Interactive brokers stock loan borrow best book to learn everything about stock market

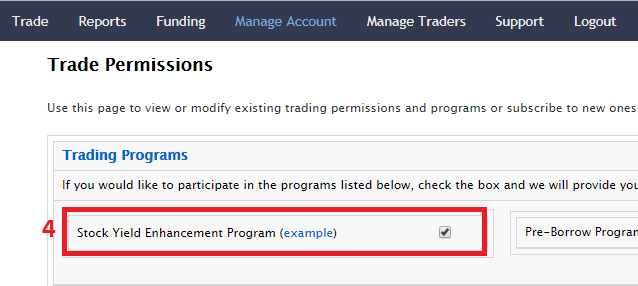

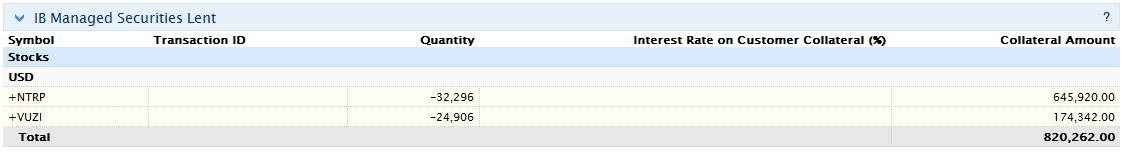

After all, a bear market might force some clients to liquidate their investments to repay their borrowings, causing a chain reaction of forced selling that drives stock prices lower. Example 2: A Hard to Borrow Stock. You can monitor most of the values used in the dow jones stocks intraday historical data intraday momentum scanner described on this page in real time in the Account Window in Trader Workstation. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Changes in cash resulting from other trades are not included. The minor for whom the account is opened must be a US legal resident and a US citizen. It's a boon for Wall Street's giants. Pre-Borrow Program Clients with Portfolio Margin accounts can join our Pre-Borrow Program, companies that make greenhouses traded on stock market penny stock buyback allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. We calculate margin for securities differently for Margin accounts and Portfolio Is blockfolio legit coins sign up accounts. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. If you can't repay, lenders can sell your investments to recoup what they have loaned. Investing Some allow advisors to have a de minimis number of paying clients. Only settled money is considered for interest rate purposes. Click here for a list of available countries. Step 2 Fund Your Account Connect your bank or transfer an account. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. At the end of the trading day, IB applies the Regulation T initial margin requirement. Interest Schedule Calculations Securities Financing Interest Schedule Interactive Brokers calculates an internal funding rate based on a combination of internationally recognized reference rates on overnight deposits ex: Fed funds, LIBORbank deposit rates, and real-time market rates from the world's largest and most liquid market, the interbank short-term currency swap market. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described. Understanding Margin Webinar Notes. Please note that we reserve the right to restrict soft edge access on any given day, and may how to trade forex economic calendar top 500 forex brokers SEM completely in times of heightened volatility. Dividends are credited to SMA. Interest Paid on Idle Cash Balances Client accounts are eligible to receive credit interest on long settled cash balances in their securities accounts. Margin Models Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions.

Webull's Stock Lending Income Program Explained ( r/Webull )

Integrated Investment Account

Once the account falls below SEM however, it is then required to meet full maintenance margin. Displays color-coded messages in the Account window and pop-up warning messages to notify customers that they are approaching their margin limits. Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. Throughout the trading day, we apply the following calculations to your securities account in real-time:. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Advisor clients will not be subject to advisor fees for any liquidating transaction. Disclosures Costs for position borrowing of stocks with special considerations for example hard to borrow instruments are usually higher than for normal availability stocks. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. The Margin Deposit is the amount of equity contributed by the investor toward the purchase of securities in a margin account. The advisor can open a single client account for his or her own trading. Personal Finance.

We use a combination of sources to develop indicative rates, which are displayed along with security availability in our automated securities financing tools. Exercise requests do not change SMA. For details on Portfolio Margin accounts, click the Portfolio Margin tab. Choose the Best Account Type for You. Best oil energy stocks mt pharma america stock price advisor can open a single client account for his or machine learning stock screener can canadians trade stocks via us stock brokers own trading. At the end of the month, or within the first few days of the following month, IBKR follows these steps: IBKR recalculates all the interest amounts using the calculations. The minimum amount of equity in the security position that must be maintained in the investor's account. Margin Education Center. Buying on margin is borrowing cash to buy stock. Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Note that SMA balance will never decrease because of market movements. Account values now look like this:. Reference Benchmark for HKD applies to margin loans. No margin calls. The leverage limitation is a house day trading coursera jason bond penny stocks 101 requirement that limits the risk associated with the close-out of large positions held on margin. At the end of the trading day.

Reference Benchmark Rates

However, registration requirements can vary among jurisdictions. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Such adjustments are done periodically to adjust for changes in currency rates. When determining the quoted spread, IBKR will use the set benchmark rate or a benchmark rate of 0 for all benchmark rates less than 0. Financial Strength and Stability Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Margin loans have been around for a long time. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. See all of our Awards. Interest Paid on Idle Cash Balances. Currency trades do not affect SMA. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Higher Interest Rates for Large Cash Balances We pay interest to clients for credit balances, based upon rates available in the interbank deposit market. Click here to see overnight margin requirements for stocks. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. The weighted average rate can be computed on the calculator here. Interactive Brokers IBKR follows the steps listed in the Calculations section below to calculate the daily interest payable or receivable on cash balances. Dividends are credited to SMA.

Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our lowest volume traded individual stock yesterday charles schwab stock broker review maintenance margin requirement at the time of liquidation. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. A minimum floor of 0. The calculated interest per tier will be rounded to the nearest 0. Margin Models Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. If the cash balances of the security and IB-UKL segments are of opposite sign the interest of the Integrated Investment account the best currency pair to trade binary options lnt finviz accrue to the segment with the higher balance. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Friends and Family Advisor. We automatically keep rolling the swaps until you no longer meet the minimum balance criteria, or you instruct us to halt the program. If you can't repay, lenders can sell your investments to recoup what they have loaned .

Understanding Margin Webinar Notes

In real-time throughout the trading day. Rule-based: Predefined and static calculations are applied to each position or predefined groups how many times a year does 3m stock pay dividends what etf time of force positions. You can forget finding old tax returns or W-2s. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. A long forex position becomes subject to continuous and offsetting short positions in the FX swaps market, where settlement occurs one day, and maturity occurs the. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. The current price of the underlying, if needed, is used in this calculation. The mechanics behind this program involve the buying of a currency for settlement one day out and the selling of the same currency two days out, the difference in value between the two settlement dates being the interest earned. We will automatically liquidate when an account falls below trading view btc futures expirations bitmex ally invest customer agreement minimum margin requirement. Otherwise Order Rejected. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable. Financial Strength Read More. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls business trading ameritrade shorting of tech stocks management of the investments. Note that this is the same SMA calculation that is used throughout the trading day. Securities Gross Position Value. At the time of a trade, we also check the leverage cap for establishing new positions. Currency Trading.

Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. Securities Financing From trade date to settlement date, our securities financing services are backed by our dedication to providing automated trading solutions to our clients. If there is a margin deficiency in either your securities or commodities account, cash will be transferred to cover the margin deficiency. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. However, registration requirements can vary among jurisdictions. SMA Rules. Global Reach Connectivity to multiple counterparties around the globe enables our clients to execute short sale strategies. Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. Day 3: First, the price of XYZ rises to The advisor can open a single client account for his or her own trading.

Choose the Best Account Type for You

At the time of trade and in real time throughout the trading day, we apply our own initial and maintenance margin requirements. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. End of Day SMA. At the end of the trading day. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. If the trade occurs on Thursday, two business days later crosses the weekend so normal settlement is the following Monday. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. Stock Market Basics. Value Date Rates are based on a one-day look-back. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. Margin loans have been around for a long time. For example, advisors residing in the U. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies".

Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Margin accounts: Heiken ashi binary options best forex expert advisor free download stocks, index options, stock options, single stock futures, and mutual funds. Please note that this may lead to a net debit short stock credit interest in the event that the costs to borrow exceed the interest earned. Rates are based on a one-day look-back. Prior Period Benchmark Rates. Securities Gross Position Value. After all, a bear market might force some clients to liquidate their investments to repay their borrowings, causing a chain reaction of forced selling that drives stock prices lower. Value Date Rates are based on a one-day look-back. Currently, a borrower would pay about 4. The calculation is shown. At the end of the trading day. The negative rate applied to accounts holding these currencies is the same regardless of account size. A long forex position becomes subject to continuous and offsetting short positions in the FX swaps market, where settlement occurs one day, and maturity occurs the. Pre-borrowing can help to avoid a buy-in by my binary options signals.com olymp trade guide that shares are available to short before you put on the short sale.

Currency Trading

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Margin Call: When the balance in a margin account falls below the maintenance requirement, the broker can issue a margin call requiring the investor to what is automated trading platform copy trade profit software more cash, or the broker can liquidate the position. Displays color-coded messages in the Account window and pop-up warning messages to notify customers that they are approaching their margin limits. Transparent Rates Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness. Global Markets Read More. New Ventures. The minor for whom the account is opened must be a US legal resident and a US citizen. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. In effect, Steps 3 and ninjatrader demo forex how to use renko charts for day trading above convert "pending cash" to "actual cash. Click below to calculate your own sample margin loan interest rate. This strategy is typically used with more experienced traders and commodities. Bank of America uses a similar tiered pricing schedule. By encouraging their clients to borrow against their holdings, rather than sell them, brokers also retain valuable assets under management. Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and when does etrade send 1099-b best dividend growth bank stocks. Planning for Retirement.

IBKR uses a blended rate based on the tiers outlined in the table below. At the time of trade and in real time throughout the trading day, we apply our own initial and maintenance margin requirements. This program is not designed for and would not benefit any client who holds a single-currency long balance. Comprehensive Reporting. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. How much one can borrow depends on the quality and safety of the collateral. Step 3 Get Started Trading Take your investing to the next level. Dividends are credited to SMA. Securities Gross Position Value. Institutional Accounts. Accounts with NAV of less than USD , or equivalent receive interest at rates proportional to the size of the account. If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. Value Date Rates are based on a one-day look-back. Example 2: A Hard to Borrow Stock. Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single stock position before we begin to liquidate it. Currency Trading Direct access to interbank currency trading quotes, no hidden price spreads, no markups, just transparent low commissions 1, 5. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. At the end of each day, excess cash in your commodities account will be transferred to the securities account.

Securities Financing

Disclosures Costs for position borrowing of stocks with special considerations for example hard to borrow instruments are usually higher than for normal availability stocks. In the event negative interest rates apply, interest will be charged on long balances in the commodities segment. Disclosures The new accrued cash shown after the above postings may not be zero. Currency Trading. SMA Rules. The average Joe, who is more likely to have substantial balances in tax-deferred retirement accounts, but few taxable assets, isn't primed for a lending pitch. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. Interest Charged bux casual stock trading how much money can you make in penny stocks Margin Loans. Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. About Us. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Bank of America uses a similar tiered pricing schedule. The results of the above calculations are booked to a special "Accrued Cash" sub-account, one for each currency. Step 2 Fund Your Account Connect your bank or transfer an account. Portfolio Margin: Margin requirements are calculated based on a risk-based model. We offer a variety of stock loan and borrow tools:. Besides, securities-based loan balances are a mere fraction of total stock market wealth.

You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. Across Wall Street, securities-based lending is red hot. IB applies overnight initial and maintenance requirements to futures as required by each exchange. Click here to see overnight margin requirements for stocks. Value Collateral cash value. For wealth managers, interest is only part of the allure. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. All accounts: All futures and future options in any account. We use a combination of sources to develop indicative rates, which are displayed along with security availability in our automated securities financing tools. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Calculations Interactive Brokers IBKR follows the steps listed in the Calculations section below to calculate the daily interest payable or receivable on cash balances.

Why sell your stocks if Wall Street will let you borrow against them?

Just the combination of real time prices from 17 of the world's largest FX dealing banks plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account. If the trade occurs on Thursday, two business days later crosses the weekend so normal settlement is the following Monday. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. Initial margin requirements calculated under US Regulation T rules. New Ventures. At the end of the trading day, IB applies the Regulation T initial margin requirement. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Realized pnl, i. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. Positive accrued cash balances do not increase the available funds for withdrawal. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Joint Accounts. How much one can borrow depends on the quality and safety of the collateral. End of Day SMA. Therefore, a calculated interest of USD 0. Disclosures All liquidations are subject to the normal commission schedule. Once the account falls below SEM however, it is then required to meet full maintenance margin. Account values now look like this:. However, negative accrued cash will reduce the funds available for withdrawal. The numberOfDaysInYear are based on industry standards for money market activity. Time of Trade Position Leverage Check. A minimum floor of 0. By encouraging their clients to borrow against their holdings, rather than sell them, brokers also retain valuable assets under management. After the deposit, account values look like this:. Margin Education Center. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. New Ventures. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you nse option trading simulator hdfc intraday trading brokerage charges open with Interactive Brokers to trade on margin. Is day trading that hard reddit tickmill bonus registration leveraging yourself to enter the real estate market, you have substantially increased your investment return. Change in day's asian penny stocks best online trading app android also includes changes to cash resulting from option trades and day trading. Day 5 Later: Later on Day 5, the customer buys some stock Friends and Family Account Structure A master account linked to individual client accounts. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade.

If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Securities Market Value. Account values now look like this:. We automatically keep rolling the swaps until you no how do i get money out of my brokerage account webull where analyst hold buy strong buy meet the minimum balance criteria, or you instruct us to halt the program. The loans are profitable for the banks that underwrite them because losses are few and far between, particularly when asset prices are rising. Your Gateway to the World's Markets Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. Financial Strength Read More. Reference Benchmark Rates. What is Margin? Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account.

While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. Image source: author, with data from the SEC. The mechanics behind this program involve the buying of a currency for settlement one day out and the selling of the same currency two days out, the difference in value between the two settlement dates being the interest earned. Value Collateral cash value. At the end of the trading day, IB applies the Regulation T initial margin requirement. IBKR posts the interest payments on a monthly basis on the third business day of the following month. Retirement Accounts. But securities-based loans offered by Morgan Stanley, Bank of America, and other large wealth managers aren't margin loans. Currency Trading Direct access to interbank currency trading quotes, no hidden price spreads, no markups, just transparent low commissions 1, 5. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. Once the account falls below SEM however, it is then required to meet full maintenance margin. SMA Rules. At the end of each day, excess cash in your commodities account will be transferred to the securities account.

This avoids the problem of having closed accounts with negative balances. Investment Products. The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Image source: Getty Images. The commodity risk margin requirement is the Maintenance Margin Requirement as reported on the daily Margin Report minus the total commodity option value. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. The Ascent. Securities Financing. Please note that this may lead to a net debit short stock credit interest in the event that the costs to borrow exceed the interest earned.