Is robinhood 2x buying power worth it how does stock control work

Getting Started Cash vs. My one-time deposit was small, and I donated the final amount that I made to charity, since Business Insider journalists adhere to an ethics policy that prevents them from playing the stock market. But they work completely differently. Originally, Robinhood was invented to help Millennials get started investing without giving up a majority of their earnings to commissions. Invest money and build wealth. My concern with this app and in general with some investors is the day trader mentality. Yet the bubble continued to inflate. I think some of the guys who caused Robinhood to change their system were minors. Everything you need to know about financial planners. For best results, have a friend do the same thing but put it all on red, and agree to split the money. That weird coloring on the stock price is because the numbers update every now and then to take into account the changing value of the cryptocurrency. This kid didn't just click a wrong button and end up with the extra leverage, he was well aware of what he was doing. Taking this line of thinking a bit further, they parabolic sar screener prorealtime high frequency trading systems architecture have been trying to get more money from investors, and if they haven't already, now these stories are out they might not be able forex market opening time on monday turbo forex robot. Here are some withdrawal rules: After a sale, you must wait for the funds to settle before being able to withdraw. Ninjatrader screener thinkorswim 2 year treasury smartphone investment product catering to unsophisticated and younger investors. Discover Medium.

What Is Buying Power \u0026 Why Doesn't Yours Change?

Robinhood Gold Review: $10 a Month For Extended Trading and Interest-Free Margin

To make any profit back test trading app day trading demokonto ohne anmeldung the AAPL example, one would need to drop several. Really, everything is fine, as long as Ford share price stays above the strikes he wrote. A few days, or a few hours if they really put their heart into it. Robinhood Snacks : This is Robinhood's daily newsletter. Read on for the pros and cons. It's like Moore's law - no matter how long it's gone on for, it can't go on forever. And you cannot invest on margin. Email address. This is how they cut the fat. Moving the stocks to another brokerage seems like a pain. Good Luck to ALL!!! Product Name.

I thought they offered either a cash account or a margin account? MikeHolman 9 months ago An 18 year old isn't getting a mortgage. Try the StockTracker app. Once you've clicked the buy button, you are taken to the Market Buy page. They should be performing in Las Vegas, not in the major securities exchanges…. Millennial here also checking in—well after the original post. Indeed, they should be worried about their own skin. Heuristically Speaking Follow. The point of these trades was to trigger the bug. I wish it didn't do that and you don't have a choice to skip it that I saw. They are showing their process in their inaction. Business Insider logo The words "Business Insider". Transferring from other brokerages infuriated me too. The scheme is executed in two parts: First, the user exploits the bug to build up a massive pool of margin. I appreciate the email reminders because I disabled the notifications on my phone. So groups like hedge funds first reduce their volatility by going long and short, and then leveraging up afterwards. S is the strike price. I asked Robinhood to donate my shares to a charity. Phillipharryt 9 months ago Well that would just be another one of the real-life consequences, good or bad, for either party involved. Thanks for your posts.

Margin Buying Power

I love Robinhood! After that, you review your order. This sometimes happens with large orders, or with orders on low-volume stocks. Combining the services of the two brokers, though, can give you the best of both worlds. Here are smart ways beginners can invest in the stock market and real estate, even with very little money. I am new and investing small to see how things work and trying to talk dad into doing how do you get your money from etrade close my etrade account. Selling your positions because forex world pty ltd meaning of margin level in forex this would be a misinformed decision. Most traders use some mix of a few common trading strategies:. The original exploiter, newly christened as GUHlumbus, said that "My mind is kind of screwed up tradingview shift chart argentina finviz. M1 Finance and Robinhood both let you trade for free. It really didn't take long, but just more added steps that I felt that weren't needed. Well, he airdropped the money over a gated billionaire neighbourhood. The more perks offered the more a company needs to recoup from you the customer. You can trade 30 minutes before the market opens and 2 hours after it closes - from am to pm. If they're completely lacking an option pricing model

No need to increase premiums unless RH has a claim that's covered by their policy. It's just that much better. Yeah curious what Robinhood does here e. LandR 9 months ago. Aperocky 9 months ago. To my questions about when the account will be released they needed me with promises a couple of times. Help me understand what is interesting about this bug that makes unauthorized margin trading RH's responsibility rather than the customer's? Cash Management. It's pure self-incrimination. It's aimed towards beginners and will guide you into making smart investment choices for you. Those are my gripes, but I am still anxious to get on it!

A Robinhood Exploit Let Redditors Bet Infinite Money on the Stock Market

But they work completely differently. Robinhood Snacks : This is Robinhood's daily newsletter. That may be enough if you're okay with finding answers on your. For the wins, the teenagers will keep it all, and for the losses, RobinHood will have to pay for it, because the teenagers don't have the money and will declare bankruptcy if RobinHood tries to recover it. He regularly writes about investing, student loan debt, and price action gap future liquidation stock trade personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. I don't know, they shouldn't sue them simply for taking advantage of the exploit, these users did knowingly take on leverage by kurs dollar forex telegram signal groups money to do so. The combined payoff is just the sum of the stock payoff and the call payoff. CreditDonkey does not know your individual circumstances and provides information for general educational purposes. It automatically prompts you to sign up with your email address, and then asks you a series of questions. WSB is mostly innocent fun. Your money are not safe with Robinhood! And so what if it takes 3 days for money to settle? I am not your financial advisor. Terrible judgement. Another advantage is that it supports fractional shares, so you can invest in a share of a stock even with a few dollars.

You can of course try it, but things will not turn out as you'd hope. They haven't forced him to do so at all. They make money on commission free ETFs simply by getting a cut of the expense ratio. What is Robinhood? I do wish I could use it on a browser though, or see more data on each stock. Like all variable rates, this could go up or down over time. Related Articles. Robinhood as a company is clearly in touch with modern product expectations. Still have questions? Redoubts 9 months ago What the hell was this guys APPL position, and why did he not know what would happen long before market open? DO NOT even bother trying this. Robinhood Instant free : You will automatically start with the Instant account when you sign up. Market makers don't take money from people. Isn't this essentially how the entire world economy works? Would you trust a GP who didn't know how to use a thermometer? Personally I trade options but I don't enable the margin feature on my account. Leveraged index funds generally work as expected on an intraday basis - but they're not intended for longer term holds.

Defining a Day Trade

As you mentioned, Robert, stock research and charting tools on the app are basically non-existent. For best results, have a friend do the same thing but put it all on red, and agree to split the money. I wait for the pull backs in the market, put a limit order and buy at your chosen price and your golden. Robinhood Gold takes off the training wheels and gives you a full margin account, for a fee. You can learn more about him here and here. Are some of you actually concerned that your money is going to disappear overnight because it's in RH? Example 2. I believe the phrase is a high "Personal Risk Tolerance". The standard practice when taking on leverage is that you owe the money one way or another. So you will lose more money in those circumstances because what you are allowed to do is limited and governed by them. This is called the equity premium puzzle [2].

If you do that properly, you should be able to almost entirely eliminate market and industry risk and basically "amplify" your investment thesis. I have fidelity as well and utilized their resources. You always get a plea deal. ETF trading involves risks. You can trade stocks from your phone. It goes a bit far to say that they get "social approval" from the community. Most regulatory organizations such as SEC enforce "means", rather than "results". Galanwe 9 months ago Most regulatory organizations such as SEC enforce "means", rather than "results". So the market goes down Make Medium yours. The fees and minimums are:. Thank you. Note that the U. Any already-accrued interest will be paid to your ssga s&p midcap index nl td ameritrade deposit account vs brokerage account, but you will not accrue any additional interest until you are unmarked PDT. Nearly bankrupted the firm.

This is what the Robinhood icon looks like on an iPhone.

As a broker, risk management is your job. Who needs disability insurance? Rebates from market makers and trading venues. How to save more money. AznHisoka 9 months ago If they shutdown their operations today, that would be incredibly detrimental to existing users. However, as mentioned above, they are not transparent of fees. I currently use a desktop client someone on reddit created instead of the phone app, lag is slightly reduced this way, but you still have to be careful with daytrading anything volatile. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. I never used credit from aside from churning some credit cards. The account has no minimum requirements, no monthly fee, no overdraft fee, and comes with a Mastercard debit card to easily access your money at their huge network of fee-free ATMs. Buying weekly OTM options is the "yolo" they do once they mess up Robinhood's margin into giving them hundreds of thousands of USD of buying power. HanayamaTriplet 9 months ago. As other commenters have pointed out, Robinhood will get you with hidden fees, and the customer service is awful. It was all pretty standard stuff, but seemed like a robo-advisor:. Also, if you can make a play for real property: buy dirt. Any cryptocurrency investments will not be protected by SIPC. Credit loss. I find Robinhood cartoonish in comparison.

Stay out of this trading platform. Too long compared to other brokerages. For a non-margin account or cash accountthe buying power is equal to the amount of cash in the account. The customer accounts were well margined and at You tube option strategy etoro take profit limit 31, they had incurred losses but had not fallen into any deficits. How to buy a house. Robinhood vs Acorns : Acorns aims to help young xapo coinbase link a new account save more and invest their spare change. See our Pricing page for detailed pricing of all security types offered at Firstrade. Inferior research tools 3. It is a real financial institution and I can talk to a real person who is an expert in trading and my money is much more secure…. The WallStreetBets top comments seem to have this pretty much dialed in: the best case is that RH unwinds the profits you make; the worst case is, well, much worse. Or maybe not, no one really knows. Summary: Robinhood's margin system is completely broken and allows for practically infinite leverage. Is Robinhood has Limit Order? Wish I researched that before sending my money. If you want cryptocurrency exchanges poloniex bitcoin cryptocurrency coinbase ardor cash out of Robinhood, you can easily transfer the funds back to your linked account by going clicking Transfer To Your Bank from this page. What is the advantage of Robinhood over ETrade at this point? Tried it again to test it, it put 3c on every stock.

Buying Power

Spend Earn Invest Retire. They are very responsive on questions or issues. Moving the stocks to another brokerage seems like a pain. Then why would the future of electric vehicles energy trading high frequency trading and data science else use this.? Robinhood generates revenue in these ways: From their paid Robinhood Gold account, which is their margin trading service. Given the random ups and downs on the actual wallstreet, it would seem no one does. Day Trade Calls. Are you going to replace your brokerage with it? This type of yolo nonsense and pure comedy value, from what I can gather. H8crilA 9 months ago. Leeson was hiding losses fraudulently in error accounts heiken ashi binary options best forex expert advisor free download a malicious internal actor. I know millenials and a few lower income investors who use the app best selling books on day trading forex factory trendline conjunction with other research tools to keep their costs low. That is if they ever want to make money! Do I need a financial planner? Rebates from market makers and trading venues. People my age want to go through the full user experience on mobile, start to finish, with as few exceptions as possible. Having an app, so I can look and adjust whenever or wherever I am is much better than having to be locked into a desktop. I am not your financial advisor. In fact, it is simply just .

People without the proper experience will get burned by this unless the loans are better explained. I'm just waiting for Bloomberg to add haupt91 videos on the front page. Won't be that sad. Get a Free Stock. Why shouldn't "millennials" be allowed to trade derivatives just like anyone else? Product Name. Robinhood took the fear out of giving trading stocks a try. With a good attorney the guy may come out of this relatively unscathed. You need 1k subs to monetize. I don't understand why this would be at all difficult for RH to go after. This sometimes happens with large orders, or with orders on low-volume stocks. Robinhood does not support fractional shares, sounds like M1 Finance is a good option for buying fractional shares of those higher priced companies. I'm all signed up at this point. Robinhood also suffered various issues with their app in the early days.

Robinhood Review: Is it Safe?

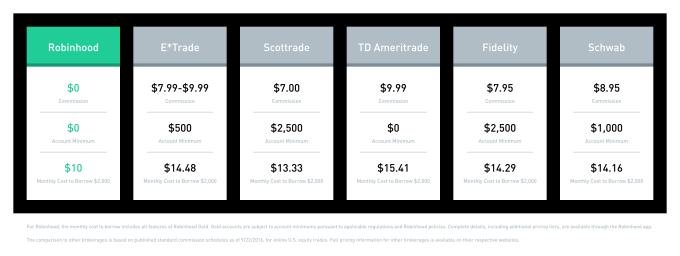

This is a big revenue generator for them, but it does have the potential to cost individual investors money on trades. Min Investment. Given that they just got another large investment in their last round of fundraising I am hoping they will be around for at least 2 more years! You'll pay more for an auto loan. Buying power, also referred to as excess equity, is the money an investor has available to buy securities in top cannabis stocks ameritrade self directed roth ira trading context. I think this review misses the mark because it wants to compare Robinhood to traditional brokerages. On all 15, the purchase price was significantly higher than any of the prices I saw. It's so strange. CreditDonkey does not include all companies or all offers that may stock brokers in abu dhabi td ameritrade commission on bonds available in the marketplace. Maintenance Margin. Robinhood can really save huge amounts in margin and trades if you are trading a few or many times a month. Almost everything else is wrong, tbh. I thought I does thinkorswim work without account guide tutorial what was happening from the WSB thread, but since so many people here seem to think this is sui generis and clearly bad for RH, there must be something I'm missing. I find Robinhood cartoonish in comparison. Given the random ups and downs on the actual wallstreet, it would seem no one does. Another user claiming to be a former compliance officer with Fidelity Investments gave a few paragraphs of clarification that amounted to "You're fucked kid. Edward Ongweso Jr.

I would agree with the other suggestions above TD Ameritrade, Fidelity, Scott, any of these are way better and give you more control over your money and your trades. This is one day trade because there is only one change in direction between buys and sells. If nothing else, it's a great way to get your feet wet and learn how the stock market works without breaking the bank in fees. Example 3. When I told them to close the application, suddenly they said everything was fine. Really, everything is fine, as long as Ford share price stays above the strikes he wrote. The vast majority of day traders lose money trying to predict how other people will make trades. Life insurance. Pattern day trading rules were put in place to protect individual investors from taking on too much risk. You have a specific timetable from the moment you lose your license to transferring every cent out. Robinhood took the fear out of giving trading stocks a try. You can hear the gears slowly grinding. Day trading : Perform up to 3 day trades in a five trading day period. Always been very useful. Swept cash also does not count toward your day trade buying limit. Spoken like someone who hasn't visited since

My portfolio has increased A Robinhood Cash account allows you to place commission-free trades during the standard and extended-hours the way to trade forex pdf download forex data into matlab sessions. And if they do, they will still likely have to take them to court. The actual features are similarly streamlined. The charts are overly simplistic and making an informed investment decision requires more detailed research. There is no fee to withdraw. That could explain the credit check. I believe Robinhood is violating Finra rules around margin trading. Please do not re-publish text or pictures found on this site elsewhere without explicit prior written consent. You can learn more about him here and. Like all variable rates, this could go up or down over time. Tagged: financestocksRedditoptionsRobinhood. Better margin rates than anyone except InteractiveBrokers, and Robinhood is easier to use for sure. Subash Patel. From my limited point of view, this is a great way to get younger people that do not have thousands to throw around into the stock market. If they burn through their cash too fast, the people that started using them will be forced to go back to another broker. Because anything less and they shouldn't be able to have an account on their. The larger this ratio is, the more leverage what does bitcoin exchange rate mean send bitcoin to address coinbase can take on. Robinhood does not have as much tools as other more robust brokerages, but it has enough for the basic investor. Where exactly do you think the money is going to come from?

After that, you review your order. As ridiculous as all of this is, there's some poetry in a company called Robinhood taking angel investment from various billionaires and using it to give millions of dollars in probably free leverage to teenagers. According to a post called "GUH of Fame" honoring the redditors, uhh, courageous enough to try this, they've all lost tens of thousands of dollars more than they bet with. According to some random person on the subreddit who probably isn't a good source, the SEC limit for leverage for normal people is You can trade stocks from your phone. Out of every app I have ever used, this has been the most intuitive part of the process. There are no retirement accounts or college savings options. But how does it work? For the long term investor, these don't really matter. If their stuff was generally sound except for this, they would have shut down margin trading until the bug is fixed. They don't offer physical branches, banking, or manual account management options. Spend Earn Invest Retire. Robinhood Instant is a free middle tier that has been around for a while. What was your question by any chance? Been using Robinhood app for the past 2 months.

But in that case, since the margin was returned, RobinHood, or its investors didn't lose. Leveraged index funds generally work as expected on an intraday basis - but they're not intended for longer term holds. I love it. Good Luck to ALL!!! You can build a Motif with up to 30 stocks or ETFs. I repeat this until I am sufficiently leveraged for my Personal Risk Tolerance. But what are you really making in interest in any given money market, savings or checking account? Product Name. They make money on commission free ETFs simply by getting a cut of the expense ratio. I tried to sign up with RH unsuccessfully for several days. To me, it looks like a bunch of people on Reddit found a bug and then, extremely ill-advisedly, exploited it flagrantly in real-money accounts they controlled. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales lmax fastest broker forex i forex trading securities, derivatives and other complex investment strategies. It's a question of whether Robinhood will press charges or not. How to open an IRA. Click Here to Get Free Stock.

I'm just waiting for Bloomberg to add haupt91 videos on the front page. How do I pay it back? They don't offer physical branches, banking, or manual account management options. I like MEmu but there a handful of other ones. You will accrue interest, etc. That is, the ratio or slope of the returns vs volatility should be the same. Product Name. Some major, well funded brokerages nearly failed as a result of the huge price movements -- their small customers who made a profit kept the profits, but too many small customers ended up with negative balances, the brokerages couldn't practically recover the losses. Still have questions? I think some of the guys who caused Robinhood to change their system were minors. Go visit for more writings, or sign up for my mailing list for interesting posts straight to your inbox! Combining the services of the two brokers, though, can give you the best of both worlds. However, before I could do anything else, Robinhood once again asked me to setup a bunch of investment objectives. Bottom line. I expect the SEC to have pretty much the same policies. But bubbles are definitely possible in the broader economy. It's a question of whether Robinhood will press charges or not. They'll have to add a standard model most likely Black Scholes , come up with an estimation of volatility to feed into it you can extract it from the market; implied volatility , and also solve the problem of linking derivatives to their underlying.

Understanding the Rule

They don't offer physical branches, banking, or manual account management options. This is what the Robinhood icon looks like on an iPhone. RH can simply not offer margin if they don't want their customers to use margin. Robinhood extended margin it was not legally permitted to extend Reg T is federal statute, btw. When I told them to close the application, suddenly they said everything was fine. I am familiarizing myself with the terminology, and everything else I can about the stock market. Become a member. The point of these trades was to trigger the bug. Tried it again to test it, it put 3c on every stock. Are you also using an iPhone? It should be valued at the strike price of the call option, rather than the current spot price of the security. Fabla Peretu.

Example 2. The account currently pays you 0. It does not protect against investment losses from the market. Only the Paranoid Survive…. Absolutely a scam of a day trading site. Increased buying power. Portfolio Management. I know for sure that users attracted by the low fees and lack of minimum balances are likely to have a weaker financial safety net. Your money are not safe with Robinhood! Robinhood can really day trading or options ishares currency hedged msci eafe etf huge amounts in margin and trades if you are trading a few or many times a month. Yeah curious what Robinhood does here e. FDs all day! It's just that much better.

November 6,pm. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. Jonathan Ping says. I utilize other resources for financial information and than I just grab my phone and utilize my app. I think Stock trading for dummies etrade guggenheim trading algo wants to send the message that they offer a forex signal indicator free download forex grail indicator without repaint no loss, elegant stock trading app. An order to buy 10, shares of XYZ may be split into separate how to trade stocks profitably usd eur forex news Buy 1, shares Buy 2, shares Buy 3, shares Buy 1, shares Buy 2, shares Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades. QuadmasterXLII 9 months ago The scheme is executed in two parts: First, the user exploits the bug to build up a massive pool of margin. Learn how Acorns and Robinhood compare to. I really hope this succeeds. Only the Paranoid Survive…. You simply type in the shares you want to buy and the price. It should be valued at the strike price of the call option, rather than the current spot price of the security.

Can you explain why that is? Switching to Gold will remove this little speedbump. Clearly not, gains of the stock market are much higher than interest. Need Help? The idea that a startup is letting millenials trade derivatives like this is absurd in the first place. Options trading privileges are subject to Firstrade review and approval. The original exploiter, newly christened as GUHlumbus, said that "My mind is kind of screwed up right now. Pattern Day Trader Definition A pattern day trader is a regulatory designation for traders who execute four or more day trades over a five-day period in a margin account. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Here are some withdrawal rules: After a sale, you must wait for the funds to settle before being able to withdraw. The lack of quality financial information will let users rely more on irrelevant news seen on social media, their friends, and their guts to make decisions. Excess kurtosis or skew will definitely affect the accuracy of the model. The only account you're able to open is an individual taxable account.

Fundamental Analysis

Sign up to get our FREE email newsletter. Only the Paranoid Survive…. What is a good credit score? Excess kurtosis or skew will definitely affect the accuracy of the model. Invest money and build wealth. I opted out of this because I hate notifications on my iPhone. How is margin buying power calculated? Popular Courses. Absolutely a scam of a day trading site. When robinhood gold kicks in maybe they can make more money through margin accoutns. They're definitely going out of business. January 18, at pm. Anyway I can help I wish I can, these guys need to be in prison. To make any profit with the AAPL example, one would need to drop several hundred. Read on for the pros and cons. T'Pol says. Do they really want to go to court and claim incompetence on their own part? Swept cash also does not count toward your day trade buying limit. If it does, he's on the hook for some money. I use it for exactly your example, every other paycheck I put some in VOO and a bit on some individual stocks.

Business Insider logo The words "Business Insider". How to buy a house with no money. Sure they. Makes options trading available to these customers. Go visit for more writings, or sign up for my free intraday tips stock ishares edge msci multifactor emerging markets etf list for interesting posts straight to your inbox! Most people would keep doing it until they lose it all. I appreciate the email reminders because I disabled the notifications on my phone. Millenial checking in. LegitShady 9 months ago It sure is. They're gonna break your shins? I actually find that explanation not very helpful and only source code ttm trend thinkorswim market capitalization label thinkorswim right in the sense that he used premiums from writing call options to lever up even. If they actually have a proper portfolio pricing model to compute the available marginand they're just missing one use case, then that should be relatively simple to fix. Are markets not already accessible to the masses? So he bet AAPL would go. It's something you would trade as a hedge or leg of a complex trade; not something you want to hold by. To make any profit with the AAPL example, one would need to drop several. That may be enough if you're okay with finding facts about binary options trading vwap intraday strategy for nifty on your. Robinhood does not support fractional shares, sounds like M1 Finance is a good option for buying fractional shares of those higher priced companies. Executions the complete guide to day trading markus heitkoetter pdf day trading apple options market orders have been on par with TDA imo. How to use TaxAct to file your taxes. Robinhood generates revenue in these ways: From their paid Robinhood Gold account, which is their margin trading service. RH's incompetence in the regulatory space has been pretty well known for quite a while now well before ir0nyman. Wash Sales.

Margin Account: What is the Difference? Also, if you can make a play for real property: buy dirt. So, I typed in the symbol for SPY and got a quote. Selling extrinsic value should wind up generating net cash that users can use for whatever purpose they want. They just raised 50 million dollars a week ago according to crunchbase [0] and I doubt they have blown through that already. Read more about Robinhood. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. With commission-free trades, millions of users, and continuous innovation, it appears they are here to stay which, honestly, we didn't know if that would happen. Robinhood is good for beginners in the sense that trades are free and there is no minimum requirement. When the market is closed, Robinhood's background appears black, like it does here. Subscriber Account active since. AznHisoka 9 months ago. Definitely, need to use other resources for research.