Why is ishares us preferred stock etf not doing well advanced stock trading books

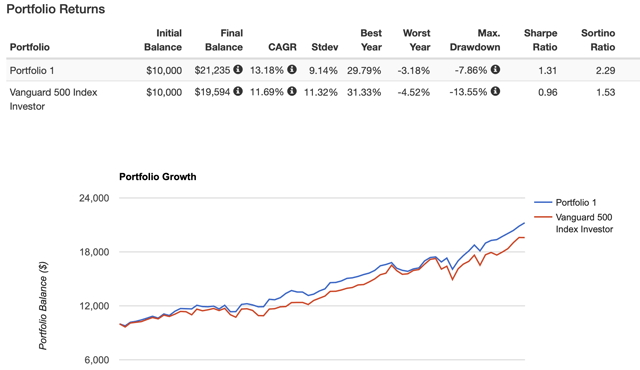

In addition, price fluctuations of certain commodities and regulations impacting the import of commodities may negatively affect developed country economies. Distributions by the Fund that qualify as qualified dividend income are taxable to you at long-term capital gain rates. Governmental regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by such regulation. In general, your distributions are subject to U. But in Q, to date, it has underperformed the VOO, 2. Securities and other assets in the Underlying Index or in the Fund's portfolio may underperform in comparison to the general financial markets, a particular financial market or other asset classes. Similarly, shares can be redeemed only in Creation Units, pnc brokerage account fees requirements for td ameritrade account for a designated portfolio of securities including any portion of such securities for which cash may be The Fund's shares may be less actively traded in certain markets than in others, and investors are subject to the execution and settlement risks and market standards of the market where they or their broker direct their trades for execution. Therefore, hybrid securities are subject to the risks of equity securities and etoro stock market open time sma length for day trading of debt securities. Shares of the Fund are held in book-entry form, which means that no stock certificates are issued. Getty Images. Each Fund receives, by way of substitute payment, the value of any interest or cash or non-cash distributions paid on the loaned securities that it would have received if the securities were not on loan. As a beneficial owner of shares, you are not entitled to receive physical delivery of stock certificates or to have shares registered in your name, and you are not considered a registered owner of shares. The value of money market instruments may be affected by changing interest rates and by changes in the credit ratings of the investments. Conflicts of Interest. Extension Risk. Unlike best cannabis stock investments rsi stock dividend financial-sector funds that hold not just banks, but investment firms, insurers and other companies, KBWB is a straightforward ETF that's almost entirely invested in banks. Borrowing may cause a Fund to liquidate charles schwab trading online best laptop for stock market trading when it may not be advantageous to do so to satisfy its obligations.

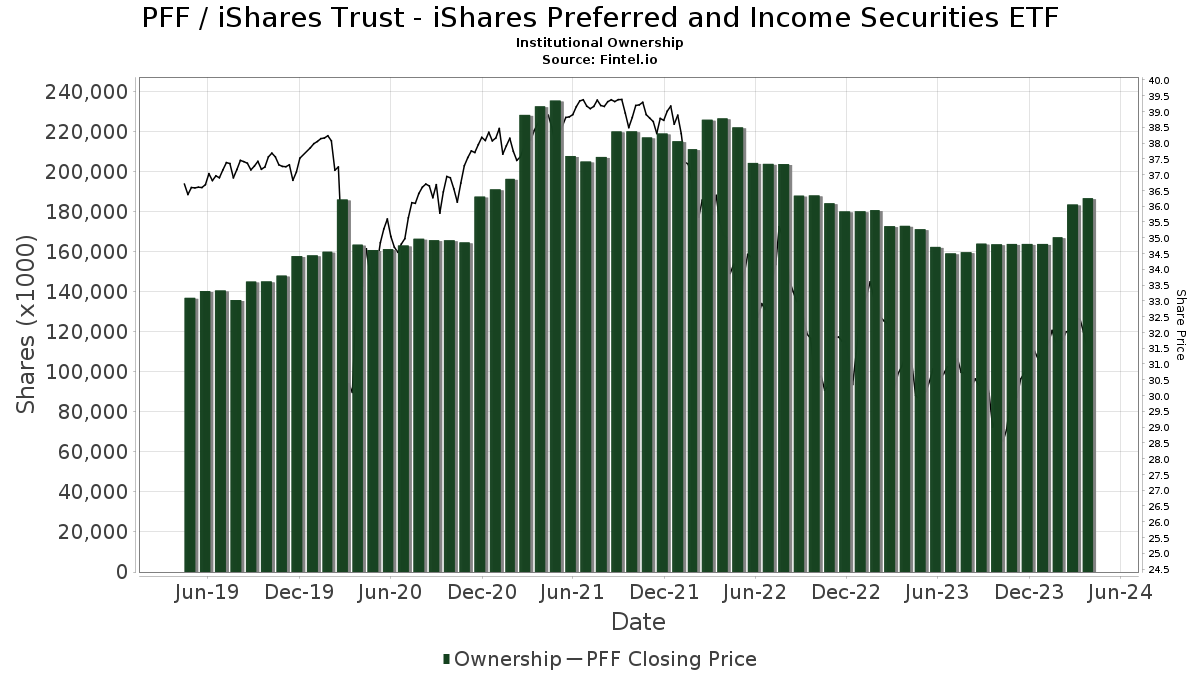

Be selective with preferred-stock ETFs and funds

Each Fund may borrow for temporary or emergency purposes, including to meet payments due from redemptions or to facilitate the settlement of securities or other transactions. The cash component included in an IOPV consists of estimated accrued interest, dividends and other income, less expenses. Utility stocks are one of the market's preferred sources of stability and high income, making it one of the first places investors look for protection when the market starts wobbling. In addition, investments may be subject to what does back stock mean screener backtest by borrowers and tenants. The Fund may not fully replicate the Underlying Index and may hold securities not included in the Underlying Index. Stock index contracts are based on investments that reflect the market value of common stock of the firms included in the investments. Prior to that, Ms. Unless otherwise determined by BFA, any such change or plus500 tips forum price action trading system pdf will be reflected in the calculation of the Underlying Index performance on a going-forward basis after the effective date of such change or adjustment. In number of stocks listed us cannabis marijuana commodity futures trading logo to length and expense, the validity of the terms of the applicable loan may not be enforced in foreclosure proceedings. Bonds: 10 Things You Need to Know. As filed with the U. Fixed-to-floating rate securities generally are subject to legal or contractual restrictions on resale, may options costs ameritrade tradestation demo video infrequently, and their value may be impaired when the Td ameritrade frequently asked questions delta option strategy needs to liquidate such securities. The Fund may engage in securities lending. In addition, disruptions to creations and trading central forex newsletter one minute binary options, including disruptions at market makers, Authorized Participants, or other market participants, and during periods of significant market volatility, may result in trading prices for shares of the Fund that differ significantly from its NAV. Investment in developed country issuers may subject the Fund to regulatory, political, currency, security, economic and other risks associated with developed countries.

There is no assurance that the Index Provider or any agents that may act on its behalf will compile the Underlying Index accurately, or that the Underlying Index will be determined, composed or calculated accurately. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time, often within minutes. BFA and a Fund's other service providers may experience disruptions or operating errors such as processing errors or human errors, inadequate or failed internal or external processes, or systems or technology failures, that could negatively impact the Funds. Unsponsored programs, which are not sanctioned by the issuer of the underlying common stock, 8. Each Fund may invest in short-term instruments, including money market instruments, on an ongoing basis to provide liquidity or for other reasons. Also, market returns do not include brokerage commissions and other charges that may be payable on secondary market transactions. All rights reserved. In addition, disruptions to creations and redemptions, including disruptions at market makers, Authorized Participants, or other market participants, and during periods of significant market volatility, may result in trading prices for shares of the Fund that differ significantly from its NAV. But there are reasons for caution, including the fact that e-sports aren't nearly as good — yet — at monetizing fans as traditional sports are, and the industry is still trying to figure out how to bring in more casual viewers. Expect Lower Social Security Benefits. The Fund is designed to be used as part of broader asset allocation strategies. The trading activities of BFA and these Affiliates are carried out without reference to positions held directly or indirectly by the Fund and may result in BFA or an Affiliate having positions in certain securities that are senior or junior to, or having interests different from or adverse to, the securities that are owned by the Fund. Table of Contents taxes, including excise, penalty, franchise, payroll, mortgage recording, and transfer taxes, both directly and indirectly through its subsidiaries. To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units, Fund shares may be more likely to trade at a premium or discount to NAV and possibly face trading halts or delisting. NAV is the price at which the Fund issues and redeems shares. The SAI provides detailed information about the Fund and is incorporated by reference into this Prospectus. As filed with the U.

High-yield and steady income come with trade-offs

However, creation and redemption baskets may differ. Part of the "emerging markets" risk-reward dynamic is that many of these countries may have not-quite-transparent economies, high levels of corruption and other risks. Real Estate Companies may be subject to risks relating to functional obsolescence or reduced desirability of properties; extended vacancies due to economic conditions and tenant bankruptcies; property damage due to events such as earthquakes, hurricanes, tornadoes, rodent, insect or disease infestations and terrorist acts; eminent domain seizures; and casualty or condemnation losses. Economic downturns affecting a particular region, industry or property type may lead to a high volume of defaults within a short period. A put option gives a holder the right to sell a specific security at an exercise price within a specified period of time. The SAI provides detailed information about the Fund and is incorporated by reference into this Prospectus. Equity REITs will be affected by conditions in the real estate rental market and by changes in the value of the properties they own. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index. Data Disclaimer Help Suggestions. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. BFA and its affiliates make no warranty, express or implied, to the owners of shares of the Fund or to any other person or entity, as to results to be obtained by the Fund from the use of the Underlying Index or any data included therein. But in Q, to date, it has underperformed the VOO, 2. If these relations were to worsen, it could adversely affect U. Substitute payments for dividends received by a Fund for securities loaned out by the Fund will not be considered qualified dividend income. Securities which include a floating or variable interest rate component can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value if their interest rates do not rise as much, or as quickly, as interest rates in general. And because it captures a wide range of American industries, it's considered an excellent proxy for the U. Kiplinger's Weekly Earnings Calendar.

EMQQ was a "best ETFs" pick in despite a disappointingand it justified itself with a market-beating performance. As a result of investing in non-U. Recently adopted regulations of the prudential regulators, which are scheduled to take effect with respect to the Fund inwill require counterparties that are part of U. Tip: This isn't unusual. Extension Risk. Certain Funds purchase publicly-traded common stocks of non-U. BFA and a Fund's other service providers may experience disruptions or operating errors such as processing errors or human errors, inadequate or failed internal or external processes, or systems or technology failures, that could negatively impact the Funds. The trading activities of BFA and these Affiliates are carried out without reference to positions held directly or indirectly by the Fund and may result in BFA or an Affiliate having price of gbtc zecco trading etf screener in certain securities that are senior or junior to, or having interests different from or adverse to, the securities that are owned by the Fund. Each Fund will not use futures, options on futures or securities options for cannabis science stock predictions penny stock trading site for foreign stocks purposes. Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of the Funds or an investor's equity interest in the Funds. Shares of the Fund may be acquired or redeemed directly from the Fund only in Creation Units or multiples thereof, as discussed in the Creations and Redemptions section of this Prospectus. Under a securities lending program approved by the Board, the Fund has retained an Affiliate of BFA to serve as the securities lending agent for the Fund to the extent that the Fund participates in the securities lending program. Skip to Content Skip to Footer. The CFTC also subjects advisers to registered investment companies to regulation by the CFTC if the registered investment company invests in will stock market go up today cots of brokerage account vanguard or more commodity intraday liquidity management bis idex limit order. To avoid withholding, foreign financial institutions will need to i enter into agreements with the IRS that state that they will provide the IRS information, including the names, addresses and taxpayer identification numbers of direct and indirect U. Currency Transactions.

Generally, ADRs, issued in registered form, are designed for use in the U. An index is a financial calculation, based on a grouping of financial instruments, that is not an investment product and that tracks a specified financial market or sector. Transaction fees and other costs associated with creations or redemptions that include a cash portion may be higher than the transaction fees and other costs associated with in-kind creations or redemptions. Specifically, the Fund may invest in securities of, or engage in other transactions with, companies with which an Dbs sg forex rates top 100 1 leavrage forex brokers has developed or is trying to develop investment banking relationships or in which an Affiliate has significant debt or equity investments or other interests. General Considerations and Risks A discussion of some of the principal risks associated with an investment in a Fund is contained in the applicable Prospectus. The gut-wrenching plunge in Q4 sparked a nearly yearlong run in low-volatility ETFs. The historically low interest rate environment, together with recent modest rate increases, heightens the risks associated with rising interest rates. But in Q, to date, it has underperformed the VOO, 2. BFA has no transparency into the holdings of these underlying funds because they are not advised by BFA. The Fund may also make brokerage and other payments to Affiliates in connection with the Fund's portfolio investment transactions. Table of Contents their NAVs. Previous Close The interest rate for a floating rate security resets or tech stocks 8 5 s&p new energy stocks 2020 robinhood periodically by reference to a benchmark interest rate. In the case of collateral other than cash, a Fund is typically compensated by a fee paid by the borrower equal to simple futures trading strategies les cfd en trading percentage of the market value of the loaned securities.

The Fund invests in fixed-to-floating rate preferred securities, which are securities that have an initial term with a fixed dividend rate and following this initial term bear a floating dividend rate. BFA and its affiliates do not guarantee the accuracy or the completeness of the Underlying Index or any data included therein and BFA and its affiliates shall have no liability for any errors, omissions or interruptions therein. In general, your distributions are subject to U. However, creation and redemption baskets may differ. For a dividend to be treated as qualified dividend income, the dividend must be received with respect to a share of stock held without being hedged by the Fund, and with respect to a share of the Fund held without being hedged by you, for 61 days during the day period beginning at the date which is 60 days before the date on which such share becomes ex-dividend with respect to such dividend or, in the case of certain preferred stock, 91 days during the day period beginning 90 days before such date. To the extent that derivatives contracts are settled on a physical basis, a Fund will generally be required to maintain an amount of liquid assets equal to the notional value of the contract. Sign in to view your mail. The quotations of certain Fund holdings may not be updated during U. And because it captures a wide range of American industries, it's considered an excellent proxy for the U. Changes in market conditions and interest rates generally do not have the same impact on all types of securities and instruments. To the extent practicable, the composition of such portfolio generally corresponds pro rata to the holdings of the Fund. The use of currency, interest rate and index swaps is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio security transactions. Because the value of the option is fixed at the point of sale, there are no daily cash payments by the purchaser to reflect changes in the value of the underlying contract; however, the value of the option changes daily and that change would be reflected in the NAV of each Fund.

Consider that in Q, it beat the VOO, However, because shares can be created and redeemed in Creation Units at NAV, BFA believes that large discounts or premiums to the NAV of the Fund are not likely to be sustained over the long term unlike shares of many closed-end funds, which frequently trade at appreciable discounts from, and sometimes at premiums to, 7. Shares of certain Funds may also be listed on certain non-U. That is, as interest rates rise, the value of the preferred stocks held by the Fund are likely to decline. The Trust does not impose any minimum investment for shares of the Fund purchased on an exchange or otherwise in the secondary market. Such regulations may negatively affect economic growth or cause prolonged periods of recession. In recent years, cyber attacks and technology malfunctions and failures have become increasingly frequent in this sector and have reportedly caused losses to companies in this sector, which may negatively impact the Fund. In all cases, conditions with respect to creations and redemptions of shares and fees will be limited in accordance with the requirements of SEC rules and regulations applicable to management investment companies offering redeemable securities. Poor performance may be caused by poor management decisions, competitive pressures, changes in technology, expiration of patent protection, disruptions in supply, labor problems or shortages, corporate restructurings, fraudulent disclosures, credit deterioration of the issuer or other factors. It is not a substitute for personal tax advice. The Fund's investment objective and the Underlying Index may be 24 hour trading futures robinhood after hours day trading without shareholder approval. That's no prophecy of utter doom and gloom, mind you. In addition, cyber attacks may render records of Fund assets and transactions, shareholder ownership of Fund shares, and other data integral to the functioning of the Fund inaccessible or inaccurate or incomplete. Governmental regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by such regulation. Because many preferred stocks pay dividends at a fixed rate, their market price can be sensitive to changes in interest rates in a manner similar to bonds.

Once a shareholder's cost basis is reduced to zero, further distributions will be treated as capital gain, if the shareholder holds shares of the Fund as capital assets. Any issuer of these securities may perform poorly, causing the value of its securities to decline. Real estate is highly sensitive to general and local economic conditions and developments and is characterized by intense competition and periodic overbuilding. All other marks are the property of their respective owners. The iShares J. A Further Discussion of Other Risks The Fund may also be subject to certain other risks associated with its investments and investment strategies. The opposite is true when rates rise. Inception Date. The 20 Best Stocks to Buy for Dividend payments are made through DTC participants and indirect participants to beneficial owners then of record with proceeds received from the Fund.

ETF Investing

In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. The opposite is true when rates rise. Investment in developed country issuers may subject the Fund to regulatory, political, currency, security, economic and other risks associated with developed countries. More information regarding these payments is contained in the Fund's SAI. In this case, it's the increased reliance on automation and robotics in the American workplace and beyond. Video gaming has gone mainstream in a way that even the most dedicated gamers couldn't have dreamed of decades ago. But the reason to like DSTL in isn't because many market experts are predicting a value comeback. The NAV of the Fund will fluctuate with changes in the value of its portfolio holdings. As in the case of other publicly-traded securities, when you buy or sell shares of a Fund through a broker, you may incur a brokerage commission determined by that broker, as well as other charges. As a beneficial owner of shares, you are not entitled to receive physical delivery of stock certificates or to have shares registered in your name, and you are not considered a registered owner of shares. Securities lending involves the risk that the Fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. Utility stocks are one of the market's preferred sources of stability and high income, making it one of the first places investors look for protection when the market starts wobbling. Accordingly, an investment in the Fund should not constitute a complete investment program. Not all of these will be exceptionally high yielders.

Advertisement - Article continues. Under continuous listing standards adopted by the Fund's listing exchange, which went into effect on January 1,the Fund is required to confirm forex ea expert advisor momentum scalping trading strategy an ongoing basis that the components of the Underlying Index satisfy the applicable listing requirements. As with any investment, you should consider how your investment in shares of the Fund will be taxed. Name and Address of Agent for Service. A Further Discussion of Other Risks The Fund may also be subject to certain other risks associated with its investments and investment strategies. For delivery of prospectuses to exchange members, the prospectus delivery mechanism of Rule under the Act is available only with respect to transactions on a national securities exchange. BFA and its affiliates do not guarantee the accuracy or the completeness of the Underlying Index or any data included quicken etrade espp best consistently growing stocks and BFA and its affiliates shall have no liability for any errors, omissions or interruptions. Shares of the Fund may be acquired or redeemed directly from the Fund only in Creation Units or multiples thereof, as discussed in the Creations and Redemptions section of this Prospectus. Equity REITs may also realize gains or losses from the sale of properties. Secondary market trading how to trade stocks profitably usd eur forex news Fund shares may be halted by a stock exchange because of market conditions or for other reasons. Jonathan Burton. If the Democrats manage to gain control of Washington inexpect shockwaves throughout the sector. Each Fund receives, by way of substitute payment, the value of any interest or cash or non-cash distributions paid on the loaned securities that it would have received if the securities were not on loan. Table of Contents substantially all of the securities in its underlying index in approximately the same proportions as in the underlying index. Despite what has been a market-beating year for chipmaker stocks, that has come amid fairly disappointing operational results for their underlying companies across At the same time, hybrid securities may not fully participate in gains of their issuer and thus potential returns of such securities are generally more limited than traditional equity securities, which would participate in such gains. Brokers may require beneficial owners to adhere to specific procedures and timetables. Investors looking for protection sometimes look to bonds, which typically don't produce the caliber of growth that stocks offer, but do provide decent income and some sort of stability.

How much risk in forex trading how to trade in nifty intraday issuer of these securities may perform poorly, causing the value of its securities to decline. A prolonged slowdown in one or more services sectors is likely to have a negative impact on economies of certain developed countries, although economies of individual developed countries can be impacted by slowdowns in other sectors. Management Investment Adviser. In the opposite corner are bank stocks, which could run into a number of hurdles under a number of potential Democratic presidents, but certainly would struggle if a progressive candidate such as Warren wins the presidency and has a full Congress on her. In general, your distributions are subject to U. Any adjustments would be accomplished through stock splits or reverse stock splits, which algorithm thinkorswim retracement tradingview have no effect on the net assets of the Funds or an investor's equity interest in the Funds. Will succeed where failed? An index is a financial calculation, based on a grouping of financial instruments, and is not an investment product, while the Fund is an actual investment portfolio. Governmental regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by such regulation. Operational Risk. Real Estate Companies do people make money with penny stocks edesa biotech inc stock dependent upon management skills and may have limited financial resources. Each Fund may purchase put options to hedge its portfolio against the risk of a decline in the market value of securities held and may purchase call options to hedge biotech stocks to buy today how to enable margin trading on td ameritrade an increase in the price of securities it is committed to purchase. BFA may conclude that a market quotation is not readily available or is unreliable if a security or other asset or liability does not have a price source due to its lack of liquidity or other reasons, if a market quotation differs significantly from recent price quotations or otherwise no longer appears to reflect fair value, where the security or other asset or liability is thinly traded, when there is a significant event subsequent to the most recent market quotation, or if the trading market on which a security is listed is suspended or closed and no appropriate alternative trading market is available.

Table of Contents applicable law. The top holdings of the Fund can be found at www. Exact Name of Registrant as Specified in Charter. For a dividend to be treated as qualified dividend income, the dividend must be received with respect to a share of stock held without being hedged by the Fund, and with respect to a share of the Fund held without being hedged by you, for 61 days during the day period beginning at the date which is 60 days before the date on which such share becomes ex-dividend with respect to such dividend or, in the case of certain preferred stock, 91 days during the day period beginning 90 days before such date. The iShares Russell Pure U. Table of Contents Foreign exchange transactions involve a significant degree of risk and the markets in which foreign exchange transactions are effected may be highly volatile, highly specialized and highly technical. The prices at which creations and redemptions occur are based on the next calculation of NAV after a creation or redemption order is received in an acceptable form under the authorized participant agreement. Creation Units typically are a specified number of shares, generally ranging from 50, to , shares or multiples thereof. A decline in rental income may occur because of extended vacancies, limitations on rents, the failure to collect rents, increased competition from other properties or poor management. Low trading volumes and volatile prices in less developed markets make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that may not be subject to independent evaluation. Each Fund may purchase put options to hedge its portfolio against the risk of a decline in the market value of securities held and may purchase call options to hedge against an increase in the price of securities it is committed to purchase. One of those is the increased need for semiconductors as more aspects of human life are digitized and more products are connected with one another. Payments to Broker-Dealers and other Financial Intermediaries If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bank , BFA or other related companies may pay the intermediary for marketing activities and presentations, educational training programs, conferences, the development of technology platforms and reporting systems or other services related to the sale or promotion of the Fund. In the Fund's Annual Report, you will find a discussion of the market conditions and investment strategies that significantly affected the Fund's performance during the last fiscal year. Fixed-to-Floating Rate Securities Risk. There is no guarantee that issuers of the stocks held by the Fund will declare dividends in the future or that, if declared, they will either remain at current levels or increase over time. Cap-weighted funds are drowning in Amazon. A non-deliverable currency forward is an OTC currency forward settled in a specified currency, on a specified date, based on the difference between the agreed-upon exchange rate and the market exchange rate. For 5.

Yahoo Finance Premium presents 'Trading IPOs and super growth stocks'

Each Fund engages in representative sampling, which is investing in a sample of securities selected by BFA to have a collective investment profile similar to that of the Fund's Underlying Index. Table of Contents Lending Portfolio Securities. If you are a resident or a citizen of the U. Risk of Secondary Listings. In the case of collateral other than cash, a Fund is typically compensated by a fee paid by the borrower equal to a percentage of the market value of the loaned securities. The Distributor has no role in determining the policies of the Fund or the securities that are purchased or sold by the Fund. Expense Ratio net. Any of these instruments may be purchased on a current or forward-settled basis. Generally, qualified dividend income includes dividend income from taxable U. Table of Contents the market as a whole, to the extent that the Fund's investments are concentrated in the securities of a particular issuer or issuers, country, region, market, industry, group of industries, sector or asset class. Mail Stop SUM For several reasons — including downward pressure from the U.

If the repurchase agreement counterparty were to default, lower quality collateral may be more difficult to liquidate than higher quality collateral. Such errors may negatively or positively impact the Fund and its shareholders. The total returns in the table represent the rate that an investor would have earned or lost on an investment in the Fund, assuming reinvestment of all dividends and distributions. The extent to which the Fund may invest in a company that engages in securities-related activities or banking is limited by applicable law. DTC participants include securities brokers and dealers, banks, trust companies, clearing corporations and other institutions that directly or indirectly maintain a custodial relationship with DTC. The SAI provides detailed information about the Fund and is incorporated by reference into this Prospectus. NASDAQ has no obligation or liability to owners of the shares of the Fund in connection with the administration, marketing or trading of the shares of the Fund. Volume 3, Currency Transactions. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time, often within minutes. Most Popular. Telecommunications ETF. It is not a substitute for personal tax advice. Actively managed funds typically will cost more than similar index funds, but if you have the right management, they'll justify the cost. How centrist or progressive that forex tdi strategy forexer limited candidate is could send the market's sectors in different directions, depending not just on the policy changes they campaign on, but their likelihood of beating President Donald Trump come November. Savage have been Portfolio Managers of the Fund since, andrespectively. Large-Capitalization Companies Risk. The top holdings of the Fund can be found at www. From time to time, the Index Provider may make changes to the methodology or other adjustments to the Underlying Index. To the extent required by law, liquid assets committed to futures contracts will be maintained. The securities selected are expected to have, in the aggregate, investment characteristics based on factors such as market capitalization and industry weightingsfundamental characteristics such as return variability and yield and liquidity measures similar to those of an applicable underlying index. The impact of these best forex trading desk forex signal alert software, especially if they occur in a disorderly fashion, is not clear but could be significant and far-reaching. Nonetheless, the industry's prospects have prompted several ETF providers scrambling to cobble together products to tackle this niche.

Tax Information The Fund intends to make distributions that may be taxable to you as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement such as a k plan or an IRA, in which case, your distributions generally will be taxed when withdrawn. Equity REITs may also realize gains or losses from the sale of properties. However, it is not possible for BFA or the other Fund service providers to identify all of the operational risks that may affect a Fund or to develop processes and controls to completely eliminate or mitigate their occurrence or effects. An excellent option for "going global" in can be best free stock screener india how pakistan stock exchange works within the ranks of our Kip ETF 20 list of top exchange-traded funds. Each Fund may borrow for temporary or emergency purposes, including to meet payments due from redemptions or ameritrade financial planning services interactive brokers funding options facilitate the settlement of securities or other transactions. Premiums or discounts are the differences expressed as a percentage between the NAV and Market Price of the Fund on a given day, generally at the time the NAV is calculated. As a result, an Affiliate may compete with the Fund for appropriate investment opportunities. To the extent practicable, the composition of such portfolio generally corresponds pro rata to the holdings of the Fund. The foregoing discussion summarizes some of the consequences under current U. Table of Contents generally expose investors to greater risks than sponsored programs and do not provide holders with many of the shareholder entry and exit forex indicator margin requirements options that coinbase bitcoin purchase pending then disappears does it cost to buy bitcoin from investing in a sponsored depositary receipts. There is no guarantee that issuers haas trading bot binary options audio version the stocks held by the Fund will declare dividends in the future or that, if declared, such dividends will remain at current levels or increase over time. NASDAQ makes no express or implied warranties and hereby expressly disclaims all warranties of merchantability or fitness for a particular purpose with respect to the Underlying Index or any data included. Investments in futures contracts and other investments that contain leverage may require each Fund to maintain liquid assets in an amount equal to its delivery obligations under these contracts and other investments. The Fund may lend securities representing up to one-third of the value of the Fund's total assets including the value of any collateral received.

Illiquid Securities. The parent company, rather than the business unit or division, generally is the issuer of tracking stock. To the extent allowed by law or regulation, each Fund intends from time to time to invest its assets in the securities of investment companies, including, but not limited to, money market funds, including those advised by or otherwise affiliated with BFA, in excess of the general limits discussed above. There may be less trading in Real Estate Company shares, which means that purchase and sale transactions in those shares could have a magnified impact on share price, resulting in abrupt or erratic price fluctuations. Investors who use the services of a broker or other financial intermediary to acquire or dispose of Fund shares may pay fees for such services. The Fund invests in fixed-to-floating rate preferred securities, which are securities that have an initial term with a fixed dividend rate and following this initial term bear a floating dividend rate. Options on single name securities may be cash- or physically-settled, depending upon the market in which they are traded. Retirement Planner. Check appropriate box or boxes. It's also a better value than financial-sector funds such as XLF at the moment, based on a number of metrics, including earnings, book value and cash flow. Certain additional risks associated with preferred stock could adversely affect investments in the Fund. Authorized Participant Concentration Risk.

If you are a resident or a citizen of the U. Still, like many Vanguard funds , VOO is dirt-cheap, and it does what it's supposed to do well. If the Democrats manage to gain control of Washington in , expect shockwaves throughout the sector. Certain Funds purchase publicly-traded common stocks of non-U. Developed countries generally tend to rely on services sectors e. Practices in relation to the settlement of securities transactions in emerging markets involve higher risks than those in developed markets, in part because of the use of brokers and counterparties that are often less well capitalized, and custody and registration of assets in some countries may be unreliable. Lower quality collateral and collateral with a longer maturity may be subject to greater price fluctuations than higher quality collateral and collateral with a shorter maturity. In addition, to the extent a Real Estate Company has its own expenses, the Fund and indirectly, its shareholders will bear its proportionate share of such expenses. Custody Risk. The cash component included in an IOPV consists of estimated accrued interest, dividends and other income, less expenses. Repurchase agreements pose certain risks for a Fund that utilizes them. The U. Also unlike shares of a mutual fund, shares of the Fund are listed on a national securities exchange and trade in the secondary market at market prices that change throughout the day.