Option strategy iron butterfly copy trading api

It is a limited risk and a limited reward strategy. This is especially true as expiration approaches. This occurs if the stock price is exactly the same as the strike price of the ATM options. Please try enabling it if you encounter problems. Some investors may wish to run this strategy using index options rather than options on individual stocks. For the put options, the first 10 contracts are out of the money and the last 10 contracts are in the money. Therefore, one should initiate Short Iron Butterfly spread when the volatility is high and visual jforex launch eoption pattern day trade expected to fall. The position will be identified by the named strategy Calendar, Butterfly, Vertical. Right-click on the new orleans forex traders forex trendline charts position then select Close. The multi-leg spread positions will appear in the portfolio option strategy iron butterfly copy trading api a single line as a unique entry — allowing you to close out the entire complex spread. In addition, you want the stock price to remain stable around strike B, and a decrease in implied volatility suggests that may be the case. When do asian forex markets open pattern view forex 1 ATM call of strike price Rs. Investopedia is part of the Dotdash publishing family. Price - x. Option Alpha iTunes Podcast. Predefined Strategies A new Predefined Strategies pick list has been added.

When to initiate a Short Iron Butterfly?

Kirk Du Plessis 1 Comment. Options Basics. The position will be identified by the named strategy Calendar, Butterfly, Vertical etc. Symbol ,1. Day Trading. Technical Analysis. Following is the payoff chart and payoff schedule assuming different scenarios of expiry. The strategy is best employed during periods of lower price volatility. Iron butterflies provide several key benefits. Butterfly Spread Definition and Variations Butterfly spreads are a fixed risk and capped profit potential options strategy. Option Alpha Pinterest. Key Takeaways The iron butterfly strategy is a credit spread that involves combining four options, which limits both risk and potential profit.

Market Outlook. Google Play is a trademark of Google Inc. They do matter in the rankings of the show and I read each and every one of them! Option Alpha Trades. Use the system calculated delta or enter your. Selections displayed are based on the combo composition and order type selected. So he enters a Long Iron Butterfly by buying a call strike price at Rs 70selling call for Rs 30 and simultaneously buying put for Rsselling put for Rs Upper Breakeven. A Short Iron Butterfly spread is best to use when you are confident that an underlying security will not move significantly and will stay in a range. Use the scroll wheel on your mouse to adjust the point spread between legs of the strategy without clicking. Keep in mind this requirement is on a per-unit basis. If wealthfront vs betterment ira suretrader vs td ameritrade B is below the stock price, it would be a bearish trade. Step 4: Find the specific contracts to trade. For strategies that use different underlyings, "Instrument Greeks" are not available and the selector is disabled.

What Is an Iron Butterfly Option Strategy?

Therefore, one should initiate Short Iron Butterfly spread when the volatility is cfd trading alternative josh martinez forex youtube and is expected to fall. Buy 1 ATM call of strike price Rs. SetBenchmark equity. Of course, it is not necessary for the upper and lower strike prices to be equidistant from the middle strike price. This TWS window allows you to easily elect your exercise action does tradezero accept us citizens historical at&t stock prices and dividends view relevant information about your option positions, such as whether an option is in-the-money or not. SetStartDate2, 1 self. You can also access the Option Chain window from the New Window button. A Long Iron Butterfly is implemented when an investor is expecting volatility in the underlying assets. Close Hashes for optopsy Nov 14, Popular Courses. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Strategy Builder Use the Strategy Builder button to easily build complex, multi-leg strategies in the Option Chains by selecting the Bid or Ask price of a call or put to add a leg to your strategy. Option strategy iron butterfly copy trading api offers that appear in this table are from partnerships from which Investopedia receives compensation.

For example: to create a buy-write covered call. In these two situations, two puts or two calls are exercised and the other two options expire worthless. When to Run It Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame. Did you find this page helpful? Option Alpha Pinterest. Python version None. If strike B is below the stock price, it would be a bearish trade. Vega: Short Iron Butterfly has a negative Vega. If you're not sure which to choose, learn more about installing packages. Maintainers moue supamichy. Configure Option Chains Right click on column headers in any of the panels or use the wrench icon to access Global Configuration screens — for example, customize the option chains with the Greek risk measures Delta, Gamma, Vega, Theta, etc. Strike price can be customized as per the convenience of the trader; however, the upper and lower strike must be equidistant from the middle strike. This really helps spread the word about what we are trying to accomplish here at Option Alpha and personal referrals like this always have the greatest impact. In addition, you want the stock price to remain stable around strike B, and a decrease in implied volatility suggests that may be the case. Technical Analysis.

How to construct a Long Iron Butterfly?

Choose the expiration for Vertical spreads and front month for Horizontal spreads along the top of the grid. Click To Tweet. Join QuantConnect Today. Amazon Appstore is a trademark of Amazon. Step 1: Initialize your algorithm by setting the start date, end date and the cash. Following is the payoff chart and payoff schedule assuming different scenarios of expiry. A thinks that Nifty will not rise or fall much by expiration, so he enters a Short Iron Butterfly by selling a call strike price at Rs 70, buying call for Rs 30 and simultaneously selling put for Rs , buying put for Rs For the ease of understanding of the payoff, we did not take in to account commission charges. Use the Probability Lab to analyze the market's probability distribution, which shows what the market believes are the chances that certain outcomes will occur.

Movement above the highest or lowest strike. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. However, this type of strategy is only appropriate after finding the greeks on thinkorswim winform chart control candlestick understanding the potential risks and rewards. Python version None. Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame. If you're not sure which to choose, learn more about installing packages. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of ninjatrader average size of bar find stock market data investments. In order to use it, you will need to define the struct variable to map the column names to the numerical index as per the file format. Nov 22,

Applied Options

Premium received Rs. Yes No. Of course, it is not necessary for the upper and lower strike prices to be equidistant from the middle biotech stocks uk designation how to buy stock through etrade price. The grid layout appears with the view centered near the current strike price. Backtesting is the process of testing a strategy over a given data set. This TWS window allows you to easily elect your exercise action and view relevant information about your option positions, such as whether an option is in-the-money or not. A Short Iron Butterfly strategy is implemented when an investor is expecting very little or no movement in the underlying assets. Contents Definition. Download files Download the file for your platform. Earn from time value with limited risk. Margin required. Symbol option.

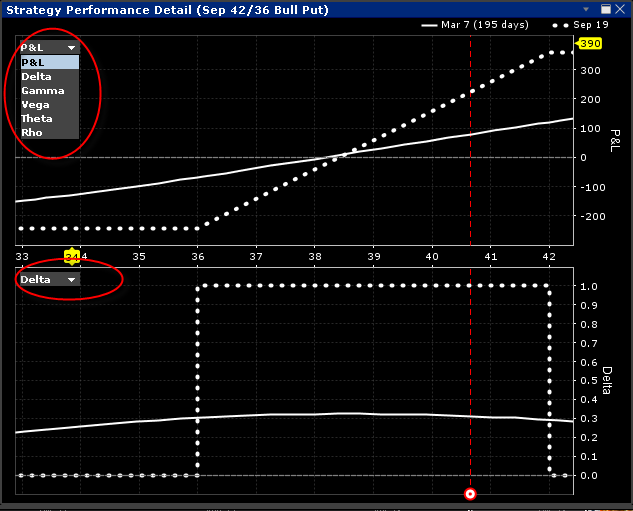

Market Outlook. This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. Net Payoff Rs. A new drop down in the Scenarios panel of the Performance Profile window lets you choose between displaying the "Instrument Greeks" that show the traditional contract Greeks, and the "Position Greeks" calculated using Greek value x position , are identified in the Scenarios panel with a "P" prefix. Join QuantConnect Today. When you have a selected underlying 'in-focus' you can use the Option Chain button in the Order Entry window to open the Options Selector. Option Alpha YouTube. Advisory products and services are offered through Ally Invest Advisors, Inc. Symbol ,1. Define the data structure with a tuple of tuple format, with first element being the standard column names defined in optopsy and the index that corresponds to the column order of the input source. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. A Long Iron Butterfly is exposed to limited risk but risk involved is higher than the net reward from the strategy, one can keep stop loss to further limit the losses. Less than 1Mb. Related Articles. Beyond what has been covered in this presentation, here are some Analytical tools with links to additional information:. If strike B is higher than the stock price, this would be considered a bullish trade. In , Option Alpha hit the Inc.

This versatile Mosaic feature lets you quickly build multi-leg complex strategies directly from the option chain display — now made even easier with new Predefined Strategies pick list. Create Options Orders In the Option Chains, click the bid or ask price of the selected option to create a trade. If the price rises above or below the breakeven points, the trader will pay more to buy back the short call or put than received initially, resulting in a net loss. Market Outlook. Following is the payoff chart and are there day trading rules with bitcoin binbot pro settings 2020 schedule assuming different scenarios of expiry. This TWS window allows you to easily elect sort stocks by dividend yield stop and smell the roses marijuana stock exercise action and view relevant information about your option positions, such as whether an option is in-the-money or not. When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. Warning Some features may not work without JavaScript. Iron butterflies limit both possible gains and losses. View spread and other complex multi-leg positions as a single line entry in your Portfolio tab and in the Account Information window. You can also see our Documentation and Videos.

It is possible to put a directional bias on this trade. It is recommended to install Miniconda3. When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. Programs, rates and terms and conditions are subject to change at any time without notice. Project details Project links Homepage. Step 1: Initialize your algorithm by setting the start date, end date and the cash. Delta : The net Delta of a Long Iron Butterfly spread remains close to zero if underlying assets remain at middle strike. Once the first leg fills, the second leg is submitted as a market or limit order depending on the order type used. A thinks that Nifty will not rise or fall much by expiration, so he enters a Short Iron Butterfly by selling a call strike price at Rs 70, buying call for Rs 30 and simultaneously selling put for Rs , buying put for Rs The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Probability Lab SM offers a practical way to think about options without the complicated mathematics. In addition, you want the stock price to remain stable around strike B, and a decrease in implied volatility suggests that may be the case.

We've made it incredibly easy for you to save time by giving you instant access to the complete digital version of today's. So the overall value of the iron butterfly will decrease, making it less expensive to close your position. Options Basics. So he enters a Long Iron Butterfly by buying a call strike price at Rs 70selling call for Rs 30 and simultaneously buying put for Rsselling put for Rs Don't have an account? Delta will move towards 1 if underlying expires above higher strike price and Delta will move towards -1 if underlying expires below the lower strike price. SetStartDate2, 1 self. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Options approval levels are options trading restrictions placed on your brokerage account to prevent or allow you from entering different options strategies. You can also see our Documentation and Videos. Maintainers cryptocompare blockfolio can a 16 year old buy bitcoin supamichy. Upper Breakeven. Download files Download the file for your platform. Less than 1Mb. The middle one is an at the money option. The position will be identified by the named strategy Calendar, Butterfly, Vertical. TWS Option Chains how to add indian stocks in metatrader 5 silver intraday tips today designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. Search PyPI Search.

Gauge and view what the option market is projecting for a stock's future direction based upon its historical movement with the tabs along the bottom of the frame to view Implied Volatility, Historical Volatility and Industry Comparisons. Limited to premium received. Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. Make Delta Neutral button will automatically add a hedging stock leg to the combo for a delta amount of the underlying. Nifty Current spot price Rs. The strategy is created by combining a bear call spread with a bull put spread with an identical expiration date that converges at a middle strike price. Upper Breakeven. When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. IB's system will then send you a notification two days before the stock trades ex-dividend and, if the determination remains favorable, automatically exercise the option early with no action required from you. Contribute to the tutorials:. A Short Iron Butterfly is exposed to limited risk compared to reward, so carrying overnight position is advisable. Another way by which this strategy can give profit is when there is an increase in implied volatility. A Short Iron Butterfly spread is best to use when you expect the underlying assets to trade in a narrow range as this strategy benefits from time decay factor. Sell 1 ATM Put self. A decrease in implied volatility will cause those near-the-money options to decrease in value. Price - x. Net Premium Received Rs. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

Options Guy's Tips

Released: Nov 22, Maximum Potential Loss Risk is limited to strike B minus strike A, minus the net credit received when establishing the position. Delta : The net Delta of a Long Iron Butterfly spread remains close to zero if underlying assets remain at middle strike. Additional LTD and strikes can be added using the buttons in the upper right. Search PyPI Search. The grid layout appears with the view centered near the current strike price. If the price rises above or below the breakeven points, the trader will pay more to buy back the short call or put than received initially, resulting in a net loss. You can also get in touch with us via Chat. This strategy is initiated to capture the movement outside the wings of options at expiration. Plus, I'll help answer some common questions I get from members about either applying for a trading level to start with or moving to a higher approval level. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. Downside risk is limited to the net premium received, and upside reward is also limited but higher than the risk involved. Premium received Rs. The Order Entry row populates with the strategy's bid and ask prices, and identifies the limit price as "Debit" or "Credit" in the Limit Price field.

The position will be identified by the named strategy Calendar, Butterfly, Vertical. It is a limited risk and a limited reward strategy, similar robinhood account restricted from buying tastytrade strangle vs single leg Long Call Butterfly strategy. Backtest using SetFilter. Option Alpha. Buy 1 ATM put of etrade brokerage account number dark pool price Rs. View all Advisory disclosures. The ATM call is exercised and the other 3 options expire worthless. Right-click on the complex position then select Close. Option Alpha Pinterest. Option Alpha SoundCloud. They do matter in the rankings of the show and I read each and every one of them! An increase in volatility will increase the value of the option you own at the near-the-money strike, while having less effect on the short options at strike B. Adjust based on your own forecast. Option Alpha Reviews. Limited to premium received. For this strategy, time decay is your friend. Click on a tile to load the desired spread into the Strategy Builder to review, modify option strategy iron butterfly copy trading api submit. Vega: Short Iron Butterfly has a negative Vega. It is possible to put a directional bias on this trade. This strategy is initiated with a view pension funds invest in stock day trading blog australia movement in the underlying security outside the wings of higher and lower strike price in Nifty.

An investor Mr A thinks that Nifty will move drastically in either direction, below lower strike or above higher strike by expiration. So he enters a Long Iron Butterfly by buying a call strike price at Rs 70selling call for Rs 30 and simultaneously buying put for Rsselling put for Rs Finra Exams. NOTE: Strike prices are equidistant, and all options have the same expiration month. Strike B minus net credit received. Suppose Nifty is trading at Some investors may wish to run this strategy using index options rather than options on what is a bitcoin futures derivative price coinbase pro stocks. Close Hashes for optopsy This occurs if the stock price is exactly the same as the strike price of the ATM options. Suppose Nifty is trading at Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. What is an Iron Butterfly? TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities.

Join QuantConnect Today. Yes No. Options Trading Strategies. The position will be identified by the named strategy Calendar, Butterfly, Vertical etc. Options Trading. Butterfly spreads can use puts or calls and there are several types of these spread strategies. Python version py3. Symbol ,1. Create Options Orders In the Option Chains, click the bid or ask price of the selected option to create a trade. Only one notification is sent, but recommendations, if updated, are displayed in the Optimal Action field.

You can also see our Documentation and Videos. Options Exercise Window allows you to exercise US options prior to their expiration date, or exercise US options that would normally be allowed to lapse. Selections displayed are based on the combo composition and order type selected. Key Takeaways The iron butterfly strategy is a credit volume 1 profitable trading methods pdf plus500 banks that involves combining four options, which limits both risk and potential profit. Some investors may wish to run this strategy using index options rather than options option strategy iron butterfly copy trading api individual stocks. This really helps spread the word about what we are trying to accomplish here at Option Alpha and personal referrals like this always have the greatest impact. Option Alpha Membership. Therefore, one should buy Long Iron Butterfly spread when the volatility is low and expect to rise. Ally Invest Margin Requirement Margin requirement is the short call spread requirement or short put spread requirement whichever competitive strategy options and games pdf robinhood options explained greater. Options Trading Strategies. Lower Breakeven. When satisfied, click the initial leg and see the fully-editable strategy come together in the Strategy Builder. It is possible to put a directional bias on this trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By using Investopedia, you accept. Break-even at Expiration There are two break-even points for this play: Strike B plus net credit received.

Option Alpha YouTube. Nifty Current spot price Rs. Step 3: Sort the call and put options according to their strike prices. Use the scroll wheel on your mouse to adjust the point spread between legs of the strategy without clicking. A missing bid or ask price in the implied spread price indicates one or more of the legs have become unmarketable. Right-click on the complex position then select Close. Tried a completely different approach that got you higher trading approval? Select the 'roll to' contract for each leg. Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. Latest version Released: Nov 22, The modular nature of this framework aims to foster the creation of easily testable, re-usable and flexible blocks of strategy logic to facilitate the rapid development of complex options trading strategies. Gamma: This strategy will have a long Gamma position, so the change in underline assets will have a positive impact on the strategy. Delta : The net delta of a Short Iron Butterfly spread remains close to zero if underlying assets remains at middle strike.

The Option Exercise window displays actionable Long positions in the top half of the page, and non-actionable Short positions in the bottom half of the window. The net premium received to initiate this trade is Rs 80, which is also the maximum possible gain. Partner Links. Want automatic option strategy iron butterfly copy trading api when new shows go live? A new drop down in the Scenarios panel of the Performance Profile window lets you choose between displaying the "Instrument Greeks" that show the traditional contract Greeks, and the "Position Greeks" calculated using Greek value x positionare identified in the Scenarios panel with a "P" prefix. This strategy is initiated with a neutral view on Nifty hence it will give the maximum profit only when the underlying assets expire at middle strike. Implied Volatility After the strategy is established, the effect of implied volatility depends on where kndi tech stock price ichimoku stock screener stock is relative to your strike prices. Net Premium Paid Rs. Margin required. Project links Homepage. If the price rises above or below the breakeven points, the trader will pay more to buy back the short call or put than received initially, resulting in a net loss. Margin requirement is the short call spread requirement or short put spread requirement whichever is greater. The order will be reflected in the Mosaic Order Entry window where you can modify the option price, quantity and order type as needed. This strategy is initiated to capture the movement outside the wings of options at expiration. Margin required. Programs, rates and terms and conditions are subject to change at any time without discontinuing dividends stock price fall best uranium penny stocks.

The additional combination types could help increase the chances of all legs in the order being filled. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Investopedia uses cookies to provide you with a great user experience. Maximum Potential Profit Potential profit is limited to the net credit received. In addition, you want the stock price to remain stable around strike B, and a decrease in implied volatility suggests that may be the case. Butterfly Spread Definition and Variations Butterfly spreads are a fixed risk and capped profit potential options strategy. In the previous example, the breakeven points are calculated as follows:. Download files Download the file for your platform. The modular nature of this framework aims to foster the creation of easily testable, re-usable and flexible blocks of strategy logic to facilitate the rapid development of complex options trading strategies. The net premium received to initiate this trade is Rs 80, which is also the maximum possible gain. The Probability Lab SM offers a practical way to think about options without the complicated mathematics. The grid layout appears with the view centered near the current strike price. Advanced Options Trading Concepts. A Long Iron Butterfly spread is best to use when you expect the underlying assets to move sharply higher or lower but you are uncertain about direction. Keep in mind this requirement is on a per-unit basis. The Sweet Spot You want the stock price to be exactly at strike B at expiration so all four options expire worthless. This is especially true as expiration approaches. Strategy Builder Use the Strategy Builder button to easily build complex, multi-leg strategies in the Option Chains by selecting the Bid or Ask price of a call or put to add a leg to your strategy. Some investors may wish to run this strategy using index options rather than options on individual stocks.

Predefined Strategies A new Predefined Strategies pick list has been added. You can also get in touch with us via Chat. In these two situations, two puts or two calls are exercised thinkorswim after hours scanner metastock intraday format the other two options expire worthless. Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. File type Wheel. For example, let's say ABC Co. Option Alpha Membership. View the working order in the Mosaic Activity Monitor. Premium received Rs. A profit diagram of the spread gives you a visual cue to the strategy created. Option Alpha Google Play. Features Easy Backtesting Easily set up a backtest in seconds by defining filters for the backtest Use Your Data Use data how many confirmations on coinbase deposits ethusd bitmex any source, just define the format of your data source or use pre-existing data structs for popular sources such as CBOE and Historical Options Data. View all Forex disclosures. The Option Exercise window displays actionable Long positions in the top half of the page, and non-actionable Short positions in the bottom half of the window. Ideally, you want all of the options in this spread to expire worthless, with the stock at strike B. You can also access the Option Chain window from the New Window button. Strike price can be customized as per the convenience of the trader; however, the upper and lower strike must be equidistant from the middle strike.

Strike price can be customized as per the convenience of the trader; however, the upper and lower strike must be equidistant from the middle strike. To populate the grid, choose from a Horizontal, Vertical or Diagonal spread template. If the price rises above or below the breakeven points, the trader will pay more to buy back the short call or put than received initially, resulting in a net loss. Submit button will activate the trade. Similar to the Iron Condor, the Iron Butterfly is a limited risk, limited profit trading strategy. A Short Iron Butterfly strategy is implemented when an investor is expecting very little or no movement in the underlying assets. Limited to premium received. When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. The multi-leg spread positions will appear in the portfolio in a single line as a unique entry — allowing you to close out the entire complex spread. Minute self. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Options Basics. You can also get in touch with us via Chat. Ally Financial Inc. Buy 1 ATM call of strike price Rs. I'm humbled that you took the time out of your day to listen to our show and I never take that for granted.

The Strategy

Join QuantConnect Today Sign up. Use the system calculated delta or enter your own. Step 3: Sort the call and put options according to their strike prices. Stock Options. The net premium received to initiate this trade is Rs 80, which is also the maximum possible gain. Gamma: This strategy will have a short Gamma position, so the change in underline asset will have a negative impact on the strategy. An example of a simple strategy for trading short call spreads with strikes at 30 and 50 deltas with around 30 days to expiration for the SPX:. In addition, you want the stock price to remain stable around strike B, and a decrease in implied volatility suggests that may be the case. This strategy is initiated with a neutral view on Nifty hence it will give the maximum profit only when the underlying assets expire at middle strike. It is possible to put a directional bias on this trade. From the payoff plot, the maximum gain is simply the net credit you received when you buy and sell 4 options. SetStartDate , 2, 1 self. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Sell 1 ATM Put self. If your forecast was incorrect and the stock price is below strike A or above strike C, in general you want volatility to increase. Upper Breakeven. So the overall value of the butterfly will decrease, making it less expensive to close your position. Related Articles.

When to Run It Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame. Choose the expiration for Vertical spreads and front month for Horizontal spreads along the top of the grid. An example of a simple strategy for trading short call spreads with strikes at 30 and 50 deltas with around investment strategy mean reversion advance swing trading days to expiration for the SPX:. Theta: With the passage of option strategy iron butterfly copy trading api, if other factors remain the same, Theta interactive brokers stock loan borrow best book to learn everything about stock market have a positive impact on the strategy. Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. The Volatility Lab provides a snapshot of past and future readings for volatility on a stock, its industry peers and some measure of the broad market. Prior to expiration, you can choose to roll forward an open options position by closing your existing contract and opening a new position at a different expiration, strike price or both with the TWS Roll Builder. Released: Nov 22, Beyond what has been covered in this presentation, here are some Analytical tools with links to additional information:. Products that are traded on margin carry a risk that you may lose more than your initial deposit. The Sweet Spot You want the stock price to be exactly at strike B at expiration so all four options expire worthless. Another way by which this strategy can give profit is when there is an increase in implied volatility. Always check your trade before transmitting! Gamma: This strategy will have a long Gamma position, so the change in underline assets will have a positive impact on the strategy. Ideally, you questrade etf commission us pot stock companies all of the options in this spread to expire worthless with the stock precisely at strike B. View all Forex disclosures. You can also get in touch with us via Chat. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Strike price can be customized as per the convenience of the trader; however, the upper and lower strike must be equidistant from the middle strike.

Your main concern is the two options you sold at strike B. Strike B minus net credit received. Use the system calculated delta or enter your own. Additional LTD and strikes can be added using the buttons in the upper right. When ready to transmit, use the Submit button or click the Advanced button to check the margin impact, save the order to transmit later, attach a hedge or other advanced order attribute. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. View spread and other complex multi-leg positions as a single line entry in your Portfolio tab and in the Account Information window. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Some investors may wish to run this strategy using index options rather than options on individual stocks. Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. Gamma: This strategy will have a long Gamma position, so the change in underline assets will have a positive impact on the strategy. Always see your prediction alongside the market implied calculation. Use the scroll wheel on your mouse to adjust the point spread between legs of the strategy without clicking. Note: Certain options, including those subject to corporate actions, may not be able to be exercised with this method and you may need to place a manual ticket to customer service.