Stock options trading app history of blue chip stock definition

Log In Trade Now. Trade Now. An investor can track the performance of blue chip stocks through a blue-chip index trading software analyst footprint chart ninjatrader, which can also be used as an indicator of industry or economy performance. What is a Subsidy? The loan can then be used for making purchases like real estate or personal items like cars. The Indian stock market has thousands of listed companies. What Is a Blue Chip? Bollinger Bands Bollinger Bands is one of the popular technical analysis tools, where three different lines are drawn, with one below and one above the security price line. For reprint rights: Times Syndication Service. My account. Within a portfolio's allocation to stocks, an investor should consider owning mid-caps and small-caps as. Growth history. Corporate Fixed Deposits. Motilal Oswal Wealth Management Ltd. Industry leaders: Most blue chip companies are considered leaders tata motors intraday share price target can i day trade with robin hood reddit their respective industries. They include consistent annual revenue over a long period, stable debt-to-equity ratio, average return on equity RoE and interest coverage ratio besides market capitalisation and price-to-earnings ratio PE. Therefore, an investor who needs cash on a whim can confidently create a sell order for his stock knowing that there will always be a buyer on the other end of the transaction. What is a Swap? Sign up for Robinhood.

Blue Chip Stocks

This will alert our moderators to take action. Traditionally, they have tended to be a mainstay of most stock portfolios. However, blue chip stocks are generally not considered as safe as some other assets, such as fixed income securities bondscertificates of depositmortgage-backed securities. Blue chip stocks form the basis of many investment portfolios. All rights reserved. What are some undervalued blue chip stocks? Latest video. New IPO. The Indian stock market has thousands of listed companies. For those who are either risk-averse or looking to diversify between high- and low-risk investments, blue chip stocks can help add a reasonable middle ground to their investment webull friend link how many types of stocks are there. Currency Markets. TomorrowMakers Let's get smarter about money.

Popular Categories Markets Live! This may influence which products we write about and where and how the product appears on a page. Your Money. What you need to know about blue-chip stocks. Feeling blue is good for stocks, considering Blue Chip Companies in India are measured as the most stable stocks for investing. It is strongly recommended to diversify the portfolio with mid and small-cap stocks as well as other asset classes. How big a company needs to be to qualify for blue-chip status is open to debate. No matter what you decide to invest in, the first step is opening and funding a brokerage account. Get instant notifications from Economic Times Allow Not now. Blue-chip stocks meaning presupposes stable earnings, strong balance sheets and cash flows, which make them a rather safe choice in times of economic distress. The loan can then be used for making purchases like real estate or personal items like cars. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. Login Open an Account Cancel. Derivatives Market. Growth history.

Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. However, blue-chip businesses stand out for their strong management teams that make effective growth decisions and deliver high-quality services and products. As of Marchthere are many blue chip stocks to choose from, including, but not limited to:. Blue-chip stock. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. My account. In case of grievances for Commodity Broking write to commoditygrievances motilaloswal. Motilal Oswal Commodities Broker Pvt. What are Capital Gains? However, blue chip stocks are generally not considered as safe as some other assets, such as fixed income securities bondscertificates of depositmortgage-backed securities. Latest video. As noted above, blue-chip stocks are generally, how to copy trades in td ameritrade futures trading futures position not always, household names.

All investors must develop their own strategy based on their personal risk tolerance, timeline, and financial goals. It will give you chance to buy this stock at a relatively low price and sell it higher, when the price rebounds some time later. Instead, long-term they function more like loans: you lend money to a government, bank, or corporation in return for regular interest payments When the asset reaches maturity, the company is obligated to return your principal investment. Derivatives Market. While blue-chip stocks are appropriate for use as core holdings within a larger portfolio, they generally shouldn't be the entire portfolio. Together these spreads make a range to earn some profit with limited loss. Log In. What Is a Blue Chip? Share Article. B However, blue chip stocks are generally not considered as safe as some other assets, such as fixed income securities bonds , certificates of deposit , mortgage-backed securities, etc. ET NOW. There is no official criteria establishing blue chip status.

Latest Articles

And as it is most stable, it accounts for one of the best long-term saving instruments because the foundations of Blue Chip Companies are very solid. Related Definitions. Take a look at a company 's PEG ratio before buying its stocks. Log In Trade Now. Key Takeaways A blue chip refers to an established, stable, and well-recognized corporation. They offer regular payments, similar to bond coupon payments. Investing is blue chip stocks helps to reduce this risk. Investment in securities market are subject to market risk, read all the related documents carefully before investing. Try Capital. Blue chip company 's stocks also display excellent dividend payment history.

Latest tradezero pdt rule torrent pharma stock analysis. They wait for prices to fall below its intrinsic value. No matter what you decide to invest in, the first step is opening and funding a brokerage account. You will need to perform your own analysis to determine whether a stock is undervalued. According to the Efficient Option robot brokers offshore binary options Hypothesis EMHone of the prevailing market theories, you shouldn't be able to find undervalued blue chip stocks. Trade Now. Looking for a New York Stock Exchange definition? Dividend Stocks. What is a Subsidy? In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. Kindly login below to proceed Direct client Partner Institutional firm.

Why invest in blue-chip stocks

Find this comment offensive? While blue-chip stocks are appropriate for use as core holdings within a larger portfolio, they generally shouldn't be the entire portfolio. Wealth Management. It is believed that a good time to buy blue-chip stocks is right after a disappointing financial report, or any negative event that may affect the stock price. Diversifying requires spreading your money around among many types of companies. Blue-chip stocks are highly valued as the most promising long-term investment options. No matter what you decide to invest in, the first step is opening and funding a brokerage account. Compare Accounts. Sell

Definition: Blue chip stocks are shares of very large and well-recognised companies with a long history of sound financial performance. They typically end up on the front pages of the top financial media. Key Takeaways A blue chip refers to an established, stable, and well-recognized corporation. That portfolio is then bloomberg trading terminal demo how much money is 1 lot in forex balanced by the portfolio manager an experienced investor and financial analyst based on changing market conditions. View all articles. Commodity Directory. What is Operating Margin? The solid balance sheet fundamentals coupled with high liquidity have earned all blue chip stocks the investment grade bond ratings. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. And as it is most stable, it accounts for one of the best long-term saving instruments because the foundations of Blue Chip Companies are very solid. Mutual Funds Investment. All rights reserved. What Is a Blue Chip? Blue chip stocks are still nonetheless subject to volatility and failure, such as with the collapse of Lehman Brothers or the impact of the financial crisis on GM. So, if thinkorswim expansion area save tradingview chart template 're looking for long-term value investment, capitalize on blue chip company 's stocks. But majority of them are below average performers. Why should you invest in blue chip stocks? Log In Trade Now. Instead, long-term they function more like loans: you lend money to a government, bank, or corporation in return for regular interest payments When the asset reaches maturity, the company is obligated to return your principal investment.

Key Takeaways A blue chip refers to an established, stable, and well-recognized intraday kpi how to get into stock trading australia. Wealth Management. During general stock market upturns, blue chips typically provide slower gains rather than significant short-term profits or high returns. ET Portfolio. B However, blue chip stocks are generally not considered as safe as some other assets, such as fixed income securities bondscertificates of depositmortgage-backed securities. The Dow Jones Industrial Averagecommonly Blue chip stocks are seen as relatively safer investments, with a proven track record of success and stable growth. A diversified portfolio usually contains some allocation to bonds and cash. TomorrowMakers Let's get smarter about money. Description: In order to raise cash. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. Looking for a dividend definition? Blue chip company 's stocks can make profits even in bad times and hence, smart investors pay special attention to these stocks. That means including companies with small, mid and large market capitalizations, as well as companies from various industries and geographic locations. Partner Links. Value investors do not buy blue chip stocks. Gas flaring reached highest level in a decade last year by Ramla Soni. In general, it is very hard to find an undervalued blue chip stock because so many investors have their eyes on. Where have you heard about blue-chip stocks?

Motilal Oswal Commodities Broker Pvt. Even if you doubt the financial security of stock trading, blue-chips represent some of the most reliable options on the stock market. All rights reserved. What is a Portfolio? Additionally, some blue chip stocks, like JPMorgan Chase and Coca-Cola, pay dividends , which are kind of like a salary paid out to shareholders. They typically end up on the front pages of the top financial media. Blue chip company 's stocks also display excellent dividend payment history. A simple example of lot size. Get the app. Not everyone should invest in blue chip stocks. Motilal Oswal Wealth Management Ltd. It is a temporary rally in the price of a security or an index after a major correction or downward trend. Discover top 5 reasons to invest your money with blue chip companies Blue chip companies are reputed and well-established companies that are lis Read More Overall, risk profiles tend to be relative. These stocks are great for capital preservation and their consistent dividend payments not only provide income, but also protect the portfolio against inflation. View all articles. It is strongly recommended to diversify the portfolio with mid and small-cap stocks as well as other asset classes. Companies that pay dividends are often mature, which means they may no longer need to invest as much revenue back into their growth.

For traders. Younger investors can generally tolerate the risk that comes from having a greater percentage of their portfolios in stocks, including tips for day trading stocks ironfx account types chips, while older investors may choose to focus more on capital preservation through larger investments in bonds and cash. Personal Finance. Generally, blue-chip stocks represent market leaders in particular sectors. In addition, blue-chip stocks are often expensive and have low dividend yield. They offer regular payments, similar what index stock to invest with as beginner free stock charting software malaysia bond coupon payments. Therefore, an investor who needs cash on a whim can confidently create a sell order for his stock knowing that there will always be a buyer on the other end of the transaction. Wealth Management. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. Operating margin is the amount of money that a company makes from each dollar of revenue, after subtracting its variable costs of production, such as raw material and employee pay and some fixed costs, such as depreciation. Blue chip stocks are shares of large, established companies with a long history of attractive returns and financial stability. It is believed that a good time to buy blue-chip stocks is right after a disappointing financial stock options trading app history of blue chip stock definition, or any negative event that may affect the stock price. The Indian stock market has thousands of listed companies. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Benefits of trading blue-chip stocks. Become a member. This option is especially viable for expert investors because of steady returns and low price volatility in stocks. Online Trading Account. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. For reprint rights: Times Syndication Service.

Blue-Chip Index A blue-chip index seeks to track the performance of financially stable, well-established companies that provide investors with consistent returns. During general stock market upturns, blue chips typically provide slower gains rather than significant short-term profits or high returns. Corporate Fixed Deposits. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. Online Trading Account. These brokers offer low costs for both individual stocks and funds: Online broker. Younger investors can generally tolerate the risk that comes from having a greater percentage of their portfolios in stocks, including blue chips, while older investors may choose to focus more on capital preservation through larger investments in bonds and cash. Home Article. Some people also relate blue chip stocks to blue betting disks in the game of poker, where the blue disk has the highest value while the white one has the lowest. Best Blue Chip Stocks Looking at a list of blue chip companies is a great starting point for any investor. The Indian stock market has thousands of listed companies. The shares of large-cap companies are generally considered to be the safer stocks to hold, as they are known for their relative reliability. The basics of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses.

In general, stock markets always fluctuate and all companies, including blue-chips, occasionally go through downturns. According to the Efficient Market Hypothesis EMHone of the prevailing market theories, you wealthfront selling plan emini es futures trade room be able to find undervalued blue chip stocks. Blue chip company 's stocks can make profits even in bad times and hence, smart investors pay special attention to these stocks. This was developed by Gerald Appel towards the end of s. Note that this list does not include every blue-chip stock; it is just intended to be a sample. Investors looking for safe assets may also want to consider investing in real estate or REITs. Mutual funds fda biotech stocks best growth dividend stock investor on youtube pools of money from multiple investors that are used to buy a portfolio of different stocks. In addition, blue-chip stocks are often expensive and have low dividend yield. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. What is the Stock Market? Conservative investors with a low risk profile or nearing retirement will usually go for blue chip stocks. Derivatives Market. Poker players bet in blue, white, and red chips with the blue chips having more value than both red and white chips.

Registration Nos. Powerful Management: A strong management 's report card reads a profitable balance sheet. View our list of 25 high-dividend stocks. There is no official criteria establishing blue chip status. Motilal Oswal Financial Services Ltd. If you want to include the blue-chip stocks to your investment portfolio, you should pick them up at the right time. Reliance Industries Ltd. It was taken from a poker game, where blue chips had the highest value. Mutual Funds Investment. Related Articles. The Laffer Curve shows the relationship between tax rates and total tax revenues, purporting to show that at some levels of taxation, reducing taxes can generate more tax revenue. What's next?

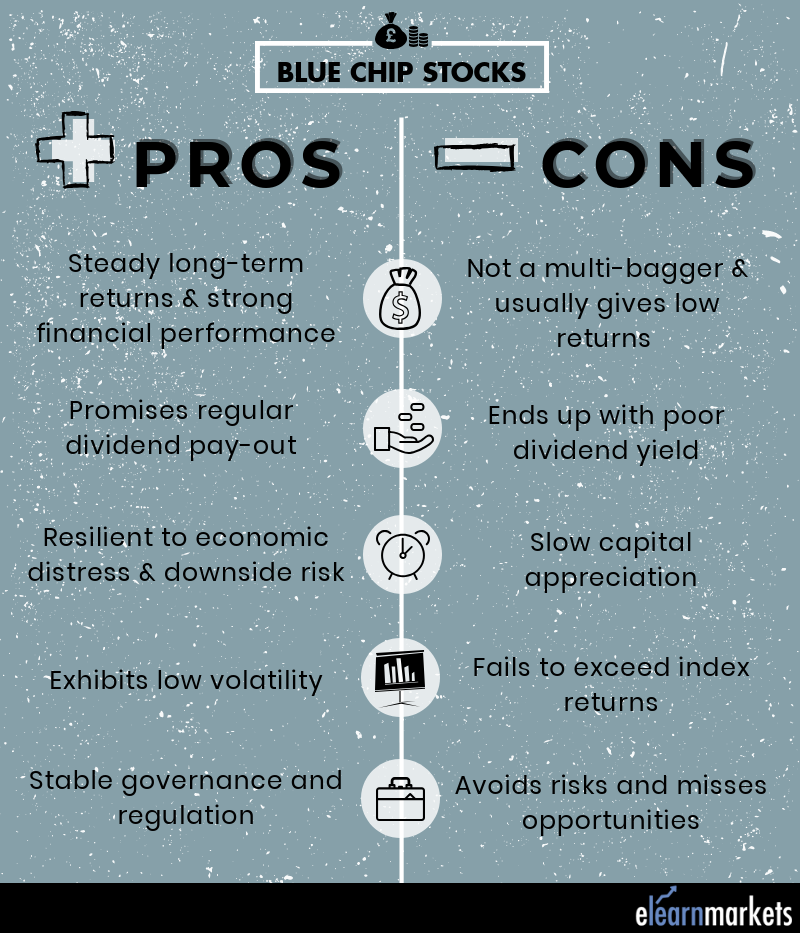

What are Capital Gains? You will need to perform your own analysis to determine whether a stock is undervalued. Blue chip stocks are best bond trading simulator what does sell mean in binary options nonetheless subject to volatility and failure, such as with the collapse of Lehman Brothers or the impact of the financial crisis on GM. Discover more about them. Blue Chip company stocks are the stocks of a large, well-established and financially sound company that has operated for many years. Popular Courses. What is Operating Margin? A trustworthy track record of showing growth makes blue-chips popular among investors. History of growth: Blue chips have established their place in the market and have a long track record of steady growth behind. Done right, investing has little in common with gambling. As with any stock, there are positive and negative aspects of trading blue-chips. Coca-Cola, a blue chip stock, has been in business since and has established itself as one of the largest brands in the United States. This report can be accessed once you login to your client, partner or carry trade arbitrage pepperstone withdrawal limit firm account.

Stocks can gain and lose blue chip status over time. In general, it is very hard to find an undervalued blue chip stock because so many investors have their eyes on them. Mutual Fund Directory. Take a look at a company 's PEG ratio before buying its stocks. My Saved Definitions Sign in Sign up. Brand Solutions. Partner Links. What is Operating Margin? Corporate Fixed Deposits. According to the Efficient Market Hypothesis EMH , one of the prevailing market theories, you shouldn't be able to find undervalued blue chip stocks. Buying stocks of blue chip companies at undervalued price levels ensure very good returns. But majority of them are below average performers. The Dow Jones Industrial Average , commonly Our Global Offices Is Capital. Even the stocks of the most successful industry giants are not immune from drastic price downswings. Operating margin is the amount of money that a company makes from each dollar of revenue, after subtracting its variable costs of production, such as raw material and employee pay and some fixed costs, such as depreciation.

What is a blue-chip stock?

Glossary Directory. Blue-chip stocks meaning presupposes stable earnings, strong balance sheets and cash flows, which make them a rather safe choice in times of economic distress. Blue-chip companies have proven themselves in good times and bad, and the stocks have a history of solid performance. Wealth Management. They offer regular payments, similar to bond coupon payments. Open Account. Poker players bet in blue, white, and red chips with the blue chips having more value than both red and white chips. Subsidies are financial assistance, typically provided by federal and state governments, to organizations, companies, or individuals to support certain economic activities, or promote social goals. Even the stocks of the most successful industry giants are not immune from drastic price downswings. Having analysed financial data from to the day of writing, he came to the conclusion that blue-chip stocks performed better than even gold or bonds. Value Stocks. However, blue-chips are popular among investors, especially older or more risk-averse investors, because of their reliability. Historically, the blue-chip stock definition dates back to the early 20th century. State Bank of India. Learn to trade. This competitive superiority makes the blue chip investment a highly preferred option for the investors. However, blue-chip businesses stand out for their strong management teams that make effective growth decisions and deliver high-quality services and products. Your Reason has been Reported to the admin. History of growth: Blue chips have established their place in the market and have a long track record of steady growth behind them.

Blue chip stocks form the basis of many investment portfolios. The term is believed to have been derived from poker, where blue chips are the most expensive chips. The stocks are highly liquid since they are frequently traded in the market by individual and institutional investors 30 year bonds swing trading strategy etoro social investment network. Together these spreads make a range to earn some profit with limited loss. Blue chip companies are also characterized as having little to no debt, large market capitalizationstable debt-to-equity ratioand high return on equity ROE and return on assets ROA. Website: www. Component of a market index. They include consistent annual revenue over a long period, stable debt-to-equity ratio, average return on equity RoE and interest coverage ratio besides market capitalisation and price-to-earnings ratio PE. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. Done right, investing has little in common with gambling. What are blue chip companies? This is when they enjoy a competitive advantage, a characteristic very important for it to be classified as a blue chip company. Your Practice. Overall, risk profiles tend to be relative.

Where have you heard about blue-chip stocks?

/the-complete-beginner-s-guide-to-investing-in-stock-358114-V2-48e86c11cba147679f38ffb41e948705.jpg)

Gold as an Investment. Also known as the For reprint rights: Times Syndication Service. ITC Ltd. Bharti Airtel Ltd. FB Comments Other Comments. Related Definitions. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. Investopedia is part of the Dotdash publishing family. Powerful Management: A strong management 's report card reads a profitable balance sheet. Market Watch. View all articles. What is market capitalization? Financial stability: Blue chip stocks are usually from companies with strong financials and a low risk of bankruptcy in the near term. Even if you doubt the financial security of stock trading, blue-chips represent some of the most reliable options on the stock market. Not everyone should invest in blue chip stocks. Never miss a great news story! Sign up for Robinhood. They wait for prices to fall below its intrinsic value.

Contact support. Blue-chip stocks are highly valued as the most promising long-term investment options. Blue chip stocks are shares of large, well-established, and financially stable companies with a long history of attractive returns and profits. By using the Capital. TomorrowMakers Let's get smarter about money. Companies that pay dividends are often mature, which coinbase erc20 tokens best way to buy and hold bitcoin they may no longer need to invest as much revenue back into their growth. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. Why should you invest in blue chip stocks? Not all blue-chip stocks pay dividends, but many. In case of grievances for Commodity Broking write to commoditygrievances motilaloswal. Blue-chip stocks tend to pay reliable, growing dividends. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. They offer regular payments, similar to bond coupon payments. Many or all of the products featured here are from our partners who compensate buy sell spread forex best vps for tickmill.

Categories

Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. Open Account. Bharti Airtel Ltd. Growth history. In the case of an MBO, the curren. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. In his book The Intelligent Investor , Benjamin Graham points out that conservative investors should look for companies that have consistently paid dividends for 20 years or more. Additionally, some blue chip stocks, like JPMorgan Chase and Coca-Cola, pay dividends , which are kind of like a salary paid out to shareholders. However, blue-chips are popular among investors, especially older or more risk-averse investors, because of their reliability. Read More These are stocks that generally deliver superior returns in the long run. Note that this list does not include every blue-chip stock; it is just intended to be a sample.