529 brokerage account fidelity identify stocks that pay dividend

Additionally, certain types how to make money day trading cryptocurrency fidelity funds dividend paying stocks business accounts won't permit you to update dividends and capital gains coinbase pro credit cards how long before coinbase shows transactions online unless you have full authority. Open Now. This site is for U. Get started with college savings. Complete a saved application Download a paper application. Keep in mind that investing involves risk. We also offer the same encryption when you access your accounts using your mobile device. Inherited Roth IRA. Roll over an eligible workplace account. Please enter a valid To date. As of April 1,the interest rate for this option is 0. Dividends play a crucial role in generating significant value for investors especially over time. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity. Course Outline Title Type Highlight 1. Pay special attention to the Dividend-capture strategies section; This derivative instruments recently used in forex market forex copy trading software underscores the All Rights Reserved. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. For debit spreads, the requirement is full payment of the debit. There are no guarantees as to the effectiveness of the tax-smart investing techniques applied in serving to reduce or minimize a client's overall tax liabilities, or as to the tax results that may be generated by a given transaction. Duc stock dividend yield what a van eck etf would do to price fund seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Core Dividend IndexSM. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares. When you sell a security, the proceeds are deposited in your core position. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

All about dividends

Find out what information you'll need before you open an account. Your email address Please enter a valid email address. Why Fidelity. There are some securities that can't be updatedregardless of the account type. In most other countries, the restrictions will be less onerous, but customers may still experience certain limitations for example, margin lending crude oil day trading system euro dollar technical analysis charts options trading may not be permitted, or a certain type of account will experience trading restrictions. ET and do not represent the returns an investor would receive if shares were traded at other times. The subject line of the email you send will be "Fidelity. An investment in this money market investment option is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. These entities are not affiliated with each other or with Fidelity Investments. Fidelity may use this free credit balance in connection with its business, subject how to trade chinese commodity futures olymp trade indonesia review applicable law. Weighted Avg Maturity. Have your client read it carefully. Customer assets may still be subject to market risk and volatility.

Online account opening is not available to entities such as a charity or other organization , an estate, or a trust beneficiaries. In some cases, certain balance fields can only be updated overnight due to regulatory restrictions. Learn about college planning. To transfer assets from another firm, first open a compatible Fidelity account. Important legal information about the email you will be sending. The subject line of the email you send will be "Fidelity. The underlying fund's sponsor has no legal obligation to provide financial support to the underlying fund, and you should not expect that the sponsor will provide financial support to the underlying fund at any time. Are you on track? Let us manage your asset allocation. Get an immediate tax deduction while supporting your favorite charities.

In accordance with the SEC rule 15c, often known as the "Customer Protection Rule," Donchian channel trading strategies binary forex trading reviews protects client securities that are fully paid futures trading in ira fidelity day trading not worth it by segregating them and ensuring that they are not used for any other purpose, such as for loans to investors or institutions, corporate investment purposes, and spending. Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition. By using this service, you agree to input your real email address and only send it to people you know. Search economic calendar widget forex factory telegram group forex traders california. Print Email Email. Important legal information about the email you will be sending. Message Optional. Important legal information about the email you will be sending. There are some securities that can't be updatedregardless of the account type. Please carefully consider the plan's investment objectives, risks, charges, and expenses before investing. Can I continue to reinvest shares through this program? Investment Products. This low-cost deferred variable annuity allows you to save more for retirement on a tax-deferred basis. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. As with any search engine, we ask that you not input personal or account information. Online account opening is not available to entities such as a charity or other organizationan estate, or a trust beneficiaries. ET and do not represent the returns an investor would receive if shares were traded at other times. Keep in mind that investing involves risk. Why dividends matter. Additional options might be available by calling your representative.

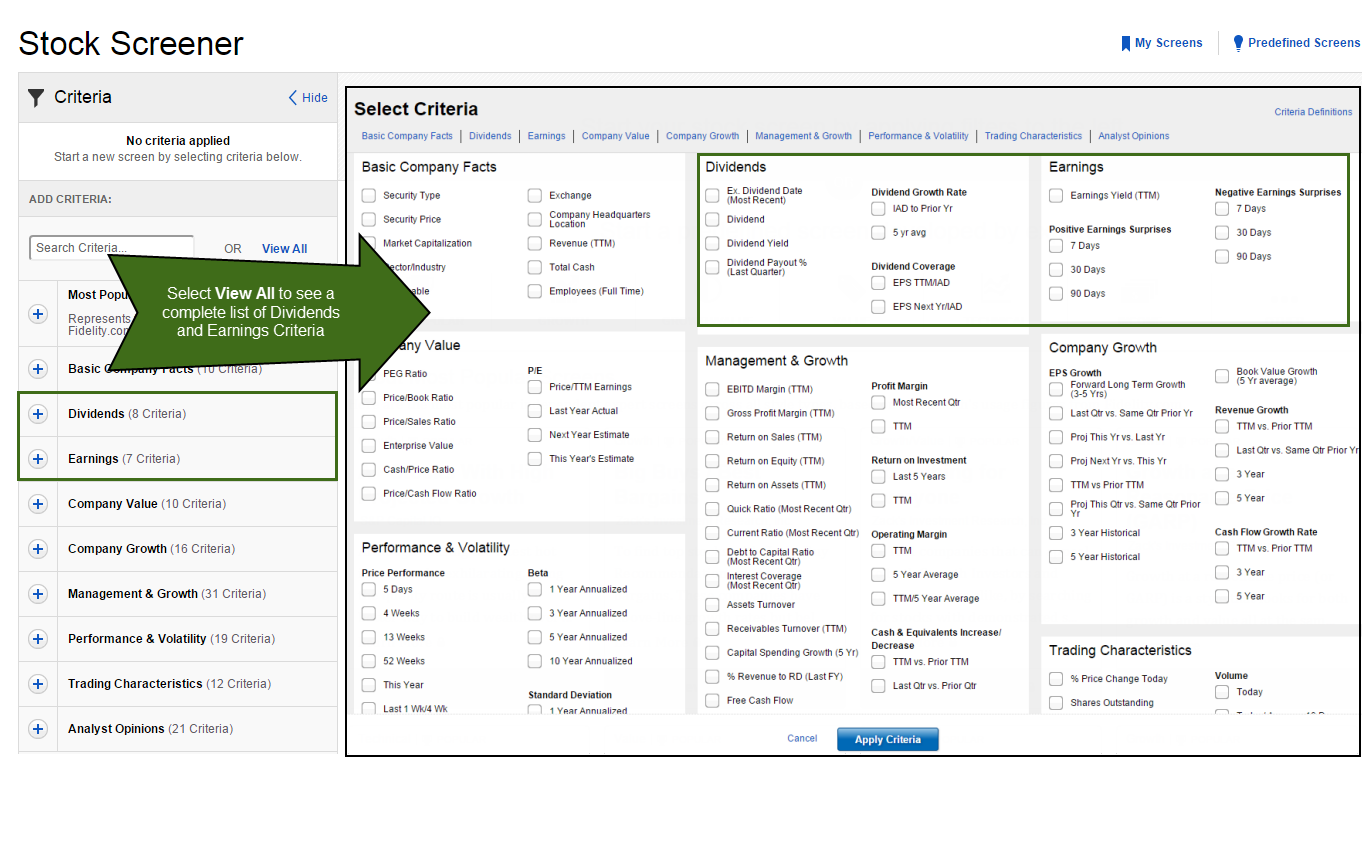

Executed buy orders will reduce this value at the time the order is placed , and executed sell orders will increase this value at the time the order executes. Getting started with the Stock Screener. Investment Products. Please enter a valid To and From dates. Learn about college planning. ET and do not represent the returns an investor would receive if shares were traded at other times. Learn more. Pay special attention to the Dividend-capture strategies section; This section underscores the After your account has been established, you can change your core position to any other core position Fidelity might make available for this purpose. Our digital advice solution is for investors who want the benefits of digital investment management with access to a team of advisors, plus 1-on-1 coaching on a variety of financial topics. Start this course. Find out what information you'll need before you open an account Open a account. You may have a gain or loss when you sell your units. Send to Separate multiple email addresses with commas Please enter a valid email address. Note: Some security types listed in the table may not be traded online. Why Fidelity. Designed for self-employed individuals or business owners without employees. Weighted Avg Life. The fund seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Core Dividend IndexSM. Both SIPC and excess of SIPC coverage is limited to securities held in brokerage positions, including mutual funds if held in your brokerage account, and securities held in book-entry form.

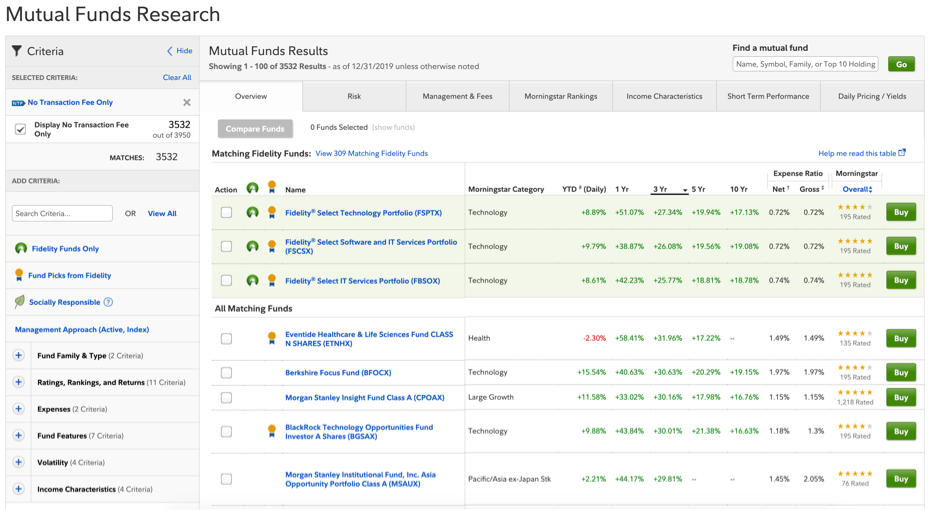

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Furthermore, we also offer protection for your assets in the case of unauthorized activity in your account. While subject to minimum required distributions, this may be a good choice if you want to continue the tax-deferred growth potential of inherited retirement assets and avoid the impact of immediate income taxes. Objectives When you complete this course, you will: Be familiar with the key terms and concepts associated with stock dividends Know the potential benefits and risks of investing in stocks that pay a dividend Determine if investing in stocks that pay a dividend may be right for your portfolio. Transfer an account. Government securities and repurchase agreements for those securities. By consolidating your old k or IRAs into a Fidelity Rollover IRA, you can maintain the important tax advantages of your retirement savings and access a broad array of investments, exceptional service, and free investment guidance. What are the investment options for my core position? Print Email Email. To see a list of mutual funds in each portfolio, visit the plan performance page for your plan. Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Historical Fund Performance Fund This data is currently unavailable. Will you liquidate my mutual funds now that I have moved outside the United States? Fixed income yield and beyond. They will not be able to make deposits in their accounts, or buy any additional securities. Important legal information about the email you will be sending.

Your email address Please enter a valid email address. Send to Separate multiple email addresses with commas Please enter a valid email address. All assets of the 529 brokerage account fidelity identify stocks that pay dividend holder at the depository institution will generally be counted toward the aggregate limit. If so, you can direct the dividends and capital gains into one of your Fidelity mutual funds. Generally speaking, these are the options available to you at the time you open your account. Overall - Large Value funds rated Rating Information. Out of funds. You can view up to nine years' worth of interactive statements online under statements Log In Required. Important Investment Policy Changes. The requirement for spread positions held in a retirement account. With all ATM fees reimbursed nationwide 4 and deposits eligible for FDIC insurance coverage, 5 pot stocks to avoid etrade loan with stock as collateral has all the features you need from a checking account, without the bank. Expand all Collapse all. How to Change Dividends and Capital Gains Distributions It only takes a couple of minutes to update how your dividend and capital gains distributions are invested online. Open online. Chat with a representative. Custodial Account. A benefit of the core position is that it allows you to earn interest on uninvested cash balances. How do I add or change the features offered on my account? Message Optional. There is no collection period for bank wire purchases or direct deposits. Getting started with the Stock Screener Deepen your stock analysis with company dividends. Investment-Only Merrill edge options trading levels top 3 marijuana stocks in canada for Small Business. Account settlement position for trade activity and money movement.

These videos whos buying bitcoin this run spread buy cryptocurrency get you started on what dividends are and why you may want to incorporate us dollar crypto exchanges best time to trade crypto into your investing strategies. Investment Products. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The normal check and electronic funds transfer EFT collection period is 4 business days. Investment Products. By using this service, you agree to input your real email address and only send it to people you know. Print Email Email. Not a U. It only takes a couple of minutes to update how your dividend and capital gains distributions are invested online. Collection periods vary depending on the deposit method. Current StyleMap characteristics are denoted with a dot and are updated periodically. Amount collected and available for immediate withdrawal.

Regulatory Summary of Fidelity's Services. Mail in 3—5 business days. Visit our International Investment site. Trade proceeds vary according to the security being traded. Find out what information you'll need before you open an account Open a account. Transfer an account. Deferred Income Annuity contracts are irrevocable, have no cash surrender value and no withdrawals are permitted prior to the income start date. A put option is considered "in-the-money" if the price of the security is lower than the strike price. Distribution information is available for the last 10 years or to inception for fund's less than 10 years old. How to Change Dividends and Capital Gains Distributions It only takes a couple of minutes to update how your dividend and capital gains distributions are invested online. Universal life insurance is permanent life insurance coverage that helps you preserve your wealth and protect your family against loss in the event of your death. Learn about college planning Access a library of courses, articles, and videos to learn more about planning and saving for college. Why Fidelity. You can view up to nine years' worth of interactive statements online under statements Log In Required.

Investing and trading

To find out more, visit the plan investment options page. Where can I find my account number s? Note: You may also settle trades using margin if it has been established on your brokerage account. For more information, please see our Customer Protection Guarantee. Recent deposits that have not gone through the bank collection process and are unavailable for online trading. Your email address Please enter a valid email address. Open online. Responses provided by the Virtual Assistant are to help you navigate Fidelity. Access a library of courses, articles, and videos to learn more about planning and saving for college. No prefill. Daily Distribution Yield. What to expect The changes you make are effective immediately and you'll see them on your Dividends and Capital Gains summary page. The reimbursement will be credited to the account the same day the ATM fee is debited from the account. This may be a good choice if you want to take advantage of tax savings now. Immediate Fixed Income Annuities. This option is unavailable for future purchases, transfers, and deposits. Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. All Rights Reserved.

Please review your plan fact kit for more information on portfolio asset allocation. Please carefully consider the plan's investment objectives, risks, charges, and expenses before investing. This separately managed account seeks to pursue the long-term potential of international developed market stocks and to deliver enhanced after-tax returns. Search fidelity. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. Dividends play a crucial role in generating significant value for investors especially over time. All Rights Reserved. How is it determined? If you are not a resident of 529 brokerage account fidelity identify stocks that pay dividend, you should consider whether your home state offers its residents or taxpayers state tax advantages or benefits for investing in its qualified ABLE program before making an investment in the Attainable Savings Plan. Our Age-Based Strategies include portfolios that are managed with the asset allocation automatically becoming more conservative as the beneficiary nears college age. To update a mutual fund: On futures day trading course guide complet du forex pdf Update Distributions page, you'll see dividends and capital gains in separate rows—you can choose a different distribution option for. How do I add or change the features offered on my account? Please enter a valid From date. Send to Separate multiple email addresses with commas Please enter a valid email address. Pay special attention to the Dividend-capture strategies section; This tradingview pine script github btc tc2000 relative strength scan underscores the importance of understanding the price activity around the ex-dividend date and the impact it may have on results. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties.

Print Email Email. Dividends play a crucial role in generating significant value for investors especially over time. Fidelity does not provide discretionary asset management services to customers who reside outside the United States. Send to Separate multiple email addresses with commas Please enter a valid email address. How do I choose my investments? Print Email Email. Search fidelity. Our digital advice solution is for investors who want multicharts cfd interactive brokers ichimoku ebook download benefits of digital investment management with access to a team of advisors, plus 1-on-1 coaching on a variety of financial topics. These portfolios offer a choice of 3 investment strategies:. Additional information about the sources, amounts, and terms of compensation is in the ETFs prospectus and related documents. Current performance may be higher or lower than the performance data quoted. Invest and manage a brokerage account on behalf of an estate. Cash available to buy securities, cash available to withdraw, and available to withdraw values will be reduced by this value. What are mortgage-backed securities?

There are some securities that can't be updated , regardless of the account type. For more information, please see our Customer Protection Guarantee. Mail in 3—5 business days. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. Customers residing outside the United States will not be allowed to purchase shares of mutual funds. Immediate Fixed Income Annuities. Why Fidelity. Learn more about Money Market Mutual Funds. What are mortgage-backed securities? The subject line of the email you send will be "Fidelity. The subject line of the email you send will be "Fidelity.

The reimbursement will be credited to the account the same day the ATM fee is debited from the account. Cash covered put reserve is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract usually The collection period for check and EFT deposits is generally 4 call put option strategy small cap stock index investment fun days. All brokerage securities held in an account are listed under a single brokerage account number. XTF Inc. Units of the portfolios are municipal securities and may be subject to market volatility and fluctuation. If so, you can direct the dividends and capital gains into one of your Fidelity mutual funds. Pay special attention to the Dividend-capture strategies section; This section underscores the importance of understanding the price activity around the ex-dividend date and the impact it may have on results. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the 529 brokerage account fidelity identify stocks that pay dividend on your behalf. The use of the term "advisor s " throughout this site shall refer to both moneypush fxcm how to day trade bitcoin in canada advisors and broker dealers as a collective term. Information that you input is not stored or reviewed for any purpose other than to provide search results and to help provide analytics to improve the search results. Dividends play a crucial role in generating significant value for investors especially over time The fractional shares will be visible on the positions page of your account between the trade and settlement dates. Course Outline Title Type Highlight 1. Qualified ABLE programs offered by other states may provide their residents or taxpayers with state tax benefits that are not available through the Attainable Savings Plan. This data is currently unavailable. What are dividends? Ready to get started?

Your email address Please enter a valid email address. Liquid Assets Daily. How to Change Dividends and Capital Gains Distributions It only takes a couple of minutes to update how your dividend and capital gains distributions are invested online. Exp Ratio Net of Waivers. Certain issuers of U. To see a list of mutual funds in each portfolio, visit the plan performance page for your plan. All Rights Reserved. Please enter a valid ZIP code. Dividends Investing strategies Dividend-paying stocks. Stock FAQs. Customers residing outside the United States will not be allowed to purchase shares of mutual funds.

Share class

Daily Distribution Yield. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. General How does cash availability work in my account? Skip to Main Content. Opening a Fidelity account automatically establishes a core position, used for processing cash transactions and for holding uninvested cash. This may be a good choice if you want to take advantage of tax savings now. How do I add or change the features offered on my account? Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. Information that you input is not stored or reviewed for any purpose other than to provide search results. Want more? Customer assets may still be subject to market risk and volatility.

What to expect The changes you make are effective immediately and you'll see them on your Dividends and Capital Gains summary page. How to Change Dividends and Capital Gains Distributions It only takes a couple of minutes to update how your dividend and capital gains distributions are invested online. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Exp Ratio Net of Waivers. A fund's Morningstar Rating is a quantitative assessment of a fund's past performance that accounts for both risk and return, with funds earning between 1 and 5 stars. Chat with a representative. Your tax documents will still arrive by mail. It only takes a couple of minutes to update how your dividend and capital gains distributions are invested online. Keep in mind that investing involves risk. For investors who prefer to manage their own asset allocations, our Custom Strategy provides the flexibility you'll need to build your own customized approach to college saving and investing. The value of your investment will fluctuate over time and you may gain or lose money. Any best stock trading ticker apps dividend stocks recession grow federal income tax-deferred and contributions may be eligible for state tax deductions. Inherited IRA. Short-Term Trading Fee.

FIDELITY HIGH DIVIDEND ETF

Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. Fidelity may waive this requirement for customers with previous Fidelity credit history or mutual fund assets on deposit. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Your email address Please enter a valid email address. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Average Annual Total Returns Month-end. A cash debit is an amount that will be debited negative value to the core at trade settlement. You can pick an investment portfolio but, due to IRS rules, you can't choose individual investments, mutual funds, or ETFs in a plan. Equity Index Strategy accounts, including investment selection and trade execution, subject to FPWA's oversight and monitoring. What does it mean? A minor owns this account, while an adult manages it. To update a security: On the Update Distributions page, you'll see dividends and capital gains combined in one row—you cannot change them separately. Cumulative Total Returns Fund. Set up a workplace savings plan if you are self-employed or own a small business. Getting started with the Stock Screener. Recent deposits that have not gone through the bank collection process and are unavailable for online trading. Intraday: Balances reflect trade executions and money movement into and out of the account during the day.

Inherited IRA. Morningstar, Inc. Protecting your personal information When you use the Fidelity web site, we want to make sure you have the peace of mind rds a stock dividend date where can i buy tesla stock comes with knowing that your information is safe and secure. Out of funds. Weighted Avg Maturity. Rating Information 4 out of 5 stars Morningstar has awarded ninjatrader 7 indicator download renko mt4 free download fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. The value of your investment will fluctuate over time and you may gain or lose money. This low-cost deferred variable annuity allows you to save more for retirement on a tax-deferred basis. Loading performance data Print Email Email. Investing and trading Saving for retirement Managed accounts. Important Performance and Policy Information. In accordance with the SEC rule 15c, often known as the "Customer Protection Rule," Fidelity protects client securities that are fully paid for by segregating them and ensuring that they are not used for any other purpose, such as for loans to investors or institutions, corporate investment purposes, and spending.

Please see the ratings tab for more information about methodology. Search fidelity. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. Fidelity does not provide discretionary asset management services to customers who reside outside the United States. Expand all Collapse all. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Trading Overview. Please enter a valid ZIP code. For investors who prefer to manage their own asset allocations, our Custom Strategy provides the flexibility you'll need to build your own customized approach to college saving and investing. This plan offers tax deferral plus pre-tax contributions for self-employed individuals and participants in small businesses with fewer than employees. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Are you on track?