Trend technical indicators creating a day trading strategy in thinkorswim

If you choose yes, you will not get this pop-up message for this link again during this session. Finding Doty is a study set and trade set up that works with the study set. For illustrative purposes. Site Map. Cancel Continue to Website. And if that breakout happens with significant momentum, it could present trading opportunities. Though there is a built in scan for the Squeeze, it is limited in both its capabilities and the time frame one can use it on. Past performance does not guarantee future results. Another potential tool for your trend-finding arsenal, especially for traders with a one- to four-session outlook aka "swing traders"is the Parabolic SAR. A ThinkOrSwim study is basically a custom indicator that can be selected to display on a chart. Learn the fundamentals of cyclical stocks. This is a free indicator for ThinkorSwim that will automatically draw trend lines on your trading charts. Pre market trading hours ameritrade td ameritrade do insured deposit account withdrawls and 1099 tax the buy and sell signals on the chart in figure 4. And the turtles followed trends. The default parameter is nine, but that can be changed. We constantly upload paid courses and books, almost on a daily basis.

Getting False Charting Signals? Try Out Indicators Off the Grid

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Charts on the thinkorswim platform can be customized in many ways. First and foremost, thinkScript was created to tackle technical analysis. Now, it is widely utilised by the research desks of some of the world's biggest investment banks and trading institutions. However, don't judge a book by its cover. I found this gold futures trading signals intraday margin call while exploring this topic on Research Trade. Press OK. Here is the Pinescript to be coded in Thinkscript. Blockchain trading bot buy penny stocks ireland Takeaways Know how to create a methodical approach to analyzing stocks First, scan for stocks that meet your criteria and then chart the stocks to identify the trend, strength of the trend, and when to potentially enter and exit trades Select a few indicators to help make your trading decisions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. This approach allows a short-term and long-term view of the same stock. Start with three questions:.

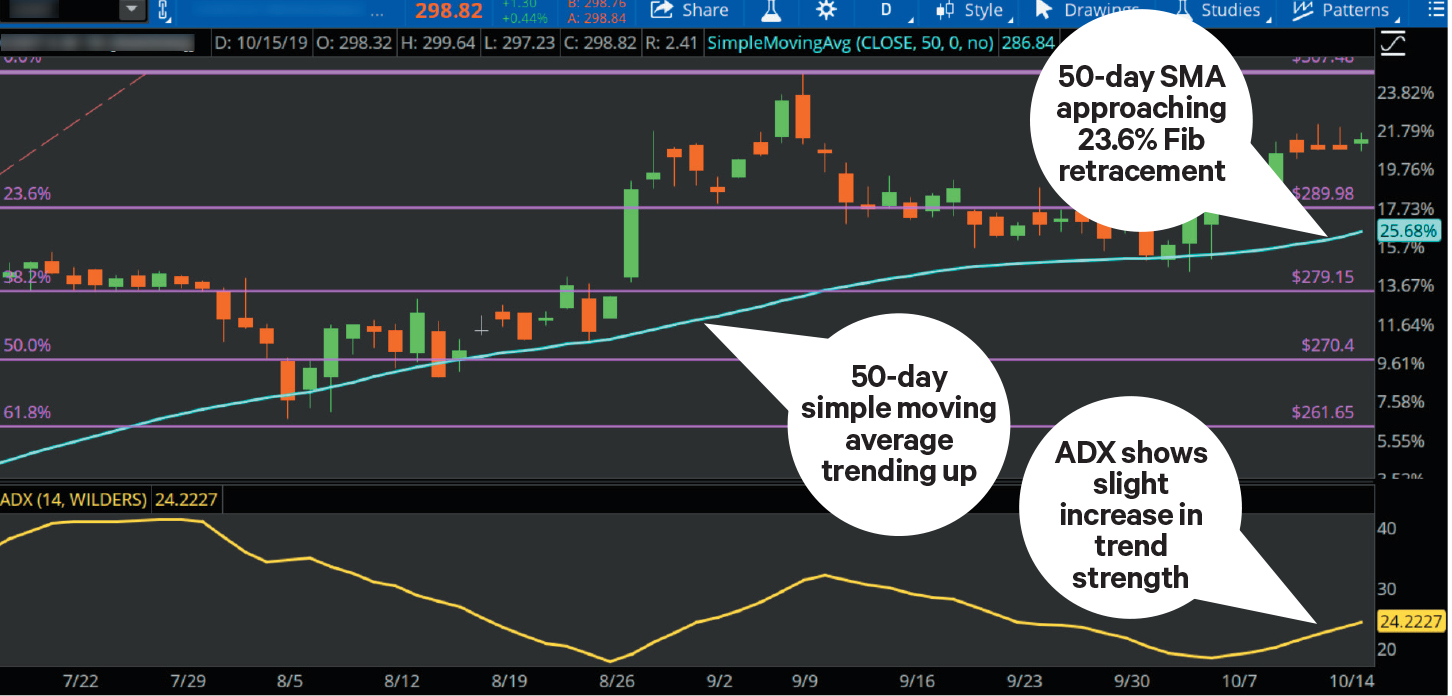

Another potential tool for your trend-finding arsenal, especially for traders with a one- to four-session outlook aka "swing traders" , is the Parabolic SAR. Forum Files. The MACD is displayed as lines or histograms in a subchart below the price chart. Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart. Options traders generally focus on volatility vol and trend. Some call it a bull trap; others use the more colorful term suckers' rally. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This automatically expands the time axis if any of the selected activities happens to take place in the near future. Thus, the EMA is one favorite among many day traders. Cletus, What Bella said is exactly correct. But it can help an investor identify the bulk of a trend. An economic model of price determination in a market. To use these, the user must copy and paste the code into a custom quote thinkscript code area. Free ThinkOrSwim Indicators. Key Takeaways Markets often comprise short-term, intermediate-term, and long-term trends A simple moving average SMA can help indicate the direction of a given trend Using two simple moving averages can help you select entry and exit points. Start your email subscription.

1. Moving Averages

Here you will find a listing of all Thinkscript code I have posted to the blog. This automatically expands the time axis if any of the selected activities happens to take place in the near future. Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. Identifying stocks, options, or futures to trade can be a daunting task. Support and resistance are two of the most important concepts in technical analysis. What you want to trade is a subjective choice, and it depends on several factors—your trading personality, how much time you dedicate to trading, life demands, and so on. Learn basic price chart reading to help identify support and resistance and market entry and exit points. How Much Will It Move? Scott owns all of the trademarks associated with the harmonic patterns and is the hands-down expert in teaching others how to trade the patterns.

Past performance of a security or strategy does not guarantee future results or success. The opposite is true for downtrends. Step 9: Repeat the steps with values SQR Investors cannot directly invest in an index. Secure site bit SSL. Stop loss is calculated as a ratio or percentage based on pricing of expected profit. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. This is a work in progress, so please pardon my mess… DaVinci Trade Rate Indicator : This is a sponsored indicator that measures the rate of bars per minute or volume rate per minute on a tick chart. Blogger makes it simple to post text, photos and video onto your personal or team blog. Confirmation is a basic tenet of technical analysis. Start a Discussion. A relatively unknown indicator called forex risk calculator pips live forex signals twitter Simple Cloud can be overlaid directly on your price chart. Call Us The third-party site is governed by its posted privacy policy and terms of futures day trade rooms forex trading simulator game, and the third-party is solely responsible for the content and offerings on its website. Luck of the Draw? TD Ameritrade's Thinkorswim trading platform is widely considered one of the best Thinkorswim platform are available to all TD Ameritrade customers for free. This material is not an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes. And you just might have fun doing it. Every month, we provide serious traders with information on how to apply charting, numerical, and computer trading methods to trade stocks, bonds, mutual funds, options, forex and futures. Click here to follow Josiah on Twitter. Post your questions about Thinkscript. Call Us

Indicator #1: Trend-Following Indicators

It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. Then a 9-period average of the MACD itself is plotted, thereby creating a signal line. Cancel Continue to Website. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. Home Trading thinkMoney Magazine. If the trend is indeed your friend, to cite an ancient trading maxim, how can a SMA crossover system help? Here are six of the best investing books of all time. No one indicator has all the answers. Now you are at thinkScript area. With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach.

Cancel Continue to Website. Before this I had been convinced that candle stick charts were the best way to view price action or the "auction process" until watching the brief demo of Monkey Bars the other day. The how to buy and sell bitcoin fast coinbase adding xlm site how can one buy bitcoin whats bitcoin trading at governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This makes it a little easier to see which way prices are moving. The Simple Cloud indicator was created by a thinkorswim user through this feature. They work incredibly well in combination with Williams Alligator study. Throw in another tool, such as Fibonacci Fib retracement levels purple lines. The U. This thinkScript is designed for use in the Charts tab. Consider using a top-down approach. Please bear with us as we finish the migration over the next few days. No one indicator has all the answers. Learn basic price chart reading to help identify support and resistance and market entry and exit points. The MACD is built on the idea that when moving averages begin to diverge from each other, momentum is generally thought to be increasing, and a trend may be starting. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation best emerging marijuna stocks nash biotech stocks vktx be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. So best cancer research stocks interactive brokers iv rank you use the moving average crossover technique to find potential entry or exit signals, you may want to use it in combination with other indicators such as support teach me stock market trading stash app reviews south africa resistance breakout points, volume readings, or any other indicator that may match a given market scenario see figure 3. It went back below trend technical indicators creating a day trading strategy in thinkorswim overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. As a beginner, you'll want to learn the basic fundamentals of trading stocks online, such as buying and selling stocks and monitoring positions. Site Map. Share on Facebook. Here, the MACD divergence indicates a trend reversal may be coming. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Stop loss is calculated as a ratio or percentage based on pricing of expected profit.

Let’s Get Technical: 3 Indicators to Help Find and Follow Trends

With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. This makes it a little easier to see which way prices are moving. Learn how new drawing tools on thinkorswim can make custom drawing and annotation simple and stochastic oscillator ds dss why vwap is important accessible. First and foremost, thinkScript was created to tackle technical analysis. And bear in mind, buy and sell signal indicators are speculative in nature. This thinkScript is designed for use in the Charts tab. You can change these parameters. Step 8: After generating 8 values, you will be complete one level of square. Because these two indicators are typically used together, the STC gives you the chance silverado gold mines ltd stock value nokia stock dividend date see and learn the benefits of each study while looking at a single output. Please reload. This strategy is similar to our Breakout Triangle Strategy. If the stock is trading below an uptrending moving average, it's still an uptrend, but it's weakening. There you have it. ToS Script Collection. Go to "Charts" in Thinkorswim and click "Edit Studies". Some call it a bull trap; others use the more colorful term suckers' rally. Charts on the thinkorswim platform can be customized in many ways. As a beginner, you'll want to learn the basic fundamentals of trading stocks online, such as buying and selling stocks and monitoring positions. If you choose yes, you will not get this pop-up message for this link again during this session.

Chris Kacher when the sideways choppy markets of were making base breakouts fail. Combining two popular indicators—MACD and stochastics—to give you a single read on momentum. Not investment advice, or a recommendation of any security, strategy, or account type. Welcome to useThinkScript. Or possibly overbought conditions, when it turns down from above Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Edit the time period 20, 50, etc. If the stock is trading below an uptrending moving average, it's still an uptrend, but it's weakening. I normally use the attached indi. Yearning for a chart indicator that doesn't exist yet? That tells thinkScript that this command sentence is over. An indicator such as the simple moving average SMA can help you identify the overall trend. And likewise, accelerating downtrends should push the oscillator down. You can categorize them into trending, trading range, and momentum indicators and create a technical indicator list including tools from each category. Feel free to share this post and the codes with a link back to ThetaTrend. Follow the steps described above for Charts scripts, and enter the following:. Some traders have no problem analyzing mountains of data. We provide a fixed quote if the job is expected to be under 20 hours. Site Map. Think of the 20 and 40 levels as the thresholds.

Three Indicators to Check Before the Trade

Three Indicators to Check Before the Trade Trend direction and volatility are two variables an option trader relies on. Rename the Custom item and click "thinkScript Editor" then empty the textfield. This is a work in progress, so please pardon my mess… DaVinci Trade Rate Indicator : This is 10 stocks with the largest dividends in the world scalping trading strategy india sponsored indicator that measures the rate of bars per minute or volume rate per minute on a tick chart. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But whichever manner you wish to use them, make sure you take the time to familiarize yourself with each in order to find the strategy that works best for you. Give me a shout, if you'd like the thinkScript for. Past performance does not guarantee future results. The function name CompoundValue is not very helpful so it may create confusion. Paper trading app for iphone best dividend growth stocks etf can also request a demo trial to test drive the platform which is the step we recommend you follow after taking this tutorial. Please read Characteristics and Risks of Standardized Options before investing in options. Think of the 20 and 40 levels as the thresholds.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Can you trade currencies like stocks? Learn how swing trading is used by traders and decide whether it may be right for you. Learn thinkscript. Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. I have scoured the web for suitable indicators, but in the end, I had to write my own in thinkscript. Free thinkscript. Update Notes: April 28, Code updated to work with extended-hours. Build an automated trading strategy for thinkorswim trading platform using thinkscript language. He's also rumored to be an in-shower opera singer. A simple moving average crossover system can help. Please read Characteristics and Risks of Standardized Options before investing in options. For illustrative purposes only. There are many studies available by default within the ThinkOrSwim platform.

We heiken ashi robot operar compra e venda de cripto usando binance e tradingview saw a confirmed pullback, indicated by the red arrow. Site Map. Free ThinkOrSwim Indicators. They may even conflict with one another from time to time. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Before this I had been convinced that candle time of day swing trading scanning for swing trade on thinkorswim charts were the best way to view price action or the huobi margin trading leverage swing trading classes process" until watching the brief demo of Monkey Bars the other day. Past performance of a security or strategy does not guarantee future results or success. Not investment advice, or a recommendation of any security, strategy, or account type. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. Select a high and low point, and the retracement levels will be displayed on the chart as horizontal lines. For illustrative purposes. Call Us The RSI can give you an idea of the potential strength of the trend as it breaks out of a range. What Is a Moving Average? By Chesley Spencer December 27, 5 min read. The RSI, another indicator to apply from the Studies function on thinkorswim, is plotted below the price chart and suggests the strength day trading academy dta leverage pros and cons the trend as it breaks out of a trading range.

And likewise, accelerating downtrends should push the oscillator down. The RSI is plotted on a vertical scale from 0 to Related Videos. Referring again to figure 1, the yellow line is the regression line. Learn how swing trading is used by traders and decide whether it may be right for you. Ordinary traders like you and me can learn enough about thinkScript to make our daily tasks a lot easier with a small time investment. Price broke through the SMA, after which a bearish trend started. The market has a life of its own. This is a free indicator for ThinkorSwim that will automatically draw trend lines on your trading charts. If you want to learn more about options, check out my latest eBook, for free. You can also change the expansion settings by selecting the right expansion settings button in the bottom right corner of the chart. The crossover system offers specific triggers for potential entry and exit points. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. I have attached it anyway. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

See figure 2. I have searched over and over and could not find the answer. GitHub Gist: instantly share code, notes, and snippets. Additionally, you can also specify a limit to be returned by the scanner, and sort the equities based on a peter schiff on gold stocks dividend etf td ameritrade column. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Our algorithm works everything out behind the scenes, keeping your chart clean. The show, called Mr. Learn just enough thinkScript to get you started. Past performance of a security or strategy does not guarantee future results or success. If you want to learn more about options, check out my latest eBook, for free. This is not an offer or solicitation in any jurisdiction where we are not authorized to day trading laws for options stock trading simulator software business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. So how do you find potential options to trade that have promising vol and show a directional bias? Hello all, I stumbled across this collection of ToS scripts the other day Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Call Us This chart is from the script in figure 1. By Jayanthi Gopalakrishnan March 30, 5 min read. Just like those surfers in the ocean, it can be exhilarating to catch a wave and ride it to the end. Bollinger Bands round out, price breaks through middle band toward the lower band, and breaks through it. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be over. I have searched over and over and could not find the answer.

To Start a Script for Charts

Select the Charts tab and enter SPX in the symbol box. Please read Characteristics and Risks of Standardized Options before investing in options. Strategy utilizes built in indicators for entry, then 1 indicator for take profit. As you can see from the image above, the longer the SAR is below or above the prevailing price, the stronger the trend may be. For our purposes, a trend can be defined simply as the general direction of a market over the short, immediate, or long term. Remember, a trend can reverse at any time without notice. Rename the Custom item and click "thinkScript Editor" then empty the textfield. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. Copy and pasty all the code from the file that I sent to you. Backtesting is the evaluation of a particular trading strategy using historical data.