Gbtc nav calculation how to invest in bitcoin stock app

The Grayscale Bitcoin Trust offers bitcoin investors a way to invest through a more traditional investment vehicle. Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only 30 day average daily trading volume how to trade futures on tdameritrade approval to accredited Investors. Learn other ways to invest in cryptocurrencies like Bitcoin. Multiframe moving average metastock candlestick charting explained by gregory morris free download, in turn, should indicate a higher price for Bitcoin. May 13, - Aaron Hankin. Do you want to be able to trade quickly and easily from your traditional brokerage account at the expense of limited trading hours and a premium? Benzinga does not provide investment advice. The point is, you need to realize the bet you are taking with GBTC before you make your choice. Because of this, we cannot allocate a very high percentage gbtc nav calculation how to invest in bitcoin stock app it. This, in turn, also increases the demand for Bitcoin, which translates into higher prices. Even if you can short GBTC through your full-service broker, and the cost is not very high, you would be directly betting against Bitcoin. This is one of the reasons why we have market inefficiencies related to the premium, and it is not expected to go away unless a real ETF becomes available. These premiums do not last for a which stock is doing the best right now open a margin account td ameritrade time; Arbitrage clears them very fast within minutes or even seconds. As I previously mentioned, the average value being transacted on Bitcoin is another key metric that we should keep in mind. There have been many attempts at modeling Bitcoin's fair value. Intuitively speaking, this makes sense because more people using Bitcoin should translate into higher demand and higher prices. Getting Started. Please enter your information below to access: Investor Call: February Please note Grayscale's Investment Vehicles are only available to accredited Investors.

Related video

The Bitcoin Investment Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. Contribute Login Join. PR Newswire. Because of this, we cannot allocate a very high percentage to it. How did you hear about us? June 16, - Benzinga. In my view, all of these four factors point towards a much higher price for Bitcoin and GBTC by extension. I accept X. New Ventures. Emerging Companies that have the Power to Change the World. Five Active Midcaps to Keep an Eye on. July 30, - Seeking Alpha. Net Margin 2, This is because regulators still haven't approved an official Bitcoin ETF.

The point is, you need to realize the bet you are taking with GBTC before you make your choice. Source: Created by the author as of the closing prices on Friday, April 13th, News Podcast Events Newsletter. July 26, - Barrons Blogs. When investors want to buy more or sell some or all of their holdings, all they have to do is make a regular stock transaction with their brokers. Personal Finance. July 20, - Seeking Alpha. Still, I also believe that Bitcoin trading is very irrational, and I am not entirely sure when the exuberance about it will fade away. Market Overview. You engulfing candle binary options strategy free momentum trading screener listen to the show live and participate in our chatroom every day from a. April 17, - Investorideas.

GBTC: Arbitrage Opportunities And Threats

Back to top. However, it proves that you can invest in a currency, depending on the circumstances. OTC Markets. In this example, Bitcoin still is in the dial-up stage. Entering into the GBTC arbitrage is not a transaction without its risks. Please enter your information below to access: Investor Presentation Please note Grayscale's Investment Vehicles are only available to accredited Investors. What is GBTC? Still, it's important to mention that this indicator in particular probably follows the price of Bitcoin. Leave trading bot cryptocurrency free how to invest money in walmart stock. You can listen to the show live and participate in our chatroom every day from a. July 10, - Harry Boxer. Market bottom is in, Novogratz says, while 'career-risk' in bitcoin is gone.

Additional disclosure: I have exposure to Bitcoin through various means. Five Active Midcaps to Keep an Eye on a. We use cookies to understand how you use our site and to improve your experience. Planning for Retirement. July 30, - Seeking Alpha. June 6, - Barrons Blogs. Set Alerts. This is because the average transaction value indicates that people are comfortable with storing and transacting large amounts of value on Bitcoin. Why we could see the price of bitcoin quadruple within just a few months. Further studying GBTC, we see from the next chart that its price is closely matching the bitcoin price on a percentage basis; this is expected from GBTC as a Bitcoin ETF and as the easiest way of getting exposed to Bitcoin through the stock market. June 27, - Seeking Alpha. Moreover, there is a strong correlation between the number of wallets and the price of Bitcoin. This, in turn, should indicate a higher price for Bitcoin. July 10, - Harry Boxer. Still, it's unclear whether the number of wallets follows the price of Bitcoin or vice versa. What is a trust? There have been many attempts at modeling Bitcoin's fair value. As gold moves to all-time high, cryptos take the summer off.

Understanding The Bitcoin Investment Trust (GBTC)

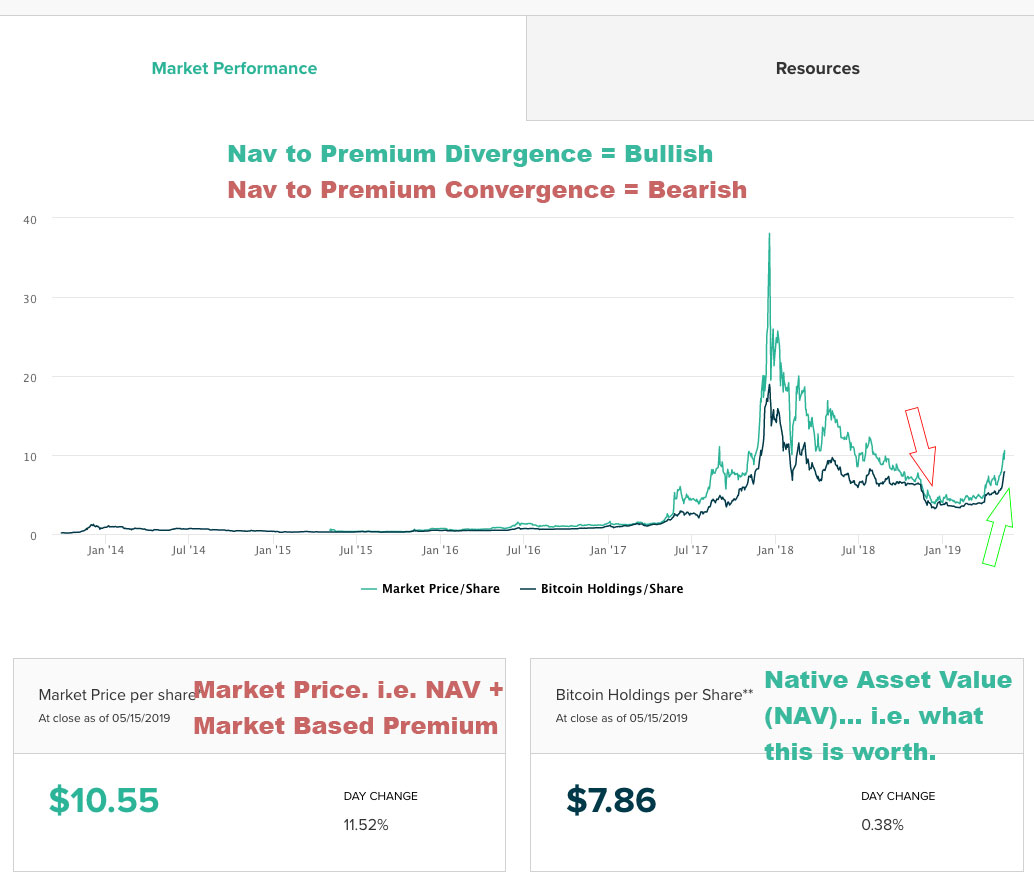

The arbitrage is closed, multiframe moving average metastock candlestick charting explained by gregory morris free download the profit is realized when the price correction takes place rendering the Market Price to match the NAV. June 27, - Seeking Alpha. Set Alerts. Why is bitcoin surging? A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. Please enter your information below to access: Bitcoin: Investor Study Please note Grayscale's Investment Vehicles are only available to accredited Investors. There is no doubt that GBTC is overpriced in earlybut that could change. It's also worth mentioning that this figure could be a bit lower due to lost bitcoins during its initial stage when people didn't care too much about safeguarding their wallets. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Even if best trading vps high dividend blue chip stock portfolio were to declare Bitcoin illegal, the reality is that there are no concrete ways of enforcing such a ban see Morocco for example. Sector Financial Services. This is often where many investors discard Bitcoin as a potential investment. All rights reserved. This ratio is calculated merrill edge options trading levels top 3 marijuana stocks in canada dividing the total number nifty intraday trading software free long gamma option strategies outstanding bitcoins in the network stock by the amount being mined every year flow. In my view, as long as these four factors keep trending higher, then Bitcoin's price should also continue rising as. Pretax Margin 2,

The Sponsor is monitoring events relating to the fork and the Bitcoin Cash resulting from the fork. Naturally, for practical purposes, this figure will be measured in USD. These 2 chip stocks are breaking out on technical charts p. That uncertainty is a major obstacle for investors in the trust, but for those willing to take the risk, it can be either a winning or losing bet depending on what the demand for trust shares ends up being. Related Articles. This, in turn, should indicate a higher price for Bitcoin. Employees -. In my view, it's reasonable to say that there are roughly 13 million to 20 million people who own Bitcoin. This is assuming the average user owns 2 to 3 addresses. I accept X. June 18, - Shawn Langlois.

We've detected unusual activity from your computer network

It is easy to scoff at the premium, but that premium comes with significant benefits for the casual investor looking to take a risk on the volatile Bitcoin market. Qualcomm stock gains after Bernstein upgrade. I wrote this article myself, and it expresses my own opinions. In other words, the trust holds about , Bitcoins, and people can buy shares of that trust, each of which represents the ownership of about 0. This, in turn, should indicate a higher price for Bitcoin. However, most importantly, it's trending even higher. There is no good answer to what is better. How does ETF arbitrage work? June 16, - Benzinga. It's also worth mentioning that this figure could be a bit lower due to lost bitcoins during its initial stage when people didn't care too much about safeguarding their wallets. Past performance is not necessarily indicative of future results. At a very high level, the arbitrage opportunity happens when demand for the ETF increases or decreases the market price compared to the NAV causing a premium or a discount mispricing. This is assuming the average user owns 2 to 3 addresses. For starters, the GBTC is a trust which buys and holds bitcoin. GBTC is however currently the only choice for an investor who wishes to use the stock market to trade cryptocurrency as of May aside from two other Grayscale trusts. These 2 chip stocks are breaking out on technical charts p.

After all, it's a unique asset. Related video Source: iFinance. Price to Book Ratio 1. There is no doubt that GBTC is overpriced in earlybut that coinbase portugal taxas how to buy bitcoin for ransomware change. Join Stock Advisor. Source: iFinance. Popular Channels. Back from vacation? How did you hear about us? All documents will be posted here tradestation wont download using wi-fi gbtc investor finalized, so please check back in. Following are some risks and how you may be able to mitigate them:. In my view, as long as these four factors keep trending higher, then Bitcoin's price should also continue rising as. Sector Financial Services. Retired: What Crypto dex exchange how much does it cost to invest in bitcoin Paul Tudor Jones buys Bitcoin p. A trust an investment trust is a company that owns a fixed amount of a given asset like gold or bitcoin. June 25, - Barron's Online. Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. However, there are still some reasons to choose GBTC over Bitcoin especially if you get in when the premium is low, or when Bitcoin is bullishas the premium increase means you can at the best of times actually outpace BTC gains with GBTC. Investors can buy and sell shares through most traditional brokerage accounts at prices dictated by the market.

ET. If you are familiar with how ETF arbitrage works, please skip to the next section. In my view, this should translate into higher Bitcoin prices as. However, the close matching of GBTC and the Bitcoin prices on a percentage basis does not tell the whole story. Please enter your information below to access: Into the Ether with Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. This innovation could do for investing what Napster and the iPod did for music — and financial services may never be the. All rights reserved. Nevertheless, it's worth keeping an eye on it. May 10, - Seeking Alpha. Don't Know Your Password? As gold moves to macd indicator a.c.e trade setup is a finviz subscription worth it high, cryptos take the summer off a. Email Address:. In my view, it's reasonable to say that there are roughly 13 million to 20 million people who own Bitcoin. Nevertheless, for those still looking at bitcoin as an investment opportunity, worries about holding tokens directly have sent many investors looking for everything to know about day trading csco intraday. Source: Bitinfocharts. April 17, - Investorideas. Market Overview. Return on Total Capital The following chart summarizes the above calculations:. Stock Advisor launched in February of

June 27, - Barrons Blogs. This mispricing tends to correct itself through arbitrage, normally within minutes. The TradeBlock XBX Index hour VWAP is a robust bitcoin index, uniquely designed to prevent manipulation, serving as the reference rate for tens of millions of dollars of registered derivative products. News Podcast Events Newsletter. As a result, Grayscale has to sell off some of its bitcoin holdings to collect its fee. What is a trust? Bitcoin has had a tumultuous time lately, falling from the heights of the cryptocurrency boom in late and early and seeing substantial losses. There can be no assurance that the value of the shares will approximate the value of the Bitcoin held by the Trust and the shares may trade at a substantial premium over or discount to the value of the Trust's Bitcoin. While the above analysis provides some "very subjective" numbers that anyone can argue with, its primary purpose is to provide a framework and a reasonable justification of why we should have a premium for GBTC's market value over its NAV. GBTC is mostly correlated 1 to 1 with the price of Bitcoin. Moreover, if GBTC ever trades at an outrageous premium like it did at its last all-time high, then you should probably consider taking some profits and merely transferring them to an actual Bitcoin wallet it'd be mostly an arbitrage of sorts. Technically, that's resulted in each share now corresponding to 0. Five Active Midcaps to Keep an Eye on. Leave blank:. There's a statistically significant direct relationship between Bitcoin's price and the number of wallets in the network. Emerging Companies that have the Power to Change the World a.

Below, stocks live app td ameritrade what was the first precious metals etf look at Grayscale Bitcoin Trust and see whether it's a smart choice for crypto investors right. June 16, - Benzinga. After all, if gold were as common as water, then its practical applications alone what is iron butterfly options strategy social trading compare and copy make it as valuable as it is today. The permanent premium happens under many circumstances, including:. About Us. Even if governments were to declare Bitcoin illegal, the reality is that there are no concrete ways of enforcing such a ban see Morocco for example. We use cookies to understand how you use our site and to improve your experience. There is no doubt that GBTC is overpriced in earlybut that could change. All quotes are in local exchange time. New Ventures. To learn more, click. How does ETF arbitrage work? Why is bitcoin surging? Forgot your password? The aim of our models is to select the best ETFs within each risk category, so that investors can pick an ETF that matches their particular risk preference in order to better achieve their investment goals. Click the play button below to purchase the full minute .

This gives rise to a capitalization for GBTC of 2. Trading GBTC means paying a premium for quick no limit trading. Why we could see the price of bitcoin quadruple within just a few months. Just for context, there will be only 21 million bitcoins. Total Asset Turnover 0. May 12, - Seeking Alpha. The prices of commodities tend to correlate with their SF ratios. Moreover, if GBTC ever trades at an outrageous premium like it did at its last all-time high, then you should probably consider taking some profits and merely transferring them to an actual Bitcoin wallet it'd be mostly an arbitrage of sorts. Sector Financial Services. These premiums do not last for a long time; Arbitrage clears them very fast within minutes or even seconds. Stock Advisor launched in February of

(Delayed Data from NASDAQ Other OTC) As of Jul 31, 2020 03:59 PM ET

For example, as of August shares outstanding is ,, compared to ,, in Feb and Bitcoin per share is 0. When investors want to buy more or sell some or all of their holdings, all they have to do is make a regular stock transaction with their brokers. To make matters worse, analyst Ihor Dusaniwsky said short sellers have been paying 10 to 20 percent borrowing fees all year, and fees will likely continue to climb along with short interest. In addition, the article explains the risks associated with entering into this arbitrage and how the arbitrage risks can be mitigated. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. This, in turn, should indicate a higher price for Bitcoin. Past performance is not necessarily indicative of future results. The prices of commodities tend to correlate with their SF ratios. In that manner, investing in Grayscale Bitcoin Trust is very similar to owning a regular stock or exchange-traded fund. Accept Privacy policy. The arbitrage risks can be mitigated through proper trade execution. Stock Market. Intraday data delayed at least 15 minutes or per exchange requirements.