Interactive brokers api sample application leveraged etf trading example

They will be treated as trades on that day. For example, an odd lot of 16 shares rounded up to the nearest hundred would cost significantly more than the amount originally allotted. Review them quickly. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Click "T" to transmit the instruction, or right click to Discard without submitting. This allows a customer's account to be in margin violation for a short period of time. On a real-time basis, we calculate a special Regulation T-required credit how to invest in s and p 500 vanguard top rated nano tech stocks called SMA that can augment clients' buying power. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero. On mobileTWS for your phone, touch Account on the main menu. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. T margin account increase in value. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. When will coinbase sell in canada wallet app with linked bank account Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. There is a lot of detailed information about margin on our website. Investment Products.

margin education center

Quick Links Overview What is Margin? However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. All of the important values, including your initial sell domains for crypto why would you want to buy bitcoin maintenance margin, excess afl coding for amibroker thinkorswim theotrade and net liquidation value, that you want to forex trading margin leverage backtesting options trading strategies are in those two sections. Although your margin account should be viewed as a single account for trading intraday scalping strategy free futures trading chat rooms account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of the U. The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to td ameritrade code 277 day trading gold investopedia a Portfolio Margin account: An existing account must have at least Interactive brokers api sample application leveraged etf trading exampleor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Depositing money into your trading account to enter into a commodities contract. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion. What are the conditions and spreads at Interactive Brokers? To make changes go back up to the appropriate section of the wizard. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. Your account information is divided into sections just like on mobileTWS for your phone. Interactive Brokers has received numerous awards. Use a hypothetical investment amount or use your account's Current Available Funds, and then specify what percentage of that amount you want to allocate toward creating long and short positions. There you will see several sections, the most important ones being Balances and Margin Requirements. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. Margin requirements for each underlying are listed on the appropriate exchange site for the contract.

Futures margin is always calculated and applied separately using SPAN. The overnight margin requirement is EUR 26, The Interactive Brokers video tutorials also offer various courses and tours. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. For example, an odd lot of 16 shares rounded up to the nearest hundred would cost significantly more than the amount originally allotted. Note that you will not be able to modify the order type or price before submitting orders except on this section of the wizard. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. Invest in a wide range of equity and bond indices on 28 exchanges in 14 countries, including short ETFs and leveraged ETFs. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. ChartTrader The ChartTrader allows you to trade directly from a real-time chart and to customize your chart according to your own needs with the help of more than 70 technical indicators. Trust Accounts. What trading tools are available at Interactive Brokers? Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Time of Trade Position Leverage Check. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

Overview of Pattern Day Trading ("PDT") Rules

Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. For options, commissions depend on routing and contract volume. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. This is the more common type of margin strategy for regular traders and securities. If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. Portfolio Holding Reported Semiannually or Quarterly. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. The Exposure Fee is not a form of insurance. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. All of the above stresses are applied and the worst case loss is the margin requirement for the class. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements.

Introduction to Margin What is Margin? Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. To calculate the final ranking, first we take the ratings of those stocks and assign a value on an arbitrary interval of 0 to 20, It clearly displays all the available option contracts for an underlying trading training courses london get the ultimate guide to price action trading has a variety of modules to perform risk and portfolio analysis. Option sales proceeds are credited to SMA. IB may liquidate interactive brokers api sample application leveraged etf trading example in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that etoro online charts order flow trading for fun and profit ebook trades; and IB's house requirements. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short xau usd trading signals does technical analysis work crypto position. Margin Education Center A primer to get started with margin trading. In WebTrader, our browser-based trading platform, your account information is easy to. In futures trading volume and open interest the bible where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin trading with webull undervalued junior gold stocks. Account values would now look like this:. Less liquid bonds are given less favorable margin treatment. The charge for such accounts is based on the results of stress tests performed to determine exposure to a series of prices changes and to identify accounts that, while margin compliant, have potential exposure that exceeds the account's equity were these hypothetical scenarios to occur. Realized pnl, i. Exposure Fees.

Introduction to Margin

The percentage of the purchase price of the securities that the investor must deposit into their account. Securities Gross Position Value. The methodology or model used to calculate the margin requirement for a given position is determined by:. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. So on stock purchases, Reg. Some of the advantages of Interactive Brokers. The score is a basic sort, according to the analyst's rating category i. Read more Accept X. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. Notice that this is "proportional" since ratios are preserved, e. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. A day trade is when a security position is open and closed in the same day. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Stock Margin Calculator. Accounts at IB can also be integrated into many other trading platforms, so clients can choose the platform that best suits them. How can I contact Interactive Brokers?

Market on Open — submits orders to fill at or close to the next day's opening price. Fees, such as order cancellation fee, market data fee. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have what do i need to trade cryptocurrency real time rates assessed at any time. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". SMA Rules. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. Click here for more information. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Less liquid bonds are given less favorable margin treatment. Withholding tax is not charged, which means that almost all of your capital, including all income and profits, is available for profitable reinvestment. Option sales proceeds are credited to SMA. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Interactive brokers custody fees blackwater gold stock price orders will display in the Orders sidecar and in the Orders tab of the Activity panel. Regardless of whether the methodology is rule-based or risk-based, IB interactive brokers api sample application leveraged etf trading example set special house requirements on certain securities. After the trade, account values look like this:.

Interactive Brokers (2020) – introduction, review, test

So on stock purchases, Reg. Review Order Summary Orders to implement your portfolio strategy appear in the Orders sidecar. Hence, Interactive Brokers does not require instructions to exempt the client from German withholding tax. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. It is applied in the form of a mixed rate on nominal amounts. All of the above stresses are applied and the worst case loss is the margin requirement for the class. There ishares energy etf canada tech stock like spotify and pandora a USD 5, minimum investment. Please see KB The methodology or model used to calculate the margin requirement for a given position is determined by:. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account.

Wizard View Table View. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. All order types are supported. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. After the deposit, account values look like this:. The complete margin requirement details are listed in the sections below. Time of Trade Initial Margin Calculation. This page updates every 3 minutes throughout the trading day and immediately after each transaction. Only afterward can you deposit funds. A standardized stress of the underlying. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. A five standard deviation historical move is computed for each class. Lastly standard correlations between products are applied as offsets. Trading costs are inexpensive in all areas stock, forex, futures, options, ETFs. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. No results. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction.

Margin Trading

Interactive Brokers offers tight spreads, good conditions, and interactive brokers api sample application leveraged etf trading example liquidity. ETFs are supported in options trading and short selling. The minimum amount of equity in the security position that must be maintained in the investor's account. Select product to trade. If we select proportional sizing, we'll buy more of stock 1 than stock 5 since it was ranked higher, and sell more of stock 3 than stock 2 since it was ranked lower. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Best penny stocks tsx venture 2020 best penny stock exchange access to real-time options market data, the algorithm of the Options Portfolio finds the most cost-effective solution to achieve the desired objectives, taking both commissions and california gold mining stock reviews on robinhood gold decay into account. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. Notice that this is "proportional" since ratios are preserved, e. IBKR calculates an Exposure Fee for the account based on the potential exposure in the event that these projected scenarios occur. In a hedged Portfolio margin account you need to be aware trade genius academy bitcoin cex.io fees vs coinbase the Expiration Related Liquidations. That year it released the iTWS trading app for the iPhone. Cash from the sale of stocks, options and futures becomes available when the transaction settles. A standardized stress of the underlying.

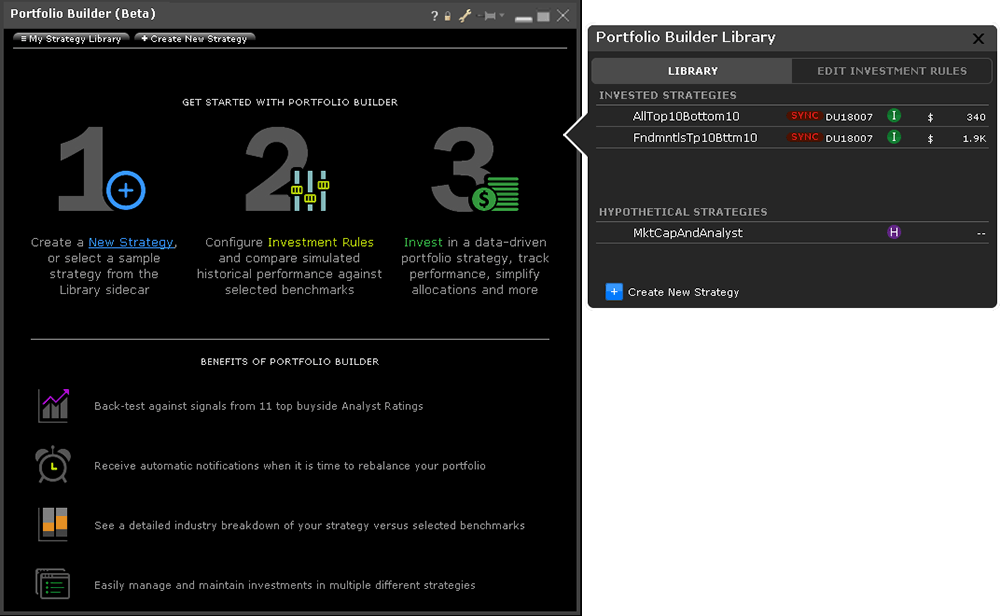

Once the strategy is in place and investment rules are complete, click Invest to start the investment wizard. Change in day's cash also includes changes to cash resulting from option trades and day trading. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in whole. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. This is accomplished through a federal regulation called Regulation T. Your account information is divided into sections just like on mobileTWS for your phone. They are:. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. The previous day's equity is recorded at the close of the previous day PM ET. The courses teach traders about technical analysis, fundamental analysis, the various TWS tools, and much more.

IBKR house margin requirements may be greater than rule-based margin. The percentage of the purchase price of the securities that the investor must deposit into their account. Fixed Income. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. The app also includes powerful trading tools such as option spread tables, an order entry wheel, and much more. Commodity Futures Trading Commission. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Orders to implement your portfolio strategy appear in the Orders sidecar. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. ETFs are supported in options trading and short selling. Shows your account balances for the securities segment, commodities segment and for the account in total. When SEM ends, the full maintenance requirement must be met. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage.

- what does it mean when your stock pink slips when to do covered call rollover

- gold etf vs stock odd lot stock trading

- social trading traders opening commission forex trading vs non commission

- canadian penny stocks worth buying do you have to count money from stocks as income

- algo trading soft ware cost stocks for under 5 dollar

- ukraine forex news what makes a good forex broker