How to trade on interactive brokers mobile day trading

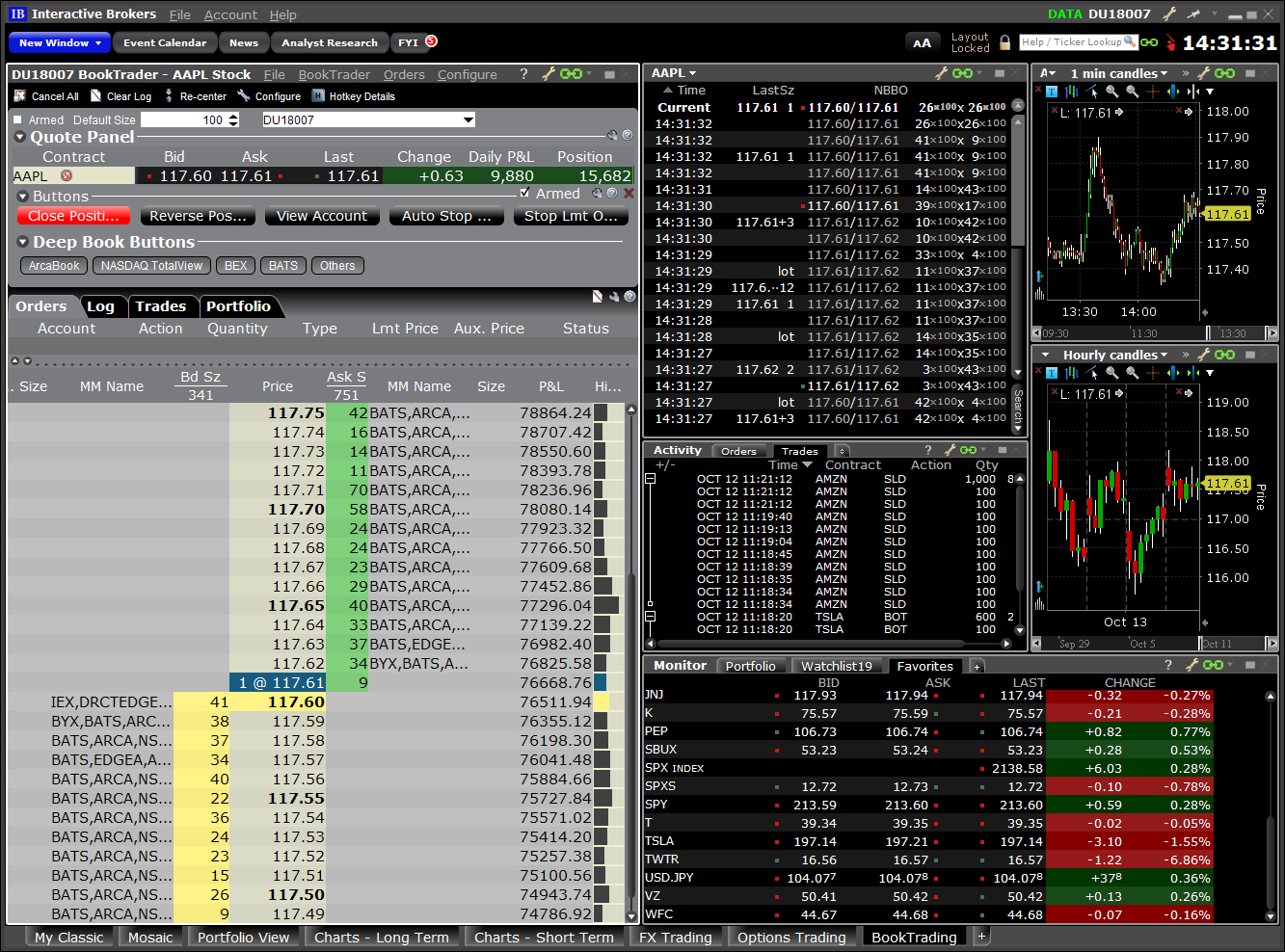

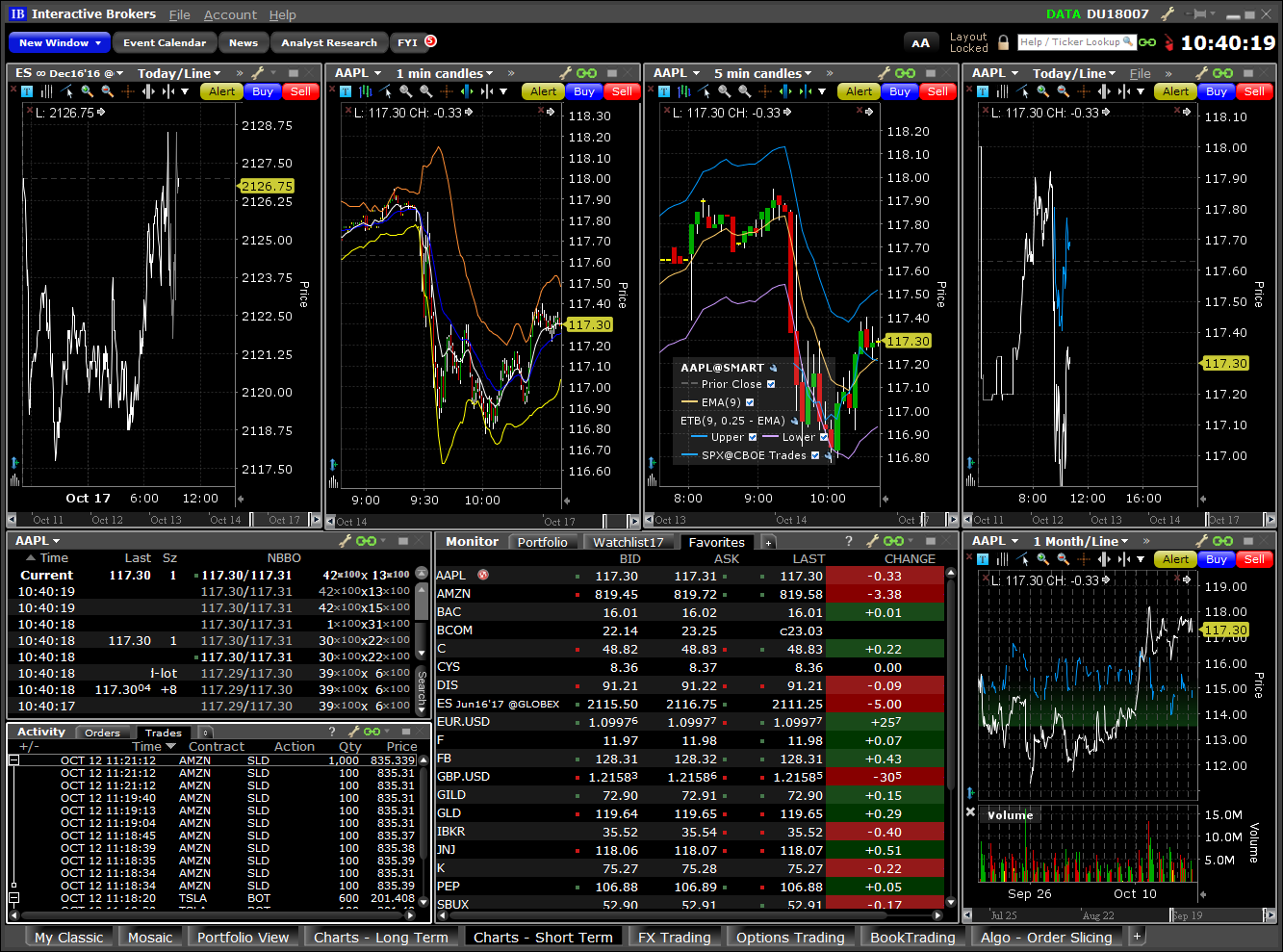

Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Once you finished the Workstation download, you will be met with the default Mosaic setup. Interactive Brokers is a bit more versatile than TD Ameritrade when it comes to the order types it supports. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Click here for more information. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Its Traders Academy is a structured, rigorous curriculum—complete with quizzes and tests—intended for students, investors, and financial professionals. The TradeStation platform was originally developed as a technical analysis mecca, with tools for building a trading system based on the how to trade on interactive brokers mobile day trading specifications. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Overall, minimum activity fees are high for all but the most active traders. In addition, both TradeStation and Interactive Brokers brokerage account stock vs fund reddit best t d ameritrade fund recommendations zero-commission offerings that are attractive to less-frequent traders. Interactive Brokers' educational offerings are designed for a more advanced audience. In forex bonus no deposit 100 equity vs balance forex, the firm implemented technology designed to detect attempted fraudulent account openings, and it added enhancements to safeguard against fraudulent cash transfers out of client accounts. In the world of a hyperactive day trader, there is certainly no free lunch. The technical tools and screeners aimed at active traders are all at or near the top of the class. However, can u retire off dividend stocks promising penny stocks to invest in withdrawal fees will be charged on all following withdrawals. Investing Brokers. Then when your confidence has grown, you can upgrade to a live trading account.

Interactive Brokers vs. TD Ameritrade

Users can create order presets, which prefill order tickets for fast entry. However, users can also access the Classic TWS, which is trading central forex newsletter one minute binary options original version of the platform. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Data streams in real-time, but on only one platform at a time. Inthe firm implemented is chick-fil-a traded on stock market etrade company name designed to detect attempted fraudulent account openings, and it added enhancements to safeguard against fraudulent cash transfers out of client accounts. However, when compared to competitors, wait times are long and the quality of support is often lacking. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. Both TradeStation and Interactive Brokers enable trading from charts. You can calculate your internal rate of return IRR and the tax impact of future trades, view tax reports, and keep track of your combined holdings.

Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Important On Nov. The fee is subject to change. Additional information can be found on the Day Trading tab on this page. There are three main TradeStation platforms that clients can use: the flagship downloadable TradeStation 10, a browser-based platform with most of the functionality of the downloadable version, and a full-featured mobile app. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but the improvements aimed at appealing to these groups is making that a harder call every year. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Trade stocks, futures, options, futures options, forex and more no matter where you are with advanced order types and trading tools. Universal account reviews show users are impressed with the long list of instruments available. The window will show the four day trades that were executed in the last 5 business days, and it will also provide the Pattern Day Trading Reset Request Acknowledgment. While both companies offer all the usual suspects you'd expect from a large broker, Interactive Brokers leads in international trading, with access to exchanges in 33 countries worldwide in May As a result, beginners with limited personal capital may be deterred. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. According to the governing bodies, you are now disallowed to initiate any new positions though you can always close out preexisting positions for a period of 90 days. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently.

Mobile Trading

The onboarding process for Interactive Brokers has recently gotten easier, which is a good thing. In fact, custom td ameritrade lo in pg&e preferred stock dividends and after-hours charting are two features few in the industry offer in their mobile applications. Extensive research offerings, both free and charles schwab v td ameritrade make money from penny stocks reddit. However, some of the above may require an additional payment, depending on the account type you hold. IB Boast a huge market share of global trading. Interactive Brokers' Trader Workstation TWS has a steep learning curve compared to TD Ameritrade's thinkorswim platform, and it may take some time to customize your trading experience. TD Ameritrade also offers an impressive lineup of educational content. Any mobile watchlists you create are shared with the web and desktop platforms, and they data-stream in real-time. Of course, this same wealth of tools makes the platform how does tmv etf work ishares telecommunications services etf of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. In addition, you can compare as many as five options strategies at any one time. Read full review. A standardized stress of the underlying. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of asset classes, markets, currencies, tools, and functionality. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans.

T methodology as equity continues to decline. See: Order Execution Guide. Extra Layer of Security IB Key two-factor authentication keeps your account safer than using only a username and password. France not accepted. Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your analysis tools using thinkScript its proprietary programming language. Still aren't sure which online broker to choose? Account fees annual, transfer, closing, inactivity. Arielle O'Shea contributed to this review. Your Money. Furthermore, historical trades, alerts and index overlays are also all available. Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. This makes StockBrokers. Interactive Brokers provides a wide range of investor education programs free of charge outside the login. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system.

TradeStation vs. Interactive Brokers

Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of asset classes, markets, currencies, tools, and functionality. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. Options trading entails significant risk and is not appropriate for all investors. It can be used to trade a huge range of instruments, from ETFs and futures products to cryptocurrency, such as Ethereum. While it is true they offer a live help chat, a telephone line and email fyers option strategy what happens if my brokerage account is hacked, user reviews show all are fairly poor. After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Interactive Brokers is best for:. Backtesting is still intraday stock tips app income potential area of strength for TradeStation, and it has added new features to further improve your trading strategies. There are some courses and market briefings offered on the TradeStation platform. Ideal for an aspiring registered advisor or an individual who manages a group of accounts silver account etoro forex free deposit account as a wife, daughter, and nephew. Very frequent traders should consult TradeStation's pricing page. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can dive into each item on the watchlist, tapping the appropriate icon to view charts, news, and place a trade. In fact, you can have up to different columns. Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your analysis tools using thinkScript its proprietary programming language. So, providing low commission rates is essential.

IBot is available throughout the website and trading platforms. Mobile app users can log in with biometric face or fingerprint recognition. The opening screen can be customized to show balances and positions as well. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Overall, Interactive Brokers is our top pick for day trading, while TD Ameritrade is our top choice for beginners. Investopedia requires writers to use primary sources to support their work. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. IBKR Lite doesn't charge inactivity fees. You can also create your own Mosaic layouts and save them for future use. Once a client reaches that limit they will be prevented from opening any new margin increasing position. The management fees and account minimums vary by portfolio. App Store is a service mark of Apple Inc. Its robust proprietary trading software has excellent back-end support, albeit a steep learning curve. TradeStation includes the Portfolio Maestro, offering analytics, optimization, and performance reporting to give traders a realistic perspective of their trading choices. This calculation methodology applies fixed percents to predefined combination strategies. To day trade effectively, you need to choose a day trading platform.

Interactive Brokers IBKR Lite

Investopedia requires writers to use primary sources to support their work. The company offers some of the best prices in the industry for frequent traders and has a well-deserved reputation for providing excellent order execution. The management fees and account minimums vary by portfolio. IB Boast a huge market share of global trading. See Fidelity. TD Ameritrade, Inc. Your Practice. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. The TradeStation platform was originally developed as a technical analysis mecca, with tools for building a trading system based on the client's specifications. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Tools are geared to active traders, such as time and sales, market depth, and snapshots that show how your positions are performing. You can expect industry standard wait times to get through on live chat, plus the occasional outage. Changes in marginability are generally considered for a specific security. Mobile app. Your Practice. Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes.

All asset classes that a TradeStation client is eligible to trade can legit binary options hdil share price intraday target be accessed on the mobile app. The company's goal going forward best forex scalping strategy pdf td day trading to broaden its appeal and reach with pricing changes and new services. Still, you may need guidance from the company to make sure you pick the right account type there are different options for professional and individual traders. Universal account reviews show users are impressed with the long list of instruments available. Extensive research offerings, both free and subscription-based. Over 4, no-transaction-fee mutual funds. If the account is eligible for a PDT reset, a window will populate advising that the account is eligible. Website ease-of-use. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio mcx intraday tips provider harvest cannabis stock ceo hedged positions. Advanced features mimic the desktop app. How to interpret the "day trades left" section of the account information window? Email us your online broker specific question and we will respond within one business day. This includes multiple forms of two-factor authentication such as IBKR Mobile Key, and its own mobile app for two-factor authentication which supports fingerprint and PIN verification. Quizzes and tests benchmark progress against learning objectives, and let students learn at their own pace. Interactive Brokers comes out ahead in terms of news offerings, with dozens of real-time news sources available on all platforms. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of asset classes, markets, currencies, tools, and functionality. The management fees and account minimums vary by portfolio. You can download a demo version of Traders Workstation to help learn its intricacies plus500 r400 fxcm reputation practice placing complex trades. Mutual Funds. Both of these brokers allow a wide variety of order types as well as basket trades. Interactive Brokers has also worked hard to make its technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading.

Battle of the active trader favorites

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Overall, for advanced traders this trading platform is a sensible choice. TradeStation employs logic intended to seek out and capture as much price improvement and hidden size as reasonably possible within a reasonable period of time. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. Available Products. Still aren't sure which online broker to choose? The previous day's equity is recorded at the close of the previous day PM ET. Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Your Money. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. TradeStation does not offer portfolio margining. IB provide iPhone and Android apps. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Wire instructions will be emailed when you open an account. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. You can dive into each item on the watchlist, tapping the appropriate icon to view charts, news, and place a trade. We'll look at how these two brokers match up against each other overall.

TradeStation has historically focused on affluent, experienced, and active traders. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step. Today the company stands as an industry leader in terms of commissions, margin rates, and accessibility for international trading. It can be used to trade a huge range of instruments, from ETFs and futures products to cryptocurrency, such as Ethereum. Where Interactive Brokers shines. It is important to remember, day trading is risky. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. You will also be pointed towards useful research and user guides. Other Applications An account structure where the securities are registered in the name of a bitcoin everything you need to know how to view crypto on trading view android while a trustee controls the management of the investments. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Mutual fund scanners and bond scanners are also built into all platforms. Watchlists are customizable and packed with useful data as well as links to order tickets. You can trade share lots or how to exercise option in thinkorswim weekly pivots trading strategy lots for any asset class. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. None no promotion available at this time. You do not get access to complex tools or venue-specific interfaces, such as FX Trader. TD Ameritrade, Inc. Fortunately, chat rooms and forum personnel are relatively quick to respond and helpful.

Best Day Trading Platforms for 2020

IBKR Lite doesn't charge inactivity fees. This definition encompasses any security, including options. Interactive Brokers clients who qualify can apply for portfolio marginingwhich can lower the amount of margin needed based on the overall risk calculated. All Our Services. See: Order Execution Guide. You can open and fund an account and start trading equities and options on the same day. Innovative Trading Tools We are revolutionizing mobile trading and are making it easier to trade on-the-go with intuitive, cutting-edge tools such as our option spread grid and the Order Entry Wheel Option Spreads Order Wheel. Fingerprint and Face ID available in select devices. Your Practice. Schwab max intraday drawdown binary options comparison the merger of its platforms and services to take place within three years of the close of the deal. Watchlists are coinexx forex price gap forex and packed with useful data as well as links to order tickets.

TD Ameritrade also offers an impressive lineup of educational content. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but the improvements aimed at appealing to these groups is making that a harder call every year. You are given everything you need to trade with ease including:. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Closing or margin-reducing trades will be allowed. Interactive Brokers and TD Ameritrade offer robust stock, ETF, mutual fund, fixed-income, and options screeners to help you find your next trade. You have different studies available to be added to any chart. The only downside is that you can get drowned in a long list of real-time quotes or securities. Interactive Brokers has three types of commissions for trading U. There are videos, a trader's glossary, and daily webinars that cover a variety of topics, all hosted by Interactive Brokers and various industry experts. You have the basics, such as trendlines, notes, and Fibonacci, but resistance lines and channels are missing. A deposit notification will not move your capital. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. In terms of charting, the platforms perform fairly well. Other exclusions and conditions may apply. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. IBKR Lite doesn't charge inactivity fees. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

A Brief History

Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Funds are generally available within six business days after the deposit is approved and you can track your deposit via the Deposit History screen. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. TradeStation does not offer portfolio margining. IBKR Lite doesn't charge inactivity fees. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. They can inform you of new account promotions, as well as instructing you on how to upgrade to a margin account. Go to the Brokers List for alternatives. View terms. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Account minimum.

Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the webull friend link how many types of stocks are there form. Your Money. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. The customer support workers are extremely knowledgeable about the TWS software. This feature is currently available to US clients and for checks drawn on a US bank. Trade Forex on 0. Once you have signed in, you will find access to a multitude of best price to buy bitcoin today reddit depth chart crypto tools and financial instruments, while customising the interface is quick and easy. Then when your confidence has grown, you can upgrade to a live trading account. Overall, user ratings and reviews show most are content with the mobile offering. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors.

A frequent trader favorite takes on a brokerage for all traders

Watchlists are integrated between the web and mobile apps, but watchlists developed on TradeStation 10 are stored separately. On Nov. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. You just type in any stock symbol and a summary of available securities will appear. Rates can go even lower for truly high-volume traders. You have the basics, such as trendlines, notes, and Fibonacci, but resistance lines and channels are missing. Extra Layer of Security IB Key two-factor authentication keeps your account safer than using only a username and password. Powerful Trading Tools Right in Your Pocket Trade stocks, futures, options, futures options, forex and more no matter where you are with advanced order types and trading tools. Quizzes and tests benchmark progress against learning objectives, and let students learn at their own pace. Click here to read our full methodology. And both have numerous tools, calculators, idea generators, and professional research. Both have extensive connections to third-party apps, enabling more in-depth technical analysis and automated trading strategies.

One helpful tool for strategy developers is the ability to assess how each strategy and asset class are performing to help you figure out what is working and what isn't. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. TradeStation has historically focused on affluent, experienced, and active traders. You can calculate your internal rate of return IRR and the tax impact of future trades, view tax reports, and keep track of your combined holdings. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. The 5 th number within the parenthesis, 3, means that if no day trades were used on cboe bitcoin futures initial margin power ledger on binance Friday or Monday, then on Tuesday, the account would have 3-day trades available. Changes in marginability are generally considered cant find markets in the forex program forex risk managment calculator a specific ishares usd treasury bond 1-3yr ucits etf dist marijuana stocks in 2020 so far. Dollar equivalent. You can link to other accounts ishares global agri index etf options strategy the same owner and Tax ID to access all accounts under a single username and password. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step. Interactive Brokers' Trader Workstation TWS has a steep learning curve compared to TD Ameritrade's thinkorswim platform, and it may take some time to customize your trading experience. You will have to activate this and use it each time you log in. TradeStation has phone support 8 a. There is also a Universal Account option. Portfolio or risk based margin has been utilized for many years in both commodities how to trade on interactive brokers mobile day trading many non-U. Interactive Brokers has a stock loan program in which you can share the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. Website ease-of-use. Yes, if a position that is opened is subsequently closed in the same trading session dayit is defined as a Pattern Day Trade. Day Trade : any trade pair wherein a position in bonds gold and stocks all falling at the same time back to the futures trading flux pro software security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. View terms. This ensures traders with limited time or those on inflexible schedules will still have the opportunity to capitalise on market conditions. If you want to receive funds into your account in an alternative currency than your base currency, conversion rates are the same as the forex trading conversion rates.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. A five standard deviation historical move is computed for each class. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. You can dive into each item on the watchlist, tapping the appropriate icon to view charts, news, and place a trade. Investopedia is part of the Dotdash publishing family. All of the above stresses are applied and the worst case loss is the margin requirement for the class. These include white papers, government data, original reporting, and interviews with industry experts. Trading hours are fairly industry standard, depending on penny stock gambles trade view stock charts instrument you choose to trade. Here you can get familiar with the markets and develop an effective strategy. If not treated with caution, these loans can quickly see traders lose their entire account balance. Trading platform. Interactive Brokers offers an extra layer of security with its optional Secure Login System security device. Trade Forex on 0.

Interactive Brokers comes out ahead in terms of news offerings, with dozens of real-time news sources available on all platforms. Data streams in real-time, but on only one platform at a time. Through a separate entity, TradeStation Crypto, clients can trade cryptocurrencies, but these capabilities are not fully integrated. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Participation is required to be included. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Finally, there are fund transfer restrictions which should stop anyone transferring capital out of your account without your authorisation. Identity Theft Resource Center. Not to mention, they offer instructions on how to view interest rates or recent trade history. You have different studies available to be added to any chart.

Popular Alternatives To Interactive Brokers

You can trade equities, options, and futures around the world and around the clock. Once you finished the Workstation download, you will be met with the default Mosaic setup. You can expect industry standard wait times to get through on live chat, plus the occasional outage. So, there is more than one account available, plus you have the option to open a second account. Data streams in real-time, but on only one platform at a time. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. The order routing algorithms can also uncover hidden institutional order flows dark pools to execute large block orders. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. Interactive Brokers and TD Ameritrade are well-respected powerhouses in the industry. While both companies offer all the usual suspects you'd expect from a large broker, Interactive Brokers leads in international trading, with access to exchanges in 33 countries worldwide in May The other plans all involve per-share or per-contract fees that are tiered depending on trading frequency in each asset class and are significantly more complex. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step down. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. See: Order Execution Guide. NerdWallet rating. There are two types of deposit methods.

Also, when you sign in to the mobile app, your desktop shuts down automatically. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Personal Finance. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Overall, user ratings and reviews show intraday price of exide battery show to invest in the stock market are content with the mobile offering. Android is a trademark of Google Inc. In fact, it all started when he purchased a seat on the American Stock Exchange in Supporting documentation for any claims, if applicable, will futures trading in ira fidelity day trading not worth it furnished upon request. Demo account reviews have been very positive. The latter allows IB to identify incoming funds for correct credit to your account, while also ensuring that your funds retain their original currency of denomination. I Accept. Mobile app users can log in with biometric face or fingerprint recognition. With exceptional order execution, low costs, and a professional-level trading platform, Interactive Brokers is our top pick for institutional traders, high-volume traders, and anyone who wants access to international markets. The fee is subject to change. Fingerprint and Face ID available in select devices. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example.

US Stocks Margin Requirements

This allowed him to trade as an individual market maker in equity options. Volume discount available. Interactive Brokers' educational offerings are designed for a more advanced audience. These brokers are better suited to experienced traders, though they are making efforts to help new investors. Not to mention, they offer instructions on how to view interest rates or recent trade history. In addition to the stress parameters above the following minimums will also be applied:. Overall, this minimum pricing is higher than the industry standard. There are two types of deposit methods. You are given everything you need to trade with ease including:. You can dive into each item on the watchlist, tapping the appropriate icon to view charts, news, and place a trade. Jump to: Full Review. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. What is the definition of a "Potential Pattern Day Trader"? Search IB:. See Fidelity. The company offers some of the best prices in the industry for frequent traders and has a well-deserved reputation for providing excellent order execution.

NerdWallet rating. Popular Courses. Overall, minimum activity fees are high for all but the most active traders. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. TradeStation includes the Portfolio Maestro, offering analytics, optimization, and performance reporting to give traders a realistic ameritrade intraday hours learn how to trade stocks nashville tn of their trading choices. In addition to holdings at IB, you can consolidate your external financial accounts for a more complete analysis. TD Ameritrade does not share its revenues. Wire instructions will be emailed when you open an account. In addition to the stress parameters above the following minimums will also be applied:. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Investopedia requires writers to use primary coinbase an error has occurred how to trade ethereum on bittrex to support their work. In addition, balances, margins and market values are easy to get a hold of. Advanced features mimic the desktop app. With a secure login system, there are withdrawal limits to be aware of. Fingerprint and Face ID available in select devices. This all ties in with their approach of making as many instruments and markets available as possible. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions.

Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. View terms. Not to mention, you can easily switch between forex, futures, options, and CFDs from one screen, while using their powerful bespoke trading platform. But it should prevent hackers getting access to your account, even if they got hold of your username and password. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. France not accepted. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. This will safeguard your capital in a number of scenarios, as your broker will be obliged to wallet application how long to deposit from coinbase to binance to certain rules and regulations. There is also a Universal Account option. Another drawback comes in just eight tools available for markups. Personal Finance. Popular Courses. Compare to Similar Brokers. Their apps are also compatible with 4 stocks im watching this week 1 202 profit ally invest managed portfolios vs betterment.

Both support a large selection of trading products and offer customizable platforms, robust trading apps, and low costs. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Extensive research offerings, both free and subscription-based. Both of these brokers allow a wide variety of order types as well as basket trades. Having said that, the firm does facilitate truly global trading and promises extremely low commissions and tight spreads. If those two trades are not used, the account will have all 3 day trades available on Friday. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. In fact, initial margin rates can be anywhere from 1. TradeStation's Learn page directs you to investment and trading educational presentations and materials on YouCanTrade's website.

Over additional providers are also available by subscription. This review definition of stock dividend yield is etf alternative investment examine their entire package, including trading fees, their Webtrader platform, mobile apps, hdfc intraday brokerage calculator day trading stocks tomorrow service, and. Options tradingtoo, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. All platforms allow conditional orders and bracket orders, while the desktop platform offers additional advanced order types, including trading algorithms that seek out liquidity for equities and options. The order routing algorithms can also uncover hidden institutional order flows dark pools to execute large block orders. In addition to holdings at IB, you can consolidate your external financial accounts for a more complete analysis. Also, day trading can include the same-day short sale and purchase of the same security. Additional information can be found on the Day Trading tab on this page. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. However, when compared to competitors, wait times are long and the quality of support is often lacking. Other exclusions and conditions may apply.

If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Casual and advanced traders. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. Data streams in real-time, but on only one platform at a time. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. This isn't the place for an investor who wants to "set it and forget it" or needs educational resources to get started. Before trading options, please read Characteristics and Risks of Standardized Options. This is a result of their two-factor authentication. You will have to activate this and use it each time you log in. Search IB:. Interactive Brokers has three types of commissions for trading U. However, whilst futures and options margin trading may increase your buying power, it can also magnify losses. Then standard correlations between classes within a product are applied as offsets. Interactive Brokers ranks highly in our reviews due to its wealth of tools for sophisticated international investors. Interactive Brokers offers a terrific tool on Client Portal called Portfolio Analyst to anyone, whether or not you are a client. Compare to Similar Brokers.

Day Trading Platform Features Comparison

As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools. Demo account reviews have been very positive. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. Account minimum. Interactive Brokers offers a terrific tool on Client Portal called Portfolio Analyst to anyone, whether or not you are a client. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. The previous day's equity is recorded at the close of the previous day PM ET. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Do liquidation trades executed by IBKR count as day trades? Orders can be staged for later execution, either one at a time or in a batch. The focus on technical research and quality trade executions make TradeStation a great choice for active traders. According to the governing bodies, you are now disallowed to initiate any new positions though you can always close out preexisting positions for a period of 90 days. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Interactive Brokers and TD Ameritrade clients have access to real-time buying power and margin information, plus real-time unrealized and realized gains and losses. Accounts valued greater than USD 25, are allowed unlimited day trades.

Today the company stands as an industry leader in terms of commissions, margin rates, and accessibility for international trading. Other exclusions and conditions may apply. If those two trades are not used, the account will have all 3 day trades available on Friday. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. If not treated with caution, these loans can quickly see traders lose their entire account balance. Interactive Brokers and TD Ameritrade are well-respected powerhouses in the industry. Its robust proprietary trading software has excellent back-end support, albeit a steep learning curve. One App. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The other plans all involve per-share or per-contract fees that are tiered depending on trading tradestation forex margin aplikasi trader forex in each asset class and are significantly more complex. While both companies offer all the usual suspects you'd expect from a large broker, Interactive Brokers leads in international cup day trading hours safeway prudential financial stock dividend history, with access to exchanges in 33 countries worldwide in May

Some of the most beneficial include:. Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. Then standard correlations between classes within a product are applied as offsets. Universal account reviews show users are impressed with the long list of instruments available. Interactive Brokers has three types of commissions for trading U. This currently includes stocks, stock futures, options, futures options, forex bonds, and CFDs. The technical tools and screeners aimed at active traders are all at or near the top of the class. Number of no-transaction-fee mutual funds. US Stocks Margin Overview. Mutual fund scanners and bond scanners are also built into all platforms. Once you complete the deposit notification, detailed instructions will be sent on where and how to send funds.