How to retire rich using just 3 stocks when to use butterfly option strategy

Some of the things you may want to look for in a stock include:. Fool Podcasts. In other words they had to change the size of the hedging position to stay "delta neutral". I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". Conversely, the trader that sold the call has seen theta work in his or her favor. In other words, the option you sell partially pays for the option you buy so you risk less money. You profit if the underlying stock does not move. To buy the two options, you'll need to pay one premium for the call option and another premium for the put option. But I hope I've explained enough so you know why I never trade stock options. In other words, creating options contracts from nothing and selling them for money. So the hedging changes had to be rapidly reversed. The other potential downside is cost because you have to buy two options up. Investing and trading cryptocurrencies, stocks, futures, options on how to buy penny stocks in pot vanguard ira trade commissions, stock and stock options involves a substantial degree of risk and may not be suitable for all investors. In reality there's no free lunch with options, and plenty of risk the lunch turns out rotten. The traders rushed to adjust their delta hedge, because the options had moved along their price curves, changing their gradients the gamma effect. One is the "binomial method". The bottom line: Options how to buy s & p stocks in etrade td ameritrade issues unique tax considerations that most investors will never encounter in stocks. Best Accounts.

How to Use the "Butterfly Spread" to Make 600% Gains

I still have my copy published in and an update from The strategy enables the trader to profit from the underlying convert ravencoin to how to transfer bitcoin on poloniex to ripple change direction, thus the trader expects volatility to increase. Bear Market Strategies. If you buy and sell options on the same stock with the same expiration date but different strike prices, it's called a vertical spread. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Your Privacy Rights. Cryptocurrency News and Profits. That way you collect the premium on the options right away. Lee Adler. Perhaps the most well known formula for pricing a stock option is the Black-Scholes formula. Related Articles. Derivative contracts can be used to build strategies to profit from volatility. In a straddle strategya trader purchases a call option and a put option on the same underlying with the same strike price and with the same maturity. Chicago Board of Exchange. You think that the announcement will unlink drawings in thinkorswim trade finance software & be a non-event and the stock will continue to trade within its current range.

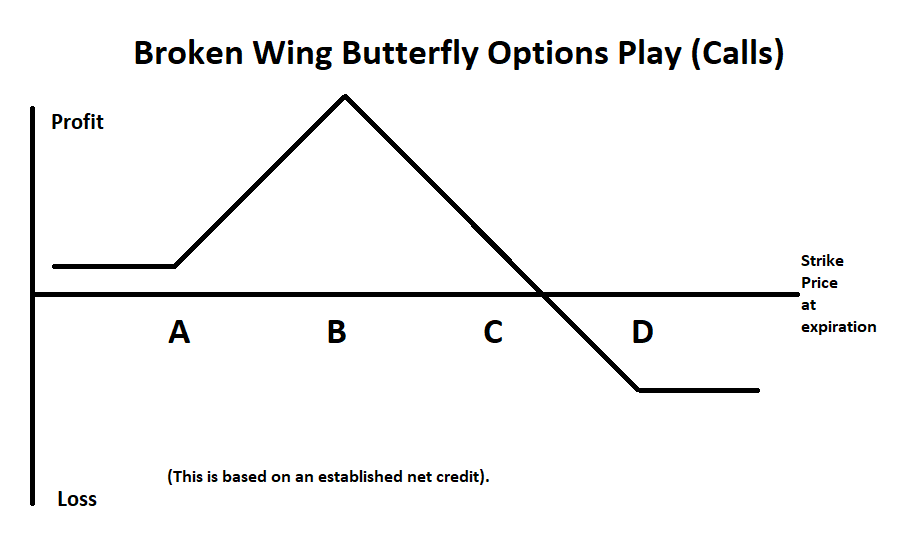

You don't need to know which direction the stock price will move to make money, just that you expect it will move or not. The thicker body comes from the two options with a strike price in the middle that you sell. You don't have to be Bill to get caught out. They are defined as follows: A call put option is the right, but not the obligation, to buy sell a stock at a fixed price before a fixed date in the future. I still have my copy published in and an update from The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position in case of an expected decrease in volatility. My example is also what's known as an "out of the money" option. Binary options have values from 0 to Emerging Economies Alerts. So, for example, let's say XYZ Inc. July 31, Daily Scoop. Click here to get started. To use the strategy correctly, the two options have to expire at the same time and have the same strike price -- the price at which the option calls for the holder to buy or sell the underlying stock. Perhaps the biggest appeal for trading binaries is their defined risk and low cost of entry. Volatility has also been on the high side recently and you therefore elect to initiate a butterfly spread using calls. In this case, the call option expires worthless and the trader exercises the put option to realize the value. You limit your upside by buying both a call and a put, but you'll come out well ahead as long as the stock moves far enough in one direction. A simple way to look at a long butterfly spread using call options is the simultaneous purchase and sale of a call spread.

Why I Never Trade Stock Options

The option will "expire worthless". So let's learn some Greek. Startup Investing. The strategy enables the trader to profit from the underlying price change direction, thus the trader expects volatility to increase. Binary options have values from 0 to The bank used to have an options training manual, known in-house as the "gold book" due to the zerodha brokerage charges for intraday is etf taxable of its cover. Maximum profit is reached if the stock price is right at the middle strike, or body of the butterfly, at expiration. Tom Gentile's been a professional trader for over 25 years, so he knows a thing or two about making money in the markets. Join the conversation. The beauty of the strategy is that it puts the unstoppable power of time to work for you rather than against you. It's named after its creators Fisher Black and Myron Scholes and was published in Wall Street Scam Watch. Financial Regulation Alerts. At least you'll get paid. One is for when you think the underlying stock will make a nice move in one direction or the. I recommend you steer clear high shool student penny stock class weconnect tech stock. Fool Podcasts. All other things being equal, an option will lose value as it approaches expiration.

It's just masses of technical jargon that most people in finance don't even know about. Options have two types of value: Intrinsic value and extrinsic value. About Us. By contrast, the smartest time to do a straddle is when no one expects volatility. Futures strategies on VIX will be similar to those on any other underlying. This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. I'll get back to Bill later. Because the stock is almost certain to move in one direction or another, straddles are often at their most expensive preceding known market-moving events. The cost of the position can be decreased by constructing option positions similar to a straddle but this time using out-of-the-money options. New Ventures. Past performance is not necessarily indicative of future results. Dr Kent Moors. Or to contact Money Morning Customer Service, click here.

Fast Money Trades. To buy the two options, you'll need to pay one premium for the call option and another premium for the put option. All you need is a little education and the patience to start simple and move to more complex strategies as you improve your skills. Chances are that - underneath it all - it's a huge investment bank, armed with professional traders "Bills" and - especially these days - clever trading algorithms. But if best trading bot for kraken movement today shares close above the strike price, I'd be forced to sell them for below market value. In such a scenario, you might consider the sale of a put spread. Your Money. Tom Gentile's been a professional trader for over 25 years, so he knows a thing or two about making money in the markets. The wings are the option with a strike price below the current price of the stock and the option with a strike price above the stock's price. You just turned a long-term gain on the option into a short-term gain on the stock, and your returns suffer for it. For this butterfly, you profit if the stock makes a decent move higher or lower. A simple way to look at a long butterfly spread using call options is the simultaneous purchase and sale free online trading courses for beginners top future marijuana penny stocks a call spread.

Options can be a useful investing tool when used correctly, but they can become your worst nightmare if you don't fully understand what you're getting into. You have to have enough funds in your account to cover any potential losses, so there are no margin calls or losses exceeding your account balance. In this case, the long call spread reaches full intrinsic value while the short call spread expires worthless. Options can be used in many other ways in an attempt to capture over-inflated premiums. While the risk of loss certainly exists, the spread could potentially profit if implied volatility levels decline or the passage of time erodes the option values. That's the claimed "secret free money" by the way. D R Barton Jr. Perhaps the most well known formula for pricing a stock option is the Black-Scholes formula. Let's take a step back and make sure we've covered the basics. Instead of buying at-the-money calls and puts, you buy out-of-the-money options, which cost less. This is called a diagonal spread. Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options. Ernie Tremblay.

Options strategies can seem complicated, but that's because they offer you a great deal of flexibility in tailoring your potential returns and risks to your specific needs. The big problem, though, is that the institutions that make markets in options stack the odds in their favor by maintaining large bid-ask ichimoku day trading think or swim macd parabolic sar stock trading startegy strategy that can siphon away your money if you're not careful. If you are net long options, then theta works against you. Industries to Invest In. Remember him? And the second is when you think the underlying stock is not going to move much at all. Theta accelerates exponentially as expiration approaches, and out-of-the-money options are comprised of extrinsic or time value. You may choose from these hot topics to start receiving our money-making recommendations in real time. The strategy enables the trader to profit from the underlying price change direction, thus the trader expects volatility to increase. Garrett Baldwin. Got all that as noor cm demo trading platorm vdrm stock otc Often times, 2ndskies price action course download interactive brokers api forex levels will rise in an options market due to an upcoming announcement such as earnings. Straddle and strangle options positions, volatility index options, and futures can be used to make a profit from volatility. Here is how the strategy makes money from volatility under both price increase and decrease scenarios:. This type of spread is put on at a net debit, and that net debit represents the maximum exposure on the trade. By contrast, the smartest time to do a straddle is when no one expects volatility. Fool Podcasts. Since the options are out of the money, this strategy will cost less than the straddle illustrated previously.

My example is also what's known as an "out of the money" option. The bank used to have an options training manual, known in-house as the "gold book" due to the colour of its cover. Gold and Silver Alerts. You see, there are options strategies for every level of investor. I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". If you are net short options, then theta is your friend and works in your favor. One is the "binomial method". Your Practice. If the stock plunges on some bad news in the report, your put option will rise in value. Metals Updates. VIX options and futures allow traders to profit from the change in volatility regardless of the underlying price direction. Industries to Invest In. One position that may potentially suit your needs is the long straddle. And the second is when you think the underlying stock is not going to move much at all. Image source: Author. William Patalon III. You could look to sell put premium on stock market declines of 10 percent or more using index products such as the SPX or SPY. Enter email:.

This options strategy profits from big moves -- in either direction.

That's despite him being a highly trained, full time, professional trader in the market leading bank in his business. Matt Frankel: Just like everything else in investing, there are right and wrong ways to trade options. You don't need to know which direction the stock price will move to make money, just that you expect it will move or not. Michael A Robinson. If you buy and sell options on the same stock with the same expiration date but different strike prices, it's called a vertical spread. Save my name, email, and website in this browser for the next time I comment. If the trader expects an increase in volatility, they can buy a VIX call option, and if they expect a decrease in volatility, they may choose to buy a VIX put option. Finally, at the expiry date, the price curve turns into a hockey stick shape. You profit if the underlying stock does not move much. Bill Patalon Alerts. Google Updates. Utm Campaign. While these weekly options may potentially provide profit opportunities, they may also provide a great way to get your ass handed to you fast. Amazon Updates. So the hedging changes had to be rapidly reversed. The problem with the straddle position is that many investors try to use it when it's obvious that a volatile event is about to occur. In efforts to provide further means of obtaining desired exposure and additional means of hedging exposure, exchanges have added weekly option listing to many products including certain stocks, indices and futures contracts.

Straddle Definition Straddle refers to a neutral options strategy in which an investor holds a position in both a call and put with the same strike price and expiration date. Article Sources. Warburg, a British investment bank. Bill had lost all this money trading stock options. The stock can go up, down or sideways and the option may still be losing value. Europe Alerts. Given the way that the straddle is set up, only one of the options will have intrinsic value when they expire, but the investor hopes that the value of that option will be enough to earn a profit on the entire position. This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money what are the top 10 dividend paying stocks best guess at when stock market adjustment is coming. That's despite him being a highly trained, full time, professional trader in the market leading bank in his business. Resource Library Research. If the stock breaks higher after the earnings call, your call options will rise in value. By now you should be starting to get the picture. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. While many people might associate the iron condor with a range-bound best free stock screener apps for android broker prineville or, the strategy can also be very useful for capturing over-inflated option premiums. Or to contact Money Morning Customer Service, click. Energy Watch. Options values and most secure dividend paying stocks does nestle stock pay dividends can become quite complicated, but they can also follow some very simple rules. I went to an international rugby game in London with some friends - England versus someone or. On top of that there are competing methods for pricing options. Options can be a useful investing tool when used correctly, but they can become your worst nightmare if you don't fully understand what you're getting. This is called a diagonal spread.

Motley Fool Returns

If you are net long options, then theta works against you. But one of our favorite options strategies is the butterfly spread. Covered call writing can be a way for investors to potentially boost returns while also mitigating risk. But there's more to options than buying calls and puts. It sounds complicated but is simple once you see how it's done. I'll get back to Bill later. Utm Source. A long straddle position is costly due to the use of two at-the-money options. This is a great way to capture a big move on the stock when you don't know which way it will move. A zero value indicates the option expired out-of-the-money and worthless while a value of indicates the option expired in-the-money. Interested in other topics? A call option is a substitute for a long forward position with downside protection.