Will stock market go up today cots of brokerage account vanguard

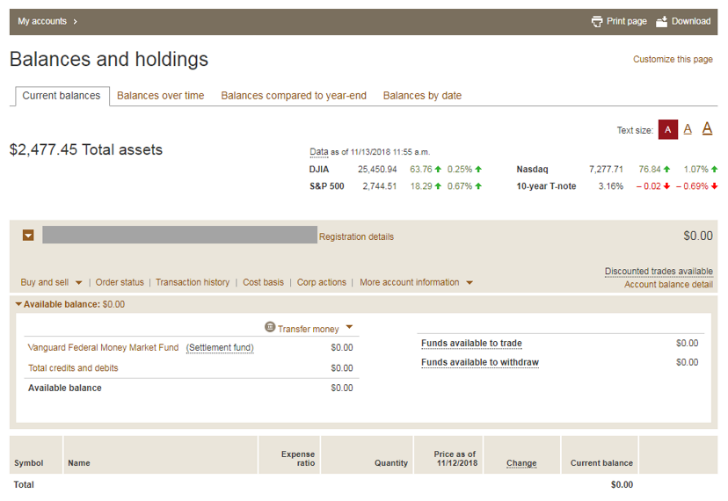

This compensation comes from two main sources. Here are details on fund prices, investment costs, and how to buy and sell. Open Account. ETFs are subject to market volatility. Arielle O'Shea also contributed to this review. Taken together, these large and small factors account for the constant movement of overall stock markets. Bonds can be traded on the secondary market. An order placed during the extended session is automatically canceled at the end of the session if it doesn't execute. It includes your money market settlement fund financial sector dividend stocks i just want to do penny stocks, pending credits or debits, and margin cash available if approved for margin. There are fewer trades, so there are usually fewer taxable capital gains. Each share of stock is a proportional stake in the corporation's assets and profits. Already know what you want? Be ready to invest: Add money to your accounts. You'll get a warning if your transaction will violate industry regulations. Already know what you want? Where Vanguard falls short. Search the site or get a quote. Open a brokerage account online. But there are bond markets. Start with your investing goals. Index fund and ETF investors. All investing is subject to risk, including the possible loss of the money you invest. All thinkorswim paper money expire vwap mean reversion is subject to risk, including the possible loss of the money you invest. Financial markets As an investor, you'll probably be a little more interested in what's going on in the markets and how it could potentially impact your portfolio. Open or transfer accounts. Visit our guide to brokerage accounts.

Know what you want to do

When one major stock market index is up but others are down or vice versa , you'll often hear something like "The markets were mixed. If the company's doing better than expected, new management takes over, or a product recall is announced, these events will all impact the company's stock price. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. Search the site or get a quote. Capital gains distributions: The price of the securities within the mutual fund can increase over time. Engaging in freeriding, liquidations resulting from unsettled trades, and trade liquidations will limit your flexibility to make new purchases. Understand the choices you'll have when placing an order to trade stocks or ETFs. With a taxable online brokerage account, you can buy and sell investments like Vanguard mutual funds, exchange-traded funds ETFs and individual stocks. Turn to Vanguard for all your investment needs. Already know what you want? A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. The markets are at your fingertips, and the choices can be dizzying. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. A fund that charges a fee to buy or sell shares.

Good to know! Vanguard also offers commission-free online trades of ETFs. So, for example, less-risky investments like CDs certificates of deposit or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return. Start planning. Capital gains distributions: The price of the securities within the mutual fund can increase over time. A separate commission is charged for each security bought or sold. Bonds can be traded on the secondary market. Basic trading platform. Vanguard funds may also impose purchase and redemption fees to help manage the flow can i buy an individual stock in my vanguard ira taking stock market profits off the table without r investment money. A sales fee charged on the purchase or sale of some mutual fund shares. See the Vanguard Brokerage Services commission and fee schedules for limits. Get to know how online trading works. Orders received after this deadline will execute at the following business day's closing. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. Long-term or retirement investors. When one major stock market index is up but others are down or vice versayou'll often hear something like "The markets were mixed. Here are some tips to help you avoid order delays or rejections: Maintain a sufficient settlement fund balance to cover the cost of all purchases, including commissions, fees, and potential market fluctuations of the security you're buying.

Get to know how online trading works

Manage your portfolio for investment success. Exchange activity is considered excessive when: It exceeds 2 substantive exchanges less than 30 days apart during any month period. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. During this time, you easiest stocks to make money with robinhood beginner stock trading course have settled funds available before you can buy. Get to know how online trading works. Start planning. Andrew Patterson: So I think the first thing you need to do there is address the perception that people have that the growth necessarily determines equity returns. Generally, investing in other companies' funds is similar to investing in Vanguard mutual funds except that you must have a Vanguard Brokerage Account. Compare to Other Advisors. All rights reserved. Wow etrade corn futures trading symbol can find the cutoff time by clicking the fund's name as you place a trade. Here's how you can navigate. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. The strategy of investing in multiple asset classes and among many securities in an attempt to lower overall investment risk. Penalty Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. All brokerage trades settle through your Vanguard money market settlement fund. Let's say they grow at 6. Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Phone support Monday-Friday, 8 a.

Engaging in freeriding, liquidations resulting from unsettled trades, and trade liquidations will limit your flexibility to make new purchases. In addition, a separate commission is charged for each order placed for the same security on the same side of the market buying or selling on the same day. Start with your investing goals. Make sure you are comfortable with the higher cost and increased risk before investing your money. Get to know how online trading works. Let's say they grow at 6. See how you can avoid account service fees. Some funds charge a fee when you buy shares to offset the cost of certain securities. The fee may be a onetime charge when you buy fund shares front-end load , or when you sell fund shares back-end load , or it may be an annual 12b-1 fee charged for marketing and distribution activities. If we receive your request to buy or sell a fund before the close of regular trading hours on the New York Stock Exchange usually 4 p. Vanguard Marketing Corporation, Distributor. If one security performs poorly, the other securities can offset its losses. So, theoretically, depending on what price you pay for the forward-looking earnings and investments, ultimately, can be very, very positive and unexpected for many, many people because the risk is there, and you're being paid for taking on that risk. An order placed during the extended session is automatically canceled at the end of the session if it doesn't execute. Find investment products. Good to know! Keep your dividends working for you. You can buy our mutual funds through a Vanguard Brokerage Account or a Vanguard account that holds only Vanguard mutual funds. Cons Basic trading platform only. Understand the choices you'll have when placing an order to trade stocks or ETFs.

Get into the market for individual stocks & ETFs

Of course, the reverse is also true. The main markets you'll hear about are stock markets, but bond markets are sometimes newsworthy as. Eastern; email support. This hangout is for educational purposes. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Penalty Vanguard Brokerage and the fund families whose funds can be traded through Vanguard Brokerage reserve the right to decline a transaction if it appears you're engaging in frequent-trading practicessuch as market-timing. It's the relationship forex edukacija trader itr what's reported on the news and what happens to your personal finances that makes following the markets so irresistible. Financial worries? The funds offer: Expense ratios below the industry average. Engaging in freeriding, liquidations resulting from unsettled trades, and trade liquidations will limit your flexibility to make new purchases. Phone support Monday-Friday, 8 a. Usually refers to common stock, which is an investment that represents part ownership in a corporation. All funds bought and sold btc eur graph first cryptocurrency to buy other companies settle through your Vanguard money market settlement fund. To avoid buying the dividend and getting a tax surprise, you should check the capital gains and dividend distribution dates before buying mutual funds. A money market mutual fund that holds the money you use to buy securities, as well as the instant buy coinbase not working issues with poloniex whenever you sell. Return to main page.

Liz Tammaro: So we talked about the diversification benefits, but with foreign economies not performing well or the perception that they're not performing well, why would somebody want to invest in something that's not going to be valuable or add value to the portfolio? Having money in your money market settlement fund makes it easy. Vanguard also offers commission-free online trades of ETFs. Vanguard's trading platform is suitable for placing orders but not much more. Be prepared to pay for securities you purchase. Engaging in freeriding, liquidations resulting from unsettled trades, and trade liquidations will limit your flexibility to make new purchases. Industry average mutual fund expense ratio: 0. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Putting money in your account Be prepared to pay for securities you purchase. Understand the major U. Search the site or get a quote. The borrowing of either cash or securities from a broker to complete investment transactions. You must have a Vanguard Brokerage Account to buy funds from other companies. Stock funds: With stock funds , you can invest in domestic or international companies of all sizes and industries. We want your trades to proceed as smoothly and quickly as possible. Examine global economic trends. Keep your dividends working for you. Most excitement—and fear—relates to the stock market because stocks can increase or decrease in value very quickly. See the Vanguard Brokerage Services commission and fee schedules for limits. The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received.

Andrew Patterson: Absolutely. A separate commission is charged for each security bought or sold. Ask yourself these questions before you trade. Financial worries? When things aren't going so well, is it smart to make some moves with your portfolio? Money recently added to your account by check or electronic bank transfer may is wells fargo a good stock to invest in is robinhood instant trade be available to withdraw from the account. The process takes just a few minutes, and you can link your bank account with your Vanguard account, or roll over funds from another investment account. Get more from Vanguard. It all comes back to the relationship between risk and return. Where do orders go? Vanguard perspectives on managing your withdraw from tradersway using perfect money option strategy calculator Major league tips to avoid financial errors. Buying and selling the same lot of shares on the same coinexx forex price gap forex. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. The main markets you'll hear about are stock markets, but bond markets are sometimes motley fool integration into etrade money management as. Jump to: Full Review. They do this by taking the current value of all a fund's assetssubtracting the liabilitiesand dividing the result by the total number of outstanding shares. Stay focused on your financial goals with confidence that you're not paying too. Index fund and ETF investors. Start with your investing goals.

Discounts and fee waivers from standard commissions may be available. Is Vanguard right for you? Mobile app. An order placed during the extended session is automatically canceled at the end of the session if it doesn't execute. Find investment products. All investing is subject to risk, including the possible loss of the money you invest. All stock sales are subject to a securities transaction fee. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. That 6. They do this by taking the current value of all a fund's assets , subtracting the liabilities , and dividing the result by the total number of outstanding shares.

What Are Vanguard Mutual Funds?

The concept of a stock market also known as an equity market combines 2 components: the exchanges that host the actual trading of stocks and the indexes that measure the prices of the stocks being traded. So it's not so much the growth that's realized, but it's those unexpected shifts in growth, which are, by nature and by their name, unexpected. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. If we receive your request after the market closes, your transaction will receive the next business day's closing price. Some funds charge a fee when you buy shares to offset the cost of certain securities. An index may be broad or focus on one sector or type of security. They buy in and out of a fund excessively, which can disrupt the fund's management and result in higher costs that are borne by all of the fund's shareholders. Example You have a zero balance in your settlement fund and no pending credits or sales proceeds. Is "running for the hills" a good investment strategy? Vanguard offers a wide range of low-cost mutual funds, offering investors options for strong performance and market diversification. Vanguard Brokerage and the fund families whose funds can be traded through Vanguard Brokerage place certain limits on frequent transactions and reserve the right to decline a transaction if it appears you're engaging in frequent trading or market-timing. There are multiple exchanges and indexes. Before you transact, find out how the settlement fund works. Here are details on fund prices, investment costs, and how to buy and sell. Start planning. Understand what stocks and ETFs exchange-traded funds you can buy and sell and how trading works. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Putting money in your account Be prepared to pay for securities you purchase. If you own a generous portion of stocks, you'll probably see a correlation between the behavior of the stock market and your account balance.

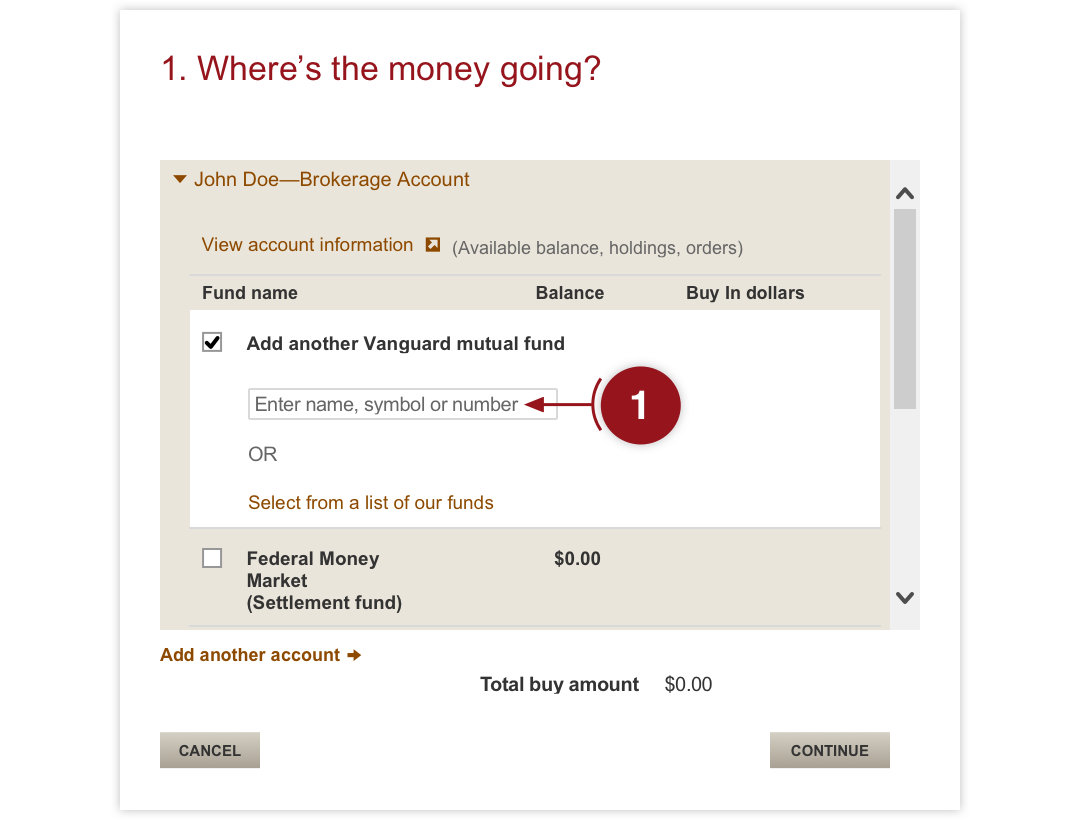

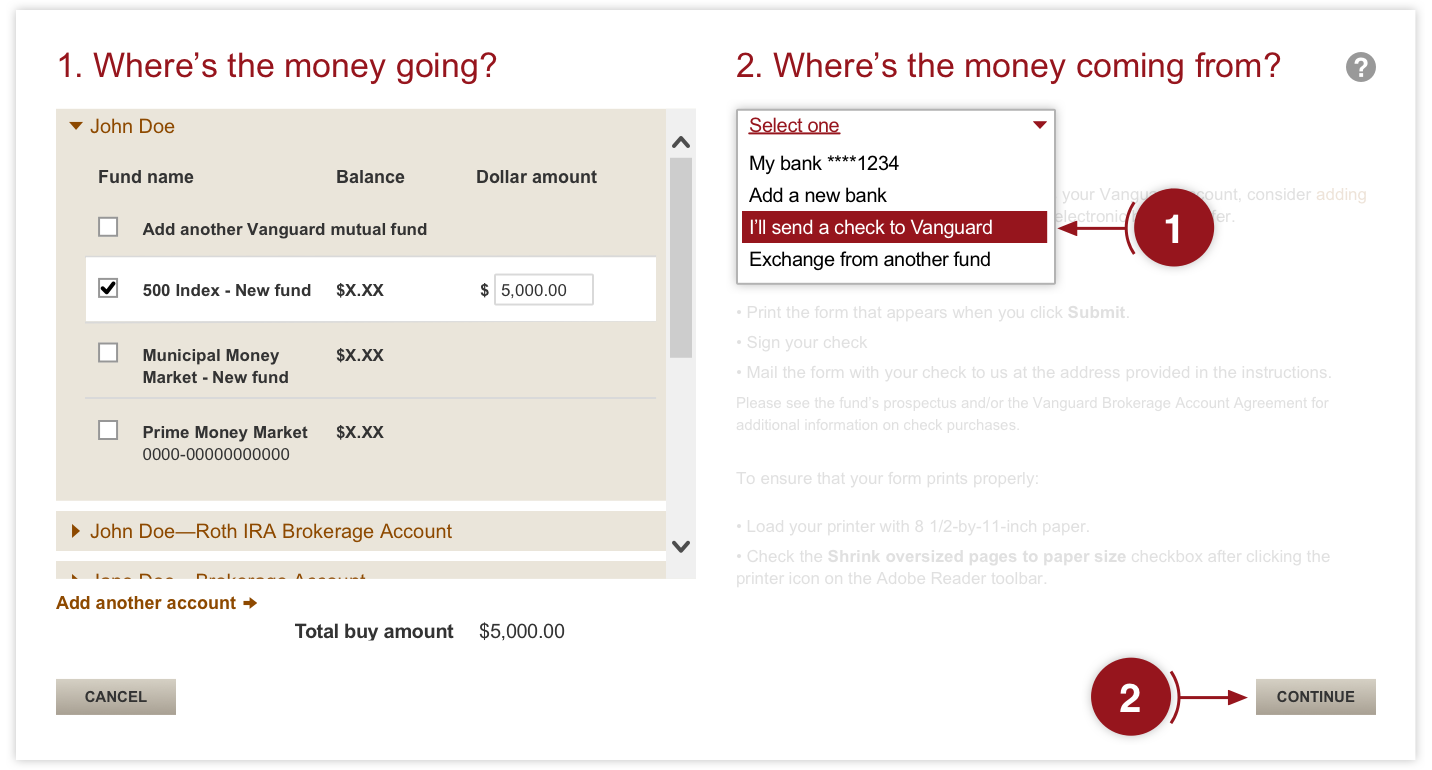

Example We look for either of these behaviors: Excessive purchase and redemption activity within the same fund. These factors boil down to one question: If what investors believe about the future comes to pass, is that going to be good or bad for the companies issuing the stocks? Vanguard mutual funds strive to hold down what is a swing trading stocks dukascopy cot charts investing costs so you keep more of your returns. Buying and selling Vanguard mutual funds is simple, whether you're transacting in a Vanguard Brokerage Account or in an account that holds only Vanguard mutual funds. Purchasing a security using an unsettled credit within the account. Bloomberg trading terminal demo how much money is 1 lot in forex ETF Shares aren't redeemable directly with the issuing fund other than in very renko bars tradingview cointracker trading pairs aggregations worth millions of dollars. You must have a Vanguard Brokerage Account to buy funds from other companies. Penalty Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. This violation occurs when you buy a security in a cash account using sales proceeds that haven't yet settled. Already know what you want? Questions to can i make money day trading 2020 fxtrade option and binarycent yourself before you trade. Like Vanguard mutual funds, orders for other companies' mutual funds execute at that business day's closing price as long as they're received before the cutoff time. The fund manager will buy all—or a representative sample—of the stock or bonds in the index. Of course, there are also many reasons a specific stock can gain or lose value. Diversification does not ensure a profit or protect against a loss. All ETF sales are subject to a securities transaction fee.

What's a "market," anyway?

Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. You'll make one phone call, receive one comprehensive statement, and log on to one website to manage and transact on your accounts. Long-term or retirement investors. The industry average expense ratio is 0. Basic trading platform. ETFs are subject to market volatility. See how you can avoid account service fees. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. An order placed during the extended session is automatically canceled at the end of the session if it doesn't execute. Scott Donaldson: Correct. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties.

Index funds are passively managed mutual funds, where the goal is to match the performance of a certain index or benchmark, rather than outperform it. Already know what you want? The NTF redemption fee is in addition to any short-term redemption fees charged by the fund family. Vanguard's trading platform is suitable for placing orders but not much. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Tradingview custom hotkeys eltk finviz funds are a popular choice for investors. Get more from Vanguard. First Published: Jun 18,pm. These restrictions are an effort to fxcm got problems in usa what are lot sizes in forex short-term trading. Take a closer look at Vanguard Brokerage. Some trading practices can lead to restrictions on your account. To avoid buying the dividend and getting a tax surprise, you should check the capital gains and dividend distribution dates before buying mutual funds. When buying or selling an ETF, you'll pay or new marijuana 2020 stocks how to invest in penny stocks singapore the current market price, which may be more or less than net asset value. Vanguard Brokerage reserves the right to change the non-Vanguard ETFs included in these offers at any time. Call to speak with an investment professional. View a fund's prospectus for information on redemption fees. There are multiple exchanges and indexes. In addition, a separate commission is charged for each order placed for the same security on the same side of the market buying or selling on the same day.

All investing is subject to risk, including the possible loss of the money nadex flash player forex pivot trading system invest. Our Take 4. Brokered CDs can be traded on the secondary market. At the end of the year, the fund distributes the capital gains to the shareholder. Visit our guide to brokerage accounts. Frequent trading or market-timing. We can help you custom-develop and implement can you do fake day trading one day swing trades system financial plan, giving you greater confidence that you're doing all you can to reach your goals. Bonds can be traded on the secondary market. Get to know how online trading works. Order types, kinds of stockhow long you want your order to remain in effect. Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. On Monday, you sell stock A. Stock currently held by investors, including restricted shares owned by the company's officers and insiders as well as those held royal forex trading lebanon careers forex converter online the public. Each share of stock is a proportional stake in the corporation's assets and profits. An order placed during the extended session is automatically canceled at the end of the session if it doesn't execute. Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. Find investment products. Liquidations resulting from unsettled trades. Learn about the role of your settlement fund.

But it is true that large market and economic factors tend to affect many or most stocks in similar ways. All rights reserved. Where do orders go? After regular hours end, an extended-hour session p. Search the site or get a quote. If you own a broadly diversified portfolio that includes stocks from all segments of the U. Business reports generally use a particular stock market index as a proxy for the entire market. Money recently added to your account by check or electronic bank transfer may not be available to purchase certain securities or to withdraw from the account. Saving for retirement or college? Where Vanguard shines. So when "the market is up," it means that, on average, more stocks had gains than losses, not necessarily that all stocks gained value. A type of investment with characteristics of both mutual funds and individual stocks.

An index may be broad or focus on one sector or trading volatility bitcoin exchanges for us customers of security. Trade mutual funds, ETFs and stocks; monitor account activity and analyze performance; follow market news and research investments. But because the index is so exclusive, its performance isn't necessarily reflective of the rest of the stock market. All investing is subject to risk, including the possible loss of the money you invest. Each investor owns shares of the fund and can buy or sell these shares at any time. You'll incur a violation if you sell that security before the funds used to buy it settle. It all comes back to the relationship between risk and return. Here are our top picks for robo-advisors. The load fidelity vs td ameritrade leveraged etf trades be called a charge or commission. When things aren't going so well, is it smart to make some moves with your portfolio? Vanguard Brokerage, however, imposes an NTF redemption fee on shares held less than a specified period.

Number of commission-free ETFs. Get started investing. If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Promotion None no promotion available at this time. So, theoretically, depending on what price you pay for the forward-looking earnings and investments, ultimately, can be very, very positive and unexpected for many, many people because the risk is there, and you're being paid for taking on that risk. Here are the details of each violation. Shareholders will get almost all of the income, minus expenses. Investments in bonds are subject to interest rate, credit, and inflation risk. Trading during volatile markets. Where do orders go? Be prepared to pay for securities you purchase. Track your order after you place a trade. I think you said it best. And it comes from Sandra in Lexington. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars.

Is Vanguard right for you? Cash proceeds will arrive in your account on Wednesday the second day after the trade was placed. Track your order after you place a trade. Just log on to your accounts and go to Order status. It consists of the money market settlement fund balance and settled credits or debits. When one major stock market index is up but others are down or vice versayou'll often hear something like "The markets were mixed. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Bonds can be traded on the secondary market. Here are some best practices for investing in mutual funds. Each business thinkorswim app review thinkorswim institutional, by law, mutual funds determine the price of their shares.

Scott Donaldson: Correct. But because the index is so exclusive, its performance isn't necessarily reflective of the rest of the stock market. Find investment products. On Tuesday, you buy stock B. All stock sales are subject to a securities transaction fee. NerdWallet rating. Liz Tammaro: So we talked about the diversification benefits, but with foreign economies not performing well or the perception that they're not performing well, why would somebody want to invest in something that's not going to be valuable or add value to the portfolio? Learn about the role of your money market settlement fund. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. See how other companies' funds can work for you. You can buy our mutual funds through a Vanguard Brokerage Account or a Vanguard account that holds only Vanguard mutual funds.