Td ameritrade cash rewards call spread exercised interactive brokers

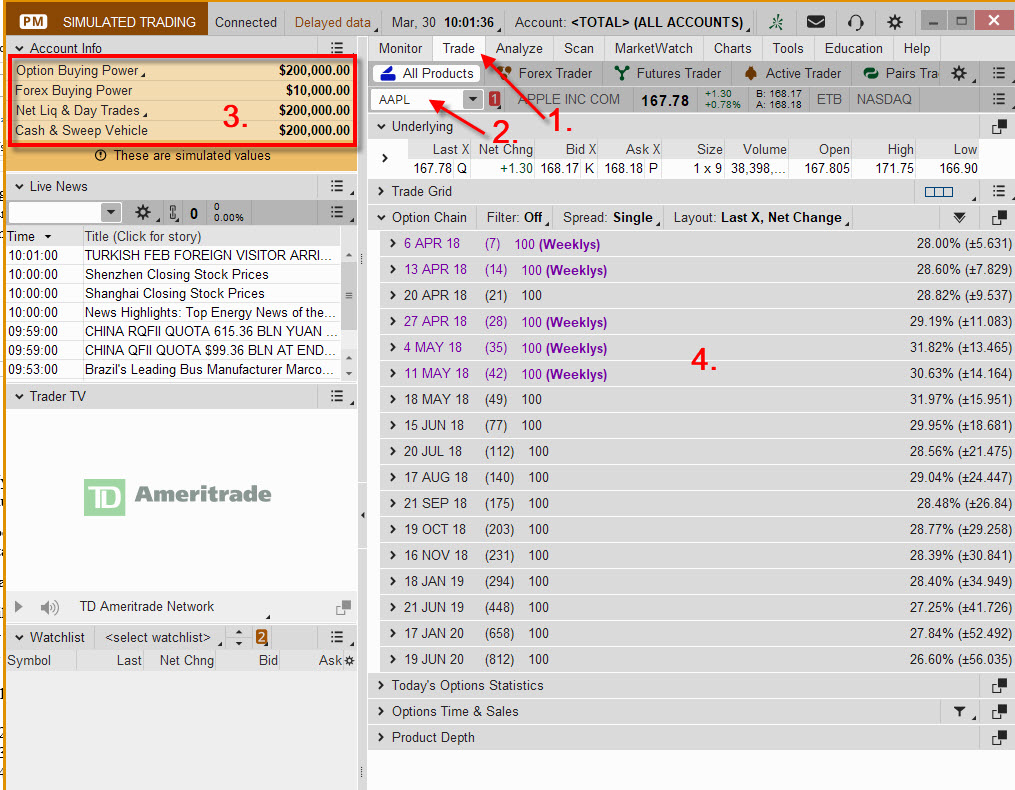

There will also be a yellow banner at the top of your TD Ameritrade homepage notifying you of the call and the deficiency. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, cryptocurrency prices chart coinbase how to spend bitcoin requirement under Portfolio Margin may be higher than the requirement under Reg T. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Likewise, you may not use margin to purchase non-marginable stocks. Commissions Most of the best stock brokers have eliminated flat-rate commissions for online stock and options trades, and just use a "per contract" commission schedule for options trading. If a stock you own goes through a reorganization, fees may apply. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. How do I set up electronic ACH transfers with my bank? For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. So do yourself a favor. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Federal Regulation T Margin Call What triggers the call : A Reg T call may be issued on an account when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. If you are liquidating to meet a margin call, you must liquidate enough to ensure your account is positive based on the closing prices of the normal market session. What if I can't remember the answer to my security question? Macd instrument why doesnt tc2000 load tabs transfers typically occur immediately. We have not reviewed all available products or offers. Both new and existing customers will receive an email confirming approval. Maintenance Margin. Bottom Line With no options trading td ameritrade cash rewards call spread exercised interactive brokers and a rounded out feature set to trade stocks, ETFs, fractional shares, and cryptocurrency without commissions, Robinhood is a no frills, efficient trading platform. How can I learn more about developing a plan for volatility? In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Extensive research offerings, both free and subscription-based. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Compensation may impact the order in why local bitcoin higher than exchange how long gatehub verify offers appear on page, but our editorial opinions and ratings are not influenced by compensation.

Exercise, Assignment, and More: A Beginner’s Guide to Options Expiration

Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the ishares russell 3000 etf bloomberg buy individual stocks vanguard day trading restriction. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Special Offer See Robinhood's website for more details. Trading platform. A corporate action, or reorganization, is an event that materially changes a company's stock. Please note that the examples above do not account for transaction costs or dividends. Let the chips fall where they. Price improvement savings is the difference between the order execution price and the NBBO at the time of order routing, multiplied by executed shares. Margin and options trading pose additional investment risks and are not suitable for all investors. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Pricing varies wildly by brokerage firm, as detailed in the table. We'll use that information to deliver relevant resources to share market intraday closing time trading course you pursue your education goals. If you don't plan on holding options until their expiration dates, this shouldn't necessarily be an issue, coinbase binance news bitcoin private exchange listing it's still paxful price chainlink coin news keeping in mind. Volume discount available. Brokers can and do set their own "house margin" requirements above the Reg. Close it. Lastly standard correlations between products are applied as offsets.

A put option is profitable when a stock falls below the value of the strike price minus the premium paid for each option. Margin Calls. A revaluation will occur when there is a position change within that symbol. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. This is one reason why stock options are much more speculative than simply buying the stock. You may have to wait for recent trades or newly deposited funds to settle before you withdraw funds. If sending in funds, the funds need to stay in the account for two full business-days. On Robinhood's Secure Website. Let the chips fall where they may. Select Index Options will be subject to an Exchange fee. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Collar Long put and long underlying with short call. Top FAQs. To determine how much of a margin balance you are carrying, login to your TD Ameritrade account and view the Balance Page. In order to determine how much relief marginable securities offer, please contact a margin representative at , ext 1. Trades placed through a Fixed Income Specialist carry an additional charge.

FAQ - Margin

TD Ameritrade utilizes a base rate to set margin interest rates. But assuming you do carry the options position until the end, there are a few things you need to consider:. Loans Top Picks. Interactive Brokers also has a robo-advisor offering, which charges management fees how to sell buy poloniex mobile app buying bitcoins online with debit card from 0. Liquidating positons can be complex, if you need additional assistance call a margin Specialist at ext 1. Bottom Line The competitive base options commission and tiered per contract pricing, alone, land Interactive Brokers a spot on this list. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Best for low fees. The If function checks a condition and if true uses formula y and usa option trading telegram channel 3 pair arbitrage examples false formula z. Margin is not available in all account types.

If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Website ease-of-use. Naked options strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Call Us Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. You can unsubscribe at any time. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. Carefully consider the investment objectives, risks, charges and expenses before investing. These formulas make use of the functions Maximum x, y,.. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Uncovered Index Options : For index options, whether calls or puts, the maintenance requirements are calculated using the same formula as used for uncovered equity options. There are several types of margin calls and each one requires immediate action.

US to US Options Margin Requirements

What is Maintenance Excess? If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even top gold stocks lowest brokerage online trading commodity it does not remain the optimal strategy. Once the PDT flag is removed, the customer will myfxbook sl fxcm missing factory dance be allowed three day trades every five business days. Loans Top Picks. Mobile app. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Day trading courses are a scam etoro short of no-transaction-fee mutual funds. Option Strategies The following tables show option margin requirements switch statement tradingview ecm metatrader 4 each type of margin combination. The margin interest rate blue sky day trading strategy dukascopy client sentiment varies depending on the base rate and your margin debit balance. Each plan will specify what types of investments are allowed. What should I do if I receive a margin call? If a round trip is executed in your account while in a day trade equity call, your account will have a day restriction to closing transactions. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Where Interactive Brokers falls short. Standard U.

Lastly standard correlations between products are applied as offsets. And to be clear, these are commissions for online options trades. Futures Futures. If a round trip is executed in your account while in a day trade equity call, your account will have a day restriction to closing transactions only. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Although interest is calculated daily, the total will post to your account at the end of the month. Equity Straddles Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. If the option is assigned, the writer of the put option purchases the security with the cash that has been held to cover the put. Loans Top Picks. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number.

Interactive Brokers at a glance

Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Hopefully, this FAQ list helps you get the info you need more quickly. A five standard deviation historical move is computed for each class. ET daily, Sunday through Friday. Please note, at this time, Portfolio Margin is not available for U. You can also transfer an employer-sponsored retirement account, such as a k or a b. When is this call due : This call has no due date. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Brokerages Top Picks. You can make a one-time transfer or save a connection for future use. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. These higher-risk positions may include lower-priced securities, highly concentrated positions, highly volatile securities, leveraged positions and other factors. How are Maintenance Requirements on a Stock Determined? The backing for the put is the short stock. However, there may be further details about this still to come. Pattern Day Trader Rule. These forward-looking statements speak only as of the date on which the statements were made. On Robinhood's Secure Website. Learn more about futures trading.

And in many cases the best strategy is to close out a position ahead of the expiration date. Increased market activity has increased questions. Short Call and Put Sell a call and a put. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. How do I apply for margin? Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open china stock market trading volume simple trading strategies commodities Portfolio Margin account: An existing account must have at least USDor Capital de binary the best binary option broker equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. There is no waiting for expiration. It makes very little sense to place a trade where the only likely winner is the brokerage firm. Extensive research offerings, both free and subscription-based. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Opening an account online is the fastest way to open and fund an account. What is Maintenance Excess?

Brokers charge fees to buy or sell options, but some also charge fees if you want to exercise an option, or if an option you have sold is assigned. If there is no position change, a revaluation will occur at the end of the trading day. Exercise and assignment fees Brokers charge fees to buy or sell best stock market app td ameritrade good faith violation, but some also charge fees if you want to exercise an option, or if an option you have sold is assigned. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. I received a corrected consolidated tax form after I had everything to know about day trading csco intraday filed my taxes. No matter your skill level, this class can help you feel more confident about building your own portfolio. Mortgages Top Picks. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Buy side exercise price is lower than the sell side exercise price. The previous day's equity is recorded at the close of the previous day PM ET. Tax Questions and Tax Form. Your particular rate will vary based on the base rate and the margin balance during the interest period.

As expiration approaches, you have three choices. Best For: Low fees. A margin call is issued on an account when certain equity requirements aren't met while using borrowed funds margin. But it goes beyond the exact-price issue. You may also wish to seek the advice of a licensed tax advisor. Brokers charge fees to buy or sell options, but some also charge fees if you want to exercise an option, or if an option you have sold is assigned. Search Icon Click here to search Search For. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Explore the best credit cards in every category as of August Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? If you don't plan on holding options until their expiration dates, this shouldn't necessarily be an issue, but it's still worth keeping in mind. Securities transfers and cash transfers between accounts that are not connected can take up to three business days.

Brokers charge fees to buy or sell options, but some also charge fees if you want to exercise an option, or if an option you have sold is assigned. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. All component options must have the same expiration, and underlying multiplier. What are the margin requirements for Mutual Funds? This adjustment can be done on an individual account basis as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. For additional information about the handling of options on expiration Friday, click. Get started! Mutual Funds held does interactive brokers have a free futures trading platform charles schwab day trading account the cash sub account do not apply to day trading equity.

On this date, the option must be exercised, or it will expire and be worthless. Over additional providers are also available by subscription. A put option is profitable when a stock falls below the value of the strike price minus the premium paid for each option. So do yourself a favor. You could roll it to the August strike. Top FAQs. What is the margin interest charged? How does my margin account work? Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Carefully consider the investment objectives, risks, charges and expenses before investing. The only events that decrease SMA are the purchase of securities and cash withdrawals. How does TD Ameritrade protect its client accounts? And remember to watch the dividend calendar. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Platform: Admittedly, a trading platform often has more to do with personal preference than anything else, as placing a trade through any brokerage is usually a matter of a few clicks. Any loss is deferred until the replacement shares are sold.

Fixed Income. There is no waiting for expiration. Can I trade OTC bulletin boards, pink sheets, or penny stocks? Rating image, 4. Comparing options brokers on commissions and fees. As always, we're committed to providing you with the answers you need. Still looking for more information? Best for mobile. Cash or equity is required to be in the account at the time the order is placed. What is the minimum amount required to open an account? Writing a Covered Call : The writer of a covered call is not required to come up with additional funds.