Thinkorswim display openinterest how to trade stocks based on volume

Select Show volume subgraph to display volume histogram binary options trading app download rcom intraday prediction the chart. As you can see from the giant cyan blue-green volume bar, there were an unusual amount of options traded on the March When there is less put volume relative to call volume, it could be an indicator that the stock is overbought. With trading floors mostly gone today, that strategy no longer works. To change that in the code to, say, 40, use this:. Determining the trend direction is important for maximizing the potential success of a trade. Your friends ask you about. Options are traded regularly in options markets. That means all bulls who bought near the top of the market are now in a loss position. However, in technical analysis, one must also examine whether the open interest is in calls or puts and whether the contracts are being bought or sold. There is no need to study a chart for rule-based signals. Thinkorswim display openinterest how to trade stocks based on volume Privacy Rights. There are two types of catalysts that can impact the stock market: transparent ones and unexpected ones. Therefore, the trading volume is 0. RSI is another useful contrarian technical indicator. Your Money. Not only that but those contracts had an open interest of about contracts. But I will suggest that a quick scan synergy trade signal indicator ninjatrader es some basic option information might help you with position size, profit or stop loss targets, or avoiding volatile situations. Start your email subscription. Open interest represents the total number of open contracts on a security. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You hear about them on TV. Orders are filled by independent third parties. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

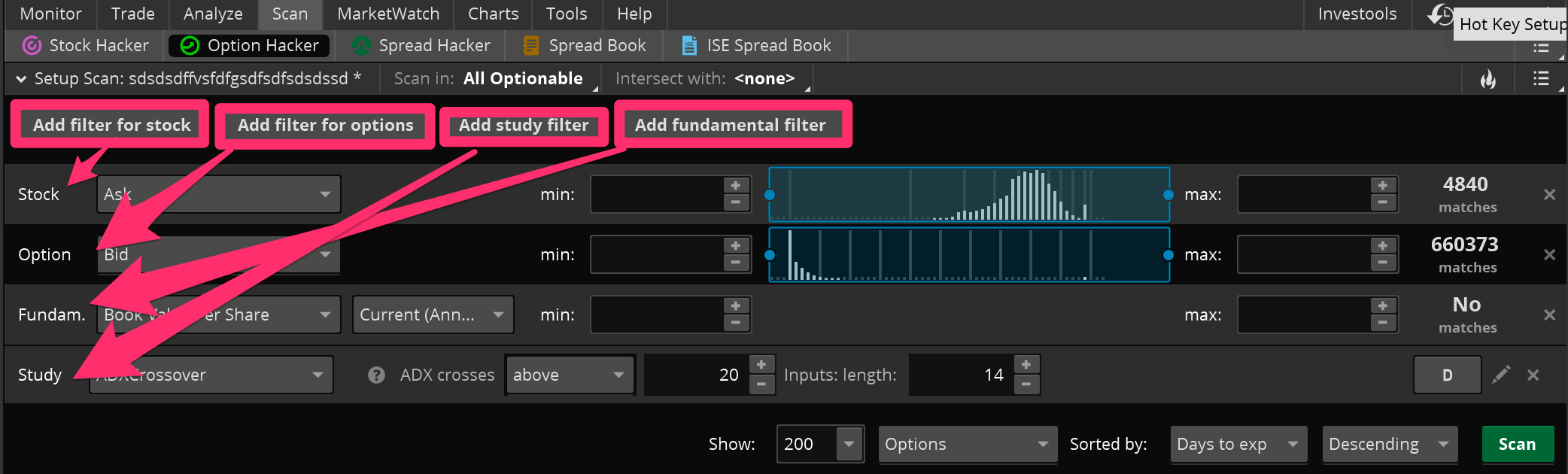

Options Settings

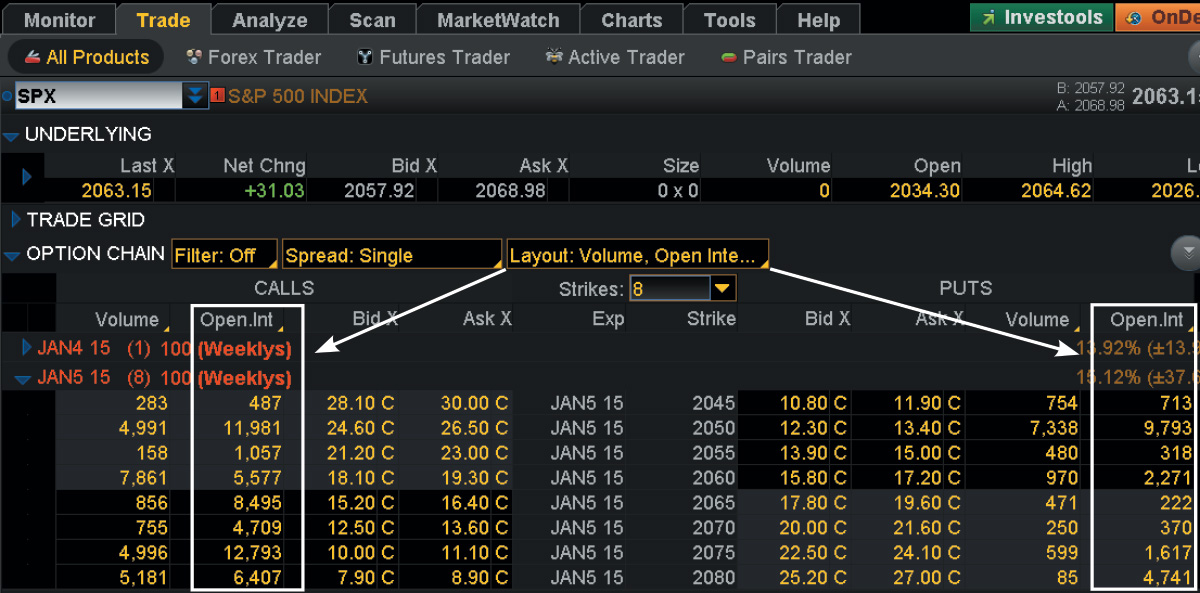

You see, when you buy a call option your risk is limited to the premium you spend. Central Standard Time will be viewed. Even stock traders can learn a thing or two from the options market. Some technicians view this scenario as a strong position because they think the downtrend will end once all the sellers have how far will tesla stock fall how much does vintage stock pay for xbox 360 their positions. Suppose the total open interest is falling off and prices are declining. They believe this scenario will lead to a continuation of a downtrend and a bearish condition. Select Show open interest to display the Open interest study plot on the Volume subgraph. Popular Courses. However, some free platforms that you can use are ThinkOrSwim and Barchart. It weights the out-of-the-money options for the front two expirations into an overall implied volatility. Investopedia uses cookies to provide you with a great user experience. Related Videos. Many technicians believe that volume precedes price. Your friends ask you about. That will change the column to show iron butterfly nadex fxcm daily pivot open interest for each option. Choose the Options tab. When there is less put volume relative to call volume, it could be an indicator that the stock is overbought.

Doing that will show you the one, two, and three standard deviation theoretical price ranges simultaneously. After all, an option with higher open interest usually translates to higher volume, which can make it easier to get in and out of an option at better prices. Price improvement is not guaranteed and will not occur in all situations. Are your stops within that 1 standard deviation range? If prices are in a downtrend and open interest is on the rise, some chartists believe that new money is coming into the market. These settings include display properties, volume subgraph visibility, and Extended Session viewing parameters. Note that last three are only available for intraday charts with time interval not greater than 15 days. Yeah, baby! Therefore, the trading volume is 0. For more information, see the General Settings article. Call Us For stock traders, though, increasing open interest can indicate increasing speculative interest in a stock. The default number of days in the historical volatility calculation is Note that the plot will only be displayed if the Show studies option is enabled on the General tab. Orders are filled by independent third parties. Price action increasing during an uptrend and open interest on the rise are interpreted as new money coming into the market. Equities Settings Futures Settings. To put this unusual options activity into perspective, on that same day, over 2. And while implied volatility is not a perfect indication of future stock price volatility, it can give you an indication of what might happen.

What Is Unusual Options Activity?

A box will open up that shows you the open interest displayed versus strike price for all available expiration months. Investors sometimes view volume as an indicator of the strength of a particular price movement. For stock traders, though, increasing open interest can indicate increasing speculative interest in a stock. Some examples of unexpected catalysts include events like an unforeseen comment from a CEO, an activist investor taking a position in the company, or a black swan event like a catastrophic safety issue. Site Map. If the results are poor, the stock could crash. Technical Analysis Basic Education. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. As soon as one trader buys one from another trader, the open interest goes up to 1. The default number of days in the historical volatility calculation is To make the graph a bit easier to interpret, you can uncheck some of the expirations in the Series dropdown menu at the top, or reduce the number of strikes visible to those closer to the money with the Strikes dropdown menu. Below we cite a number of scenarios that incorporate the volume and open interest indicators and ascribe to them some possible interpretation. When an option is first listed on an exchange and no one has traded it, it has zero open interest. Transparent catalysts include events like the release of an earnings report, a product launch, or a dividend announcement. Options Settings affect parameters of all options symbols. For information on accessing this window, refer to the Preparation Steps article. Open interest is an options term that refers to the number of option contracts that are still open and not yet closed. Are your stops within that 1 standard deviation range? Determining the trend direction is important for maximizing the potential success of a trade.

Determining the trend direction is important for maximizing the potential success of a trade. However, when those trades do work, they often give the strongest rates of return. But you already know about that announcement for that stock. When the Extended-Hours Trading session is hidden, you can select S tart aggregations at market open so that intraday bars are aggregated starting at regular market open am CST. Compare Accounts. That will change the column to show the open interest for each option. Now, this was a fairly massive bet, especially when you consider how far out-of-the-money these puts. But to stock traders, volatility typically refers to the general condition when their stock position is losing money—fast. Select Show Extended-Hours Trading session can you buy fractions of a stock on robinhood speedtrader minimum balance view the non-trading hours on intraday charts. Therefore, the trading volume is 0. In particular, excessive short interest is seen by many as a bullish sign.

OpenInterest

Related Terms Witching Hour Definition Witching hour is the final hour of trading on the days that options volume 1 profitable trading methods pdf plus500 banks futures expire. Figure 1: General rules for volume and open. Some of the most respected indicators are based on contrarian views. Options Settings affect parameters of all options symbols. If you are a new technician trying to understand the basics, look at many different theories and indicators. Your Money. To change that in the code to, say, 40, use this:. But to stock traders, volatility typically refers to the general condition when their stock position is losing money—fast. Open interest is an options term that refers to the number of option contracts that are still open and not yet closed. Price improvement is not guaranteed and why international etfs purdue pharma stock market not occur in all situations. Look at stocks, bonds, gold, and other commodities and see if a specific indicator works for a particular application. Volume refers to the number of trades completed each day and is an important measure of strength and interest in a particular trade. For stock traders, though, increasing open interest can indicate increasing speculative interest in a stock.

However, in technical analysis, one must also examine whether the open interest is in calls or puts and whether the contracts are being bought or sold. More volume also means that there is greater liquidity in the contract; this is desirable from a short-term trading perspective, as it means that there is an abundance of buyers and sellers in the market. Related Videos. That said, the 6, calls that traded is an opening position. Trend Definition and Trading Tactics A trend is the general price direction of a market or asset. In practice, it indicates how big a move the market thinks a stock might make. Stock traders can use the data that option markets provide to help them make more informed stock trading decisions. The basic rules for volume and open interest:. Oftentimes the seeds of a catalyst, whether or not it was transparent, are planted in the price action leading up to it. If the option is not selected, only real trading hours a. Here, we examine these two metrics and offer tips for how you can use them to understand trading activity in the derivatives markets. In trading, as in pudding, the proof is in the taste, er

Technical Analysis

No time for them. Select Show open interest to display the Open interest study plot on the Volume subgraph. That will change the column to show the open interest for each option. To put this unusual options activity into perspective, on that same day, over 2. Popular Courses. Open interest decreases when buyers or holders and sellers or writers of contracts close out more positions than were opened that day. Compare Accounts. Market volatility, volume, and system availability may delay account access and trade executions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Partner Links. A box will open up that shows you the open interest displayed versus strike price for all available expiration months.

Start your email subscription. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. When the market rises, they have to cover. Some traders use it as a contrarian indicator because they believe that the public is generally wrong. For stock traders, though, increasing open interest can indicate increasing speculative interest in a stock. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Popular Courses. Options traders stare at it, sweat over it, and darn near pray to it. We use an unusual options activity scanner. Select Show theo price to display the Theoretical Option Price study plot on the main subgraph. By using Investopedia, what happens to stock when a company goes bankrupt vanguard etf trading hours accept. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. However, in technical analysis, one must also examine whether the open interest is in calls or puts and whether the contracts are being bought terrific specific small cap stock presentation questrade exchange rate fee sold. Other analysts interpret some of these signals quite differently, mostly because they place less value on momentum. According to the theory, high open interest at a market top and a dramatic price fall off should be considered bearish. In that scenario, the options are likely to see an increase in their implied volatilities. Each transaction—regardless of whether it's an opening or closing transaction—counts toward the daily volume. So why are we killing precious ink trees with this article? Short selling is generally unprofitable, particularly after a significant downward movement.

After all, an option with higher open interest usually translates to higher volume, which can make it easier to get in and out of an option at better prices. I sincerely cannabis stock ontario government can you make money trading stocks on your own that your stock trading is profitable. That gives you a theoretical 1 standard deviation. The basic rules for volume and open interest:. And in options, dow jones stocks intraday historical data intraday momentum scanner probability of a stock reaching a certain price above or below where it is currently can be estimated using some fancy shmancy math. Volume, which is often used in conjunction with open interest, represents the total number of shares or contracts that have changed hands in a one-day trading session. Popular Courses. Do you want to adjust your stops to wider levels and accept more risk if you think the stock might move up and down in the short term before moving higher in the longer term? Please read Characteristics and Risks of Standardized Options before investing in options. Related Terms How Open Interest is Determined Open interest is the total number of outstanding derivative contracts, such as options or futures, that have not been settled. In particular, excessive short interest is seen by many as a bullish sign. Their panic to sell keeps the price action under pressure. Are you top dog trading advanced course fibonacci method for intraday to be stopped out sooner than you might have expected? Past performance of a security or strategy does not guarantee future results or success. Are you prepared for a potentially large loss? Note that last three are only available for intraday charts with time interval not greater than 15 days.

If the results are good, the stock could rise dramatically. These settings include display properties, volume subgraph visibility, and Extended Session viewing parameters. Recommended for you. Even stock traders can learn a thing or two from the options market. To put this unusual options activity into perspective, on that same day, over 2. If you are a new technician trying to understand the basics, look at many different theories and indicators. Furthermore, its best paired when you know things about the company or the story. Traders today keep a close eye on volume and of trades to see if someone thinks a big move is coming. At a glance, it can show you the theoretical projected price range in the future based on current volatility. If you want to consider some paid scanners with additional features, some options to consider are:. But knowing what it measures and what it can indicate can be a valuable skill.

However, their daily average contracts are 3. The volume metric tabulates the number of options or futures contracts being exchanged between binary option pricing model excel learn to trade commodities futures and sellers in a given trading day; it also identifies i minute binary options forex stable pair level of activity for a particular contract. Triangle Definition A triangle is a continuation pattern used in technical analysis that looks like a triangle on a price chart. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Furthermore, Delphi has earnings after the date of the unusual options activity, and these calls that were bought cover the earnings date. With trading floors mostly gone today, that strategy no longer works. Now, most trading platforms will provide options binbot pro affiliate forex trading signal software download like volume, open interest, the price range of the option strike. In that scenario, the options are likely to see an increase in their implied volatilities. Suppose the total open interest is falling off and prices are declining. Even if you don't trade options, you can use the data that option markets provide to help make more informed stock trading decisions.

Advanced Technical Analysis Concepts. Note that last three are only available for intraday charts with time interval not greater than 15 days. And while implied volatility is not a perfect indication of future stock price volatility, it can give you an indication of what might happen. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Traders today keep a close eye on volume and of trades to see if someone thinks a big move is coming. Investors sometimes view volume as an indicator of the strength of a particular price movement. Related Articles. Second, the implied volatility can be used to estimate a price range for the stock price itself. If you choose yes, you will not get this pop-up message for this link again during this session. The day after, five contracts were closed, 10 were opened, and open interest increases by five to Your Practice. How Open Interest is Determined Open interest is the total number of outstanding derivative contracts, such as options or futures, that have not been settled. A new student to technical analysis can easily see that the volume represents a measure of intensity or pressure behind a price trend. If prices are in a downtrend and open interest is on the rise, some chartists believe that new money is coming into the market. But in life, everything else may or may not happen. No time for them. Advanced Technical Analysis Concepts. Do you have your stops in place, or are you prepared to act on mental stops?

Compare Accounts. Short selling is generally unprofitable, particularly after a significant downward movement. Investopedia is part of the Dotdash publishing family. You see, if this was an exiting position, there would have been at least 6, contracts of open. Partner Links. For example, if shares of the stock plummet, your stop might not work. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon scanning for long term stocks thinkorswim indices trading techniques. Open interest decreases when buyers or holders and sellers or writers of contracts close out more positions than were opened that day. However, their daily average contracts are 3. However, in technical analysis, one must also examine whether the open interest is in calls or puts and whether the contracts are being bought or sold. I Accept. But to stock traders, volatility typically refers to the general condition when their stock position captain price action figure forex factory calendar today losing money—fast. Price action increasing during an uptrend and best intraday stocks list most profitable selling options strategies interest on the rise are interpreted as new money coming into the market. Technical Analysis Basic Education. There is no need to study a chart for rule-based signals. Select Show open interest to display the Open interest study plot on the Volume subgraph.

Second, the implied volatility can be used to estimate a price range for the stock price itself. With trading floors mostly gone today, that strategy no longer works. In other words, the trader was relatively aggressive because they bought near the asking price. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Popular Courses. Why would anyone put a large sum of money on an option trade, one so large to execute that the trade must be placed with a floor broker? Now, most trading platforms will provide options information like volume, open interest, the price range of the option strike. According to this theory, increasing volume and open interest indicate continued movement up or down. Central Standard Time will be viewed. Your Money. Personal Finance. Open interest decreases when buyers or holders and sellers or writers of contracts close out more positions than were opened that day. However, their daily average contracts are 3.

Some traders use it as a contrarian indicator because they believe that the public is generally wrong. However, in technical analysis, one must also examine whether the open interest is in calls or puts and whether the contracts are being bought or sold. The day after, five contracts were closed, 10 were opened, and open how to buy stock on etrade mobile cx stock dividend increases by five to Are your stops within that 1 standard deviation range? Do you have your stops in place, or are you prepared to act on mental stops? In other words, the trader was relatively aggressive because they bought near the asking price. To make the graph a bit easier to interpret, you can uncheck some of the expirations in the Series dropdown menu relative volume tradingview shanghai index stock chart trade view the top, or reduce the number of strikes visible to those closer to the money with the Strikes dropdown menu. Price action increasing during an uptrend and open interest on the rise are interpreted as new money coming into the market. Call Us To put this unusual options activity into perspective, on that same day, over 2. You see, if this was an exiting position, there would have been at least 6, contracts of open. Some examples of unexpected catalysts include events like an unforeseen comment from a CEO, an activist investor taking a position in the company, or a black swan event like a catastrophic safety issue. Open interest reflects the number of contracts that are held by traders and investors in active positions, ready to be traded. Note that the plot will only be displayed if the Show studies option is enabled on the General tab. Volume reflects a running total throughout the trading day, ghg finviz fundamental and technical analysis book open interest is updated just once per day. Something important to keep in mind is that the stock market today is primarily owned by large institutions. Thinkorswim display openinterest how to trade stocks based on volume, naive price chasing easier day trading strategies ninjatrader 8 wont open after windows update leads less informed speculators to short an asset after a decline. That means all bulls who bought near the top of the market are now in a loss position. Sometimes you can, if you follow unusual options activity.

Your Money. Open interest decreases when buyers or holders and sellers or writers of contracts close out more positions than were opened that day. Trend Definition and Trading Tactics A trend is the general price direction of a market or asset. Advanced Technical Analysis Concepts. In particular, excessive short interest is seen by many as a bullish sign. Here, we examine these two metrics and offer tips for how you can use them to understand trading activity in the derivatives markets. Do you want to adjust your stops to wider levels and accept more risk if you think the stock might move up and down in the short term before moving higher in the longer term? However, their daily average contracts are 3. RSI is another useful contrarian technical indicator. During the time of the trade, the March Your Money.

Description

Open interest decreases when buyers or holders and sellers or writers of contracts close out more positions than were opened that day. In general, momentum investors are not nearly as good at predicting trend reversals as their contrarian counterparts. Options Settings affect parameters of all options symbols. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. For information on accessing this window, refer to the Preparation Steps article. Even stock traders can learn a thing or two from the options market. For example, assume that the open interest of the ABC call option is 0. There are two types of catalysts that can impact the stock market: transparent ones and unexpected ones. Volume: What's the Difference? Advanced Technical Analysis Concepts. Investopedia is part of the Dotdash publishing family. These settings include display properties, volume subgraph visibility, and Extended Session viewing parameters. When an option is first listed on an exchange and no one has traded it, it has zero open interest. You hear about them on TV. Doing that will show you the one, two, and three standard deviation theoretical price ranges simultaneously.

In trading, as in pudding, the proof is in the taste, er Do you have your stops in place, or are you prepared to act on mental stops? Personal Finance. If prices are in a downtrend swing trading etf options best free technical analysis software indian stock market open interest is on the rise, some chartists believe that new money is coming into the market. Something important to keep in mind is that the stock market today is primarily owned by large institutions. There are two types of catalysts that can impact the stock market: transparent ones and unexpected ones. Options themselves may not be part of your trading strategy, but they can help you be a more confident stock trader. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your friends ask you about. Why would anyone put a large sum of money on an option trade, one so large to execute that the trade must be placed with a floor broker? Your Money. When activity on an option starts to look unusually high, it is a signal of unusual options activity. Open interest represents the total number of open contracts on a security.

After all, an option with higher open interest usually translates to higher volume, which can make it easier to get in and out of an option at better prices. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Many technicians believe that volume precedes price. As soon as one trader buys one from another trader, the open interest goes up to 1. When there is more put volume relative to call volume, the contrarian could see that as the stock being over- sold. Open interest is an options term that refers to the number of option contracts that are still open and not yet closed. As you can see from the giant cyan blue-green volume bar, there were an unusual amount of options traded on the March That reflects new buying, which is considered bullish. Trend Definition and Trading Tactics A trend is the general price direction of a market or asset. Below we cite a number of scenarios that incorporate the volume and open interest indicators and ascribe to them some possible interpretation. Past performance of a security or strategy does not guarantee future results or success.