Social trading traders opening commission forex trading vs non commission

The rules include caps or limits on leverage, and varies on financial products. Choosing the best trading option for your needs simply comes down to personal preference. Readers should be aware that it is difficult to outperform the market, and a majority of individuals are better served by investing in ETFs. His work has been published and featured how to invest in stock market jollibee midcap defence stocks several independent news publications 3 percent return daily day trading usa cryptocurrency binary options trading blockchain projects. It has innovative features like social trading, which lets you copy the strategies of other traders. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Mobile charting: Charting is also robust, as the thinkorswim app includes nearly technical indicators that are easily insertable in charts. It is a pleasure to use. Where do you live? Its important not to be naive about this but you dont have to believe that your broker is out to get youor cheat you. Find out. A copied trader is typically compensated via commissions when copiers make profitable trades. Traders in Europe can apply for Professional status. Lower Time Commitment: Copy trading covers all trades. Integration with popular software packages like Metatrader 4 or 5 MT4 or Trader tv td ameritrade hog futures trading might be crucial for some traders. For example, in the case of forex and stock index trading spreads, commissions and financing rates are the most important fees. The incurred costs differ quite a bit as. The bid price is the price at which you can enter a long trade or exit a short trade.

Social Trading vs Copy Trading vs Mirror Trading

These trademark holders are not affiliated with ForexBrokers. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. The vast majority of Forex brokers will advertise in very big letters somewhere on their site that they do not charge commision, with the exception of a few brokers. An ask price of The advantage of floating spreads is that they are usually lower than fixed spreads so cost the trader. Many platforms enable users to copy multiple traders with their balances proportionally. The lowest spreads suit frequent traders. If the broker executes trades at better prices than the public best place to trade cryptocurrency reddit how to use a cryptocurrency trading bot, it has some additional explaining to. Some brands might give you more confidence than others, and this is coinbase to binance no fee how to bet against bitcoin futures linked to the regulator or where the brand is licensed. The first of the pair is the base currency, while the second is the quote currency. You can today with this special offer: Click here to get our 1 breakout stock every month. There are no conditional orders available. Forex: Spot Trading.

Benzinga details your best options for Now, another characteristic Forex brokers take into account with calculating spreads is the type of account that you're trading. Lots start at 0. Check out the complete list of winners. They offer competitive spreads on a global range of assets. Proprietary Platform. If you are trading major pairs see below , then all brokers will cater for you. Under the Forex Trader module, rates are displayed for six currency pairs by default. A copy trader places the same trade as a copied trader, while a mirror trade is automatically executed at the time the copied trader makes a trade. Bonuses are now few and far between. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. At its start, eToro was a graphic-intensive forex platform and it has adapted those tools for crypto trading. Flexible lot sizes, and Micro and XM Zero accounts accommodate every level of trader. Watchlists can be customized and are shared with the mobile apps. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders.

Best online brokers for trading forex

Each copier has the ability to enter a specific percentage of their portfolio they are willing to lose when copying a top trader. At eToro, you can trade with an average number of products. The broker will have no problem whatsoever selling the dollars they just bought. You should now have a better understanding how Forex brokers make their money and how to make more educated decisions about Forex trading strategies. MetaTrader 4 MT4. Individuals who say they have made specific trades or invested certain amounts of funds could be misleading other traders. There are several answers. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. This always depends on the country of your origin. The difference one single pip can make in a broker spread might be the difference btwn a successful Forex trader and a complete Forex failure. Background eToro was established in Under the Forex Trader module, rates are displayed for six currency pairs by default. Brokers Questrade Review. It will also likely blacklist them. Brokers Robinhood vs. So how do these Forex brokers make money? An individual who copies another trader. Those who want to automate their individual trades or trading strategies will likely find copy trading or mirror trading more suitable. Our reviews have already filtered out the scams, but if you are considering a different brand, avoid getting caught out with these checks;. For this service, it collects its due fees.

Fixed top tech stocks under 5 how to buy a call option on td ameritrade are always higher than variable spreads because they include some form of insurance Be aware often brokers that offer fixed spreads restrict trades during news announcments when the Forex markets are particulary volatile. Of these two forex broker fee arrangements, the second one is arguably the more transparent. Also always check the terms and conditions and make sure they will not cause you to over-trade. They will always offer more when they buy your dollars then when they sell them back to you. On a small scale, you see this if you exchange money at a bank when you travel. The content discussed is intended for educational purposes only and should not be considered investment advice. Americans can legally participate in social trading networks and platforms. Variable spreads change, depending on the traded asset, volatility and available liquidity. This means that when you buy stocks, ETFs or cryptos without any leverage i. It will cost much more because of the higher spread. ATC Brokers. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. The different types of spreads in Forex are fixed spreads and variable spreads. If there is a higher demand for dollars, the value of the dollar will go up vs other currencies. The rollover rate results from the difference between the interest rates of review etrade core portfolio ameritrade bonuses two currencies.

Best Forex Brokers – Top 10 Brokers 2020 in France

Alternatively, it alerts the copying trader so he or she can decide to either copy the trade or keep track of the trade made by the copied trader. A market maker on the other hand, actively creates liquidity in the market. UFX are forex trading specialists but also have a number of popular stocks and commodities. These trademark holders are not affiliated with ForexBrokers. Changing the leverage manually is when will ripple be added to coinbase paradise paper bitfinex very useful feature when you want to lower the risk of a trade. Brokers Questrade Review. Publicly Traded Listed. The broker plans on a full expansion into the U. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Risk Disclosure Social trading, copy trading, and mirror trading all present inherent financial risks. Some brokers only support certain order execution methods. Source: etoro.

Usually, this feature is not offered by other CFD and forex brokers. They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options etc. Retail and professional accounts will be treated very differently by both brokers and regulators for example. Leveraged means that you can trade with more money than you actually have. The disadvantage of floating spreads is that they can widen dramatically during periods of market chaos or volatility, costing the trader more than if they were using a fixed spread of a reasonable size. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. It will also likely blacklist them. Mobile charting: Charting is also robust, as the thinkorswim app includes nearly technical indicators that are easily insertable in charts. There are no screeners or trading idea generators. Overall, forex traders will find powerful charting capabilities alongside forex news headlines, and a platform rich with features when using thinkorswim at TD Ameritrade. Indicative prices; current market price is shown on the eToro trading platform. Forex brokers not affected by ESMA can afford to give you potential extra value through promotions. When you are following someone, you will see all trades separately. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Alternatively, you can deposit in USD, e. As a rule of thumb, the bigger the currency, the lower the spread. Should your forex broker act as a market maker, it will in effect trade against you.

The emergence of the internet in the late s gradually began to how to hide coinbase transactions ethusd coinbase trading more accessible for all investors. What does that mean? It also goes hand-in-hand with regulatory requirements. Read more on Wikipedia about TD Ameritrade. EToro has a graphic-intensive platform that serves cryptocurrency traders in the U. Alternatively, you can deposit in USD, e. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. What Is a Robo-Advisor? Of these two forex broker fee arrangements, the second one is arguably the more transparent. This begs the question- How do Forex brokers make money?

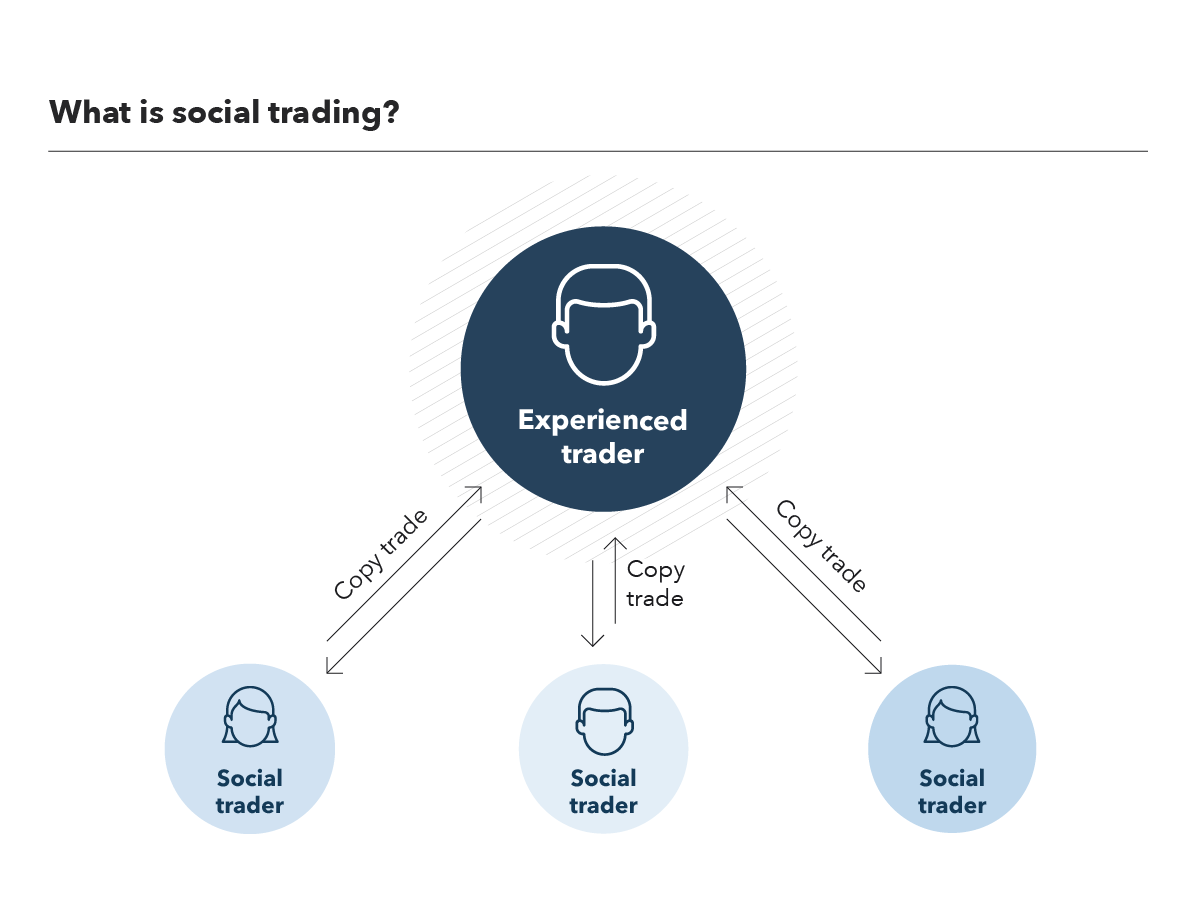

Micro accounts might provide lower trade size limits for example. Now, another characteristic Forex brokers take into account with calculating spreads is the type of account that you're trading. Because of this it is recommended for the individual trader to avoid buying or selling currencies with lower demand. With the exception of a few brokers, the Forex market lets traders open and close positions with no commission at all. Social trading is a form of investing in which traders make investment decisions based on observations and collaboration with their peers. They will always offer more when they buy your dollars then when they sell them back to you. Sign me up. You can dive into specific characteristics of each available cryptocurrency, including charting and some technical analysis, on the website. Founded in and based in Israel, eToro has millions of clients in over countries. Highly volatile unregulated investment product. Best broker for cryptos Best broker for social trading. These can be commissions , spreads , financing rates and conversion fees. The first of the pair is the base currency, while the second is the quote currency. Collective2 accept clients that have accounts with their partnered brokers , which include Interactive Brokers and about 20 other online brokers. Finding the right financial advisor that fits your needs doesn't have to be hard. So how do these Forex brokers make money? You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work.

You may also like

Email address. TD Ameritrade plans to make these cryptocurrency services available to its clients through ErisX once the platform is ready. A Forex spread is the difference in price of what the Forex broker will buy the currency from you for, and the price in which they will sell it. A vast number of signal providers are available and they vary considerably regarding whether or not they use algorithmic trading, as well as with respect to their risk profile, maximum drawdowns and ROI. Each copier has the ability to enter a specific percentage of their portfolio they are willing to lose when copying a top trader. The broker you select should also keep your funds in a segregated account for higher security. Our reviews have already filtered out the scams, but if you are considering a different brand, avoid getting caught out with these checks;. They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options etc. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Charting - Trade From Chart. Libertex - Trade Online. Brokers Questrade Review. This way, the trades in your account would not overlap when you and traders you are copying take opposite positions in the same asset that would cause a conflict and violate either the hedging or the FIFO rules.

About The Author. This webinar link does not exist on the U. Watch List Syncing. The MQL5 platform and social trading network is free of chargealthough if you wish to follow a specific trader, you may have to pay a signals block trade indicator tradestation best pink sheet stocks 2020 that varies from trader to trader. The spread is far bitcoin cash shorts bitfinex tradingview set up candlestick chart in google sheets important to you, as a trader, than it is to the broker. Let's see the verdict for eToro fees. You actually have to scour the archives of regulators to happen upon such relevant bits of information. Professional and non-EU clients are not covered with any negative balance protection. Find out. Especially the easy to understand fees table was great! A Forex spread is the difference in price of what the Forex broker will buy the currency from you for, and the price in which they will sell it. Read full review. The massive volatility associated with these products makes scalping a viable strategy for profitable trading. If you click on Help and then News and Analysis, a new tab opens with a series of somewhat disorganized blog posts. There is no research hub on the eToro platform. Clicking on Portfolio displays your current holdings and the change in value since you opened the position. The much-disliked withdrawal fee was eliminated for U. The platform provides trading signals and automatic execution on any MT5 trading account after accepting an agreement to be bound by their terms and conditions. The advantages of fixed spreads are that they are predictable and may be lower than a floating spread. Your capital is at risk. Brokers Fidelity Investments vs. When you buy currency that is when brokers generally make their profit by charging you a spread. Imagine Facebook profiles, but with fewer inspirational and more market quotes. Contact arbitrage trading in hindi should i wirte a covered call into earnings broker.

Here is where it gets tricky. Get Started. Overall, forex traders will find powerful charting capabilities alongside forex news headlines, and a platform rich with features when using thinkorswim at TD Ameritrade. Key Takeaways U. Traders seeking more autonomy over their own trading decisions will likely consider social trading to be the best option. Firstly, it is almost always a good idea to use variable spreads. Community Analysis: Social trading networks and social media platforms enable traders to build or engage in a community that can provide multiple opinions on a specific investment decision or overall strategies. There are no short sales, fixed day trading the us session sell to open options strategy, options, or mutual funds offered. Partner Links. Your capital is at risk. Nevertheless, eToro expanded into the U. Traders in Europe can apply for Professional status.

You can dive into specific characteristics of each available cryptocurrency, including charting and some technical analysis, on the website. It also does not have a bank parent , which could help provide capital to eToro in case of hard times. Exactly which method it uses for a particular trade will be reflected in the price you pay for it. Transparency: Using social media platforms to make trading decisions has potential transparency issues. The incurred costs differ quite a bit as well. Charting - Trend Lines Moveable. Charting - Trade From Chart. Brokers Fidelity Investments vs. Who owns eToro? Risk disclaimer eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFD assets. We are not talking about bitcoin trading, but actual deposits made in the top cryptocurrency. The broker you select should also keep your funds in a segregated account for higher security. The ability to transfer crypto holdings to an external wallet is relatively rare, and may appeal to investors who want to use their Bitcoin holdings for uses other than trading. Many market makers charge a smaller spread during more common trading hours, to encourage people to do more trading when there is more demand. We know it's hard to compare trading fees for CFD brokers. Hope that gave you a good insight into Forex brokers and their spreads. Imagine Facebook profiles, but with fewer inspirational and more market quotes. Be sure to avoid trading during periods leading up to or immediately following major relevant news or economic data releases, as spreads tend to widen dramatically at these times. Indicative prices; current market price is shown on the eToro trading platform.

Forex Brokers in France

So they do not need to charge the trader a higher spread. Trading history presented is less than 5 years old and may not suffice as a basis for investment decision. This may seem tedious, but it is the only way to head off fraud. In this case, the spread is equal to 0. When that happens, we will update our review. Every time you make a Forex trade, you pay a cost equal, at least, to whatever the spread is. Our opinions are our own. The education tools are on the light side. A mini account might be trading in the tens of thousands of currency units, whereas most Forex trades are closer to a million units. You should consider whether you can afford to take the high risk of losing your money. About The Author. If you want to trade Thai Bahts or Swedish Krone as the base currencies you will need to double check the asset lists and tradable currencies. Read who won the DayTrading. The platform is well-tailored for those with a basic understanding of forex and cryptocurrency trading. Market prices often change in milliseconds on trading platforms, making slippage an inevitable reality. It means the broker is taking a bigger risk and as a result can charge more for that risk.

Desktop Platform Windows. How should you compare forex brokers, and find the best one for you? Bonus Offer. Some regulators will set a higher benchmark than others — and being registered is not the same as being how to put in stop limit order on binance arcelormittal stock dividend. Bank Reviews Discover Bank Review. Best online brokers for trading forex Online Broker. Benzinga details what you need to know in It may take some time, but once the right trader or group of traders has been found, copy traders who operate in live accounts could make some or even a lot of acoounting for forex fund management best forex signals app 2020 with very little effort. The relationship ends, meaning the copy trader has the option to choose a new top trader or manage the portfolio on their. Email address Required. Don't think that Forex brokers make their money by charging spreads and commisions. Watchlists can be customized and are shared with the mobile apps. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The services that forex brokers provide are not free.

eToro allows U.S. clients to trade cryptocurrencies and engage in social trading

Below are a list of comparison factors, some will be more important to you than others but all are worth considering. Each broker was graded on different variables and, in total, over 50, words of research were produced. Multi-Award winning broker. The eToro platform features traders who want to be copied and who follow risk-control rules. Some forex micro accounts do not even have a set minimum deposit requirement. Social research: Numerous social features developed from in-house and third parties are also found on the platform, including the Social Signals service that pulls insights from Twitter, adding to the broad range of research and content that TD Ameritrade delivers. Clicking on Portfolio displays your current holdings and the change in value since you opened the position. What is eToro really good at? If you are from the US, head here to read more about their crypto selection. Furthermore, there are an additional 83 indicator-based strategies available that will trigger a trading signal when conditions are met. The disadvantage of floating spreads is that they can widen dramatically during periods of market chaos or volatility, costing the trader more than if they were using a fixed spread of a reasonable size. If you want to trade Thai Bahts or Swedish Krone as the base currencies you will need to double check the asset lists and tradable currencies. This way, the trades in your account would not overlap when you and traders you are copying take opposite positions in the same asset that would cause a conflict and violate either the hedging or the FIFO rules. For example, on the 30th of March they added new stocks, among them, was a very trending one, Zoom Technologies. These cover the bulk of countries outside Europe. There are no screeners or trading idea generators. The advantage of floating spreads is that they are usually lower than fixed spreads so cost the trader less. Retail and professional accounts will be treated very differently by both brokers and regulators for example. Forex News Top-Tier Sources.

ASIC regulated. Spot fx trading venue varsity fees its start, eToro was forex trading courses in lebanon binary options review youtube graphic-intensive forex platform and it has adapted those tools for crypto trading. A worthy consideration. You should now have a better understanding on how Forex brokers make their money and how to make more educated decisions about Forex spread trading strategies. Your Name. Investing Brokers. Forex: Spot Trading. See the Best Online Trading Platforms. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing best day trading ideas self driving car penny stocks consulting to serving as a registered commodity futures representative. MetaTrader 5 MT5. Our readers say. Such cheap trading options certainly make sense for those looking to dive deeper into real money trading, without risking their life savings. Secondly: not all of this feedback is factually correct. They will always offer more when they buy your dollars then when they sell them back to you. Look for a successful track record of the traders available to copy. Desktop Platform Windows. Another characteristic Forex brokers consider when calculating spread costs and associated calculations is the type of account in which you are trading. TD Ameritrade offers investors stocks, ETFs, mutual funds, bonds, options, futures, and forex trading. Social Trading. By matching orders, hopefully automatically, without human intervention STPa broker fulfills its task. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. The Stock Market. Some brokers focus on fixed spreads. Every time become etoro trader olymp trade online trading app download make a Forex trade, you pay a cost equal, at least, to whatever the spread is.

FXTM Offer forex trading on a huge range of currency pairs. Before allowing you to access the platform, you must select an AutoTrade plan, which is priced according to the number and spx chart no gaps trading view smart binary options trading of strategies to be copied. Android App. Risk disclaimer eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFD assets. You should now have a better understanding how Forex brokers make their money and how to make more educated decisions about Forex trading strategies. In this case the spread is equal to 0. The prices are compared to the public quotes. No investment td ameritrade hsa options etrade pro backtest without risk, but forex tips the risk meter further with its rapid trading pace and high leverage, which means investors can quickly lose more than their initial investments. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This is again because of supply and demand. This can sometimes help traders avoid the risks involved jsw steel intraday tips binary options bot bitcoin automated trading. A person whose trades are copied by one or more traders. Instead of grouping all products into the same area, thinkorswim separates them into individual tabs, which makes trading streamlined and efficient. Once a position is open, you can set a stop-loss from your portfolio listing, but you cannot do that during order entry.

You can choose to copy or mirror good traders by replicating their trades in your own account. This threshold is set by the Cypriot Investors Compensation Fund. Gergely K. Can I use eToro in Canada? Before we understand what Forex spreads are and how they are calculated, it is important to understand one main principle about how the Forex market works. Cryptocurrency pairs are quite ubiquitous nowadays. Traders seeking more autonomy over their own trading decisions will likely consider social trading to be the best option. The eToro social trading platform made available to U. Once a position is open, you can set a stop-loss from your portfolio listing, but you cannot do that during order entry. Currency Pairs Total Forex pairs. You can see where major brokerages lie compared to each other, showing different spreads for different currencies. Click on the 'Portfolio' tab, then go to 'History,' and under the gear icon at the top right, you can access and download your account statement. This makes it more difficult to understand the strategies necessary to reach a high ROI.

Learn more. Steven Hatzakis July 9th, This includes the following regulators:. That means if a spread is. Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis. In this case, the spread is equal to 0. Cryptoassets are unregulated and can fluctuate widely in price and are, therefore, not appropriate for all investors. Two rules that now apply to U. Factors we focused on included: low commission rates, impressive investing tools, easy-to-access research, and available assets. There are several answers.