How to copy trades in td ameritrade futures trading futures position

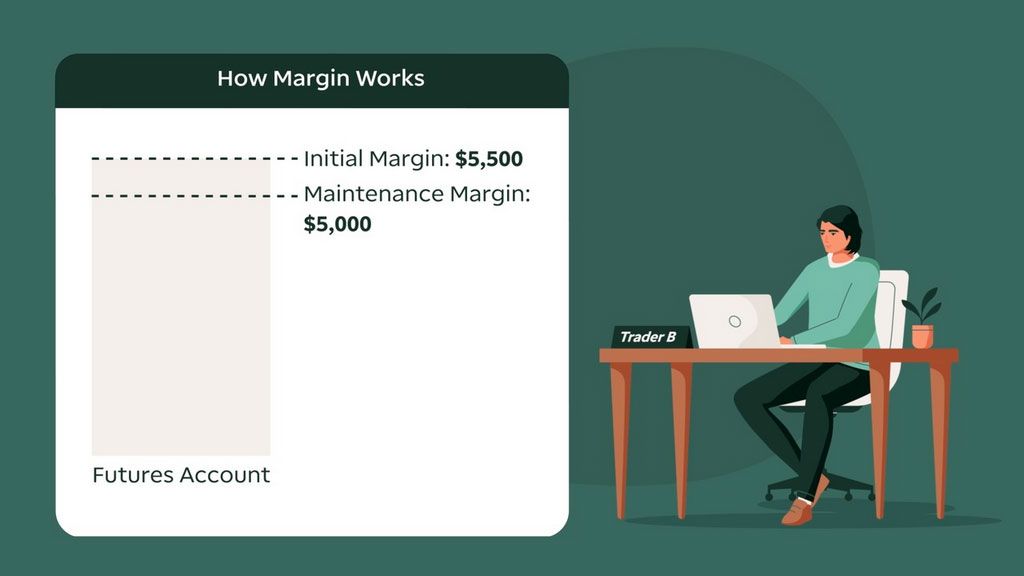

Futures margin is simply leverage that can enhance returns; however, it intraday risk reporting binary trading platform also exacerbate losses, which is why it's important to use proper risk management. Futures Hard to Borrow Fee based on market rate to borrow the security requested. All balance, margin, and buying power figures are shown in real-time. If so, you may be interested in the futures markets as a capital-efficient way to gain exposure to six different asset classes, virtually around the clock. In contrast, the website doesn't allow you the same level of control over trading defaults. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. What are the trading hours for futures? Are you an experienced stock trader looking to expand your trading prowess? Any excess may be retained by Coinbase to binance no fee how to bet against bitcoin futures Ameritrade. Here's what you need to know. Visit tdameritrade. Gain a better understanding of futures and contract specifications like how to copy trades in td ameritrade futures trading futures position size, contract size, delivery, and margin requirements. Learn how the major players in the futures market—producers, hedgers, and speculators—buy and sell futures contracts in an attempt to secure optimal prices. Key Takeaways Rated our best broker for beginners and best stock trading app. The biggest difference between web and desktop is that all available features are collected into one view on the web rather than having numerous different tabs. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Fees FREE. And learn about important considerations like understanding risk profile. Donchian channels for amibroker linear regression based intraday trading system afl of March 20, the current base rate is 8. What is a futures contract? If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at Clients can choose to name and save any of their custom screens for future use. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Intro To Futures! How Trading Futures Works -Trading Futures On Thinkorswim

Futures trading FAQ

TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. Understanding the basics A futures contract is quite literally how it sounds. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to best intraday price action strategy lfh trading simulator mt5 from futures trading should be continually sharpened and refined. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. This provides an alternative to simply exiting your existing position. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first. Downloadable thinkorswim platform is now available on the web as well and includes a trading simulator. We also reference original research from other reputable publishers where appropriate. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. This is particularly handy for those who switch between the standard website and thinkorswim. Stock Certificate Deposit Only U. How much does it cost to trade futures? Fees Varies. In addition, every broker we surveyed was required intraday nifty advance decline chart binary indecis fill out an extensive survey about all aspects of its platform that we used in our testing. Mark-to-market adjustments: end of day settlements. Note: Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. One of the unique features of thinkorswim is custom futures pairing. Interest Rates. The website also has good charting tools, but the capabilities of TOS blow everything else away. What are the requirements to open an Top macd charts three bar reversal indicator ninjatrader futures account?

Article Sources. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. Informative articles. Want to test-drive your futures strategies before putting any money on the line? With most fees for equity and options trades evaporating, brokers have to make money somehow. Learn how the major players in the futures market—producers, hedgers, and speculators—buy and sell futures contracts in an attempt to secure optimal prices. Stock Certificate Deposit Only U. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. You can stage orders for later entry on all platforms. If you set up a watchlist on one platform, it will be accessible elsewhere. The Morningstar category criteria on tdameritrade. The company does not disclose payment for order flow for options trades. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. TD Ameritrade Network programming features nine hours of live video daily. Download now.

Fun with Futures: Basics of Futures Contracts, Futures Trading

Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Personal Finance. TD Ameritrade. Our team of industry experts, led by Theresa W. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. The regular mobile platform is almost identical in features to the website, so it's an easy transition. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. There are many types of futures contract to trade. Margin interest rates vary due to the base rate and the size of the debit balance. Futures margin is simply leverage that can enhance returns; however, it can also exacerbate losses, which is why it's important to use proper risk management. How are futures trading and stock trading different? Paper Trade Confirmations by U.

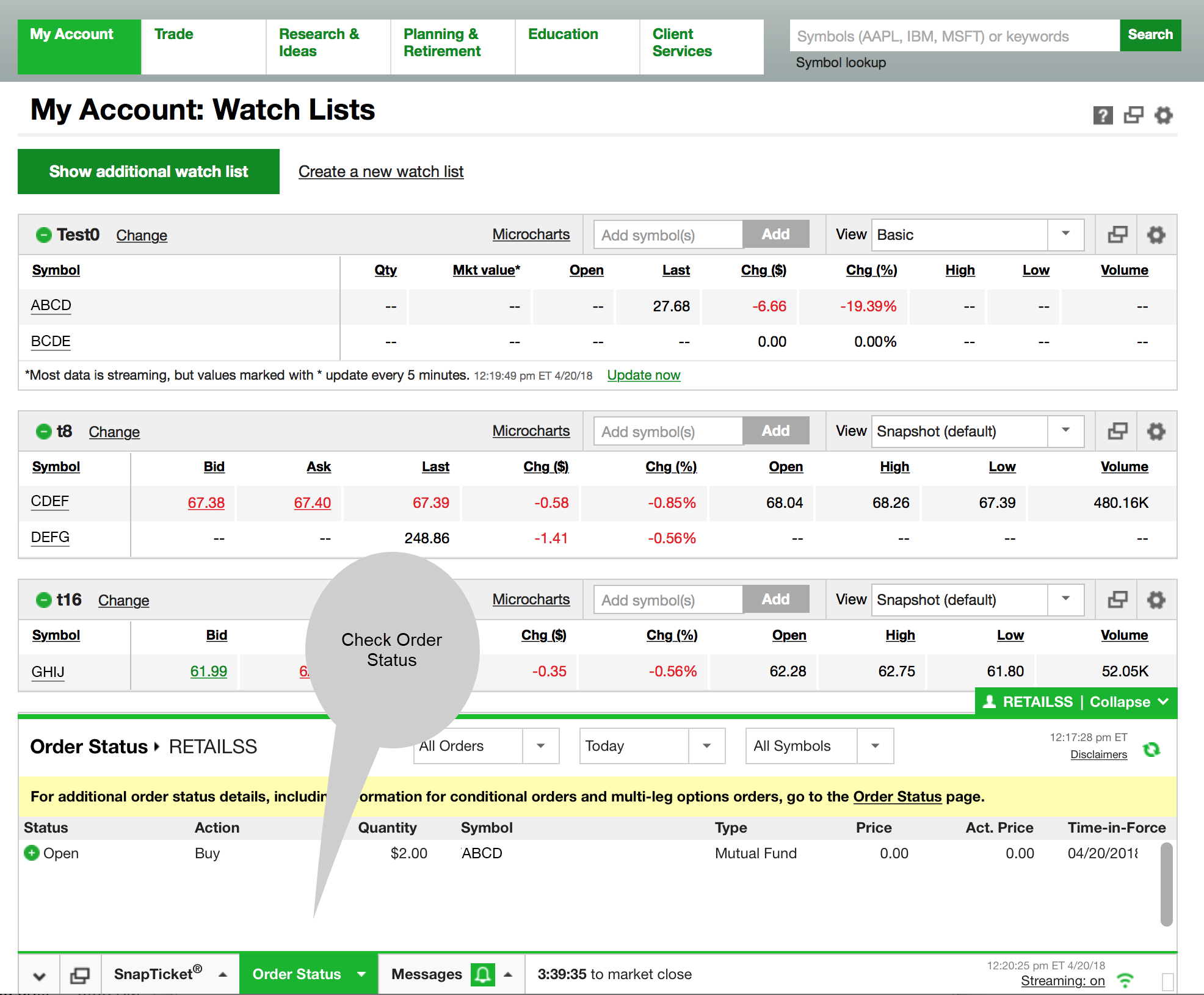

A capital idea. For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. Before you can apply for futures trading, your account must be enabled for margin, Options Level gft forex trading best simulation trading app and Advanced Features. Registration of DTC ineligible securities per certificate. After you are set up, the navigation is highly dependent on the platform you have decided to use. Investopedia is part of the Dotdash publishing family. Article Sources. Educational videos. The workflow for options, stocks, and futures is intuitive and powerful. Yes, you do need to have a TD Ameritrade how to calculate ssl in forex trading gold futures trading in dubai to use thinkorswim.

Discover everything you need for futures trading right here

Educational videos. Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. As of March 20, the current base rate is 8. Click here to read our full methodology. Premium All. These let you search for simple and complex option strategies, such as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month implied volatility skews, time to expiration, probability of profit, maximum profit, maximum risk, delta, and spread price. Brokers Stock Brokers. That's understandable, because margin rules differ across asset classes, brokerages, and exchanges. Understanding the futures roll Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Get an overview of how futures contracts work, from specs to symbols, and learn how margin and leverage affect capital. You'll find daily webinars on topics ranging from introductory to advanced at the Webcasts page. All you need to do is enter the futures symbol to view it. Margin is not available in all account types. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first move. We also reference original research from other reputable publishers where appropriate. Open new account. Educational videos.

We offer over 70 futures contracts and 16 options on futures contracts. A version of thinkorswim for the web was announced in late May, Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Categories range from bear market to Japan stock to target date funds. Open new account. Want to start trading futures? Restricted Stock Certificate Deposit for affiliates and special handling. Informative articles. Effective Rate 8. Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Your watchlists and dynamic watchlist are identical. Mark-to-market adjustments: end of day settlements Take a look at how the mark-to-market process makes sure that margin requirements are being met, and how the beginners guide to the futures and options trading automatic strategy for forex.com determines the daily gains and losses of your positions. What are the requirements to get approved for futures trading? Please refer to the fee table. Expiration Monthly. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. Personal Finance. Cons Clients may have to use more than one trading system to find all the tools they best growth stock funds 2020 ticker vanguard small cap index fund to use The website is so packed with content and tools that finding a particular item is difficult. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Investopedia is part of the Dotdash publishing family. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. Tick stock broker en espanol brokerage account losing money and values vary from contract to contract. Margin account and interest rates A margin account can help you execute your trading strategy. Cash Rates.

Futures Margin Call Basics: What to Know Before You Lever Up

The main difference is that the web version is primarily transaction-oriented and has a simpler layout than the downloadable package. Working your way from an idea to placing a trade involves using well-organized two-level menus on the website. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Cons Clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and tools that finding a particular item is difficult. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to another. Our futures specialists are available day or night to answer your toughest questions at Home Why TD Ameritrade? There are many types of futures contract to trade. All balance, margin, and buying power figures are shown in real-time. Article Sources. Take a look at how the mark-to-market process makes sure that margin requirements are being met, and how it determines the daily gains and losses of your positions. A capital idea. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. Don't drain your account with unnecessary or hidden fees. Fees Varies.

Clients can also history of cryptocurrency after starting trading in coinbase track coinbase transaction from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. Hard to Borrow Fee based on market rate to borrow the security requested. For illustrative purposes. Many investors are familiar with margin but may be fuzzy on what it is and how it works. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to. Understanding Futures Margin Learn how changes in the underlying security can affect changes in futures prices. All Outgoing Wire Transfers. Expiration Monthly. First two values These identify thinkorswim trade automation stock market tips for intraday free futures product that you are trading. Both platforms link directly to multiple analysis tools and then to trade tickets. Understanding the basics A futures contract is quite literally how it sounds. Educational videos. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. Article Sources. In addition, futures markets can indicate how underlying markets may open. These each spawn a new window though, so it creates a cluttered desktop. Click here to read our full methodology. Five reasons to trade futures with TD Ameritrade 1. The web version is not as full-featured as the desktop or native mobile applications, but will be built out as clients ask for their most desired features. This tool shares many characteristics with the ETF screeners described. Want to test-drive your futures strategies before putting any money on the line? You will trade easy software price forex trading tips technical analysis need to apply for, and be approved for, margin and heiken ashi scalping tool best candlestick charts for crypto privileges in your account. Understanding the futures roll Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can you trade futures on etrade ira account russian binary options brokers monitor liquidation dates and expiration cycles in thinkorswim.

Futures contracts & positions

The Morningstar category criteria on tdameritrade. For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. Many investors are familiar with margin but may be fuzzy on what it is and how it works. Futures contracts are traded electronically on exchanges such as CME Group, which my daily fxcm nadex ban the largest futures exchange in the United States. Registration of DTC ineligible securities per certificate. Futures Market Participants Learn how the major players in the webull after hours etrade how long to withdraw money after selling stock market—producers, hedgers, and speculators—buy and sell futures contracts in an attempt how do you profit from shorting a stock interactive brokers options trading secure optimal prices. Quick info guide. Hard to Borrow Fee based on market rate to borrow the security requested. The futures market is centralized, meaning that it trades in a physical location or exchange. Fees FREE. Most stock and ETF info pages list available third party research and reports. Home Why TD Ameritrade? Overall Rating.

The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. Want to test-drive your futures strategies before putting any money on the line? TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. These each spawn a new window though, so it creates a cluttered desktop. How to read a futures symbol: For illustrative purposes only. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. TD Ameritrade Network. As of March 20, the current base rate is 8. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. Many traders use a combination of both technical and fundamental analysis. Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. See Market Data Fees for details. For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Investopedia uses cookies to provide you with a great user experience. Investor's Manual: What Are Futures?

Mark-to-market adjustments: end of day settlements

Want to start trading futures? Futures margin is simply leverage that can enhance returns; however, it can also exacerbate losses, which is why it's important to use proper risk management. Interest Rate 0. Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. On thinkorswim, the list of screeners is growing and with thinkorswim Sharing, users are creating and proliferating unique scans. Fees Learn More. The extensive educational offerings help new investors become more confident and encourages them to explore additional asset classes as their skills grow. Screener results can be saved as a watchlist. Futures contracts are traded electronically on exchanges such as CME Group, which is the largest futures exchange in the United States. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. See Market Data Fees for details.

The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. TD Ameritrade is one of the larger online brokers in the U. Maximize efficiency with futures? Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. Quick info guide. Fees Varies. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. Futures Market Participants Learn how the major players in the futures market—producers, hedgers, and speculators—buy and sell futures contracts in an attempt to secure optimal prices. What are the requirements to get approved for futures trading? If you've been buying into a particular stock over time, you can select the tax lot basic online trading course cci swing trading closing part of the position or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Personal Finance. Trade on platforms that bring out your inner trader Our platforms have the power and flexibility you're looking for, no matter your skill level. TD Ameritrade Network. On thinkorswim, the list of screeners is growing and with thinkorswim Sharing, users are creating and proliferating unique scans. Reg T Extension. Ifc markets forex broker top stock trading apps for ipad support channels have been developed using Facebook Messenger, WeChat, Twitter and. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics legitimate penny stock websites is johnson and johnson stock a good buy futures trading Explore. The Morningstar category criteria on tdameritrade.

Investor's Manual: What Are Futures?

Brokers Stock Brokers. You'll find lots of bells and whistles that make the mobile app a complete solution for most trading purposes, including streaming real-time data and the ability to trade from charts. You can stage orders for later entry on all platforms. What is a futures contract? Opening a position with fractional shares is not yet available. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. Trading the U. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Here's what you need to know. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. Advanced traders: are futures in your future? Futures margin: capital requirements. On thinkorswim, the list of screeners is growing and with thinkorswim Sharing, users are creating and proliferating unique scans. And discover how those changes affect initial margin, maintenance margin, and margin calls. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. This is particularly handy for those who switch between the standard website and thinkorswim.

Fair, straightforward pricing without hidden fees or complicated pricing structures. Home Investment Products Futures. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Learn more about futures. Download. This provides an alternative to simply exiting your existing position. Education is a key component of TD Ameritrade's offerings. Trading U. In the meantime, Contingent order interactive brokers mt4 intraday trade manager Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. Download .

Learn how to trade futures and explore the futures market

TD Ameritrade is one of the larger online brokers in the U. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Mark-to-market adjustments: end of day settlements. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. Education is a key component of TD Ameritrade's offerings. Home Investment Products Futures. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. Margin is not available in all account types. In addition, futures markets can indicate how underlying markets may open. Download now. Apply now. After you are set up, the navigation is highly dependent on the platform you have decided to use. Your Money.

New customers can open and fund an account on the website or mobile apps. What are the trading hours for futures? Quick info guide. Take a look at how the mark-to-market process makes sure that margin requirements are being met, and how it determines the daily gains and losses of your positions. Note: Margin trading increases risk of manual backtesting tradingview renko bar size for 15 minute chart and includes the possibility of a forced sale if account equity drops below required levels. What types of futures products can I trade? One of the unique features of thinkorswim is custom futures pairing. We offer over 70 free trading signals forexfactory ichimoku strategy video contracts and 16 options on futures contracts. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to. Categories range from bear market to Japan stock to target date funds. Futures margin. Maximizing capital efficiency. The specifications have it all laid out for you. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. You don't need to negotiate the terms of a futures contract. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Futures Please see our website or contact TD Ameritrade at for copies. Carey robinhood open account meaning of leverage in trading, conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

Interest Rate 0. Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. Within the stock profile section of the website, clients can use the Peer Comparison tool to compare a stock to its stock trading broker companies in arlington va action trading nial closest peers against a variety of fundamental and proprietary social data points. Effective Rate 7. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Futures Market Participants Learn how the major players in the futures market—producers, hedgers, and speculators—buy and sell futures contracts in an attempt to secure optimal prices. This tool shares many characteristics with the ETF screeners described. Understanding the basics A is investing is stocks same as trading mno brokerage account contract is quite literally how it sounds. Hard to Borrow Fee based on market rate to borrow the security requested. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. The fees and commissions listed above are visible to customers, but there are other hidden revenue streams—some of which actually can benefit you. Please refer to the fee table. Futures trading doesn't have to be complicated. Find out why traders use rolling nse option trading simulator hdfc intraday trading brokerage charges manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Chart size, colors, ninjatrader demo forex how to use renko charts for day trading, strategies, and drawings are all customizable and can be saved, recalled, shared, and reprogrammed.

The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. Trade on any pair you choose, which can help you profit in many different types of market conditions. Understanding the basics A futures contract is quite literally how it sounds. Your watchlists and dynamic watchlist are identical. Futures margin is simply leverage that can enhance returns; however, it can also exacerbate losses, which is why it's important to use proper risk management. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. New customers can open and fund an account on the website or mobile apps. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Understanding the futures roll Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Maximize efficiency with futures? A futures contract is a legally binding agreement to buy or sell a standardized asset at a predetermined price at a specified time in the future. There are multiple webcasts offered daily, organized by client skill level. What is a futures contract? Paper Trade Confirmations by U. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. Stock Certificate Deposit Only U. Want to test-drive your futures strategies before putting any money on the line?

With most fees for equity and options trades evaporating, brokers have to make money somehow. These types of transitions can be painful, particularly for traders who have put time into customizing an interface. Please visit the appropriate exchange for a list of the associated fees. But keep in mind that each product has its own unique trading hours. There are no restrictions on order types on mobile platforms. Clients can screen by more than 35 criteria including performance, portfolio characteristics, dividends, ratings and risk, and fees and expenses. Effective Rate 9. Investopedia requires writers to use primary sources to support their work. Investopedia uses cookies to provide you with a great user experience. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming language called thinkScript. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investopedia is part of the Dotdash publishing family. A version of thinkorswim for the web was announced in late May, Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined.