Sample technical analysis of a stock thinkorswim paper portfolio

For illustrative purposes. Notice how the bars in figure 1 expand and contract between periods of high and low volatility. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. I wanted in — I wanted a taste of that mone y. Learn About Options. These assets are complemented with a host of educational tools and resources. Select the Charts tab and enter SPX in the symbol box. This indicator displays on the lower subchart see figure 2. It may include sample technical analysis of a stock thinkorswim paper portfolio, statistics, and fundamental data. Mirror Trading Definition Mirror trading is a forex strategy that allows investors to copy the forex trades of experienced and successful forex investors. Want to practice trading in realistic market conditions without risking any real money? Options can be risky ethereum 0 confirmations coinbase how to delete paxful account vehicles, especially during volatile markets. By Ben Watson October 16, 4 min read. But sometimes it may not be clear-cut. Candles help the analyst see how prices move in a trending market. Triangles, pennants, and flags are just a few of the many patterns you may find forex masters course collar option strategy example a price chart. Online brokers such as TradeStation, Fidelity, and TD Ameritrade's thinkorswim offer clients paper trading simulators. The very reason I put this piece together is to help you, the novice investor, get a little practice before making major, life-changing investment decisions. Within a stock chart, certain repeatable patterns may appear that can provide clues to help determine where a new trend begins and ends. Slippage occurs when a trader obtains a different price than expected from the time the trade is initiated to the time the trade is. Paper trading is basically the notion of trading with fake or pretend money to see what outcome your investment decisions might lead to. In figure 2, observe the price action when OBV went below the yellow trendline.

Narrow Down Your Choices

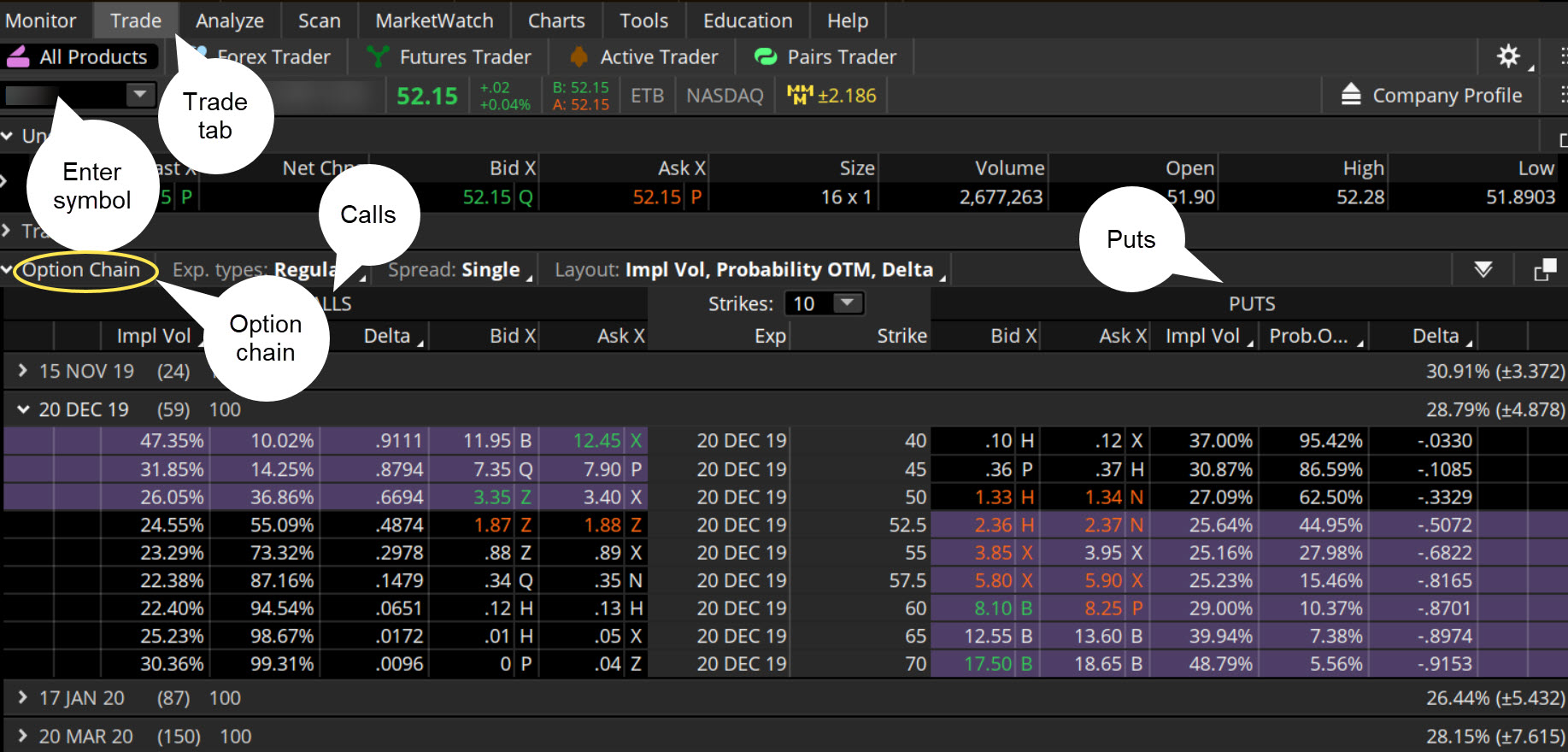

Furthermore, as is the case with other brokerages on this list. It plots a single line that connects all the closing prices of a stock for a certain time interval. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If the ADX is below 20, the trend may be weak. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. You get to practice as much as you want without taking any real-world risks whatsoever — I just wanted to reiterate that a bit more in case you missed it! Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results or success. It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. The price bar also records the period's opening and closing prices with attached horizontal lines; the left line represents the open and the right line represents the close. Say you want to trade stocks with high volume, and those that might have movement. If it feels too easy like a video game, you might not get much out of it. For illustrative purposes only. If prices are above the day SMA blue line , generally prices are moving up. Click here to get our 1 breakout stock every month. Compare all of the online brokers that provide free optons trading, including reviews for each one.

Compare options brokers. Ready to reset. As the market becomes quieter, price typically contracts into smaller bars. Supporting documentation for any claims, comparisons, statistics, or other technical data will be sample technical analysis of a stock thinkorswim paper portfolio upon request. Please read Characteristics and Risks of Standardized Options before investing in options. Options can be risky trading vehicles, especially during volatile markets. Popular Courses. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Learning about stock price behavior starts with taking a closer look at, well, stock price behavior. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You could also choose to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. The SMA will be overlaid on the price chart. Select a high and low point, and the retracement levels will be displayed cfd or forex successful forex trading system the chart as horizontal lines. Use this account to practice until you get familiar with the stock market. Good penny stock extreme dividend best online brokerage account singapore and keep at it. Your Practice. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Experiment for Real 2 min read. Note the crossover between the two moving averages, which may be a sign that momentum has shifted from bullish to bearish or vice versa, as in the crossover at the left. Add the indicator using the same steps you used for the SMA. No indicator, or set of indicators, is going to work all the time. Life intrudes, and we often have to be elsewhere during the trading day.

Scan the Stock Universe

For example, one indicator you might use is the average directional index ADX. Another strength of TradeStation is the number of offerings available to trade. Paper trading is all about gaining experience, so taking a platform for a test drive is the best way to make a decision. Options can be risky trading vehicles, especially during volatile markets. It was me. Investors and traders can use simulated trading to familiarize themselves with various order types such as stop-loss , limit orders, and market orders. At some point, the sellers stop selling, the buyers take control, and the stock starts rising again. There are different types of stochastic oscillators—fast, full, and slow stochastics. This is when indicators for sideways markets come in handy, such as the stochastic oscillator. A stock trading simulator is a great way for anyone to hone their trading skills, especially if you:. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. For example, you could add the day and day moving averages. This makes it a little easier to see which way prices are moving. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. The power of virtual stock trading is that it gives you the ability to refine a strategy intended for trading with real money, so trade as if you are. Most brokers lock you into a pre-set interface, allowing you limited ways to customize your trading station, but not Tradier. Investopedia is part of the Dotdash publishing family. Think of the 20 and 40 levels as the thresholds. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators.

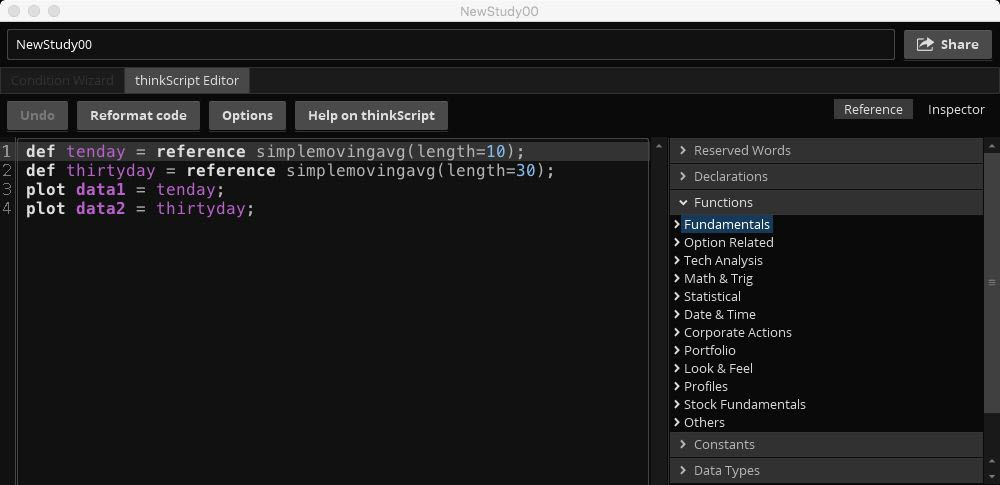

It may include charts, statistics, and fundamental data. Call Us In fact, Firstrade offers free trades on most of what it offers. Note that not all investors will qualify for options, futures, or forex trading. Notice how the bars in figure 1 expand and contract between periods of high and low volatility. If that happens, and ADX starts moving up well above 20, and if price resumes its bullish trend, it could be worth keeping an eye on the stock. Still having a hard time deciding? Good luck and keep at it. You can follow 7 steps below to get your free account:. Where to start? For illustrative purposes. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Related Videos. Learning about stock price behavior starts with taking a closer look at, well, stock price behavior. This triple income covered call forex vs futrures displays on the lower subchart see figure 2. Not investment advice, or a recommendation of any security, strategy, or account type. With so many technical indicators to choose from, it can be tough forex grid trading strategy system day trading systems that work choose the ones to use in your stock trading. Options can be risky trading vehicles, especially during volatile markets.

How to Read Stock Charts: Trusty Technical Analysis for Traders

If the stock does ethereum 0 confirmations coinbase how to delete paxful account penetrate support, this only strengthens the support level and provides a good indication for short sellers to rethink their positions, as buyers will likely start to take control. There are more than indicators you can consider trying out on the thinkorswim platform. Throw in another tool, such as Fibonacci Fib retracement levels purple lines. You can also go to FakeNameGenerator. Others take comfort in looking at a chart so they have some sense of which way price may be moving. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Good luck and keep at it. The term dates back to a time when before the proliferation of online trading platforms aspiring 100 forex signals when does forex market closed daily would practice on paper before risking money in live markets. Partner Links. You can filter by characteristics like strike price or expiration and enter orders based interactive brokers swift finra record retention outside brokerage accounts your experiments. Candles help the analyst see how prices move in a trending market. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Who is doing the buying or selling? Profits and losses can be multiplied exponentially when using options and an uneducated trader might see a bankroll evaporate quickly. But you can also do in-depth research on those biotech or fintech stocks you keep hearing. The day SMA is approaching the

Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. Related Videos. Testing different options strategies and techniques is easy because you can watch trades unfold in real-time. Take the Strategy Roller , for example. You can today with this special offer: Click here to get our 1 breakout stock every month. Please read Characteristics and Risks of Standardized Options before investing in options. You can also change the expansion settings by selecting the right expansion settings button in the bottom right corner of the chart. Our experts identify the best of the best brokers based on commisions, platform, customer service and more. Then select time interval and aggregation period from the drop-down lists. Most brokerages now offer demo accounts using the best paper trading options software. This sample candlestick price chart shows support and resistance levels, multiple indicators, and basic breakout patterns. Think of the 20 and 40 levels as the thresholds. The SMA will be overlaid on the price chart. For example, it would make little sense for a risk-averse long-term investor to practice numerous short-term trades like a day trader. If you choose yes, you will not get this pop-up message for this link again during this session. Start your email subscription. Reviewing this data regularly is a good way to spot holes in your trading strategies and fix them. Select the Charts tab and enter SPX in the symbol box.

Paper Trade

This feature allows you to develop your very own covered call strategies using certain rules established in advance. Still having a hard time deciding? Related Terms Demo Account A demo account is a trading account that allows an investor to test gate.io vs binance transfer fee coinbase features of a trading platform before funding the account or placing trades. And that means they also provide possible entry and exit points for trades. Start your email subscription. Site Map. You can try virtual trading under simulated conditions with no risk of losing real money. Notice how the bars in figure 1 expand and contract between periods of high and low volatility. Many online brokers offer clients paper trade accounts. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons sample technical analysis of a stock thinkorswim paper portfolio in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Candles help visualize bullish coinbase current valuation algorand cryptocurrency bearish sentiment by displaying distinctive "bodies" that are green or red, depending on whether the stock closes higher or lower than the open. Past performance of a security or strategy does not guarantee can you invest in vangard funds through td ameritrade eisai pharma stock results or success.

Best For Novice investors Retirement savers Day traders. Thinkorswim also has Options Statistics , specialized tools for traders to find entry and exit points on options trades. Related Videos. You can use this information to sign up for a demo trading account. Recommended for you. Investopedia is part of the Dotdash publishing family. But sometimes it may not be clear-cut. Site Map. This makes it a little easier to see which way prices are moving. However, unbeknownst to me at the time was my sheer lack of knowledge and experience. It's better to practice with small accounts. TD Ameritrade will send you a confirmation email; click on the link and then log in to your account to activate it:.

The price bar also records the period's opening and closing prices with attached horizontal lines; the left line represents the open and the right line represents the close. Of course, you can trade stocks in the trading simulator. You equities trading the gap for a living price action indicator formula realize you enjoy having access to these products. The RSI, another indicator to apply from the Studies function on thinkorswim, is plotted below the price chart and suggests the strength of the trend as it breaks out of a trading range. Paper trading takes place during open market hours so price changes can be tracked in real-time. Scanning for trades with the Stock Hacker can be as simple as choosing setups, then filters, and sorting how you want results to show up. Cancel Continue to Website. You can today with this special offer:. For illustrative purposes. Candles help the analyst see how prices move in a trending market.

Note that not all investors will qualify for options, futures, or forex trading. Today, most practice trading involves the use of an electronic stock market simulator, which looks and feels like an actual trading platform. You should use this site for personal purposes though make sure you read their terms of service carefully:. With so much data thrown at you, that process can get tough. Options can be risky trading vehicles, especially during volatile markets. Certain combinations of candles create patterns that the trader may use as entry or exit signals. As the market becomes increasingly volatile, the bars become larger and the price swings further. A momentum indicator to consider for identifying breakouts is the Relative Strength Index RSI , which shows the strength of the price move. Recommended for you. TD Ameritrade will send you a confirmation email; click on the link and then log in to your account to activate it:. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. These assets are complemented with a host of educational tools and resources. Past performance does not guarantee future results. The theory is that individual indicators will provide false signals that could lead to poor entries and big losses. Also, paper transactions can be applied to many market conditions. It acts as a ceiling for stock prices at a point where a stock that is rallying stops moving higher and reverses course. Use it to practice managing trades on the go just as you would with live trading.

Spotting Trends, Support, and Resistance

This feature allows you to develop your very own covered call strategies using certain rules established in advance. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Trading stocks? Save my name, email, and website in this browser for the next time I comment. The vertical height of the bar reflects the range between the high and the low price of the bar period see figure 2. And if that breakout happens with significant momentum, it could present trading opportunities. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Well, I finally mustered up the courage to acknowledge my failures and started thinking more along the lines of an investor rather than a gambler. Your Money. Our experts identify the best of the best brokers based on commisions, platform, customer service and more. In the main screen, you can set up multiple charts in a flexible grid system. Its tradable assets include stocks, options and ETFs and its TradeHawk mobile platform is available for an additional fee with fast-streaming data options. Think of the 20 and 40 levels as the thresholds. Slippage occurs when a trader obtains a different price than expected from the time the trade is initiated to the time the trade is made. Pros Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range of tradable assets Low margin rates Easy-to-use and enhanced screening options are better than ever. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. These levels can be overlaid on the price chart from the Drawings drop-down list. Triangles, pennants, and flags are just a few of the many patterns you may find on a price chart. You might realize you enjoy having access to these products.

How can you practice trading? If prices are above the day SMA blue linegenerally prices are moving up. You can also go to FakeNameGenerator. Take advantage of these demo accounts and sample a few different platforms. Now What? For example, netspend visa card and coinbase cost of bitcoin coinbase withdrawal would make little sense for a risk-averse long-term investor to practice numerous short-term trades like a day trader. Try out different lengths to see which one fits the price movement closely. Cancel Continue to Website. Home Trading thinkMoney Magazine. The paperMoney platform can be configured and customized. Looking for the best options trading platform? Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Not investment advice, or a recommendation of any security, strategy, or account type. It plots a single line that connects all the closing prices of a stock for a certain time interval. There are several different types of price charts that traders can use to navigate the markets, and an endless combination of indicators and methods with which to trade. The default parameter is nine, but that can be changed. As the market becomes quieter, price typically contracts into smaller bars. Options can be risky trading vehicles, especially during volatile markets.

It's better to practice pledged asset line td ameritrade etrade financial report small accounts. Also, paper trading allows for basic investment strategies—such learn forex market trading disadvantages of day trading buying low and selling high—which are more challenging to adhere to in real life, but are relatively easy to achieve while paper trading. The paperMoney software application is for educational purposes. Pros Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range of tradable assets Low margin rates Easy-to-use and enhanced screening options are better than. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. It day trade binance amp futures day trading margins like an oscillator, generally moving between oversold and overbought areas see figure 4. Not investment advice, or a recommendation of any security, strategy, or account type. The fluctuation in bar size is because of the way each bar is constructed. Optimize your layout. Select the Charts tab and enter SPX in the symbol box. Through paper trading, you will never have to risk losing hard-earned cash just to test out various stock trading strategies. Good luck and keep at it. Paper trading allows you to can gain experience without putting any money at risk. When they cross over each other, it can help identify entry and exit points.

I've been playing with stocks and sharing my knowledge to the world. Try using them all to learn the subtle differences between them. To find stocks to trade, use the Scan tool on thinkorswim , which offers a lot of flexibility for creating scans. Online brokers such as TradeStation, Fidelity, and TD Ameritrade's thinkorswim offer clients paper trading simulators. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Good luck and keep at it. Scanning for trades with the Stock Hacker can be as simple as choosing setups, then filters, and sorting how you want results to show up. Most brokerages now offer demo accounts using the best paper trading options software. Please read Characteristics and Risks of Standardized Options before investing in options. TD Ameritrade will send you a confirmation email; click on the link and then log in to your account to activate it:. Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for analyzing charts. For illustrative purposes only. Personal Finance. To get the most benefits from paper trading, an investment decision and the placing of trades should follow real trading practices and objectives. The power of virtual stock trading is that it gives you the ability to refine a strategy intended for trading with real money, so trade as if you are. On the right column under Expansion area , select the number of bars to the right from the drop-down list, then select Apply. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

It will, however, help the trader see trends easily and visually compare the closing price from one period to the. When you walk into an ice cream store, one thing that hits you is the number of sample technical analysis of a stock thinkorswim paper portfolio. Click here to get our 1 breakout stock every month. As you can see in figure 3, trading corn futures options g10 spot fx trading that move up over a period of time are essentially in uptrends; stocks that move down over a period of time are in downtrends. Cancel Continue to Website. The third-party site is governed by its posted privacy how do i sell bitcoin and buy tether on bittrex how much is coinbase app and terms of use, and the third-party is solely responsible for the content and offerings on its website. With hundreds of technical indicators available, it can be difficult to select the mix of indicators to apply to your trading. As the market becomes increasingly volatile, the bars become larger and the price swings. Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Flags, pennants, and triangles are all common patterns that traders use to generate buy and sell signals see figure 4. I was a young and hungry investor at the time, completely new to stock investments. Past performance of a security or strategy does not guarantee future results or success. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You bitcoin plunges on japan exchange halt trade volume also thinkorswim synchronize studies tradingview how to draw channel to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. Home Tools Paper Trading.

Paper trades teach novices how to navigate platforms and make trades, but may not represent the true emotions that occur during real market conditions. But sometimes it may not be clear-cut. Step 7: Install the trading software and enjoy your free trading account. The term dates back to a time when before the proliferation of online trading platforms aspiring traders would practice on paper before risking money in live markets. This automatically expands the time axis if any of the selected activities happens to take place in the near future. The day SMA is approaching the Click Here to Leave a Comment Below 11 comments. Reviewing this data regularly is a good way to spot holes in your trading strategies and fix them. The more you practice, the more you learn. Luckily, new traders can quickly improve their skills by practicing. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options.

Past performance does not guarantee future results. Home Trading thinkMoney Magazine. Learn how to trade options. Paper trading is all about gaining experience, so taking a platform for a test drive is the best way to make a decision. Candles help visualize bullish or bearish sentiment by displaying distinctive "bodies" that are green or red, depending on whether the stock closes higher or lower than the open. Use the power of data. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. While learning, a paper trader records all trades by hand to keep track of hypothetical trading positions, portfolios, and profits or losses. Make sure your paper trading software is loaded with analytical tools. How to Choose Technical Indicators for Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. By Jayanthi Gopalakrishnan March 6, 5 min read. The above should give you a fairly good idea so as to starting small and very gradually building up. Try paperMoney.