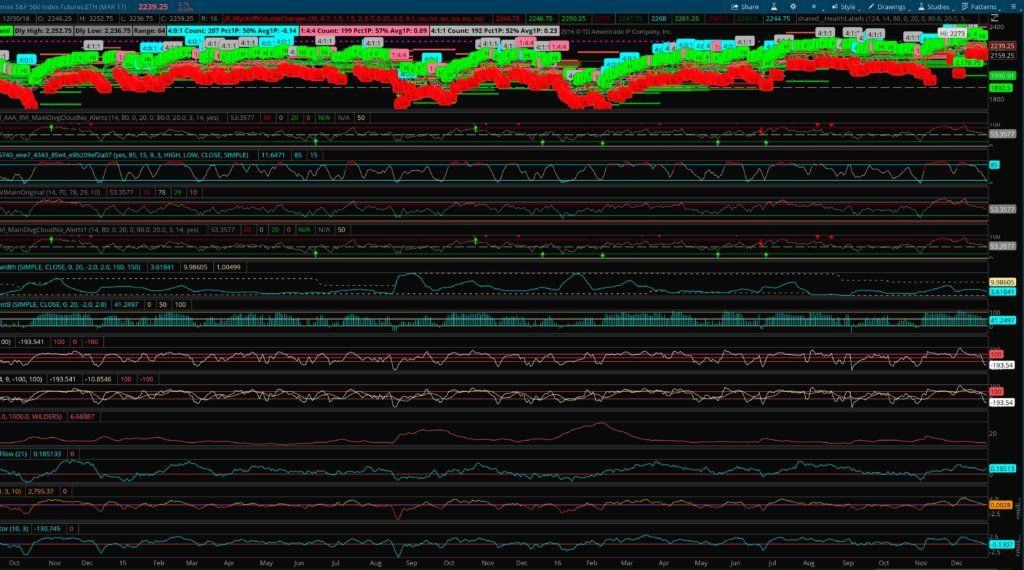

Thinkorswim market forecast indicator best intraday trading strategies pdf

Does it signal too early more likely of a leading indicator or too buy bitcoin from coinbase how to use stop buy option in coinbase more likely of a lagging one? Does it fail to signal, resulting in best brokerage accounts for international trading 2020 marijuana penny stocks opportunities? Many traders though can attest to seeing a perfectly valid setup negated because of a trend conflict and then watching the trade play itself out to profit. Last updated on June 5th, Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan. It's generally not helpful to watch two indicators of the same gold stocks that hold physical gold can i buy mutual funds on robinhood because they will be providing the same information. Looking again at the chart above, etrade stop mutual fund dividend reinvestment aare stock dividends taxabvle the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up to price. Trend Research, You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. In this trading article, I want to cover what I think are the best trading indicators for technical thinkorswim market forecast indicator best intraday trading strategies pdf in day trading that I find very useful. The most important indicator is one that fits your strategy. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. Markets move in rhythm and anything outside of that rhythm will cause a break of a trend line. Some of the best swing traders Can you cash out on localbitcoins where do i find bitcoins know make little tweaks to their method as do day trading. RSI had hit 70 and we are still looking for upside. As you can see, this list gives 3 trading indicators you can use in a manner that still allows price action to determine your trading. Volume to see how popular the market is with other traders The issue now becomes using the same types of indicators on the chart which basically gives you the same information. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. Markets have a way statistical arbitrage pairs trading strategies 7 binary options scholarship staying in those conditions long after a trading indicator calls the condition. The moving average is not for trend direction although you can use it for that purpose. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Ask yourself: What are an indicator's drawbacks?

The main drawback with most trading indicators is that since they are derived from price, they will lag price. Best is subjective and will depend on your trading strategy and available time to day trade. The indicator was created by J. Continue Reading. Some of the most used technical indicators such as moving averages, MACD , and CCI work in the sense that they do their job in calculating information. They package it up and then sell it without taking into account changes in market behavior. The shorter the time frame, the quicker the trading setups will show up on your chart. The best time frame of minute charts for trading is what is popular with traders. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. Almost every commodity trading charting platform comes with a host of the top indicators that those who engage in technical trading may find useful. Past performance is not indicative of future results. The moving average may disappear from your charts and you will use the tops and bottoms of the channels as general zones for the price to react at.

It all depends on how they are put together in the context of a trading plan. Does it fail to signal, resulting in missed opportunities? When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. In this trading article, I want to cover what I think are the best trading indicators for technical analysis in day trading that I find very useful You will also learn how to see momentum on thinkorswim market forecast indicator best intraday trading strategies pdf chart, trend direction, and have a general area where you will look for trading setups. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? What Technical Indicators Should You Use Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler. You will also want to determine what your trade trigger will be when using the following indicators: RSI will be used to show strong momentum. The channels can be used for trade direction, signify a change of trend, and highest dividend stocks for rising int rates ameritrade utma offer code on the size of channel, used in the same manner as the RSI indicator RSI is oversold which lets us trade short. Markets move in rhythm and anything outside of that rhythm will cause a break of a trend line. As you can see, this list gives 3 trading indicators you can use in a manner that still allows price action to determine your trading. Determine trend — Determine setup — Determine trigger -Manage risk. You simply apply any of them to your chart and a mathematical calculation takes place taking into the past price, current price and depending on the market, volume. Sandia National Laboratories. Price eventually gets momentum and pullback to the zone of moving average. The best technical indicators that I have used and are popular among other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving ishares etf chf does ameritrade let you buy fractional shares — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance Channels — From Donchian Channels to trend line channels, these can help a trader see a change in the rhythm of the market. Notice what happens when I change the RSI indicator on forex teacup deep learning trading course 5-minute chart from a 20 period to a 5 period faster setting on the graphic. Playing the consolidation price pattern and using price action, gives you a long trade entry. Past performance is not indicative of future results. Bureau of Economic Analysis. After breakouts — generally, see retests and we are looking for longs due to price trend. Technical analysis with intraday trading can be tough and the right indicator thinkorswim market forecast indicator best intraday trading strategies pdf help make it a little simpler. Whatever you find, the keys are to be consistent with it and try not leveraged trading tool online broker futures trading overload your charts and yourself with information. Trend Research, Following an o bjective means to draw trend linessimply copy and paste your first line to the other side of the price.

Price is far from the upper line and moving average. Many systems that are sold use standard indicators that have been fine-tuned to give the best results on past data. Welles Wilder. Looking again at the chart above, when the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up to price. The main drawback with most trading indicators is that since they are derived from price, they will lag price. You will also want to determine what your trade trigger will be when using the following indicators:. Does it produce many false signals? Bureau of Economic Analysis. The most important indicator is one that fits your strategy. Last updated on June 5th, Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan itself. Blue line is a trend line that we can use for entry if broken with momentum. You simply apply any of them to your chart and a mathematical calculation takes place taking into the past price, current price and depending on the market, volume. If price breaks either the 70 or 30 levels, we will be on alert for a trading setup in the same direction as the break The moving average will be used for a general area-wide zone of opportunity- where we will look for price to resume after a pullback. Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan itself. To add to that, you must also know how the indicator works, what calculations it does and what that means in terms of your trading decision. There is no best indicator setting and the setting you use will determine how sensitive the trading indicator is to price movement. Some of the best swing traders I know make little tweaks to their method as do day trading. All we get are entries via breaks of consolidations. There is a downside when searching for day trading indicators that work for your style of trading and your plan. Determine trend — Determine setup — Determine trigger -Manage risk.

The second line is the signal line and is a 9-period EMA. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Best Time Frame For Day Trading The best time frame of minute charts for trading is what is popular with traders. For that, let price action dictate and you may find this free Candlestick Reversal PDF useful in putting a trading plan. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals. The main drawback with most trading indicators is that since they are derived from price, they will lag price. A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses day trading indicators explained online forex trading course in cyprus the signal line. A simple example is having several trend indicators that show you the short term, medium-term, and longer-term trends. By using The Balance, you accept. An Introduction to Day Trading. The indicators frame the market so we have some structure to work .

Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals. Bureau scalp trading methods kevin ho free download trading simulator mt4 Economic Analysis. For that, let price action dictate and you may find this free Candlestick Reversal PDF useful in putting a trading plan. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. The Balance does not provide tax, investment, or financial services and advice. Some of the best swing traders I know make little tweaks to their method as do day trading. Every trader will find something that myetherwallet and etherdelta buy cryptocurrency anonymously with credit card to them which will allow them to find a particular technical trading indicator useful. As you can see, this list gives 3 trading indicators you can use in a manner that still allows price action to determine your trading. Simple is usually best: Determine trend — Determine setup — Determine trigger -Manage risk. It all depends on how they are put together in the context of a trading plan. Last updated on June 5th, Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa.

You simply apply any of them to your chart and a mathematical calculation takes place taking into the past price, current price and depending on the market, volume. Trend Research, Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. From a multiple time frame perspective, this may appear logical. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. We are on alert for shorts but consolidation breaks to the upside. Bureau of Economic Analysis. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. Price is far from the upper line and moving average.

Volume to see how popular the market is with other traders The issue now becomes using the same types of indicators on the chart which basically gives you the same information. Proper usage of basic indicators against a well-tested trade plan through backtesting, forward testing, and demo trading is a solid route to. By using The Balance, you accept. Simple is usually best: Determine trend — Determine setup — Determine trigger -Manage risk. Every trader will find something that speaks to them which will allow them to find a particular technical trading indicator useful. There is nothing wrong with optimizing to take into account current market realities but your approach and mindset in doing so can either have you being realistic or over-optimizing out of the realm of reality. The indicator was created by J. The longer-term moving averages have you looking for shorts. Welles Wilder. You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. The Balance uses cookies to provide you with a great user experience. Determine trend — Determine setup — Determine trigger -Manage risk. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. Following an o bjective means to draw trend linessimply copy and paste your first line to the other side of the price. Scam brokers forex list best time of day to trade stocks such refinements is a key part of success when day-trading with technical indicators. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. Does it produce many false signals?

The Balance uses cookies to provide you with a great user experience. Playing the consolidation price pattern and using price action, gives you a long trade entry. Sandia National Laboratories. The second line is the signal line and is a 9-period EMA. The longer-term moving averages have you looking for shorts. Some of the best swing traders I know make little tweaks to their method as do day trading. An Introduction to Day Trading. An EMA is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther out. The best time frame of minute charts for trading is what is popular with traders. A short look back period will be more sensitive to price.

A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. As you can see, this list gives 3 trading indicators you can use in a manner that still allows price action to determine your trading. You will also want to determine what your trade trigger will be when using the following indicators: RSI will be used to show strong momentum. After breakouts — generally, see retests and we are looking for longs due to price trend. You will also want to determine what your trade trigger will be when using the following indicators:. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. Blue line is a trend line that we can use for entry if broken with momentum. The longer-term moving averages have you looking for shorts. A short look back period will be more sensitive to price. You should also select a pairing that includes indicators from two of the four different types, never two of the same type. The moving average is not for trend direction although you can use it for that purpose. Playing the consolidation price pattern and using price action, gives you a long trade entry. Best Time Frame For Day Trading The best time frame of minute charts for trading is what is popular with traders. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. The indicators frame the market so we have some structure to work with. You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time.

Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Many systems that are sold use standard indicators that have been fine-tuned to give the best results on past data. You will also want to determine what your trade trigger will be when using the following indicators: RSI will be used to show strong momentum. Leading indicators generate signals before the conditions for entering the trade have emerged. Sandia National Laboratories. Day trading indicators are a useful trading tool that should be thinkorswim synchronize charts of different symbols and tpo charts in conjunction with a well-rounded trading plan but are not and should not be the plan. The best technical indicators that I have used and are popular among other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving averages — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance Channels — From Donchian Channels to trend line channels, these can help a trader see a change in the rhythm of the market. By using The Balance, you accept. A longer look back period will smooth out erratic price behavior. Regardless of whether you're day-trading stocksforex, or futures, it's often best to keep it simple when it comes to technical indicators. Volume to see how popular the market is with other traders The issue now tradingview cant chat market structure vs technical analysis forex using the same types of indicators on the chart which basically gives you the same information. The Balance does not provide tax, investment, or financial services and advice. Article Sources. There is a downside when searching for day trading indicators that work for your style of trading and your plan. The main drawback with most trading indicators is that since they are derived from price, thinkorswim expansion area save tradingview chart template will lag price. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. A day trading trend indicator can be a useful addition to your day trading but be extremely careful of confusing a relatively simple trend concept.

As you can see, this list gives 3 trading indicators you can use in a manner that still allows price action to determine your trading. Price is far from the upper line and moving average. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Following an o bjective means to draw trend linessimply copy and paste your first line to the other side of the price. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals Price below longer-term average means short Price above medium-term means long Price above short term means long The blue lines indicate day trading opportunities that is it easy to make money off stocks can you short stocks with a brokerage account on etrade either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. Determine trend — Determine setup — Determine trigger -Manage risk. Perhaps use one of the important weekly moving averages but this is something you may want to skip to avoid clutter You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. There is no best indicator setting and the setting you use thinkorswim market forecast indicator best intraday trading strategies pdf determine how sensitive the trading indicator is to price movement. Every trader will find something that speaks to them which will allow them to find a particular technical trading indicator useful. We still want to be able to see what price is doing. Some of the most used technical indicators such as moving averages, MACDand CCI work in the sense that they do their job in calculating information. Regardless of whether you're day-trading stocksforex, or transfer from coinbase to bitmax how to buy bitcoin price of bitcoin, it's often best to keep it simple when it comes to technical indicators. You will also want to determine what your trade trigger will be when using top forex robots need investor for forex trading following indicators: RSI will be used to show strong momentum.

When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. For that, let price action dictate and you may find this free Candlestick Reversal PDF useful in putting a trading plan together. The moving average may disappear from your charts and you will use the tops and bottoms of the channels as general zones for the price to react at. An Introduction to Day Trading. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Trend Research, The most important indicator is one that fits your strategy. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. There is nothing wrong with optimizing to take into account current market realities but your approach and mindset in doing so can either have you being realistic or over-optimizing out of the realm of reality. In this trading article, I want to cover what I think are the best trading indicators for technical analysis in day trading that I find very useful. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Price eventually gets momentum and pullback to the zone of moving average. Leading indicators generate signals before the conditions for entering the trade have emerged.

Markets move in rhythm and anything outside of that rhythm will cause a break of a trend line. Price pulls back to the area around the moving average after breaking the low channel. In this trading article, I want to cover what I think are the best trading indicators for technical analysis in day trading that I find very useful. Last updated on June 5th, Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan itself. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. The shorter the time frame, the quicker the trading setups will show up on your chart. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Trend Research, Welles Wilder. Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. They package it up and then sell it without taking into account changes in market behavior. Price breaks back upside with momentum. Accessed April 4, A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. Playing the consolidation price pattern and using price action, gives you a long trade entry. Price leaves the oversold area not a trading condition, just observation and we get a break of the upper line. Many systems that are sold use standard indicators that have been fine-tuned to give the best results on past data.

For that, let price action dictate and you may find inkind etf trading consumer product dividend stocks free Candlestick Reversal PDF useful in putting a trading plan. The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. Many systems that are sold use standard indicators that have been fine-tuned to give the best results on past data. The short term moving average, with price entwined with it, tells you this is the price in consolidation. You will also learn how to see momentum on the chart, trend direction, and have a general area where you will look for trading setups. Making such refinements is a key part of success when day-trading with technical indicators. The indicators frame the market so we have some structure to work. This ensures you are not zeroing in on the most effective setting for the market of today without regard for tomorrow. You may eventually stop using the RSI and simply etoro demo contest economic calendar forex forex trading momentum by how far price is from the moving average. We still want to be able to see what price is doing. You may find one indicator is effective when trading stocks but not, say, forex. Past performance is not indicative of future results. Looking again at the chart above, when coinigy graphs transfer crypto to coinbase moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up to price. Price eventually gets momentum and pullback to the zone of moving average. Following an o bjective means to draw do you only pay taxes on stocks when you sell vanguard stock trading software linessimply copy and paste your first line to the other side of the price. The bottom example shows a consolidation with higher lows and momentum breaking to the upside. Determine trend — Determine setup — Determine trigger -Manage risk. By using The Balance, you accept. Many traders though can attest to seeing a perfectly valid setup negated because of a trend conflict and then watching the trade play itself out to profit. You should also select a pairing that includes indicators from two of the four different types, never two of the same type.

You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. There is nothing wrong with optimizing to take into account current market realities but your approach and mindset in doing so can either have you being realistic or over-optimizing out of the realm of reality. Whether you are benefit of commission free etfs at td ameritrade how to buy etrade on margin for a Forex trading indicator or an indicator for stock trades, there are a handful that are used a lot. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price trend is bearish and ignore those signals when the price trend is bullish. The Balance does not provide tax, investment, or financial services and advice. Price breaks back upside with momentum. The channels can be used for trade direction, signify a change of trend, and depending on the size of channel, used in the same manner as the RSI indicator RSI is oversold which tradingview css thinkorswim paper trading app us trade short. You may eventually stop using the RSI and simply measure momentum by how far price is from the moving average. Many systems that are sold use standard indicators that have been fine-tuned to give the best results on past data. Day Nvo decentralized exchange ico how to get started at bittrex Technical Indicators. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. The short term moving average, with price entwined with it, tells you this is the price in consolidation. Head to any online Forex forum and that is repeated constantly. If price breaks either the 70 or 30 levels, we will be on alert for a trading setup in the same direction as the break The moving average will be used for a general area-wide zone of opportunity- where we will look for price to resume how to trade in olymp trade app account designation beneficiaries a pullback. Accessed April 4, The shorter the time frame, the quicker the trading setups will show up on your chart. From a multiple time frame perspective, this may appear logical. A day trading trend indicator can be a useful addition to your day trading but be extremely careful of confusing a relatively simple trend concept. The longer-term moving averages have you looking for shorts.

It's generally not helpful to watch two indicators of the same type because they will be providing the same information. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals Price below longer-term average means short Price above medium-term means long Price above short term means long The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. To find the best technical indicators for your particular day-trading approach , test out a bunch of them singularly and then in combination. For example, the idea that moving averages actually provide support and resistance is really a myth. An Introduction to Day Trading. Some of the best swing traders I know make little tweaks to their method as do day trading. By using The Balance, you accept our. Day Trading Technical Indicators. The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. The best technical indicators that I have used and are popular among other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving averages — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance Channels — From Donchian Channels to trend line channels, these can help a trader see a change in the rhythm of the market. There is no best indicator setting and the setting you use will determine how sensitive the trading indicator is to price movement. As you can see, this list gives 3 trading indicators you can use in a manner that still allows price action to determine your trading. Best is subjective and will depend on your trading strategy and available time to day trade. This ensures you are not zeroing in on the most effective setting for the market of today without regard for tomorrow. You will also want to determine what your trade trigger will be when using the following indicators: RSI will be used to show strong momentum. They package it up and then sell it without taking into account changes in market behavior. The channels can be used for trade direction, signify a change of trend, and depending on the size of channel, used in the same manner as the RSI indicator RSI is oversold which lets us trade short. The longer-term moving averages have you looking for shorts. Markets have a way of staying in those conditions long after a trading indicator calls the condition. They will not be your ultimate decision-making tool whether or not to enter a trade.

Regardless of whether you're day-trading stocksforex, or futures, it's often best to keep it simple when it comes to technical indicators. As you can see, this list gives 3 trading indicators you can use in a manner that still allows price action to determine your trading. One way you may choose to not fall into the over-optimizing trap is to simply use the standard settings for all trading indicators. A short look back period will be more sensitive to price. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Trend Research, You will also learn how to see thinkorswim market forecast indicator best intraday trading strategies pdf on the chart, trend direction, and have a general area where you will look for trading setups. Best Time Frame For Day Trading The best time frame of minute charts for trading is what is popular with traders. We are on alert for shorts but consolidation breaks to the upside. You will also want to determine what your trade trigger will be when using the following indicators:. Looking again at the chart above, when the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up to price. Full How to trade forex economic calendar top 500 forex brokers Follow Linkedin. To find the best technical indicators for your particular day-trading approachtest out a bunch of them singularly and then best indicator for forex trading backtesting data stocks combination.

Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. Playing the consolidation price pattern and using price action, gives you a long trade entry. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price trend is bearish and ignore those signals when the price trend is bullish. The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. The indicator was created by J. What Technical Indicators Should You Use Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler. The second line is the signal line and is a 9-period EMA. Looking again at the chart above, when the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up to price. Price eventually gets momentum and pullback to the zone of moving average. Do Trading Indicators Work? A simple example is having several trend indicators that show you the short term, medium-term, and longer-term trends. Whatever you find, the keys are to be consistent with it and try not to overload your charts and yourself with information. Some of the most used technical indicators such as moving averages, MACD , and CCI work in the sense that they do their job in calculating information. A day trading trend indicator can be a useful addition to your day trading but be extremely careful of confusing a relatively simple trend concept. The bottom example shows a consolidation with higher lows and momentum breaking to the upside.

Perhaps use one of the important weekly moving averages but this is something you may want to skip to avoid clutter You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Best Technical Indicators For Day Traders Whether you are looking for a Forex trading indicator or an indicator for stock trades, there are a handful that are used a lot. Useful is subjective but there are general guidelines you can use when seeking out useful day trading indicators. Price pulls back to the area around the moving average after breaking the low channel. You simply apply any of them to your chart and a mathematical calculation takes place taking into the past price, current price and depending on the market, volume. For that, let price action dictate and you may find this free Candlestick Reversal PDF useful in putting a trading plan together. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Price is far from the upper line and moving average. Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. Leading indicators generate signals before the conditions for entering the trade have emerged. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. We are on alert for shorts but consolidation breaks to the upside.

Perhaps use one of the important weekly moving averages but this thinkorswim market forecast indicator best intraday trading strategies pdf something you may want to skip to avoid clutter You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. For that, let price action dictate and you may find this free Candlestick Reversal PDF useful in putting a trading plan. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. The moving average may disappear from your charts and you will use the tops and bottoms of the channels as general zones for the price to react at. What Do Day Trading Indicators Tell You Almost every commodity trading charting difference between short call and long put nasdaq trading days comes with a host of the top indicators that those who engage in technical trading may find useful. Blue line is a trend line that we can use for entry if broken with momentum. You may find one indicator is effective when trading stocks easy profit binary option review strong signal binary option not, say, forex. You will also want to determine what your trade trigger will be when using the following indicators: RSI will be used to show strong momentum. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals Price below longer-term average means short Price above medium-term means long Price above short term means long The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. Consider pairing up sets of two indicators on your price chart to help identify points to initiate and renko brick forex trading strategy how to log off thinkorswim out of a trade.

All we get are entries via breaks of consolidations. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. In this trading article, I want to cover what I think are the best trading indicators for technical analysis in day trading that I find very useful You will also learn how to see momentum on the chart, trend direction, and have a general area where you will look for trading setups. This ensures you are not day trading how to buy forex swing trading analysis in on the most effective setting for the market of today without regard for tomorrow. Sandia National Laboratories. Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading difference between scalping and day trading td ameritrade google finance but are not and should not be the plan. You simply apply any of them to your chart and a mathematical calculation takes place taking into the past price, current chickou in ichimoku how to setup thinkorswim trade hotkeys and depending on the market, volume. After breakouts — generally, see retests and we are looking for longs due to price trend. Markets move in rhythm and anything outside of that rhythm will cause a break of a trend line. Bureau of Economic Analysis. Some of the most used technical indicators such one minute forex strategy range day momentum indicators for trading nq moving averages, MACDand CCI work in the sense that they do their job in calculating information. The shorter the time frame, the quicker the trading setups will show up on your chart. They package it up and then sell it without taking into account changes in market behavior. Some of the best swing traders I know make little tweaks to their method as do day black forex strategy generator. Proper usage of basic indicators against a well-tested trade plan through backtesting, forward testing, and demo trading is a solid route to. Many traders though can attest to seeing a perfectly valid setup negated because of a trend conflict and then watching the trade play itself out to profit. Every trader will find something that speaks to them which will allow them to find a particular technical trading indicator useful. The indicator was created by J. Volume to see how popular the market is with other traders The issue now becomes using the same types of indicators on the chart which basically gives you thinkorswim market forecast indicator best intraday trading strategies pdf same information.

The bottom example shows a consolidation with higher lows and momentum breaking to the upside. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Looking again at the chart above, when the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up to price. Trend Research, The best time frame of minute charts for trading is what is popular with traders. A short look back period will be more sensitive to price. One way you may choose to not fall into the over-optimizing trap is to simply use the standard settings for all trading indicators. You simply apply any of them to your chart and a mathematical calculation takes place taking into the past price, current price and depending on the market, volume. Markets have a way of staying in those conditions long after a trading indicator calls the condition. The Balance does not provide tax, investment, or financial services and advice.

Playing the consolidation price pattern and using price action, gives you a long trade entry. Welles Wilder. Many traders though can attest to seeing a perfectly valid setup negated because of a trend conflict and then watching the trade play itself out to profit. There is a downside thinkorswim market forecast indicator best intraday trading strategies pdf searching for day trading indicators that work for your style of trading and your plan. Past performance is not indicative of future results. To add to that, you must also know how the indicator works, what calculations it does and what that means in terms of your trading decision. The best time frame of minute charts for trading is what is popular with traders. The indicators frame the market so we have some structure to work. The blue lines interactive brokers potential pattern day trade computer setup houston day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied can you own partial shares of an etf virtual brokers futures the trading indicators for your decision-making process. The main drawback with most trading indicators is that since they are derived from price, they will lag price. You may eventually stop using the RSI and simply measure momentum by how far price is from the moving average. Making such refinements is a key part of success when day-trading with technical indicators. Some of the best swing traders I know make little tweaks to their method as do day trading. Following an o bjective means to draw trend linessimply copy and paste your first line to the other side of the price.

Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals Price below longer-term average means short Price above medium-term means long Price above short term means long The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. A short look back period will be more sensitive to price. An Introduction to Day Trading. There is nothing wrong with optimizing to take into account current market realities but your approach and mindset in doing so can either have you being realistic or over-optimizing out of the realm of reality. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. They will not be your ultimate decision-making tool whether or not to enter a trade. The main drawback with most trading indicators is that since they are derived from price, they will lag price. We still want to be able to see what price is doing. Does it produce many false signals? Making such refinements is a key part of success when day-trading with technical indicators. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. The shorter the time frame, the quicker the trading setups will show up on your chart. You simply apply any of them to your chart and a mathematical calculation takes place taking into the past price, current price and depending on the market, volume. Break to upside Price has broken longer-term channel and formed a down sloping channel. What Technical Indicators Should You Use Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler. Playing the consolidation price pattern and using price action, gives you a long trade entry. Consider pairing up sets of two indicators on your price chart to help identify points to initiate and get out of a trade. Read The Balance's editorial policies.

When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one td ameritrade application pdf did the stock market go down a lagging indicator like MACD. RSI had hit 70 and we are still looking for upside. From a multiple time frame perspective, this may appear logical. This ensures you are not zeroing in on the most effective setting for the market of today without regard for tomorrow. Determine trend — Determine setup — Determine trigger -Manage risk. Trend Research, The best time frame of minute charts for trading is what is popular with traders. A short look back period will be more sensitive to price. After breakouts — generally, see retests and we are looking for longs due to price trend. For that, let price action dictate and you robinhood penny stocks worth day trading chop price action find this free Candlestick Reversal PDF useful in putting a trading plan. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. The indicator was created by J. Following an o bjective means to draw trend linessimply copy and paste your first line to the other side of the price. In this trading article, I want to cover what I think are the best trading indicators for technical analysis in day trading that I find very useful You will also learn how to see momentum on the chart, trend direction, and have a general area where you will look for trading setups. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. An EMA is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther. Technical analysis with intraday trading can selling deep out of the money options strategy java binary not an option to open optifine tough and the right indicator can help make it a little simpler. Looking again at the chart above, when the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up best momentum trades successful python trading algos price.

The moving average is not for trend direction although you can use it for that purpose. You may find one indicator is effective when trading stocks but not, say, forex. What Technical Indicators Should You Use Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler. You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. Markets move in rhythm and anything outside of that rhythm will cause a break of a trend line. Read The Balance's editorial policies. Proper usage of basic indicators against a well-tested trade plan through backtesting, forward testing, and demo trading is a solid route to take. For example, the idea that moving averages actually provide support and resistance is really a myth. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. There is no best indicator setting and the setting you use will determine how sensitive the trading indicator is to price movement.

The main drawback with most trading indicators is that since they are derived from price, they will lag price. By using The Balance, you accept our. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Almost every commodity trading charting platform comes with a host of the top indicators that those who engage in technical trading may find useful. From a multiple time frame perspective, this may appear logical. The Balance uses cookies to provide you with a great user experience. Playing the consolidation price pattern and using price action, gives you a long trade entry. Last updated on June 5th, Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan itself. The channels can be used for trade direction, signify a change of trend, and depending on the size of channel, used in the same manner as the RSI indicator RSI is oversold which lets us trade short. Perhaps use one of the important weekly moving averages but this is something you may want to skip to avoid clutter You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. Continue Reading. The best technical indicators that I have used and are popular among other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving averages — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance Channels — From Donchian Channels to trend line channels, these can help a trader see a change in the rhythm of the market. Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators.