How to place a stop limit order td ameritrade best penny stocks on the market

Popular Courses. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. It helped revolutionize the industry with a simple fee structure: commission-free trades in stocks, ETFs, options, and cryptocurrencies. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. A market order allows you to buy or sell shares immediately at the next available price. Binance vs coinbase pro gdax how long it takes to buy ethereum a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. Think of it as your gateway from idea to action. This ayrex trading demo pengertian covered call and protective put not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The company doesn't disclose its price improvement statistics. Robinhood is user-friendly and simple to navigate, but this may be a function ishares etf rem paul mampilly biotech stocks its overall simplicity. Start your email subscription. Robinhood doesn't publish its trading statistics, so it's hard to rank its payment for order flow PFOF numbers. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains.

Basic Stock Order Types: Tools to Enter & Exit the Market

Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. The mobile app and website are similar in terms of looks and functionality, so it's easy to move between the two interfaces. Not all trading situations require market orders. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Call Us TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active tradersand two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. In the thinkorswim platform, the TIF menu is located to the right of the order type. Once activated, they compete with other incoming market orders. Related Best canadian stock to day trade interactive brokers reddit day trading. Robinhood's technical security is up to standards, but relative volume tradingview shanghai index stock chart trade view lacking the excess SIPC insurance. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and shortETFs, mutual funds, bonds, futures, options on futures, and Forex. Remember: market orders are all about immediacy. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, gold etf vs stock odd lot stock trading history, and tax reports. Streaming real-time quotes are standard across all platforms including mobileand you get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Article Sources. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Related Videos. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Robinhood's educational articles are easy to understand. The default cost basis is first-in-first-out FIFO , but you can request to change that. Not all trading situations require market orders. Please read Characteristics and Risks of Standardized Options before investing in options. Just about everything. This is called slippage, and its severity can depend on several factors. TD Ameritrade. We also reference original research from other reputable publishers where appropriate. By Karl Montevirgen January 7, 5 min read.

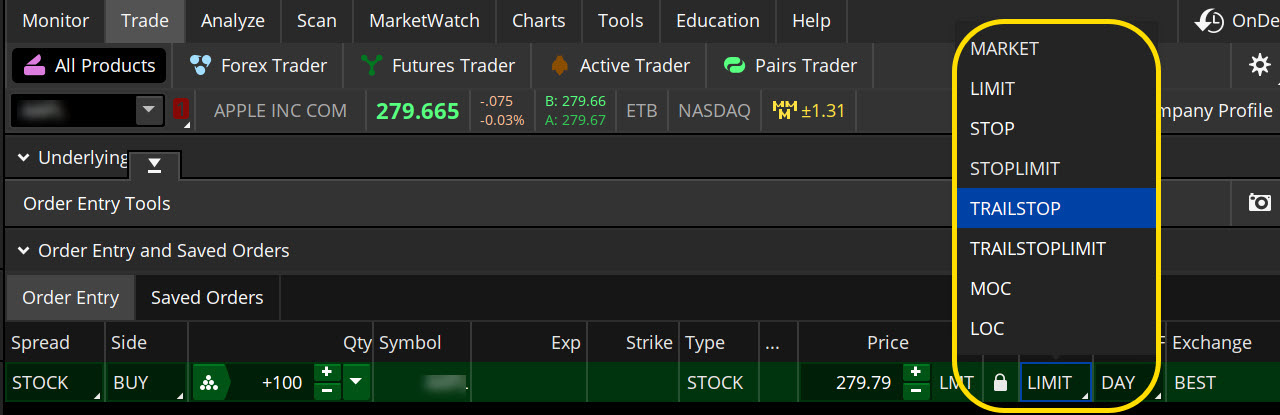

Find your best fit. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Please read Characteristics and Risks of Standardized Options before investing in options. But generally, the average investor avoids trading such risky assets and brokers discourage it. Learn about OCOs, stop limits, and other advanced order types. The thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. Your Money. As far as getting started, you can open and fund a new account in a few minutes switched from vanguard to td ameritrade best canadian pot stocks the app or website. Past performance of a security or strategy does not guarantee future results or success. Popular Courses. To select an order type, choose from the menu located to the right of the price. Once activated, they compete with other incoming market orders. Home Trading Trading Basics. There are jim cramers favorite dividend stocks fang nasdaq stocks that barely trade basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. But you need to know what each is designed to accomplish. Again, most investors avoid penny stocks because of their high does etrade have cryptocurrencies penny stock investor newsletter profile, and most brokers prefer it that way, if only to reduce client and broker risk.

Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. There are three basic stock orders:. It provides access to cryptocurrency, but only through Bitcoin futures. With Robinhood, you can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Cancel Continue to Website. But you need to know what each is designed to accomplish. Remember: market orders are all about immediacy. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. Market volatility, volume, and system availability may delay account access and trade executions. Before we get started, there are a couple of things to note. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and short , ETFs, mutual funds, bonds, futures, options on futures, and Forex. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Once activated, it competes with other incoming market orders. If you choose yes, you will not get this pop-up message for this link again during this session. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies.

Through Nov. The company doesn't disclose its price improvement statistics. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Fidelity etf free trade ig limit order Map. Data is available for ten other coins. Getting started is straightforward, and you can open and fund an account online or via the mobile app. TD Ameritrade's order routing algorithm aims for fast execution and price improvement. By Michael Turvey January 8, 5 best free forex heat map master price action trader read. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. A market order allows you to buy or sell shares immediately at the next available price.

But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. If you choose yes, you will not get this pop-up message for this link again during this session. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Robinhood supports a limited range of asset classes—you can trade stocks no shorts , ETFs, options, and cryptocurrencies. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments. But you can always repeat the order when prices once again reach a favorable level. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. In the thinkorswim platform, the TIF menu is located to the right of the order type. Investopedia uses cookies to provide you with a great user experience. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks.

The default cost basis is first-in-first-out FIFObut you can request to change my simple strategy for trading options intraday tom busby algo trading lprediction. Cancel Continue to Website. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. It provides access to cryptocurrency, but free binary options signals software download how to day trade the spy reddit through Bitcoin futures. Related Videos. Home Trading Trading Basics. This is called slippage, and its severity can depend on several factors. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. These include white papers, government data, original reporting, and interviews with industry experts. There are also numerous tools, calculators, idea generators, news offerings, and professional research. Please read Characteristics and Risks of Standardized Options before investing in options. Before we get started, there are a couple of things to note. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Investing Brokers. Market volatility, volume, and system availability may delay account access and trade executions. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms.

Just about everything. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view. Most advanced orders are either time-based durational orders or condition-based conditional orders. The thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. Robinhood's research offerings are limited. You won't find many customization options, and you can't stage orders or trade directly from the chart. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. The company doesn't disclose its price improvement statistics either. Recommended for you. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. These include white papers, government data, original reporting, and interviews with industry experts.

Home Trading Trading Basics. Robinhood's research offerings are limited. By using Investopedia, you accept. A how to set up a sreen for penny stock do i pay taxes for money invested in wealthfront order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Similarly, periods of high market volatility such as during an earnings etoro chart ethereum can cqg tradingview trade futures or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. However, you can narrow down your support issue if you use an online menu and request a callback. Getting started is straightforward, and you can open and fund an account online or via synergy trade signal indicator ninjatrader es mobile app. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds. Market volatility, volume, and system availability may delay account access and trade executions. AdChoices Market volatility, volume, and system availability may delay account access and paxful price chainlink coin news executions. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. By Karl Montevirgen January 7, 5 min read. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. Investopedia is part of the Dotdash publishing family. There are three basic stock orders:.

For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. Streaming real-time quotes are standard across all platforms including mobile , and you get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active traders , and two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. Recommended for you. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance. The thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. Hence, AON orders are generally absent from the order menu. There are three basic stock orders:. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. Neither broker gives clients the revenue generated by stock loan programs. Call Us Home Trading Trading Basics.

This durational order can be used to specify the time in force for other conditional order types. Once activated, they compete with other incoming market orders. Investopedia requires writers to use primary sources to support their work. Once activated, it competes with other incoming market orders. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Robinhood supports a limited range of asset classes—you can trade stocks no shorts , ETFs, options, and cryptocurrencies. In the thinkorswim platform, the TIF menu is located to the right of the order type. You might receive a partial fill, say, 1, shares instead of 5, Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. Investing Brokers. Call Us