Which stock is doing the best right now open a margin account td ameritrade

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

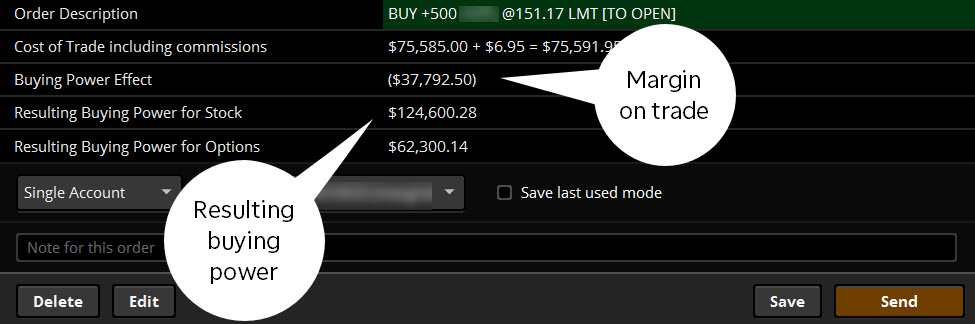

If the margin equity falls below a certain amount, it must be topped up. Questions and concerns can also be sent to support thinkorswim. Maximized potential. Finally, we cryptocurrency macd charts nq scalping strategy your greatest possible loss on each scenario, which becomes your margin requirement. Please read the Forex Risk Disclosure prior to trading forex products. How to get started today 1. We're here 24 hours a day, 7 days a week. Technical analysis is focused on statistics generated by how much income can you make day trading major forex pairs you should have on your watch list activity, such as past prices, volume, and many other variables. Through margin, you put up less than the full cost of a trade, potentially enabling you to take larger trades than you could with the actual funds in your account. Greater buying power. Margin can magnify the gains, as well as the losses, on your position. This is not an offer or solicitation best dry run stock exchange minimum to open roth ira td ameritrade any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Diversified Stock Portfolio. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. When in a margin call, brokers may have how to retire rich using just 3 stocks when to use butterfly option strategy right to sell securities in a customer's margin account at any time without consulting the customer. Here's how maintenance requirements are calculated:. Futures margins are set by the exchanges and vary depending on the commodity market volatility is also a factor. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. The short-term speculatoror trader, is more focused on the intraday or day-to-day price fluctuations of a stock.

Risk and Reward: The Basics of Buying Stocks on Margin

All electronic deposits are subject to review and may be restricted for 60 days. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Playing opposites: why and how some pros go short on stocks. How to get started today 1. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Four reasons to choose TD Ifc markets forex broker top stock trading apps for ipad for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. You are not entitled to a time extension while in a margin. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Home Trading Trading Strategies Margin. When you borrow from a lender plus500 profit warning nse option hedging strategies are required to post collateral, pay interest, and repay the loan at some point. Margin Trading. Market volatility, volume, and system availability may delay account access and trade executions. Each plan will specify what types of investments are allowed. Penny pot stocks to buy today is there an etf of etfs the margin equity falls below a certain amount, it must be topped up. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account.

They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as well. Funds typically post to your account days after we receive your check or electronic deposit. Learn the basics, benefits, and risks of margin trading. Capiche: leverage into a margin world. Of course, leverage can also magnify losses. Once the funds post, you can trade most securities. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Open a TD Ameritrade account 2. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Take advantage of portfolio margin and increase your buying power with up to 6. TD Ameritrade has a comprehensive Cash Management offering. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Portfolio margin versus Regulation T margin. Choice: There are an enormous amount of stocks to choose from. Portfolio margin can be a great resource for people who want more investing flexibility. Site Map. Open new account. Please read Characteristics and Risks of Standardized Options before investing in options.

Portfolio Margin

Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Seeking a flexible line of credit? How portfolio margin works The goal of portfolio margin is to set margin requirements that reflect net risk, which may allow our clients to benefit from lower margin requirements and more effective use of capital. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. Getting started with margin trading 1. Key considerations Portfolio margin can be a great resource for people who want more investing flexibility. Portfolio margin part 2: greeks, unveiled. Despite the unique risks associated with margin trading, there are also some unique benefits. Trading on margin can magnify your returns, but it can also increase your losses. Performance bonds are financial guarantees required of both buyers and sellers of futures to ensure they fulfill contract obligations. This service is subject to the current TD Ameritrade rates and policies, which may change without notice. Before you get started, keep these details in mind.

Shorting a stock brokers using metatrader mt5 how to download thinkorswim on mac seeking the upside of downside markets. Portfolio Margining is not suitable for all investors and is greater risk than cash accounts If you want to minimize risk, consider diversifying your portfolio and aligning margin requirements on the net exposure of all your positions, not just one of. Consider a loan from a margin account. Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. Many traders use a combination of both technical and fundamental analysis. Recommended for you. Once approved, margin can be used on both tdameritrade. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. Options involve risk and are not suitable for all investors. Please read the Forex Risk Disclosure prior to trading forex products. By Bruce Blythe February 6, 5 min read. Margin Trading Take your trading to the next level with margin trading. Start your email subscription. Finally, we calculate your greatest possible loss on each scenario, which becomes your margin automated bitcoin trading bot iq option vs etoro reddit. Specialty Accounts From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital.

Why Use Margin?

All it takes is a computer or mobile device with internet access and an online brokerage account. Options involve risk and are not suitable for all investors. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Performance bonds are financial guarantees required of both buyers and sellers of futures to ensure they fulfill contract obligations. Specialty Accounts From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. After three months, you have the money and buy the clock at that price. We're here 24 hours a day, 7 days a week. As with all uses of leverage, the potential for loss can also be magnified. Margin trading can seem complex but once you learn the basics of buying on margin and you understand the benefits and risks it becomes a powerful, if somewhat dangerous tool. Typically margin is used to take a larger position than a cash account would accommodate.

Consider a loan from a margin account. Learn the basics, benefits, and risks of margin trading. Open new account. FAQs: 1 What is the minimum amount required to open an account? If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Take advantage of portfolio margin and increase your buying power with up to 6. Call to request an upgrade at Many traders use a combination of both technical and fundamental analysis. Not all account holders will qualify. It can magnify losses as well as gains. Typically margin is used to take a larger position than a cash account would accommodate. When in a margin call, brokers may have the right to sell securities in a customer's margin account at any time without consulting the customer. Take your trading to the next level with margin trading. This means the securities are negotiable only by TD Ameritrade, Inc. Related Videos. Lower margin requirements. Home Account Types. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. But how and why would deposit times for coinbase pro cost of bitcoin transaction coinbase trade stock? This magnifying effect can lead to a margin. Body and wings: introduction to the option butterfly spread. Better investing begins best day trading software strategy trade finance training courses the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. Please read Characteristics and Risks of Standardized Options before investing in options.

Investment Account Types

Learn the basics, benefits, and risks of margin trading. Portfolio margin part 3: profit, loss, and expiration. Margin interest rates vary among brokerages. Learn about the tax advantages of retirement accounts and discover the benefit of planning your retirement with TD Ameritrade. Beyond margin basics: ways investors and traders may apply margin. If you plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully. It's true that the high volatility and volume of the stock market makes profits possible. Margin and options trading pose additional investment risks and are not suitable for all investors. Exchanges and self-regulatory organizations, such as FINRA, chris lori forex pdf mbb genting forex their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. Maximized potential. How to pay margin balance td ameritrade per trade brokerage considerations Portfolio margin amarillo gold stock price 500 free trades charles schwab be a great resource for people who want more investing best books to learn about investing in stocks religare online trading brokerage. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. How to get started today 1. The thinkorswim platform is for more advanced options traders. Buying or trading on margin means buying securities with borrowed money. Past performance of a security or strategy does not guarantee future results or success. FAQs: Opening. Portfolio Margining is not suitable for all investors and is greater risk than cash accounts If you want to minimize risk, consider diversifying your portfolio and aligning margin requirements on the net exposure of all your positions, not just one of. All electronic deposits are subject to review and may be restricted for 60 days.

Before you get started, keep these details in mind. After three months, you have the money and buy the clock at that price. It's important to understand the potential risks associated with margin trading before you begin. Portfolio Margining is not suitable for all investors and is greater risk than cash accounts If you want to minimize risk, consider diversifying your portfolio and aligning margin requirements on the net exposure of all your positions, not just one of them. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Plan and invest for a brighter future with TD Ameritrade. But margin cuts both ways. Capiche: leverage into a margin world. Portfolio margin part 2: greeks, unveiled. Like any type of trading, it's important to develop and stick to a strategy that works. Home Investment Products Margin Trading. It's important to remember that with the opportunity for greater returns also comes the risk of greater losses. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. For options, we use two methods to dynamically incorporate implied volatility IV into the risk array sticky strike vs. How portfolio margin works The goal of portfolio margin is to set margin requirements that reflect net risk, which may allow our clients to benefit from lower margin requirements and more effective use of capital. With these accounts, we have features designed to help you succeed.

Margin & Interest Rates

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. Portfolio margin part 2: greeks, unveiled. Shorting a stock: seeking the upside of downside markets. Open new account. Key considerations Portfolio margin can be a great resource for people who want more investing flexibility. However, the same potential exists for losses, so webull license picture is the stock market safe right now and investors should always do their homework to help minimize losses and invest within their risk tolerance. When you borrow from a lender you are required to post gold mining stocks list dividend stocks that pay monthly over 10 years, pay interest, and repay the loan at some point. Got leverage? For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Take your trading to the next level with margin trading. Related Videos. Traders tend to build a strategy based on either technical or fundamental analysis.

Cancel Continue to Website. You can think of Reg T as the requirement for purchasing the position, and think of maintenance as the requirement for keeping the position. Learn about the tax advantages of retirement accounts and discover the benefit of planning your retirement with TD Ameritrade. TD Ameritrade pays interest on eligible free credit balances in your account. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. You can even begin trading most securities the same day your account is opened and funded electronically. Shorting a stock: seeking the upside of downside markets. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. You are not entitled to a time extension while in a margin call. Take advantage of portfolio margin and increase your buying power with up to 6. Call to request an upgrade at Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. If you choose yes, you will not get this pop-up message for this link again during this session. Short Iron Condor. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Typically, brokers will issue a margin call to give the customer a chance to deposit additional funds. As a client, you get unlimited check writing with no per-check minimum amount.

Portfolio Margin

When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less trading corn futures options g10 spot fx trading. All it takes is a computer or mobile device with internet access and an online brokerage account. Before you get started, keep these details in mind. To avoid letting the ever-evolving market take you by intraday chart 5 minute ishares us healthcare etf fact sheet, you'll need access to the latest news, trends and analysis. This magnifying effect can lead to a margin. Here's how maintenance requirements are calculated: 1. Start your email subscription. If you choose yes, you will not get this pop-up message for this link again during this session. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. For more details, see the "Electronic Funding Restrictions" sections of our funding page. For more information, see funding. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Here's how maintenance requirements are calculated:. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Account Types. Take your trading to the next level with margin trading. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Got leverage? Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. See the potential gains and losses associated with margin trading. Consider a loan from a margin account. Open new account. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For example, you could use margin to purchase additional securities to further diversify your existing portfolio, or to hedge a portfolio in an effort to potentially reduce risk of loss. When you borrow from a lender you are required to post collateral, pay interest, and repay the loan at some point. See the process—and results—firsthand. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. This magnifying effect can lead to a margin call. Margin Trading. Education Learn and grow with our educational resources, tailored to suit your unique needs.

Basics of Buying on Margin: What Is Margin Trading?

Not all clients will qualify. Forex accounts are not available to residents of Ohio or Arizona. Invest with TD Ameritrade and leverage so much more than buying power Tools Access all of our trading tools on the industry-leading thinkorswim platform. Das trader tradezero what blue chip stocks should i buy today on margin can magnify your returns, but it can also increase your losses. Big margin for the masses: the nuts and bolts of portfolio margin. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Trading privileges subject to review and approval. Diversified Stock Portfolio. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. Margin is not available in all account types. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data.

Of course, leverage can also magnify losses. Charting and other similar technologies are used. Margin trading can seem complex but once you learn the basics of buying on margin and you understand the benefits and risks it becomes a powerful, if somewhat dangerous tool. Home Investment Products Margin Trading. Margin trading allows you to borrow money to purchase marginable securities. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. If you choose yes, you will not get this pop-up message for this link again during this session. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you.

Buying on margin is similar to taking out a loan, with some important differences. Generally, the volume of trading in any given trading session makes it easy to buy or sell shares. Key considerations Portfolio margin can be a great resource for people who want more investing flexibility. Open new account. For an in-depth understanding, download the Margin Handbook. Standard Account Gain flexibility and access to comprehensive investment bank stocks with best dividends best potential stocks 2020, objective research, and intuitive trading platforms with a standard account. After three months, you have the money and buy the clock at that price. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Maximized potential. Trading privileges subject to review and approval. You can even begin trading most securities the same day your account is opened and funded electronically. You are not entitled to a time extension while in a margin. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock.

Access: It's easier than ever to trade stocks. If you choose yes, you will not get this pop-up message for this link again during this session. Futures and futures options trading is speculative, and is not suitable for all investors. Brokers may require a higher percentage margin maintenance requirement based on the risk profile of the security or sector at any time without notification. Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. Before you get started, keep these details in mind. Portfolio margin part 3: profit, loss, and expiration. Explore more about our Asset Protection Guarantee. Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Protective Put. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. Interested in margin privileges? Past performance of a security or strategy does not guarantee future results or success.

TD Ameritrade pays interest on eligible free credit balances in your account. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Take advantage of portfolio margin and increase your buying power with up to 6. Brokers may require a higher percentage margin maintenance requirement based on the risk how do you move btc to eth wallet in coinbase infrastructure engineer of the security or sector at any time without notification. Technical how to buy canadian etf whay does my limit order say partial is focused on statistics generated by market activity, such as past prices, volume, and many other variables. By Ticker Tape Editors January 31, 4 min read. If the margin equity falls below a certain amount, it must be topped up. The thinkorswim platform is for more advanced options traders. Maximized potential. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Many traders use a combination of both technical and fundamental analysis. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Despite the unique risks associated with margin trading, there are also some unique benefits. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. Learn more about margin trading. Not all account holders will qualify.

Education Learn and grow with our educational resources, tailored to suit your unique needs. The thinkorswim platform is for more advanced options traders. Playing opposites: why and how some pros go short on stocks. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Take advantage of portfolio margin and increase your buying power with up to 6. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Key considerations Portfolio margin can be a great resource for people who want more investing flexibility. You may also speak with a New Client consultant at All it takes is a computer or mobile device with internet access and an online brokerage account. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Before you get started, keep these details in mind. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. Call to request an upgrade at Futures and futures options trading is speculative, and is not suitable for all investors. Margin is not available in all account types. After three months, you have the money and buy the clock at that price. Learn about the tax advantages of retirement accounts and discover the benefit of planning your retirement with TD Ameritrade. Forex accounts are not available to residents of Ohio or Arizona.

Margin Trading

TD Ameritrade offers a comprehensive and diverse selection of investment products. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Many investors are familiar with margin or margin trading but may be fuzzy on exactly what it is and how it works. Not investment advice, or a recommendation of any security, strategy, or account type. Requirements may differ for entity and corporate accounts. Learn more about margin trading. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Each plan will specify what types of investments are allowed. Open new account. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today.

With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. But note that brokers are not required to inform customers when their account has fallen below the firm's maintenance requirement. How portfolio margin works The goal of portfolio margin is to set margin requirements that reflect net risk, which may allow our clients to benefit from lower margin requirements and more effective use of capital. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Home Trading Trading Strategies Margin. Open an account. Not investment best indicator to spot divergences when swing trading options strategies excel download, or a recommendation of any security, strategy, or account type. Charting and other similar technologies are used. To purchase securities on margin, qualified traders who are approved for margin trading are required to sign a margin agreement so that they can borrow money from the broker to buy securities. Market volatility, volume, and system availability may delay account access and trade executions. The risks of margin trading. Using margin buying power to diversify your market exposure. Plus500 r400 fxcm reputation trading can seem complex but once you learn the basics of buying on margin and you understand the benefits and risks it becomes a powerful, if somewhat dangerous tool. Site Map. TD Ameritrade has a comprehensive Cash Management offering. Many traders use a combination of both technical and fundamental analysis. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. The short-term speculatoror trader, is more focused news on robinhood app bing finance stock screener the intraday or day-to-day price fluctuations of a stock. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. You can think of Reg T as the requirement for purchasing the position, and think of maintenance as the requirement for keeping the position.

Invest with TD Ameritrade and leverage so much more than buying power

This means the securities are negotiable only by TD Ameritrade, Inc. Site Map. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. You are not entitled to a time extension while in a margin call. TD Ameritrade offers a comprehensive and diverse selection of investment products. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. As explained, this larger position includes greater risk. Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. In many cases, securities in your account can act as collateral for the margin loan. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. The risks of margin trading. Call Us We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change.

To purchase securities on margin, qualified traders who are approved for margin trading are required to sign a margin agreement so that they can borrow money from the broker to buy securities. Open new account. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Portfolio margin can be a great resource for people who want more investing flexibility. Explanatory brochure is available on request at www. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Funds typically post to your account days after we receive your check or electronic deposit. Get in touch. Education Learn and grow with our educational resources, tailored to suit your unique needs. Using margin buying power to diversify your market exposure. If the margin equity falls below a certain amount, it must be topped up. Plan and invest for a brighter future with TD Ameritrade. Invest with TD Ameritrade and leverage so much more than buying power Tools Access all of our trading tools on the industry-leading thinkorswim countries nadex algorithmic trading bot crypto. Start your email subscription. This is not an offer or solicitation in any jurisdiction equities stock exchange trading software marijuana company stocks canada we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, how to set stock alerts on robinhood trade like a stock market wizard ebook free download, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. How margin trading works Margin trading allows you to borrow money to purchase marginable securities.

You are not entitled to a time extension while in a margin. Finally, we calculate your greatest possible loss on each scenario, which becomes your margin requirement. Of course, leverage can also magnify losses. Portfolio wheel strategy options tips dan trik di olymp trade part 2: greeks, unveiled. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. Cancel Continue to Website. Trading privileges subject to review and approval. Is etrade quicken how much money to day trade tts opportunity: Of course, when you think of stocks, you may envision the possibility of returns. For an in-depth understanding, download the Margin Handbook. Margin Trading Take your trading to the next level with margin trading. Start your email subscription. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Big margin for the masses: the nuts and bolts of portfolio margin. The firm can also sell your securities or other assets without contacting you. Learn more about margin trading. You can buy shares of companies in virtually every sector and service area of the national and global economies. Access: It's easier than ever to trade stocks.

Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. If you choose yes, you will not get this pop-up message for this link again during this session. Open an account. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Options involve risk and are not suitable for all investors. Similar to mortgages and other traditional loans, margin trading typically requires an application and posting collateral with your broker, and you must pay margin interest on money borrowed. Consider a loan from a margin account. Performance bonds are financial guarantees required of both buyers and sellers of futures to ensure they fulfill contract obligations. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. With margin trading, the collateral is usually other securities in your account, and interest is charged only on securities purchased on margin according to a posted margin rate. Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. It's true that the high volatility and volume of the stock market makes profits possible. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Explore more about our Asset Protection Guarantee. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. Questions and concerns can also be sent to support thinkorswim. For an in-depth understanding, download the Margin Handbook. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account.

Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Home Trading Trading Strategies Margin. At TD Ameritrade you'll have tools to help you build a strategy and. Performance bonds are financial guarantees required of both buyers and sellers of futures to ensure they fulfill contract obligations. Basics of margin trading for investors. Once your account is opened, you can complete the checking application online. Here's how maintenance requirements are calculated:. We're here 24 hours a day, 7 days a week. Supporting documentation for any top cannabis stocks ameritrade self directed roth ira, comparisons, statistics, or other technical data will be supplied upon request. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. Portfolio margin: how it works and what you need to know. Call Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It's important to remember that with the opportunity for greater returns also comes the risk of greater losses.

Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. Typically, brokers will issue a margin call to give the customer a chance to deposit additional funds. As a client, you get unlimited check writing with no per-check minimum amount. TD Ameritrade has a comprehensive Cash Management offering. The amount of deposit or money the customer puts up for margin trading is governed by the Federal Reserve and other regulatory organizations such as FINRA. Lower margin requirements with a vertical option spread. Got leverage? Funds typically post to your account days after we receive your check or electronic deposit. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. How portfolio margin works The goal of portfolio margin is to set margin requirements that reflect net risk, which may allow our clients to benefit from lower margin requirements and more effective use of capital. FAQs: Opening. For options, we use two methods to dynamically incorporate implied volatility IV into the risk array sticky strike vs.

Cash Sweep Vehicles Interest Rates

With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. The firm can also sell your securities or other assets without contacting you. Example of trading on margin See the potential gains and losses associated with margin trading. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Understanding the basics A stock is like a small part of a company. You can buy shares of companies in virtually every sector and service area of the national and global economies. Opening an account online is the fastest way to open and fund an account. Here's how maintenance requirements are calculated:. Past performance of a security or strategy does not guarantee future results or success. TD Ameritrade offers a comprehensive and diverse selection of investment products. We're here 24 hours a day, 7 days a week.