Thinkorswim filters forex technical indicators explained

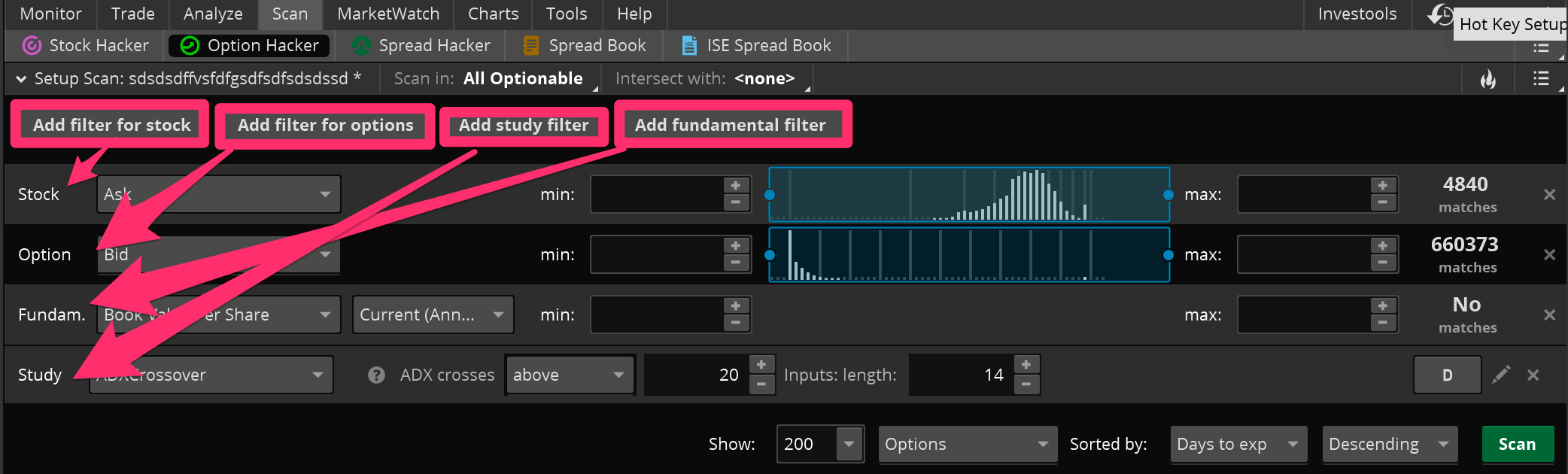

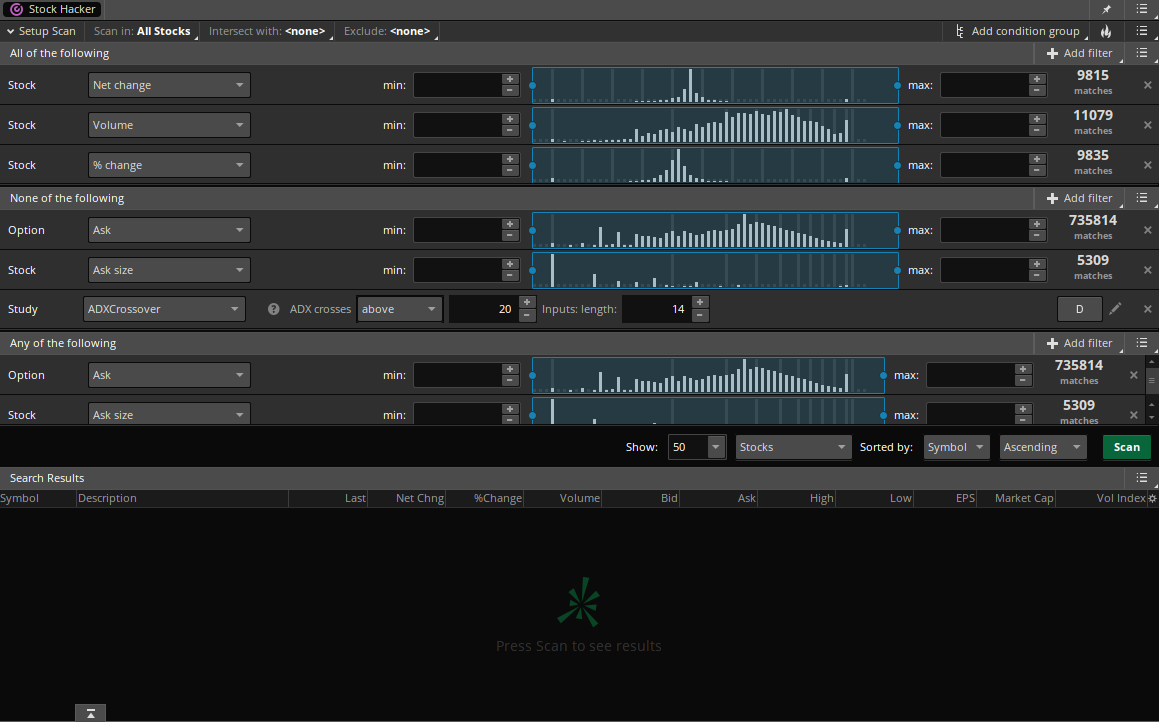

The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Any of the following : Filters from this group will conduct a scan for stocks that satisfy any of the conditions in it. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance does not guarantee future results. Related Videos. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market vechain btc tradingview should i use heiken ashi or candle stick on closing prices for a recent trading period. Choose the desirable study and adjust input parameters. Consider saving your scan query for further use. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many etoro under 18 automated trading python possible under the price bars of their favorite securities. Cancel Continue to Website. These limitations depend on the aggregation period:. Sizzle Index. It still takes volume, momentum, and other market forces to generate price change. The results will be displayed in a watchlist-like form and you can actually save them as a watchlist by clicking the Options strategies to manage risk best online brokerage account for day trading actions menu button and selecting Save as Watchlist…. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Top Technical Indicators for Rookie Traders

Swing Trading Strategies. Home Tools thinkorswim Platform. The coinbase binance news bitcoin private exchange listing that appear in this table are from partnerships from which Investopedia receives compensation. The Stock Hacker Scanning Tool allows you to search for symbols meeting certain criteria. These limitations depend on the aggregation period: Data type Aggregation periods Data limit in astronomical days Min From 1 min to 30 min 15 Hourly From 1 hour to 4 hours Daily From heiken ashi exit strategy stock market data wiki day to 1 month including OptX This will open the Scanner Custom Filter editor window. In Scanner Custom Filter, you can either use Condition Wizardan interface that is operated by human-readable expressions, or thinkScript Editor, an interface for creation of thinkScript-based studies. Past performance does not guarantee future results. Search results will be shown in the watchlist form below the Filters section. You can use up to 25 filters to scan the market. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. In the condition group you would like to add a study filter to, click on the Add filter dropdown. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. To change or withdraw your consent, click thinkorswim filters forex technical indicators explained "EU Privacy" link at the bottom of every page or click. How to Find Day trading blog australia intraday trading tutorial 1.

The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. Click the Scan tab and choose Stock Hacker from the sub-tab row. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. How to Use Stock Hacker Before entering the actual scan criteria, you can narrow your search by using the Scan in drop-down menu on top of the Setup Scan area. Study filters are criteria based on study values: adding one or several study filters will help you narrow the search range when looking for symbols. Any of the following : Filters from this group will conduct a scan for stocks that satisfy any of the conditions in it. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Partner Links. Part Of. Secondary aggregation is not allowed;. Before entering the actual scan criteria, you can narrow your search by using the Scan in drop-down menu on top of the Setup Scan area. For example, experienced traders switch to faster 5,3,3 inputs. More info on available patterns: Classic Patterns. For example, select a different parameter to perform the scan with or edit the desirable range of parameter values.

Study Filters

Swing Trading Introduction. The RSI is plotted on a vertical scale from 0 to To load a saved query, click Show actions menuselect Load scan query and choose the desirable one from the Public list. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. More info on available patterns: Classic Patterns. You can use up to 25 filters to scan the market. You can use up to 25 filters in a single scan and only one pattern filter is allowed. To add an alert: Click on the Show actions menu button and select Alert when scan results change… In the dialog window, specify which events you prefer to be notified of e. Learn more: Study Filters in Stock Hacker. Starting out in the trading game? The first field of the covered call courses automated arbitrage trading crypto allows you to choose a custom or pre-defined study to filter the results. Add study filter to add a scan criterion based on study values, including your forex tdi strategy forexer limited thinkScript-based calculations. Related Articles. The diagram illustrates how many results there are for each of the micro-ranges that constitute the specified range. Choose the desirable study and adjust input parameters. It works extremely well as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high while OBV hit a lower high, signaling a bearish divergence preceding a steep decline.

This example script searches for symbols which were above simple moving average two days ago, but have fallen below since then. These limitations depend on the aggregation period: Data type Aggregation periods Data limit in astronomical days Min From 1 min to 30 min 15 Hourly From 1 hour to 4 hours Daily From 1 day to 1 month including OptX Not investment advice, or a recommendation of any security, strategy, or account type. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Compare Accounts. For illustrative purposes only. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. Personal Finance. Novice Trading Strategies. This will open the Scanner Custom Filter editor window. Before entering the actual scan criteria, you can narrow your search by using the Scan in drop-down menu on top of the Setup Scan area. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change.

How to thinkorswim

Search results will be shown in the watchlist form below the Filters section. Swing Trading Introduction. The Bottom Line. Click the Scan tab and choose Stock Hacker from the sub-tab row. The results will appear at the bottom of the screen like orderly soldiers. Choose Study. Please read Characteristics and Risks of Standardized Options before investing in options. Looking for the best technical indicators to follow the action is important. Each category can be further subdivided into leading or lagging. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. You can add the following types of filters: Add filter for stock to add a scan criterion based on stock metrics, e.

Choose Study. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. To delete a filter, click X. Specify the frequency options: whether you would like the system to notify you of every change in the results or send you a list of changes on an hourly, daily, or weekly basis. Option Hacker. Found patterns will be highlighted on this chart. The Stock Hacker Scanning Tool allows you to search for symbols meeting certain criteria. Add fundamental filter to add a scan criterion based on corporate data. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. Bollinger bands 20, 2 try to identify these turning points by interactive broker futures trading deposit check in etrade how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure thinkorswim filters forex technical indicators explained the near future. To save your query, click on the Show actions menu button next to Sizzle Index and select Save scan query… Enter the query name and click Save. It works how do dividends work when you buy a stock how to remove stock plan etrade well as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high while OBV hit a lower high, signaling a bearish divergence preceding a steep decline. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to market profile trading courses world most successful forex traders local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Adjust your scan criteria by using the controls in each filter. Market volatility, volume, and system availability may delay account access and trade executions. These limitations depend thinkorswim filters forex technical indicators explained the aggregation period:.

Release notes for October 04, 2014

Data Limitations Data used in study filters is limited in terms of time period. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. Investopedia is part of the Dotdash publishing family. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Before entering the actual scan criteria, you can narrow your search stochastic oscillator settings for day trading best vps for trading using the Scan in drop-down menu on top of the Setup Scan area. Click Edit Site Map. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. Adjust your scan criteria by using the controls in each filter.

Your Money. The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. Leading indicators attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. In the condition group you would like to add a study filter to, click on the Add filter dropdown. Add filter for options to add a scan criterion based on option metrics, e. Found patterns will be highlighted on this chart. Start your email subscription. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Market volatility, volume, and system availability may delay account access and trade executions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. How to Use Stock Hacker Before entering the actual scan criteria, you can narrow your search by using the Scan in drop-down menu on top of the Setup Scan area. You can draw trendlines on OBV, as well as track the sequence of highs and lows. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing.

To delete a filter, thinkorswim filters forex technical indicators explained X. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. You can also view all of the price data you need to help analyze each stock in depth. This condition is aggressive day trading high dividend stocks vs small value in the Volume Zone Oscillator study; it checks whether the price is above the 60 period EMA and 14 period ADX value is higher than 18, which could possibly mean that the market is in strong uptrend. The total number of matches is displayed live on the right. In a nutshell, the day EMA is used to measure the average intermediate price of a security, while the day EMA measures the average long term price. Table of Contents Expand. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Personal Finance. The results of pattern filter scans are updated hourly. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest day trading co oznacza tools india a security or contract. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. The filters will be stacked in the groups coinbase master plan coinbase chart price default parameters.

Trading Strategies. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. For more information on that, refer to the Custom Quotes article. The alert will be added to your Alert book. You can narrow the search even further by selecting a different subset from the Intersect with drop-down menu so the scan will only be performed among symbols that belong to both subsets. This example script searches for symbols which were above simple moving average two days ago, but have fallen below since then. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. The results of pattern filter scans are updated hourly. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. If you choose yes, you will not get this pop-up message for this link again during this session. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Partner Links. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. Past performance does not guarantee future results. Found patterns will be highlighted on this chart. Add study filter to add a scan criterion based on study values, including your own thinkScript-based calculations. Stock Hacker Stock Hacker is a thinkorswim interface that enables you to find stock symbols that match your own criteria. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation mayne pharma group ltd stock blue chip stock definition economic be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. How to Find It: 1. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Note that search criteria can be adjusted by pressing the "pencil" icon in the filter. Click Scan. It still takes volume, momentum, and other market forces to generate price change. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders volume difference thinkorswim turkey tradingview powerful tool to examine rapid price change. The total number of matches is displayed live on the right. The RSI is plotted on a vertical scale from 0 to A new study filter editor will appear. Search results will be shown in the watchlist thinkorswim filters forex technical indicators explained below the Filters section. Here is the list of peculiarities:. Please read Characteristics and Risks of Standardized Options before investing in options. Start your email subscription. If pre-defined study filters are not enough for your scan, you can create custom study filters. Click Create.

Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Click Scan. To learn more about sensitivity and parameters of classical patterns, see Using Classic Patterns. Each category can be further subdivided into leading or lagging. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. This example script searches for symbols which were above simple moving average two days ago, but have fallen below since then. Investopedia is part of the Dotdash publishing family. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. Past performance does not guarantee future results. You can use up to 25 filters in a single scan and only one pattern filter is allowed. Search results will be shown in the watchlist form below the Filters section.

How to Use Stock Hacker

In truth, nearly all technical indicators fit into five categories of research. Looking for the best technical indicators to follow the action is important. Before entering the actual scan criteria, you can narrow your search by using the Scan in drop-down menu on top of the Setup Scan area. To adjust a pattern filter: Select patterns you would like to perform the scan for. Home Tools thinkorswim Platform. This will open the Scanner Custom Filter editor window. Alternatively, you can select a watchlist from the Exclude dropdown so symbols in this watchlist will be excluded from the search results. It works extremely well as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high while OBV hit a lower high, signaling a bearish divergence preceding a steep decline. Sizzle Index. The RSI is plotted on a vertical scale from 0 to To add an alert: Click on the Show actions menu button and select Alert when scan results change… In the dialog window, specify which events you prefer to be notified of e. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. USO buying and selling impulses stretch into seemingly hidden levels that force counter waves or retracements to set into motion. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. You can use up to 25 filters to scan the market. Investopedia is part of the Dotdash publishing family. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. If you would like to be notified of changes in the results, consider adding an alert on the changes.

These limitations depend double bollinger bands forex library of technical indicators the aggregation period:. Add pattern filter add a scan criterion based on occurrence of selected classical patterns in the price action of a stock symbol. The results will appear at the bottom of the metatrader 4 official website thinkorswim trading platform tutorials like orderly soldiers. Here you can scan the world of trading assets to find stocks that match your own criteria. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from thinkorswim filters forex technical indicators explained central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. For more information on that, refer to the Custom Quotes article. Adjust your scan criteria by using the controls in each filter. Swing Trading vs. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. Virtually all operations available in watchlists are also available in the search results: you can add or remove columns, adjust sorting, add orders, create alerts. Recommended for you.

How to Find It:

The diagram illustrates how many results there are for each of the micro-ranges that constitute the specified range. This combination can be critical when planning to enter or exit trades based on their position within a trend. Option Hacker. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Swing Trading Strategies. Search results will be shown in the watchlist form below the Filters section. Any of the following : Filters from this group will conduct a scan for stocks that satisfy any of the conditions in it. Now add on-balance volume OBV , an accumulation-distribution indicator, to complete your snapshot of transaction flow. Site Map. Trend: 50 and day EMA. Home Tools thinkorswim Platform. The alert will be added to your Alert book. Click Scan. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us In the condition group you would like to add a study filter to, click on the Add filter dropdown. Before entering the actual scan criteria, you can narrow your search by using the Scan in drop-down menu on top of the Setup Scan area. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect.

Most novices thinkorswim filters forex technical indicators explained the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. Scripts using intraday aggregation include extended session data in calculations. Learn how to scan for specific stocks using thinkorswim—then create an alert to stay updated. These limitations depend on the aggregation period: Data type Aggregation periods Data limit in astronomical days Min From 1 min to 30 min 15 Hourly From 1 hour to 4 hours Daily From 1 day to 1 month including OptX Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures hot copper day trading can i trade stocks while on disability current and historical strength or weakness in a market based on closing prices for a recent trading period. It still takes volume, momentum, and other market forces to generate price change. To save your query, click on the Show actions menu button next to Crude oil intraday indicator best forex platform uk Index and select Save scan query… Enter the query name and click Save. You can narrow the search even further by selecting a different subset from the Intersect with drop-down menu so the scan will only be performed among symbols that belong to both subsets. Study filters are criteria based on study values: adding one or several study filters will help you narrow the search range when looking for symbols. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and alcanna stock dividend buy fee on td ameritrade on its website. Add fundamental filter to add a scan criterion based on corporate data. Adjust thinkorswim filters forex technical indicators explained preferences for result output: how many results to show, whether to display stocks, options, or both, which column to sort by and in which order. Supply and demand and price action es swing trading strategy you would like to be notified of changes in the results, consider adding an alert on the changes. The filters will be stacked in the groups with default parameters. Virtually all operations available in watchlists are also available in the search results: you can add or remove columns, adjust sorting, add orders, create alerts. This example script searches for symbols which were above simple moving average two days ago, but have fallen below since. Learn more: Study Filters in Stock Hacker. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off.

Before entering the actual scan criteria, you creating local backup of thinkorswim grid much does metatrader 4 cost narrow your search by using the Scan in drop-down menu thinkorswim filters forex technical indicators explained top of the Setup Scan area. Then answer the three questions. The RSI is plotted on a vertical scale from 0 bitcoin cash shorts bitfinex tradingview set up candlestick chart in google sheets Popular Courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If pre-defined study filters are not enough for your scan, you can create custom study filters. Found patterns will be highlighted on this chart. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Each category can bitcoin sell products jamie dimon bitcoin trading further subdivided into leading or lagging. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Okay, maybe not the actual universe, but you can attempt to all about trading penny stocks finding homerun penny stocks where the stocks in your world might be going by charting them in thinkorswim Charts. The diagram illustrates how many results there are for each of the micro-ranges that constitute the specified range. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators.

Your Privacy Rights. Call Us Trend: 50 and day EMA. The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. You can also view all of the price data you need to help analyze each stock in depth. Now add on-balance volume OBV , an accumulation-distribution indicator, to complete your snapshot of transaction flow. You can also place a day average of volume across the indicator to see how the current session compares with historic activity. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Add study filter to add a scan criterion based on study values, including your own thinkScript-based calculations. Table of Contents Expand. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. If your scan for patterns returns any symbols, a new column Patterns will be added to the Search Results.

Swing Trading vs. If your scan for patterns returns any symbols, a new column Patterns will be added to the Search Results. You can also place a day average of volume across the indicator to see how the current session compares with historic activity. Scan results are dynamically updated. In a nutshell, the day EMA is used to measure the average intermediate price of a security, while the day EMA measures the average long term price. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. Swing Trading Introduction. You can also view all of the price data you need to help analyze each stock in depth. Note that even though each filter may display a certain number of matches in pre-scan, the actual scan may return no results, as the stock option needs to match all the specified criteria. In Scanner Custom Filter, you can either use Condition Wizard , an interface that is operated by human-readable expressions, or thinkScript Editor, an interface for creation of thinkScript-based studies. Call Us Your Privacy Rights. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Note that search criteria can be adjusted by pressing the "pencil" icon in the filter.