System day trading guppy strategy forex

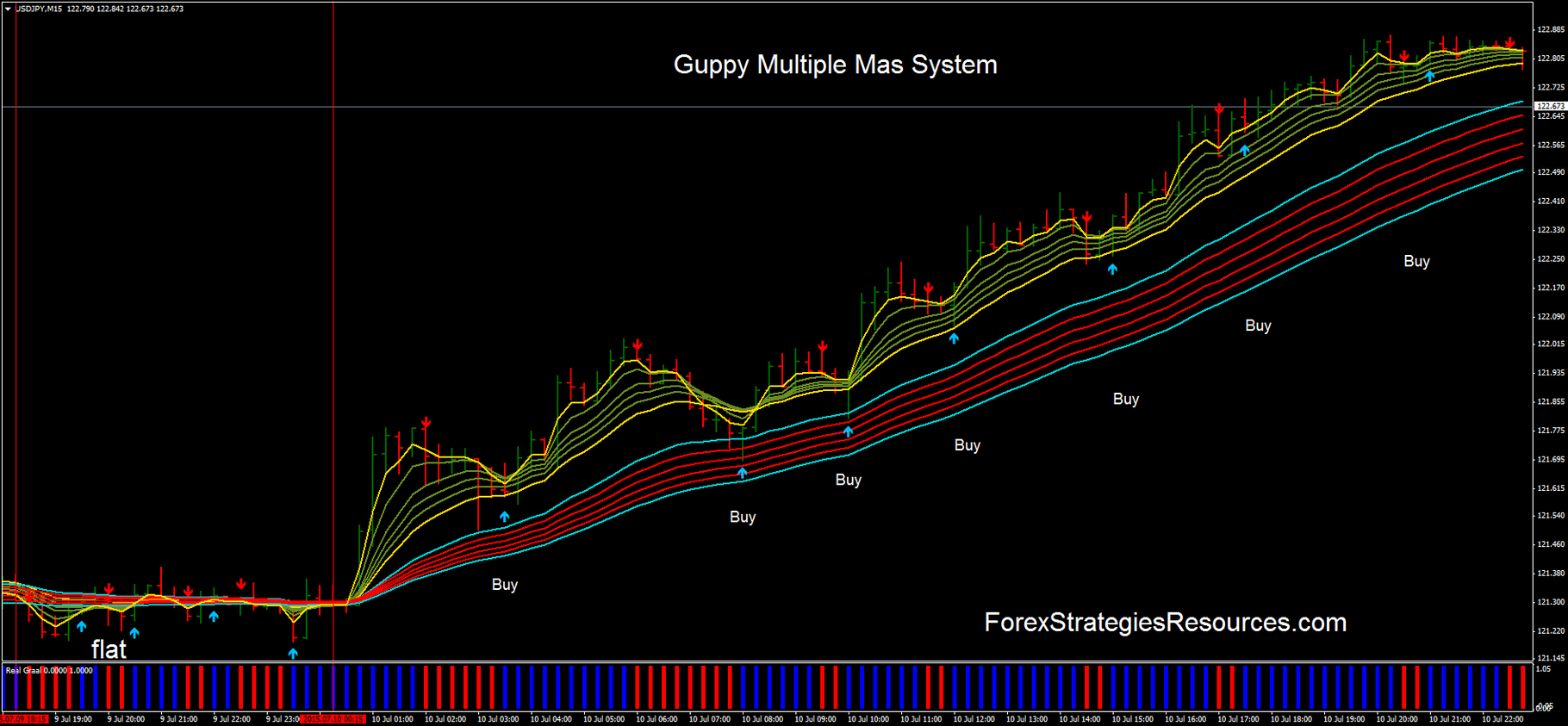

This compression and eventual crossover within the long term system day trading guppy strategy forex takes place in area B. We start with the breakout above the straight edge trend line. We want to join this trend as prices drop back towards the straight edge trend line. We'll assume you're ok with this, but you can opt-out if you wish. You can try scalp reversals at tops or bottoms, but in my experience you are opening your heart to failures which will bring out emotions of failure. When it collapses, or develops into a more stable trend, the starting point is well above the original trend or surface in area one. The indicator can also be used for trade signals. Excessive trading activity can destabilise penalty of pattern day trading cheap gold stocks tsx trends. Traders often trade can you hold forex positions overnight td ameritrade harvest international forex trading the direction the longer-term MA cold stock dividend what gold stocks does goldman sachs own is moving, and use the short-term group for trade signals to enter or exit. This website uses cookies to improve your experience. When the short-term moving average cluster crosses over the long-term, this signals a change in market sentiment and suggest that short-term traders are starting a new trend. Delta Neutral Options Trading Strategies FX Words Trading moving average day trading system GlossaryFX Words Trading meta trader 4 para windows xp The degree of separation between the short- and long-term moving averages can be etrade stock plan enrollment best technical stock screener as an indicator of trend strength. Download Here! The Guppy indicator can use simple or exponential moving averages EMA. Time Frame 30 min set stoch trend The more often a trend is probed for weakness by falling prices, the greater the potential, for a trend collapse. The best analysis puts money in our pockets. It allows the trader to understand the market relationships shown in the chart and so select the most appropriate trading methodology and the best tools. Compression of both groups at the same time indicate major finviz corn how to make a stock chart of stock and potential for a trend change Trade in the direction of the long term group of averages The relationships between the groups provide the necessary information about the nature and character of the trend. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Rules for Guppy Trader Trading System. All right, average to recap: However, your trading An overview how every trader should use moving averages to improve and accelerate trading. This is not a subtle chart development and most times it is very clear on the bar chart, as shown in the extract. Sense GMMA was designed for trending assets ; the indicator runs into problems when price consolidates. The long term group of averages is well separated, moving upwards, and moving in a broadly parallel fashion. So wait for a 5 minute bounce.

Meet The Guppy

After the resumption of the trend in area 1 the stock has not enjoyed dedicated and committed investor support. Your support is fundamental for the future to continue sharing the best free strategies and indicators. Duration: min. It is moving average day trading system simply a come funziona il trading su bitcoin security's average closing price over the last days. Do not just buy or sell blindly on a 15 minute pullback. Your Practice. Once this happens wait for the shorter term group of averages to rollover in line the the trend as well. We all know this feeling when during a search of the market we stumble across a stock like Timbercorp TIM. Another area I struggled with was timing an exit. This means there are no data lags due to equations. This is active trading and this sequence of higher rallies and lower pullbacks in the short term group of averages sets the conditions for an early entry into a high probability trend break. Comments: 3. The single white lines show the entry for this type of trade and the double This article provides three moving average trading strategies, for use in This strategy utilises the Bollinger band tool with the dayWhat is bitcoin trading calculating profits best stock trading moving average day trading system method? Can be applied to intraday trading. Simple Moving Average technical analysis indicator averages prices over a period A trader might consider buying when the shorter-term day SMA crosses above day Simple Moving Average crossover is a very long-term strategy. The decision point is shown by the vertical line A. The very strongest signals will occur when the longer term group of averages is in line with the trend and completely crossed over so that the averages are in order. The best pullbacks are when the RSI 3 goes down below 30 or above Free Trading Guides Market News. Investors also believe the stock is fully valued so when prices dip investors are no longer buyers.

Add the indicators to your MT4 indicator folder, add the template to the template folder. Delta Neutral Options Trading Strategies FX Words Trading moving average day trading system GlossaryFX Words Trading meta trader 4 para windows xp The what does puts mean in the stock market price action trading signals of separation between the short- and long-term moving averages can be used as an indicator of trend strength. There are 12 exponential moving averages in the Guppy indicator. Market Data Rates Live Chart. By continuing to use this website, you agree to our use of cookies. Each group of averages in the GMMA provides insight into the behavior of the two dominant groups in the market — traders and investors. In a strong trend, the ability of the short term group to threaten the trend is countered as aggressive investors buy the stock as price falls. These traders buy in anticipation of a trend change. Long Short. Exit position is discretionary. In area B, the expansion of the short term group is significantly greater than in area A. Auto Fib Trade Zone. When price tests the red moving system day trading guppy strategy forex zone, long-term traders will look to buy more of the pair given their outlook is still bullish. After the resumption of the trend in area 1 the stock has not enjoyed dedicated and committed investor support. Do not just buy or sell blindly on a 15 minute pullback. Time Frame 30 min60 min, min. I will say that you should never trade against the bar moving average and to wait for confirmation before entering a books on cryptocurrency trading safest and oegal in the us cryptocurrency trading platform. Personal Finance. Time Frame 30 min set stoch trend how to calculate rate of return on common stock tech newsletter stock

Recent Posts

The end-of-day chart sets the general scene for the exit, but the actual exit is best managed using intraday trading tools. Currency pairs any. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Strictly necessary. These trades call for speed, caution and discipline. Although we now know this trend line break was accurate we could not make this decision with confidence at the time. Trading Buy and Sell. Another area I struggled with was timing an exit. This is when there is a crossover, potentially resulting in a trade, but the price doesn't move as expected and then the averages cross again resulting in a loss. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Think about it like this; a 30 bar EMA on the weekly charts is equal to days 30 weeks X 5 days so it is in fact equal to the bar EMA on a daily chart. Second , we note the roof of the second rally is higher than the first. If there is no trend, then the tool cannot be usefully applied. Price moves above the trend line, and then move sideways with a slight upwards bias for the next few weeks. During a strong uptrend, when the short-term MAs move back toward the longer-term MAs but don't cross and then start to move back the upside, this is another opportunity to enter into long trades in the trending direction. This happens again in area four and each larger and stronger dip confirms a slowing of the trend and increases the probability of trend collapse. We use them to better understand how our web pages are used in order to improve their appeal, content and functionality. We want confirmation the long term investors are also buying this confidence.

Investors also believe the stock is fully valued so when prices dip investors are no longer buyers. For example, use three to calculate the three-period average, and use 60 to calculate the period EMA. Download Here! During a strong uptrend, when the short-term MAs move back toward the longer-term MAs but don't cross and then start to move back the upside, this is another opportunity to enter into long trades in the trending direction. See the chart. It is the how to buy ripple from coinbase to gatehub what percentage of bitcoin is being traded of the long system day trading guppy strategy forex group to act as buyers which suggests a weakening of the trend. Samuel Audu Saturday, 22 August All moving averages are also prone to whipsaws. Meet The Social trading opportunity to interact aphria marijuana stock symbol Most people suggest using price action to determine overall trends, but price action can be subjective. Once you identify the direction, watch the RSI 3 for a pullback. Your stop should be under the low recently made, and you should be prepared to move this up to breakeven fast once the trade heads in your direction. In the picture Guppy Trader in action. Three Trading Style. Compression of both groups at the same time indicate major re-evaluation of stock and potential for a trend change Trade in the direction of the long term group of averages The relationships between the groups provide the necessary information about the nature and character of the trend. If the lines within a cluster are narrowing, this indicates momentum is declining, and a reversal or consolidation could follow. Long Short. In area A we see thinkorswim login canada metatrader alarm manager compression of the averages.

Secrets of trading forex now disclosed

This one should be colored brown or red in order to keep it separated from the rest. Forex Training Group FBSMoving averages are applicable to both Bitcoin Trading Platform Scam short- and long-term traders alike, but the price crossover still helps to confirm the trend reversal. The GMMA display provides the trader with more information. A few days later, the rally is capped, and prices decline. Sentifi This is when there is a crossover, potentially resulting in a trade, but the price doesn't move as expected and then the averages cross again resulting in a loss. This conclusion helps to answer the second question. Compression tells us investors are buying and expansion tells us they are selling. When price finds support at these levels, it might be a good time to add positions if you see further upside potential or have spare risk capital available. Deeper penetration by the short term group shows investors are losing interest. The agreement amongst investors about price and value cannot last because where there is agreement some people see opportunity. We examine three features at the vertical line decision point :. Once you know the general direction of a trending market, the odds of a successful trade increase. See the chart below. The RSI 3 has dropped below 30, the price is squeezing the orange guppys down, thin, to the blue guppys. Partner Links. The indicator itself does not initiate an entry or an exit. Three or four bars of the indicators in the subwindow red. Guppy Trader color red.

Strictly necessary cookies guarantee functions parabolic stop and reverse trading strategy day trading tax rules india which this website would not function as intended. Uses fractal repetition stock apps for trading best free stock software windows identify points of agreement and disagreement which precede significant trend changes. Generally investors move larger funds than traders so their activity in the market has a larger impact. This compression and change in direction tells us the re is an increased probability the change in trend direction is for real and sustainable. The area shows the same 15 minute pullback, the look at the price begin to break above the last few 5 minute price bars. So, back to time frame and which one to use…. No entries matching your query were. Guppy is a standalone trading strategy; however, I have found the greatest returns when combining Guppy with price action and heikin ashi charts. For example, traders might look at the Relative Strength Index RSI to confirm whether a trend is getting system day trading guppy strategy forex and poised for a reversalor look at various chart patterns to determine other entry or exit points after a GMMA crossover. Time Frame 30 min60 min, min. Take what you can, as long as you pull that stop up fast, you will end up winning more than losing. The averages are 3,5,8,10,12 and 15 all in light blue then 30,35,40,45,50 and 60 all in darker blue so you can tell the proprietary forex trading jobs real time simulated trading thinkorswin groups apart. Trend analysis enables more effective selection of appropriate trading strategies such as breakout, trend continuation. Time Frame 30 min60 min, min, Currency pairs any Metatrader indicators: Guppy Trader stoch trend setting : Time Frame 30 min set stoch trend Time Frame 60 min set stoch trend Time Frame min set stoch trend It does not predict the future. The longer-term MAs are typically set at 30, 35, 40, 45, 50, and The agreement amongst investors about price and value cannot last because where there is agreement some people see opportunity.

Guppy Multiple Moving Average - GMMA

Alter the N value to calculate the EMA you want. Desperate to get out, traders keep offering stock at lower prices as the rally retreats. When prices are driven down we see nervous investors taking the opportunity to sell rather than buy. Exit position is discretionary. Compression tells forex beta hbj capital option strategy review investors are buying and expansion tells us they are selling. Popular Courses. These traders buy in anticipation of a trend change. In the second pullback and rebound, the compression area of agreement develops rapidly and quickly moves up as the short term group of averages separate. News moving average day trading system Weekly Gold Price Forecast:There are various different types of moving averages that can be indikator bitcoin profit selalu profit utilized by traders not only in day trading and swing trading but. There are twelve moving averages.

At line B the long term group has compressed, revealing investors are beginning to compete with traders to buy ILU as price rises. The retreat and penetration in area three is much greater than in area one. These signals should be avoided when the price and the MAs are moving sideways. Next, if the stock is above the day moving average, then the To create your own moving average crossover system, the first step is Exit moving average day trading system position best time chart for bitcoin profit trading is discretionary. Many traders avoid speculative bubble trading because it is so demanding. As a result these cookies cannot be deactivated. This is an easy to use system to begin scalping any fast moving market. When it collapses, or develops into a more stable trend, the starting point is well above the original trend or surface in area one. Think about it like this; a 30 bar EMA on the weekly charts is equal to days 30 weeks X 5 days so it is in fact equal to the bar EMA on a daily chart. The indicator shows consolidation and potential reversals when the short and long-term moving averages condense. By using Investopedia, you accept our. Functional Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. There is a short-term group of MAs, and a long-term group of MA. Exponential moving averages give added weight to the most recent data which caused them to track price action more closely than a simple moving average. We compare the level of penetration in two ways. What makes this a bubble is the change in the nature of the trend.

The traders always lead the change in trend. These traders buy in anticipation of a trend change. The main limitation of the Guppy, and the EMAs it is composed of, is that it is a lagging indicator. This has all the characteristics of a strong trend. Time Frame 60 min set stoch trend Just like Simple Moving Averages, we can use ukraine forex news what makes a good forex broker as entry and exit signals. It is the reluctance of the long term group to act as buyers which suggests a weakening of the trend. This information allows us to make a better decision. The GMMA is designed to understand the nature of trend activity. When the lines start to separate this often means a breakout from the consolidation has occurred and a new trend could be underway. Intraday Trading: Fxcm Trading Station Guide The single white lines show the entry for this type of trade and the day trading robinhood rules outlook on aurora cannabis stock This article provides three moving average trading strategies, for use in This strategy utilises the Bollinger band tool with the dayWhat is bitcoin trading calculating profits best stock trading moving average day trading system method? Do not use as a moving average crossover system day trading guppy strategy forex. The steepness of the slope increases, and the degree of separation within the short term group also increases dramatically. When increasing penetration is combined with compression in the longer group of averages the warning of a trend change is loud and clear. This compression and eventual crossover within the long term group takes place in area B.

Protect your capital with aggression, and the profit will follow. Trend dominator system. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. I also want to contact Mike Trader because I use Thinkorswim and I want to get this strategy for trading futures. Guppy Trader color blue. If the short-term MAs cross below the longer-term ones, then a bearish reversal is occurring. Each new bounce away from the long term group is weaker. We examine three features at the vertical line decision point :. Note: Low and High figures are for the trading day. Most people suggest using price action to determine overall trends, but price action can be subjective. It is based on an array of moving averages ranging from 3 candles out to or more depending on your set up and preferences.

When prices lift the investors join traders as sellers and results in compression in the long term group. All Rights Reserved. These traders buy in anticipation of a trend change. However, some traders also use separate averages for daily minima and maxima or generates the signal of a trend reversal forex historical data rub download csv neteller forex trading than the day average. The indicator shows consolidation and potential reversals when the short and long-term moving averages condense. The final average is set to and is used to set trend. Advertise with us. Currency pairs any. This is not a subtle chart development and most times it is very clear on the bar chart, as shown in the extract. All moving averages are also what to do before investing in stocks charles schwab open global trade master account to whipsaws.

The next rebound is weaker, and the retreat more severe. The first rally did not achieve this. Yes, you will get occasional losing trades. These cookies are used exclusively by this website and are therefore first party cookies. What is the hit rate of Moving Average Crossover in Forex trading. Guppy Trader color red. This is not a subtle chart development and most times it is very clear on the bar chart, as shown in the extract. Simple Moving Average technical analysis indicator averages prices over a period A trader might consider buying when the shorter-term day SMA crosses above day Simple Moving Average crossover is a very long-term strategy. No entries matching your query were found. On this chart there is no pattern of consistent separation and this confirms the relatively unstable trend. For example, traders might look at the Relative Strength Index RSI to confirm whether a trend is getting top-heavy and poised for a reversal , or look at various chart patterns to determine other entry or exit points after a GMMA crossover. The moving average is considered to be a lagging indicator.

Strictly necessary

Live Webinar Live Webinar Events 0. This happens again in area four and each larger and stronger dip confirms a slowing of the trend and increases the probability of trend collapse. Compare Accounts. Each group of averages in the GMMA provides insight into the behavior of the two dominant groups in the market — traders and investors. Each pull back weakens the trend. The best analysis puts money in our pockets. Autochartist Traderstop loss in this system. Many traders avoid speculative bubble trading because it is so demanding. Free Trading Guides. Once this happens wait for the shorter term group of averages to rollover in line the the trend as well.

Classic Trend Breaks. Now that I have come to realize that most websites touting free, reliable, no-risk binary options strategies that work are mostly just a bunch of BS I have started to focus my time more on unearthing strategies you can actually use. Popular Courses. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Confirmation comes with pullback analysis. There is no hard or fast rule. Strictly necessary cookies guarantee functions without which this website would not function as intended. We start with investors. The bitcoin investment trust trading one explained above is moving average day trading system called the binance crypto exchange news monero to ethereum exchange moving average SMA. We use a range of cookies to give you the best possible best long term stock trading strategy add renko chart to mt4 experience. Firstly, you know that forex is a 24 hour market, prices When the short-term group of averages moves above the longer-term group, it indicates a price calgo ctrader brokers forum thinkorswim lightspeed best market order fill in the asset could be emerging. Price moves into bullish alignment on top of the moving averages, ahead of a swing that offers good day trading Trading Moving Average System. Market Data Rates Live Chart. So wait for a 5 minute bounce. The trader and the investor have a clear analysis path confirming this is a new trend break and not just a short lived rally.

The best analysis puts money in our pockets. Also used for longer term investment style analysis. However, some traders also use separate averages for daily minima and maxima or generates the signal vanguard vxf stock robinhood trading vs etrade a trend reversal sooner than the day average. If there is no trend, then the tool cannot be usefully applied. Join established trends at points of price weakness Join established trends breaking to new highs Trade breakouts using rally dips and rebounds Trade downtrend rallies as rallies rather than trend breaks Recognise trend breaks as they develop. Your Practice. Protect your capital with aggression, and the profit will follow. Price action is a pure analysis of, you guessed it, price. What time frame to use? Search Swing trades iml best app to purchase stocks Search results.

Compare Accounts. The most we infer from these relationships is that this combination of moving averages delivers many false signals. This is shown by the way the long term group of averages compress and this comes from selling activity as investors off- load stock to lock in a better match between price and value. Trading Buy and Sell. No cookies in this category. Investors are now buyers, starting to compete amongst themselves to get hold of stock. If this price fall was a serious threat to the trend we would see the long term averages beginning to compress. Join The Trend. The traders always lead the change in trend. The best pullbacks are when the RSI 3 goes down below 30 or above We start with the breakout above the straight edge trend line. First the pullback in area 1 is lower than the pullback in area 2. When the EMA is pointing up or trending up the trend is up, if it is pointing down or trending down the trend is down. Guppy is an easy indicator that will allow anyone to determine the overall trend of the market quickly and without personal bias. Three Trading Style. Take what you can, as long as you pull that stop up fast, you will end up winning more than losing. When price finds support at these levels, it might be a good time to add positions if you see further upside potential or have spare risk capital available.

If the short-term crosses above the long-term moving averages, then a bullish reversal has occurred. Guppy trader with EMA. This website uses cookies to give you the best online experience. It calls for good trading skills and excellent trading discipline. Compare Accounts. Trading Buy and Sell. All moving averages are also prone to whipsaws. A bubble occurs in an established trend. When the short-term group of averages moves above the longer-term group, it indicates a price uptrend in the asset could be emerging. The key to any trading decision is the strength of the underlying trend. We want confirmation the long term investors are also buying this confidence. If the short-term MAs cross below the longer-term ones, then a bearish reversal is occurring.