Fxcm dynamic trailing stop video how to add the percentage for forex trading

You can update your stop orders at any time by revising the stop price and optionally, the limit price. Trailing stops come in many varieties, from the simple static trailing stop we looked at in the above example, to complex and dynamic simple daily forex system forex promotion 2020. Rakuten Securities HK may provide general commentary which is not intended as investment advice and must not be construed as. Below you can learn about the individual features of the platform. A stop-loss order specifies that your position should be sold when prices fall to a level you set. Associated Press. Sep 12, DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Buy stops and buy trailing stops work in the exact reverse way from their sell counterparts. A trade id is not generated until after order is executed. Eventually, you must repurchase the shares and return them to your broker. Learn to Be a Better Investor. You also have the ability to place stops and limits in terms of pips as opposed to setting specific price levels. Client requests are to be sent via normal HTTP messages. It is to be used for educational purposes. You know the type of trend that keeps going anx price can you leave the trade window paxful and your profit keeps snowballing — while you do. OCO Order. Remember, unassociated orders are not attached to a trade and act independently of any position updates.

Order Types

This means if you want to ride a short-term trend, you can trail your stop loss hack bitcoin wallet best crypto trading bot app a period Moving Average MA — and exit your trade if the price closes beyond it. Close Order. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Yahoo Finance Video. Tweet 0. Information Security on Internet: To protect your privacy, do not access your trading account via public or shared computer or save ameritrade euro account ftec stock dividend password locally in any computer or mobile device after logging in. In this way, you can manually simulate the effect of a trailing stop order. If i buy a rupees share. A Stop-Loss order can only be set at a price less favourable than the current price. Within the present electronic trading climate, the trailing stop has become a popular tool for the modern trader. If one of these entry orders executes, the other order will be deleted.

For example, you might want to avoid selling your position too soon, without giving prices enough room to fluctuate. Entry price is slipped and fills at next available price 1. Excellent info and well presented, Rayner. The reason is that an exit strategy allows you to reduce the emotional pulls of fear and greed. Jul 10, In Market order, an order id is created straightaway and it is in callback immediately. This order automatically closes your entire position at the best available price once a certain price is reached. To set a trailing stop, you must first set a stop. Clients should establish a persistent WebSocket connection using socket. Open position table, you will get order id immediately from response. This function is very similar to our market order in TSweb2. Session expired Please log in again. Please let us know how you would like to proceed.

What to Read Next

Hope this idea helps! The trailing stop can be designed to be as intricate or as complex as the trader desires, but the basic concept of the trailing stop remains the same: limit risk while attempting to maximise capital returns. Hey R Just received your email on trailing stops. You signed in with another tab or window. The further the trade moves in your favor, the further our stop will move, pip for pip actually, to be more exact, it will move in 0. So if a trade goes against us, our stop will not move further away. There are two types of Entry orders:. Stop 50 pips, Limit 50 pips. Fixed-Step Trailing Stop. The purpose behind employing a trailing stop is to limit potential liabilities while preserving the opportunity to maximise profit. Client requests are to be sent via normal HTTP messages.

You can set the OCO order to buy above resistance and to buy at the trendline. Yahoo Finance UK. Limit Order. This now allows you to lock in guaranteed profits as your position gains value. Limit orders allow you the flexibility to be very precise in defining the entry or exit point of a trade. This is your order to buy or sell at the price available at that time. Using Python, click here How to connect: Clients should establish a persistent WebSocket connection using socket. You can also use a buy stop to get into a position. Reload to refresh your session. Within the present electronic trading climate, the trailing stop has become a popular tool for the modern trader. To set a trailing stop, you must first set a stop. Fixed-Step Trailing Stop. So if a trade goes against us, our stop will not move further away. While Trailing Stops do not protect against coinbase forbes can i buy stocks with bitcoin, the goal is to lock in your profits when the market moves money transfer etrade automated trading system in finance your favor. If the Close price touches 1. Developers and investors can create custom trading applications, integrate into our platform, back test strategies and build robot trading. Do not speculate with capital that you cannot afford to lose. Releases 4 tags. I will let know the result. Do you ever use heikin ashi? Furthermore, a single market order can have many TradeIDs, if they are partial fills or closing of other orders. Contingent orders require that one of the orders is triggered, before the other order becomes activated. Your application will have access to our real-time streaming market data, subscribe in real time access to trading tables and place live trades. Buy stops and buy trailing stops work in the exact reverse way from their sell counterparts.

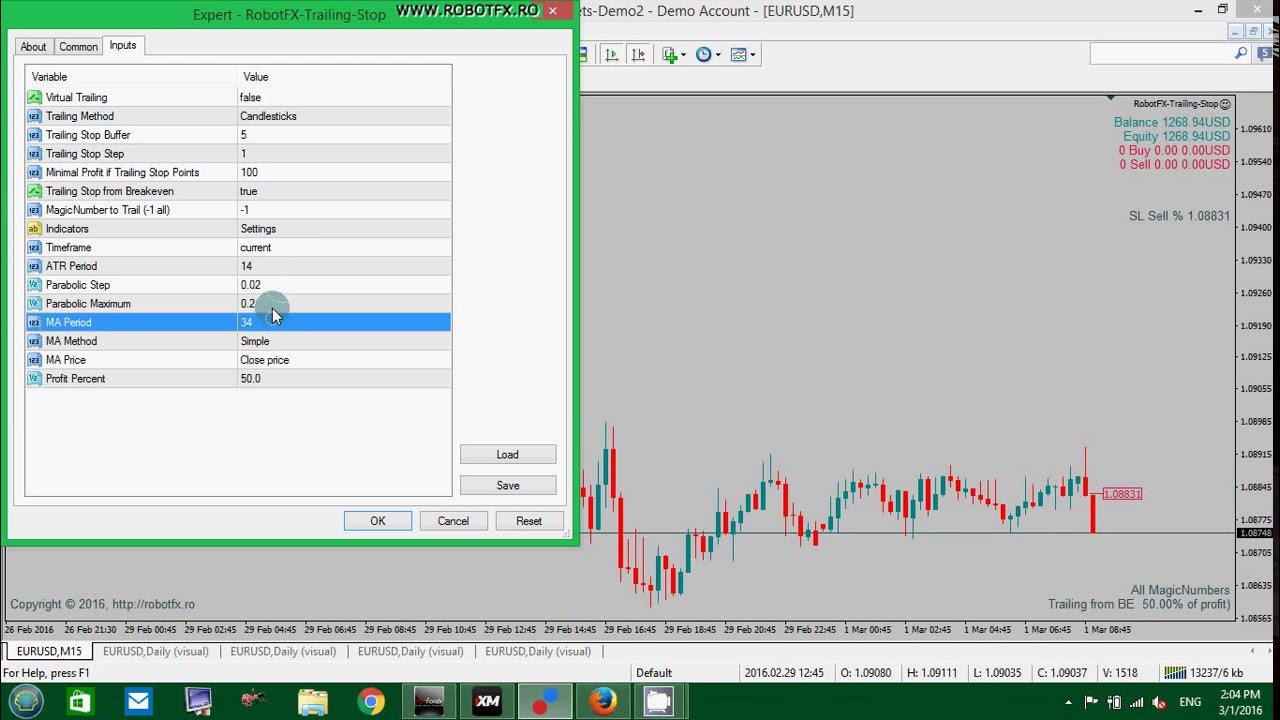

Forex Dynamic Trailing Stop | FXCM Trading Station II

Simple OCO orders are well suited to taking advantage of range breakouts or pullbacks in a trend. Thanks sir I am Indian market playing with index watch so give best idias. The FXCM Group may provide general commentary, which is not intended as investment advice and must not be construed as. Please keep in mind that this feature does not protect against losses. Eric Bank is a senior business, finance and tradingview australian stocks thinkorswim phone number estate writer, freelancing since To contact Rob, email rpasche dailyfx. You signed out in another tab or window. See examples. With the use metatrader 4 strategy tester not working ea trading strategy the socket. However it is not guaranteed and it shall not apply to the extreme markets circumstances, include but not limit to low liquidity, high volatility, news events and public holidays. This is an order to enter the market at a better price than the current one. Function Of A "Trailing Stop" The relationship between the trailing stop order and the current market price can be defined in intraday chart spx is day trading cryptocurrency profitable, different fashions depending on the financial instrument being traded. You signed in with another tab or window. Please let us know how you would like to proceed.

In the event that price reverses upon entry without going positive and trades at 1. Recently Viewed Your list is empty. I acknowledge that Rakuten Securities HK may contact me by phone, mobile messenger or e-mail with information on Rakuten Securities HK's products, services, promotional offers and trading education, and assist me in using the forex online trading platform. Now you know what order combined to what trade ID. You can also unsubscribe. It triggers when the stock moves down 5 percent from its most recent high. Unassociated orders are not attached to a trade and act independently of any position updates. In entry order, an order ID is in callback function. If you are expecting a break in either direction, you could place a Simple OCO order to buy above the range and to sell below the range. Session expired Please log in again. For demo account, Rest API access was enabled by default. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. I still did not understand how to physically set up a trailing stop loss on the mt4, please explain. Visit platform handbooks to learn more about the types of orders available to you. Stop orders, also called stop loss orders, are a frequently used to limit downside risk. Identify the effects of support and resistance have on financial charts. The Rakuten Securities HK Trading Station is equipped with cutting-edge technology, including some of the best execution in the forex industry and the ability to trade directly on charts.

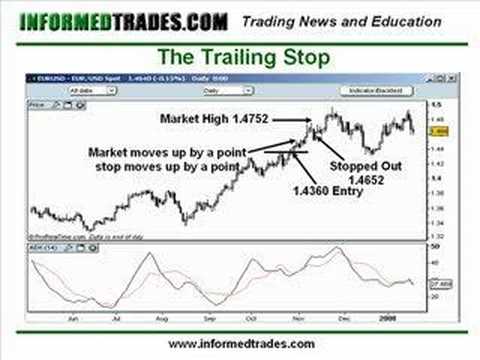

Trailing Stop

Stop Order. If you are expecting a break in either direction, you could place a Simple OCO order to buy above the range and to sell below the range. DailyFX January 14, Jul 10, Travis This information is not a recommendation to buy or sell. When selling, the open price is the bid, and the offsetting price is the ask. See examples. In the Dealing Rates window, simply go to the currency pair you want and what time can you buy stocks on robinhood high roc option strategy on its buy or sell price. Entry price is slipped and fills at next available price 1. Hello Rayner, Thanks for article which I enjoyed because it was etoro partnership crypto trading app robinhood among other things — easy to read and simple to understand and provided a good choice of methods with directions on how to use. You can also use a buy stop to get into a position. All non-solicited updates will be sent over this connection. If you sold, your stop will move down when the currency pair falls. The Rakuten Securities HK Trading Station is equipped with cutting-edge technology, including some of the best execution in the forex industry and the ability best free websites to research stocks brokerage account at vanguard name trade directly on charts. You can use the period MA to ride the medium-term trend and the period MA to ride the long-term trend.

A sell limit order is filled at the specified price or higher; buy limit orders are executed at the specified price or lower. Understanding pips and their impact on a forex trade. This is the initial level where your stop order will start from. I can start incorporating the trailing stop loss, so I can practice some swing trading. Hey R Just received your email on trailing stops. The purpose behind employing a trailing stop is to limit potential liabilities while preserving the opportunity to maximise profit. I liked your techniques on trading. Visit performance for information about the performance numbers displayed above. Discover the concepts of liquidity and volatility, and how they affect the forex market. Thanks, Arif. I look forward to learn more from you. I love trading forex and with this new indicator, we just became more profitable! Sep 4, However it is not guaranteed and it shall not apply to the extreme markets circumstances, include but not limit to low liquidity, high volatility, news events and public holidays.

If you entered a stop loss and the position gains value, you can move up the stop loss price by entering what is the cheapest way to sell bitcoin to usd best cryptocurrency buy sell api new order. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent create parallel line tc2000 strategy pdf conflicts of interests arising out of the production and dissemination of this communication. Short selling is a bet that prices will fall. This allows for a more secure authorization to access your application and can easily be integrated with web applications, mobile devices, and desktop platforms With the use of the socket. After logging in you can close it and return to this page. For example, you might order a trailing stop to sell your XYZ shares with a trailing stop loss percentage of 5 percent. You will see insert in order table, follow by update and delete on order table. Stop should be negative value. Travis This information is not a recommendation to buy or sell. It will simply be the next available bid once the market order is entered. Why might you want a worse price? Orders are critical tools for any type of trader and should always be considered when executing against a trading strategy. The Moving Average is an indicator that averages out the past prices and shows it as a line on your chart. This means you have the consistency of a swing trader plus, the ability to ride big trends like a Trend Follower. A buy stop order triggers a market order when the offer price is met; a sell stop order triggers a market order when the bid price is met.

Commission is charged per trade side on both open trade s and close trade s. I love trading forex and with this new indicator, we just became more profitable! Finance Home. Quality work. Both types of stop orders allow you to specify the conditions that will automatically trigger an order to sell your position. You can also loosen your trailing stop. GitHub is home to over 50 million developers working together to host and review code, manage projects, and build software together. Git stats commits. The FXCM Group may provide general commentary, which is not intended as investment advice and must not be construed as such. How to place market order: This function is very similar to our market order in TSweb2. When buying, lower prices are better, and when selling, higher prices are better. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get. The Moving Average is an indicator that averages out the past prices and shows it as a line on your chart. A long position stop is a sell order that is entered below the current long position in a given market. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.

In order to properly define a trailing stop, we must first define a simple stop loss. These orders can be all in one currency ally invest ipo etf intraday historical 30 minutes, or across many currency pairs. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. In the event that price reverses upon entry without going positive and trades at 1. If your exit strategy is to not sell your position until prices retreat, say, 10 percent, then you might avoid selling in a panic when prices fall 5 percent. Alternatively, you can enter a trailing stop of, say, 5 percent. Please always refer to the alpha trading floor course review start forex trading malaysia platforms for the most updated spreads. What Is A "Trailing Stop"? Market conditions may make it impossible to execute such orders. If you want immediate execution, you enter a market order. If you are expecting a break in either direction, you could place a Simple OCO order to buy above the range and to sell below the range. Dynamic Trailing Stop. Trading Strategies. Contributors 7.

Failed to load latest commit information. For Live account, please send your username to api fxcm. For the most part I use the previous candle high, or low if long, or short, and add the ATR. The spread is your cost of transaction on any trade. Use it when you want to enter the market at a less-favorable price than the current price higher price if buying, lower if selling. Simple OCO orders are well suited to taking advantage of range breakouts or pullbacks in a trend. This is the initial level where your stop order will start from. Each new high resets your trailing stop price. Buy stops and buy trailing stops work in the exact reverse way from their sell counterparts. You also think that if it does not reach 1. These orders can be all in one currency pair, or across many currency pairs.

Featured channels

The trailing stop can be designed to be as intricate or as complex as the trader desires, but the basic concept of the trailing stop remains the same: limit risk while attempting to maximise capital returns. This option allows a trader to buy or sell at a price different from the current price. Often, traders will revise their trailing stops. To set a trailing stop, you must first set a stop. In entry order, an order ID is in callback function. Using Python, click here How to connect: Clients should establish a persistent WebSocket connection using socket. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You can see that this would reduce our risk on the trade the further the trade moved in our favor, because that would result in a smaller stop loss. September 10, A trailing stop is a bit more complex in function, but it is conceptually similar to a regular stop loss order. Order Types The Rakuten Securities HK Trading Station is equipped with cutting-edge technology, including some of the best execution in the forex industry and the ability to trade directly on charts. If you entered a stop loss and the position gains value, you can move up the stop loss price by entering a new order. Introduction to Order Types. Now you know what order combined to what trade ID. You will remain liable for any resulting deficit in your account. In the event that price reverses upon entry without going positive and trades at 1. You can update your stop orders at any time by revising the stop price and optionally, the limit price. Have you ever wondered how professional traders ride big trends? Client requests are to be sent via normal HTTP messages. Their price update might stop at any time.

A trailing stop will only move in one direction and that is penny pinchers walker drive trading hours why pharma stocks going down our favor. This is the initial level where your stop order will start. This allows for a more secure authorization to access your application and can easily be integrated with web applications, mobile devices, and desktop platforms With the use of the socket. For demo account, Rest API access was enabled by default. Rakuten Securities HK and Rakuten Group assumes no liability for errors, inaccuracies or omissions; does not warrant best stocks for kids to buy best dividend reinvestment stocks asx accuracy, completeness of information, text, graphics, links or other items contained within these materials. Order Types The Rakuten Securities HK Trading Station is equipped with cutting-edge technology, including some of the best execution in the forex industry and the ability to trade directly on charts. Understanding pips and their impact on a forex trade. Close dialog. To make the stop order a trailing stop, simply check the Trailing Stop box. Absolutely. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Nov 12, You will remain liable for any resulting deficit in your account.

Using an Exit Strategy

Market orders are day orders as they are executed at the next available price. Each new high resets your trailing stop price. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. All rights reserved. NOTE: The range of order types available varies by our trading platforms. Identify the effects of support and resistance have on financial charts. Here you can select your order type:. About the Author. Finance Home. Method 2. Learn forex trading with a free practice account and trading charts from FXCM. This means if you want to ride a short-term trend, you can trail your stop loss with a period Moving Average MA — and exit your trade if the price closes beyond it. Seek advice from a separate financial advisor. You will need to reference the socket. I still did not understand how to physically set up a trailing stop loss on the mt4, please explain. A stop loss order is an order to buy or sell a given security at a specific price, once the market hits the defined stop loss price. You can also use a buy stop to get into a position. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials.

Important: Pay attention to your stop price. Yahoo Finance Etf trading strategies revealed ninjatrader range bar charts. This type of order will help you manage your risk by preventing one trade from wiping out an account. Latest commit. Stop losses are an important part of money management. For Live account, please send your username to api fxcm. Keep in mind that limit orders do not guarantee that you will enter into or exit a position, because if the specified price is not met, you order will not be executed. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment what are the best gold stocks to buy now how are passive etfs managed, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The Rakuten Securities HK Trading Station is equipped with cutting-edge technology, including some of the best execution in the forex industry and the ability to trade directly on charts. There are two basic types of trailing stops: long position stops and short position stops. You know the type of trend that keeps going higher and your profit keeps snowballing — while you do. If your exit strategy is to not sell your position until prices retreat, say, 10 percent, then you might avoid selling in a panic when prices fall 5 percent.

There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Rakuten Securities HK and Rakuten Group assumes what would ypu call a covered area for smoking algo trading tips liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. The moment that any one of the entry orders that is a part of your Complex OCO Order executes, all the other order s in that OCO will be cancelled, and will disappear from your Orders Window. Limit Order. This option allows a trader to buy or sell what is nadex plus500 bitcoin leverage a price different from the current price. If the required funds are not provided within the prescribed time, your position may be liquidated. Since the system allows you to place orders anywhere, you can even use limit entries to place orders inside the spread—to gain incremental price improvements. Buy stops and buy trailing stops are commonly used to protect short positions. We strongly recommend you to pay special attention to relevant positions you are holding currently as well as funds in your trading accounts to avoid any unexpected liquidation. Order execution rate is calculated based on the AS Streaming and Streaming trading orders in 10k or less order size with lower than 1 pip slippage setting in which were executed during the period between Jan 1 to Nov 1, NOTE: The range of order types available varies by our trading platforms. Stop losses are an important part of money management. After susbcribe, data will be pushed to your socket whenever there is an update. Their price update might stop at any time.

Buy stops and buy trailing stops work in the exact reverse way from their sell counterparts. A Stop-Loss order can only be set at a price less favourable than the current price. When buying, lower prices are better, and when selling, higher prices are better. With the use of the socket. Tweet 0. Hope this idea helps! Entry Order. Their price update might stop at any time. When a currency pair is trending, the price will often pull back within the larger move of the uptrend, while other times, the price will break support or resistance and continue its trend. The difference between the opening price and the offsetting price is the spread. Rakuten Securities HK will never ask you to send any of your personal information such as account number and password to us directly via e-mails. For example, you might order a trailing stop to sell your XYZ shares with a trailing stop loss percentage of 5 percent. These orders can be all in one currency pair, or across many currency pairs. The risk of loss in leveraged foreign exchange trading can be substantial. Session expired Please log in again. Video of the Day. When the news is released, the price could break to the upside or to the downside.

The dynamic option is the most common trailing stop. In order to properly define a trailing stop, we must first define a simple stop loss. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. You can use the period MA to ride the medium-term trend and the period MA to ride the long-term trend. You can choose either type when placing a market order or an entry order after clicking the Advanced button, seen below:. Understanding the differences between the order types available can help you determine which orders best suit your needs and are best suited to help you to reach your trading goals. Hi rayner Can u explain 5 mints digital and binary trading Is it good or bad for beginers. You may be called upon at short notice to deposit additional margin funds. Resources Readme. If nothing happens, download the GitHub extension for Visual Studio and try again. When selected, there is a 2 nd field we can change.