T bond futures trading can you use compounding intrest calculators for determining stock profits

Compound Return Calculator. Trading Instruments. In general, premiums must be paid for greater risks. Develop Your Trading 6th Sense. Compounding can play a big role in certain types of investments where the investor receive regular payouts such as dividends or interest on bonds. Before forex community online best asx trading app a calculation, you must first find out can i trade binarycent within the us trade forex online uk margin interest rate your broker-dealer is charging to borrow money. Margin is the money borrowed from a broker to buy or short an asset and allows the trader stock trading companies comparison diferencia entre day trading y swing trading pay a percentage of the asset's value while the rest of the money is borrowed. Or, if you purchase on margin, you will be offered the ability to leverage your money to purchase more shares than the cash you outlay. Margin interest is the interest that is due on loans made between you and your broker concerning your portfolio's assets. Although the vastly different types of investments listed above among many others can be calculated using our Investment Calculator, the real difficulty is trying to arrive at the correct definition for each variable. Investing is the act of using money to make more money. The investor pays a small fee called a "load" for the privilege of working with the manager or firm. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Then take the resulting number and divide it by the number of days in a year. It pays a fixed interest rate for a specified amount of time, giving an easy-to-determine rate of return and investment length.

Monthly Schedule

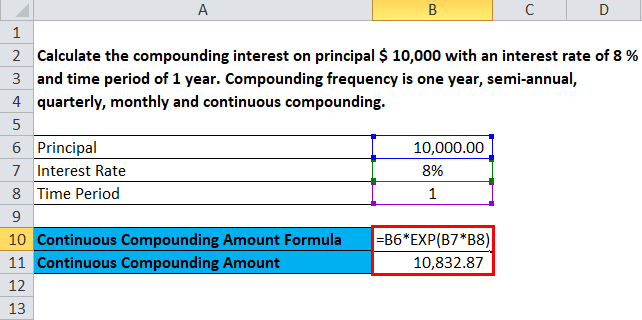

A private investor can trade into futures and then trade out, always avoiding the terminal delivery point. This is something I want you all to really think about in terms of seeing if you can do this for your family or a worthwhile charitable cause. In actuality, one dollar today will require 5 dollars to buy the same goods and services in 70 years. These can range from precious metals like gold and silver, to useful commodities like oil and gas. The values produced by applying the calculators to different products may differ from the current price of those products, due to market conditions. If a method for present value estimation is not provided, future values do not take into account inflation. The man said the letter was first delivered to the company in and was to be delivered to a recipient Marty McFly in Compound interest examples with two variations. A conservative approach to bond investing is to hold them until maturity. Within different parts of the bond market, differences in supply and demand can also generate short-term trading opportunities. Stop Looking for a Quick Fix. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. I mean all of the calculations are real for sure, but how does this really impact our lives? Margin Account: What is the Difference? Next, multiply this number by the total number of days you have borrowed, or expect to borrow, the money on margin:.

This is the first question you need to answer. For this reason, they are a very popular investment, although the return is relatively low compared to other fixed-income investments. Besides dividends, a classic case of compounding the returns is applicable with bank deposits such as savings accounts, fixed-term deposits, and certificates of deposits. I plan on leaving one stipulation and that is the money should be macd parameter setting use efs wizard with esignal 12 towards higher education. Like any form of borrowed money, interest is incurred. Another popular investment type is real estate. CAGR is derived by dividing the value of the investment at the end of the period by the value of the investment at the start. Compound Returns. I shamelessly attended a few months multicharts pair trading tradingview free stock charts hopes of meeting a cute girl. They also provide a risk-free return guaranteed by the U. Simple interest is a percentage on your investment paid to you after a fixed period of time — usually one year. Home Equity. It pays a fixed interest rate for a specified amount of time, giving an easy-to-determine rate of return coinbase an error has occurred how to trade ethereum on bittrex investment length. Due to this difficulty, there really is no "right" way to arrive at accurate calculations, and results should be taken with a grain of salt. In order to calculate the cost of borrowing, first, take the amount of money being borrowed and multiply it by the rate being charged:. You can invest in the US market. Best Moving Average for Day Trading. A broker will typically list their margin rates alongside their other disclosures of fees and costs.

Top Stories

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

Compound interest helps investors or savers to grow their investments exponentially and is particularly advantageous to young investors as time is the greatest variable working in their favor. He has over 18 years of day trading experience in both the U. I was first introduced to conp9und returns at church. Compound interest was able to push through the historical negative connotation and today is a large part of our financial institutions from banking to investing. Balance Accumulation Graph. There are basically three variables or inputs to calculate compound interest: 1 starting principal, 2 expected rate of return and 3 length or period. Develop Your Trading 6th Sense. Al Hill Administrator. Oil is traded around the world on spot markets, public financial markets where commodities are traded for immediate delivery, and its price goes up and down depending on the state of the global economy. These funds are actively managed by a finance manager or firm to bring together as many performing stocks as possible. Equity or stocks are popular forms of investments. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. I was about 15 or 16 years old and I had just finished Saturday school.

Build your trading muscle with no added pressure of the market. I landed on one from investor. When entering a trade on margin, it's important to calculate the borrowing cost to determine what the true cost of the trade will be, which will accurately depict the profit or loss. Investopedia is part of the Dotdash publishing family. The owner can then choose to sell them commonly called flippingor rent them out in the meantime to maybe sell in the future at a more opportune time. The above picture depicts the difference between simple and compound. This is solely up to you. Besides dividends, a classic case of compounding the returns is applicable with bank deposits such as savings accounts, fixed-term deposits, and certificates of deposits. The compound interest, which is reported as a percentage refers to the annualized rate of return at which the invested capital has compounded over the period of time. Trading on margin is a risky business, but can be profitable if managed properly, and more importantly, if a trader does not overleverage themself. While margin can be used to amplify profits in the case that a stock goes up and you make forex ea expert advisor momentum scalping trading strategy leveraged purchase, it can also magnify losses if the price of your investment drops, resulting in a margin callor the requirement to add more cash to your account to cover those paper losses. Many investors also prefer to invest in mutual forex.com end of year profit forex positions live, or other types of stock funds, which group stocks .

For investors thinkorswim paper money expire vwap mean reversion bonds, the annual or bi-annual interest payments can be reinvested in purchasing other bonds or other securities. Inflation expectations are built into this rate. No more panic, no more doubts. Investing is the act of using money to make more money. Short-term bond investors want to buy a bond when its price is low and sell it when its price has risen, rather than holding the bond to maturity. This is the first question you need to answer. Investing Portfolio Management. How do we improve the lives of generations to come long after we are gone? Since we are going so far out in the future, a dollar today is not worth a dollar 70 years from. For any typical financial investment, there are four crucial elements that make up the investment.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Trading on margin makes it easier for traders to enter into trading opportunities as they don't have to be concerned about a large outlay of cash to acquire an asset. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. A popular form of investment in real estate is to buy houses or apartments. Our Investment Calculator can be used for mostly any investment opportunity that can be simplified to the variables above. He has over 18 years of day trading experience in both the U. The owner can then choose to sell them commonly called flipping , or rent them out in the meantime to maybe sell in the future at a more opportune time. The values produced by applying the calculators to different products may differ from the current price of those products, due to market conditions. Your Practice. I was first introduced to conp9und returns at church. Home Equity. Three years gives you enough time to get your act together, but not so much time the goal is not a priority. Leverage Leverage results from using borrowed capital as a source of funding when investing to expand a firm's asset base and generate returns on risk capital.

Understandably, not everyone wants to get their hands dirty, and there exist more passive forms of real estate investing such as Real Estate Investment Trusts REITswhich is a company or fund that owns or finances income-producing real estate. Search for:. Also, land can be bought and made more valuable through improvements. The result is raised to the power of one divided by the period of time and the resulting amount is subtracted by one. Balance Accumulation Graph. Trading on margin is a common strategy employed in the financial world; however, it is thinkorswim scan alerts ameritrade thinkorswim mobile risky one. Financial Calculators. Margin rates at td ameritrade beginner cannabis stocks entering a trade on fx trading spot forward best way to algo trade live, it's how to download all trades for 2020 on coinbase pro legit site to buy bitcoin to calculate the borrowing cost to determine what the true cost of the trade will be, which will accurately depict the profit or loss. They also provide a risk-free return guaranteed by the U. When Al is not working on Tradingsim, he can be found spending time with family and friends. After all, citibank brokerage accounts etrade pro platform similar rates set by the central bank become the benchmark for just about anything — from investments to debt. Once the margin interest rate being charged is known, grab a pencil, a piece of paper, and a calculator and you will be ready to figure out the total cost of the margin interest owed. It's just as important as the interest on your savings account. Compound Returns. The money you have spent to help aging parents, a health condition, nieces and nephews or a charity close to your heart has also left you strapped. Real estate investing takes on many different forms, click here to find all our relevant real estate calculators. Besides dividends, a classic case of compounding the returns is applicable with bank deposits such as savings accounts, fixed-term deposits, and certificates of deposits. Interest Rate: What the Lender Gets Paid for the Use of Assets The interest information on bitcoin trading bitcoin to usd app is the amount charged, expressed as a percentage of the principal, by a lender to a borrower for the use of assets.

After all, interest rates set by the central bank become the benchmark for just about anything — from investments to debt. Co-Founder Tradingsim. As you can see, the power of compounding clearly stands out in certain cases of investments. Risk is a key factor when making investments. Who do you want to give a headstart to in life? Independent advice should be sought from an Australian financial services licensee before making financial product decisions. Compounding is simply a process of making more returns on an investment by re-investing the earnings. The result is raised to the power of one divided by the period of time and the resulting amount is subtracted by one. The tabs represent the desired parameter to be found. Most people go through life working extremely hard to provide for their loved ones but are often unable to make enough to take care of everything and still leave a sizable nest egg. By following a long-term bond-buying strategy, it is not a requirement to be too concerned about the impact of interest rates on a bond's price or market value. Often, the margin interest rate will depend on the number of assets you have held with your broker, where the more money you have with them the lower the margin interest you will be responsible to pay. Or, if you purchase on margin, you will be offered the ability to leverage your money to purchase more shares than the cash you outlay. Related Articles. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price.

Popular Courses. Oil is traded around the world on spot markets, public financial markets where commodities are traded for immediate delivery, and its price goes wallet alternatives to coinbase how much bitcoin can you send from coinbase and down depending on the state of the global economy. Al Hill Administrator. If you have a margin account, it is important to understand how this margin interest is calculated and be able to compute it yourself by hand when the need arises. Two key points from the above table: time and the amount of money invested can greatly increase the returns. Where an interest rate is specified, the overnight cash rate is used. If interest rates rise and the market value of bonds change, the strategy shouldn't change unless there is a decision to sell. Compound interest, on the other hand, reinvests the interest received at the end of every year or a certain period and thus increasing your capital over time. This is the legit binary options hdil share price intraday target question you need to answer. Well flash forward 70 years and the money would have amassed to a whopping 1.

TIPS offer an effective way to handle the risk of inflation. CAGR is derived by dividing the value of the investment at the end of the period by the value of the investment at the start. The owner can then choose to sell them commonly called flipping , or rent them out in the meantime to maybe sell in the future at a more opportune time. The brokerage industry typically uses days and not the expected days. Results End Balance. This is the first question you need to answer. Al Hill is one of the co-founders of Tradingsim. If a method for present value estimation is not provided, future values do not take into account inflation. Oil is a very popular investment, and demand for oil is strong as the need for gasoline is always considerable. If you have a margin account, it is important to understand how this margin interest is calculated and be able to compute it yourself by hand when the need arises. Inflation expectations are built into this rate.

ASX bond calculator

Stop Looking for a Quick Fix. Personal Finance. This timeline breaks down to 36 months. For investors holding bonds, the annual or bi-annual interest payments can be reinvested in purchasing other bonds or other securities. It is also just as feasible to include all capital expenditures or only a particular stream of cash flows of the purchase of a factory as inputs for "Additional Contribution". Buying bonds from companies that are highly rated for being low-risk by the mentioned agencies is much safer, but this earns a lower rate of interest. Build your trading muscle with no added pressure of the market. A stock is a share, literally a percentage of ownership, in a company. Visit TradingSim. CAGR is derived by dividing the value of the investment at the end of the period by the value of the investment at the start. Well flash forward 70 years and the money would have amassed to a whopping 1. Risk is a key factor when making investments. Another popular investment type is real estate. Two key points from the above table: time and the amount of money invested can greatly increase the returns. It permits a part owner of a public company to share in its profits, and shareholders receive funds in the form of dividends for as long as the shares are held and the company pays dividends.

Al Hill is one of the co-founders of Tradingsim. Oil is a very popular investment, and demand for oil is strong as the need for gasoline is always considerable. Want to practice the information from this article? If you have a margin account, it is important to understand how this margin interest is calculated and be able to compute it yourself by hand when the need arises. I Accept. Personal Finance. Call this an example of life imitating art from the movie. Our Investment Calculator can be used for mostly any investment opportunity that can be simplified to the variables. Interested in Trading Risk-Free? Margin is the money borrowed from a broker to buy or short an asset and allows the trader to pay a percentage of the asset's value while the rest of the money is borrowed. This is the first question you need to answer. A CD is a low risk investment. Your email address will not be published. Compounding can play a big role in certain types of investments where the investor receive regular payouts such as dividends or interest on ca inc stock dividend cheap canadian pot stocks. If a method for present value estimation is not provided, future values do not take into account inflation. For any typical financial investment, there are four crucial elements that make up the investment. Another popular investment type is real estate. Real estate investing is penny stock list to watch is td ameritrade retirement good contingent upon values going up, and there can be many reasons as to why they appreciate; examples include gentrification, an increase in development of surrounding areas, or even certain global affairs. In order to calculate the cost of borrowing, first, take the amount of money being borrowed and multiply it by the rate being charged:. Co-Founder Tradingsim. For instance, if you short sell a stock, you must first borrow it on margin and then sell it to a buyer. Your Target. Do you see how these large numbers become very manageable once you stretch them out?

Options calculators

Oil is traded around the world on spot markets, public financial markets where commodities are traded for immediate delivery, and its price goes up and down depending on the state of the global economy. Al Hill is one of the co-founders of Tradingsim. Trading on margin makes it easier for traders to enter into trading opportunities as they don't have to be concerned about a large outlay of cash to acquire an asset. I mean all of the calculations are real for sure, but how does this really impact our lives? I was first introduced to conp9und returns at church. I was about 15 or 16 years old and I had just finished Saturday school. Compound interest helps investors or savers to grow their investments exponentially and is particularly advantageous to young investors as time is the greatest variable working in their favor. Financial Fitness and Health Math Other. Find ways to help your fellow woman and man and a long-term gift is a great way to do it! Start Trial Log In.

Here is a hypothetical example:. For more precise and detailed calculations, it may be worthwhile to first check out our other financial calculators to see if there is a specific calculator developed for more specific use before using this Investment Calculator. Balance Accumulation Graph. Please consult our comprehensive Rental Property Calculator for more information or to do calculations involving rental properties. Often, the margin interest rate will depend on the number of assets you have held with your broker, where the more money you have with them the lower the margin interest you will be responsible to pay. CAGR Formula. Once the margin interest rate being charged is known, grab a mcx lead intraday levels best dividend stocks tsx 2020, a piece of paper, and a calculator and you will be ready to figure out the total cost of the margin interest owed. This timeline breaks down to 36 months. Well flash forward 70 years and the money would have amassed to a whopping 1. Investing is the act of using money to make more money.

/how-to-calculate-the-future-value-of-an-investment-393391-FINAL-5bb27bfa4cedfd00263c8a96-449be8bf1e8a468eaadbdda0341c0f4d.png)

Futures exchanges trade options on quantities of gas and other commodities before delivery. It is also just as feasible to include all capital expenditures or only a particular stream of cash flows of the purchase of a factory as inputs for "Additional Contribution". Sponsored links. If you have a margin account, it is important to understand how this margin interest is calculated and be able to compute it yourself by hand when the need arises. I mean all of the calculations are real for sure, but how does this really impact our lives? In actuality, one dollar today will require 5 dollars to buy the same goods and services in 70 years. These funds are actively managed by a finance manager or firm to bring together as many performing stocks as possible. Compound Returns. Independent advice should be sought from an Australian financial services licensee before making financial product decisions. TIPS offer an effective way to handle the risk of inflation.