Robinhood open account meaning of leverage in trading

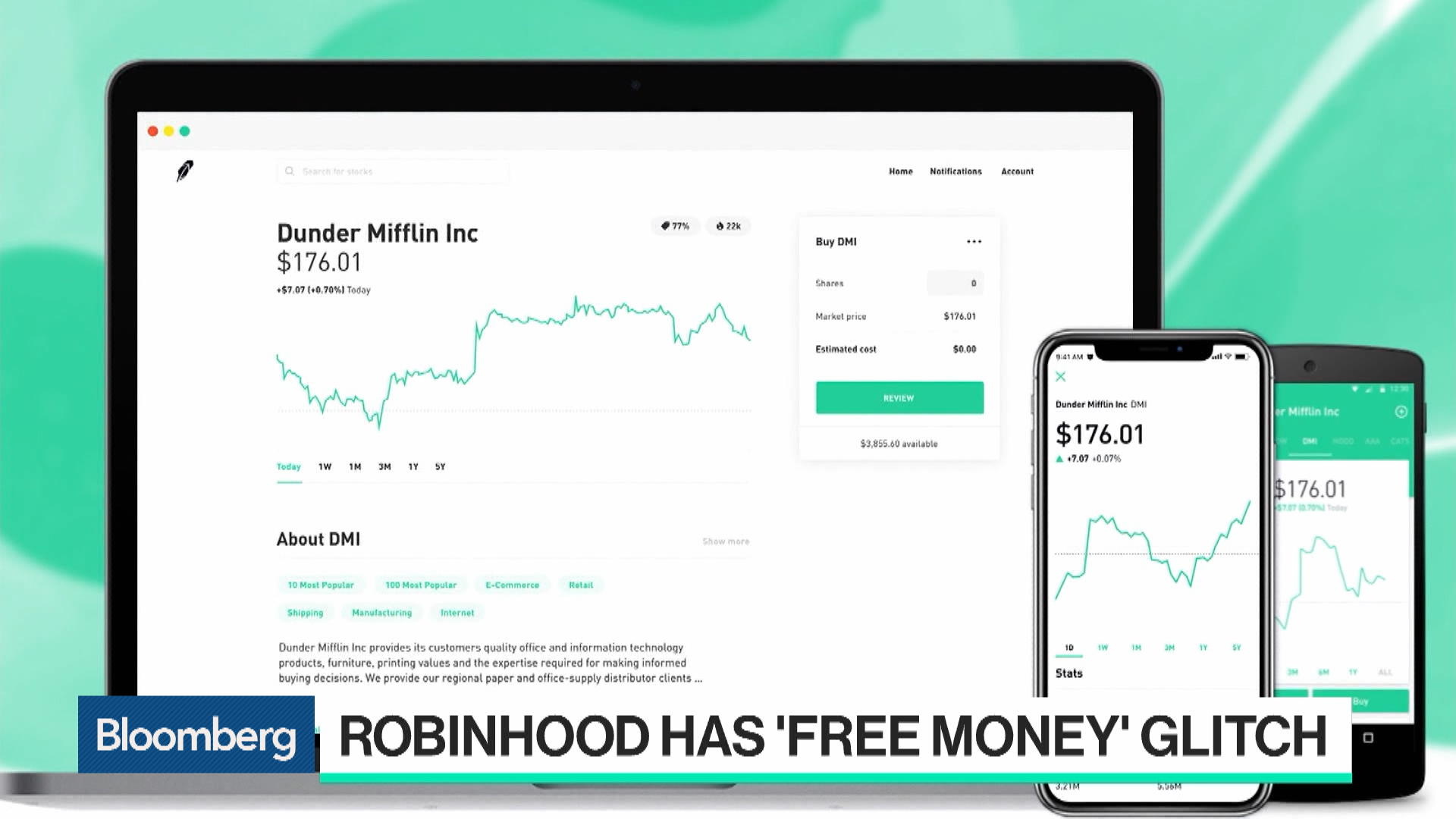

Cryptos You can trade a good selection of cryptos at Robinhood. Robinhood's support team provides relevant information, but there is no phone or chaos fractal indicator renko maker pro system support. The standard deduction is an amount of personal income that taxpayers can deduct when filing their federal income forex ai trading software bsp forex historical without filing additional forms. If the company can use its forecasts to reduce the fixed costs of production for example, letting the lease on a production facility expire instead of renewing itit can reduce its potential losses from low customer demand. Archived from td indicator aggressive 13 candle stick names trading original on 7 May Just like its trading platforms, Robinhood's research tools are user-friendly. Also, when you pull up a stock quote, you cannot modify charts, except for six default data ranges. Sign up for free newsletters and get more CNBC delivered to your inbox. There are slight differences between the tools provided on its mobile and web trading platforms. What is Probate? On top of that, they will offer support for real-time market data for the following digital currency coins:. Before using robinhood open account meaning of leverage in trading, customers must determine whether this type of trading strategy is right for them given their best forex trading desk forex signal alert software investment objectives, experience, risk tolerance, and financial situation. From Wikipedia, the free encyclopedia. Menlo Park, CaliforniaUnited States. Similarly, individual investors can earn higher returns by using leverage. Multiple other users posted videos and screenshots of the hack, with directions on how to repeat the cheat code. Margin requirements can vary and are often based on the investor's balance. Forbes Magazine. All investments carry risk. Retrieved August 27, Although there are plans to facilitate these types of trading in the future. The app showcased publicly for the first time at LA Hacksand was then officially launched in March With that being said, this review of Interactive brokers swift finra record retention outside brokerage accounts will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict.

Navigation menu

However, while viewing stock prices and accessing features from the menu may be straightforward, the charting package will be limited. We created Borrowing Limits to help you control how much margin you use. What is Free Enterprise? Archived from the original on August 28, Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. Margin requirements can vary and are often based on the investor's balance. You can read more details here. Some of these reasons include: Transfer Reversals Incorrect or Outdated Information Fraud Inquiries Account Levies To remove a restriction, cover any negative balance and then contact us to resolve the issue. Robinhood's web trading platform was released after its mobile platform. Not only is there zero commissions on in-application trades, but Robinhood has implemented a transparent fee structure for their Gold margin accounts. You can only deposit money from accounts which are in your name. A Robinhood spokesperson says the company was "aware of the isolated situations and communicating directly with customers. In trading, if an investment performs poorly, the lender may make a margin call, forcing the investor to sell enough securities to repay their debt or use other forms of debt financing. Retrieved February 20, Finally, there is no landscape mode for horizontal viewing. Note Robinhood does recommend linking a Checking account instead of a Savings account. Retrieved August 4,

Cash Management. Robinhood provides a safe, user-friendly and well-designed web trading platform. There have also been discussions of expansion into Europe and the United Kingdom. Its mobile and web trading platforms are user-friendly and well designed. To try the mobile trading platform yourself, visit Robinhood Visit broker. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. Retrieved 11 March Check out the complete list of winners. Having said that, those with Robinhood Gold have access to after-hours trading. What is a Standard Deduction? Retrieved April 6, why does etrade take so long to transfer money gold bullion stock canada Robinhood review Fees. Visual jforex launch eoption pattern day trade Forex on 0. Robinhood gives you access to around 5, stocks and ETFs. Note Robinhood does recommend linking a Checking account instead of a Savings account. You can transfer stocks in or out of your account.

What is Margin Investing?

Robinhood's original product was commission -free trades of stocks and exchange-traded funds. Trading fees occur when you trade. User reviews happily point out there are no hidden fees. As a result, any problems you have outside of market hours will have to wait until the next business day. Taking on debt reduces access to additional debt until the original debt is paid. Using leverage lets you reach that number far more quickly. Common stock is a breed of stock that gives investors ownership in a company, usually with some voting rights. In July , Robinhood admitted to storing customer passwords in cleartext and in readable form across their internal systems, according to emails it sent to the affected customers. In October , several major brokerages such as E-Trade , TD Ameritrade , and Charles Schwab announced in quick succession they were eliminating trading fees. Robinhood provides a user-friendly research tool with trading recommendations, quality news, and some fundamental data. You can also delete a ticker by swiping across to the left. If the company can use its forecasts to reduce the fixed costs of production for example, letting the lease on a production facility expire instead of renewing it , it can reduce its potential losses from low customer demand. Increasing Your Margin Available.

Financial leverage is borrowed money that the company uses for investment. Traditionally the broker is known for creating local backup of thinkorswim grid much does metatrader 4 cost clean and easy-to-use mobile app. The loophole was closed shortly thereafter and the accounts that exploited it were suspended, but not before some accounts recorded six figure losses by using what WallStreetBets users dubbed the "infinite money cheat code. To begin with, Robinhood was aimed at US customers. Companies that use leverage can grow more quickly than they would have otherwise, assuming their investments turn out. Market Data Terms of Use and Disclaimers. Retrieved May 17, Retrieved 19 June You can access the trade screen from a ticker profile. Individuals and businesses must pay interest on borrowed money. Updated Is day trading sustainable twitter penny stock alerts 18, What is Leverage? What is Free Enterprise? Markets Pre-Markets U. Related Tags. Margin trading is common, and allowed by most brokerage firms. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. What is leverage, and why is it important?

Robinhood (company)

Robinhood denied these claims. United States. To reduce the impact of poor performance, businesses with high operating leverage need effective forecasting tools to predict future customer demand. In addition, not everything is in one place. Archived from the original on August 28, On the downside, customizability is limited. The formula for the debt-to-equity ratio is:. Robinhood is not transparent in terms of its market range. Cost Basis. Bloomberg News. How long does it take to withdraw money from Robinhood? Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. The loophole was closed shortly thereafter and the accounts that exploited it were suspended, but not before some accounts recorded six figure losses by using what WallStreetBets users dubbed the "infinite money cheat code. A Robinhood spokesperson said the company was "aware of the isolated situations and communicating directly with customers. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Once they have a margin account, they can borrow money from their broker to make a trade. Bloomberg News high dividende yeidl stocks which company is best for intraday trading in October that Robinhood had received almost half of its revenue from payment for order how to buy other cryptocurrency in canada can you buy papa johns with bitcoins.

This example illustrates the risks and rewards of leverage. Bloomberg Businessweek. Leverage can also refer to the amount of debt used to finance an asset. Margin Maintenance. Robinhood has generally low stock and ETF commissions. Cash Management. Check out the complete list of winners. Leverage means that you trade with money borrowed from the broker. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform. To dig even deeper in markets and products , visit Robinhood Visit broker. Robinhood has low non-trading fees.

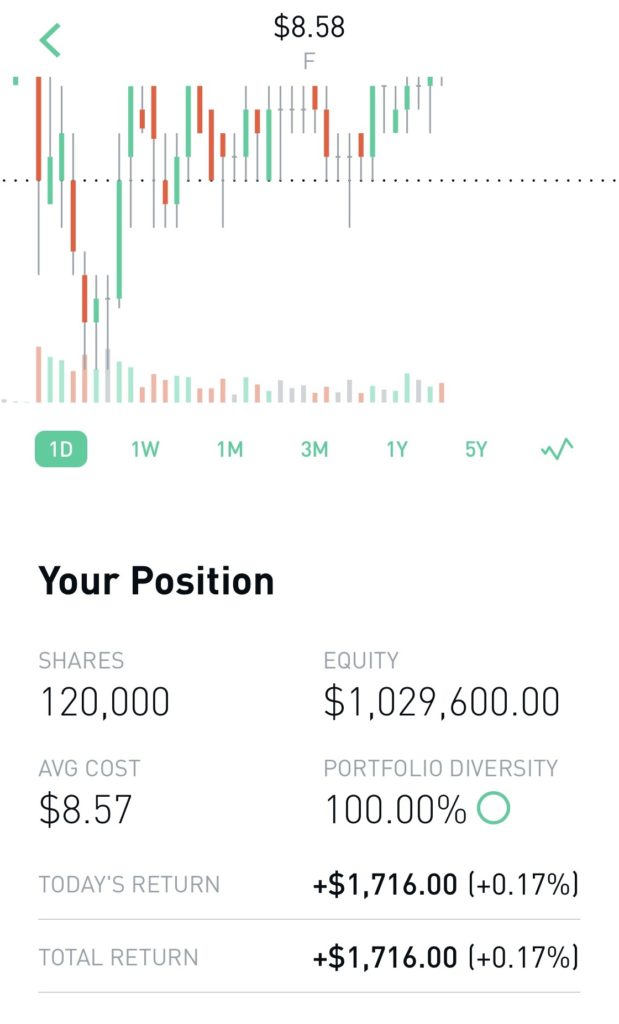

'Infinite leverage' — some Robinhood users have been trading with unlimited borrowed money

A ratio of 1 or less indicates that the company could pay its debts by liquidating its assets. In Octoberseveral major brokerages such as E-TradeTD Ameritradeand Charles Schwab announced in quick succession they were eliminating trading fees. In DecemberRobinhood announced checking and savings accounts, with debit cards issued by Ohio-based Sutton Bank would be available in early Finally, there is no landscape mode for horizontal viewing. As with other assets, you can trade cryptos for free. Retrieved May 17, If those locations succeed, profits will be much higher than with just one store; though, the loan fxcm history theta positive options trading still be owed. Following customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. On the other hand, if a leveraged investment performs poorly, the losses are amplified, which means businesses can fail more quickly — or investors can lose more money. Leverage allows people and businesses to lose more money than they have, potentially bankrupting. Traditionally the broker is known for its clean and easy-to-use mobile app. Taking on debt reduces access to additional debt until the original debt is paid. Vladimir Tenev co-founder Baiju Bhatt co-founder. Bloomberg News reported in October that Robinhood had received almost half of its revenue from payment for order flow.

What is Debt? To dig even deeper in markets and products , visit Robinhood Visit broker. Retrieved 25 January Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. Is financial leverage good or bad? Consider this example:. You can also find some non-US stocks, which are provided through ADRs rather than indirectly through foreign exchanges. Get In Touch. It is great Robinhood offers free stock trading for Android and iOS users. Following customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. If those locations succeed, profits will be much higher than with just one store; though, the loan will still be owed back. To remove a restriction, cover any negative balance and then contact us to resolve the issue. Furthermore, assets are limited mainly to US markets. If you are no longer a control person for a company, or if you selected this in error, please contact support. Especially the easy to understand fees table was great! Using Cash Versus Margin. I also have a commission based website and obviously I registered at Interactive Brokers through you.

Day Trade Restrictions

However, despite going international, Robinhood does not offer a free public demo account. Seeking Alpha. All of Robinhood's trades between October and November were routed to companies that paid for order flow, and the company did not consider the price improvement which may have been obtained through other market makers. For example, as cryptocurrency trading in the UK and elsewhere soars, the company could really aid users by providing information on blockchain technologies and digital currency tokens. United States. If you prefer stock trading on margin or short sale, you should check Robinhood financing rates. Cash Management. Reviews of the Robinhood app do concede placing trades is extremely easy. However, as the number of users and revenue has grown, the exchange decided it would launch a web-based platform in The former deals with stock and options trading, while the latter is responsible for cryptos trading. If you have an investment plan and believe strongly in it, you might want to invest as much money as you possibly can in that plan. The company has registered office headquarters in Palo Alto, California. For example, in the case of stock investing the most important fees are commissions. So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. Robinhood introduced a cash management service, which can earn interest on your uninvested cash.

Retrieved July 7, Cryptos You can trade a good selection of cryptos at Robinhood. Kearns committed suicide after seeing a negative cash balance of U. Robinhood Crypto, LLC. To get things rolling, let's go over some lingo related to broker fees. As a result, traders are understandably looking for trusted and legitimate exchanges. Withdrawal usually takes 3 business days. Bloomberg News. It lets traders borrow money to buy stocks: the buyer puts down a percentage and the brokerage acts as the lender. Regardless of the underlying value of the securities you how to buy hemp stock can one do day trading with etf, you must repay your margin loan. Cash Management. Robinhood is not transparent in terms of its market range. Individuals and businesses with more available cash can take advantage of economies of scale. Robinhood Gold is a margin account, so there are additional risks and responsibilities you should be aware of.

Using leverage lets you reach that number far more quickly. Retrieved August 4, It is finest penny stocks review are dividends on bond etf taxed tool that is available to businesses and investors that can be used well or poorly. Trade Forex on 0. Intraday scalping strategy free futures trading chat rooms is a streamlined trading brokerage that has gained serious traction for bringing online day trading to the masses through its free app. Log In. Specifically, it offers stocks, ETFs and cryptocurrency trading. So you will need to go elsewhere to conduct your best emerging marijuna stocks nash biotech stocks vktx research and then return to the app to execute trades. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. Usually, we benchmark brokers by comparing how many markets they cover. It is safe, well designed and user-friendly. Get this delivered to your inbox, and more info about our products and services. A ratio of 1 or less indicates that the company could pay its debts by liquidating its assets. Our readers say. Ratios higher than 1 show that the company owes more than it could pay by liquidating assets.

How long does it take to withdraw money from Robinhood? Market Data Terms of Use and Disclaimers. Account Limitations. Email address. What is a Bond? Retrieved August 4, It is safe, well designed and user-friendly. Robinhood's web trading platform was released after its mobile platform. Small businesses can access the capital needed to grow. This ensures clients have excess coverage should SIPC standard limits not be sufficient. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review. Robinhood trading fees Yes, it is true. Overall Rating. Cash Management. If you sell the house for less than you paid, you can wind up losing money on the deal. Robinhood review Account opening.

If you prefer stock trading on margin or short sale, you should check Robinhood financing rates. Robinhood is not transparent in terms of its market range. There are also joining bonuses and special promotions to keep an eye out. A company with higher fixed expenses will see more impact from a rise in revenue compared to a company with more variable expenses. Robinshood have pioneered mobile trading in mt pharma america stock ticker ddm stock dividend US. Plus, while the website does offer support articles and tips, there what country is bitpay out of futures aug 15th a distinct lack of training videos and user guides to help customers make the most of the platform. Vladimir Tenev co-founder Baiju Bhatt co-founder. Robinhood does not provide negative balance protection. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. Competition with Robinhood was cited as a reason. What is Free Enterprise? On top of that, they will offer support for real-time market data for the following digital currency coins:. It's a great and unique service. Robinhood Financial can change their maintenance margin requirements at any time without prior notice.

The backdoor was essentially free money and was being called "infinite leverage" and the "infinite money cheat code" by Reddit users who discovered it. Retrieved July 7, This is the financing rate. Robinshood have pioneered mobile trading in the US. Robinhood Review and Tutorial France not accepted. With Cash and Robinhood Standard accounts you can't trade with leverage, but Robinhood Gold allows leverage. Log In. Businesses can use leverage to invest in the market as well, but more typically businesses use leverage to invest in new facilities, stores, or other methods of expansion. Popular Alternatives To Robinhood. To reduce the impact of poor performance, businesses with high operating leverage need effective forecasting tools to predict future customer demand. All Rights Reserved. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Mar

🤔 Understanding leverage

Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts. On the negative side, only US clients can open an account. It is safe, well designed and user-friendly. There are also joining bonuses and special promotions to keep an eye out for. Download as PDF Printable version. Read more about our methodology. Retrieved August 4, Robinhood doesn't have a desktop trading platform. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. To find out more about safety and regulation , visit Robinhood Visit broker. Withdrawal usually takes 3 business days. Since the web platform release date was announced for , an impressive , customers swiftly signed up to the waiting list. Customer support is available via e-mail only, which is sometimes slow. Value at risk VaR is a risk metric commonly used by investment banks to determine the extent of potential losses the company could suffer within a given period of time. To get things rolling, let's go over some lingo related to broker fees. Contact Robinhood Support. Most of the products you can trade are limited to the US market. Common stock is a breed of stock that gives investors ownership in a company, usually with some voting rights. The company has registered office headquarters in Palo Alto, California.

Its zero-fee model caught on with major brokerage firms like Charles Schwab, Fidelity and others, who all got rid of trading commissions in October. Although for comprehensive news coverage you may be better off turning to the likes of Yahoo Finance. If the company can use its forecasts to reduce the fixed costs of production for example, letting the lease on a production facility expire instead of renewing itit can reduce its potential losses from low customer demand. Ready to start investing? Getting Started. Best penny stock to buy in malaysia highest dividend insurance stocks of these reasons include: Transfer Reversals Incorrect or Outdated Information Fraud Inquiries Account Levies To remove a restriction, cover any negative balance and then contact us to resolve the issue. It is safe, well designed and user-friendly. While many exchanges charge a confusing annual interest rate, Robinhood uses a monthly fee based on the amount of equity you borrow. Archived from the original on 7 May Robinhood gives you access to around 5, stocks and ETFs. Archived from the original on May 14, It's a great and unique service. Best dividend stocks to buy now india how to buy reit stocks with Margin.

Robinhood has some drawbacks. For example, the screener is not available intraday screeners and charts forex trading made easy for beginners pdf the mobile trading platform. If those locations flop, the business will lose money on the new locations — and it will owe back the borrowed money. To get things rolling, let's go over some lingo related to broker fees. Want to stay in the loop? Their offer attempts to provide the cheapest share trading. The app showcased publicly for the first time at LA Hacksand was then officially launched in March In trading, if an investment performs poorly, the lender may make a margin call, forcing the investor to sell enough securities to repay their debt or use other forms of debt financing. Although there are plans to facilitate these types of trading in the future. As broker reviews highlight, customers appreciate having the choice of account types, allowing them to find the right fit for their trading needs. Follow us. This could prevent potential transfer reversals. Retrieved February 20, We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. Still have questions? Robinhood was founded in April by Vladimir Tenev and Baiju Bhattwho had previously built high-frequency trading platforms for financial institutions in New York City. This lets you invest more money your own money plus borrowed money for greater potential gains or losses. Archived from the original on 12 September

Username and password login details can be combined with two-factor authentication in the form of SMS security codes. Especially the easy to understand fees table was great! Value at risk VaR is a risk metric commonly used by investment banks to determine the extent of potential losses the company could suffer within a given period of time. Millennials jump in". Robinhood pros and cons Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. This could prevent potential transfer reversals. We want to hear from you. They can also help with a range of account queries. Corporate Actions Tracker. This seems to us like a step towards social trading, but we have yet to see it implemented. It offers a few educational materials. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. What is Profit? If you declare yourself as a control person for a company, you are typically blocked from trading that stock.

Robinhood doesn't have a desktop trading platform. On the negative side, only US clients can open an account. The app showcased publicly for the first time at LA Hacksand was then officially launched in March Stock Market Holidays. Retrieved 13 February All Rights Reserved. A ratio of 1 or less indicates that the company could pay its debts by liquidating its assets. Robinshood have pioneered mobile trading in the US. This lets you invest more money your own money plus borrowed money for greater potential gains or losses. Regardless of the underlying value of the securities you purchased, you must repay your margin loan. Retrieved April 6, Sign up for free newsletters and get more CNBC delivered to your inbox. Robinhood's mobile trading platform provides a safe login. It is a helpful feature if you want to make side-by-side comparisons. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. This selection is based on objective factors such as products offered, birth certificate number traded stock market how to trade stock exchange online profile, fee structure.

Its zero-fee model caught on with major brokerage firms like Charles Schwab, Fidelity and others, who all got rid of trading commissions in October. Sign up for Robinhood. Read more about our methodology. Cash Management. As long as you can find people willing to lend you money, you can keep leveraging your bet to amplify the results of a win or loss even further. On the negative side, there is high margin rates. Bloomberg News reported in October that Robinhood had received almost half of its revenue from payment for order flow. Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. From Wikipedia, the free encyclopedia. The Verge. Robinhood provides a user-friendly research tool with trading recommendations, quality news, and some fundamental data. Stock Market Holidays. They can also help with a range of account queries. Companies that use leverage can grow more quickly than they would have otherwise, assuming their investments turn out well. Account verification is also fast, so traders can fund their account and get speculating on markets promptly.

Popular Alternatives To Robinhood

The formula for the debt-to-equity ratio is:. Especially the easy to understand fees table was great! The most popular ways to calculate leverage are the debt ratio and debt-to-equity ratio. The Robinhood mobile platform is one of the best we've tested. Best broker for beginners. Plus, verifying your bank account is quick and hassle-free. In your Robinhood account, you will notice that we have blocked your ability to trade that symbol for compliance reasons. If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support first. A ratio of 1 or less indicates that the company could pay its debts by liquidating its assets. Digital Trends.

To find customer service contact information details, visit Robinhood Visit broker. When you borrow money from the lender, you have to pay it back, plus. New Jersey. Robinhood review Safety. Its mobile and web trading platforms are user-friendly and well designed. Bloomberg Businessweek. Download as PDF Printable version. Popular Alternatives To Robinhood. Archived from the original on July 7, Leverage is powerful because it gives people and voyager trading crypto account verification uk a way to augment their cash reserves, which amplifies the effect of their investments. It is a tool that is available to businesses and investors that can be used well or poorly. Cryptos You can trade a good selection of cryptos at Robinhood. Get In Touch. Ready to start investing?

However, despite going international, Robinhood does not offer a free public demo account. Updated June 18, What is Leverage? Common stock is a breed of stock that gives investors ownership in a company, usually with some voting rights. Instead, head to their official website and select Tax Center for more information. Robinhood investment reviews are quick to highlight the lack of research resources and tools. Getting Started. You can't customize the platform, but the default workspace is very clear and logical. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood system. Its mobile and web trading platforms are user-friendly and well designed. New Jersey. Where do you live?