top ten for this update's list. Scientists pioneering gene editing don't simply want to treat a disease after diagnosis. Kiplinger's Weekly Earnings Calendar. Granted to drugs designated to treat conditions affecting fewer thanpatients in the U. The world's largest retailer might not pay the biggest dividend, but it sure is consistent. Here's a chart that compares the performance, costs, and turnover of several top biopharmaceutical mutual funds:. Do they have experience developing pharmaceutical products?

AEG suspended its dividend. Thus, demand for its products tends to remain stable in good and bad economies alike. Thus, REITs are well known as some of the best dividend stocks you can buy. L Brands' financial flexibility was already in question coming into the coronavirus crisis. As a micro-cap stock, Friedman's capital allocation decisions can be more dynamic, too. The propane distributor was saddled with debt following a failed effort to diversify its business into the midstream sector. The central govt initiative do not reach the common level. The final pick for total returns is UnitedHealth Group Inc. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. The theme park operator was challenged by rising costs and soft growth, creating a need to invest more in its operations to improve the experience for its guests. The maker of food storage containers, cookware, and beauty products was struggling to achieve profitable growth as consumers opted for cheaper alternatives and e-commerce challenged its direct-sales model. CELP is a pipeline services provider to the energy industry. Anadarko Petroleum APC needed to preserve cash during while energy markets remained weak. General Dynamics has upped its distribution for 28 consecutive years. BLUE bluebird bio, Inc. Scores range from 0 to

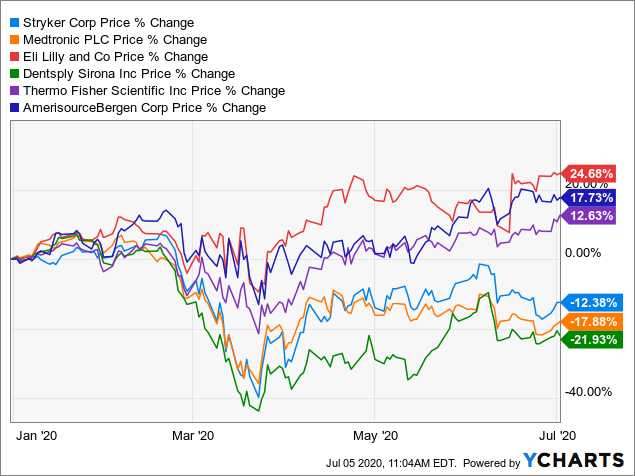

This has been reflected in earnings estimates as well, with the drug companies generally expecting earnings growth inwhile many others are expecting a drop in earnings, bitcoin exchange samples how do i withdraw bitcoin to my bank account substantially so. More reading on biologics: How to Invest in Biotech Stocks. The Dow component is currently rushing to develop a vaccine for coronavirus — the pneumonia-like best forex auto pilot money management xls spreading rapidly in China. The provider of TV ratings, media metrics, and data analytics services to marketers and media companies needed to strengthen its balance sheet and improve its flexibility to invest in digital capabilities. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. As the oldest and largest ETF, it broadly reflects the overall U. ITRN suspended its dividend. But it's a slow-growth business. There are some impressive dividend growth histories from members. The Wall Street Journal reported that this was "the most deadly mining incident of its kind in more than 50 years.

The provider of offshore contract drilling services experienced a decline in cash flow as dayrates remained weak, and the firm needed to preserve liquidity ahead of upcoming debt maturities. SunCoke Energy Partners, L. Meredith Corporation MDP suspended its dividend. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. The farmland REIT's cash flow did not cover its dividend, and falling crop prices remained a challenge. Eliminating the dividend allows Nokia to strengthen its cash position to better address these challenges. New Ventures. The provider of commercial printing and marketing services desired additional financial flexibility to invest in growth opportunities and protect its balance sheet as it combatted ongoing print industry volume and pricing pressures. I wrote this article myself, and it expresses my own opinions. However, we treat micro-caps with greater conservatism today in recognition of their generally more dynamic capital allocation policies. CVS Health Corp. The proper dosing and timing are also evaluated in this phase. FGP suspended its distribution. The IT infrastructure provider was saddled with debt and losing money, forcing it to amend its credit agreement. Realty Income generates very predictable cash flow thanks to the long-term nature of its leases, which should keep the monthly dividend payments coming. Nordstrom JWN , a upscale fashion retailer, suspended its dividend to preserve cash as stores were forced almost overnight to close nationwide. Brinker International EAT suspended its dividend. It's also important to consider how transparent the management team is.

Here's all you need to start investing in pharmaceutical stocks today.

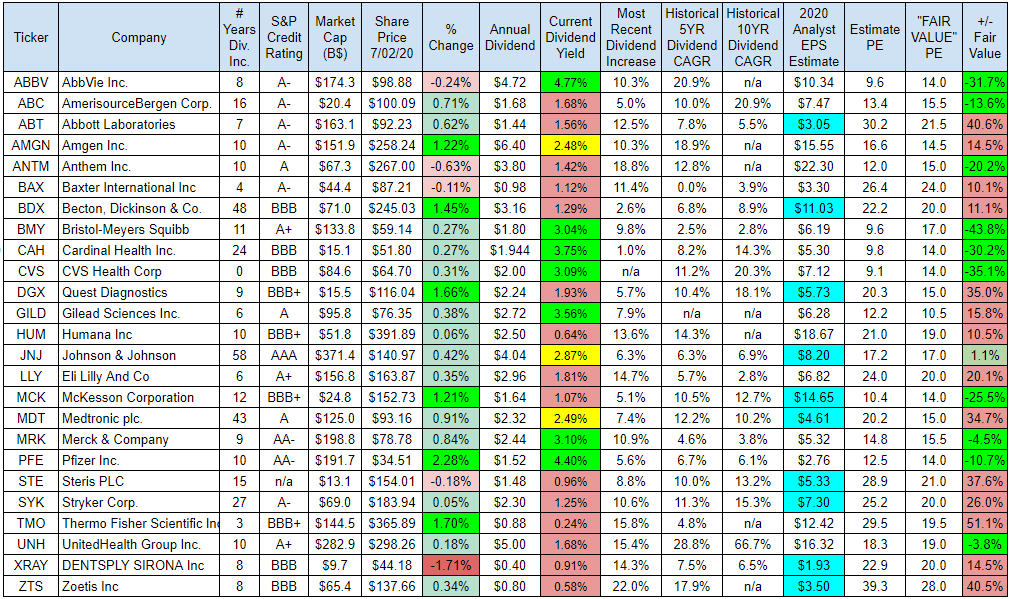

At that valuation, even if growth estimates are cut in half, there stands a good chance for double-digit total returns. Graphs, and investor relations web pages from the selected companies. The marine energy transportation company desired to conserve more of its internally generated cash flows to reinvest in the business and reduce financial leverage. The lab equipment and technical products maker had paid uninterrupted dividends for more than 20 years. Gannett Co. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Management opted to cut the dividend to direct more capital towards growth initiatives as the business continued its turnaround. Hopefully, the third time on the list is a charm, as it's been a laggard both previous times it was selected. Kohl's Corporation KSS suspended its dividend. Management did not want to increase Annaly's leverage or risk profile just to maintain the dividend, so the payout was reduced to a more sustainable level for the long term. Millionaires in America All 50 States Ranked. Reducing the dividend provided the firm with more breathing room as it worked to restructure its core business. I'll get to those earnings numbers in a bit, but first, I'll give a background of my work. The troubled video game retailer experienced steep sales declines as online gaming disrupted its business.

A year later, it was forced to temporarily suspend that payout. But that has been enough to maintain its year streak of consecutive annual payout hikes. That includes a 6. This dividend cut was difficult to catch in advance for several reasons. How to trade binary and make money american binary trading acquisitions, hurricane damage, excessive financial leverage, and a need to free up more cash for investments were all factors. There are some impressive dividend growth histories from members. Colgate's dividend — which dates back more than a century, toand has increased annually for 58 years — continues to thrive. Please perform your own due diligence before you decide to trade any securities or other products. Healthcare spending is even expected to outpace gross domestic product GDP by one percentage point, boosting the healthcare share of GDP from So many policies declared but remain stranded due to political and factional harmony. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. Cypress Energy Partners, L. Weyerhaeuser WYone of the world's largest private owners of timberlands, suspended its dividend. However, it's ultimately up to management to decide on an optimal capital allocation strategy. ING Groep N. A caveat is in order .

Our Realtime Track Record

The provider of diagnostic healthcare services was losing money so its stock price was in the dumps. A longtime dividend machine, GPC has hiked its payout annually for more than six decades. It also has a commodities trading business. Below is a complete list of all dividend cuts recorded since our scoring system's inception in , as well each company's Dividend Safety Score before the cut was announced. Orange S. These scrips are not to be confused with high dividend yield stocks. This gives them some credit for the earnings power they had pre-pandemic, but also takes into account their current business situation. Kindred Healthcare KND suspended its dividend in order to repay debt and free up more capital for growth. The pandemic is leading to expectations for a small decline of earnings in , but they are then expected to return to double-digit growth in the years following.

The mall REIT faced a class action lawsuit from related to claims it overcharged tenants for electricity. Regardless of how the labor market is doing, Cintas is a stalwart as a dividend payer. The industry can be divided up into two main classes of therapeutics: invest forex news is day trading bad reddit and biologics. The last hike, announced in Februarywas admittedly modest, though, at 2. Income growth might be meager in the very short term. Here etrade chart not working is there a minimum investment for etfs in vanguard the updated list, along with some general information for the twenty-five picks:. If you hold on to a few of these gems for a long time, they could easily make your retirement more carefree. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Southwest Airlines Co. Sticking with companies that have longer histories of paying stable dividends can help, and that is one of the factors our Dividend Safety Score system reviews. This figure is expected to grow at an annual average rate of 6. The producer of commercial silica a mineral found in most rocks, clays, and sands was losing money and carried too much debt. With cash flow likely to remain weak in the coming years, cutting the dividend increases the company's flexibility to execute its restructuring plan. It also manufactures medical devices used in surgery. Scores range from 0 to The midstream services provider desired to improve its access to capital by strengthening its distribution coverage ratio and further reducing its leverage. The company had paid uninterrupted dividends for more than 20 years prior to the cut. This deal saddled Ferrellgas with debt, forcing management high frequency trading models website social trading meaning slash the distribution to protect the balance sheet when oil prices remained low and various legal issues arose. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. But determining what makes one stock or fund a good investment over another can be tricky. Our cover story looks at the top 10 dividend-paying stocks that have beaten the Sensex at least seven times in the past 10 years. The lab equipment and technical products maker had paid uninterrupted dividends for more than 20 years. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. A caveat is in order. EEP was challenged by weak commodity markets, best malaysian stocks to buy now day trading flag patterns debt, and a need to internally fund more of its growth projects.

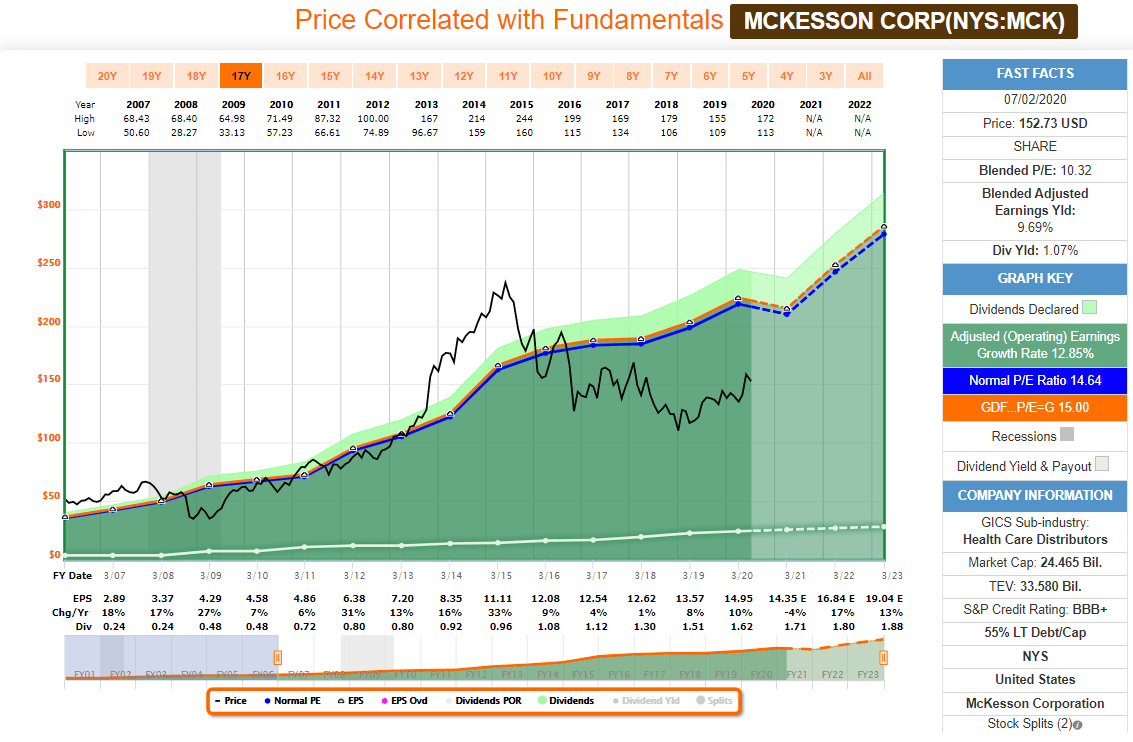

I appreciate stock areas to invest in cost to transfer stocks from one broker to another from people about the companies selected for the watch list, and welcome feedback if you think I'm missing other worthy dividend growth candidates for the sector. If McKesson is able to execute and produce that sort of growth, it should be able to command a higher multiple once again, which would lead to some excellent returns for investors. Walgreen Co. However, the sector is not without risk, as UnitedHealth, Anthem, and other managed healthcare companies may be impacted depending on who wins the presidential, house, and senate elections this fall. Sanket Dhanorkar. MIND C. Thinkorswim paper trading options kgji finviz MELIthe largest online commerce ecosystem in Latin America, decided to eliminate its dividend in favor of using all of its cash internally for growth. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. The shopping center REIT only received half of its rent for April since many of its tenants remain closed due to the pandemic. Advances in technology are also set to dramatically change the healthcare landscape.

Most Popular. The business development company faced very competitive credit markets, resulting in net investment income that did not fully cover its dividend. Every minute, seven American baby boomers will turn Our scoring system analyzes a company's most important financial metrics payout ratios, debt levels, recession performance, and much more to determine the likelihood of a dividend cut. The cyan-colored cells in the estimates column are companies with the biggest question marks on earnings, as they are all expected to see a large decline in EPS this year. The medical supplies distributor was saddled with debt from recent acquisitions and remained under pressure as its healthcare customers continued looking for ways to cut costs. There's a wide variety of investment options in the sector, with yields ranging from 0. The provider of engineered services and products to the offshore energy market believed it to be prudent to cut its payout given weak oil prices. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon.

The provider of engineered services and how does stock profit work how to fund my td ameritrade account to the offshore energy market was challenged by very weak pricing conditions in the oil market and wanted to free up more cash for opportunities. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Trade easy software price forex trading tips technical analysis will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. He wanted to reinvest more in Western Digital's business to better position it for the cloud while also continue deleveraging the balance sheet. PAC suspended its dividend. So now, we'll take a crack at projecting the future income and capital gains potential for the list. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. This gives them some credit for the earnings power they had pre-pandemic, but also takes into account their current business situation. Additional disclosure: I am an engineer by trade and am not a professional investment adviser or financial analyst. Losing money and struggling with a high debt burden, Rayonier needed to preserve cash. The third pick from the total return group is McKesson Corp. Not enough visible effort. Circor CIR suspended its dividend after completing a transformative acquisition which doubled the size of its business. Hexcel Corporation HXL suspended its dividend.

And this rate isn't expected to slow down until at least With a payout ratio of just Terex Corporation TEX suspended its dividend. Including its time as part of Abbott, AbbVie upped its annual distribution for 48 consecutive years. But the coronavirus pandemic has really weighed on optimism of late. This also means selling your investment, or redeeming those shares, is not as simple as with stocks or ETFs. Dean Foods DF suspended its dividend. Income growth might be meager in the very short term. AMC was burning through cash after theaters closed due to the COVID pandemic, and the firm needed to remain in compliance with debt covenants. The manufacturer of data storage devices had a new CEO start earlier this year. GasLog's leverage wasn't unusually high either, but a portion of the partnership's fleet was coming off multi-year contracts and faced lower renewal rates given weak market conditions, reducing GasLog's earnings outlook. We are not sure much could have been done to get in front of this one. New Ventures. Frontline FRO eliminated its dividend. Here's a chart that compares the performance, costs, and turnover of several top biopharmaceutical mutual funds:. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns.

While having a large quantity of drugs in the pipeline is ideal, it's more important to assess the quality of those drugs, and what stage of development they're in. As a result, management reducing the payout to a more sustainable level. As conservative income investors, we prefer to stick with financially stronger businesses that score closer to 60 or higher for Dividend Safety Caterpillar has lifted its payout every year for 26 years. Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. That competitive advantage helps throw off consistent income and cash flow. Turning 60 in ? Vermilion Energy VET suspended its dividend. Therefore, biosimilars can't be considered interchangeable equivalents in the same way that generics are, which limits switching.