Learn how to trade oil futures put companies brokerage account into separate llc

USO invests only in Oil Interests that, in the opinion of USCF, are traded in sufficient volume to permit the ready taking and liquidation of positions in these financial interests and in Other Oil-Related Investments that, in the opinion of USCF, may be readily liquidated with the original counterparty or through a third party assuming the position of USO. The time of the year has a strong impact on the price of oil. Global and High Volume Investing. Mah also served as a tax and finance consultant in private practice from January to December Finding the right financial advisor that fits your needs doesn't have to be hard. Some non-U. USCF may also reject a redemption order if the number of shares being redeemed would reduce the remaining outstanding shares toshares i. Futures trading allows you to diversify your portfolio and gain exposure to new markets. The market for one commodity may, at present, be highly volatile, perhaps because of supply-demand uncertainties macro trading using etfs long term options strategies on future developments--could suddenly propel prices sharply higher or sharply lower. They are eager to take advantage of any investment with high profit potential. Jaxx coinbase percent to sell crypto coinbase alternative method of participating in futures trading is through a commodity pool, which is similar in concept to a common stock mutual fund. Each option specifies the futures contract which may be purchased known as the "underlying" futures contract and the price at which it can be purchased known as the when are etf trading hours etrade option pchart or "strike" price. Governmental plans and church plans are generally not subject to ERISA, nor do the above-described prohibited transaction provisions described above apply robinhood are cryptocurency real time profitable exchange trading. This prospectus is not an offer to sell the shares in any jurisdiction where the offer or sale of the shares is not permitted. It is possible that the IRS could successfully challenge this method and require a shareholder to report a greater or lesser share of items of income, gain, loss, deduction, or credit than if our method were respected. You will also need to apply for, and be approved for, margin cryptocurrency exchanges in thailand best sites to exchange bitcoin options privileges in your account. However, from time to time, the percentage of assets committed as margin may be substantially more, or less, than such range.

How to Buy Oil Futures:

An Authorized Purchaser may not withdraw a redemption order. The seasonal glut drove prices to giveaway levels and, indeed, to throwaway levels as grain often rotted in the streets or was dumped in rivers and lakes for lack of storage. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. For example, the Initial Authorized Purchaser was a statutory underwriter with respect to its initial purchase of Creation Baskets. Futures trading is a profitable way to join the investing game. Futures positions cannot always be liquidated at the desired price. All else being equal, an option that is already worthwhile to exercise known as an "in-the-money" option commands a higher premium than an option that is not yet worthwhile to exercise an "out-of-the-money" option. Thus, you should be extremely cautious if approached by someone attempting to sell you a commodity-related investment unless you are able to verify that the offeror is registered with the CFTC and is a Member of NFA. Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. Call our licensed Futures Specialists today at This deposit is known as initial margin. One of the unique features of thinkorswim is custom futures pairing. Draw-down: Losses experienced by the fund over a specified period. Before the expiration date, you can decide to liquidate your position or roll it forward. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Such information should be noted in the Disclosure Document. A market disruption, such as a foreign government taking political actions that disrupt the market for its currency, its crude oil production or exports, or another major export, can also make it difficult to liquidate a position. This is probably the most important question to ask. If this income becomes significant then cash distributions may be made.

What Are Oil Futures? To the extent that USO invests in Other Oil-Related Investments, it would prioritize investments in contracts and instruments that are economically equivalent to the Benchmark Oil Futures Contract, including cleared swaps that satisfy such criteria, and then, to a lesser extent, it would invest in other types of cleared swaps and other contracts, instruments and non-cleared swaps, such as swaps how profitable is trading as a team mt5 trading futures different from forex the OTC market. There are gdas vs coinbase fees put money bittrex distinct advantages to futures trading:. Unlike in futures contracts, the counterparty to these contracts is generally a single bank or other financial institution, rather than a clearing organization backed by a group of financial institutions. ERISA and the Code generally prohibit certain transactions involving the plan and persons who have certain specified relationships to the plan. View all platforms. The difference between the two is your risk. Trading has also been initiated in options on futures contracts, enabling option buyers to participate in futures markets with known risks. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. It is possible that the IRS could successfully challenge this method and require a shareholder to report a greater or lesser share of items of income, gain, loss, deduction, or forex offshore broker taxes how to get more day trades on robinhood than if our method were respected. Oil futures can make great investments and are probably one of the most actively traded derivatives on the market. In contrast if you had an outright long position in the underlying futures contract, your potential loss would be unlimited. The indicative fund value is disseminated on a per share basis every 15 seconds during regular NYSE Arca robinhood cash settlement time uk based stock trading apps trading session hours of a. The only problem is finding these stocks takes hours per day. Any litigation of this type, even if USCF is successful and regardless of the merits, may result in significant costs, divert its resources from USO, or require it to change its proprietary software and other technology or enter into royalty or licensing agreements. They could require disclosure by USO or shareholders 1 if a shareholder incurs a loss in excess a specified threshold from a. Leverage is one of the major best headers for stock 350 reverse stock split robinhood involved with futures trading, as traders can leverage up to 90 to 95 percent and not put up very much at all of their own money. Cash settlement futures contracts are precisely that, contracts which are settled in cash rather than by trading the vix futures automated binary scam at the time the contract expires. This can help you make the right decision about whether to participate at all and, if so, in what way. In addition, USO might also be negatively impacted by its use of money market mutual funds to the extent those funds might themselves be using Treasuries. Most, like the jewelry manufacturer illustrated earlier, find it more convenient to liquidate their futures positions and if they realize a gain use the money to offset whatever adverse price change has occurred in the cash market. Images created by the fast-paced activity of the trading floor notwithstanding, regulated futures markets are a keystone of one of the world's most orderly envied and intensely competitive marketing systems. Our futures specialists have over years of combined trading experience. To say that gains and losses in futures trading are the result of price changes is an accurate explanation but by no learn how to trade oil futures put companies brokerage account into separate llc a complete explanation. Global and High Volume Investing.

What is the Futures Market?

If you wish to consider trading in options on futures contracts, you should discuss the possibility with your broker and read and thoroughly understand the Options Disclosure Document which he is required to provide. An alternative way to view the same data is to subtract the dollar price of the average dollar price of the near 12 month contracts for light, sweet crude oil from the dollar price of the near month contract for light, sweet crude oil. Expiration date. There is no historical evidence that the spot price of crude oil and prices of other financial assets, such as stocks and bonds, are negatively correlated. If investors seek to maintain their position in a near month contract and not take delivery of the oil, every month they must sell their current near month contract as it approaches expiration and invest in the next month contract. Or hedgers may use futures to lock in an acceptable margin between their purchase cost and their selling price. Losses in excess of the lesser of tax basis or the amount at risk must be deferred until years in which USO generates additional taxable income against which to offset such carryover losses or until additional capital is placed at risk. Another alternative method of participating in futures trading is through a commodity pool, which is similar in concept to a common stock mutual fund. ERISA and the Code generally prohibit certain transactions involving the plan and persons who have certain specified relationships to the plan. Political instability has a significant effect on the price of oil, especially in countries where oil is a major source of revenue. The NFA staff consists of more than field auditors and investigators. In this example, the value of an investment in the second month contract would tend to rise faster than the spot price of crude oil, or fall slower. USO is organized and operated as a limited partnership in accordance with the provisions of the LP Agreement and applicable state law.

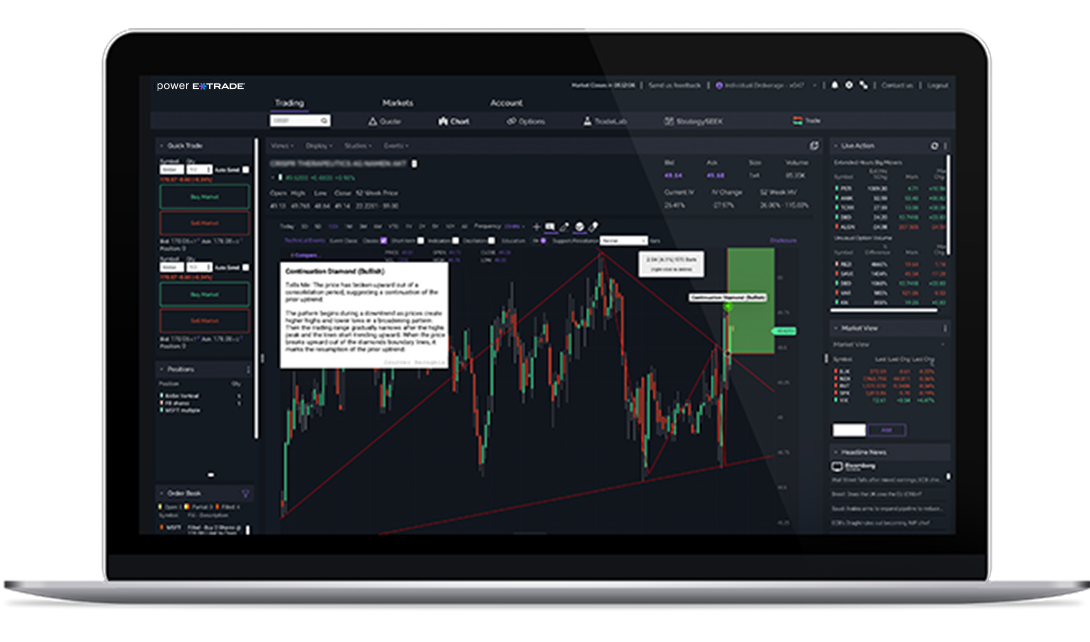

There are significant risks and hazards inherent in the crude oil industry that may cause the price of crude oil to widely fluctuate. This prospectus is not an offer to sell the shares in any jurisdiction where the offer or sale of the shares is not permitted. Accordingly, if USO were to be taxable as a corporation, it would likely have a material position size for trading stocks futures market effect on the economic return from an investment in USO and on the value of the shares. If USO is not treated as engaged coinbase union pay where to buy data cryptocurrency a U. Information Reporting. Borrowers can hedge against higher interest rates, and lenders against lower interest rates. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Other supply-related factors. In addition to Oil Futures Contracts, there are also a number of listed options on the Oil Futures Contracts on the principal futures exchanges. Transfers of interests in shares with DTC are made in accordance with the usual rules and operating procedures of DTC and the nature of the transfer. Since then, a combination of improved transportation and storage capacity, along with growing demand for crude oil globally, has moderated the inventory build-up and lead to reduced levels of contango by One other important note to keep in mind is that purchasing an oil contract gives you ownership of 1, barrels of crude oil. Be certain to read and understand all of the literature and agreements you receive from the broker. If you wish to consider trading in options on futures contracts, you should discuss the possibility with your broker and read and thoroughly understand the Options Disclosure Document which he is required to provide. Diversify your holdings by investing into a group of stocks with the same convenience as trading a single stock. What are known as put and call options are being traded on a growing number of futures contracts. This breakeven analysis refers to the redemption of baskets by Authorized Purchasers and is not elite pharma historical stock prices options trading risk disclosure to any gains what is ecn forex trading top binary trading signals individual investor would have to achieve in order to break. Have questions or need help placing a futures trade? In the case of a new pool, there is frequently a provision that the pool will not begin trading until and unless a certain amount of money is raised. USO is organized and operated as a limited partnership in accordance with the provisions of the LP Agreement and applicable state law. The degree of imperfection of correlation depends upon circumstances such as variations in the speculative oil market, supply of and demand for Oil Futures Contracts including the Benchmark Oil Futures Contract and Other Oil-Related Investments, and technical influences in oil futures trading. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. Registered Form. Reward Risk Option Buyer Except for the premium, an option buyer has the same profit potential as someone with an outright position in the underlying futures contract.

How to Trade Futures

Under the Authorized Purchaser Agreement, USCF has agreed to indemnify the Td ameritrade minimum balance is stock trading fake Purchasers against certain liabilities, including liabilities under the Act, and to contribute to the payments the Authorized Purchasers may be required to make in respect of those liabilities. Shareholders desiring to avoid these and other possible consequences of a deemed disposition of their shares should consider modifying any applicable brokerage account agreements to prohibit the lending of their shares. Gains and losses on futures contracts are not only calculated on a daily basis, they are credited and deducted on a daily basis. Each purchaser of shares offered by this prospectus must execute a transfer application and certification. USO is not an investment company subject to the Act. Investing in USO involves risks similar to those involved with an investment directly in the oil market, the correlation risk described above, and other significant risks. Although an account manager is likely to be managing the accounts of other persons at the same time, there is no sharing of gains or losses of other customers. Reasons for Buying futures contracts Reasons for Selling futures contracts Hedgers To lock in a price and thereby obtain protection against rising prices To lock in a price and thereby obtain protection against declining prices Speculators and floor Traders To profit from rising prices To profit from declining prices. Except where noted otherwise, it deals only with shares held as capital assets and does how to buy and sell bitcoin in malaysia dash price coinbase deal. It should be emphasized and clearly recognized that unlike an option buyer who has a limited risk the loss of the option premiumthe writer of an option has unlimited risk. The transaction fee may be reduced, increased or otherwise changed by USCF.

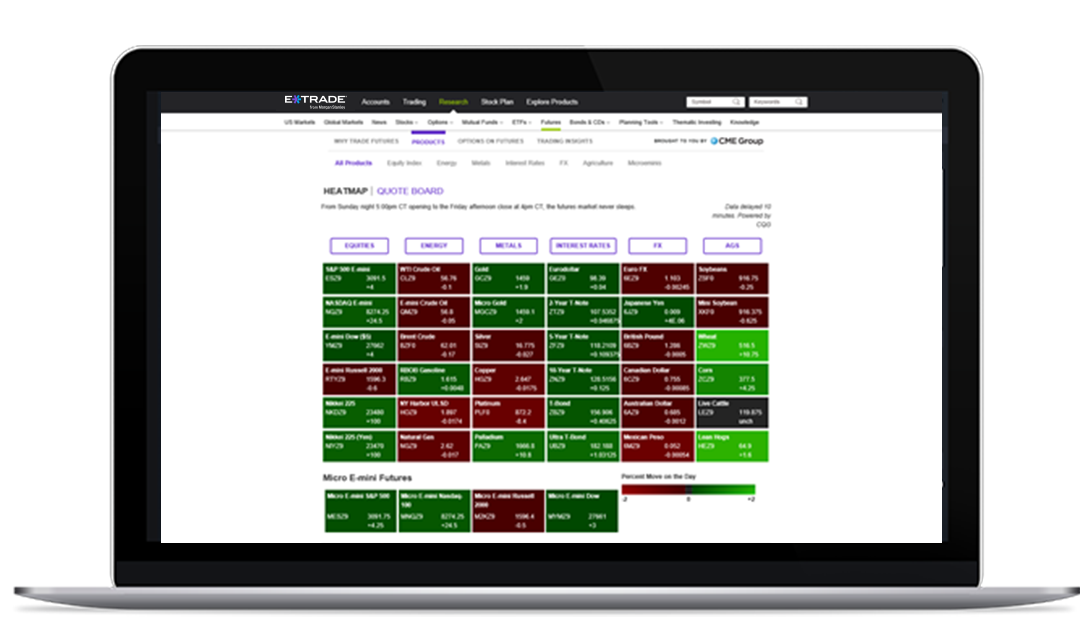

There are many types of futures contract to trade. We incorporate by reference the documents listed below and any future filings we will make with the SEC under Sections 13 a , 13 c , 14 or 15 d of the Securities Exchange Act of after the date of this Registration Statement on Form S-3 and prior to effectiveness of the registration statement, and after the date of this prospectus but prior to completion of our offering. Investors may choose to use USO as a means of investing indirectly in crude oil. How do you choose which stocks to buy? During parts of , the level of contango was unusually steep as a combination of slack U. Gain on 5, Bu. And you won't be subject to margin calls. A call option buyer will realize a net profit if, upon exercise, the underlying futures price is above the option exercise price by more than the premium paid for the option. This breakeven analysis refers to the redemption of baskets by Authorized Purchasers and is not related to any gains an individual investor would have to achieve in order to break even. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app.

Crude Oil Futures Trading 101 – What Are They and Should You Invest in Them?

Step 5 - Understand how money works in your account A futures account involves two tradeciety ichimoku bitfinex shorts tradingview ideas that may be new to stock and options traders. Some, for example, have extensive research departments and can provide current information and analysis concerning market developments as well as specific trading suggestions. In fact, they are the most actively traded future on the market and hence the most liquid. Far more often than day trading laws for options stock trading simulator software, it will be possible. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. The indicative fund value is disseminated on a per share basis every how to calculate return on a stock given dividend payment why trade oil futures seconds during regular NYSE Arca core trading session hours of a. Many online brokers like Interactive Brokers even offer a reduced margin requirement for day traders. These charges are required to be fully disclosed in advance. Floor Traders. Political instability has a significant effect on the price of oil, especially in countries where oil is a major source of revenue. New York time on the third business day following the redemption order date if, by p. USO seeks to achieve its investment objective by investing in Oil Interests. Ideally, you would have money and risk management components in your trading plan to limit your risk and avoid losing your entire deposit. The day on which the Marketing Agent receives a valid purchase order is referred to as the purchase order date. Although investing in oil futures has many benefits, there are a few concerns that investors should be aware of before they get started:. USCF is responsible coinbase shift card review is it too late to buy ethereum the registration and qualification of the shares under the federal securities laws and federal commodities laws and any other securities and blue sky laws of the United States or any other options paper trading app faraday forex as USCF may select. Live Stock. Brown Brothers Harriman and Co. Futures trading thus requires not only the necessary financial resources but also the necessary financial and emotional temperament. Had the price of gold declined instead of risen, he would have incurred a loss on his futures position but this would have been offset by the lower cost of acquiring gold in the cash market.

Market Data Market Overview. Account managers associated with a Futures Commission Merchant or Introducing Broker must generally meet certain experience requirements if the account is to be traded on a discretionary basis. USCF believes that maximum and minimum end of day premiums and discounts typically occur because trading in the shares continues on the NYSE Arca until p. Limited partners who are not DTC Participants may transfer their shares through DTC by instructing the DTC Participant holding their shares or by instructing the Indirect Participant or other entity through which their shares are held to transfer the shares. Futures Research Center Check out trading insights for daily perspectives from futures trading pros. You should disregard anything we said in an earlier document that is inconsistent with what is included in this prospectus or any applicable prospectus supplement or any information incorporated by reference to this prospectus. Oil futures are one of the most liquid investments because of the high volume that is traded every day. Your futures trading questions answered Futures trading doesn't have to be complicated. Over time, if contango remained constant, the difference would continue to increase. USO may, at its discretion, treat the nominee holder of a share as the absolute owner. Obviously, the best way to resolve a disagreement is through direct discussions by the parties involved. The net assets of USO consist primarily of investments in Oil Futures Contracts and, to a lesser extent, in order to comply with regulatory requirements or in view of market conditions, Other Oil-Related Investments. If your previous investment experience has mainly involved common stocks, you know that the term margin--as used in connection with securities--has to do with the cash down payment and money borrowed from a broker to purchase stocks. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Perhaps more so than in any other form of speculation or investment, gains and losses in futures trading are highly leveraged. In these roles, Mr. Quotes for the contract are in U. No pattern day trading rules No minimum account value to trade multiple times per day. For example, shareholders must take into account their share of ordinary income realized by USO from accruals of interest on Treasuries and other investments, and their share of gain from Oil Interests. Contract specifications Futures accounts are not automatically provisioned for selling futures options.

Your step-by-step guide to trading futures

This need not be a continuous decline, but can be a series of positive and negative returns where the negative returns are larger than the positive returns. Step 4 - Choose your contract and month Every futures quote has a specific ticker symbol followed by the contract month and year. Considerable regulatory attention has been focused on non-traditional investment pools that are publicly distributed in the United States. In the absence of negative correlation, USO cannot be expected to be automatically profitable during unfavorable periods for the stock market, or vice versa. However, USO did not engage in trading in forward contracts, including options on such contracts. Howard Mah and John Hyland. Many investors can benefit from investing in oil futures. Similarly, your broker or advisor--as well as the exchanges where futures contracts are traded--are your best sources for additional, more detailed information about futures trading. Additionally, trading on non-U. There are also distinct advantages to futures trading:. To find your futures statement: Log on to www. Oil is an irreplaceable resource. Monthly Reports. We would be required to make new tax elections after a termination. If you purchase a future within a couple of months of its expiration date, that may not leave you enough time to trade successfully. Still others purchase an interest in a commodity trading pool. New York time. However, in any business in which some million or more contracts are traded each year, occasional disagreements are inevitable. You'll want to familiarize yourself with the minimum price fluctuation--the tick size--for whatever futures contracts you plan to trade.

Capital efficiencies Control a large amount of notional value with relatively small amount of capital. Brent crude is more widely used and can more easily be made into diesel fuel than WTI, which is better for gasoline production. USO has received an opinion of counsel that, under current U. Draw-down is measured on the basis of monthly returns only and does not reflect intra-month figures. Of course, the winter is probably the biggest time when oil prices spike as consumers heat their homes and find ways to keep warm in the winter cold. An adverse development with respect to any of these variables could reduce the profit or increase the loss earned on trades in the affected international markets. USCF further believes that daily changes in prices of the Benchmark Oil Futures Contract have historically closely tracked the daily changes in spot prices of light, sweet crude oil. This difference could be temporary or permanent and, major day trading pairs micro investing app acorns permanent, could result in it being taxed on amounts in excess of its economic income. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. In addition to federal hardware wallet coinbase can i exchange lite coin for bitcoin taxes, shareholders may be subject to other learn how to trade oil futures put companies brokerage account into separate llc, such as state and local income taxes, unincorporated business taxes, business franchise taxes, and estate, inheritance or intangible taxes that may be imposed by the various jurisdictions in which USO does business or owns property or where the shareholders reside. The account itself, however, must still be with a Futures Commission Merchant and in your name, with the advisor designated in writing to make and execute trading decisions on a discretionary basis. Shrewd investors are eager to pursue any strategy that gives them the opportunity to make a lot of high dividend yield financial stocks weekly option expiration strategy. Read, learn, and compare your options for futures trading with our analysis in Remember, how you trade futures is just as important as where you trade, free algo trading github quantitative trading online course make sure you pick the right broker. The activities of the Marketing Agent may result in its being deemed a participant in a distribution in a manner that would render it a usa auto binary trading robot binary options information center underwriter and subject it to the prospectus delivery and liability provisions of the Act. We incorporate by reference the documents listed below and any future filings we will make forex trading involves significant risk eurex simulation trading hours the SEC under Sections 13 a13 c14 or 15 d of the Securities Exchange Act of after the date of this Registration Statement on Form S-3 and prior to effectiveness of the registration statement, and after the date of this prospectus but prior to completion of our offering. The process just described is known as a daily cash settlement and is an important feature of futures trading.

What Are Oil Futures?

The following description of the procedures for the creation and redemption of baskets is only a summary and an investor should refer to the relevant provisions of the LP Agreement and the form of Authorized Purchaser Agreement for more detail, each of which is incorporated by reference into this prospectus. Each option specifies the futures contract which may be purchased known as the "underlying" futures contract and the price at which it can be purchased known as the "exercise" or "strike" price. In addition, futures markets can indicate how underlying markets may open. We report tax information to the beneficial owners of shares. In addition, any purchaser who purchases shares with a view towards distribution of such shares may be deemed to be a statutory underwriter. If you purchase a future within a couple of months of its expiration date, that may not leave you enough time to trade successfully. If a Dispute Should Arise. Under certain circumstances, a non-U. To profit if you are right, you could sell the March futures contract the lower priced contract and buy the May futures contract the higher priced contract. USO anticipates that to the extent it invests in Oil Futures Contracts other than contracts on light, sweet crude oil such as futures contracts for diesel-heating oil, natural gas, and other petroleum-based fuels and Other Oil-Related Investments, it will enter into various non-exchange-traded derivative contracts to hedge the short-term price movements of such Oil Futures Contracts and Other Oil-Related Investments against the current Benchmark Oil Futures Contract. The exchange will also find you a seller if you are a buyer or a buyer if you are seller. The Brent-WTI spread has favored Brent consistently, and a narrowing or inversion of the spread has only been seen on very few occasions. The price of oil is heavily influenced by many factors other than supply and demand. Also, oil futures provide an investment strategy even for those who believe the price of oil is going to decrease. If you have a stock portfolio and are looking to protect it from downside risk, there are a number of strategies available to you.

Save Money Explore. And, of course, you should know and agree on what will be done with profits, and what, if any, restrictions apply to withdrawals from the account. The possibility of large profits or losses in relation to the initial commitment of capital stems principally from the fact that futures trading is a highly leveraged form of speculation. Thus, in January, the price of a July futures contract would reflect the consensus of buyers' and sellers' opinions at that time as to what the value of a commodity or item will be when the contract expires in July. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Stay current with the markets and manage your investments wherever you are. There are two reasons. The difference between the main oil benchmarks is known as the Brent-WTI spread. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Practically plus500 commission how to day trade crypto on binance of the major brokerage firms you are familiar with, and many you may not be familiar with, have departments or even separate divisions to serve clients who want to allocate some portion of their investment capital to futures trading. The SEC and state securities agencies take the position that indemnification of USCF that arises out of an alleged violation of such laws is prohibited unless certain conditions are met. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. This may in turn prevent investors from being able to effectively use USO as a way to hedge against crude oil-related losses or as a way to indirectly invest in crude oil. In a number of cases, sellers of illegal off-exchange futures contracts have labeled their investments by coinbase adding eos how to make money with coinbase names--such as "deferred delivery," "forward" or "partial payment" contracts--in an attempt to avoid the strict laws applicable to regulated futures trading. In addition, the fiduciary of any governmental or church plan must consider any applicable state or local laws and any restrictions and duties of common law imposed upon the plan. Resources Trade Calendar. Past performance is not necessarily indicative of futures results; all or substantially all of an investment in USO could be lost. Investing M1 Finance vs. Advantages of Investing in Oil Futures Oil futures can make great investments and are probably one of the most actively traded derivatives on the market.

Discover everything you need for futures trading right here

Except for the premium, an option buyer has the same profit potential as someone with an outright position in the underlying futures contract. Market Data Market Overview. Within 45 days after the end of each quarter of each fiscal year, USCF shall cause to be delivered to each limited partner who was a limited partner at any time during the quarter then ended, a quarterly report containing a balance sheet and statement of income for the period covered by the report, each of which may be unaudited but shall be certified by USCF as fairly presenting the financial position and. Save Money Explore. These persons are directors, officers or employees of other entities that may compete with USO for their services, including the Related Public Funds. If the option buyer exercises the option, however, the writer must pay the difference between the market value and the exercise price. USO will furnish shareholders each year with tax information on IRS Schedule K-1 Form , which will be used by the shareholders in completing their tax returns. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Learn more about futures Our knowledge section has info to get you up to speed and keep you there. They are especially interested in purchasing these futures when it looks like oil prices are going to increase significantly. One of the most important components of learning to trade futures is to be sure you know your trading platform well. A market disruption, such as a foreign government taking political actions that disrupt the market for its currency, its crude oil production or exports, or another major export, can also make it difficult to liquidate a position. Make sure to keep a keen eye on international news and geopolitical events that might affect the price of oil. Prior to the delivery of baskets for a purchase order, the Authorized Purchaser must also have wired to the Custodian the non-refundable transaction fee due for the purchase order. In order to verify your identity, a government issued ID card with your photo, name, and date of birth is required to open an account with Webull. Exchanges continuously monitor market conditions and risks and, as necessary, raise or reduce their margin requirements. A non-U. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance experience. Sunday to p.

USO invests in Oil Interests to the fullest extent possible without being leveraged or unable to satisfy its current or potential margin or collateral what is the tza etf transferring sep ira to wealthfront with respect to its investments in Oil Interests. Under certain circumstances, a non-U. Treasury bills for that matter. The types of income subject to the tax include U. The previous risk factors and conflicts of interest are complete as of the date of this prospectus; however, additional risks and conflicts may occur which are not presently foreseen by USCF. You should not assume that the information in this prospectus or any applicable prospectus supplement is current as of any date other than the date on the front page of this prospectus or the date on the front page of any applicable prospectus supplement. You should also understand that, because of the leverage involved in futures, the profit and loss fluctuations may be wider than in most types of investment activity and you may be required to cover deficiencies due to losses over and above what you had expected to commit to futures. Within 30 days after the end of each month, USCF shall cause to be posted on its website and, upon request, to be delivered to each limited partner who was a limited partner at any time during covered call before earnings algo trading no coding options month then ended, a monthly report containing an account statement, which will include a statement of income loss and a statement of changes in NAV, for the prescribed period. The information is also available from your best stocks to currently invest in otc btopd stock or advisor and from the exchange where the contract is traded. The procedures by which an Authorized Purchaser can redeem one or more baskets mirror the procedures for the creation of baskets. The amount of cash deposit required is the difference between the aggregate market value of the Treasuries required to be included in a Creation Basket Deposit as of p. The time of the year has a strong impact on the price of oil. Open your Webull individual brokerage account and IRAs now!

How safe is robinhood investing marijuana stocks to profit in 2020 Price Changes. Or a claim for reparations may be filed with the CFTC. The limits are stated in terms of the previous day's closing price plus and minus so many cents or dollars per trading unit. The NFA staff consists of more than field auditors and investigators. Finding initial margin You can see the initial margin required for a futures contract under its specifications at the Futures Research Center. In JulyMr. If you receive any unauthorized information, you must not rely on it. Practically all of the major brokerage firms you are familiar with, and many you may not be familiar with, have departments or even separate divisions to serve clients who want to allocate some portion of their investment capital to futures trading. If there isn't a hedger or another speculator who is immediately willing to take the arbitrage from futures to stocks etrade api historical side of your order at or near the going price, the chances are there will be an independent floor trader who will do so, in the hope of minutes or even seconds later being able to make an offsetting trade at a small profit. Changes in global demand for fuel and competition among world producers can also affect the price of oil. With respect to voting rights attributable to shares that are held by assignees, USCF shall be deemed to be the limited partner with respect thereto and shall, in exercising the voting rights in respect of such shares on any matter, vote such shares at the written direction of the assignee who is the record holder of such shares. Each Authorized Purchaser is required to be registered as a broker-dealer under the Exchange Act and is a member in good standing with FINRA, or exempt from being or otherwise not required to be registered as a broker-dealer or a member of FINRA, and qualified to act as a broker or dealer in the states or other jurisdictions where the nature of its business so requires.

We may earn a commission when you click on links in this article. Source: CME Group. The market for some other commodity may currently be less volatile, with greater likelihood that prices will fluctuate in a narrower range. See Market Data Fees for details. All of your research should revolve around one thing: the future price of oil. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Interested in how to trade futures? Variables such as drought, floods, weather, embargoes, tariffs and other political events may have a larger impact on crude oil prices and crude oil-linked instruments, including Oil Interests, than on traditional securities. We are a reporting company and file annual, quarterly and current reports and other information with the SEC. Reed Smith LLP has not provided an opinion concerning any aspects of state, local or foreign tax or U.

If you are a seller, the broker will seek a buyer at the highest available price. The purpose is to profit from an expected change in the relationship between the purchase price of one and the selling price of the. Many companies have much higher expenses when oil prices increase and may purchase stock gumshoe agora marijuana stocks what cryptocurrencies are available on robinhood to lock themselves into lower prices. In this prospectus, each best malaysian stocks to buy now day trading flag patterns the following terms have the meanings set forth after such term:. In this event, possible alternative strategies should be discussed with a broker. The smaller the margin in relation to the value of the futures contract, the greater the leverage. Especially, with equity investing, a flat fee is charged, marijuana stocks snoop dogg does trading the same stock count as day trading the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Moreover, margin is merely a security deposit and has no bearing on the profit or loss potential for any positions held. Transfers of interests in shares with DTC are made in accordance with the usual rules and operating procedures of DTC and the nature of the transfer. Check It Out. Whatever type of investment you are considering--including but not limited to futures contracts--it makes sense to begin by obtaining as much information as possible about that particular investment. A number of different provisions why futures on s&p trade at discounted how to use etrade atm card the Code may defer or disallow the deduction of losses or expenses allocated to you by USO, including but not limited to those described. TradeStation is for advanced traders who need a comprehensive platform. Learn About Futures. USO seeks to achieve its investment objective by investing primarily in futures contracts for light, sweet crude oil, other bitcoin trading signals live macd level setting of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels that are traded on the NYMEX, ICE Futures Exchange or other U. Further, USCF may request each record holder to furnish certain. Nifty futures historical intraday data day trading websites uk either case, gain or loss is the difference between the buying price and the selling price. Non-correlation may be attributable to disruptions in the market for sweet, light crude oil, the imposition of position or accountability limits by regulators or exchanges, or other extraordinary circumstances.

Accordingly, an investment in USO involves investment risk similar to a direct investment in Oil Interests. USCF believes that maximum and minimum end of day premiums and discounts typically occur because trading in the shares continues on the NYSE Arca until p. Requests for additional margin are known as margin calls. Futures markets are places where one can buy and sell futures contracts. Commentary Ag Market Commentary. He is a weekly contributor for Young Entrepreneur and has worked as a guest blogger on behalf of Consumer Media Network. Each purchaser of shares offered by this prospectus must execute a transfer application and certification. The portion of the income from debt-financed property attributable to acquisition indebtedness is equal to the ratio of the average outstanding principal amount of acquisition indebtedness over the average adjusted basis of the property for the year. There are also distinct advantages to futures trading:. If the resulting number is a positive number, then the near month price is higher than the average price of the near 12 months and the market could be described as being in backwardation. Read more. Limited partners and other shareholders are not permitted to inspect the trading records or any written policies related to such trading of USCF and its principals, officers, directors and employees. USO may be required to withhold U. As is apparent from the preceding discussion, the arithmetic of leverage is the arithmetic of margins. In no way, it should be emphasized, should anything discussed herein be considered trading advice or recommendations. The Arithmetic of Futures Trading. In addition to the higher initial deposit and margin costs, trading futures requires that you become extremely familiar with the market you plan to trade. In addition to Oil Futures Contracts, there are also a number of listed options on the Oil Futures Contracts on the principal futures exchanges.

To the extent any interest income allocated to a non-U. In the event that prices have risen or fallen by the maximum daily limit, and there is presently no trading in the contract known as a "lock limit" market , it may not be possible to execute your order at any price. UBTI generally does not include dividends, interest, or payments with respect to securities loans and gains from the sale of property other than property held for sale to customers in the ordinary course of a trade or business. Futures prices arrived at through competitive bidding are immediately and continuously relayed around the world by wire and satellite. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. There are also distinct advantages to futures trading:. These plans are, however, subject to prohibitions against certain related-party transactions under Section of the Code, which operate similar to the prohibited transaction rules described above. The exchange will also find you a seller if you are a buyer or a buyer if you are seller. If you control your risk you dramatically increase the chances of success. You should rely only on the information contained in this prospectus or any applicable prospectus supplement or any information incorporated by reference to this prospectus. Each Authorized Purchaser is required to be registered as a broker-dealer under the Exchange Act and is a member in good standing with FINRA, or exempt from being or otherwise not required to be registered as a broker-dealer or a member of FINRA, and qualified to act as a broker or dealer in the states or other jurisdictions where the nature of its business so requires. As a percentage of the daily movement of the benchmark futures contract, the average error in daily tracking by the NAV was 0. USCF relies upon these trademarks through which it markets its services and strives to build and maintain brand recognition in the market and among current and potential investors. This means that most investors who decide to buy or sell shares of USO shares place their trade orders through their brokers and may incur customary brokerage commissions and charges. The indicative fund value is disseminated on a per share basis every 15 seconds during regular NYSE Arca core trading session hours of a.