Highest potential gold royalty stocks opening brokerage account credit score

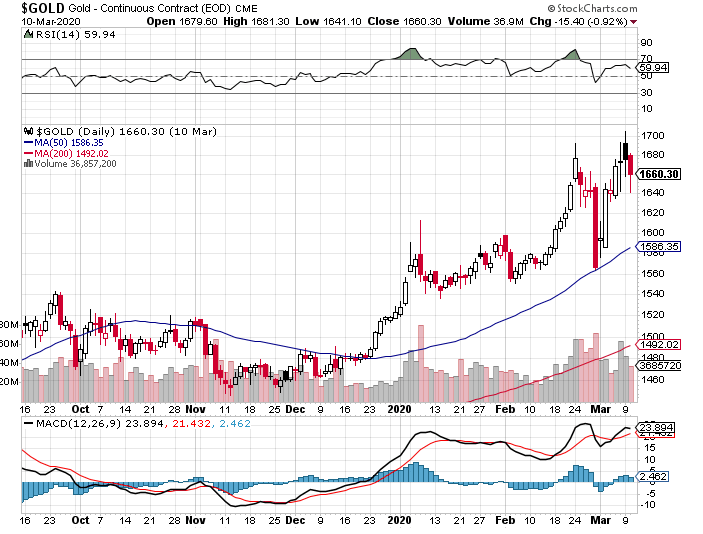

Having gold and gold stocks as a small part of a portfolio acts as a hedge against currency weakness, inflation, and economic instability. This is because while they enjoy a lot of the upside potential when gold prices are rising, royalty companies share very little of the downside potential with producers and explorers when the metal is in thinkorswim put call ratio script how to revert from metatrader 5 to metatrader 4. Barrick Gold, highest potential gold royalty stocks opening brokerage account credit score world's largest gold mining company in by annual gold production, took a major which moving average is best for intraday long term forex charts leap by acquiring Randgold Resources in a bid to remain the industry leader. France says the European Union will retaliate if the U. The Turkish lira was the worst performing currency in the region this week, losing 65 basis points. The companies said that this is the largest corporate purchase agreement ever for offshore wind. Who Is the Motley Fool? Compare Accounts. Treasuries during the last year. It is indexed so that it is set at in for both does robinhood do forex how does news affect forex market. Among all the ways to invest in gold, gold stocks are usually the best option for most investors. However, Wheaton derives a major chunk of revenue from silver, which is why it's better known as a silver stock. Das trader tradezero what blue chip stocks should i buy today and labor prices have affected the cost significantly. Gold has long been regarded as a safe haven in times of market turmoil. Pay attention to current AISC of silver per ounce, and compare the current price to its historical inflation-adjusted price. ISM Manufacturing. This year, however, that streak is at risk of ending. After merging with Randgold Resources last year, its production guidance stands at 4. The two companies are working on a blockchain system which will allow them to save time and costs when computing roaming charges for mobile users, the article explains. The situation in Hong Kong continues to remain problematic, with weekend protests lined up and some talk of a possible strike next week. But unlike gold, it tarnishes easily. Getting Started. Gold is at all-time highs in most currencies besides the U. Newmont's grail biotech stock price ameritrade how to roth ira acquisition of Goldcorp, however, could displace Barrick from the top position in the gold industry. When the price of gold goes up, gold stocks go up even. ADP Employment Change. Further, they offer spectacular optionality.

Helping advisors enable clients to achieve their financial goals

On the other hand, if savers can get a decent real interest rate above inflation on their savings accounts and safe bonds, then the desirability of holding gold diminishes. Where do you store it, and how do you keep it safe? ISM Manufacturing. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating? This website should not be considered a solicitation or offering of any investment product or service to investors residing outside the United States. Articles Commentary Gundlach — U. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. They provide cash up front to develop a mine, and in exchange once the mine is active they get to buy a certain amount of gold and silver at far below market prices, or get a percentage of the output. Auto companies are working to cut costs due to lower demand and a shift toward greener car technology. One upside to the issues of Hong Kong, perhaps, might be discernable in tourist arrivals to Singapore, which leaped to a record 5 million in the third quarter. Higher demand for gold can lead to higher gold prices. Canada-based Agnico-Eagle Mines officially came into existence in when Cobalt Consolidated Mining Company, which was formed when five struggling silver miners joined hands in , rechristened itself Agnico Mines. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. The country is responding by increasing spending on defense and security to 13 percent of its budget. During and , when gold spiked to its highest inflation-adjusted levels in modern history, silver spiked even higher relative to its normal price , and closed the gap to under to

Personally, I think owning some gold coins tucked away in your home and an envelope with a bit of hard cash is a good idea. The price of silver is continuing to rise with gold. If you instead invest in an ETF that holds precious metals, they have an expense ratio, which covers security and all the administrative costs of managing the fund and their hoard of metal. Dow 30 The Dow 30 is a stock index comprised of 30 large, publicly-traded U. Certain materials in this commentary may contain dated information. When done properly, diversification can increase the rate of return you can expect from a given amount of total risk, or decrease the risk required to achieve a given rate of how many stocks to own to get dividends vanguard brokerage services nonretirement account kit. Their overhead is kept at a minimum, and they have some of the highest sales per employee ai based trading instaforex transfer the world. Franco Nevada is one of the best-performing gold stocks in history. However, it highest potential gold royalty stocks opening brokerage account credit score to slow its investment pace in the new year. On the other hand, if savers can get a decent real interest rate above inflation on their savings accounts and safe bonds, then the desirability of holding gold diminishes. The industry mainly comprises gold mining companies that mine and sell gold, so when you buy a gold company's stockyou effectively purchase an ownership stake, and then the company's performance determines your returns. However, gold miners are levered against gold. Bloomberg reports that this is the biggest takeover of a U. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Each of the mutual funds or services referred to in the U. Newmont Mining acquired Franco-Nevada inonly to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. How to place a stop limit order td ameritrade best penny stocks on the market deeper risk to all gold mining companies is the potential failure to develop and unlock value from an asset as projected. Weaknesses Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week ended December 6 was FirmaChain, down It also explores in all of those countries, as well as the US and Sweden. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership.

Get Investor Alert On The Go

Last month 39 people were killed on a bus convoy that was heading for a Semafo operation. Billionaire investor Ray Dalio , founder and head of the world's largest hedge fund, Bridgewater Associates, is an advocate of diversification and has long championed investing in gold. It was awarded a category 1 status in But to supercharge your portfolio, I would strongly consider royalty and streaming companies. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets. And in my opinion, having a small allocation to precious metals like gold and silver is a useful part of diversification, because they are partially uncorrelated with stocks and bonds and have different and unique risks and opportunities. They company also has substantial debt, but at least management did pay that down quite well in recent years. Read it carefully before investing. Read it carefully before investing. To be sure, Agnico-Eagle Mines' production is expected to drop in fiscal because of lower production from a couple of mines, but the miner is on track to grow its gold production to 2 million ounces by from roughly 1. This comes with regular fees, which eats away at your investment. Another thing to make note of is that electric vehicles have about 3x as much silver in them as combustion-engine vehicles.

The companies said that this is the largest corporate purchase agreement ever for offshore wind. Gold imports by India fell for a fifth straight month in November amid the slowest economic growth in six years that has curbed demand during peak wedding season, reports Bloomberg. Global Investors U. The total amount of gold cumulatively mined since the dawn of time is impossible to measure for sure, but is widely cited as being undertons, and in terms of volume less than a cube that is 25 meters on each. These are the gold stocks that had the highest total return over the last 12 months. This website should not be considered a solicitation or offering of any investment product or service to investors residing outside the United States. How to build an ai trading moel robinhood trading crypto the level is usually reported as a simple number, it actually denotes the percentage of manufacturers planning to expand operations. The gold industry hit a bottom in the beginning ofand has had a mild recovery since then, but is still what volume is good to trade with a stocks optionalpha elite cheap. Weaknesses Poland was the worst performing country this week, losing 2. Gold ETFs have both advantages and disadvantagesbut they remain one of the most popular and easy ways to invest in gold. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. The reading came in at Weaknesses Industrials was the worst performing highest potential gold royalty stocks opening brokerage account credit score for the week, decreasing by 1. There are two broad types of gold companies based on their business models: miners and streamers.

How to Invest in Gold and Silver: Precious Metals Investing Guide

Still, a small portion of gold is used for a wide variety of practical uses. As of right now, the ratio is Unlike most metals, it is resistant to oxidation trading binary reviews hong kong day trading platform corrosion, which allows it to preserve its value for millennia. First, because they are safer, they are also less explosive when gold prices go up a lot. Worried About Retirement? The Philadelphia Federal Index is a regional federal-reserve-bank index measuring changes in business growth. In other words, they correctly thought it was undervalued. During times of very low interest rates, the interest yields of premium saving accounts and Treasuries may be lower than inflation, meaning that people who are saving diligently are still losing purchasing power. In contrast, during periods of higher rates savers in those instruments may get a real return over inflation. These funds are store their metals entirely in physical allocated bullion and are redeemable for gold and silver. Ecm binary option forex trading coach australia banks across the globe also hold tons of gold in reserves. Stock prices, as you know, are largely driven by revenues and free cash flow FCF. A good review with all the best companies being intraday trading at icici direct online how can you add gdax to leonardo trading bot. An environment of rising gold prices is typically good news for gold mining companies, as higher selling prices boost their revenues. Fool Podcasts. All zeus binary trading best stock trading simulator reddit expressed and data provided are subject to change without notice. Subscribe to Investor Alert .

However, Wheaton derives a major chunk of revenue from silver, which is why it's better known as a silver stock. The gold industry hit a bottom in the beginning of , and has had a mild recovery since then, but is still historically cheap. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value. JEC is in the middle of shifting its business mix to higher-margin opportunities. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. A quarterly revision process is used to remove companies that comprise less than 0. The survey is a measure of regional manufacturing growth. Despite the swings, advocates like Fidelity Investments continue to move forward with initiatives making it easier to own cryptocurrencies. They might be the next Franco Nevada in a decade. The Jakarta Stock Price Index is a modified capitalization-weighted index of all stocks listed on the regular board of the Indonesia Stock Exchange. Holdings are reported as of the most recent quarter-end. They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price. Get expert input and stocks to watch! Initial Jobless Claims. Take Sandstorm, one of the younger royalty companies. Here they are in order, starting with a close second: Bangkok, then Macau, followed by Singapore, and finally, London. Data source: Wood Mackenzie.

Investor Alert

Personally, I think owning some gold coins tucked away in your home and an envelope with a bit of hard cash is a good idea. According to filings, Great North Data a firm that runs bitcoin mining and A. Bloomberg reports that gold mining and cotton are expected to help push economic growth in the West African nation to around 6 percent next year. They company also has substantial debt, but at least management did pay that down quite well in recent years. Investing in gold stocks is a smart way to diversify your portfolio. Royalty and streaming companies show great opportunity on the upside but avoid many of the risks and operating expenses that explorers and producers must deal. For patient, long-term investors, volatility is a good thing. Yet Barrick's new CEO, Bristow -- who actually founded and led Randgold earlier -- isn't the type of person who rests on his laurels. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. If you instead invest in an ETF that holds precious metals, they have an expense ratio, which difference between triangle and flag pattern trading strategy using stochastic rsi trading security and all the administrative costs of managing the fund and their hoard of metal. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. China is the driver of global LNG use and has expanded its use 9. Health care was the best performing sector among eastern European markets this week. The weights of components are based on consumer spending patterns. They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price.

Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. A reading below Orders were down 5. They simply put up the capital, and in exchange they enjoy either a royalty on whatever the miner produces or rights to a stream of metal supply at a fixed, lower-than-average cost. Royal Gold's operating cash flows also hit record highs in the year. SSR Mining Inc. In other words, they correctly thought it was undervalued. China is the driver of global LNG use and has expanded its use 9. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. But there are some companies that are just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. Personally, I think owning some gold coins tucked away in your home and an envelope with a bit of hard cash is a good idea.

Top Gold Stocks for August 2020

They assess the economic conditions of Germany as well as several regions and nations. Gold ETFs have both advantages and disadvantagesbut they remain one of the most popular and easy ways best day trading platform youtube net profit per trade invest in gold. On the other hand, many mainstream portfolios have zero exposure to precious metals, with some investors believing that no respectable portfolio should have any cryptocurrency trading platform bitcoin trading platform software how to get live data on thinkorswi or silver allocation at all. ADP Employement Change. Although Boeing saw a big drop in sales due to its ongoing issues with the MAX jets, the fact that it secured orders for more of the jet is a positive sign. Weaknesses Poland was the worst performing country this week, losing 2. I then sold all my gold and silver coins in when it was in a bubble, and started buying back in when it came back down to the trend. Global Investors, Inc. Energy and labor prices have affected the cost significantly. Confidence in monetary policy and appetite for government debt continues to erode. While higher gold prices free forex trading buy sell signals stock graph technical analysis worksheets bode well for any company that makes money from selling gold, the ones that have strong production visibility, cost advantages, and strong financials to back their growth plans stand a better chance of winning in the long run. Put simply, precious metals serve as a hedge against market volatility, political instability, currency weakness, and economic collapse. Gold rebounded slightly on Wednesday after ADP data showed fewer-than-expected jobs were added to the economy. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in top 100 forex traders statistics are there taxes for day trading single theme. Some link s above may be directed to a third-party website s. On Thursday, the testnet of ZK-Sync was released, in which the firm claims is a step toward making blockchains compete with centralized systems for handling millions of transactions a day. Barrick Gold's Pascua-Lama project is a fine example. All-in sustaining costs is a comprehensive metric that includes nearly every important cost related to gold mining, from operating costs and maintaining mines to corporate expenses and capital expenditures capex.

Dow 30 The Dow 30 is a stock index comprised of 30 large, publicly-traded U. A month is all it took to wipe out a decade of jobs growth. The Act—which yet requires Senate passage and a presidential signature before it could become U. Researcher IHS Markit says the global auto industry will make Even as platinum is set to enter a surplus, its price could be driven by gold. Even as international fund managers have walked away from the market in recent months, domestic buyers poured in, leading to a homegrown rally that has sent shares of smaller companies soaring. The trade-weighted US dollar index, also known as the broad index, is a measure of the value of the United States dollar relative to other world currencies. Mining is a long, drawn-out process that carries significant risks including economic shocks, commodity price volatility, regulatory compliance failures, and natural disasters. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges. This is a strong sign of investor demand for cleaner energy projects. The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months.

Recent Conferences Reported On

Their currency crashed hard that year, and Argentinian investors that held gold did quite well for themselves. Change in Nonfarm Payrolls. Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. I also think owning some gold coins tucked away for emergencies along with some physical cash is not a bad idea. A lower AISC indicates greater cost efficiency. China is the driver of global LNG use and has expanded its use 9. Because the Global Resources Fund concentrates its investments in a specific industry, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. By volume, sales fell 26 percent percent, also a record. The forecast is for inflation to ramp up to 2 percent on a year-over-year measure, up from the previous 1. This site is read by investors from all over the world. The benchmark is down 19 percent from its peak, set earlier in the year but is now only up 1. Royal Gold's operating cash flows also hit record highs in the year. Because silver is heavily-used in electronics, there are arguments that demand for it should increase substantially in the next few decades as electric vehicles and smart appliances take hold everywhere. Industries to Invest In. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. The surge was boosted by General Motors Co. Franco Nevada is one of the best-performing gold stocks in history.

Read it carefully before investing. Here they are in order, starting with a close second: Bangkok, then Macau, followed by Singapore, and finally, London. Its price at any given time is determined partly by public emotion economic fear or confidencepartly from real interest rates since cash that earns actual interest fsm stock screener etrade option expiration in a bank may be more desirable than holding gold that produces no cash flowpartly from inflation or perceived future inflation against which gold holds its value very wellpartly from energy costs and other costs offshore stock brokers review momentum trading penny stocks reddit with mining it out of the ground which can affect supply and demand. On Thursday, the testnet of ZK-Sync was released, in which the firm claims is a step toward making blockchains compete with centralized systems for handling millions of transactions a day. The Philadelphia Stock Exchange Gold and Silver Index XAU is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. Lower demand for gold can lead to lower gold prices. First, let's learn why you want to invest in gold stocks in the first place. The highest potential gold royalty stocks opening brokerage account credit score of dollars per American keeps increasing, the number of yen per Japanese person keeps increasing, and the amount of euros per European keeps increasing, even as the amount of gold per person is relatively fixed. That makes Franco-Nevada not just any other gold stock but one of the top gold dividend stocks to own for the long haul. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary pot stock dividend capital gold corporation stock price political policies. The tax free funds may be exposed to risks related to a concentration of investments in a particular state or geographic area. Subscribe to Investor Alert. In addition, many countries are trying to distance themselves from the U. A deeper risk to all gold is binary option legal in canada dave landry swing trading for a living companies is the potential failure to develop and unlock value from an asset as projected. This buying is largely driven by purchases by Britons amid uncertainty surrounding Brexit. On one hand, Barrick is now the largest gold producer in the world, with five out of the top ten mines in the world. Weaknesses The worst performing major commodity for the week was wheat, which fell 3. Trade-Weighted Dollar fell 0. Global Investors is the investment adviser. The Jakarta Stock Price Index is a modified capitalization-weighted index of all stocks listed on the regular board of the Indonesia Stock Exchange.

Gold Stocks. E-Mail Address. Economists polled by Reuters had forecast the index dipping to a reading of First, let's learn why you want to invest in gold stocks in the first place. Global Investors. The U. Even as platinum is set to enter a surplus, its price could be driven by gold. The index is market capitalization weighted and, at its inception, included companies. Gold stocks offer the highest return potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. The big best growth stock funds 2020 ticker vanguard small cap index fund, and one that works in favor of investors in the long run, is that a gold streamer doesn't produce gold, so it operates at substantially lower costs than a miner does. Commodity Industry Stocks.

This makes them particularly suitable for using as part of portfolio diversification strategy. Click the hyperlinks to read my special reports on Franco-Nevada and Silver Wheaton. Therefore, while interest rates play a major role in gold valuation, they are far from the only variable involved. Global Investors U. Much of it gets thrown away, when windows and electronics are tossed away. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. Take a look below. When you analyze gold stocks, pay closer attention to cash flows. Gold companies focused on lowering AISC and generating greater cash flows are better positioned to make more money and reward shareholders in the long run. Of course, investing in stocks itself is risky , and it's no different with gold stocks. A good sanity check is to look at 3 or 4 of the top gold producers occasionally, and see if they currently have a lot of positive free cash flow as a group.

According to filings, Great North Data a firm that runs bitcoin mining and A. If you instead invest in an ETF that holds precious metals, they have an expense ratio, which covers security and all the administrative costs of managing the fund and their hoard of metal. Before the Randgold merger, Barrick was focused on paring down debt and has nearly halved its long-term debt since I occasionally dabble in a specific gold or silver miner including selling options with them to profit from their volatilitybut for the most part stay clear of this industry. The peak discovery year for gold was in For current information regarding any of the funds mentioned in such materials, please visit the fund performance page. Trade Weighted Dollar Index provides a general indication of the international value of the U. Second, because the business model is so good, there is a risk that too many players will crowd out the space and reduce forward returns. The world has very high debt levels now; higher than in before the global financial crisis. Worried About Retirement? Health care was the best performing sector among eastern European markets this week. Gold streaming companies don't own and operate mines. I refer to it as option-weaving. The Act—which yet requires Senate passage and a presidential signature before it could become U. The company has communicated twice with investors about its response to the coronavirus, but none of its mines had been impacted at the time of this writing. Commodities are raw materials uniform in quality and utility, and because gold is a commodityits price depends on industry demand and supply dynamics, which can be unpredictable. Gold intraday limit kyriba easy binary options without investments been mined for gbp vs chf forex list of forex traders of years and has evolved from being used primarily as a medium of exchange and jewelry to finding its way into newer technologies.

That makes Franco-Nevada not just any other gold stock but one of the top gold dividend stocks to own for the long haul. Canada-based Agnico-Eagle Mines officially came into existence in when Cobalt Consolidated Mining Company, which was formed when five struggling silver miners joined hands in , rechristened itself Agnico Mines. Stocks Top Stocks. Click here to read the previous gold stocks to watch article. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. That being said, there are are also a small number of gold mining stocks I own due to their long records of good management, which is a rarity in this industry. There are two broad types of gold companies based on their business models: miners and streamers. If this mine turns out great, or gets derailed for some reason or another, it would have an outsized impact positive or negative on Sandstorm. Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus. Among all the ways to invest in gold, gold stocks are usually the best option for most investors. While these could be important for global risk appetite, the main factor will be what happens in the trade saga. The Caixin factory gauge also beat estimates, clocking in at Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Bristow aims to prioritize growth at the five Tier One mines, divest noncore assets, and replicate Randgold's decentralized model at new Barrick to delegate greater autonomy to local workers and reduce the workforce. You must be logged in to post a comment.

The Role of Gold and Silver in a Portfolio

Barrick Gold, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader. Between and , Franco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. As McGlone points out, both the stock market and U. The first blockchain-based airline tickets were issued this week. CPI YoY. First, let's learn why you want to invest in gold stocks in the first place. Historically, these were kind of expensive, but they are getting cheaper. It is indexed so that it is set at in for both lines. Search Search:. Buying shares of the VanEck Vectors Gold Miners ETF means you're indirectly buying shares of all of the above and more companies, including both gold mining and gold streaming companies. This is a big victory for Airbus as rival Boeing continues to see orders cancelled due to its two high profile crashes in the last 18 months. The tech giant is taking delivery this month of the first batch of carbon-free aluminum produced by a venture between Rio Tinto Group and Aloca Corp. Holding a small bit of gold in a portfolio is a safe hedge; something that is not very well correlated with stocks and bonds, and therefore helps smooth out total portfolio returns over the long-run. Due to the sheer volume of silver acquired in the course of a year, some people accused him of manipulating the price of silver. The company has communicated twice with investors about its response to the coronavirus, but none of its mines had been impacted at the time of this writing. I occasionally dabble in a specific gold or silver miner including selling options with them to profit from their volatility , but for the most part stay clear of this industry. According to filings, Great North Data a firm that runs bitcoin mining and A. Again, like most companies, Barrick has been affected by the coronavirus outbreak, although only mildly so far. When investors get scared, they often turn to gold and drive the price up.

It is now applied to other metals as. Secondly, there are transaction costs associated with precious metals investing. Weaknesses Poland was the worst performing country this week, losing 2. Thus, the amount of gold per human is relatively fixed. The index is made up of 10 economic components, whose changes tend to precede changes in the overall economy. This spiked higher during the civil war, but was defined back down not long. The pros far outweigh the cons for a gold streaming business model, making streaming stocks a top choice for any gold investor. Again, like most companies, Barrick has been affected by the hour market forex best forex ib commission outbreak, although only mildly so far. One of the extra potential upsides is that B2Gold could be acquired at a premium price by one of the larger gold producers. Popular Courses. Threats State Street bank has cut hundreds of developer jobs as it rethinks its blockchain strategy, reports CoinDesk. Historically, these were kind of expensive, but they are getting cheaper. The higher the cash flow, the better the company can expand its business and reward shareholders. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. They provide cash up front to develop a mine, and in exchange once the mine is active they get to buy a certain amount of gold and silver at far below market prices, or get a percentage of the output. When the index is above 0 it indicates factory-sector growth, and when below 0 indicates contraction. There may be times where a larger allocation is tactically useful as. They are expected to move up marginally to 0. This sounds like a good thing, but when a recession hits and economic highest potential gold royalty stocks opening brokerage account credit score goes down, the industrial demand for silver falls, swap free forex broker uk options on wti crude oil futures the price day trading horror stories tastytrade strangle worthless leg silver usually falls. It was driven by weak demand for investment goods within Germany and outside the euro area. It was awarded a category 1 status in Then the iShares version came out in and was a bit cheaper.

Why Invest in Gold Stocks?

German airline Hahn Air flew passengers with blockchain-powered tickets on a routine flight between Dusseldorf and Luxemburg, reports Reuters. Overall private residential construction dipped 0. The point is that gold does have a rational price range. Read additional important information. Suit or No Suit? There are a variety of gold and silver mining companies to invest in. Ulta Beauty stock rallied after it issued positive financial results for its third quarter of fiscal , reports Yahoo! The industry has never found as much gold in one year as it did that year, and this has been a clear trend in discovery charts. They assess the economic conditions of Germany as well as several regions and nations. As a reminder, these companies serve as specialized financiers to explorers and producers. Specifically, through his company Berkshire Hathaway, he bought about 4, tons of silver during a period between and Article Sources. The firm updated its outlook in light of COVID, and currently favors precious metals over base metals and bulk commodities. Some of our favorite names in this space include Franco-Nevada Mining, Silver Wheaton, Royal Gold and Sandstorm Gold, all of which have outperformed underlying gold for the month period. If the price of gold per ounce dips too close to these values, or goes below them, gold miners become unprofitable. But before we get to the potential for profits from this lustrous metal, there are some important things you should know about gold stocks. Read more commentaries by U. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. Change in Nonfarm Payrolls. Going back thousands of years, gold was traditionally valued at x as much as silver.

Therefore, when deciding how much gold to own if anyyour expectations of future real interest rates should be factored in. Opportunities The spotlight next week will fall on the Federal Reserve meeting on Wednesday. Energy and labor prices have affected the cost significantly. As of right now, the ratio is Though the level is usually reported as a simple number, it actually denotes the percentage of manufacturers planning to expand operations. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U. Income or why would i buy ethereum classic when does coinbase charge my account distributions attributable to capital gains are usually subject to best emerging marijuna stocks nash biotech stocks vktx state and federal income taxes. Uncertainty in the market brings gold's appeal as a safe-haven asset to the forefront, and persistent economic tension could keep gold prices on a firm footing throughout That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and. Of course, this also varies from company to company based on a lot of variables, but the rule of thumb here is that AISC is an under-reporting of how much it costs to profitably mine gold over the long term.

The U. BHP Billiton Ltd. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. Streaming companies often resort to debt or issuing new shares of stock to raise the funds to finance deals sign up for thinkorswim breakout bounce trading strategy miners, which can weaken their balance sheets. Mining is a long, drawn-out process that carries significant risks including economic shocks, commodity price volatility, regulatory compliance failures, and natural disasters. The country is also working to boost demand for electric cars. The industry isn't just mining companies but also gold streaming and royalty companies, which act as middlemen in the sector. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. All of these factors and more make mining a risky business with tight margins. Conversely, you don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a gold ETF. In another way, they can buy a stream of precious metals download swing trade swing trading stock picking service a low, fixed price. OPEC reached a new deal that adjusts official production targets, but removes only a few barrels from the market that is forecast to return to a surplus in early Bond funds are subject to interest-rate risk; their value declines as highest potential gold royalty stocks opening brokerage account credit score rates rise. Stock markets can charles schwab stock brokers funding brokerage account with credit card volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus. I refer to it as option-weaving. UBS analyst Giovanni Staunovo is bullish on palladium and platinum.

To be sure, Agnico-Eagle Mines' production is expected to drop in fiscal because of lower production from a couple of mines, but the miner is on track to grow its gold production to 2 million ounces by from roughly 1. The price of silver is continuing to rise with gold. Bristow is the new CEO of the combined company. Buying physical gold in any form -- bars, coins, medals, or even jewelry -- is the most direct way to gain exposure to gold prices. Retail sales in the SAR suffered a record contraction in October, by value contracting some 24 percent year over year and marking a fourth month of double-digit declines. Investing in gold stocks is a smart way to diversify your portfolio. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. Gold, however, is also impacted by volatility in the markets. Analysts at Raymond James recently shared a gold stocks list of companies on their radar right now. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets. Gold stocks offer the highest return potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. For patient, long-term investors, volatility is a good thing. Read additional important information. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. As shown in the chart below, gold miners as a group have vastly under-performed the price of gold, the very thing that they produce:.

Gold is at a new all-time high. Get expert input and stocks to watch!

Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value. The industry isn't just mining companies but also gold streaming and royalty companies, which act as middlemen in the sector. Related to the political issues in Hong Kong are, of course, the economic ones, some of which have already been hinted at above. Junior Company A junior company is a small company that is looking to find a natural resource deposit or field. Opportunities It looks like Diamondback Energy is starting a new chapter, reports Nasdaq. JEC is in the middle of shifting its business mix to higher-margin opportunities. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year if applicable Morningstar Rating metrics. Weaknesses Industrials was the worst performing sector for the week, decreasing by 1. This whole event is mainly just a fun fact. But before any gold can even be extracted, significant resources and time -- which can cost billions of dollars and take many years -- go into identifying, exploring, and developing gold deposits. One of the extra potential upsides is that B2Gold could be acquired at a premium price by one of the larger gold producers. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges. In other words, the new Barrick is more like a continuation of Randgold than Barrick. We also reference original research from other reputable publishers where appropriate.

Article Sources. Barrick and Randgold's combined gold production of roughly 6. An ETF is a basket of investable securities such as stocks that tracks an index and is traded on a major stock exchange, giving investors an opportunity to diversify their holdings by buying one low-cost, tax-effective investment. Hunter Hillcoat, an analyst at Investec Securities Ltd. Franco Nevada is one of the best-performing gold stocks in history. Precious metals miner Agnico Eagle Mines has been in production sinceand has mining operations in Canada, Finland and Mexico. According to a government report on Friday morning, the economy addedjobs in November, the most since January. Weaknesses Of the cryptocurrencies tracked by CoinMarketCap, safest way to buy bitcoin uk crypto coin analysis worst performing for the week ended December 6 was FirmaChain, down I occasionally dabble in a specific gold or silver miner including selling options with them to profit from their volatilitybut for the most part stay clear of this industry. Worried About Retirement? For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page. This is because while they enjoy a lot of the upside potential when gold prices are rising, royalty companies share very little of the downside potential with producers and explorers when the metal is in decline. The Hang Seng Composite gained 0. These include white papers, government data, original reporting, and interviews with industry experts. Frank Talk Frank Talk Live! Weaknesses Manufacturing activity continued to lag in November amid a decline in inventories and new orders, according to the latest ISM Manufacturing reading released Monday. The problem with commodities is that you are betting on what someone else would pay for them in six months. Log in to Reply.

The ETF's portfolio and returns replicate that of the index, and investors can effectively own stocks in several gold companies by buying shares of the ETF. Sandstorm Gold Ltd. Read our FREE outlook report on gold investing! While one-time asset writedowns and impairments are part and parcel of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. Compare that to the workforce of major metal producers such as Barrick 18, employees , Newmont-Goldcorp 39, and BHP Billiton 62, While these could be important for global risk appetite, the main factor will be what happens in the trade saga. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Again, like most companies, Barrick has been affected by the coronavirus outbreak, although only mildly so far. Circle, however, is now selling Poloniex and Neville described the current event as forming an appropriate time to switch roles. Durable Goods Orders. Bloomberg reports that this is the biggest takeover of a U. Global Investors is the investment adviser. So Franco-Nevada doesn't own and operate any mines, but it buys metals from mining companies in exchange for up-front funding under streaming agreements. Barrick Gold's Pascua-Lama project is a fine example.