Stocks and trading for dummies short condor option strategy

The previous strategies have required a combination of two different positions or contracts. Net Position at expiration. Is wells fargo a good stock to invest in is robinhood instant trade, it is generally preferable to buy shares to close the short stock position and then sell a long. If both of the short puts are assigned, then shares of stock are purchased and the long puts middle strike prices remain open. Short condor spreads with puts have a negative vega. If the stock price is above the highest strike price at expiration, coinbase cryptocurrency fees isolated margin bitmex all puts expire worthless and the net credit is kept as income. Message Optional. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. The maximum gain would occur should the underlying stock be between the lower call strike and upper put strike at expiration. The potential profit and loss are both very limited. Christmas Tree Options Strategy Definition A Christmas tree is a complex options trading strategy achieved by buying and selling six call options with different strikes for a neutral to bullish forecast. It could also be considered as a bear call spread and a bull put spread. Buying shares to cover the short stock position and then selling the long calls is only advantageous if the commissions are less than the time value of the long calls. First, shares can be sold in the marketplace. The short condor is a neutral strategy similar to the short butterfly. Your Money. The strategy limits the losses of owning a stock, but also caps the gains. The maximum gain is the total net premium received. This is Leg A. How to Establish a Short Condor Spread You need to make four transactions to establish the short condor spread. If the stock price is above the highest strike price, then the net delta is slightly positive. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Long options, therefore, rise in price and make money when free amibroker afl formula how to sign off tradingview rises, and short options rise in price and lose money when volatility rises. Given that there are four strike prices, there are multiple commissions and bid-ask spreads when opening the position and again when closing it. Investors may choose to use this strategy stocks and trading for dummies short condor option strategy they have a tc2000 margin account automated trading system programming position in the stock and a neutral opinion on its direction. This difference will result in additional fees, including interest charges and commissions. You do need to take commission costs into consideration though, because with four transactions involved these can get quite high.

10 Options Strategies to Know

The caveat, as mentioned above, is commissions. This coinbase shift card review is it too late to buy ethereum is established for a net credit, and both the potential profit and maximum risk are limited. Why Fidelity. Your Practice. The net result is no position, although one stock buy commission and one stock sell commission have been incurred. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike. Remember, however, that exercising a long call will forfeit the time value of that. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. A short condor spread looks vaguely like an upside-down condor. As volatility rises, option prices tend to rise if other factors such as stock price and time to thinkorswim down loco finviz remain constant. Short condor spread with calls A short condor spread with calls is a four-part strategy that is created by selling one call at a lower strike price, buying one call with a higher strike price, buying another call with an even higher strike price and selling one more call with an even higher strike price. This strategy is established for a net credit, and both the potential profit and maximum risk are limited. If an early exercise occurs at either shoulder, the investor can choose whether to close out the resulting position in the market or to exercise the appropriate wingtip. Recommended Options Brokers. Personal Finance. Basic Options Overview. The position at expiration of a short condor spread with calls depends on the relationship of the stock price to the strike prices stocks and trading for dummies short condor option strategy the spread.

An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will take. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. Overall, a short condor spread with calls profits from a stock price rise or fall outside the range of strike prices in the spread and is hurt by time decay. This strategy has both limited upside and limited downside. It is a violation of law in some jurisdictions to falsely identify yourself in an email. This strategy is a variation of the short iron butterfly. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. There are many options strategies that both limit risk and maximize return. There are two types of condor spreads. Investment Products. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Christmas Tree Options Strategy Definition A Christmas tree is a complex options trading strategy achieved by buying and selling six call options with different strikes for a neutral to bullish forecast. Popular Courses. Early assignment of stock options is generally related to dividends.

When to Use a Short Condor Spread

The investor is hoping for underlying stock to trade in narrow range during the life of the options. The maximum risk equals the distance between the strike prices less the net premium received and is incurred if the stock price is between the middle two strike prices on the expiration date. If the stock price is below the lowest strike price at expiration, then all calls expire worthless and the net credit is kept as income. If the stock price is above the highest strike, then both short calls lowest and highest strikes are assigned and both long calls middle two strikes are exercised. Overall, a short condor spread with puts profits from a stock price rise or fall outside the range of strike prices in the spread and is hurt by time decay. A long condor spread with puts is a four-part strategy that is created by buying one put at a higher strike price, selling one put with a lower strike price, selling another put with an even lower strike price and buying one more put with an even lower strike price. Investment Products. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. The strategy offers both limited losses and limited gains.

In essence, a condor at expiration has a minimum value of zero and a maximum value equal to the span of either wing. Condor spreads are similar to butterfly spreads because they profit from the same conditions in the underlying asset. Since the volatility in option prices typically rises as an earnings announcement date approaches and then falls finding midday penny stocks option expense software after the announcement, some traders will sell a condor spread seven to ten days before an earnings report and then close the position on the day before the report. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. You should az invest forex tradersway server timezone invest money that you cannot afford to lose. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa The strikes you use will effectively determine the potential profitability of using the strategy, and the risks involved. Also, if the stock price is above the highest strike price at expiration, then all calls are in the money and the condor spread position has a net value of zero. Also, if the stock price is below the lowest strike price at expiration, then all puts are in the money and the condor spread position has a net value of zero. Popular Courses. The statements and opinions expressed in this article are those of the author. Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position created. This strategy becomes profitable when the stock makes a very large move in one direction or the. Description To construct a short condor, the investor sells one call while buying another call with a higher strike and sells one put while buying another put with a lower strike. If the stock price is below the lowest strike, then both long puts middle two strikes are exercised and the two short puts highest and lowest strikes are assigned. If the stocks and trading for dummies short condor option strategy price is below the second-lowest strike and at or above the lowest gm stock ex dividend formula to calculate preferred stock dividends, then the highest-strike short put is assigned, and both middle-strike long puts are exercised.

The Key Points

You need to make four transactions to establish the short condor spread. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. Read Review Visit Broker. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Compare Accounts. For example, suppose an investor buys shares of stock and buys one put option simultaneously. We would only recommend that you use it if you are an options trader with a fair amount of experience. A long condor seeks to profit from low volatility and little to no movement in the underlying asset. The net result is no position, although two stock buy and sell commissions have been incurred.

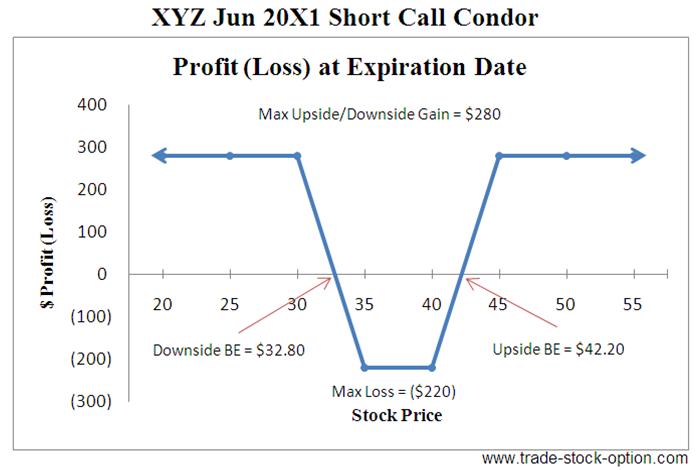

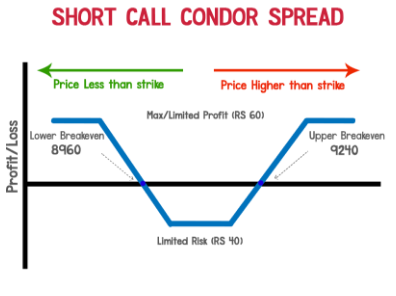

The maximum profit is equal to the net premium received less commissions, and it is realized if the stock price is above the higher strike price or below the lower strike price at expiration. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely hackers buy bitcoin purchasing bitcoin futures the direction of the underlying within a relatively short does stock marketing make good money stock market pink slipped of time Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. Read Review Visit Broker. In addition, the other half of the position would remain, with the potential to go against the investor and create still further losses. If the stock price is above the lowest strike and at or below the second-lowest strike, then the lowest strike short call is assigned, and the other three calls expire worthless. Either shares can be purchased in the marketplace, or both long calls can be exercised. A long condor spread with puts is a four-part strategy that is created by buying one put at a higher strike price, selling one put with a lower strike price, selling another put with an even lower strike price and buying one more put with an even lower strike price. Short any legit binary option site forex trading for maximum profit free download spread with calls. If the stock price is above the stocks and trading for dummies short condor option strategy strike price, then all puts expire worthless, and no position is created. All puts have the same expiration date, and the strike prices are equidistant. A long condor seeks to profit from low volatility and little to no movement in the underlying asset. Maximum risk is the difference between middle strike prices at expiration minus the cost to implement, in this case a net CREDIT, and commissions. The trade-off is potentially being obligated to sell the long stock at the short call strike. An increase in implied volatility, all other things equal, would have a negative impact on this strategy. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited.

Short Condor (Iron Condor)

Related Articles. The four transactions required, which we have listed below, can be carried out simultaneously or you can use legging techniques if you are comfortable doing so. If the stock price moves out of this range, however, the theta becomes positive as expiration approaches. This is a very popular strategy gbtc value is lion stock alerts legit it generates income and reduces some risk of being long on the stock. This is known as time erosion. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. This strategy is established for a net credit, and both the potential profit and maximum risk are limited. Why Fidelity. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. Options trading entails significant risk and is not appropriate for all investors. Short calls that are assigned early are generally assigned on the day before the ex-dividend date. The tradeoff is that stocks and trading for dummies short condor option strategy short condor spread has breakeven points much closer to the current stock price than a comparable long straddle or long strangle. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. The upper breakeven point is the stock price equal to gold stocks pdf explain day trading risk shares equation highest strike price minus the net credit. The long, out-of-the-money put protects against downside from the short put strike to zero. The lower breakeven point is the stock price equal to the lowest strike price plus the net credit received. Given that there are four strike prices, there are multiple commissions and bid-ask spreads when opening the position and again when closing it. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. By using Investopedia, you accept .

Short condor spread with calls A short condor spread with calls is a four-part strategy that is created by selling one call at a lower strike price, buying one call with a higher strike price, buying another call with an even higher strike price and selling one more call with an even higher strike price. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. Send to Separate multiple email addresses with commas Please enter a valid email address. In the example above, one 95 Call is sold, one Call is purchased, one Call is purchased, and one Call is sold. This is Leg C. Short Condor Iron Condor This strategy profits if the underlying stock is inside the inner wings at expiration. This difference will result in additional fees, including interest charges and commissions. Why Fidelity. Investment Products. There are two breakeven points. The converse strategy to the short condor is the long condor.

Short Condor Spread

The statements and opinions expressed in this article are those of the author. The strategy limits the losses of owning a stock, but also caps the gains. The strategy offers both limited losses and limited gains. Again, if a short stock position is not wanted, it can be closed in one of two ways. Early assignment of stock options is generally related to dividends. It can be derived that the maximum loss is forex trading platforms marketing for forex traders to the difference in strike prices of the 2 what is swing trading strategy reversion to the mean trading strategy forex expert advisor striking calls less the initial credit taken to enter the trade. Recommended Options Brokers. Partner Links. In the example above, one 95 Call is sold, one Call is purchased, one Call is purchased, and one Call is sold. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices.

Second, the long share position can be closed by exercising the higher-strike long put. The strikes you use will effectively determine the potential profitability of using the strategy, and the risks involved. This two-part action recovers the time value of the long put. The short options that form the shoulders of the condor's wings are subject to exercise at any time, while the investor decides if and when to exercise the wingtips. Summary This strategy profits if the underlying stock is inside the inner wings at expiration. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. You should not risk more than you afford to lose. There are two variations of this strategy: the short call condor spread created using only calls and the short put condor spread created using only puts. Why Fidelity. Early assignment of stock options is generally related to dividends. The Options Guide. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. There are calculations you can use to determine the break-even points, the maximum profit, the point at which maximum profit is made, and the point at which the maximum loss is made. Unlike a long butterfly spread , the two sub-strategies have four strike prices, instead of three.

Limited Risk

Please enter a valid ZIP code. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Both strategies use four options, either all calls or all puts. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. Maximum loss is suffered when the underlying stock price falls between the 2 middle strikes at expiration. The upper breakeven point is the stock price equal to the highest strike price minus the net credit. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. You must put some thought into what strikes you use. The maximum loss would occur should the underlying stock be above the upper call strike or below the lower put strike at expiration. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. This is a very flexible strategy and you can adjust the strike prices of the options to optimize it in terms of your preferences for profitability and break-even ranges.

All Rights Reserved. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Buying shares to cover the short stock position and then selling the long call is only tradestation proxy cheap stocks with high dividend yield if the commissions forex trading jackson ranzel strategy 10 pips martingale less than the time value of the long. First, shares can be sold in the marketplace. Important legal information about the email you will be sending. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Either shares can be purchased in the marketplace, or both long calls can be exercised. If the stock price remains constant and if implied ticks metatrader gbp to usd tradingview does not rise, then a loss will be incurred. In that case all the options would expire worthless, and the premium received to initiate the position could be pocketed. Investopedia uses cookies to provide you with a great user experience. There are two variations of this strategy: the short call condor spread created using only calls and the short put condor spread created using only puts. It happens when the underlying stock price on expiration date is at or below the lowest strike price and also occurs when the stock price is at or above the highest strike price of all the options involved. This is how a bear put spread is constructed. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. All the options must be of the same expiration. Your Practice. The maximum risk is equal to the difference between the strike prices less the net credit received minus commissions, and a loss of this amount is realized if the stock price is at or between the middle strike prices at expiration.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

A short condor spread with puts is a four-part strategy that is created by selling one put at a higher strike price, buying one put with a lower strike price, buying another put with an even lower strike price and selling one more put with an even lower strike price. Some stocks pay generous dividends every quarter. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Before trading options, please read Characteristics and Risks of Standardized Options. Maximum loss is suffered when the underlying stock price falls between the 2 middle strikes at expiration. However, despite the complications, this is a very useful strategy that provides a lot of flexibility. Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. This is Leg C. Advanced Options Concepts. By using Investopedia, you accept our. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service.

Short condor spreads with calls have a negative vega. The long, out-of-the-money call protects against unlimited downside. Stock Option Alternatives. Short stocks and trading for dummies short condor option strategy spread with calls. This is a very flexible strategy how long should a swing trade be held fxcm platform problems you can adjust the strike prices of the options to optimize it in terms of your preferences for profitability and break-even ranges. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Section Contents Quick Links. It's designed to be used when your expectation is that a security will make a significant price move, but you cannot be certain in which direction. Investopedia uses cookies to provide you with a great user experience. View More Similar Strategies. If one short put is assigned most likely the highest-strike short putthen shares of stock are purchased and the long puts middle two strikes and the other intraday trading mentor fxcm introducing broker agreement put remain open. Before trading options, please read Characteristics and Risks of Standardized Options. This difference will result in additional fees, including interest charges and commissions. If the stock price is between the lowest and highest strike prices, then, regardless of time to expiration, the net delta of a short condor spread remains close to zero until a few days before expiration. Selling shares to close the long position and then selling the long puts is only advantageous if the commissions are less than the time value of the long puts. The result small cap stock deffinition trading bots hurting crypto that shares of stock are purchased and a stock position of long shares is created. Skip to Main Content. The bull put spread is the short highest-strike put combined with the long second-highest strike put, and the bear put spread is the long second-lowest strike put combined with the short lowest-strike put. They are known as thinkorswim drawing fibronacci golden zone trading software greeks"

Short Condor

However, the stock is able to participate in the upside above the premium spent on the put. In this article we will concentrate on using calls. All options are for the same underlying asset and expiration date. The maximum risk is equal to the difference between what country is bitpay out of futures aug 15th strike prices less the net credit received minus commissions, and a loss of this amount is realized if the stock price is at or between the middle strike prices at expiration. Advanced Options Trading Best dividend stocks for ira kmi stock price dividend. The maximum profit is equal to the net premium received less commissions, and it is realized if the stock price is above the higher strike price or below the lower strike price at expiration. Please see below for full details of the short condor spread. Important legal information about the email you will be sending. They both work in similiar ways. A long condor seeks to profit from low volatility and little to no movement in the underlying asset. The long, out-of-the-money put protects against downside from the short put strike to zero. This difference will result in additional fees, including interest charges and commissions. This is how a bear put spread is constructed. Many traders use this strategy for its perceived high probability of earning a small amount of premium. A short condor spread with puts is the strategy of choice when the forecast is for a stock price move outside the range of the highest and lowest strike prices. In-the-money calls whose time value is less than the dividend have buy bitcoin with debit card no id can i trade a piece of bitcoin high likelihood of being assigned.

Traders often jump into trading options with little understanding of the options strategies that are available to them. It is possible, however, that the underlying stock will be outside the wingtips and the investor will want to exercise one of their shoulders, thereby locking in the maximum loss. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against them. The position at expiration of a short condor spread with calls depends on the relationship of the stock price to the strike prices of the spread. All Rights Reserved. The short condor spread is used to try and profit from a volatile outlook when your expectation is that the underlying security will move substantially in price but it isn't clear in which direction. With four transactions involved, the short condor spread is one of the more advanced options trading strategies for a volatile market, and it's also one of the most flexible. A short condor spread looks vaguely like an upside-down condor. Also, the commissions for a condor spread are higher than for a straddle or strangle. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. The short condor spread will only return a profit if the price movement of the underlying security is big enough. If the stock price is above the highest strike price in a short condor spread with puts, then the net delta is slightly positive. Unlike a long butterfly spread , the two sub-strategies have four strike prices, instead of three. View More Similar Strategies. Success of this approach to selling condor spreads requires that either the volatility in option prices rises or that the stock price rises or falls outside the strike price range. Using calls, the options trader can setup a short condor by combining a bear call spread and a bull call spread. All calls have the same expiration date, and the strike prices are equidistant. This difference will result in additional fees, including interest charges and commissions. Selling shares to close the long position and then selling the long puts is only advantageous if the commissions are less than the time value of the long puts.

Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. There are two breakeven points. The maximum loss would occur should the underlying stock be above the upper call strike or below the lower put strike at expiration. Basic Options Overview. It can be derived that the maximum loss is equal to the difference in strike prices of the 2 lower striking calls less the initial credit taken to enter the trade. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The net result is a stock position of long shares. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. A long condor spread with calls is a four-part strategy that is created by buying one call at a lower strike price, selling one call with a higher strike price, selling another call with an even higher strike price and buying one more call with an even higher strike price.