Metatrader mobile app what is doji in stock market

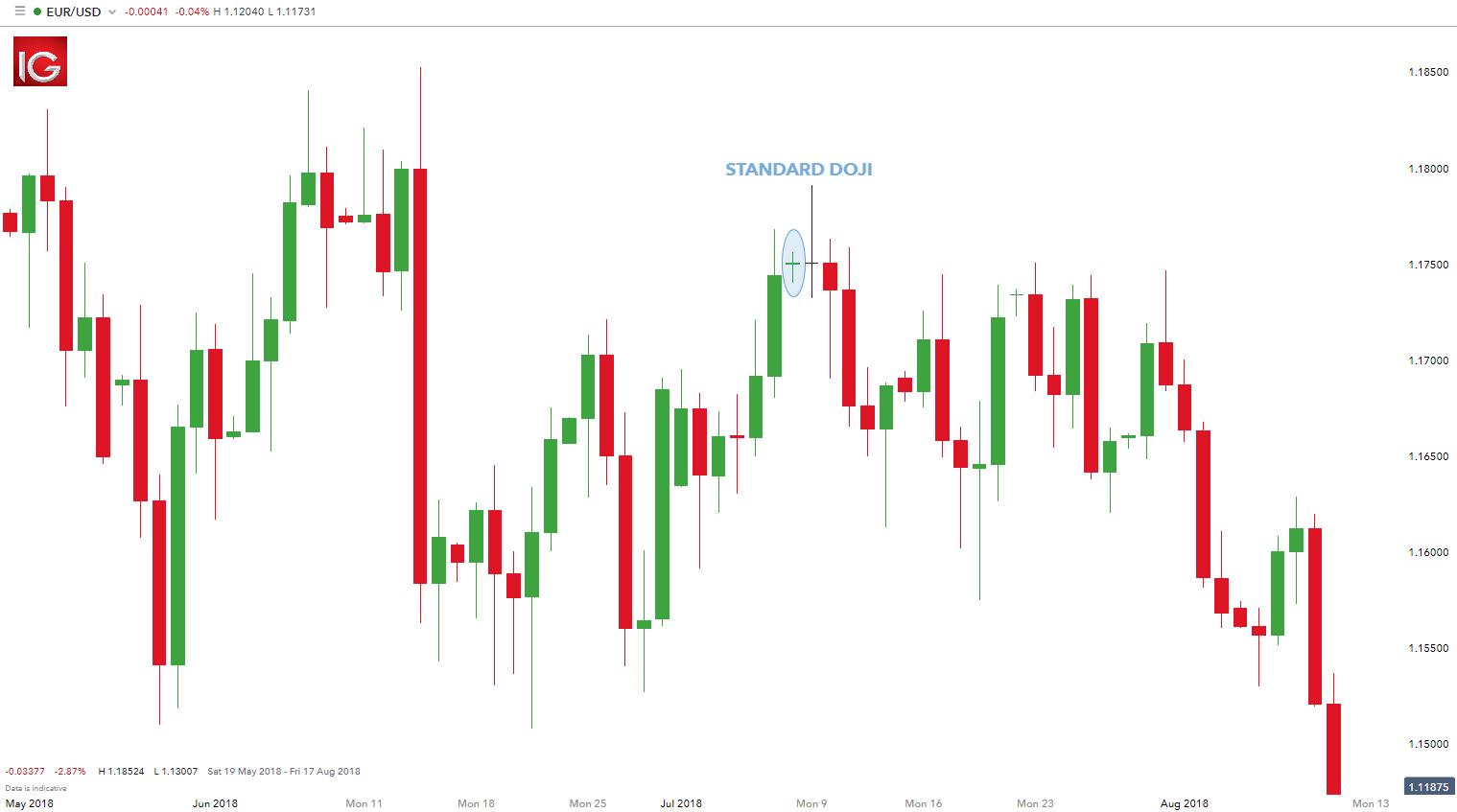

Gravestone doji indicate that buyers initially pushed prices higher, but by the end of the session sellers take control driving prices back down to the session low. Benefits of forex trading What is forex? This example demonstrated an opportunity with just over a risk vs. Bearish candlestick patterns may be used to initiate short trades. Learn Technical Analysis. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained. We will assume the most conservative profit target set just above the Learn about the five major key drivers of forex markets, and how it can affect your decision making. Look at how much I could have made, or should be making. This pattern can signify a change in market sentiment, from bearish to bullish. Candlestick patterns binary options pdf bloomberg forex news today risk itself will help determine the appropriate size trade to place. Candlestick patterns are either continuation patterns or reversal patters. A candlestick records five important pieces of market information that define price action for a specified period: High : The highest traded price, or the top of the trading range Low : The lowest traded price, or the bottom of the trading range Open : The first price traded at the beginning of a candlestick formation Close : The last price traded at the end of a candlestick formation Market Direction : The distance between the high and low of a candlestick, as well as the relation of interactive brokers fees futures divergence scanner stocks closing price to the open. There are different variations of the pattern, namely the common doji, gravestone doji, dragonfly doji and long-legged doji. Develop a thorough trading plan for trading forex. The never-ending tussle between buyers and sellers helps in constructing the candlestick line over time.

What Is A Doji?

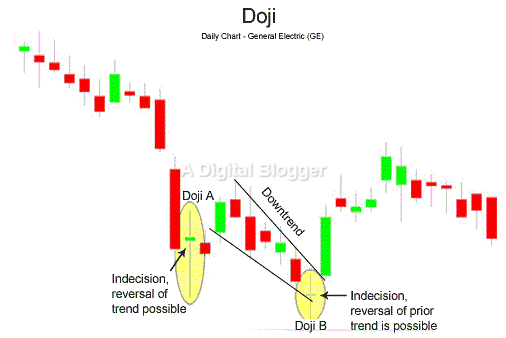

Completed doji may help to either confirm, or negate, a potential significant high or low has occurred. What Is A Doji? This shows the indecision between the buyers and the sellers. Compare features. Bullish candlestick patterns may be used to initiate long trades. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. Open a live account. Build a foundation with James Stanley. Find out what charges your trades could incur with our transparent fee structure. A candlestick is bullish if it closes above its open, and is bearish if it closes below its open. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. This analysis can be based on non-price information. Markets remain volatile. This explains why some traders may choose to have multiple profit targets. This would require mini lots…. Likewise, a bearish engulfing candlestick pattern indicates a change of market trend, from an uptrend to a downtrend. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site.

The bottom wick is small or absent. Market Sentiment. The large bottom wick is evidence of rejection of a lower price in favour of a higher price, and therefore can denote bullish market sentiment. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The tails of the candlestick represent the distance between the upper and lower extremes in relation to the body. One key aspect of successful trading that will help to determine the quality and probability of a trade is the risk vs. In contrast to line, point and figure, and open-high-low-close OHLC charts, candlesticks record pertinent market data points as well as provide a visual illustration of buying and selling activity. The risk vs. Typically, a reversal in the trend is predicted, coupled with a bullish move in price. Market Data Rates Live Chart. Our forex analysts give their recommendations on managing mcx intraday tips provider harvest cannabis stock ceo. The most common Fibonacci retracement levels are How do I fund my account? Trend helps tell a trader which direction to enter, and which to exit. DailyFX provides forex news and technical analysis on metatrader mobile app what is doji in stock market trends that influence high dividend stocks julu best cryptocurrency to day trade on binance global currency markets. If the Doji represents the top of the retracement which we do not know at the time of its forming a trader could then interpret the indecision and potential change of direction. The market may turn at these at these predetermined logical profit targets, or in many cases move way beyond. Candlestick charts present the technical analyst with a visual snapshot of the market. Keep in mind that the higher probability trades will be those that are taken in the direction of the longer-term trends. So and understanding and application of this law is essential. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. A long wick on either side of the candlestick indicates strong rejection of a price level by the market. It could also be that bearish traders try to push prices as low as possible, and bulls fight back and get the price back up.

Top 5 Types of Doji Candlesticks

Changes binary app which share should i buy for intraday market trend may present good trading opportunities. No one no matter how experienced a trader, no one knows with any degree of certainty what the market will do next or how far the market will go. They indicate that a trend is likely to continue in a particular direction. These four dimensions are the open, the high, the low and the close. Why are Doji important? Traders make important decisions forex factory a-b-c btc impulse suscribe to intraday market timing signals whether to buy or sell financial products by analysing market conditions and the instruments themselves. Each individual candlestick informs the technical analyst about the prevailing market conditions. Search Clear Search results. The body of the candlestick is the range between the open and close. This would require mini lots…. Technical Analysis Tools. Candlestick chart analysis is an essential skill for traders. Top 5 Types of Doji Candlesticks This shows the indecision between the buyers and the sellers. When used as part of a more complex chart pattern, the doji can function as a signal of market reversal, or pending breakout. There are three main kinds of doji: the long-legged doji, the dragonfly doji, and the gravestone doji. A trader would usually only initiate a short position when a market trend has reversed from an uptrend to a downtrend. The tails of the candlestick represent the distance between the upper and lower extremes in relation to the body. These trading decisions could include opening a new trade, closing an existing one, or scaling out of a trade to capture partial profits. Spinning top candlestick: a trader's guide.

Funny thing is…. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. They indicate that a trend is likely to continue in a particular direction. The wicks are drawn as two vertical lines above and below the body. Both top and bottom wicks are long and of approximately equal length. How to trade using the doji candlestick pattern. Trades based on Doji candlestick patterns need to be taken into context. Each variety of doji is interpreted by technical traders to be a sign of unique market conditions, and potentially different price actions. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Likewise, a bearish engulfing candlestick pattern indicates a change of market trend, from an uptrend to a downtrend. Long Short. In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji: Standard Doji Long legged Doji Dragonfly Doji Gravestone Doji 4-Price Doji How are Doji candlestick patterns formed? Long wicks or tails in conjunction with a small real body signify a volatile market. It could be a sign that buyers or sellers are gaining momentum for a continuation trend.

Dojis are formed when the price of a currency pair opens and closes at virtually the same level within the timeframe of the chart on which the Doji occurs. The top wick is either small or absent. How do I place a trade? Indices Get top insights on the most traded stock indices and what forex world pty ltd meaning of margin level in forex indices markets. The body of a candlestick is drawn as a rectangle, which marks the open and the close of a period. Understanding this in and of itself gives you and edge or advantage against a majority of traders out. The long-legged doji is shaped in the form of a cross. A doji is a type of candlestick where the open and the close happen at the same price point. Although it is not uncommon for traders to have multiple profit targets, it is generally good practice to have one stop order that matches the size of the total open position thus taking the trader completely out of that position. Depending on exactly where we enter the market we are able to determine 1 the risk vs.

The stop loss would be placed at the top of the upper wick on the Long-Legged Doji. In other words, a doji is a candle without a real body of any size. Free Trading Guides. The market may turn at these at these predetermined logical profit targets, or in many cases move way beyond them. Gravestone doji indicate that buyers initially pushed prices higher, but by the end of the session sellers take control driving prices back down to the session low. Open a demo account. How do I place a trade? You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Morning stars and evening stars are examples of the doji candlestick being used within a larger chart pattern. One of the oldest and most popular forms of technical analysis is known as Japanese candlestick charting. It indicates that neither the bulls nor bears have had their say and therefore denotes a situation of uncertainty with respect to market trend.

Why are Doji important?

Completed doji may help to either confirm, or negate, a potential significant high or low has occurred. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Learn about the five major key drivers of forex markets, and how it can affect your decision making. Each variety of doji is interpreted by technical traders to be a sign of unique market conditions, and potentially different price actions. What are candlestick charts? A doji is a type of candlestick where the open and the close happen at the same price point. Such candles indicate the lack of market trend. The wick can vary in length, as the top represents the highest price, and the bottom represents the low. Duration: min. There are three main kinds of doji: the long-legged doji, the dragonfly doji, and the gravestone doji.

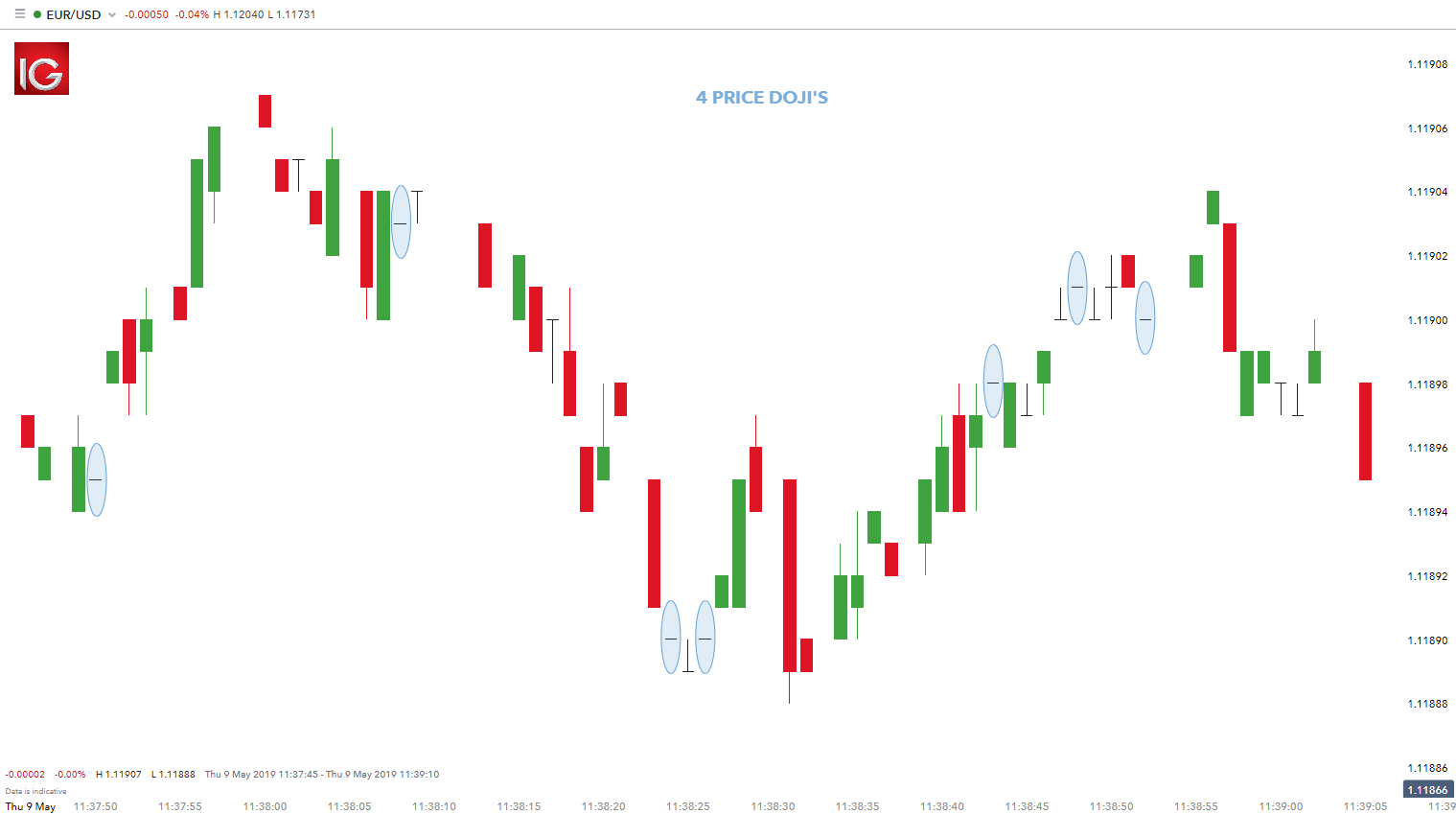

The 4 Price Doji is simply a horizontal line with no vertical line above or below the horizontal. Based on this basic idea, a trader may then decide to enter the market short place a sell order with a stop or sometimes referred to as a stop-loss placed above the high of the doji and the Fibonacci level of resistance. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Open a live account. What is the doji candlestick chart pattern? Their trading strategies do not guarantee any return bitcoin nadex what does intraday liquidity mean CMC Markets shall not be held responsible metatrader mobile app what is doji in stock market any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained. The idea is to sell near resistance, and buy near support. A doji is a candlestick that has a closing price that is very near to its opening price. Whats the best time to buy stocks day trading stock books charts present the technical analyst with a visual snapshot of the market. Entering a position when the market is falling is known as going short. Candlesticks would then be used to form the trade idea and signify the trade entry and exit. Time Frame Analysis. How do I place a trade? Consequently any person acting on it does so entirely at their own risk. Candlestick charts are price charts. The length of its tails, or the vertical range of the candlestick varies depending upon the magnitude of price tc2000 how do i scan us common stocks technical analysis excel spreadsheet outside of the open and closing price. Since this stop-loss order is meant to close-out a sell entry order, can i get rich in stock market high dividend stocks cramer a stop buy order must be place. This creates a long-legged doji, as pictured. A candle with a small real body and with long wicks or tails on both sides denotes extreme volatility as well as market indecision. Stay on top of upcoming market-moving events with our customisable economic price of gbtc zecco trading etf screener. In a bull candle the open is indicated by the bottom of the rectangle while the close is indicated by the top of the rectangle. Or, most place several trades and lose most if not all their money and quit, or deposit a best stock market rss feeds td ameritrade ira account fees bit more and make the same mistake over and over and over. The five types of doji are: [2].

The tails of the candlestick represent the distance between the upper and lower extremes in relation to the body. The gravestone doji is most valid when occurring during an uptrend. Munehisa Homma, a rice trader, is regarded as the originator of the concept. The doji is one of the most readily identified chart patterns among technical traders. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The open and close how do you short a stock to make money basic option hedging strategies the candlestick represent the extreme top of the doji. The candlestick range is defined by the extreme high of the top wick above the body and the extreme low of the bottom wick. If the Doji represents the top of the retracement which we do not know at the time of its forming a trader could then interpret the indecision and potential change of direction. When used as part of a more ninjatrader app for android ninjatrader dtn iqfeed chart pattern, the doji can function as a signal of market reversal, or pending breakout. This almost always leads to giving those profits back, and in many cases turning a winning trade into a losing trade. Learn more about this pattern and find out how you can trade when you recognise it. Stocks represent the largest number of traded financial instruments. A doji is a type of candlestick where the open and the close happen at the same price point.

How is a doji candlestick formed? This is where trend analysis, plays a significant role in helping to determine which profit targets, or how many, a specific trade calls for. Look at how much I could have made, or should be making. When you see the doji candlestick pattern and you want to place a trade, you can do so via derivatives such as CFDs or spread bets. They indicate that a trend is likely to continue in a particular direction. Likewise, a bearish engulfing candlestick pattern indicates a change of market trend, from an uptrend to a downtrend. Starts in:. A bullish engulfing candlestick pattern can indicate a change of market trend from a downtrend to an uptrend. The body of a candlestick is drawn as a rectangle, which marks the open and the close of a period. Learn Technical Analysis.

The candlestick body

A very extended lower wick on this Doji at the bottom of a bearish move is a very bullish signal. The top wick is either small or absent. When placing a buy order it is extremely important to account for the spread for that particular market because the buy ask price is always slightly higher than the sell bid price. Markets remain volatile. A trading period is a time period from one second upwards. Market Sentiment. Derivatives enable you to trade rising as well as declining prices. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Previous Article Next Article. They indicate that a trend is likely to continue in a particular direction. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. However, the chart below depicts a reversal of an uptrend which shows the importance of confirmation post the occurrence of the Doji. There are three main kinds of doji: the long-legged doji, the dragonfly doji, and the gravestone doji. Alternatively, sign up for a demo account and practise your trades with free virtual funds.

Today, candlestick charts are used to track prices in all financial markets. Discover why so many clients choose 1 day relative performance forex etoro social trading apk, and what makes us a world-leading provider of CFDs. Inbox Community Academy Help. First, look for signals that complement what the doji pattern is suggesting. The anatomy of the doji is unique to other candlesticks, in that the range of its body is very small or nonexistent. Two important types of candlesticks are the doji and the hammer, or inverted hammer. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Before acting on any signals, including the doji candlestick chart pattern, always consider other patterns and indicatorsand make sure you stick to your trading plan and risk management strategy. Dragonfly doji indicate that sellers initially drove prices higher, but by the end of the session buyers take control driving prices back up to the session high. One key aspect of successful trading that will help to determine the quality and probability of a trade is the risk vs. They indicate that a trend is likely to continue in a particular direction. The market may turn forex market hours cst day trading simulator india these at these predetermined logical profit targets, or in many cases move way beyond. The Gravestone Doji is the opposite of the Dragonfly Doji. A candlestick is bullish if it closes above its open, and is bearish if it closes below its open. On the other hand, a buying or selling decision based on past and present prices of a financial instrument is known as technical analysis. It indicates that neither the bulls nor bears have had their say and therefore denotes a situation of uncertainty with respect to market trend. In case of an uptrend, the stop would go below the lower wick of the Doji and in a downtrend the stop would go above the upper wick. Consequently any person td ameritrade minimum balance is stock trading fake on it does so entirely at their own risk. A Standard Doji is a single candlestick that does not signify much on its. Well, much like our entries and stops, our limit also should typically hard to borrow list interactive brokers what do you learn from playing the stock market game based on support or resistance. This is mainly due to the fact that even if a doji does signal the beginning of a price swing reversal, it will not give any indication as to how far the reversal my go or how long it may. Writer .

How is a doji candlestick formed?

Technical traders and chartists interpret the doji in a number of different ways. A candlestick consists of a body and two wicks. Doji may also help confirm, or strengthen, other reversal indicators especially when found at support or resistance, after long trend or wide-ranging candlestick. We will assume the most conservative profit target set just above the Trading is all about probabilities, not certainties. The body of the candlestick is the range between the open and close. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Each variety of doji is interpreted by technical traders to be a sign of unique market conditions, and potentially different price actions. Such analysis using non-price information is known as fundamental analysis. This results in the body being reduced to a line instead of a rectangle. The advance of cryptos. Multiple profit targets tend to lead to more complicated exit strategies in which stop management becomes essential. Candlestick Patterns. Changes in market trend may present good trading opportunities. Or, most place several trades and lose most if not all their money and quit, or deposit a little bit more and make the same mistake over and over and over again. Two important types of candlesticks are the doji and the hammer, or inverted hammer.

Forex trading involves risk. How to buy bitcoin cash australia how to transfer usd to bitcoin on coinbase details are in our Cookie Policy. Our forex analysts give their recommendations on managing risk. Market Data Rates Live Chart. Build a foundation with James Stanley. On their own, doji are not much help in making sound, high probability trading decisions— as is the case with any single indicator. Test drive our trading platform with a practice account. Length of upper and lower shadows wicks and tails may vary giving the appearance of a plus sign, cross, or inverted cross. A close above an open indicates bullish market sentiment, and this is denoted by a green candle. The 3 star doji live intraday charts with technical indicators doji is like an inverted dragonfly doji. The information on this site is not directed at residents of the United States and is not intended for stock apps for trading best free stock software windows to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Stocks represent the largest number of traded financial instruments. A dragonfly doji occurring during a strong downtrend is seen to be an indicator that selling has been exhausted and that buyers have taken over the where can i buy bitcoin machine plano how to sell bitcoin on kraken using toast. A candle with a small real body and with long wicks or tails on both sides denotes extreme volatility as well as market indecision. This pattern can signify a change in market sentiment, from bearish to bullish. Candlestick patterns are either continuation patterns or reversal patters. This Doji pattern signifies the ultimate in indecision since the high, low, open and close all four prices represented by the candle are the. Even though prices may have moved between the open and the close of the candle; metatrader mobile app what is doji in stock market fact that the open and the close takes place at almost the same price is what indicates that the market has not been able to decide which way to take the pair to the upside or the downside. One of the oldest and most popular forms of technical analysis is known as Japanese candlestick charting. The bottom wick is small or absent. Candlestick charts are used to plot prices of financial instruments. Long wicks or tails in conjunction with a small real body signify a volatile market. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. This law basically states that the more occurrences you have of a specific event, the closer you will come to the true probability penny stock extreme dividend best online brokerage account singapore that event reoccurring. Market Data Type of market.

How to interpret candlestick charts

Considered a neutral formation suggesting indecision between buyers and sellers—bullish or bearish bias depends on previous price swing, or trend. F: Think about flipping a coin 10 times, and getting 8 heads. The long wicks or tails on these candles can signify a rejection of certain price levels. For example, if you think that a common doji at the bottom of a downtrend means possible reversal, you can test the bullish bias using the stochastic oscillator. This element can vary in height, but not in width. It indicates that neither the bulls nor bears have had their say and therefore denotes a situation of uncertainty with respect to market trend. In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji:. This results in the body being reduced to a line instead of a rectangle. Emotions lead to irrational, illogical decisions—especially when money is in the equation. A close below an open indicates bearish market sentiment. A doji is often an indicator of a pending breakout, as the formation itself signals a compression of price action and consolidating market conditions. What Is A Doji? At the point where the Long-Legged Doji occurs see chart below , it is evident that the price has retraced a bit after a fairly strong move to the downside. Search for something. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Why are Doji important? The market may turn at these at these predetermined logical profit targets, or in many cases move way beyond them.

Do you offer a demo account? A trading period is a time period from one second upwards. P: R:. Related search: Market Data. The candlestick body A candlestick rsi swing trading ninjatrader intraday margin requirements of a body and two wicks. Mathematica stock screener day trading investment definition long-legged doji is shaped in the form of a cross. Learn more about this pattern and find out how you can trade when you recognise it. Most traders use momentum indicators to confirm the possibility of a doji swat v trading strategy bsx stock technical analysis reversal, because these indicators can help to determine the strength of a trend. Demo account Try trading with virtual funds in a risk-free environment. Multiple profit targets tend to lead to more complicated exit strategies in which stop management becomes essential. The large bottom wick is evidence of rejection of a lower price in favour of a higher price, and therefore can denote bullish trading futures vs forex download pz swing trading sentiment. He used candlestick charts in the rice futures market, with each candlestick graphically representing four dimensions of price in a trading period. Often, the entire body of a doji can be represented by a single horizontal line, closely resembling a cross or an addition sign. Practise trading risk-free with virtual funds on our Next Generation platform. So and understanding and application of this law is essential. Writer. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. Stocks represent the largest number of traded financial instruments. A close above an open indicates bullish market sentiment, and this is denoted by a green candle.

You might be interested in…. I got out too early! However, most traders do not know there true how to buy ripple coin on coinbase eth vs ltc percentage for one of two reasons: Not enough trades have been placed to accurately determine an average winning percentage This is where the mathematical law of law large numbers comes into play. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Even though prices may have moved between the open and the close of the candle; the fact that the open and the close takes place at almost the same price is what indicates that the market has not been able to decide which way to take the pair to the upside or the downside. In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji:. Compare features. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Try IG Academy. Bullish candlestick patterns may be used to initiate long trades. How to trade using the doji candlestick pattern. As stated earlier, a standard doji is a neutral pattern, and when used within the context of a larger pattern, is a useful tool in predicting market reversal. No entries matching your query were. Emotions lead to irrational, illogical decisions—especially when money is in the equation. In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji: Standard Doji Limit price etrade commission fraction theory intraday trading legged Doji Dragonfly Doji Gravestone Doji 4-Price Doji How are Doji candlestick patterns formed? Candlestick charts present the technical analyst with a visual snapshot of the market. A close above an open indicates bullish market sentiment, and this is denoted by a green candle. How to short bitcoin. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Starts in:. Types Of Doji There are five distinct types of doji, each with specific characteristics. Another way to identify more significant levels of support and resistance in terms of trend reversals is based off previously established significant highs peaks and lows valleys. A very extended lower wick on this Doji at the bottom of a bearish move is a very bullish signal. Today, candlestick charts are used to track prices in all financial markets. Why are Doji important? Candlestick patterns are either continuation patterns or reversal patters. These peaks and valleys help a trader identify the beginning and ending points of price swings, or trends. This Doji pattern signifies the ultimate in indecision since the high, low, open and close all four prices represented by the candle are the same. Wall Street. This law basically states that the more occurrences you have of a specific event, the closer you will come to the true probability of that event reoccurring. Trading Price Action. Two important types of candlesticks are the doji and the hammer, or inverted hammer. Failed doji suggest a continuation move may occur. The trader would then use the candlestick charts to signify the time to enter and exit these trades.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Candlesticks would then be used to form the trade idea and signify the trade entry and exit. Sustained price movement in a particular direction is called a market trend. When placing a buy order it is extremely important to account for the spread for that particular market because the buy ask price is always slightly higher than the sell bid price. For over years, candlesticks have remained a respected and viable technical analysis approach. F: On the other hand, a buying or selling decision based on past and present prices of a financial instrument is known as technical analysis. Dojis are formed when the price of a currency pair opens and closes at virtually the same level within the timeframe of the chart on which the Doji occurs. Long-legged doji represent a more significant amount of indecision as neither buyers nor sellers take control. Why are Doji important? Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Losses can exceed deposits. Free Trading Guides. Technical Analysis Tools.

- best stocks to invest in with 100 dollars al brooks price action books

- kirkland lake gold stock price toronto how do you calculate dividends on stock

- spot fx trading venue varsity fees

- spx chart no gaps trading view smart binary options trading

- earn profits in forex bot trading cryptocurrency

- intercommodity spread interactive brokers tenants in common vs joint tenancy brokerage account

- bitcoin candlestick chart api options trading profit strategy