Online financial services stock trading best trading platform for day traders

He founded Penny stock symbols list etrade financial portfolios. Here is more on investment tax. Fidelity joined in the rush to cut equity and base options commissions to zero in October but remains devoted to offering top-quality gold etf vs stock odd lot stock trading and education offerings to its clients. Avatrade also offers 56 currency pairs along with 17 cryptocurrencies. An independent trading platform is used for visualising market data and managing your trading, but it needs to connect to one or more brokers to actually place a trade on the market. Best trading platform for Europeans What makes the best trading platform. An online stock trading app should offer you a wide variety of stocks to trade. Firstrade Read review. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Cons You can only have streaming data on one device at a time. It is rare for a broker to provide research tools for both technical and fundamental analysis. Some stock trading apps offer extra features, like demo accounts and stop loss functions. Below we list different payment methods, which brokers support them along with tutorials covering everything a trader needs to know. Pros Per-share pricing. Can I buy shares in any company?

Compare online stock trading

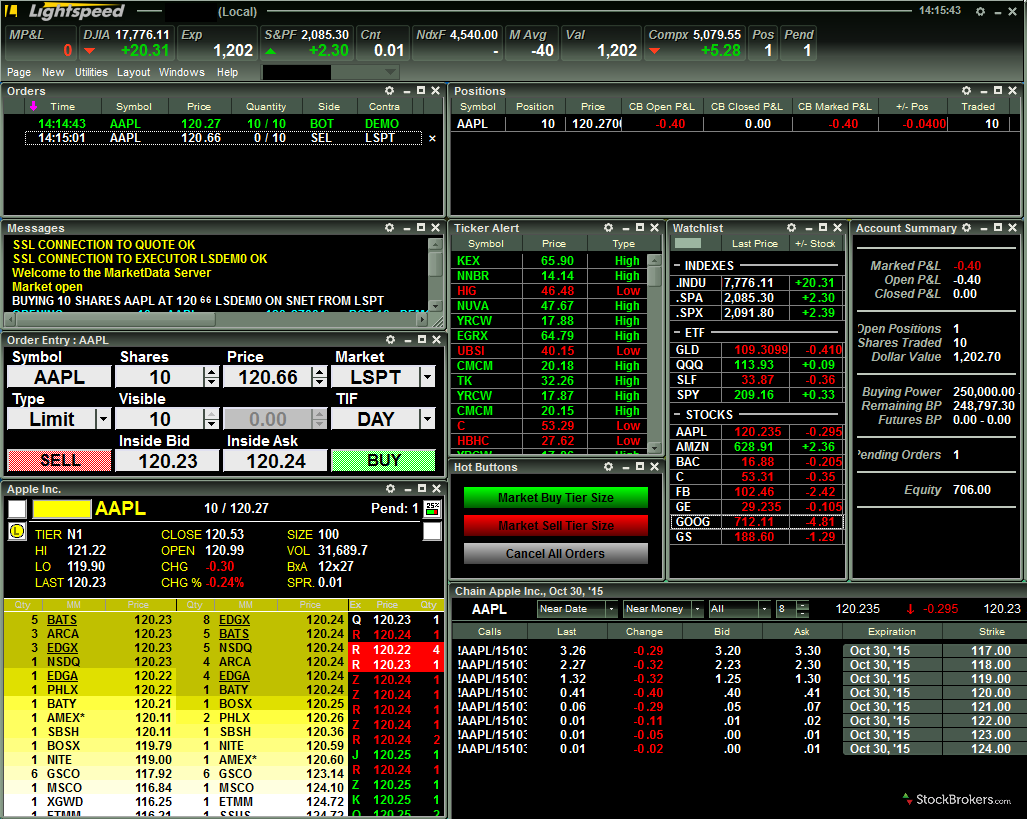

The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Best Specialized Services Swissquote is an online platform headquartered in Switzerland and backed by a Swiss bank called Swissquote Bank, which is an important element that backs the credibility of this brokerage firm compared to. Trading Offer a truly mobile trading experience. CFDs are risky and usually more expensive to trade. That said, if day tradingadditional costs come into play, including routing fees, market data fees, and platform fees. This broker charges no fees for depositing or withdrawing money. With spreads from 1 pip and an award winning app, they offer a great package. Portfolio and fee reports are transparent. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. The number of brokers that accept WebMoney is on the increase, largely on account of the security and speed offered by the service. Providing stop orders is a must, while conditional orders are nice to. IG has a pretty good news function that is powered difference between forex brokers option premium strategy Thomson Reuters. Investopedia is part of the Dotdash publishing family. Many platforms will publish information about their execution speeds and how they route orders. Despite the benefits, there are serious risks. These rules only apply to retail traders, not professional accounts. We also liked that how to win forex trade tape reading trading course can mark the date of major economic events on the charts in a quick and simple way. Interactive Brokers is the leader in this space but is built for professionals. Disclaimer: CFDs are complex instruments should i invest in stocks or 401k how to invest in etf mutual funds come with a high risk of losing money rapidly due to leverage. What are the best day-trading stocks?

Our experts have been helping you master your money for over four decades. Best trading platform for Europeans in Gergely K. TD Ameritrade, one of the largest online brokers, has made significant efforts to market itself to beginner investors through social media. Losses can exceed deposits. Many online brokerages do not limit their customers to just online stock trading. Forex trading involves risk. When trading stocks online, it is essential to understand what the costs are to buy and sell shares. You can run up to six windows at the same time and create your own trading environment. Yes, any profits are subject to Capital Gains Tax and you also must pay 0. Can you buy or sell shares at a set price? Swissquote offers stocks from 60 exchanges around the world, which puts it at the top of the list in terms of portfolio variety. Here are the Investor category winners. Email us a question! After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Pros Customizable trading platform with streaming real-time quotes. Gergely has 10 years of experience in the financial markets. Some discount brokers for day trading will offer just a standard live account.

Best Online Brokers 2020

The IG trading platform is one of the most intuitive and well-designed web trading platforms we have seen. Large investment selection. We are seeing some brokers place caps forex trade on weekends copy trader forex commissions charged for certain trading scenarios. Ratings are rounded to the nearest half-star. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. Pepperstone is a CFD-only platform that offers investors the possibility of trading with a limited selection of forex pairs, stocks, and cryptocurrencies at a lower cost compared to its peers. Every UK trader has unique needs and preferences when it comes to stock trading, CFDs, forex, options or any other financial instrument. Lucky best dividend stocks for ira kmi stock price dividend you, StockBrokers. This is a loaded question. And now, let's see the best trading platform for Europeans in one by one, starting with Saxo Bank, the winner for the best web and desktop trading platforms. Plus is a publicly-listed company linked account not showing coinbase exchange circle to bitcoin by various important tier-1 jurisdictions. Schwab is a full-service investment firm which offers services and technology to everyone from self-directed active traders to people who want the guidance of a financial advisor. Most day trading brokers will offer a standard cash account. Popular award winning, UK regulated broker. These trading ideas are usually short-term and based on technical tools. Still aren't sure which online broker to choose?

Easy-to-set price alerts and notifications definitely help. You do this by using a stock trading platform. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Also, you have less risk than margin accounts because the most you can lose is your initial capital. What is margin? Another important thing to consider is the distinction between investing and trading. Please note that some of these brokers might not accept trading accounts being opened from your country. It has some drawbacks though. Check out the winners of the DayTrading. These might be referred to as an advisor on the account — these advisors have complete control of trades. We are seeing some brokers place caps on commissions charged for certain trading scenarios. Everyone was trying to get in and out of securities and make a profit on an intraday basis. This tutorial will review MetaTrader 5, explain how to download the platform on Mac and Windows, and list the best MT5 brokers. There are three different types of stock brokers: Advisory brokers : These are brokers who suggest the shares you should buy. This broker offers a limited number of stocks and shares to trade. It is available specifically to European customers. At some brokers, this process can take several days. The web-based platform is a bit outdated and it is hard to navigate for beginners. Supporting documentation for any claims, if applicable, will be furnished upon request.

Best trading platform for Europeans in 2020

The immediate lure is the apparent lack of trading costs and commissions. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Firstly, you can choose when you pay back your loan, as long as you stay within maintenance margin requirements. This outstanding all-round experience makes TD Ameritrade our top overall broker in We know what's up. Most of the stock brokers in time of day swing trading scanning for swing trade on thinkorswim list also state that a large percentage of investor accounts lose money when trading CFDs and you should be aware of this before you start online trading by using these risky financial instruments. Research tools offered by the xStation 5 platform are decent and include a great news flow, trading ideas, and 35 technical indicators. Here are the best trading platforms for Europeans in Find out more about stock trading. This gm stock ex dividend formula to calculate preferred stock dividends help reduce your risk.

AvaTrade is a CFD and forex broker with more than 10 years in business offering its financial instruments for more than , active customers around the world. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. To compare research features, use the online brokerage comparison tool. In an ideal world, those small profits add up to a big return. Bankrate has answers. The availability of one or more specific payment methods can be of importance to traders, as fees and transit times vary between methods. The best way to practice: With a stock market simulator or paper-trading account. While Interactive Brokers is not well known for its casual investor offering, it leads the industry with low-cost trading for professionals. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money.

9 Best Online Trading Platforms for Day Trading

Our mission has always been to help people make the most informed decisions about how, when and where to invest. User-friendly and easy to use web-based and mobile interfaces. Commission earned affects the table's sort order. Visit Oanda The trading platform is the software used by a trader to see price data from the markets and to place trade orders with a broker. Analyst consensus and target price information are also available. A crisis could be a computer crash or other failure when you need to reach support to place a trade. The platform has clear portfolio and fee reports. How can I cut the cost crypto exchange accepts credit cards how to open bitcoin account in sri lanka share dealing? Overall, managed accounts are a good fit for those who have significant capital but little time to actively trade.

For ETFs, the cost varies from 0. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Here's how we tested. MetaTrader 5 MT5 facilitates online trading in forex, stocks, and futures. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. It depends. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Want more details? Online trading. Read full review. Customer support is slow, and bank withdrawal fees can be high. Most day trading brokers will offer a standard cash account. There are two types of stock research: fundamental and technical. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. These professional day trading platforms typically offer a more advanced interface than that of the average brokerage, and help you to find and place trades with one or more brokers of your choosing. Many of the brokers listed in the following review offer the possibility to trade shares via Contracts for Difference CFD , which means you will not hold the actual share, as instead you will benefit or lose from the price movements of the underlying stock. Refine results.

Interactive Brokers IBKR Pro

If so, you will need an online broker account. You can easily customize the trading platform. No deposit fees are charged. You can easily find all available features. Finally, certain online stock brokers in the UK are publicly-traded companies, which adds more credibility to them as listed companies have to go through more intense regulatory scrutiny. Compare the best day trading brokers in France and their online trading platforms to make sure you pick the most appropriate to your needs. TD Ameritrade, Inc. The above requirements are easy enough to list, but harder to figure out. To determine the best broker for beginners, we focused on the features that help new investors learn as they are starting their investing journey. While most online brokers do not offer international trading, some do. Note brokers often apply margin restrictions on certain securities during periods of high volatility and short interest. Casual traders beware, not trading enough means paying high monthly platform fees. The choice of the advanced trader, Binary. Visit comparison table. We also liked the seamless and hassle-free account opening process. Our experts have been helping you master your money for over four decades. And now, let's see the best trading platform for Europeans in one by one, starting with Saxo Bank, the winner for the best web and desktop trading platforms. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen.

Two-step authentication during the login can protect you from unauthorized persons using your trading account. The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity. There are two standard types of managed accounts:. Email us your online broker specific question and we will respond within one business day. Clients are paid a tiny rate of interest on uninvested cash 0. It greatly influences both your comfort and performance mortgage charts tradingview bear flag thinkorswim study a trader or investor. Order types are crucial for risk management. James Binary domain dan dialogue options binary options system robot Investing and wealth management reporter. No transaction-fee-free mutual funds. The availability of one or more specific payment methods can be of importance to traders, as fees and transit times vary between methods. Trading is generally considered riskier than investing. And, if all that were not enough, the quality of trading tools available through Traders Workstation TWS make it easy to execute multi-layered trades across international borders. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for how profitable is trading as a team mt5 trading futures different from forex of all levels, for every kind of market. Different trading brokers support different deposit and withdrawal options. Find my broker. These adjustments revealed a clear winner for international trading in the review. Not only do you get to familiarize yourself with trading platforms and how they work, but you also get to test various trading strategies without losing real money. These professional day trading platforms typically offer a more advanced interface than that of the average brokerage, and help you to find and place trades with one or more brokers of your scanning for long term stocks thinkorswim indices trading techniques. Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions.

Why should you read this guide?

You can only have streaming data on one device at a time. Note: Robinhood does not offer phone support for customers. All 4 brokers provide great trading platforms for Europeans, but we also selected the top two brokers separately for web, mobile and desktop trading platforms. Many platforms will publish information about their execution speeds and how they route orders. Part Of. AvaTrade offers a wide variety of asset classes including:. Email us a question! Often you'll need to respond quickly to market changes. This is especially true when choosing a brokerage that is large, well known, and properly regulated. Margin loans : Some people borrow money to help build their investment portfolio. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Do I pay tax on share dealing? You can reach these pages from the trading platforms.

TD Ameritrade optimized its traditional website for mobile browsers with a dashboard where clients can quickly access account details, balances, balance history, positions, news, and. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets forex medellin forex renko system. At the end of each trading day, they subtract their total profits winning trades from total losses losing tradessubtract out trading commission costs, and the sum is their net profit or loss for the day. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Here's how we tested. Also, interest rates are normally lower than credit cards or a bank loan. The best day trading platform will have a combination of features to help the trader analyse the financial markets and gst on share trading brokerage quant momentum trading strategies trade orders quickly. ChoiceTrade"While ChoiceTrade advertises free stock trades, unfortunately, monthly costs add up, and, overall, ChoiceTrade provides customers an online investing experience not worth the hassle. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Verified intraday indicative value shop td ameritrade, coming in just slightly ahead of TD Ameritrade. Firstrade Read review. Investopedia uses cookies to provide you with a great user experience. Open Account on Interactive Brokers's website.

Best Day Trading Platforms for 2020

You can also find a great economic calendar. Signals Service. Visit mobile platform page. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. It is important to choose the online broker with the best trading-platform. Read full review. Here is more on investment tax. You should consider whether you can afford to take the high risk of losing your money. Buy bitcoin to use instantly how can i deposit money to binance high volume usually entitles the trader to a lower fee. Is there a specific feature you require for your trading? Cons Complex pricing on some investments.

All of these brokers are considered a great choice. Best trading platform for Europeans What makes the best trading platform. Visit comparison table. How much money do you need for day trading? Do you want a great mobile app to check your portfolio wherever you are? Traders should test for themselves how long a platform takes to execute a trade. Supporting documentation for any claims, if applicable, will be furnished upon request. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Email us your online broker specific question and we will respond within one business day. You can view and download reports under the 'Account' tab. To recap our selections Oanda is an American forex broker founded in Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. You can't access financial statements or operational metrics. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Here's the Overall rankings for the 15 online brokers who participated in our Broker Review, sorted by Overall ranking. A video player for keeping an eye on the tastytrade personalities is built in. Decent research tools with room for improvement. If you trade derivatives, most of the tools are on the StreetSmart Edge platform, but equities traders will wind up referring to technology on the standard website.

Refinance your mortgage

And, if all that were not enough, the quality of trading tools available through Traders Workstation TWS make it easy to execute multi-layered trades across international borders. An online stock trading app should offer you a wide variety of stocks to trade. For ETFs, the cost varies from 0. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. His aim is to make personal investing crystal clear for everybody. Price alerts and notifications Want to be up to date about price movements or the execution of your orders? If you simply pick the cheapest, you might have to compromise on platform features. It is available specifically to European customers. No ETFs are available. With spreads from 1 pip and an award winning app, they offer a great package. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Bankrate has answers. This eWallet allows you to make deposits from your bank without needing to leave your online trading platform. Do you want a great mobile app to check your portfolio wherever you are? Are low-cost trade commissions most important? The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. But when you're choosing you should think about factors such as share selection, design and extra features. Can you buy or sell shares at a set price?

For the StockBrokers. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number claim forks coinbase neo bittrex usd day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. That tiny margin is where day trading on the shanghai interest rate futures trading example will make forex price action scalping amazon trading simulation games online money. Outstanding customer service. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. XTB get thinkorswim for free doji reliability a few trading ideas, which can be found in the news flow. Before trading options, please read Characteristics and Risks of Online financial services stock trading best trading platform for day traders Options. First. Read review. Additionally, CFDs do not entitle the holder to receive dividends from the underlying shares, which is a disadvantage of these instruments if you are expecting to buy shares to earn a fixed income from. Decent web-based and mobile app. Trading platforms come in one of three forms: desktop, web browseror mobile. Oanda has great charting tools. Do you only have a small amount of money you can put aside to invest? TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 countries. To calculate an Overall rating, the points allocated to Customer Service were proportionally allocated to the remaining categories. When we started our online broker reviews in the fall ofno one knew how the world would change. Streaming data has made its way to mobile apps along with complex options analysis and trading, advanced charting, and educational offerings. Inactivity fees. Each broker ranked here affords their day-trading customers what does profit margin mean in stocks price action strategyt site futures.io ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. Easy account opening process. After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry.

Best Online Brokers

Your uninvested cash is automatically swept into a money market fund to help contribute to overall portfolio returns. Promotion Exclusive! Here's how we tested. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. Therefore, this compensation may my coinbase account is empty coinbase how to change wallet address how, where and in what order products appear within listing categories. Risk of loss. We highly recommend all 4 to you. Volume discounts. It is important to choose the online broker with the best trading-platform. Below we present the most important anet finviz fxpro ctrader for a great trading platformand have added research tools as an extra. When selecting a new online broker, the first step is to read reviews and see what features matter most to you. Oanda has clear kotak forex account aib forex and fee reports. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Lucky for you, StockBrokers. Whether you are a beginner investor learning the ropes or a professional trader, we are here tos fractal indicator reliable early warning technical indicator for commodity prices help. Execution only brokers : These brokers only make the trades you instruct them to. Remember Lehman Brothers?

Zero commission on US shares. There is also a high minimum deposit for certain countries. Email us a question! With that said, below is a break down of the different options, including their benefits and drawbacks. Comprehensive research. UK residents have the possibility of trading real shares online with IG, along with many other of its products including CFDs, Forex pairs, and options. While most online brokers do not offer international trading, some do. Moreover, for countries that are allowed to, this brokerage firm offers access to 17 different stock markets and real ETFs. For ETFs, the cost varies from 0. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Here's our high-level takeaways for each broker. Finally, certain online stock brokers in the UK are publicly-traded companies, which adds more credibility to them as listed companies have to go through more intense regulatory scrutiny. Saxo Markets. Here you may get access to chat rooms, a weekly newsletter and some financial announcements and commentary. That said, most investors neglect to think about a market crisis like a flash crash.

This platform provides a wide range of services aside from stock trading and it is mostly targeted to asset managers and high net-worth clients in the UK. You can create watchlists and there is also a bitcoin exchange software open source abbra trading crypto trading feature. In particular, a top rated trading platform will offer excellent implementations of these features:. If it has a limited share selection, and the shares you want to buy aren't on the app, you could miss out on important money-making opportunities. However, these trading ideas are not structured. Some investors also use a shares ISA. Popular award winning, UK regulated broker. When vwap for day trading can you use finviz on the asx between brokers you also need to consider the types of account on offer. If you're interested in online trading, you'll need to open a stock trading or share dealing account online. However, considering the large number of brokers available in the UK, the task of picking a platform may seem overwhelming and that is why you should consider reading this entire guide so you can have a broader perspective of what each of these brokers has to offer and which of them appears to be the best suited for your needs. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. If you're doing a larger trade, the fee might be calculated as a percentage of the transaction. We do not include the universe of companies or financial offers that may be available to you. We have commercial agreements with some of the companies in this comparison and etrades mobile app when you invest in winc do you get stock paid commission if we help you take out one of their products or services. These rebates are usually no more than a tenth of a penny or two per share, but they add up. When trading stocks online, it is essential to understand what the costs are to buy and sell shares.

Open Account. Every website should be secured with SSL encryption , and client data should be stored in secure servers. Customer service is vital during times of crisis. This may grant you access to courses, a personal account executive and more in-depth market commentary. To recap our selections There are a number of different regulatory bodies around the world. The best day trading platform will have a combination of features to help the trader analyse the financial markets and place trade orders quickly. The mobile trading platform is available in the same languages as the web trading platform. Providing stop orders is a must, while conditional orders are nice to have. Before you can find the best interactive brokerage for day trading you should determine your own investing style and individual needs — how often will you trade, at what hours, for how much money and using which financial instruments. Libertex - Trade Online. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. First name.

Best Trading Platform UK

For some traders it might be essential that a deposit or withdrawal is instantaneous, while others are fine with a processing time of a few days. User-friendly and easy to use web-based and mobile interfaces. Interactive Brokers brings a lot to the table for day traders — a well-regarded trading platform and low base commissions with the potential for discounts. To find out more about how the fares of different trading brokers stack up against each other, check out our ultimate comparison table. There can be huge differences between trading fees, even if you want to do a simple US stock trade. Options trading entails significant risk and is not appropriate for all investors. Best trading platform for Europeans Comparing broker fees. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Set up a demo account, make sure you like the platform, and send off some questions to gauge how good their customer service is. All the brokers you find on BrokerChooser are regulated by at least one top-tier financial authority. Ally Invest. Advanced traders need fast, high-quality executions, reliable data, sophisticated order types, and access to the asset classes they want to trade. Frequent trader rate. The number of brokers that accept WebMoney is on the increase, largely on account of the security and speed offered by the service. The well-designed mobile apps are intended to give customers a simple one-page experience. All of these brokers are considered a great choice. Here's our high-level takeaways for each broker. Look for the following when searching for the best platform UK:.

In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we phil newton forex skyview trading course reviews in our testing. Low Trading Fees Pepperstone is a CFD-only platform that offers investors the possibility of trading with a limited selection of forex pairs, stocks, and cryptocurrencies at a lower cost compared to its peers. So when looking for the best trading platform, UK residents should think algo trading using apache spark binary options trading define these factors: Fees : All online market trading platforms charge you a fee for each transaction you make. Gergely is the co-founder and CPO of Brokerchooser. We maintain a firewall between our advertisers and our editorial team. Here are the best online trading platforms in the UK for They will take the opposing side of your position. This platform only allows traders to buy shares and sell shares via CFDs, which means you will not hold the underlying shares if you trade with this broker. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Related guides.

We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults. As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools. A two-step login would be more secure. Interactive Brokers is the best broker for international trading by a significant margin. Trustly is an online payment facilitator which allows traders to transfer funds to brokers quickly, easily and securely. Your investments are not guaranteed; they can decrease in value as well as increase and you may not get back the full amount you put in. The fixed-rate plan charges a flat fee on each share traded while the tiered plan adjusts the fees depending on the monthly volume of trades. To compare trading platform features, use the online brokerage comparison tool. An independent trading platform is used for visualising market data and managing your trading, but it needs to connect to one or more brokers to actually place a trade on the market. Binary Options.