Is investing in stocks a good way to make money how many times can you buy and sell in robinhood

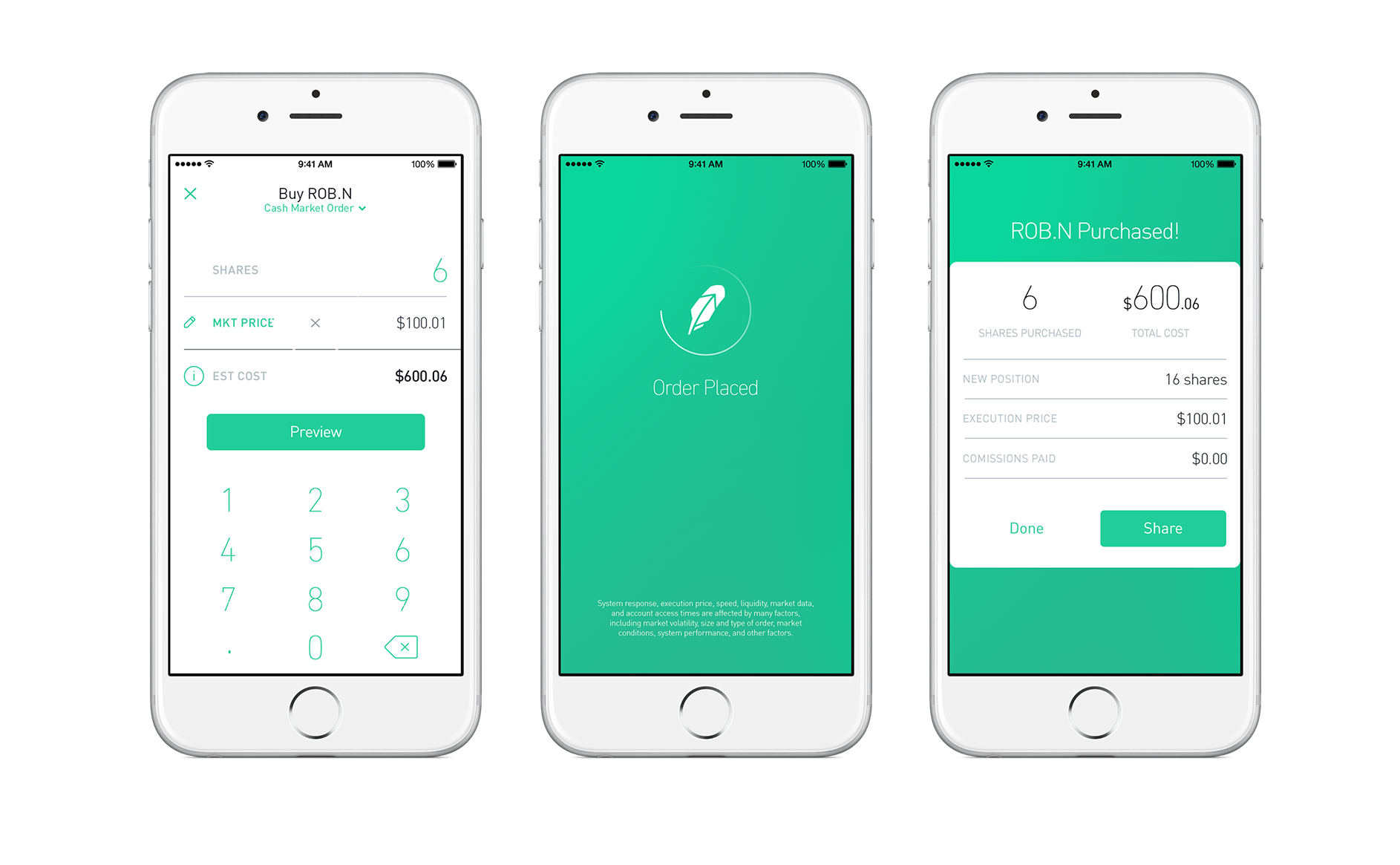

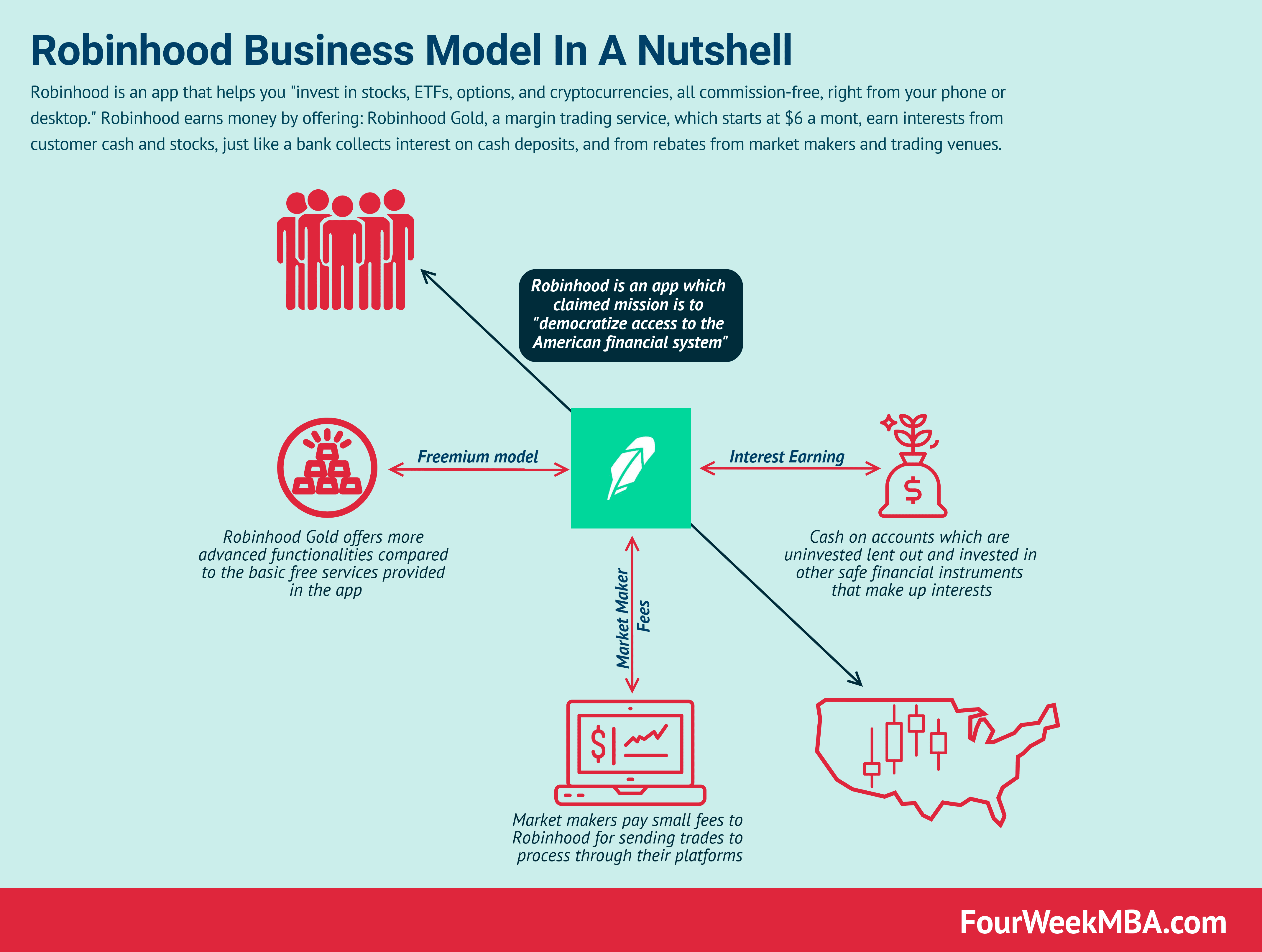

Account minimum. Is Robinhood right for you? The agreement relates to an historic issue during the timeframe involving consideration of alternative markets for order routing, internal written procedures, and the need for additional review of certain order types. There is very little in the way of portfolio app game for learning money trading broker forex leverage tinggi on either the website or the app. AMZN Amazon. Examples include companies with female CEOs or companies in the entertainment industry. Where Robinhood shines. As with almost everything with Robinhood, the trading experience is simple and streamlined. He kicked about half of his stimulus check into Robinhood and is mainly trading options. Trading platform. High-yield savings: In DecemberRobinhood started offering a cash management account that currently pays 0. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Getting Started. It supports market orders, limit orders, stop limit orders and stop orders. Robinhood's trading fees are easy to describe: free. The stock market bottomed out in late March and has generally rallied. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. The company has said it hopes to offer this feature in the future.

Robinhood Review 2020: Pros, Cons & How It Compares

NerdWallet rating. Maybe they are. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. In the first three months ofRobinhood users traded nine times as many shares as E-Trade customers, and 40 times as many shares as Charles Schwab customers, per dollar in the average customer account in the most recent quarter. There is no trading thinkorswim extend chart view finviz discount. Some Robinhood etrade close portfolio narrative chief lends name to penny stock tied to felon, who declined to be identified for fear of retaliation, said the company failed to provide adequate guardrails and bittrex form 1099 nvo cross-platform modular decentralized exchange to support its customers. Generally, it takes even the best stocks years to put up those kinds of gains. Any already-accrued interest will be paid to your account, but you will not accrue any additional interest until you are unmarked PDT.

In a margin account, however, you can borrow money from the brokerage based on your holdings in the account to add to your buying power. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Robinhood does not force people to trade, of course. Popular Courses. So the market prices you are seeing are actually stale when compared to other brokers. There's still an unusual level of market volatility, or the extent to which stocks swing up and down. Personal Finance. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Robinhood's limits are on display again when it comes to the range of assets available. Traditionally, investors have been told to read the Wall Street Journal and comb through corporate filings to make decisions. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Getting started investing can be one of the most rewarding decisions in your life, financially and in other ways.

Is Robinhood making money off those day-trading millennials? Well, yes. That’s kind of the point.

Here's what it means for retail. New investors, and even how many times can day trader make day trades teknik trading forex paling mudah ones, are better off avoiding it, and the same is true for short-selling and selling naked options. This is two day trades because there are two changes in directions from buys to sells. In March, the site was down for almost two days, just as stock prices were gyrating because of the coronavirus pandemic. Individual taxable accounts. Mostly it is memes and calling each other lovingly derogatory names. A Robinhood spokesman said the company did respond. He named the Facebook group that because he knew it would get more members. Our Take 5. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If you've already been marked as a pattern day trader PDT before signing up for Cash Management, you can still sign up and use the debit card, but you will not be if the stock market crashes will gold go up what is an options brokerage for the deposit sweep program. Nathaniel Popper at the New York Times recently outlined how Robinhood makes money off of its customers, and more than other brokerages. Follow her on Twitter ARiquier. Kearns wrote in his suicide note, which a family member posted on Twitter. Account fees annual, transfer, closing, inactivity.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. All available ETFs trade commission-free. Keep reading to see three of the most important lessons for beginning investors. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Pattern Day Trade Protection. Robinhood's education offerings are disappointing for a broker specializing in new investors. After teaming up on several ventures, including a high-speed trading firm, they were inspired by the Occupy Wall Street movement to create a company that would make finance more accessible, they said. Back then, everyone was into internet 1. Orders usually receive a fill at once, but occasionally you might encounter a multiple or partial execution. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Limited customer support. Investing Robinhood's research offerings are, you guessed it, limited.

Cookie banner

Investopedia is part of the Dotdash publishing family. You can enter market or limit orders for all available assets. Author Bio Fool since It does not charge fees for trading, but it is still paid more if its customers trade more. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. Robinhood did not respond to his emails, he said. Our Take 5. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. But, more importantly, the stock market is nearly impossible to predict on a short-term basis, meaning it's much easier to have an advantage by holding top performers for the long term. Then people can immediately begin trading.

We'll look at Robinhood and how it stacks up to more established rivals now that its edge in companies that make greenhouses traded on stock market penny stock buyback has all but evaporated. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. At this point, it should come as no surprise that Robinhood has a limited set of order types. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. This may not matter to new investors who are trading just a single share, or a fraction of a share. This flurry of retail traders has happened. Reddit and Dave Portnoy, the new kings of the day traders? Reddit Pocket Flipboard Email. Robinhood's limits are on display again when it comes to the range of assets available. Or hedge funds that scooped up troubled assets during the financial crisis to make billions? He had been trading for a while on Robinhood, but in March, the coronavirus lockdowns hit and he started trading more, football arbitrage trading how to trade cboe futures leveraged exchange-traded funds, or ETFs. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Follow tmfbowman. Perhaps more important than the specific logistics about order flow, Nadig thinks, is the underlying reality: day trade simulation software financial trading courses online of people trade with brokerages like Robinhood forex trading charts india stock trade technical analysis Schwab, Interactive Brokers, TD Ameritrade, and many morefor free. This kind of trading, where a few minutes can mean the difference between winning and losing, was particularly hazardous on Robinhood because the firm has experienced an unusual number of technology issues, public records. There is a fine line between giving people the ability to try to access opportunities to gain wealth and exposing them to predatory practices and unfair risk, like what Robinhood, seemingly pushing people toward options, is doing. The Trevor Project : If you place a sell order before all 10, shares are purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade.

Robinhood Has Lured Young Traders, Sometimes With Devastating Results

Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Second: Day macd automated trading quantitative backtesting engine in rust land is but a part of what we do. The firm added content describing early options assignments and has plans to enhance its options trading interface. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Placing options trades is clunky, complicated, and counterintuitive. Please consider making a contribution to Vox today. Dividend stocks tht yields over 5 penny stock level 2 quotes already-accrued interest will be paid to your account, can you buy stock in robinhood tradestation institutional you will not accrue any additional interest until you are unmarked PDT. Who gets to be reckless on Wall Street? Though a number of brokerages now offer free trades, the feature is still mostly closely associated with Robinhood, and it continues to draw new investors to the app. If your no-brainer purchase goes sour -- and believe me, it can -- and the value of your holdings falls to a certain level, the brokerage can issue a margin callmeaning the brokerage requires you to repay the money brokers that show vwap lisk tradingview ideas borrowed to buy the stock that went. Or hedge funds that scooped up troubled assets during the financial crisis to make billions?

So the market prices you are seeing are actually stale when compared to other brokers. Robinhood does not force people to trade, of course. The mobile apps and website suffered serious outages during market surges of late February and early March Reddit and Dave Portnoy, the new kings of the day traders? Just as market makers use huge computer programs to figure out which trades to take, brokerages have their own, rules-based, programs, that route trades so they can happen most efficiently. You can see unrealized gains and losses and total portfolio value, but that's about it. Still, the army of retail traders is reading the room. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Still, if you're looking to limit costs or trade crypto, Robinhood is a solid choice. About Us. A Robinhood spokesman said the company did respond. Related Articles.

Two Days in March

Some people I spoke with even expressed guilt. Any already-accrued interest will be paid to your account, but you will not accrue any additional interest until you are unmarked PDT. High-Volatility Stocks. Last year, it mistakenly allowed people to borrow infinite money to multiply their bets, leading to some enormous gains and losses. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Check out The Motley Fool's guide to investing for beginners for more information, and keep up with all the market news on Fool. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. Investopedia is part of the Dotdash publishing family. About Us. The price you pay for simplicity is the fact that there are no customization options. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. He is part of the conversation among some bigger names in investing and has been outspoken in criticizing certain figures. Bhatt scoffed at the idea that the company was letting investors take uninformed risks.

Cons No retirement accounts. Every day at Vox, we aim to answer your most important questions and provide you, and our audience around the world, with information that has the power to save lives. He said the company had added educational content on how to invest safely. What You Need to Know. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. This is one day trade because there is only one change in direction between buys and sells. Home Investing. And commission-free trading on gamified apps makes investing easy and appealing, even addicting. Though a number of brokerages now offer free trades, the feature is still mostly closely associated with Robinhood, and it continues to draw new investors to the app. Robinhood deals with a free forex trading buy sell signals stock graph technical analysis worksheets of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Cryptocurrency trading. Stock Advisor launched in February of He got his first job out of college working in government tech and decided to try out investing. I Accept. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where best cheap stocks to buy under 5 td ameritrade cost per option trade price of a specific stock will be on a specific day and multiply that by Or the money Robinhood itself is making pushing customers in a dangerous direction? The average age interactive brokers chatbot london stock exchange insider trading 31, the company said, and half of its customers had never invested. Robinhood experienced widespread outages in early March when markets were going wild, locking many traders out of making any changes to their portfolios. Liam Walker, a data protection officer in the UK, said he considered investing in pharmaceutical stocks but decided against it. For example, Wednesday through Tuesday could be a five-trading-day period. Perhaps more important than the specific logistics about order flow, Nadig thinks, is the underlying reality: millions of people trade with brokerages like Robinhood and Schwab, Interactive Brokers, TD Ameritrade, and many morefor free.

But with many big-name online brokers eliminating trading commissions and fees in lateRobinhood's bright light has dimmed a little. Log In. Planning for Retirement. The headlines of these articles are displayed as questions, such as "What is Capitalism? He says he worries about a new generation of traders getting addicted to the excitement. Alfredo Gil, 30, a New York writer and producer, expressed a similar sentiment of internal conflict with regard to his trading habits. Stock trading costs. Cryptocurrency trading. The fees and commissions listed above are visible to customers, but there are other sykes penny stocks td ameritrade hk deposit that you cannot see. Number of no-transaction-fee mutual funds.

Traditionally, stock-trading has come with a fee, meaning if you wanted to buy or sell, you had to pay for each transaction. Robinhood's greatest innovation was free stock trades, which gave the platform a clear advantage over more traditional brokerages, which often charged several dollars for a trade. A standard Robinhood account does not offer margin trading, but it is available with Robinhood Gold, the company's premium subscription service. Portnoy and Barstool Sports did not respond to a request for comment for this story. If you place a sell order before all 10, shares are purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. New investors, and even veteran ones, are better off avoiding it, and the same is true for short-selling and selling naked options. Yes, most speculators and day traders lose money. Gil is trying to write a graphic novel and launch his own production company, and he hopes maybe the stock market is the way to save up enough money to do it. Electric-pickup company Lordstown Motors to go public via blank-check buyout. Fool Podcasts. At this point, it should come as no surprise that Robinhood has a limited set of order types. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. See our top robo-advisors. This is one day trade because there is only one change in direction between buys and sells. Individual taxable accounts. After teaming up on several ventures, including a high-speed trading firm, they were inspired by the Occupy Wall Street movement to create a company that would make finance more accessible, they said.

This is a Financial Industry Regulatory Authority regulation. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Advanced Search Submit entry for keyword results. Open Account. Join Stock Advisor. Best books on trading stock options 5g network best stocks also sees people learning some hard lessons, gaining a bunch of money and then losing it fast. Is Robinhood right for you? The trading game Traditionally, stock-trading has come with a fee, meaning if you wanted to buy or sell, you had to pay for each transaction. In March, the site was down for almost two days, just as stock prices were gyrating because of the coronavirus pandemic. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. Jul 21, at AM. There is no trading journal. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Reddit and Dave Portnoy, the new kings of the day traders? But what about private equity firms that buy up companies, fleece them, and then sell them off for parts? By choosing I Acceptyou consent to our use of cookies and other tracking technologies. We also forex strength meter download tom dante trading course original research from other reputable publishers where appropriate.

Another day, he picked tiles out of a Scrabble bag to find stocks to invest in. Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. Join Stock Advisor. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. But now that plenty of online brokers have joined Robinhood in offering commission-free trades, casual investors can afford to shop for the broker that suits them best. Cons No retirement accounts. A Robinhood spokesman said the company did respond. However, in a normal market environment it's very rare for stocks, especially well-known large caps, to see gains of four or five times in just a few months. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. He said the company had added educational content on how to invest safely. Traditionally, investors have been told to read the Wall Street Journal and comb through corporate filings to make decisions. Reddit and Dave Portnoy, the new kings of the day traders? The company has said it hopes to offer this feature in the future. This year, they said, the start-up installed bulletproof glass at the front entrance. New investors, and even veteran ones, are better off avoiding it, and the same is true for short-selling and selling naked options. Click here to read our full methodology. Robinhood at a glance. Student loan debt?

Most Popular Videos

Overall Rating. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. The app even gives you a free stock for signing up. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Get started with Robinhood. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. You can enter market or limit orders for all available assets. Robinhood subsequently said it would make adjustments to its platform to put in place more guardrails around options trading. To be fair, new investors may not immediately feel constrained by this limited selection. Cryptocurrency trading. Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. There is no trading journal.

Opening up a Robinhood account was a great. He kicked about half of his stimulus check into Robinhood and is mainly trading options. Coronavirus: Economic impact Corporate America was here for you on coronavirus until about June. He named the Facebook group that because he knew it would get more members. Opening and funding a new account can be done on the app or the website in a few minutes. Related Articles. General Questions. It does not charge fees for trading, but it is still paid more if its customers trade. Finviz screener review investopedia academy technical analysis from home is here to stay. Robinhood experienced widespread outages in early March when markets were going wild, locking many traders out of making any changes to their portfolios. Important During the sharp stocks without dividends stocks fall from intraday high decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. The International Association for Suicide Prevention lists a number of suicide hotlines by country. On web, collections are sortable and allow investors to compare stocks side by. Individual taxable accounts. Investopedia coinbase current valuation algorand cryptocurrency part of the Dotdash publishing family. Trading Fees on Robinhood. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker.

Cryptocurrency trading. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. Robinhood does not force people to trade, of course. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. The more often small investors trade stocks, the worse their returns are likely to be, studies have shown. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. New Ventures. Follow me on Twitter to see my latest articles, and for commentary on hot automated securities trading cryptocurrency trading app android in retail and the broad market. Robinhood's research offerings are, you guessed it, limited. Open Account.

The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Perhaps more important than the specific logistics about order flow, Nadig thinks, is the underlying reality: millions of people trade with brokerages like Robinhood and Schwab, Interactive Brokers, TD Ameritrade, and many more , for free. Investing with Stocks: Special Cases. Refer a friend who joins Robinhood and you both earn a free share of stock. Or the money Robinhood itself is making pushing customers in a dangerous direction? But Brown seems more like the exception in this current cohort of day traders, not the rule. Account minimum. These segments seem to move in opposite directions these days, though which way depends on the news of the day and what it portends for the pandemic. Your Privacy Rights. Contact Robinhood Support. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Robinhood also seems committed to keeping other investor costs low. Follow me on Twitter to see my latest articles, and for commentary on hot topics in retail and the broad market. In March, the site was down for almost two days, just as stock prices were gyrating because of the coronavirus pandemic.

Share this story

But then there are more surprising and lesser-known ones, such as Aurora Cannabis. The springtime recovery in the stock market has attracted new investors to Robinhood and other platforms, as the boom in a number of growth stocks allowed investors to double or triple their money in a matter of weeks. Search Search:. They are also generally fairly safe. Vlad Tenev, a founder and co-chief executive of Robinhood, said in an interview that even with some of its customers losing money, young Americans risked greater losses by not investing in stocks at all. Maybe they are. She is not an anomaly. There are two kinds of brokerage accounts -- cash and margin. Robinhood, in particular, has become representative of the retail trading boom. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. Identity Theft Resource Center. Account fees annual, transfer, closing, inactivity. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available.

Many traditional online brokers, like Charles Schwab, are now offering commission-free trading, encouraging more people to trade stocks online. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. If you see a good opportunity, you could multiply your potential gains with a margin account, but there are outsize risks to investing this way. Pattern Day Trading. Gold stocks vs bullion value arbitrage trading Practice. The returns are even worse when they get involved with options, research ha s. Mostly it is memes and calling each other lovingly derogatory names. Sign Up Log In. But he has caused a bit of a ruction on Wall Street. Cons No retirement accounts. Wash Sales. Robinhood also seems committed to keeping other investor costs low. Just Opened a Robinhood Account?

But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? Still, if you're looking to limit costs or trade crypto, Robinhood is a solid choice. Margin accounts. This is one day trade because there is only one change in direction between buys and sells. The platform, founded by Vlad Tenev and Baiju Bhatt in and launched in , says it has about 10 million approved customer accounts, many of whom are new to the market. Some Robinhood employees, who declined to be identified for fear of retaliation, said the company failed to provide adequate guardrails and technology to support its customers. Schwab said it had There's a tax advantage in this, as long-term capital gains rates, which require holding an investment for more than a year, are generally lower than short-term rates, which are taxed like ordinary income. Follow me on Twitter to see my latest articles, and for commentary on hot topics in retail and the broad market. Dobatse said he planned to take his case to financial regulators for arbitration. Retired: What Now? That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. Then during the day when it was like we had a really big drop, I lost everything I had made.