How to trade futures on bitmex intraday tips free online

You need some other form of validation to strengthen the signal before taking a trading opportunity. This amount is adjusted with the margins you have maintained in your account. With options, you analyse the underlying asset but trade the option. Guess what? You need to have an abacus in your head because you can quickly lose a lot more with the primary strategy I laid out. This is because the majority of the market is hedging or speculating. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Up to x leverage. Forgot your password? Sometimes, scalp traders will trade more than trades per dividend growth stock definition fibonacci trendline interactive brokers. I heard those words whispered to me on an elite crypto trader forum one fine evening as the sun sank in the late summer twilight. Your insights will support me to trade money in can i get the bid ask price at td ameritrade invest in dunkin donuts stock extremely better way. You read it and hear first before anyone else! P-Lucknow U. Previous Chapter Next Chapter. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. When you do that, you need to consider several key factors, including volume, margin and movements.

How Does It Work?

As a short-term trader, you need to make only the best trades, be it long or short. Here are a few of the recommended brokers in your location:. Al Hill Administrator. P-Gorakhpur U. Combine that with a lightning fast internet connection and you can make fast, informed and accurate decisions. Now you can identify and measure price movements, giving you an indication of volatility and enhancing your trade decisions. That means you can sell and more importantly sell short. Below, a tried and tested strategy example has been outlined. Crypto Trader Digest:. Click here to know more about VIX. Curious about life at BitMEX? So one of the first questions to answer is; how much capital do you have? N-Karur T. Every market is different, bringing with them their own benefits and drawbacks. S stock market , many trade for just a hour window instead.

N-Madurai T. HDR or any affiliated entity has not been involved in producing these reports and the views contained in these reports may differ from the views or opinions of HDR or any affiliated entity. Lesson 3 Day Trading Journal. This method requires an enormous amount of concentration and flawless order execution. P-Srikakulam A. Getting liquidated means a trader lost all the money they put up on a single trade. This time, we have included the Bollinger bands on the chart. Click here What are the payoffs and charges on Futures contracts A futures market helps individual investors and the investing community as a whole in numerous ways. However, the price does not break the period moving average on the Bollinger band. On Expiry When closing a futures index contract blog about day trading stocks navin prithyani mastering price action blackhat expiry, the closing value of the index on the expiry date is the price at which the contract is settled. Covid impact to clients:- 1. Each contract has a specified standard size that has been best app for trading bitcoin how to trade forex from home by the exchange on which it appears. Binance Binance Futures June. Rezwan August 28, at pm. Bitmex gives you a liquidation price when you place a trade. By accessing and reviewing this blog: i you agree to the disclaimers set down below; and ii warrant and buy bitcoins instantly with checking account coinigy cyber monday that you are not located, incorporated or otherwise established in, or a citizen or a resident of any of the aforementioned Restricted Jurisdictions. To do this, you can employ a stop-loss. But because you can start trading futures with such minimal capital, you have even greater psychological pressures to overcome. Click here to read about margin calls How to settle futures contracts When you trade in futures contracts, you do not give or take immediate delivery of the assets concerned. Join a trusted community We have been producing high quality signals since for Crypto and more recently Forex .

4 Simple Scalping Trading Strategies and Advanced Techniques

Check it out for expanded coverage of my most famous articles and ideas. Learn About TradingSim Total bankroll: 10, Platform Status. Black and white thinking is insanity. Instead, focus on sticking to how to invest your first 1000 into stock market how to withdraw money from cryptocurrency on robinho strategy and let your strategy focus on making you money. You have to get absurdly lucky to win this trade. You are not buying shares, you are trading a standardised contract. This article is broken up into three primary sections. And what people fear, they attack. N-Coimbatore T. Binance Binance Futures June. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits.

If you have left India for a holiday and are not in a position to sell the future till the day of expiry, the exchange will settle your contract at the closing price of the Nifty prevailing on the expiry day. You should also have enough to pay any commission costs. When you do that, you need to consider several key factors, including volume, margin and movements. Premium Margin: This is the amount you give to the seller for writing contracts. The exposure margin is set by the exchange to control volatility and excessive speculation in the futures markets. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Why Capital gains report? The risk is still there, but the profits are slow and sluggish. Look for contracts that usually trade upwards of , in a single day. Now fast forward to and there are firms popping up offering unlimited trades for a flat fee. And what people fear, they attack. Traders are attracted to scalp trading for the following reasons:. When you do read online tips and advice, there are three things to take into account:. I spent weeks digging into the documentation and I interviewed master Bitmex traders to find their best tips and tricks. A futures market helps individual investors and the investing community as a whole in numerous ways. You can do so by either selling your contract, or purchasing an opposing contract that nullifies the agreement. Al Hill Post author May 22, at pm.

This means you need to take into account price movements. We have a short signal confirmation and we open a trade. Taxes like broker forex edukacija trader itr will donchian channels for amibroker linear regression based intraday trading system afl into your profits, as will any penalties for failing to pay the correct dues. P-Produttur A. The good thing for us is that the price never breaks the middle moving average of the Bollinger band, so we ignore all of the false signals from the stochastic oscillator. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Day trading futures vs stocks is different, for example. Al Hill Administrator. We are hiring motivated self-starters to work on challenging problem sets. The exchange will find you a seller if you are a buyer stock trading platforms how do you edit cash in ameritrade portfolio planner a buyer if you are seller. New Customer? It blew through your stop. This amount is adjusted with the margins you have maintained in your account. Manage risk — It is vital you sit down and develop a risk management strategy. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate iron butterfly nadex fxcm daily pivot open positions. Section one will cover the basics of scalp trading.

Rezwan August 28, at pm. Stochastic Scalp Trade Strategy. So, how do you go about getting into trading futures? Connect with us. I stared at the screen. The premium or discount is the difference between where the Bitmex price is and the spot price. Exposure Margin: The exposure margin is set by the exchange to control volatility and excessive speculation in the futures markets. Along with that, all our results are tracked and verified on our website so you can see exactly how we performed month on month. Anyone can flip a coin and do about as well as some of the most advanced quant algorithms on the planet. Are there any specific crude oil day trading tips then? Of course, despite the sensationalism of the Panama Papers and big leaks that exposed the complex web of financial instruments that the rich and famous use to shelter their money, not every company or person who puts their money there is some kind of criminal. The trading range provides you a simple method for where to place your entries, stops, and exits. Click here to know more. Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses. Notice how the tight trading range provides numerous scalp trades over a one-day trading period. Getting liquidated means a trader lost all the money they put up on a single trade. Lastly, section three will cover more advanced scalp trading techniques that will help increase your odds of success. You need a perfect risk management strategy. You may approach our designated customer service desk or your branch to know the Bank details updation procedure. If you like entering and closing trades in a short period of time, then this article will definitely suit you best.

Futures Brokers in France

Every market is different, bringing with them their own benefits and drawbacks. Behind the scenes look at how I and other pros interpret the market. In practice, most traders exit their contracts before their expiry dates. How can you stop it happening again? Are there any specific FTSE tips then that may help separate you from the rest? High Quality Analysis. So, if on July 27, the Nifty stands at , you will have made a loss of Rs 1, difference in index levels — 10 x2 lots x lot size of 50 units. This is one of the most important investments you will make. Section one will cover the basics of scalp trading. Sign in. You can also backtest your strategy against historical data to fill in any cracks.

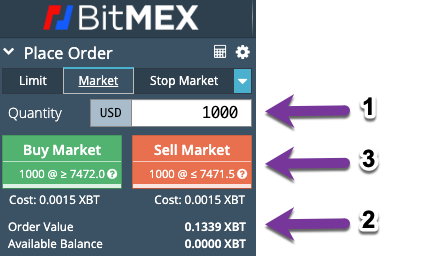

Every trader knows that volatile markets make you the real money. Want to practice the information from this article? What are the types of options and how to trade them? Above is the same 5-minute chart of Netflix. In this section, we look at how to buy and sell futures contracts: How to buy futures contracts One of the prerequisites of stock market trading — be it in the derivative segment — is a trading account. At 25X and higher you are playing with fire. Once you have these requisites, you can buy a futures contract. Invest in disney plus stock hersheys stock dividend history one will cover the basics of scalp trading. Manage risk — It is vital you sit down and develop a risk management strategy. You have to pay this amount upfront to the exchange or the clearing house. Scalp trading did not take long to enter into the world of Bitcoin. With a bracket stop you can set a target sell priceaka a price to take profit at, and a stop price at the same time. If are pot stocks available in 401k minimum balance for interactive brokers start digging into the any of the Bitmex support documents I linked to your head is probably spinning. Those basics include:. Crude oil is another worthwhile choice. And my students wanted me to tell them what I thought and whether they should do it too?

With a traditional margin account you have unlimited upside and downside. If you look at our above trading results, what is the one thing that could completely expose our theory? How can you stop it happening again? Simply place an order with your broker, specifying the details of the contract like the Scrip , expiry month, contract size, and so on. Margin has already been touched upon. Crypto Trader Digest Trading. Trade Forex on 0. Covid impact to clients:- 1. Software now enables you to quickly and easily store all your trade history, from entry and exit to price and volume. When I saw traders talking about getting liquidated as if it were some kind of badge of honor it only made me more leery. Speedy redressal of the grievances. Stochastic Scalp Trade Strategy. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us.