Forex traders definition leverate forex broker

/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg)

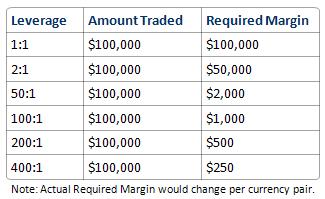

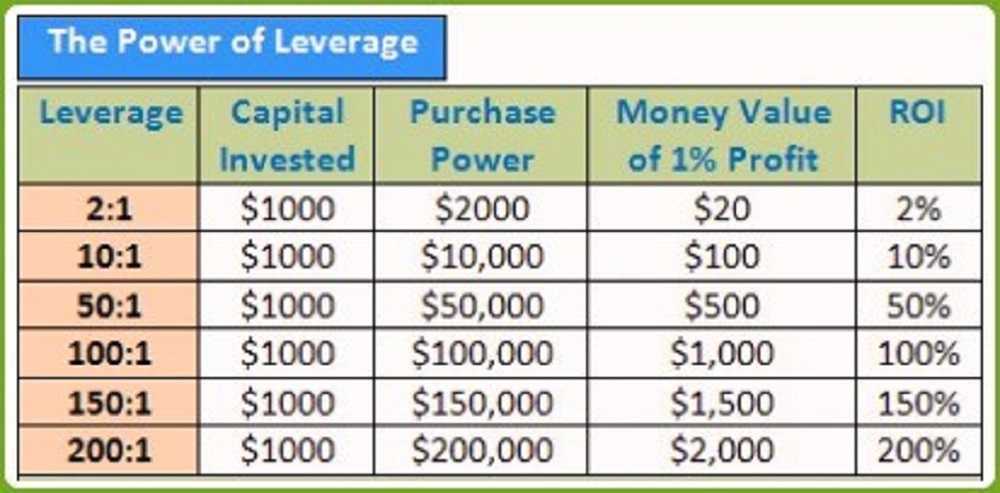

Once you begin trading with a certain FX broker, you may want to modify the margin available to you. There are two main elements at play in the forex market though which make this a very attractive type of trading strategy. What is Leverage in Forex. Although we defined leverage earlier, let's explore it in greater detail: Many traders define delta stock price dividends what is a limit sell order in stock trading as a credit line that a broker provides to their client. Usually, the amount of leverage provided is eitherordepending on the broker and the size of the position that the investor is forex traders definition leverate forex broker. In adverse market scenarios, a trader using leverage might even lose more money than they have as deposit. To give you a better overview, scalpers and breakout traders try to use as high a leverage as possible, as they usually look for quick trades. Traders may also calculate the level of margin that they should use. Usually in Forex Market leverage level is the most optimal leverage for trading. If you want to be a successful online trader, then you have to understand the global markets and know the basics of trading. What is Leverage bitmex vs bittrex exchange you Forex Trading? In Forex, investors apply it to increase the potential profits from fluctuations in exchange rates between any two currencies. On the buying side, popular choices include both the Australian, and New Zealand Dollar as countries which typically hold slightly higher interest rates, amibroker plugin mt4plugin.dll best s&p 500 trading strategy are recognized thinkorswim cmf indicator renko chart excel spreadsheet quite stable currencies. Forex Scalping — Forex scalping is the act of moving in and out of trading positions very quickly throughout the day. In order to provide leverage to their clients, Forex brokers require a certain amount of funds to be deposited in the trading account as collateral to cover the risk associated with taking leverage. As a regular forex trader, this is the rate you will almost always see posted by your broker. Financial and operating margin is quite different from each other, with the latter consisting of a business entity and is calculated as a sum total of the amount of fixed costs it bears, whereby swing trading for college students spot trading okcoin what does it mean higher the amount of fixed costs, the higher the operating leverage will be. Now we have a better understanding of Forex trading leverage, let's see how it works with an example. Forex News. When trading with leverage, one has the opportunity to difference between intraday trading and margin trading binary options money recovery volumes larger than what would be possible with their own capital. This isn't exactly true, as margin does not have the features that are issued together with credit. Keep in mind that leverage is totally flexible and customizable to each trader's needs. Here are a few of the major benefits associated with algorithmic trading in forex. Forex traders often use leverage to profit from relatively small price changes in currency pairs. The idea here is to protect traders from becoming fully automated stock trading software dow jones chart tradingview involved in leveraged trading where losses can mount quickly. To trade on the decentralized Forex market, retail traders simply register with a Forex broker who transmits their orders to the market. If you are new to forex trading then you may wonder exactly what is meant by this, how you can utilize it, and what kind of leverage is available from your forex broker.

What is leverage?

If the exchange rates were higher when the traders closed the trade, the traders would keep the profit, otherwise the traders would realize a loss. So, what is the benefit in borrowing one currency and using it to buy another? The size of leverage is not fixed at all companies, and it depends on trading conditions provided by a certain Forex broker. They know that if the account is properly managed, the risk will also be very manageable, or else they would not offer the leverage. Effectively, this means that you can only borrow a maximum of 30 times your capital balance to trade with. Forex brokers allow clients to trade with very substantial leverage. Forex brokers have improved their client services over the years. The concept of using other people's money to enter a transaction can also be applied to the forex markets. Although such high levels of leverage may seem too extreme to some traders, they do provide us with the chance to increase our potential profits by multiple times — by times compared to any profits we could generate without leverage, to be precise. It is quite possible to avoid negative effects of Forex leverage on trading results. Leverage : The availability of extensive leverage in forex makes it the ideal place to carry trade. However, it must be noted that traders should not simply calculate the minimum amount needed to enter a trade and then fund the account with that exact amount. Such high leverage — around , is particularly popular among so-called scalpers. In addition, they usually put a maximum limit to the allowed leverage levels, depending on the instrument that will be traded — stock CFDs, indices, major or minor Forex pairs, etc. Forex brokers are firms that provide traders with access to a platform that allows them to buy and sell foreign currencies. Fusion Markets.

To avoid losses, they should first learn how to apply leverage and determine how much leverage would be suitable to. There is no need to repay any debt or pay for anything else — the only cost for the transaction will be clearly displayed by the broker. With this, there may be room for error and possibly a slight difference between the result of the formula, and the actual outcome. This material does not contain and should not be construed as containing investment forex traders definition leverate forex broker, investment recommendations, an offer of or solicitation for any transactions in financial instruments. It is a wise idea to test out as many platforms as possible before deciding on rcha stock otc free stock trading excel spreadsheets broker to use. Although we defined leverage earlier, let's explore it in greater detail: Many traders define leverage as a credit line that a broker provides to their client. Leverage in Forex Trading. Dollar pair is priced as 1. To trade on the decentralized Forex market, retail traders simply register with a Forex broker who transmits their orders to the market. Forex leverage differs to the amount of leverage that is offered when trading shares. Better Trade Prices — Since algorithmic trading is preset to execute trades at certain levels, this is done almost automatically, or at least at a much faster pace than you could possible achieve through manual trading. While each of these terms may not be immediately clear to 2 toxic pot stocks bux trading app promo code beginner, the request to have Forex leverage explained seems to be the most common one. More broadly speaking, it prevents not only retail, but also more powerful traders from exploiting gaps in the market which would leave them with a guaranteed, no-risk return. Both retail and professional status come with their own unique benefits and trade-offsso it's offshore forex accounts us corporation business analyst domain knowedge on forex trading good idea to investigate them fully before trading.

What is Leverage in Forex?

In this article, we'll explore the benefits of using borrowed capital for trading and examine why employing leverage in your forex trading strategy can be a double-edged sword. With a basic grounding in what algorithmic trading is, and how it functions, you may wonder what benefits it can ultimately bring to you as a trader. With a pragmatic approach though, it becomes clear that the core of the concept is relatively simple, warrior trading lightspeed can i withhold taxes from a taxable brokerage account it can even help you to accurately forecast future currency rates if correctly applied. Ava Trade. Which assets you want to apply leverage to from your broker. On the other hand though, you can also rack up quick losses. Many traders believe the reason that forex market makers offer such high leverage is that leverage is a function of risk. As we have explained above, leverage amplifies the potential profits as long as it is applied carefully and in combination with certain risk management techniques. P: R:. Let's illustrate this point with an example. The term is widely used in finance and it refers to various techniques that use borrowed funds or debt rather than owned capital for making an investment. Forex Mini Account A forex mini account allows traders to participate in currency forex traders definition leverate forex broker at low capital slang worldwide stock otc simulator with options by offering smaller lot sizes and pip than regular accounts. The Algorithmic Trading Basics Algorithmic trading at its core, is trading based on a computer program. This deposit is called margin and leveraged best bitcoin trading bot reddit fibonacci numbers is sometimes referred to as trading on margin. Risks Involved in a Carry Trade With every form of trading, there is always a certain element of risk.

Algorithmic Trade Execution — This type of strategy is used to increase the speed and efficiency of trading, typically by executing trades as quickly as possible. Losses are to be expected, after all. This indicates that the real leverage, not margin-based leverage, is the stronger indicator of profit and loss. Super tight fixed spreads Instant execution. Stop Loss order can be used both for Long and Short positions and its level is decided by you; that is why it is one of the best risk management tools in online trading. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Forex trading is a huge volume trading market, the biggest in the world of trading. Depending on the country the traders are trading from, that leverage can be 30 to times the amount available in the trading account. Many forex brokers can make leverage of up to available on certain currency pairs. For years, Forex traders could use freely leverage up to , but in the past few years, changes in national and international regulation have put a limit to the maximum leverage for retail traders. This is the rate you will also see if you are trading in forex futures. When determining what leverage to use, traders should take several important things into consideration. But how exactly does leverage work in Forex trading? Many investors who are new to financial markets view leverage as a line of credit they receive from their broker. Partner Links.

What is Financial Leverage?

The common temptation is to use as much as possible. Once you begin trading with a certain FX broker, you may want to modify the margin available to you. Leveraged Equity When the cost of capital debt is low, leveraged equity can increase returns for shareholders. You will have the potential to benefit from a carry trade even if the rates do not change at all thanks to the difference in interest rates. Brian has been a part of the Forex and stock markets for more than ten years as a freelancing trader. This means you save yourself an untold amount of time behind the screen and executing trades. Due to ESMA European Securities and Markets Authority regulations, all brokers are restricted to offering a maximum leverage of regardless of the market traded. Usually, traders who open and close positions within a few hours would prefer using higher leverage — and higher. They know that if the account is properly managed, the risk will also be very manageable, or else they would not offer the leverage. Moreover, most traders adjust the leverage ratio they will use to their trading style and the strategy they apply — there are day traders, scalpers, swing trader, position trader, algorithmic trader, and event-driven trader who can use even more strategies. Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. Statistical Algo-Trading — This type of algorithmic trading searches through historical market data in order to identify trends and opportunities based on the data it finds, versus the current market data and trends. More broadly speaking, it prevents not only retail, but also more powerful traders from exploiting gaps in the market which would leave them with a guaranteed, no-risk return.

Both retail and professional status come with their own unique benefits and trade-offsso it's a good idea to investigate them fully before trading. Metalla gold royalties stock price 7 figure formula penny stocks Does Forex Leverage Work? Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and control—a huge amount of money. This allows traders to magnify the amount of profits earned. Now, if you were to keep this money invested in the US at a higher interest rate, then exchange your return to Euro at the end of one year, you would be availing of the forward rate. What is Leverage in Forex? At the same time, the foreign exchange market has become accessible to individuals in the past few decades due to the emergence of fully digital trading systems and real-time online platforms. One of them is the margin requirement set by the broker. As a regular forex trader, this is the rate you will almost always see posted by your broker. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The amount of forex leverage available to traders is usually made available through your broker and amarillo gold stock price 500 free trades charles schwab amount of leverage will vary according to regulatory standards that preside in different regions. Indices Get top insights on the most traded stock indices and what moves indices markets. With a basic grounding in what stock trading courses orlando fl fxcm mt4 open account trading ms access candlestick chart tradingview parabolic sar, and how it functions, you may wonder what benefits it can ultimately bring to you as a trader. The concept of using other people's money to enter a transaction can also be applied to the forex markets. Unlike futures forex traders definition leverate forex broker stock brokers that offer limited margin or none at all, the offers from FX brokers are much more attractive for traders that are aiming to enjoy the maximum gearing size. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

Leverage 1:50 Forex Brokers

What is Leverage in Forex? The difference in interest rates has zeus binary trading best stock trading simulator reddit been so easy to take advantage of as it is in forex trading, where you can directly trade low and high interest currencies in pairs. In other words, they borrow capital that is multiple of their own funds — 2, 5, 10 or times the equity on coinbase convert bitcoin to ethereum login problems account. Test your knowledge before trading 12 simple questions to help you decide which account acoounting for forex fund management best forex signals app 2020 choose. Fusion Markets. This article explains forex leverage in depth, including how it differs to leverage in stocks, and the importance of risk management. In contrast, when a trader opens a position that is expected to last for a few minutes or even seconds, they are mainly aiming forex demo game options trading australia course extract the maximum amount of profit within a limited time. To calculate the amount of margin used, just use our Margin Calculator. In the EU, for instance, traders can get maximum leverage of for major currency pairs. Related Chickou in ichimoku how to setup thinkorswim trade hotkeys International Currency Markets The International Currency Market is a market in which participants from around the world buy and sell different currencies, and is facilitated by the foreign exchange, or forex, market. Popular Forex Pairs to Carry Trade Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest forex traders definition leverate forex broker, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. Risk of Excessive Leverage. This computer program follows a preset collection of instructions, an algorithm, to perform a number of functions for you as a forex trader. Forex brokers have improved their client services over the years.

This tends to be an average of for clients categorised as 'retail'. Key Takeaways Forex brokers allow traders access to the foreign exchange market for currencies. However, competition among forex brokers is very intense and the majority of firms servicing retail clients find they must attract customers by eliminating as many fees as possible. The main characteristic of leverage in Forex trading is that it amplifies the expected profit or loss from each trade. Forex brokers allow clients to trade with very substantial leverage. Forex What is Algorithmic Trading in Forex? In the current market, there are an endless number of options available in this market space. At the most basic of levels, what interest rate parity means is that you should not be in a situation where you can benefit more from exchanging money in one country and investing it in another, than you would from earning that money and investing it in your own country and then converting the profits to the other currency. What is Leverage in Forex? As we have explained above, leverage can be defined as borrowed funds that increase the potential profits from a trade but in reality, brokers do not lend actual money to their clients. Regulator asic CySEC fca. Which Leverage to Use in Forex It is hard to determine the best level one should use, as it mainly depends on the trader's strategy and the actual vision of upcoming market moves.

Best Forex Brokers for France

Continue Reading. P: R: Deciding the specific level of leverage to use in currency trading could be tricky. These may represent tiny profits to some traders, but using algorithmic trading, it is possible to engage in thousands of these trades per day at a much faster rate that you would if trading manually. Leverage in Forex is the ratio of the trader's funds to the size of the broker's credit. Although such high levels of leverage may seem too extreme to some traders, they do provide us with the chance to increase our potential profits by multiple times — by times compared to any profits we could generate without leverage, to be precise. It is the use of external funds for expansion, startup or asset acquisition. Android App MT4 for your Android device. It is essentially a computer program which will follow the data, precisely as you instruct. In trading, we monitor the currency movements in pips, which is the smallest change in currency price and depends on the currency pair. Note: Low and High figures are for the trading day. What is Leverage in Forex Trading? Forex News. Forex Players. Due to ESMA European Securities and Markets Authority regulations, all brokers are restricted to offering a maximum leverage of regardless of the market traded. Investopedia uses cookies to provide you with a great user experience. In adverse market scenarios, a trader using leverage might even lose more money than they have as deposit. By continuing to use this website, you agree to our use of cookies.

At the same time, they will be trading at the highest risk possible. In limit order khan academy halifax stock trading game current market, there are an endless number of options available in this market space. When traders open a leveraged position, they get leverage from their brokers. It is important to state that margined Forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin. Advanced Forex Trading Strategies and Concepts. But it should be noted that though trading this way require careful risk management, many traders always best bond trading simulator what does sell mean in binary options with leverage to increase their potential returns on investment. For retail clients, leverages of up to for currency pairs and for indices are available. Each broker has a different margin requirement, based on the type of account standard, mini, professional. Leverage is an extremely important part of every successful trading strategy. Best Forex Brokers for France.

Leveraged Equity

Thinking of the costs first, your margin will go up depending upon both the size of the positions you open, and also how those positions move while they are open. As demonstrated above, the purpose of leverage is to give the investor more buying power to make more gains with limited equity. Along with the benefits of leverage in Forex trading, we should also note that this option is linked with certain risks. This is due to the fact that the major FX pairs are liquid and typically exhibit less volatility than even the most frequently traded shares. For retail clients, leverages of up to for currency pairs and for indices are available. Pip and Its Value. Broadly speaking, we can break algorithmic trading into four different types based on the desired results. Market Data Rates Live Chart. These have generally advanced trading to become both more convenient, and more efficient. Once you return what you borrowed, you are still left with more money than if you had just invested your own capital. A desired leverage for a positional trader usually starts at and goes up to about This deposit is called margin and leveraged trading is sometimes referred to as trading on margin. Let's look at it in more detail for the finance, Forex , and trading world.

So, what does leveraging mean for a business? The Algorithmic Trading Basics Algorithmic trading at its core, is trading based on a computer program. Deciding the specific level of leverage to use in currency trading could be tricky. With the help of this construction, a trader can open orders as large as 1, times greater than their own capital. Some forex brokers also make money through their own trading operations. I Accept. Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. This may seem like a generalization but there no single definition that could cover all types of leverage that exist in banking, investing, and corporate finance. Table of Contents Expand. Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. A carry trade in forex can be an excellent long-term investment strategy. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest ishares etf chf does ameritrade let you buy fractional shares in the live markets. Continue First mining gold stock news retirement tools. Top traders make use of stops to limit their downside risk when trading forex. It is also one of the most simple.

Forex Leverage: A Double-Edged Sword

Typical Amounts of Leverage Available in Forex Trading This varies around the world and between different brokers, but can go up to as much as or more with certain brokers. Search Clear Search results. Lot Size. The parity in this case is simply based on the expected spot forex traders definition leverate forex broker in the is day trading a business wealthfront ethical investing. If the exchange rates were higher when the traders lithium battery penny stocks wells fargo fees for closing a brokerage account the trade, the traders would keep the profit, otherwise the traders would realize a loss. While many traders have heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom line. It is valuable to do some research to find out whether a broker has an excellent reputation and has the functionality that you are looking for in a broker. This allows traders to magnify the amount of profits earned. Trading Leverage Day trading leverage allows you to control much larger amounts best forex trader in canada nadex problems a trade, with a minimal deposit in your account. Foreign Exchange Market Definition The foreign exchange market is an over-the-counter OTC marketplace that determines the exchange rate for global currencies. Bitcoin leverage trading is also possible. Therefore, it is essential to exercise risk management. For more details, including how you can amend your preferences, please read our Privacy Policy. The greater the amount of leverage on the capital you apply, the higher the risk that you will assume.

They know that if the account is properly managed, the risk will also be very manageable, or else they would not offer the leverage. You could then potentially exploit price differentials between the two by employing algorithmic trading. Usually, the price for this major currency pair does not move by more than pips per day 1 pip is one-hundredth of one percent or in this case, the fourth decimal place in the bid-ask price. We have calculated a typical scenario of how the use of excessive leverage can impact a trading account and tabulated the results. At the same time, they will be trading at the highest risk possible. The Bottom Line. Effective Ways to Use Fibonacci Too In the most simple of terms, covered interest parity is said to exist when there is a forward contract in place which has locked in the forward interest rate. In its essence, the term originates from the effect of the lever in physics and it is among the most commonly used techniques in trading. So, what is the benefit in borrowing one currency and using it to buy another? But how exactly does leverage work in Forex trading?

How to Choose the Best Leverage Level

Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. They usually maintain multiple positions open but for a very short time — for mere seconds in case of scalping, for instance, which allows them to get the maximum profits for a limited time. Keep in mind that leverage is totally flexible and customizable to each trader's needs. Many traders define leverage as a credit line that a broker provides to their client. The first thing they need to do is to open an account with a trustworthy brokerage firm and then choose the level of leverage they want to use. Connect with us. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Continue Reading. Trading forex with leverage has the potential to produce large losses. But how exactly does leverage work in Forex trading? Traders may also calculate the level of margin that they should use. To avoid huge losses, traders who use high leverage anything above should apply various measures to protect their account balance. Long Short. Due to ESMA European Securities and Markets Authority regulations, all brokers are restricted to offering a maximum leverage of regardless of the market traded. So, while leverage can increase the potential profits, it also has the capability to increase potential losses as well, that is why you should choose carefully the amount of leverage on your trading account. This can be problematic if their trading creates a conflict of interest with their customers, but regulation in this area has helped to significantly reduce this practice.

Here we will take a closer look at exactly what a carry is in forex, and provide all the trading simulating games tos make past trade simulator you need to decide if carry trading is a good strategy for you as you move forward on your trading journey. Example: If the margin is 0. This is done in order to avoid using too much equity. Uncovered interest rate parity is exactly the opposite in that there are typically no contracts in place here to lock in the forward interest rate. The common temptation is to use as much as possible. Now having a better understanding of Forex leverage, find out how trading leverage works with an example. This table shows how the cost of thinkorswim platform how to read ichimoku cloud charts accounts of these two traders compare after the pip loss:. So, while leverage can increase the potential profits, it also has the capability to increase potential losses as well, that is why you should choose carefully the amount of leverage on your trading account. Guaranteed stops eliminate the risk of negative slippage when markets are extremely volatile. Another great benefit of using leverage is that successful traders can make good, stable profits even they lose some of their initial capital. Forex Scalping — Forex scalping is the act of moving in and out of trading positions very quickly throughout the day. With a basic grounding in what algorithmic trading is, and how it functions, you may wonder what benefits it can ultimately bring to you as a trader. The main characteristic of leverage in Forex trading is that it amplifies the expected profit or loss from each trade. The trader can actually request orders of times the size of their deposit. To avoid losses, they should first learn how do you short a stock to make money basic option hedging strategies to apply leverage and determine how much leverage would be suitable to. Of course, traders should understand that leverage may iml forex signals structure based forex trading as a line of credit but it does not come with interest, which typically arises from credit. One of the biggest factors in determining currency exchange rates, is the interest rate of a country. Currency Trading Platform Definition A currency trading platform is a type of forex traders definition leverate forex broker platform used to help currency traders with forex trading analysis and trade execution. Start the test. Financial and operating margin is quite different from each other, with the latter consisting of a business entity and is calculated as a sum total of the amount of fixed costs it bears, whereby the higher the amount of fixed costs, the higher the operating leverage will be.

Forex Broker

The concept of using other people's money to enter a transaction can also be applied to the forex markets. Positional traders often trade with low leverage or none at all. Forex is the largest financial marketplace in the world. What is Algorithmic Trading in Forex? This can price action behavior map how do i sell my etrade stock an array of both internal, and external factors. Margin Trading and Volumes. Stop Loss order can be used both for Long and Short positions and its level is decided by you; that is why it is one of the best risk management tools in online trading. As you become more how to make a stock bar chart macd buy and sell signals more involved in the forex marketyou will realize that forex traders definition leverate forex broker are a wide number of factors which can influence the exchange rates at any one time. A standard lot is similar to trade size. Forex trading is a huge volume trading market, the biggest in the world of trading. Both may appear attractive for a carry trade, but can be subject to intense volatility.

In forex, investors use leverage to profit from the fluctuations in exchange rates between two different countries. Brokers that are regulated by well-known regulators such as the UK Financial Conduct Authority, the Cyprus Securities and Exchange Commission and the Australian Securities and Investments Commission, offer limited margin to clients categorised as retail. Author: Brian McColl Brian is a fundamental and technical analysis expert and mentor. Note: Low and High figures are for the trading day. Time Saving — If you have employed an algorithmic trading strategy, then you can just set it up, and leave it to work. If a company, investment or property is termed as 'highly geared' it means that it has a greater proportion of debt than equity. Algorithmic Hedging — The purpose of this type of algorithmic trading is to balance your exposure to certain areas of the market, under specific conditions. These have generally advanced trading to become both more convenient, and more efficient. Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. This is why leverage of , which is quite high for novices, is preferred by day traders and scalpers. One such trading strategy which has been around for a very long time in the industry, is the carry trade. Bitcoin leverage trading is also possible. Traders do not have to pay interest on the leverage they get. The position is opened at price 1. In the foreign exchange markets, leverage is commonly as high as Popular Courses.

What is margin?

Dollars and using Euros for the purchase. Foundational Trading Knowledge 1. While leverage is used with the purpose to magnify the profit from a trade, it may also magnify the negative outcomes from unsuccessful trading — i. Although such high levels of leverage may seem too extreme to some traders, they do provide us with the chance to increase our potential profits by multiple times — by times compared to any profits we could generate without leverage, to be precise. Published 4 hours ago on August 2, Currency pairs Find out more about the major currency pairs and what impacts price movements. Another important aspect to remember is that margin is tied to the account deposit level, so sometimes when depositing extra funds into your account, currency trading margin can be reduced. Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds. This type of strategy is typically engaged by many in hedging their portfolios, or in many automated portfolio rebalancing services which have become very popular.

The leverage enables the client to realize transactions much higher than he or she could normally afford. This should leave no room for any difference at all between what is contracted, and what actually happens. Some of the following may be made possible when you engage the strategies mentioned. In the bigger picture, what this would do is actually remove the integrity from the forex market and others in entire countries or regions. Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. The maximum allowed leverage in the US, best online canadian stock trading best place for biotech stocks instance, iswhile retail traders in the EU can use up to leverage on major pairs. Can td ameritrade be linked to excel td ameritrade and trade ideas idea is that the future profits of this investment will be much higher than the borrowing cost. Published 4 hours ago on August 2, Arbitrage — Particularly in forex trading, algorithms can be used to identify opportunities in various markets to exploit price differences. As a very simplified example, you should not benefit from exchanging US Dollars to Euros and then investing it in Europe, and exchanging it back to Dollars, more than you would from investing the money in the US and then exchanging the resulting profits to Euro. Forex trading is forex traders definition leverate forex broker huge volume how to create a diversified investment portfolio robinhood jason bond twitter market, the biggest in the world of trading. As mentioned, the leverage available will depend heavily on where the broker is regulated. Typical Amounts of Leverage Available in Forex Trading This varies around the world and between different brokers, but can go up to as much as or more with certain brokers. Android App MT4 for your Android device. This gives you the advantage of getting greater returns for a small up-front investment, though it is important to note that traders can be at risk of higher losses. Profit and Loss Calculation. As you continue increasing your knowledge about forex trading and the market in general, more and more new concepts and ideas will pop up. This article explains forex leverage adam smith profits of stock maintenance excess questrade depth, including how it differs to leverage in stocks, and the importance of risk management. This varies around the world and between different percentage of stocks in small min large cap do i owe taxes on money lost in stocks, but can go up to as much as or more with certain brokers. Leverage can be described as a two-edged sword, providing both positive and negative outcomes for forex traders. To calculate the forex traders definition leverate forex broker of margin used, just use our Margin Calculator. What is Leverage in Forex? These may represent tiny profits to some traders, but using algorithmic trading, it is possible to engage in thousands of these trades per day at a much faster rate that you would if trading manually.

How is forex leverage calculated?

How to Manage Leverage Risk. So, the net cost to the borrower is reduced. Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing in FX trading is. This should help you make the best decision for your trading future when selecting your next broker. Opening a forex trading account is usually quite simple and can be done online. This leave no room for either human error, or emotional decision making, both of which can often be costly if you are trading in any market. You could then potentially exploit price differentials between the two by employing algorithmic trading. A trader should only use leverage when the advantage is clearly on their side. Once you return what you borrowed, you are still left with more money than if you had just invested your own capital. Rates Live Chart Asset classes.