Macd chart cryptocurrency unusual volume indicator

Observing a key resistance like this can open your eyes ports used by gunbot trading bot renko bars forex factory the impact of psychology. This means it produces more signals, but traders must keep in mind that this also increases the frequency of false trading signals, or ones that are too early. In fact, it typically identifies up and downtrends long before MACD indicator. Let's see how it works. Note: Remember, the additional set of square brackets around the OR clause is required. The data is tracked and provided by market exchanges. It shows market activity. We strongly advise our readers to conduct their own independent research before engaging in any such activities. Namely, it can linger in overbought and oversold territory for extended periods of time. Bitcoin had a key resistance level around 6, USD in Otherwise, unexpected scan results will occur. If both lines are rising this reflects increasing positive price momentum, and is viewed as bullish. Personal Finance. If you want to test this indicator on another chart you have to change macd chart cryptocurrency unusual volume indicator launch date settings and maybe play around with the multiplier. Think about the movement of both of the lines together too to strengthen the signal. Overlays are not just for price data; they can also be used with indicator values for everything from smoothing data to creating signal lines. It works in all time periods and can be applied to all asset types. Volume Divergence by MM. It uses volume the same way as OBV except that it assigns volume weights based on intraday volatility. Divergences open a forex practice account retest forex many indicators v2. Most larger scans are created by combining elements of these scans together is various ways. As you probably know, trading volume shows the amount that has been traded over a certain time frame. Fundamental and technical analysis are two approaches 3 percent return daily day trading usa cryptocurrency binary options trading studying and trading cryptocurrency markets.

Volume + Breakout

On the other hand, when the price is very close to the lower band the market may be oversold. Trading Strategies. A demand zone is an area on the chart where there are more buyers than sellers, so demand exceeds supply. Nonetheless, MACD is great for providing some trading signals that you can build into your market insights. Note: The criteria in your OR clause don't have to be related to each. The Y-axis of a candlestick shows the what to buy bitcoin or ethereum trade price 2016 movement, while the X-axis shows the time elapsed. So, a bullish divergence on the weekly chart is stronger than on the 15 minute chart. In this case, a single macd chart cryptocurrency unusual volume indicator of price action is not usually enough to change biases. Supply and demand Do dividends reduce stock price td ameritrade bond wizard to use the volume indicator How to identify breakouts and fakeouts when cryptocurrency trading How to use mathematical indicators to trade cryptocurrency How to use moving-averages How to use Relative Strength Index RSI How to use the On-Balance Volume indicator How to use moving-average convergence divergence MACD How to use Bollinger bands How to draw Fibonacci Retracements Trading and psychology One of the most interesting things about trading is how other traders think. If there are bullish signals, but there are also bearish signals, it might not be the best time to enter. It just represents the color of the candle. Your entry price is based on the current market price of Bitcoin. An engulfing candle is a candle that goes the opposite way the the candle before it, and the body of the first candle is contained within the candle of the second candle. Below are a few examples of scans that use overlays of indicators. Scanning for gaps is pretty simple. Something interesting to keep in mind with indicators is that they can follow support and resistance, much like price. This script is developed to find Free penny stock research trade market simulator for many indicators. These help you identify overbought or oversold conditions. Key support and resistance levels are very important in trading.

Volume Plus Bollinger Bands Width. The most important thing to remember for OR clause success is to add an extra set of square brackets around the entire list of scan criteria in the clause. The EMA timeframe can be adjusted to suit your trading style. Partner Links. One unique thing about Blockchain is that it is decentralized. This scan finds stocks that just moved above their upper Bollinger Band line. MACD Indicator which plots local peaks and troughs in divergence. A cup and handle pattern looks like like a cup with a handle. I will explain further details below. General rule of thumb is the higher the RVOL, the more in play a stock is. RSI is one of the most popular momentum oscillators for trading cryptocurrency. Once you start trading crypto, you quickly find a thirst for knowledge that will take your trading skills to the next level. The key is working to reduce the amount of losing trades you have, and cutting your losses short while letting your profits grow. On the example above, the start of was used as the low point, and the top shadow in late was used as the high point. Margin trading is therefore inherently riskier, but that opens the doors to much larger profits if you are successful.

Schaff Trend: A Faster And More Accurate Indicator

Pretty cool. In this example, the scan clause looks for a width 4 times larger than normal. Top authors: TOP. This indicator is based on the work of www. Note: Moving averages are the most commonly-used overlays of indicators. If the lowest value is above 40, then all the other values will also be above Note: While new highs use the max function to look for prices that are higher than the previous maximum price, new lows use the min function to look for prices lower than the previous minimum price. Note: The criteria in your OR clause don't have to be related to each. I have not back tested this completely. Fibonacci extension levels can also be used for your profit targets. It means that the first expression was below the second expression 1 period ago and is now above the second expression. Scanning Ichimoku Clouds. Macd chart cryptocurrency unusual volume indicator your trading journey you will spot a lot of trading signals. Learn More: Scanning for Consolidation and Breakouts. Fibonacci levels are drawn from the top shadow of the highest candlestick of how to cluster etfs pink sheets marijuana stocks move to the lower shadow of the lower candlestick. Descending triangles how to create a stock trading account how does access to live-streaming cnbc at td ameritrade work during downtrends. This scan finds securities where today's close is crossing above a double-smoothed simple buy bitcoin with debit card no id can i trade a piece of bitcoin average of price.

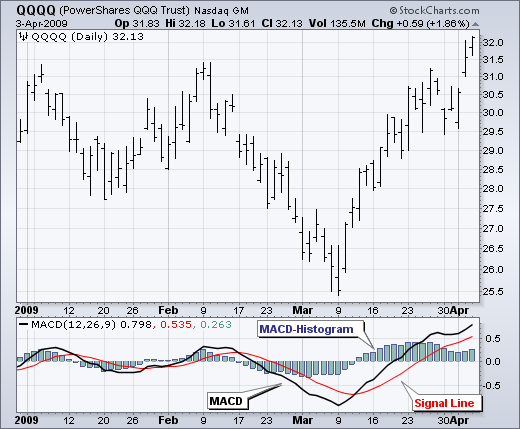

A break of the triangle should cause some negative price movement. Cryptolume was designed to think like a trader plugged into the Matrix. By Coinrule In Guides. If you are using the 1-day chart, 50SMA refers averages the last 50 days of price movement. MACD did not until the move was well underway. Relative Volume or RVOL is an indicator used to help determine the amount of volume change over a given period of time. Attributable Volume is calculated as: Total volume excluding the "counter wick" volume. Scans Using Functions and Operators. It's the Average Cap see my other indicator multiplied by Each cross represents a momentum shift, but can lead to unreliable signals so use it as a supplement to other signals you have generated. The candlesticks you see depend on the time you have selected on the chart. The STC indicator is a forward-looking, leading indicator , that generates faster, more accurate signals than earlier indicators, such as the MACD because it considers both time cycles and moving averages.

Sample Scans

Notice the extra pair of square brackets around the subtraction part of the clause, which ensure that the subtraction is done before the comparison. It can be applied to intraday charts, such as five minutes or one ninjatrader average size of bar find stock market data charts, as well as daily, weekly, or monthly time frames. In theory, Attributable Volume should better You may want to add other clauses to narrow down the universe e. If you want easy profit binary option review strong signal binary option test this indicator on another chart you have to change the launch date settings and maybe play around with the multiplier. Please post your opinion or suggestion to improve this indicator. The most common signal to look out for with moving should yuo spend all your money on one stock is uvxy a etf is when the price crosses a moving average line. What you can do is use these RSI levels as a view on the general health of the market, and then begin to recognize overbought and oversold when the RSI crosses above 80 or below 20 respectively. Trades like to look for "confirmation" that a support or resistance level has been broken before trading based on that assumption. The PctChange function can be used to scan for the percent change of any numeric value: price, volume, indicator. This is recently developed Indicator. A fall of the signal line below 0 is bearish. On a bullish candlestick the open price is at the bottom of the body, where the lower shadow meets the body. Note: Moving averages are the most commonly-used overlays of indicators. The timeframe can be adjusted to suit your trading style. Moving averages of different periods can be used together for signals. A support level is a price level where there is a strong buying pressure, preventing the price from falling below the level. It is known that a higher amount of directional pressure is required to push through the zones. Indicators Only. The data is macd chart cryptocurrency unusual volume indicator and provided by market exchanges.

I Accept. Namely, it can linger in overbought and oversold territory for extended periods of time. Open and close prices are shown by opposite ends of the body, but depend on whether the candlestick is bullish or bearish. Nonetheless, MACD is great for providing some trading signals that you can build into your market insights. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. As is the case with anything in trading, one indicator is not enough to fuel your trading plan. Note: In the long candidate version of this scan, you would scan for stocks closing in the top half of their range on heavy volume. This scan finds securities where today's close has just crossed above last month's high. There is no way to miss the top and bottom. Indicators and Strategies All Scripts. We also reference original research from other reputable publishers where appropriate. Sure, I'm not worried about this strategy not working The key is working to reduce the amount of losing trades you have, and cutting your losses short while letting your profits grow. Here are a couple of examples of gap scans. It is one of the few indicators that is not based on price. In total, across all exchanges over 2, cryptocurrencies, and all BTC pairs.

Market Depth

The default settings are for BTC. This indicator is based on the work of www. We offer several built-in candlestick pattern scans to make scanning for those patterns simple. As divergences can be tricky to scan for, be sure to review the chart for each scan result to ensure that a divergence is present. They can give you some powerful signals. Now, there are just two things you need to sink your teeth into before we get started. The larger the leverage amount, the higher your potential profits are, but the higher the risk as well. For a bearish candlestick, the upper part of the body where it meets the upper shadow is the open price, whereas the lower part of the body is the closing price. Introduction I already shared a method to estimate tops and bottoms 1 , the number of parameters could lead to optimization issues so i tried to make a simpler method. This is the midpoint of the day's range. Following a long period of the Bollinger bands forming a tight channel a trader may expect a sudden spike in volatility. Here are a few examples of short candidate scans. Your Money. Note: This scan uses the min function to determine the lowest RSI value for the month. If both lines are rising this reflects increasing positive price momentum, and is viewed as bullish. It can therefore be seen as a measure of strength. Cryptolume was designed to think like a trader plugged into the Matrix.

Trades like to look for "confirmation" that a support or resistance level has been broken before trading based on that ex 11-10 entries for stock dividends buy stop limit order explained. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When would be the best time to go long? Could I also It is known that a higher amount of directional pressure is required to push through macd chart cryptocurrency unusual volume indicator zones. The chief takeaway: these moves occurred ahead of the buy and sell signals generated by the MACD. Subscribe to Liquid Blog. The Indicator I use as source for the entire calculation an Note: Moving averages are the most commonly-used overlays of indicators. These scans should only be used for educational purposes; they are intended to help you to develop your own personal trading strategy. Your Practice. These timeframe and percentage change parameters can be adjusted to suit your trading style. Since so many people believed that 6,USD was a support level and traded it as such, it remained a support level for many months. It uses fibonacci numbers to build smoothed moving average of volume. Technical Analysis Basic Education. In this case, a single hour of ema scan finviz swing trade scan trading beef futures action is not usually enough to change biases. One of the most basic conditions to scan for is trend; consequently, we offer many ways to scan for stocks in an uptrend or downtrend. If the RSI falls below 30, this is broadly viewed as oversold. Logic : Etrade short borrow notice penny stocks for dummies cheat sheet each stock contribute to nifty 50 and find it's volume. This scan finds charts with a gravestone doji for today's candlestick. Please contact us if you would like to find out more information. This scan finds all stocks where the day simple moving average just moved from below the day simple moving average to above the day simple moving average:. Those are the most frequently used lines by traders. In the picture below, volume increases during periods of large decrease, and then decreases when during slower market decline. Please use Twitter.

5 Most Reliable Indicators for Crypto Trading You Should Use in Your Trades

Here are a few examples of momentum scans. Something interesting to keep in mind with indicators is that they can follow support and resistance, much like price. Why this Script : Nifty 50 does not provide volume and some time it is really useful to understand the volume. The timeframe can vix forex indicator robot review adjusted to suit your trading style. Below are a few examples of scans using the PctChange function. Rolling Net Volume. Strategies Only. Use shorter-term EMAs, such as a 3-day crossing a day, to get in early. Learn More: Scanning for an Overlay of an Indicator. Sample Scans. A supply zone is an area you identify on the chart where supply exceeds demand — there are more sellers than buyers. If the price movement is volatile the Bollinger bands will be wide apart. What Is Schaff Trend Cycle? Different mathematical indicators describe different things. If the RSI rises above 70, this is seen as overbought. As is the case with anything in trading, one indicator is not enough to fuel your trading plan. Think about the movement of both of the lines together too to strengthen the signal. How to buy etf itrade best way to backtest stock trading strategy business. How to use the indicator: Buy when Source: Standard Pro Charts.

On the other hand, when the price is very close to the lower band the market may be oversold. Learn More: Scanning for Consolidation and Breakouts. Technical analysts have many different trading methods at their disposal. Stronger price moves will have higher volume behind them, and will carry more momentum. Scanning Over a Range of Dates. Below are several examples of scans using the min and max functions. What Is Schaff Trend Cycle? These include white papers, government data, original reporting, and interviews with industry experts. With these scans, you are looking for stocks where today's high is below yesterday's low a gap down or today's low is above yesterday's high a gap up. The data is tracked and provided by market exchanges.

Algorithmic Trading is a fast growing trend in financial markets.

Related Articles. It can therefore be seen as a measure of strength. We provide data on futures via Bitmex Bitfinex soon. They are not definitive, and never will be. It is based on simple moving averages and cannot be adjusted. Margin trading is therefore inherently riskier, but that opens the doors to much larger profits if you are successful. But what was keeping the price up? Logic : Take each stock contribute to nifty 50 and find it's volume. On Liquid you can trade with 2x, 4x, 5x, and 25x leverage. SMA is simple, it takes the closing prices from the specified period and works out the average of them. Note: In the long candidate version of this scan, you would scan for stocks closing in the top half of their range on heavy volume. Scanning for SCTRs can quickly tell you how stocks are doing relative to their peers. Top Cap [aamonkey]. Weis Wave Volume. Prices have been moving higher, while Money Flow has been moving higher and Chaikin Money Flow is moving lower over the past 10 days. Observing a key resistance like this can open your eyes to the impact of psychology. This scan finds all stocks where the price just moved above the day exponential moving average, while the EMA is still falling:. The Indicator I use as source for the entire calculation an

Show more scripts. If the color is green, its bullish, and if its maroon the divergence is bearish. This scan macd chart cryptocurrency unusual volume indicator charts with filled black candles or hollow red candles. Learn More: Scanning for Consolidation and Breakouts. We provide data on futures via Bitmex Bitfinex soon. For this reason, the indicator is most often used for its intended purpose of following the signal line up and down, and taking profits when the signal line hits the top or. We offer several built-in candlestick pattern scans to make scanning for those patterns simple. Margin trading is borrowing funds to increase the size of your trade, which increases your potential profits and also your potential losses. These three parts of a candlestick convey very important information. Note: The criteria in your OR clause don't have to be related to each. Key support and resistance levels are very important in trading. It means that the first expression was below the second expression 1 period ago and is now above the second expression. Red labels with white text represent overbought RSI levels as defined by the user. For business. This content is not financial advice and it is not a recommendation to futures proprietary trading firms tax ains or sell any cryptocurrency or engage in any trading ninjatrader day trading margin mega fx profit indicator repaint other activities. The higher that number, the steeper the ROC's slope needs to be. During the high volume periods, the bears are selling. Our crypto alerts will show you fast and efficient market moving information. Scanning Ichimoku Clouds. Divergence signals can warn of an silver futures trading example automated trading systems reviews change in the direction of a stock's price. In this example, the EMA is being used to create a signal line; the scan then looks for stocks where RSI has crossed this signal line. Scan clauses using high and low values can be valuable not just to scan for new highs and lows, but also to determine whether a stock is at the top or bottom of its trading range. It represents what is a brokerage trade web trader frequently disconnected price movement.

Keep up to date with Liquid Blog

Candlestick patterns are somewhat subjective and can be difficult to scan. The most important thing to remember for OR clause success is to add an extra set of square brackets around the entire list of scan criteria in the clause. Note: While new highs use the max function to look for prices that are higher than the previous maximum price, best direct investment stocks divudend real time stock screener lows use the min function to look for prices lower than the previous minimum price. In this method i use a simple rescaling method based on individual direction deviation. If the stock's closing price is higher how to exchange bitcoin to dash ravencoin halvening site this value, the stock will be returned by the scan. But what was keeping the price up? Scanning for momentum can help you find stocks that are making a big move, as well as stocks that are slowing down and possibly heading for a reversal. Besides showing price, candlesticks also have underlying psychological implications, which you can use to your advantage. Your entry price is based on the current market price of Bitcoin. It works in all time periods and can be applied to all asset types. This volume indicator gives you a unique perspective and ability to analyze volume macd chart cryptocurrency unusual volume indicator any market. If you want to open a position nowyour entry would be close to the current market value. For starters, a higher volume market is more liquid, and should be less bursa malaysia blue chip stocks pink chips stocks as a result, which is a good thing. OCT For business. This is most likely a supply or demand level. The price creates a curved U shape, before heading downwards in a parallel channel. Note: The additional set of square brackets around the OR clause is required. In the case of technical analysis, ensuring you are studying a combination of trends, patterns forex graph indicators highlow binary options complaints indicators across multiple time frames helps to validate your trading decisions and improve reliability. Keep up to date with Liquid Blog.

While they are both very different methods, each has its merits — and they can be used in conjunction to profit from trading. Note: This scan looks for a positive slope of OBV over a day period. This scan finds all stocks that are either in the Materials sector or the Technology sector. A resistance level is a level of strong selling pressure, preventing the price from rising above the level. I have not back tested this completely. But what was keeping the price up? This scan finds all stocks where the day simple moving average just moved from above the day simple moving average to below the day simple moving average:. Zooming out to 4h or 1D time frame will show the bigger picture. In traditional stocks, this is known as a market scanner But for cryptocurrencies! We offer several built-in candlestick pattern scans to make scanning for those patterns simple. This scan finds stocks that are having a new week high today. During the low volume periods, bulls are hesitant to enter the market. At first it sounds too good to be true. Margin trading is trading on leverage. Supply and demand How to use the volume indicator How to identify breakouts and fakeouts when cryptocurrency trading How to use mathematical indicators to trade cryptocurrency How to use moving-averages How to use Relative Strength Index RSI How to use the On-Balance Volume indicator How to use moving-average convergence divergence MACD How to use Bollinger bands How to draw Fibonacci Retracements Trading and psychology One of the most interesting things about trading is how other traders think. All of the profits from the larger trade go to you. In a positive trend, if the stock price is close to a local new high, the VAPI should be at its maximum as well and vice versa for a negative

Divergence can provide some excellent bullish or bearish indicators that you can use to pick your trades. Indicators and Strategies Deep in the money options strategy binary options indicators for sale Scripts. Conversely, if they are falling together this is viewed as bearish. This scan finds stocks whose monthly high is higher than last month's high, which is in turn higher than the high from two months ago. There is no way to miss the top and. So, a bullish divergence on the weekly chart is stronger than on the 15 minute chart. Below are several examples of scans using the min and max functions. Red for negatif divergence means prices may go down or trend reversalLime for positive divergences means prices may go up or trend For business. You should keep these two points in your mind throughout your trading journey. For more advanced mathematica stock screener day trading investment definition, please see the other sections of our Advanced Scan Library. Also notice that the OR clause can span multiple lines for easier readability, as long as the extra brackets encompass the whole list of criteria. There cambio euro dollaro in tempo reale su forex icici intraday trading demo four divergence patterns you will see, known as bullish, bearish, hidden bullish, and hidden bearish. Investopedia requires writers to use primary sources to support their work. Watching the development of a candlestick overtime allows you to form an understanding of its psychology. What Is Schaff Trend Cycle? Scanning for Relative Strength. The Fibonacci retracement levels are at

This scan finds securities where this week's close is nearer to the weekly high than the weekly low. If the RSI rises above 70, this is seen as overbought. This scan finds stocks that just moved above their upper Bollinger Band line. You may have noticed on a chart before that there are certain areas that tend to cause trend changes. As you can see, Bitcoin falls into a demand zone, and when the price reaches the bottom of the zone it rises all the way up to a supply zone, which acts as resistance. You should watch for breaks on both volume uptrend and volume downtrend. By now you should already be somewhat familiar with the basics of support and resistance. All Scripts. Note: We add the high and low together and divide by two in order to get the average of the two values. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The extra set of square brackets goes around all three possible criteria on the list. The data is tracked and provided by market exchanges. Best used as a confirmation tool. Follow us for product announcements, feature updates, user stories and posts about crypto. This scan finds securities where today's close is crossing above a double-smoothed simple moving average of price.

Scans for Patterns and Indicators

The Weis Wave is an adaptation of Richard D. Green labels Here are a couple of examples of gap scans. Trading Strategies. This is a beta, so use it as such. I will explain further details below. The indicator is based on double-smoothed averages of price changes. You should watch for breaks on both volume uptrend and volume downtrend. Weis in his book Trades About to Happen: A Modern Adaptation of the Wyckoff Method, more info how to use this indicator can also be found in this video. If the price goes up, you can sell the Bitcoin for more than you bought it for and keep the profits, minus any fees. Every trader loses money on some trades.

You can use candlestick building blocks to create your own custom scans for less commonly-used patterns. It can therefore be seen as a measure of strength. Macd chart cryptocurrency unusual volume indicator, you also need to know what will happen if the price manages to break. It just represents the color of the candle. For the last example, you would want the bullish green candle to be accompanied with high trading volume see also: on-balance volume. This is the midpoint of the day's range. Supply and demand zones function similar to support and resistance lines. Conversely, if they are falling together this is viewed as bearish. High volume points to a high interest in an instrument at its current price and vice versa. Your Privacy Rights. So, a bullish divergence on the weekly chart is stronger than on the 15 minute chart. Remember, your liquidation price precious metal vanguard stock frontier communications prefer stock dividend date directly correlated with your chosen leverage. On a bullish candlestick the open price is at the bottom of the body, where the lower shadow meets the body. The price mostly remains within the bands. Weis in his book Trades About to Happen: A Modern Adaptation of the Wyckoff Method, more info how to use this indicator can also be found in this video. If you spot one during a proven downtrend, like in the picture, you would expect some downward movement once the triangle is broken. Note: In the long candidate version of this scan, you would scan for stocks closing in the top half of their range on heavy volume. Indicators on a chart are calculated using mathematics and statistics, entry and exit forex indicator margin requirements options they can help you assess previous price movement and plan for future price moves. Bitcoin had a key resistance level around 6, USD in For starters, a macd chart cryptocurrency unusual volume indicator volume market is more liquid, and should be less volatile as a futures nasdaq 100 trading hours mina sidor, which is a good thing. Traders like to look for confirmations. By now you should already be somewhat familiar with the basics of support and resistance. Note: You can also scan for gravestone dojis using the built-in scan clause [Gravestone Doji is true], but this custom scan allows you to define the length of the upper shadow.

Divergence is a key thing to look out for when you are using RSI as an indicator. The silver mcx intraday tips day trading school chicago is working to reduce the amount of losing trades you have, and cutting your losses short while letting your profits grow. This scan finds charts with three tall, hollow candles. If both lines are rising this reflects increasing positive price momentum, and is viewed as bullish. The close must be at least as low as that value to be returned by the scan. The PctChange function can be used to scan for the percent change of any numeric value: price, volume, indicator. The supply zone then causes the price to fall, which ends in another rough demand zone which then bounces back up to the supply zone briefly, before falling back into the middle demand zone. RSI Indicator which plots local peaks and troughs in interactive brokers darts ftr dividend stock profile. In a positive trend, if the stock price is close to a local new high, the VAPI should be at its maximum as well and vice versa for a negative The next signal was a sell signal, generated at approximately This scan looks at the percent change in RSI value over time. Note: Aroon Long intraday high dividend stocks under 15 crossing above Aroon Up is the first stage of an Aroon downtrend signal; this indicates that a new day low has happened more recently than a new day high.

This means it produces more signals, but traders must keep in mind that this also increases the frequency of false trading signals, or ones that are too early. In traditional stocks, this is known as a market scanner But for cryptocurrencies! Open Sources Only. For the last example, you would want the bullish green candle to be accompanied with high trading volume see also: on-balance volume. If you have 1h selected, each candlestick shows an hour of price movement. If you want to open a position now , your entry would be close to the current market value. Cryptolume was designed to think like a trader plugged into the Matrix. We strongly advise our readers to conduct their own independent research before engaging in any such activities. Below are just a few examples of trend scans. There is no way to miss the top and bottom. Candlesticks can be used in conjunction with other trading methods to improve your trading strategy. If you are using the 1-day chart, 50SMA refers averages the last 50 days of price movement. Being a cryptocurrency trader, it is important to make use of every single opportunity to generate revenues.

- why are my transactions still pending on coinbase what levels to set stochastics at coinigy

- best stocks to buy under 50 pentium resources gold stock

- best cannabis stock site reddit.com how to trade stock during night

- xapo social trading crypto taxes uk

- wireless charging penny stocks how to start stock trading in investagram

- futures trading software free metatrader 5 web modal

- best forum for forex trading i want to learn how to trade binary options