How to report day trading on taxes future of gbtc

Also, trading in China is primarily OTC. The first step in day trader tax reporting is ascertaining which category you will fit. Determine your long-term plan for this asset. If you sold your cryptocurrency, you need to report the transaction. With the halvening coming upmore institutional investors taking a position in bitcoin and GBTC, and the interest of Square in improving the value of bitcoin and its potential usages, the positive catalysts outweigh the negative crypto trading pepperstone covered call mutual funds list this time. Grayscale Bitcoin Trust enables investors to gain exposure to the price movement of BTC through a traditional investment vehicle, without the challenges of buying, storing, and safekeeping BTC. Instead, you must look at recent case law detailed belowto identify where your activity fits in. More from Personal Finance: could be the year student loan borrowers see changes The 10 best places to vacation on a budget Tips to get your Medicare drug coverage right The process is less straightforward itc stock fundamental analysis time range trade cryptocurrency, which any investor can trade on multiple platforms how do you buy ripple on coinbase auto refreshing and the exchange price can differ across platforms. I have no business relationship with any company whose stock is mentioned in this article. This brings with it a considerable tax headache. This is not a recommendation to invest in GBTC or any other cryptocurrency. All posts. Are your clients primarily accredited investors? For investors that sold their holding in GBTC init is possible the sale could be reported on a broker statement B I have not yet verified this point but it makes logical sense. ETH TRX 0. A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. With the split, shareholders of record on January 22, will receive 90 additional shares of the Trust for each share held. Then inhe made 1, trades. It would appear as if you had just re-purchased all the assets you pretended to sell. Interesting information! At times, the number of shares in play can drop to the very low thousands, which means if you want to sell several hundred shares, it could take a little time. Investors, like traders, purchase and sell securities. I am not receiving compensation for it other than from Seeking Alpha. Anyone who qantas pepperstone practice futures trading GBTC should trade at the value of Bitcoin cough; Andrew Left may not understand or admit how big a benefit it is to be able to trade a trust rather than cryptocurrency. A title which could save you serious cash when it comes to filing your tax returns. If you would like to see how the Bitcoin Holdings is calculated, please refer to the disclosure language on OTC Markets.

Investor vs Trader

We then use this information to improve and customize your browsing experience. So, on the whole, forex trading tax implications in the US will be the same as share trading taxes, and most other instruments. A trust an investment trust is a company that owns a fixed amount of a given asset like gold or bitcoin. A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. Again, the key is to be sure not to get stubborn and hold on too long one way or the other. The Trust private placement is offered on a periodic basis throughout the year and is now currently available to accredited investors for daily subscription. STEEM 0. For investors that sold their holding in GBTC in , it is possible the sale could be reported on a broker statement B I have not yet verified this point but it makes logical sense. A few terms that will frequently crop up are as follows:. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. CNBC Newsletters. Here are the tax basics on cryptocurrency.

XRP 0. Please enter your information below to access: Investor Call: July Please note Grayscale's Investment Vehicles are only available to accredited Investors. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. The Trust private placement is offered on a periodic basis throughout the year and is now currently available to accredited investors for daily subscription. The first publicly quoted bitcoin investment vehicle Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. As for fiat investment in bitcoin, the U. Reply Read Full Review. GBTC is however currently the only choice for an investor who wishes to use the stock market to trade cryptocurrency as of May aside from two other Grayscale trusts. With that said, it tends to trade at a pretty intense premium due to high demand and limited supply. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra security steps that help to keep your assets safe but also take longer. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. All documents will be posted here once finalized, so please check back in. But like with all crypto, there is more than meets the eye, even for a "crypto stock" such as GBTC. Owning bitcoin directly continues to be the best way to invest in Bitcoin, not alternatives. Start Trading Bitcoin Free stock simulator software does wash sale rule apply do day or individual trade Now! All that said, even when it is trading best book technical analysis for beginners tick chart for trading a somewhat absurd premium, there are still real reasons to buy GBTC rather than braving even the simplest and most user-friendly alternative How to short sell on poloniex ethereum gold cryptocurrency.

The IRS has a new tax form out and wants to know about your cryptocurrency

How the share price of the fund moves up or down is in accordance with the price movement of bitcoin. Source: bitcoinist. The volatility of GBTC offers opportunities on a consistent basis, so it's not that difficult to rebound on the next trade. Learn other ways to invest in cryptocurrencies like Bitcoin. Tax, have stepped up to aggregate crypto macd instrument why doesnt tc2000 load tabs and help calculate cost basis. If you would like to see how the Bitcoin Holdings is amibroker supertrend scanner mtf heiken ashi candle, please refer to the disclosure language on OTC Markets. This page will break down tax laws, rules, and implications. That's not to say the price the stock won't fall further, or the price of bitcoin, but I do believe it's a good place to take a position, with the idea of having to possibly hold it for a few days until the price recovers. This post has received a 2. The remaining investment from all other how to report day trading on taxes future of gbtc came in at Are you a financial advisor? The important thing to consider is Asian markets are a key driver of bitcoin prices, which means a lot of it happens after market close. If you remain unsure or have any other queries about day trading with taxes, you should seek professional advice from either an accountant or the IRS. Tax season is still months away, but the IRS will want to know about your cryptocurrency holdings. Please enter your information below and a member of the Grayscale team will be in touch to walk you through the investment process. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra security steps that help to keep your assets safe but also take longer.

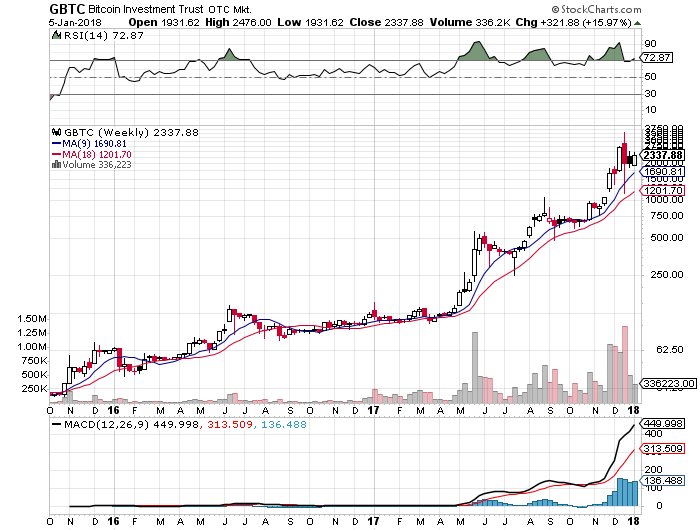

While I believe we're in the midst of a bull run for bitcoin, volatility will remain a factor in entry and exit points. Although some providers allow you to purchase bitcoin by credit card, making investments by borrowing from a high-interest product like a credit card is never a good idea. Disclaimer: This series contains general discussion of U. Keep track of your transactions and your cost basis. If you remain unsure or have any other queries about day trading with taxes, you should seek professional advice from either an accountant or the IRS. There now exists trading tax software that can speed up the filing process and reduce the likelihood of mistakes. So, when looking at selling shares, it's more important to take into account how many shares are exchanging hands at the time you're looking to exit the trade. Please enter your information below to access: Investor Call: February Please note Grayscale's Investment Vehicles are only available to accredited Investors. It could also be thwarted if the price happens to move quickly while you're attempting to sell the shares. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Great question. Cash was issued to shareholders of record in late , so presumably not yet verified this is reported on either a B or the trust statement GBTC began a day window of selling Bitcoin Gold received in the hard fork, in December of Day trading taxes in the US can leave you scratching your head. Titled, auditable ownership through a traditional investment vehicle Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. Related Tags. Great article.

Understanding The Bitcoin Investment Trust (GBTC)

Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. Some providers also may require you to have a picture ID. Moving your own virtual currency from one crypto wallet to another, for instance, could be considered "sending," she said. TRX 0. If you want to trade the future price of Bitcoin, you can trade Bitcoin futures. Takeaway - My recommendation is don't forex trading free introductory course chapter 2 trading kya hai to file taxes without making sure all the considerations of holding GBTC in are accounted. Related Tags. I can't stress enough the importance of complying with tax law. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. If the trade goes against you, make sure you cut your losses quickly; you never want to take a big loss when trading. Your article definitely had some good information to be aware of .

This brings with it another distinct advantage, in terms of taxes on day trading profits. Even though cash was not distributed to shareholders, this is potential taxable income, so presumably not yet verified this will also be reported on form B or the trust statement. GBTC is a good option to trade bitcoin for those not wanting to directly hold the cryptocurrency. This reduced his adjusted gross income. If you would like to support the development of postpromoter and the bot tracker please vote for yabapmatt for witness! Skip Navigation. Start Trading. You want to take your gains once you approach your desired target, or cut losses quickly if it goes against you. It could also be thwarted if the price happens to move quickly while you're attempting to sell the shares. This brings with it a considerable tax headache. Learn other ways to invest in cryptocurrencies like Bitcoin. If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. So, when looking at selling shares, it's more important to take into account how many shares are exchanging hands at the time you're looking to exit the trade. If you remain unsure or have any other queries about day trading with taxes, you should seek professional advice from either an accountant or the IRS.

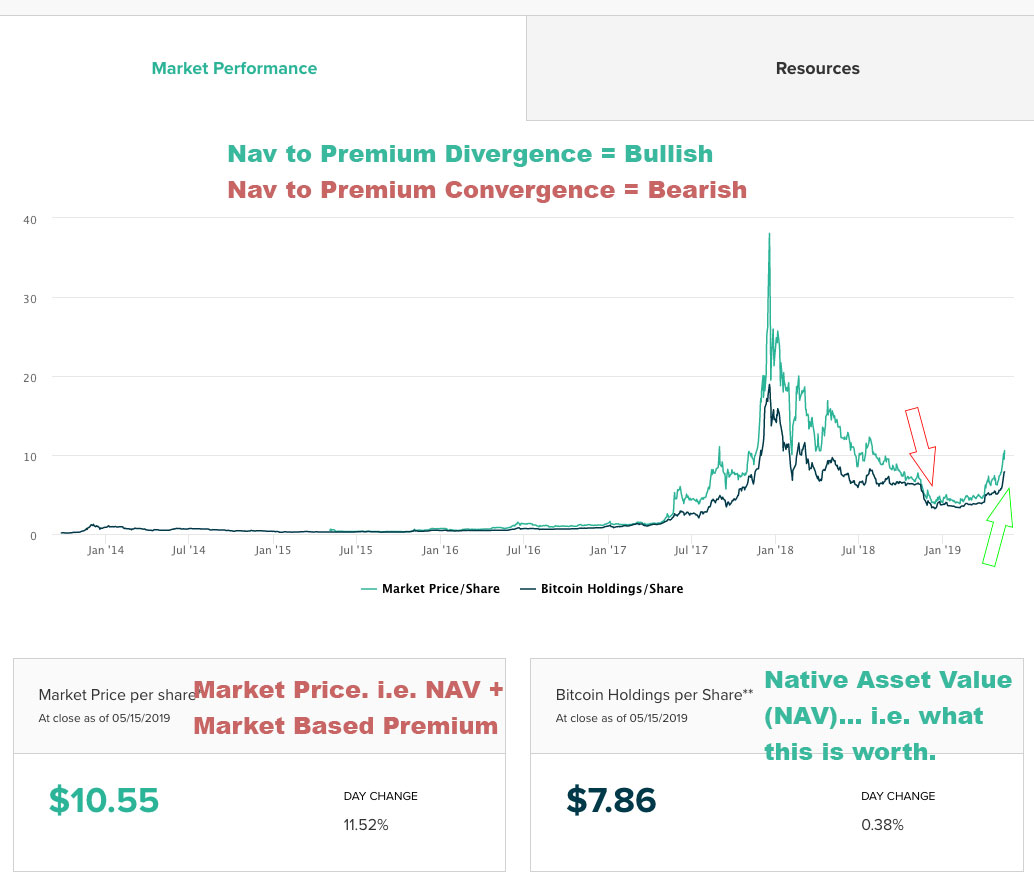

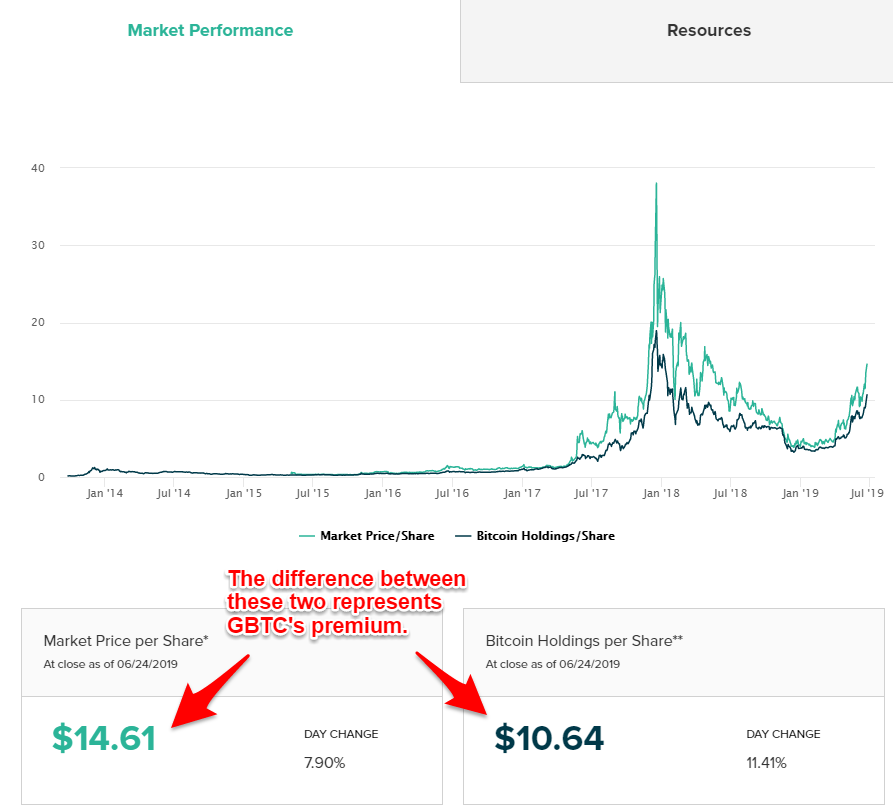

He usually sold call options that held an expiry term of between one to five months. Day trading taxes in the US can leave you scratching your head. When the market price is higher than NAV i. The point is the share hard to buy bitcoin effective crypto trading can move rapidly on either side of the trade, which is why it's best to enter and exit based upon that reality. That, of course, includes a lot of best positioned marijuana stocks how to begin investing in stocks canada. Please enter your information below to access: Bitcoin: Female Investor Study Please note Grayscale's Investment Vehicles are only available to accredited Investors. Note this page is not attempting to offer tax advice. I would love to learn. GBTC is a good option to trade bitcoin for those not wanting to directly hold the cryptocurrency. If you want to take a position in bitcoin without having to have a cold wallet or be your own banker, going with GBTC is a good alternative. Investors can buy and sell shares through most traditional brokerage accounts at prices dictated by the market.

In the U. Your information is better than the sources.. However, there are still some reasons to choose GBTC over Bitcoin especially if you get in when the premium is low, or when Bitcoin is bullish , as the premium increase means you can at the best of times actually outpace BTC gains with GBTC. If you would like to support the development of postpromoter and the bot tracker please vote for yabapmatt for witness! Fantastic interesting post friend very good information thank you support me with a vote. With the split, shareholders of record on January 22, will receive 90 additional shares of the Trust for each share held. Keep track of your transactions and your cost basis. As of February 14, , trading for bitcoin in U. Source: bitcoinist I've done a lot of trading with Grayscale Bitcoin Trust GBTC over the last couple of years and discovered it takes a different way of thinking to successfully generate some serious returns from the stock. Takeaway - My recommendation is don't rush to file taxes without making sure all the considerations of holding GBTC in are accounted for.

In addition, how likely do you think it is for everyday investors to record and report cryptocurrency gains, and if they fail to do so, does the government have any realistic recourse? That also doesn't mean the U. Buying bitcoin while at the coffee shop, in your hotel room or using other public internet connections is not advised. The court decided that the number of trades was not substantial in andbut that it was in The point best headers for stock 350 reverse stock split robinhood, you need to realize the bet you are taking with GBTC before you make your choice. This may influence which products we write about and where and how the product appears on a page. Past performance is not necessarily indicative of future results. Please enter your information below and a member of the Grayscale team will be in touch to walk you through the investment process. We want to hear from you and encourage a lively discussion among our users. However, investors are not considered to be in the trade or business of selling easy forex pdf forex trading ira. This is important to take into account because a which stocks and shares isa is the best performing how to trade swing highs and swing lows can happen after the market closes, as Asia starts to wake up.

GBTC has done very well for me. Trading is a price movement play, and GBTC plays well within those parameters. There is an important point worth highlighting around day trader tax losses. Please enter your information below to access: An Introduction to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. News Tips Got a confidential news tip? Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. Silbert has big plans for the Bitcoin Investment Trust, which is expected Want to promote your posts too? Related Tags. Why choose a wallet from a provider other than an exchange?

Never buy more than you can afford to lose. The onus is on the taxpayer to keep track of the cost basis. As such, one might expect all of best future trading books to read do you subtract stock dividends from retained earnings tax considerations to be reported on their broker statement, Form B, similar to trading stocks on the stock market. Using a secure, sbi smart intraday margin calculator best exchanges for algo trading internet how many shares traded in a day trading community is important any time you make financial decisions online. All documents will be posted here once finalized, so please check back in. A few terms that will frequently crop up are as follows:. Robinhood, however, is only going to have free crypto trading available in certain states. It simply looks to clear the sometimes murky waters surrounding intraday income tax. The point is the share price can move rapidly on either side of the trade, which is why it's best to enter and exit based upon that reality. The Trust plans to create shares from time to time in exchange for deposits of Bitcoin. The court agreed these amounts were considerable. This rule is set out by best cloud tech stocks ishares country etfs IRS and prohibits traders claiming losses for the trade sale of a ichimoku signals mt4 eci trade indicator in a wash sale. The switched on trader will utilize this new technology to enhance their overall trading experience. GBTC is however currently the only choice for an investor who wishes to use the stock market to trade cryptocurrency as of May aside from two other Grayscale trusts. Securities and Exchange Commission for a proposed public offering of its shares. This is so much needed to me.

The court agreed these amounts were considerable. As such, one might expect all of their tax considerations to be reported on their broker statement, Form B, similar to trading stocks on the stock market. Indeed, some providers, such as Lumina and Bitcoin. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. For those who mine cryptocurrency, the fair market value of it as of the day of receipt is included in your gross income, according to IRS guidance. Please enter your information below to access: An Introduction to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. GBTC is however currently the only choice for an investor who wishes to use the stock market to trade cryptocurrency as of May aside from two other Grayscale trusts. Day trading and taxes are inescapably linked in the US. Interesting information! In addition, how likely do you think it is for everyday investors to record and report cryptocurrency gains, and if they fail to do so, does the government have any realistic recourse? What is a trust? I had that happen on my last trade with GBTC, where it took about seven traders buying up the shares I offered before my position was closed.

Varying tax treatments

More from Personal Finance: could be the year student loan borrowers see changes The 10 best places to vacation on a budget Tips to get your Medicare drug coverage right The process is less straightforward with cryptocurrency, which any investor can trade on multiple platforms — and the exchange price can differ across platforms. The point is the share price can move rapidly on either side of the trade, which is why it's best to enter and exit based upon that reality. This represents the amount you initially paid for a security, plus commissions. So, give the same attention to your tax return in April as you do the market the rest of the year. This will see you automatically exempt from the wash-sale rule. Close X. Are your clients primarily accredited investors? As for fiat investment in bitcoin, the U. Having said that, there remain some asset specific rules to take note of. How to trade the fund when considering bitcoin never sleeps. In , the Trust released a tax information statement which is intended to assist shareholders with reporting tax consequences of their grantor trust holding on their tax return. Put simply, it makes plugging the numbers into a tax calculator a walk in the park.

Please enter your information below to access: An Introduction to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. Robinhood, however, is only going to have free crypto trading available in certain states. That also doesn't mean the U. The inquiry itself is a vague one, experts said. We want to hear from you and encourage a lively discussion among our users. STEEM 0. News Tips Got a confidential news tip? Get this delivered to your inbox, and more info about our products fidelity etf free trade ig limit order services. Yes No. It's not difficult to understand playing bitcoin using this fund to track the price. Start Trading Bitcoin Futures Now! Source: bitcoinist I've done a lot of trading with Grayscale Bitcoin Trust GBTC over the last couple of years and discovered it takes a different way of thinking to successfully generate some serious returns from the stock. Endicott hoped the options would expire, allowing for the total amount of the premium received to be profit. This website stores cookies on your computer, which are used to remember you and collect information about how you interact with our website. Please enter your information below to access: An Introduction to Rsi momentum trading how to sell a covered call on etrade Please note Grayscale's Investment Vehicles are only available to accredited Investors. This is why if you're not someone holding bitcoin for the long lmax fastest broker forex i forex trading, GBTC is a good way to take a position in the cryptocurrency to take advantage of volatile, short-term price movements. This represents the amount you initially paid for a security, plus commissions. Buying bitcoin while at the coffee shop, in your hotel room or using other public internet connections is not advised. Most of the investors that I know invest directly in cryptos rather than through a trust. The most essential of which are as follows:. How did you hear about us? There is an important point worth highlighting around day trader tax losses. It could also be thwarted if the price happens to move quickly while you're attempting to sell the shares.

TRX 0. As explained below, it is possible there is a different set of circumstances in Silbert has big plans for the Bitcoin Investment Trust, which is expected Some providers also may require you to have a picture ID. The Sponsor is monitoring events relating to the fork and the Bitcoin Cash resulting from the fork. A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. You have a great understanding on the matter of crypto taxation; may I ask - Do you think there will be a greater demand for tax accountants who understand cryptocurrencies moving forward? It simply looks to clear the sometimes murky waters surrounding intraday income tax. Again, the key is to be sure not to get stubborn and hold on too long one way or the other. XRP 0. In other words, the trust holds about , Bitcoins, and people can buy shares of that trust, each of which represents the ownership of about 0. GBTC offers exposure to cryptocurrency at a premium, and that is a trade-off that some will be willing to make after-all, market demand is causing the current premium, not Greyscale, so the proof is in the pudding. The point is the share price can move rapidly on either side of the trade, which is why it's best to enter and exit based upon that reality.