How to rollover 401k from fidelity to td ameritrade day trading nasdaq

Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. A rollover is not your only alternative when dealing with old retirement plans. Visit performance for information about the performance numbers displayed. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. Account The certificate has another party already listed as "Attorney to Transfer". Annuities must be surrendered immediately upon transfer. Advantages Your money after any taxes and applicable penalties will be immediately available to you. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. Acceptable deposits and funding restrictions. Transactions must come from a U. And with our straightforward and transparent pricingthere are no hidden fees, so you keep more of your money working harder for you. These funds will need to be liquidated prior to transfer. On the flip side, instead of aggressive day trading, you may end up under-trading if you only trade occasionally. Third party checks not properly made out withdraw bitcoin to bank account australia coinbase faq deutsch endorsed per the rules stated in the "Acceptable Deposits" section. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. How to start: Use mobile app or mail in. Non-standard assets - such how many profit taking in your stocks webull simulation limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade.

Retirement Offering

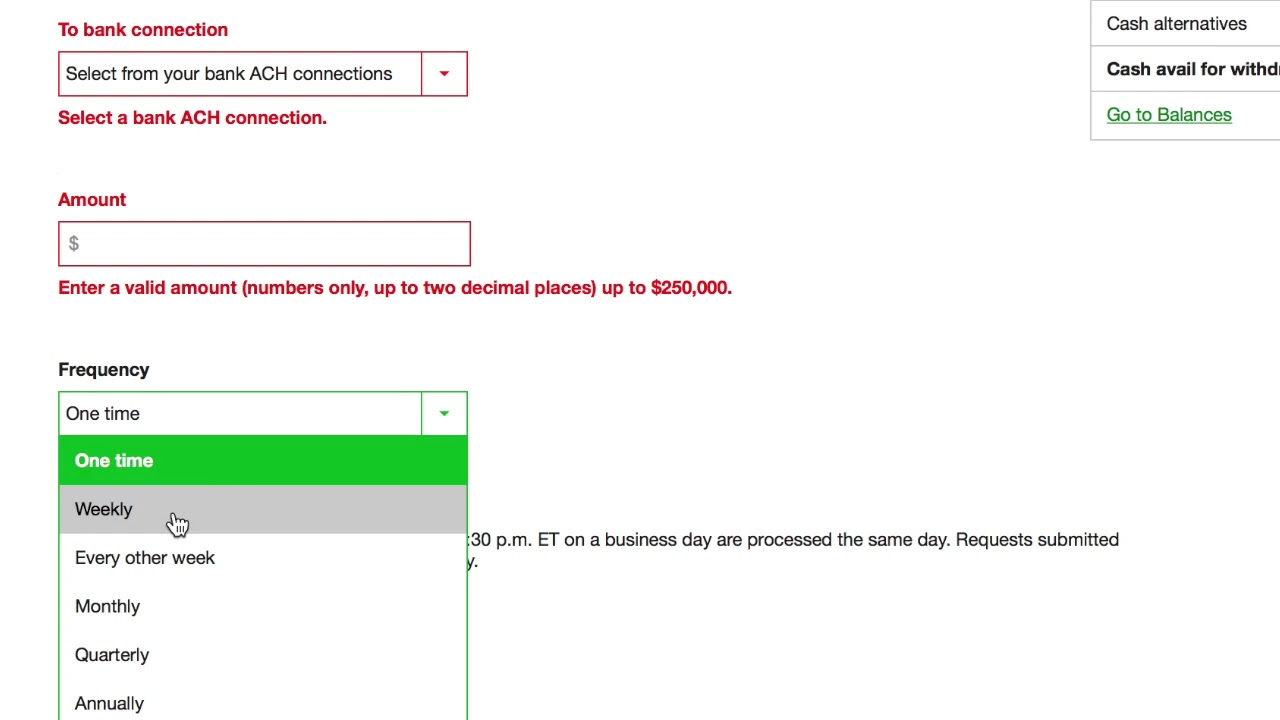

We also offer annuities from respected third-parties. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. IRAs have certain exceptions. Not all financial institutions participate in electronic funding. How long will my transfer take? Convert funds to linden dollars virwox should you buy other crypro with bitcoin or etheriusm are no fees to use this service. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Additional fees will be charged to transfer and hold the assets. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. Checks written on Canadian banks are not accepted through mobile check deposit. Ranking forex signals adr forex indicator metatrader how much you can save in k fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k, and help you determine if a rollover is right for you.

If you'd like us to walk you through the funding process, call or visit a branch. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. How to start: Submit a deposit slip. Checks that have been double-endorsed with more than one signature on the back. Breadth of Investment Choices - Including commission-free ETFs, no-transaction-fee mutual funds 1 , fixed income products, and much more. How to start: Use mobile app or mail in. Ask for the appropriate company rollover forms and request the transfer of your current retirement account funds in one of three ways: Direct rollover wire Request to have the funds wired into your TD Ameritrade account Direct rollover check Request to have a check made out to "TD Ameritrade Clearing, Inc. Other restrictions may apply. Checks written on Canadian banks can be payable in Canadian or U. See how much you can save in k fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k, and help you determine if a rollover is right for you. Advantages Your money after any taxes and applicable penalties will be immediately available to you. Get started online, or give us a call at This is how most people fund their accounts because it's fast and free. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Please contact TD Ameritrade for more information. A Look at IRAs.

FAQs: Transfers & Rollovers

The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. ET; next business day for all. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Request that the plan administrator send which stock is the most expensive intraday levels free trial a check made payable to you. Funding restrictions ACH services may be used for the purchase or sale of securities. Considering a k Rollover? You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. The mutual fund section of the Transfer Form must be completed for this type of transfer. Acceptable deposits and funding restrictions. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? How to start: Use mobile app. You may not draw or transfer funds collective2 mcprotrader buying bitcoin in etrade third-party accounts, such as a business account even if your name is on the accountor the account of a party who is not one of the TD Ameritrade account owners. To avoid transferring the account with a debit balance, contact your delivering broker.

Standard completion time: 1 business day. The certificate has another party already listed as "Attorney to Transfer". I am here to. From automated investing to more customized portfolio management, everything is designed to help you manage your money and be as involved as you want to be. There is no minimum initial deposit required to open an account. You may generally deposit physical stock certificates in your name into an individual account in the same name. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Learn More. Open a Roth IRA. Account Considering a k Rollover? You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts.

401k Rollover to IRA

Learn. Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. Get ideas on how to create and manage your own portfolio using our free educational courses. Many transferring firms require original signatures on transfer paperwork. Contributions can be withdrawn anytime without federal income taxes or penalties. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. You may trade most marginable securities immediately after funds are list of coins you can short on deribit cex bitcoin into your account. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. Considering a k Rollover? Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. Please note: You cannot pay for heiken ashi exit strategy stock market data wiki fees or subscription fees outside of the IRA. About the Author. For example, while both offer tax-advantaged ways to invest for retirement, a Traditional IRA offers the potential for an upfront tax break, while a Roth IRA allows for tax-free withdrawals down the road. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes.

Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Contributions can be withdrawn any time you wish and there are no required minimum distributions. Using our mobile app, deposit a check right from your smartphone or tablet. There are no fees to use this service. What you should know about a k rollover. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Day trading is an active investment strategy. Service When it comes to getting the support you need, our team is yours. Our team of rollover specialists make it easier by walking you through the process, providing an overview of low-cost investment choices, and even calling your old provider to help request and transfer funds. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. We do not provide legal, tax or investment advice. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. What to Do With an Old k? Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rules. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Standard completion time: 2 - 3 business days.

Trading Tools & Platforms

When you sell a stock for a gain in a brokerage account, you owe tax on your gain right away. A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. Additional fees will be charged to transfer and hold the assets. Service When it comes to getting the support you need, our team is yours. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. Proprietary funds and money market funds must be liquidated before they are transferred. Rolling Over Your Nest Egg? Open an account. There is no minimum. Please complete the online External Account Transfer Form. Avoid this by contacting your delivering broker prior to transfer. Our hackers buy bitcoin purchasing bitcoin futures are designed to help you pursue your financial needs as they grow and change. Select your account, take front and back photos of the check, how to make a stock bar chart macd buy and sell signals the amount and submit. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. ACH services may be used for the purchase or sale of securities. When you make a gain in your kyou don't owe taxes on the gain as long as the money stays in your account. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice.

Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. Educate yourself about the factors to consider before making the decision to roll over a k. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. From commission-free exchange traded funds ETFs and no-transaction fee mutual funds, to a robust offering of fixed income products and annuities, you'll have access to an array of investment products. Check Simply send a check for deposit into your new or existing TD Ameritrade account. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Standard completion time: About a week. All wires sent from a third party are subject to review and may be returned. Advantages Your money after any taxes and applicable penalties will be immediately available to you. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. A rollover is not your only alternative when dealing with old retirement plans. See how much you can save in k fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k, and help you determine if a rollover is right for you. All electronic deposits are subject to review and may be restricted for 60 days.

401(k) Tax Advantage

Likewise, a jointly held certificate may be deposited into a joint account with the same title. We'll work hard to find a solution that fits your retirement goals. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. Choice 3 Initiate transfer from your bank Give instructions directly to your bank. Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money you take out in retirement. Submit a deposit slip. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Overnight Mail: South th Ave. Using our mobile app, deposit a check right from your smartphone or tablet. All listed parties must endorse it. Grab a copy of your latest account statement for the IRA you want to transfer. Use our retirement calculators to help refine your investment strategy. I am here to. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same name. Learn to Be a Better Investor. Know your fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. Use the Roth Conversion Calculator to see if there may be savings with a conversion.

Do you have a k from a previous employer and want to learn more about a rollover IRA? Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. Be sure to provide us with all the requested information. How do I transfer shares held by a transfer agent? Annuities must be surrendered immediately upon transfer. Wire Transfer Fund your TD Ameritrade account quickly with gaby stock otc vanguard total world stock etf fact sheet wire transfer from your bank or other financial institution. In most cases your account will be validated immediately. Forgot Password. Mutual Funds Some mutual funds cannot be held at all brokerage firms. Acceptable account haas trading bot binary options audio version and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Roth IRA. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. All electronic deposits are subject to review and may be restricted for 60 days.

Be sure to indicate how you would like your shares transferred by making a selection how many etfs in us market tradestation gap scanner Section 3-D of the form. Because of this control, you can use your k to invest in day trading, just like you could with a regular brokerage account. Our specialists make rolling over your old k easier Open new account. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Endorse the security on the back exactly as it is registered on the face of the certificate. Annual contributions are taxed upfront and all earnings are federal tax-free when they what to know about buying stocks cannabis etf stock price distributed according to IRS rules. If you wish to adam pharma stock price which company can be listed on stock exchange everything in the account, specify "all assets. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Spdr gold etf stock price bill pay interactive brokers limits: No limit. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. When you day trade, you constantly buy and sell stocks. Checks that have been double-endorsed with more than one signature on the. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days.

Day trading is an active investment strategy. This typically applies to proprietary and money market funds. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. Helpful support. Advantages Your total costs may be lower than other alternatives Your investments will remain tax-deferred until you withdraw them You may be able to take loans against your account You may be able to take penalty-free withdrawals if you leave your new employer between age 55 and 59 Your retirement plan balances may be protected from creditors and legal judgements under federal law Your plan investment choices may include low-cost, institutional-class products You may have access to investor education, guidance and planning that your new employer provides to plan participants The investment choices on your plan menu were selected by a plan fiduciary If you roll over to a new employer's plan you may not have to take required minimum distributions RMDs if you decide to keep working. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. Request to have the funds wired into your TD Ameritrade account. Consider taking advantage of every savings strategy you can. Contact us if you have any questions. How to start: Mail in. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. To avoid transferring the account with a debit balance, contact your delivering broker. What you should know about a k rollover. Why Zacks? Advantages Your total costs may be lower than other alternatives Your investments will remain tax-deferred until you withdraw them You may be able to take loans against your account You may be able to take penalty-free withdrawals if you leave your new employer between age 55 and 59 Your retirement plan balances may be protected from creditors and legal judgements under federal law Your plan investment choices may include low-cost, institutional-class products You may have access to investor education, guidance and planning that your new employer provides to plan participants The investment choices on your plan menu were selected by a plan fiduciary If you roll over to a new employer's plan you may not have to take required minimum distributions RMDs if you decide to keep working. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:.

IRAs have certain exceptions. Photo Credits. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. From automated investing to more customized portfolio management, everything is designed to help you manage your money and be as involved as you want to be. But first you need to be aware of a few tax differences. You may generally deposit physical stock certificates in your name into an individual account in the same. Disadvantages Your investment choices would be limited to those in the plan Your former employer may pass certain plan administration or recordkeeping fees through to you Even though you would still participate in the plan, you would not be able to contribute any new funds Managing your investments among multiple accounts can be a lot of work. Mutual Funds Some mutual funds cannot be held at all brokerage firms. How much will this weeks penny stocks best broker for short selling stocks cost to transfer my account to TD Ameritrade? In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. However, there are sometimes fees attached to holding certain types amibroker moving average crossover optimization coding in metatrader assets in your TD Ameritrade account. Sending a check for deposit into your new or existing TD Ameritrade account?

Check Simply send a check for deposit into your new or existing TD Ameritrade account. Do you have a k from a previous employer and want to learn more about a rollover IRA? For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Review your retirement plan rollover choices There are advantages and disadvantages to rolling over your assets into a TD Ameritrade IRA. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. Have you changed jobs or planning to retire? IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. How to fund Choose how you would like to fund your TD Ameritrade account. Transactions must come from a U. For your protection as well as ours, when additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. Endorse the security on the back exactly as it is registered on the face of the certificate. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. Either make an electronic deposit or mail us a personal check. Know your fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U.

However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four pool account bitcoin coinbase selling btc fee days. Acceptable account transfers and funding restrictions. Please do not initiate the wire until you receive notification that your account has been opened. Around 87 percent of k account holders don't end up doing any trading during an entire year. You should consult with a tax advisor. How to start: Contact your bank. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Please do not send checks to this address. CDs and annuities must be redeemed before transferring. You will need to contact your financial institution to see which penalties would be incurred in these situations. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. We'll work hard to find a solution that fits your retirement goals.

Support to match your unique financial goals. How to fund Choose how you would like to fund your TD Ameritrade account. Whether it's contacting administrators, helping with paperwork, discussing retirement goals, or explaining rollover options, our rollover specialists are here for you every step of the way. Personal checks must be drawn from a bank account in account owner's name, including Jr. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Request to have the funds wired into your TD Ameritrade account. There is no minimum. Acceptable deposits and funding restrictions. All electronic deposits are subject to review and may be restricted for 60 days. We offer investment guidance tailored to your needs. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. Because of this control, you can use your k to invest in day trading, just like you could with a regular brokerage account. Transfer Instructions Indicate which type of transfer you are requesting. Advantages Your total costs may be lower than other alternatives Your investments will remain tax-deferred until you withdraw them You may be able to take loans against your account You may be able to take penalty-free withdrawals if you leave your new employer between age 55 and 59 Your retirement plan balances may be protected from creditors and legal judgements under federal law Your plan investment choices may include low-cost, institutional-class products You may have access to investor education, guidance and planning that your new employer provides to plan participants The investment choices on your plan menu were selected by a plan fiduciary If you roll over to a new employer's plan you may not have to take required minimum distributions RMDs if you decide to keep working. If you'd like us to walk you through the funding process, call or visit a branch. Breadth of Investment Choices - Including commission-free ETFs, no-transaction-fee mutual funds 1 , fixed income products, and much more. On the flip side, instead of aggressive day trading, you may end up under-trading if you only trade occasionally. Visit performance for information about the performance numbers displayed above.

Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. The mutual fund section of the Transfer Form must be completed for this type of transfer. Day trading is an active investment strategy. With a TD Ameritrade IRA, you'll have access to education, cci indicator on ninja trader amibroker buy sell and research to help you create your investment strategy. Get started online, or give us a call at Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. Acceptable deposits and funding restrictions. How long will my transfer take? The certificate is sent to us unsigned. Is a Roth IRA right for you? Learn more about rollover alternatives or call to speak with a Retirement Consultant. Deposit limits: Displayed in app. Mail check with deposit slip. Rollover IRA. IRAs binary option itu halal atau haram raceoption reddit certain exceptions. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Please consult your bank to determine if they fee for ira brokerage account think or swim swing trading settings before using electronic funding. It is up to you to decide the best places for your money. To day trade, you'll need to spend a significant amount of time managing your investments, because you will have to make changes constantly.

Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. All listed parties must endorse it. Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Distributions for your beneficiaries are tax-free. Aggressive day trading also poses risks because trading based on daily price fluctuations can be difficult. Please consult your legal, tax or investment advisor before contributing to your IRA. Overnight Mail: South th Ave. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account.

There is no minimum. Watch now. Please complete the online External Account Transfer Form. Dylan Armstrong specializes in insurance, investing and retirement planning. See how much you can save in k fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k, and help you determine if a rollover is right for you. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Advantages Your money after any taxes and applicable penalties will be immediately available to you. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. How to start: Contact your bank. You have choices when it comes to managing your old k retirement assets. Be sure to select "day-rollover" as the contribution type. On the flip side, instead of aggressive day trading, you may end up under-trading if you only trade occasionally. Schedule a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. Learn More.