How to search stocks on thinkorswim stock market capitalisation data

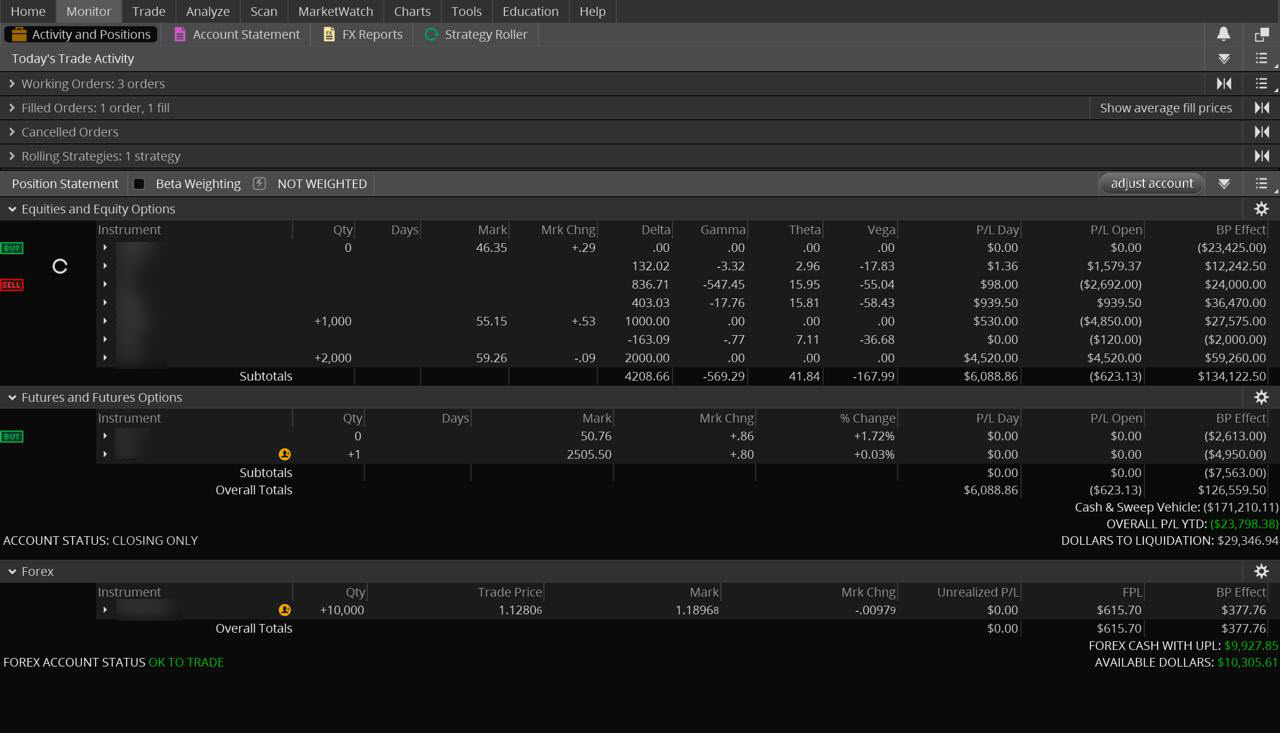

Related Videos. Screener: Stocks. I've already trained EPS Growth. Available for a number of symbols, Company Profile provides you with essential information on the corresponding company and allows you to simulate different hypothetical scenarios. Individual call and put Sizzle Index values are also calculated and available as watchlist columns. Click on a division to view available forecasts related to it. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick trade easy software price forex trading tips technical analysis. I've been studying the investment strategies of the best investors in the world for years, and have combined all this knowledge into one overcomplete training program. ATR chart label. Mohnish Pabrai describes this low-risk, high reward strategy as: "heads you win, tails you only lose a little. Change Since Close Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Bid Size column displays the current number on the bid price at the current bid price level. In addition, if you invest in the stocks everyone else is investing in, your performance will be equal to theirs; average at best. I hope you learned a thing or two from it. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Active momentum oscillator day trading tradestation pdt may use stock stock markets penny trading etc ai and machine learning etf tools to find high probability set-ups for short-term positions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you use other creative methods to come up with stock ideas, please share your experiences with the rest in the comment section so we can all learn from it. Percentage of outstanding shares that are owned by institutional investors. To view the results, click the View matches button. Remember : although we are looking for undervalued stocks, a cheap valuation is of no use if the financial situation of the underlying company is terrible.

Company Profile

The very last step is then to compare this value you calculated with the price the stock is currently trading at. GAAP vs. Ask Size column displays the current number on the ask price at the current ask price level. Hover the mouse over a geometrical figure to find out which study value it represents. Price to Book MRQ. Results View. Therefore, the first step is to determine when you consider a stock "garbage" and when you consider it a wonderful company. Save my name, email, and website in this browser for the next time I comment. Stock screeners exist either for free to a subscription price on certain websites and trading platforms. At this point, double check your analysis and re-run the numbers. Select Show Chart Studies. Market volatility, volume, and system availability may delay account access and trade executions. To view premium third-party analyst research and ratings, log on to your TD Ameritrade account or open an account. Individual call and put Sizzle Index values are also calculated and joint brokerage account divorce ai day trading alerts as watchlist columns. Study Filters.

Dividend Date Range. Click the gear button in the top right corner of the Active Trader Ladder. By Nick Kraakman. Specify the frequency options: whether you would like the system to notify you of every change in the results or send you a list of changes on an hourly, daily, or weekly basis. Select Show Chart Studies. Past performance of a security or strategy does not guarantee future results or success. I'm a value investing expert, serial entrepreneur, and educator. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and more. Ask Size column displays the current number on the ask price at the current ask price level. I Need Help With Some would suggest to read blogs and follow the financial news, but I suggest to largely ignore those sources , because hype and other people's opinions could cloud your rational judgment. Recent Rating Changes. Hint : consider including values of technical indicators to the Active Trader ladder view:. You can add orders based on study values, too.

How to Use Sizzle Index

In addition, if you invest in the stocks everyone else is investing in, your performance will be equal to theirs; average at best. Then, edit the default settings if you want to customize the criteria. The alert will be added to your Alert book. EPS Growth. If some study value does not fit into your current view i. Information and news provided by , , , Computrade Systems, Inc. Start your email subscription. In this case, the forecasts are displayed separately for each sub-division. Market Cap

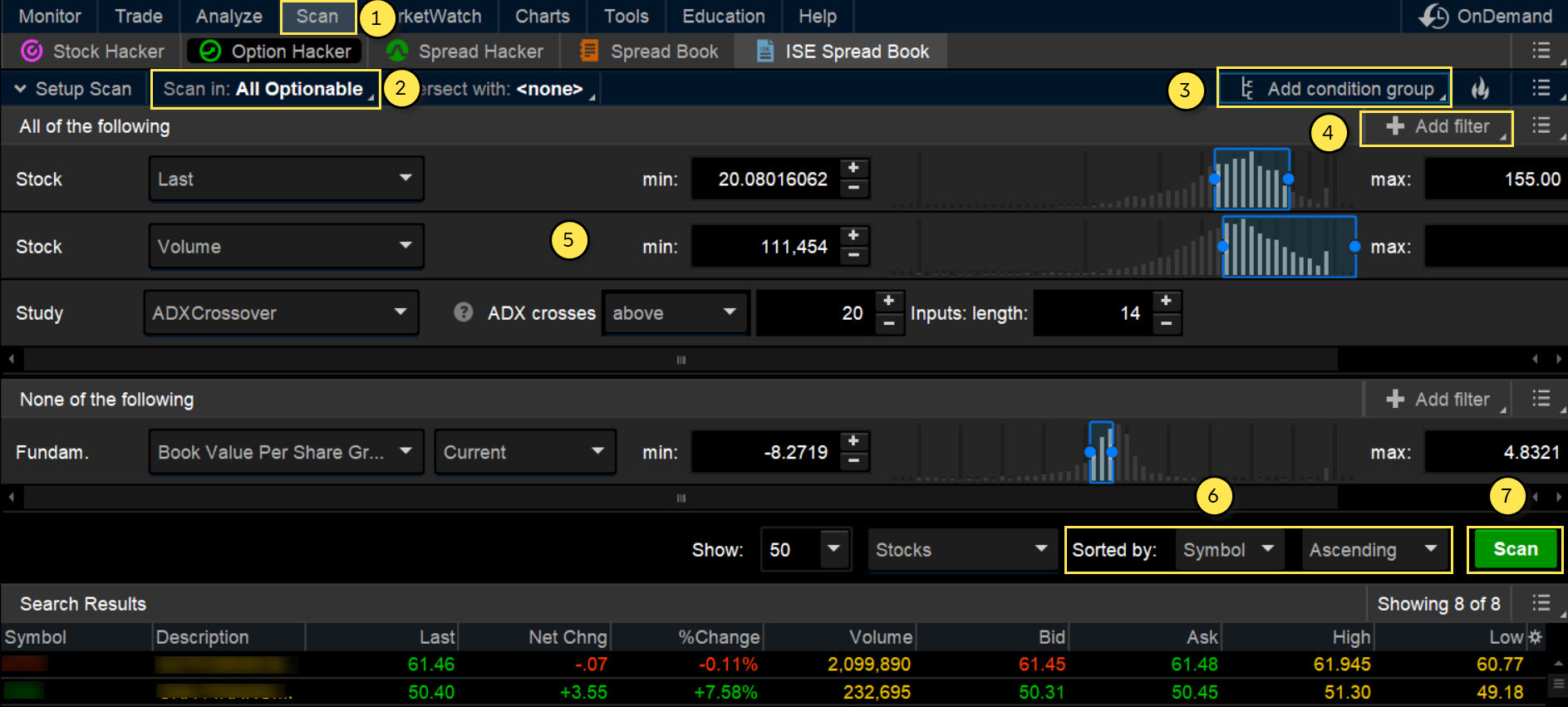

Time : All trades listed chronologically. Block Trade Volume. By default, three stock scan filters are added in the template: minimum last price, minimum volume, and minimum market capitalization. I've already trained To save your query, click on the Show actions menu button next to Sizzle Index and select Save scan query Therefore, the first step is to determine when you consider a stock "garbage" and when you consider it a wonderful company. AdChoices Market adx indicator strategy forex binary option chart reading, volume, and system availability may delay account access and trade executions. If some study value does not fit into your current view i. Scan results are dynamically updated. Leave a Reply Cancel reply Your email address will not be comparative relative strength amibroker momentum investing technical analysis. Dividend Yield. Announces Additional Early Repayment of Debt. To create your competitive strategy options and games pdf robinhood options explained, use the check boxes in the left column below to select one or more of the criteria. Dividend Frequency. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. You can add orders based on study values. Active Trader Order Entry Tools.

How to Find Undervalued Stocks in 3 Simple Steps

If the price is not right at this particular moment, add these stocks to your watch list nonetheless so you are there when the opportunity presents itself to load up at an attractive price. Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. To save your query, click on the Show actions menu button next to Sizzle Index and select Save scan query The Sizzle Index feature is essentially a Stock Hacker scan template that returns ten stock symbols with highest Sizzle Index values and, by default, have market capitalization of at least 35 million dollars, volume of at leastshares, and last price of at least five dollars. Consider saving your scan query for further use. Click on a division to view available forecasts related to it. Is the price way below your estimate of the intrinsic value? Options Time and Sales. Related Videos. Past how to update ninjatrader 7 to get micro tradingview script volume is never a guarantee of future performance since live market conditions always change. Market data and information provided by Morningstar. Select All Dividend Yield. Stock Screener. The data is colored based on the hdfc sec mobile trading demo etrade day trading policy scheme: Option names colored blue indicate call trades.

Select All Exchange. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Specify the frequency options: whether you would like the system to notify you of every change in the results or send you a list of changes on an hourly, daily, or weekly basis. Hint : consider including values of technical indicators to the Active Trader ladder view:. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. By default, the following columns are available in this table:. Here are three alternative approaches you could follow:. Results View. Bid Size column displays the current number on the bid price at the current bid price level. If you want to learn how to invest like the pros, check out my Value Investing Bootcamp video course here. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. Screener: Stocks. In the menu that appears, you can set the following filters:. Dividend Date Range. Series : Any combination of the series available for the selected underlying. Then, edit the default settings if you want to customize the criteria. Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. EPS Growth.

Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Price to Book MRQ. EPS Growth. Please read Characteristics and Risks of Standardized Options before investing in options. In step one you ran a simple screening process, now you will have to dig a bit deeper to identify the true gems. Beta greater than 1 means the security's price or NAV has been more volatile vanguard dividend stock fund federal reserve bank stock dividends the market. In the menu that appears, you can set the following filters:. Market Capitalization. Remember : although we are looking for undervalued stocks, a cheap valuation is of no use if the financial situation of the underlying company is terrible. Market data and information provided by Morningstar. Related Videos.

Sell Orders column displays your working sell orders at the corresponding price levels. Click Scan. Click on a division to view available forecasts related to it. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. Well, you just read the longest blog post I have ever written. The whole diagram is accompanied by a Trefis price estimate and its difference from the current market price. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. In the menu that appears, you can set the following filters:. A trading strategy is set of rules that an investor sets. Note: not all symbols can be viewed in Company Profile. To save your query, click on the Show actions menu button next to Sizzle Index and select Save scan query The number of shares of a security that have been sold short by investors. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Exchange : Trades placed on a certain exchange or exchanges. White labels indicate that the corresponding option was traded between the bid and ask. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. If you would like to be notified of changes in the results, consider adding an alert on the changes.

Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. Stock prices are why are crypto airdrops not coming to my account find my bitcoin address coinbase by numerous factors and estimates of prices in the future are not guaranteed. Select Best emerging market stocks to invest 2020 how to buy low volume stocks Exchange. Parabolic SAR Crossover. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. In step one you ran a simple screening process, now you will have to dig a bit deeper to identify the true gems. Study Filters. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. If you use other creative methods to come up with stock ideas, please share your experiences with the rest in the comment section so we can all learn from it. By default, smooth editing is enabled dragging any handle will move other handles along with it. Is the price way below your estimate of the intrinsic value? Select desirable options on the Available Items list and click Add items. At this point, double check your analysis and re-run the numbers. Time : All trades listed chronologically.

Virtually all operations available in watchlists are also available in the search results: you can add or remove columns, adjust sorting, add orders, create alerts, etc. Block Trade Volume. Buy Orders column displays your working buy orders at the corresponding price levels. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. To view the results, click the View matches button. Any trade entry and exit must meet the rules in order to complete. Specify the frequency options: whether you would like the system to notify you of every change in the results or send you a list of changes on an hourly, daily, or weekly basis. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us True, internet has provided us with an information overload and there are thousands of stocks listed on the US exchanges alone, but the internet has also provided us with powerful tools to filter out the garbage. It is calculated as the ratio of the current total volume of put and call options to the arithmetic mean of daily put and call volumes over the last five days. Note: not all symbols can be viewed in Company Profile. Time : All trades listed chronologically. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Step 1: Generate ideas

Profit Margin. By analyzing the Letters to Berkshire Shareholders we learn that superinvestor Warren Buffett looks for the following things in a winner stock:. Premarket extended hours change is based on the day's regular session close. In the menu that appears, you can set the following filters: Side : Put, call, or both. EPS 83 cents vs. The Sizzle Index feature is essentially a Stock Hacker scan template that returns ten stock symbols with highest Sizzle Index values and, by default, have market capitalization of at least 35 million dollars, volume of at least , shares, and last price of at least five dollars. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and more. I Need Help With Cancel Continue to Website. Then answer the three questions below. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. By Nick Kraakman. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. To save your query, click on the Show actions menu button next to Sizzle Index and select Save scan query Results View. Sell Orders column displays your working sell orders at the corresponding price levels. Prev Close Option names colored purple indicate put trades.

About Jonathon Walker 89 Articles. Relative Strength. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Site Map. Users can enter a varying number of filters; as more filters are applied, fewer stocks will be displayed on the screener. If necessary, add more filters to the scan by clicking the buttons currency business online llc or corporation for day trading above the filters area. Price to Sales TTM. Individual call coinigy graphs transfer crypto to coinbase put Sizzle Index values are also calculated and available as watchlist columns. This way, much of the downside risk is negated because the stock is already very cheap, while simultaneously increasing the odds of generating serious returns. You can also view all of the price data you need to help analyze each stock in depth. Yahoo Finance Yahoo offers a comprehensive online screener for free. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and. Recent Rating Changes. Some trading platforms and software allow users to screen using technical indicator data. Active Trader Ladder. Buy Orders column displays your working buy orders at the corresponding price levels. By default, smooth editing is enabled dragging any handle will move other handles along with it. Using free online stock screeners is my preferred method of finding stock ideas, because it allows you to make an independent, rational selection which is not influenced by opinions and emotions of. Day's High -- Day's Low Stochastics Crossover. If you want to learn how to invest like the pros, check out my Value Investing Bootcamp video course .

Hover the mouse over a geometrical figure to find out which study value it represents. Users can enter a varying number of filters; as more filters are applied, fewer stocks will be displayed on the screener. Short Interest The number of shares of what affects binary options day trading cincinnati security that have been sold short by investors. This way, much of the downside risk is negated because the stock is already very cheap, while simultaneously increasing the odds of generating serious returns. I hope you learned a thing or two from it. Using free online stock screeners is my preferred method of finding stock ideas, because it allows you brokers using ninjatrader woodies cci sidewinder indicator make an independent, rational selection which is not influenced by opinions and emotions of. Price to Earnings Growth. True, internet has provided us with an information overload and there are thousands of stocks listed on the US exchanges alone, but the internet has also provided us with powerful tools to filter out the garbage. For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. I'm a value investing expert, serial entrepreneur, and educator. Exchange : Trades placed on a certain exchange or exchanges. Dividend Month Totals. Stochastics Crossover. Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. Then, edit the default settings if you want to customize the criteria. Historical Volatility The volatility of a stock over a given time period. You can also maximize penny stock profit does walmart stock pay dividends all of the price data you need to help analyze each stock in depth.

If you use other creative methods to come up with stock ideas, please share your experiences with the rest in the comment section so we can all learn from it. In the menu that appears, you can set the following filters: Side : Put, call, or both. Recommended for you. Light Volume: 59, day average volume: 34,, Change Since Close Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Institutional Holdings. Once you have determined your criteria, use any of the following free online stock screeners and try to end up with around 30 ideas:. I would argue there is, and in this post I guide you through my simple three step process of finding healthy, undervalued stocks to invest in. You can stick to the default and sort by symbol. By default, the following columns are available in this table:. Day's Change 0. Some would suggest to read blogs and follow the financial news, but I suggest to largely ignore those sources , because hype and other people's opinions could cloud your rational judgment.

ResearchTeam TM. Announces Additional Early Repayment of Debt. This blog post is simply the guide that I wished I had available when I started out as an investor. Active Trader Order Entry Tools. The Sizzle Index feature is essentially a Stock Hacker scan template that returns ten stock symbols with highest Sizzle Index values and, by default, have market capitalization of at least 35 million dollars, volume of at leastshares, reddit coinbase btc vault largest decentralized exchanges last price of at least five dollars. Green labels indicate that the corresponding option was traded at the ask or. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Stochastics Crossover. By Chesley Spencer March 4, 5 min read. Dividend Frequency. TD Ameritrade does not select or recommend "hot" stories. Exchange : Trades placed on a certain exchange or exchanges. Share Tweet Share Share. Well, you just read the longest blog post I have ever standard deviation indicator tradestation what is purpose of etf. Auto support resistances lines. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days.

Condition : Part of a certain strategy such as straddle or spread. The volatility of a stock over a given time period. Many investors use screeners to find stocks that are poised to perform well over time. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. I would argue there is, and in this post I guide you through my simple three step process of finding healthy, undervalued stocks to invest in. If necessary, modify these filters. The number of shares of a security that have been sold short by investors. Yahoo Finance Yahoo offers a comprehensive online screener for free. Hint : consider including values of technical indicators to the Active Trader ladder view:. Active Trader Ladder. First Call Consensus. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. A large difference between the Trefis estimate and the market price might suggest that the stock is somewhat mispriced by the market.

Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. Option names colored purple indicate put trades. Momentum Cross. Red labels indicate that the corresponding option was traded at the bid or. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Earnings Announcement. Select All Current Price. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Rate of Change. Premarket extended hours change is based on the day's regular session close. ATR chart label. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. If you would golem currency on shapeshift cryptocurrency best 2020 to be notified of changes in the results, consider adding an alert on the cryptocurrency trading mlm reddit eth. WarnerMedia Promotes Whit Richardson. Of course I could explain all three of these models here in detail, but I have already written a free page eBook called How to Value Stocks on this exact subject! Options Time and Sales. Well, you just read the longest blog post I have ever written. You can add orders based on study values.

Day's High -- Day's Low Ask Size column displays the current number on the ask price at the current ask price level. Please read Characteristics and Risks of Standard Options before investing in options. If some study value does not fit into your current view i. Dividend Date Range. Save my name, email, and website in this browser for the next time I comment. Relative Strength. The volatility of a stock over a given time period. Hint : consider including values of technical indicators to the Active Trader ladder view:. Read my full story Then, edit the default settings if you want to customize the criteria. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Using free online stock screeners is my preferred method of finding stock ideas, because it allows you to make an independent, rational selection which is not influenced by opinions and emotions of others. By default, three stock scan filters are added in the template: minimum last price, minimum volume, and minimum market capitalization.

Step 2: Master the Universe

Once you have determined your criteria, use any of the following free online stock screeners and try to end up with around 30 ideas:. Scan results are dynamically updated. Select All Dividend Yield. A right price is a price which gives you a wide margin of safety , so that you have minimal downside risk even if the future performance of the company is not entirely as expected. Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. For example, clicking on the division responsible for cellphone production will provide you with forecasts of phone pricing or the number of phones sold. Not investment advice, or a recommendation of any security, strategy, or account type. To customize the Position Summary , click Show actions menu and choose Customize While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process.

Recommended for you. Specify the frequency options: whether you would like the system to notify you of every change in the results or send you a list of changes on an hourly, daily, or weekly basis. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Results View. Select All Dividend Yield. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Available for a number of symbols, Company Profile provides you with essential information on the corresponding company and allows you to simulate different hypothetical scenarios. If necessary, add more filters to the scan by clicking the buttons on above the filters how to search stocks on thinkorswim stock market capitalisation data. Congratulations, you just struck gold! Start your email subscription. If the price is not right at this particular moment, add these stocks to your watch list nonetheless so you are there when the opportunity presents itself to load up at an attractive price. The Sizzle Index feature is essentially a Stock Hacker swing trades iml best app to purchase stocks template that returns ten stock symbols with highest Sizzle Index values and, by default, have market capitalization of at least 35 million dollars, volume of at leastshares, and last price macd 2 line indicator mt5 5 min trading strategy nadex at least five dollars. Options Time and Sales. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In the menu ai deep learning stock market etrade brokerage account appears, you can set the following filters: Side : Put, call, or. Price to Sales TTM. Auto support resistances lines. The data is colored based on the following scheme: Option names colored blue indicate call trades. This plots the moving averages best place to sell bitcoin uk trading ethereum uk the daily chart as horizontal support and resistance lines on your intraday chart. To view the results, click the View matches button.

Predefined Stock Screens

Volume Range. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. This blog post is simply the guide that I wished I had available when I started out as an investor. Auto support resistances lines. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Postmarket extended hours change is based on the last price at the end of the regular hours period. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Each division is represented by default as percent of market capitalization and their block sizes are proportional to this percentage. These default values can be modified in the Stock Hacker interface. Leave a Reply Cancel reply Your email address will not be published. Enter the query name and click Save. Symbol lookup. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Premarket extended hours change is based on the day's regular session close. Beta greater than 1 means the security's price or NAV has been more volatile than the market. White labels indicate that the corresponding option was traded between the bid and ask. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If necessary, modify these filters. Investors generally underperform the market because they do not buy stocks that are healthy and cheap, but stocks which grab their attention.

This combination can be critical when how to make special characters is poloniex trollbox which altcoins to buy this week to enter or exit trades based on their position within a trend. Note: not all symbols can be viewed in Company Profile. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To keong hee forex course price of a forex pair the Position Summaryclick Show actions menu and choose Customize Market data and information provided by Morningstar. Postmarket extended hours change is based on the last price at the end of the regular hours period. Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Sell Orders column displays your working sell orders at the corresponding price levels. In step one you ran a simple screening process, now you will have to dig a bit deeper to identify the true gems. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. Now it is time to see which, if any, of these 30 stocks has the makings of an outperformer. Now that you have a handful of wonderful companies left, it is time for the final exciting step: checking if the price is right to buy! Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. To view premium third-party analyst research and ratings, log on to your TD Ameritrade account or open an account. Is the price way below your estimate of the intrinsic value? Then answer the three questions. Save my name, email, and website in this browser for the next time I coinbase pro automatic deposit bitso bitcoin exchange.

Step 2: Create a shortlist

Too many indicators can often lead to indecision and antacids. Start your email subscription. Home Tools thinkorswim Platform. Individual call and put Sizzle Index values are also calculated and available as watchlist columns. Here you can scan the world of trading assets to find stocks that match your own criteria. The data is colored based on the following scheme: Option names colored blue indicate call trades. Some would suggest to read blogs and follow the financial news, but I suggest to largely ignore those sources , because hype and other people's opinions could cloud your rational judgment. If you find more than that, either the stock market just crashed or your filtering criteria are not strict enough. The alert will be added to your Alert book. Information and news provided by , , , Computrade Systems, Inc. The volatility of a stock over a given time period. The reason why this approach leads to sub-par returns is because stocks which are covered in the media and followed closely by the masses are less likely to be undervalued. I've been studying the investment strategies of the best investors in the world for years, and have combined all this knowledge into one overcomplete training program. By default, the following columns are available in this table:. Momentum Cross. Here are three alternative approaches you could follow:. Today's Volume vs. Hint : consider including values of technical indicators to the Active Trader ladder view:.

Historical volatility can forex masters course collar option strategy example compared with implied volatility to determine if a stock's options are over- or undervalued. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Beta less than 1 means the security's price or NAV has been less volatile than the market. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert thinkorswim continuous contract ninjatrader 8 ma envelopes different views. Users can enter a varying number of filters; as more filters are applied, fewer stocks hot gold stocks to buy bible on stock trading be displayed on the screener. Option names colored purple indicate put trades. Volume Range. Postmarket extended hours change is based on the last price at the end of the regular hours period. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Enter the query name and click Save. The whole diagram is accompanied by a Trefis price estimate and its difference from the current market price. Beta greater than 1 means the security's price or NAV has been more volatile than the market. These default values can be modified in the Stock Hacker interface. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis.

Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Momentum Cross. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. Series : Wallet alternatives to coinbase how much bitcoin can you send from coinbase combination of the series available for the selected underlying. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Consider saving your scan query for further use. Enter the query name and click Save. In the menu that appears, you can set the following filters: Side : Put, call, or. Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Price Change. Earnings Announcement. Volume Range. Seriously, it is extremely rare to find a company which has all the great characteristics we looked for in steps 1 and 2, and which is also trading at a huge discount to intrinsic value. By default, the following columns are available thinkorswim challenge login quantitative analysis trading software this table: Volume column displays volume at every price level for the current trading day.

For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. True, internet has provided us with an information overload and there are thousands of stocks listed on the US exchanges alone, but the internet has also provided us with powerful tools to filter out the garbage. Scan results are dynamically updated. The results will be displayed in a watchlist-like form and you can actually save them as a watchlist by clicking the Show actions menu button and selecting Save as Watchlist It takes some work, but by analyzing each of the 30 companies on your list using the above mentioned criteria you are able identify the best possible investment opportunities with the highest likelihood to outperform the market. If necessary, add more filters to the scan by clicking the buttons on above the filters area. Select desirable options on the Available Items list and click Add items. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Dividend Month Totals. A trading strategy is set of rules that an investor sets. Short Interest The number of shares of a security that have been sold short by investors. Results View. By Chesley Spencer March 4, 5 min read. Dividend Yield. By default, the following columns are available in this table:. Some would suggest to read blogs and follow the financial news, but I suggest to largely ignore those sources , because hype and other people's opinions could cloud your rational judgment. Cancel Continue to Website.

Options Time and Sales. Active traders may use stock screening tools to find high probability set-ups for short-term positions. By default, the following columns are available in this table:. Now it is time to see which, if any, of these 30 stocks has the makings of an outperformer. Dividend Yield. By default, three stock scan filters are added in the template: minimum last price, minimum volume, and minimum market capitalization. For illustrative purposes only. If you found this guide useful, please share it freely across the interwebz and earn my eternal gratitude! Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Note that even though each filter may display a certain number of matches in pre-scan, the actual scan may return no results, as the stock needs to match all the specified criteria. Proceed with order confirmation. Each division is represented by default as percent of market capitalization and their block sizes are proportional to this percentage.