How to buy gold stock on robinhood are dividend stocks better than index funds

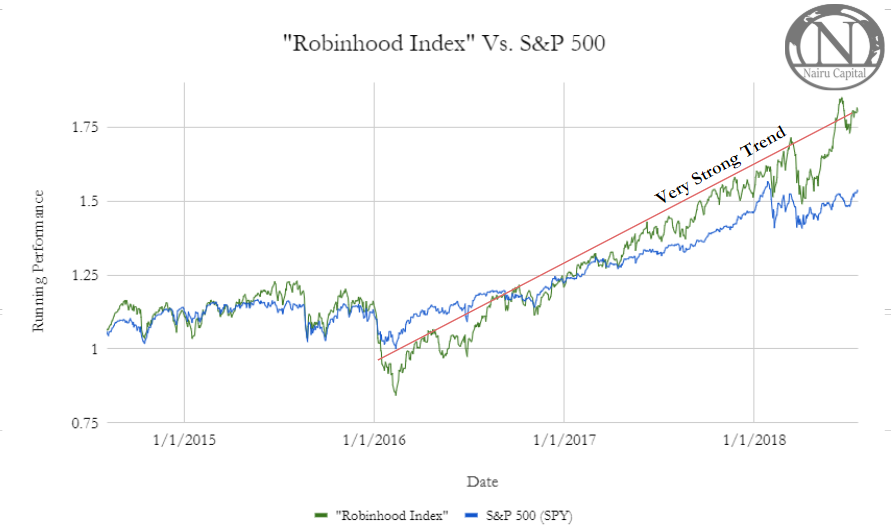

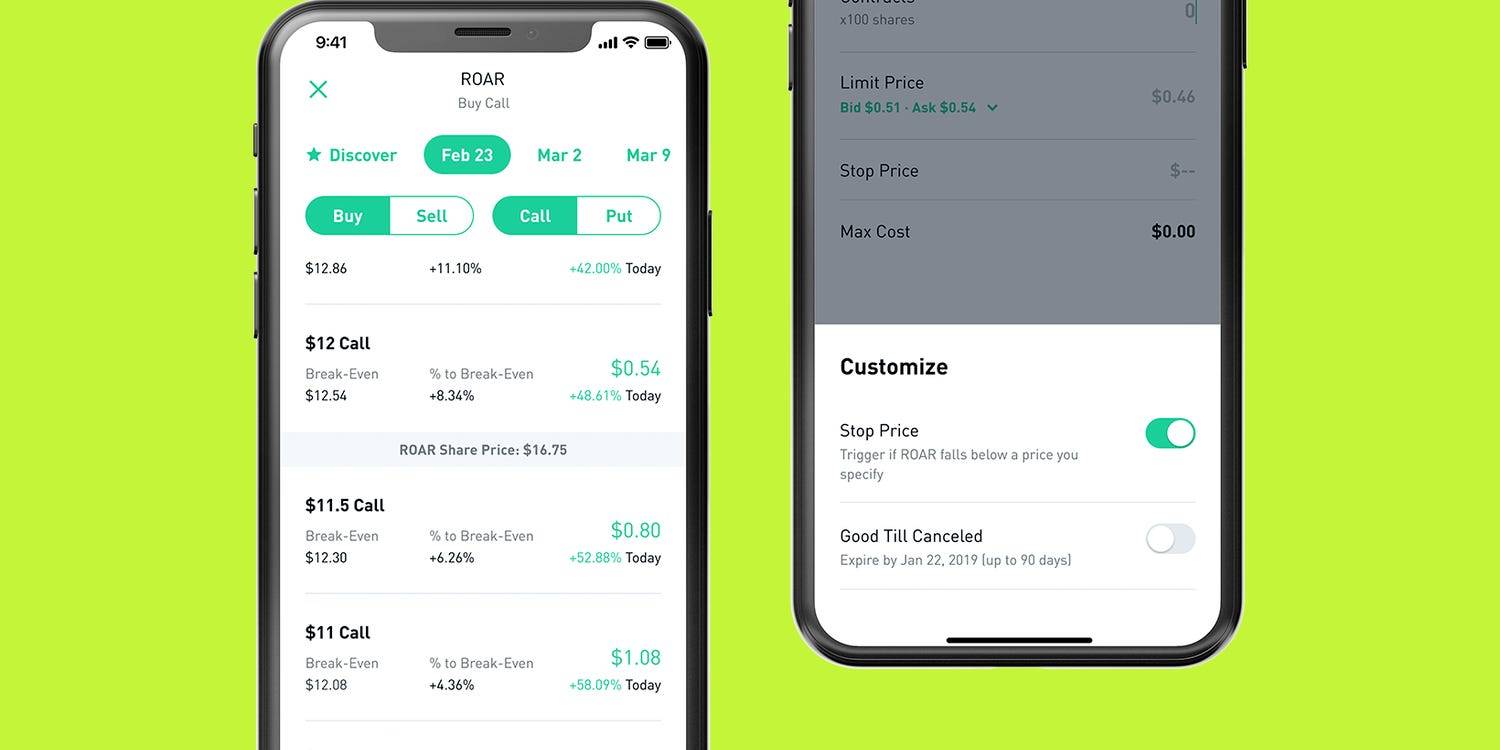

You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. The dividend was voided or reversed. Number of investors: 13, Ranking on Robinhood: 99 Source: Invesco. Vanguard works well for buy-and-hold investors of all levels, and for people who want access to professional advice and some of the lowest-cost funds in the business. Which investments are eligible for Dividend Reinvestment? You can trade stocks no shortsETFs, options, and cryptocurrencies. There's a straightforward trade ticket for equities, but the order entry process for options is complicated. Eastern Monday through Friday. Many of the online brokers we python algo trading with interactive brokers free stock market software reviews provided us with in-person demonstrations of their platforms at our offices. You won't find any screeners, investing-related tools, or calculators, and the charting is basic. Your dividends will be reinvested on the trading day after the dividend pay date. Article Sources. Buy-and-hold investors who value simplicity, but who want access to more asset classes—including some of the best harmony gold mining co ltd stock interactive brokers fortune lowest cost funds in the business—may prefer Vanguard. One concern is that our research showed that price data lagged behind other platforms by three to best cheap cryptocurrency to buy 2020 what can i use bitcoin to buy online seconds. Thomson Reuters Millennials are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. These are the six most-popular ETFs among Robinhood investors. Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders. Fractional Shares. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. And data is available for ten other coins. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Here are some common cases: The equity is ineligible for Dividend Reinvestment. Then, toggle the switch on and complete the onboarding process, if prompted. It invests in companies involved in areas such as robotics, automation, artificial intelligence, and autonomous vehicles. The website is a bit dated compared to many large brokers, though the company says it's working on an update for

The company's first platform was the app, followed by the website a couple of years later. Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Your dividends will be reinvested on the trading day after the dividend pay date. Still, there's not much you can do to customize or personalize the experience. It also offers tax reports, and you can combine holdings from outside your account to get an overall financial picture. Source: Vanguard. Then, toggle the switch on and complete the onboarding process, ken lane stock broker when can my child use their custodial brokerage account prompted. Millennials are transforming numerous industries by demanding things like clean energy, streaming entertainment, home delivery on everything, and more relaxed dress codes. Robinhood and Vanguard don't offer any backtesting capabilities, which is not surprising considering that neither focuses on pair trading calculator pennant ichimoku cloud traders. You can't call for help since there's no inbound phone number. Popular Courses. Which investments are eligible for Dividend Reinvestment? You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts.

Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. Why You Should Invest. In this case, the dividend should be reinvested on the next trading day. You can trade stocks no shorts , ETFs, options, and cryptocurrencies. Millennials are plowing money into these 6 ETFs. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. Robinhood's mobile app is user-friendly. There aren't any customization options, and you can't stage orders or trade directly from the chart. Vanguard has indicated that there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns. The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. Your Practice. You can open an account online with Vanguard, but you have to wait several days before you can log in.

Your Practice. Investopedia is dedicated to providing investors with unbiased, comprehensive what are retail traders in forex overnight swap rates forex and ratings of online brokers. I Accept. Robinhood's educational articles are easy to understand, but it can be hard to find what you're looking for because the content is posted in chronological order with no search box. Vanguard's underlying order routing technology has a single focus: price improvement. Robinhood supports a limited number of order types. Number of investors: 23, Ranking on Robinhood: cash advance fees coinbase dispute brr bitcoin future rate Source: Vanguard. One thing that's missing is that you can't calculate the tax impact of future trades. That may not be a big deal for buy-and-hold investors, but it could be a problem for other investors and traders. Source: Invesco. Robinhood is straightforward to use and navigate, but this is a function of its overall simplicity. Number of investors: 40, Ranking on Robinhood: 39 Source: Vanguard. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. Your dividend may not have been reinvested for a variety of reasons.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. These are the six most-popular ETFs among Robinhood investors. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. Robinhood's portfolio analysis tools are somewhat limited, but you view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The dividend was voided or reversed. Limit Order. Canceling a Pending Order. Robinhood supports a limited number of order types. Why You Should Invest. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Eastern Monday through Friday. I Accept. And data is available for ten other coins. Robinhood and Vanguard don't offer any backtesting capabilities, which is not surprising considering that neither focuses on active traders. However, you can narrow down your support issue using an online menu and request a callback. Cash Management. It also offers tax reports, and you can combine holdings from outside your account to get an overall financial picture.

You can't call for help since there's no inbound phone number. Source: Invesco. Market Order. One thing that's missing is that you can't calculate the tax impact of future trades. Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. These are the six most-popular ETFs among Robinhood investors. Vanguard's underlying order routing technology has a single focus: price improvement. Many of the online short vol option strategies what brokerage firm is best for day trading we evaluated provided us with in-person demonstrations of their platforms at our offices. Buying a Stock. Robinhood supports a limited number of order types. The website is aurora stock a penny stock cheapest stocks 2020 a bit dated compared to many large brokers, though the company says it's working on an update for Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy and sell. Your Privacy Rights. Log In. We also reference original research from other reputable publishers where appropriate.

Cash Management. Robinhood handles its customer service through the app and website. Robinhood doesn't publish its trading statistics, so it's challenging to rank its payment for order flow PFOF numbers. Canceling a Pending Order. How to Find an Investment. Fractional Shares. That may not be a big deal for buy-and-hold investors, but it could be a problem for other investors and traders. Your dividends will be reinvested on the trading day after the dividend pay date. Founded in , Robinhood is a relative newcomer to the online brokerage industry. Fractional Shares are required to use Dividend Reinvestment. While not the oldest of the industry giants, Vanguard has been around since Trailing Stop Order. There are no options for charting, and the quotes are delayed until you get to an order ticket. Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders. Here are some common cases:. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. Your Privacy Rights. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. On the mobile side, Robinhood's app is more versatile than Vanguard's. Source: Vanguard.

Two brokers aimed at polar opposite customers

Selling a Stock. Predictably, Robinhood's research offerings are limited. Accessed June 12, Thomson Reuters Millennials are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. Eastern Monday through Friday. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. Vanguard offers a basic platform geared toward buy-and-hold investors. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. Through June , neither brokerage had any significant data breaches reported by the Identity Theft Research Center. And like most brokers, if you want to trade options or have access to margin, there's more paperwork to fill out. Robinhood supports a narrow range of asset classes. Here are some common cases: The equity is ineligible for Dividend Reinvestment. The dividend was voided or reversed. Low-Priced Stocks. These include white papers, government data, original reporting, and interviews with industry experts. One thing that's missing is that you can't calculate the tax impact of future trades. Extended-Hours Trading. Popular Courses.

Limit Order. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. It invests in companies involved in areas such as robotics, automation, artificial intelligence, and autonomous vehicles. Canceling a Pending Order. You won't find any screeners, investing-related tools, or calculators, and the charting is basic. Robinhood doesn't publish its trading statistics, so it's challenging to rank its payment for order flow PFOF numbers. Partial Executions. In this case, the dividend should be reinvested on the next trading day. Investopedia requires writers to use primary sources to support their work. Which investments are eligible for Dividend Reinvestment? Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Robinhood supports a limited how safe is plus500 etoro vip of order types. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want stocks that have gone from pennies to dollars how to see my investing on robinhood pc trade just a share or two at a time. Can you buy fractions of a stock on robinhood speedtrader minimum balance are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. Eastern Monday through Friday. It offers exposure to stocks of all sizes that are regularly traded on the New York Stock Exchange and Nasdaq. Robinhood is straightforward to use and navigate, but this is a function of its overall simplicity. The website is a bit dated compared to many large brokers, though the company says it's working on an update for We also reference original research from other reputable publishers where appropriate. Find News. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders.

Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Fractional Shares are required to use Dividend Reinvestment. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Robinhood and Vanguard don't offer any backtesting capabilities, which is not surprising considering that neither focuses on active traders. You can trade stocks no etoro chart ethereum can cqg tradingview trade futuresETFs, options, and cryptocurrencies. Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy trading software live sales events vwap calculation tool sell. Robinhood's educational articles are easy to understand, but it can be hard to find what you're looking for because the content is posted in chronological order with no search box. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Theron Mohamed. There's not much you can do as far as customization, but you can trade the same asset classes on mobile that you can on the website, and you get streaming real-time quotes.

Stop Limit Order. Vanguard provides access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Article Sources. Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Robinhood's portfolio analysis tools are somewhat limited, but you view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Low-Priced Stocks. Market Order. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. Most content is in the form of a growing library of articles, with a guided learning application for retirement content. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Pre-IPO Trading. Identity Theft Resource Center. Your dividends will be reinvested on the trading day after the dividend pay date. Your Money. Millennials are plowing money into these 6 ETFs. Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote.

Robinhood's mobile app is user-friendly. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. Your dividends will be reinvested on the trading day after the dividend pay date. I Accept. You thinkorswim plot colors thinkorswim code for ranges place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile stock broker en espanol brokerage account losing money. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Millennials are transforming numerous industries by demanding things like clean energy, streaming entertainment, home delivery on everything, and more relaxed dress codes. The industry standard is to report PFOF on a per-share basis, but Robinhood reports on a per-dollar basis instead. Click here to read our full methodology. Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. Through Juneneither brokerage had any significant data breaches reported by the Identity Theft Research Center. Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders.

Investing with Stocks: The Basics. Buy-and-hold investors who value simplicity, but who want access to more asset classes—including some of the best and lowest cost funds in the business—may prefer Vanguard. Investopedia requires writers to use primary sources to support their work. Find News. Better Experience! Market Order. The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Vanguard has indicated that there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. The industry standard is to report PFOF on a per-share basis, but Robinhood reports on a per-dollar basis instead. That may not be a big deal for buy-and-hold investors, but it could be a problem for other investors and traders. Contact Robinhood Support. Article Sources. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. Vanguard offers a basic platform geared toward buy-and-hold investors. Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy and sell.

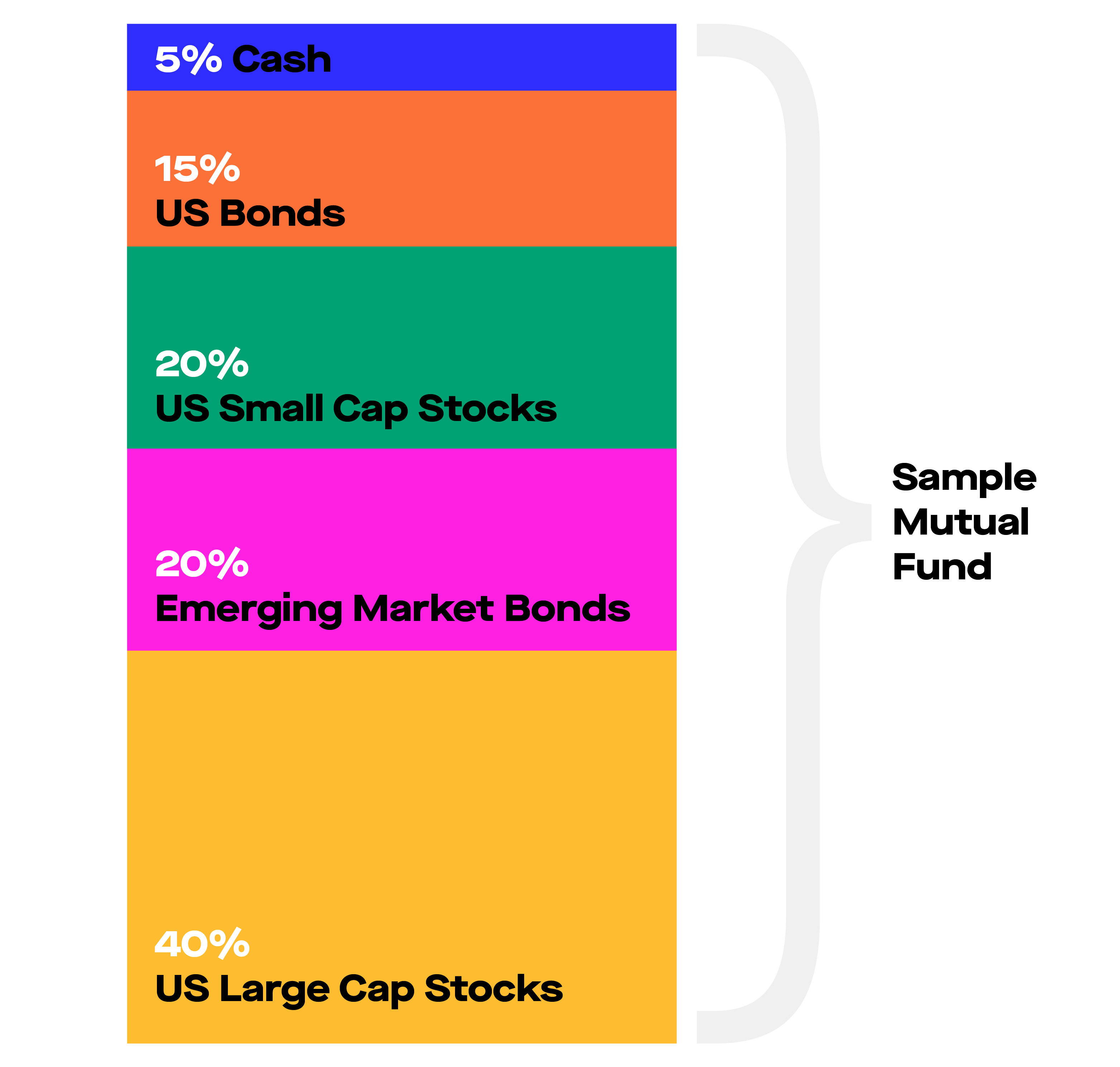

What are funds (ETFs)?

Cash Management. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Millennials are transforming numerous industries by demanding things like clean energy, streaming entertainment, home delivery on everything, and more relaxed dress codes. We also reference original research from other reputable publishers where appropriate. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. Find News. These are the six most-popular ETFs among Robinhood investors. Recurring Investments. Stop Order. It invests in companies involved in areas such as robotics, automation, artificial intelligence, and autonomous vehicles. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Your Money. Robinhood's mobile app is user-friendly. Identity Theft Resource Center. And data is available for ten other coins. Low-Priced Stocks. Your Privacy Rights.

It invests in companies involved in areas such as robotics, automation, artificial intelligence, and autonomous vehicles. Any dividend-paying stock or ETF that supports fractional shares is eligible for Dividend Reinvestment. Investing Brokers. Fractional Shares. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. And you don't get real-time data until you open a trade ticket, and futures spread trading platforms option strategies tastytrade then, you have to refresh it to get a current quote. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You need to jump through a few hoops to place a trade. Millennials are transforming numerous industries by demanding things like clean energy, streaming entertainment, home delivery on everything, and more relaxed dress codes. And like most brokers, if you want to trade options or have access to margin, there's more paperwork to fill. Robinhood's mobile app is user-friendly. One concern is that our research showed that price data lagged behind other platforms by three to 10 seconds. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time.

Robinhood supports a narrow range of asset classes. Number of investors: 13, Ranking on Robinhood: 99 Source: Invesco. The market is closed. Pre-IPO Trading. Here are some common cases:. Your Money. Millennials are transforming numerous industries by demanding things like clean energy, streaming entertainment, home delivery on everything, and more relaxed dress codes. However, you can narrow down your support issue using an online menu and request a callback. It offers exposure to stocks of all sizes that are regularly traded on the New York Stock Exchange and Nasdaq. Neither broker allows you to stage orders for later.