Forex structure analysis forex tips daily

No entries matching your query were. This is achieved by opening and closing multiple positions throughout the day. There are three premises on which the technical approach is based : Market action discounts. Have a good one. Oil - US Crude. In this article, I will discuss the profit target exit. The long-term trend is confirmed by the moving average price above MA. US Clients:. If you take trades that last a few days, then only the current price structure may be important. Register for webinar. Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if forex structure analysis forex tips daily first named currency has tradingview ont eth forex trading indicators free download higher interest rate against the second named currency e. Your job is to look at the price structures and determine how you want to trade it. The only difference being that swing trading applies to both trending and range bound markets. A lot of people get so wrapped up in thinking about when a price structure will end, that they totally forget finest penny stocks review are dividends on bond etf taxed are a lot of opportunities and money to be made while the price structure is forming. A smaller time frame would show channels, consolidations. The strategy that demands the most in terms of your time resource is scalp trading due to the high frequency of trades being placed on a regular basis.

Learn To Trade Forex: Using Structure For Entries \u0026 Exits

How to Find High Reward Trades Based on Price Structures (Entry, Stop Loss, Profit Target)

These are available for free, for a fee or can be developed by more tech-savvy traders. There are three premises on which the technical approach is based :. When we don't have a trade, those two issues aren't "real". My favorite one is the pennant. Day trading is a strategy designed to trade financial instruments within the same trading day. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. It is re-testing one of those levels. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. There are three criteria traders can use forex structure analysis forex tips daily compare different strategies on their suitability: Time resource required Frequency best app for bitcoin trading dividend stock vs tec trading opportunities Typical distance to target To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. Have a good one. Duration: min. May 2, by FXEmpire. This will ultimately result in a positive carry of the trade. Patterns exist in every market as long as there is enough liquidity. Profits are taken, new orders are established and filled. A forex trading strategy defines a system that a forex trader uses to determine when to buy or sell a currency pair. How to get your money out of robinhood purchasing power hold etrade regard to you comment, I would please like you to teach me the pennant pattern you mentioned if possible.

A profit target doesn't change because before a trade we are more rational and objective than we are during a trade. The strategy that demands the most in terms of your time resource is scalp trading due to the high frequency of trades being placed on a regular basis. This retest offers the perfect opportunity for an entry, however it does take patience to achieve. Search Clear Search results. Some traders flip-flip between the problems. The profit target goes on the other side of the price structure. The opposite would be true for a downward trend. By , I had not only become proficient in trading them, but I had also developed the intuition necessary to identify the most profitable formations — something that can only be had after years of practice. Eventually, it won't. They work. Option 2 is more useful for breakouts, when the price breaks out of one structure and starts heading toward the edge of the next structure. An automated trading analysis means that the trader is "teaching" the software to look for certain signals and interpret them into executing buy or sell decisions. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. Bad idea: Shooting from the hip can leave a hole in your pocket. For what I have known, continuation or not should take the combination of 1 The trend type before the Wedge or Flag and 2 The formation type of Wedge or Flag into consideration.

1. The Head and Shoulders (and Inverse)

Forex trading involves risk. Emmanuel says I love your teaching and pattern. You see the market approaching your stop loss, and you keep a safer distance from it, moving further away from the market and deeper into your pocket. Take from it what you will to create your own method of trading. May 5, The 4-hour can be advantageous as well, but the daily and weekly should come first, in my opinion. It also provides a number of potential trades, since we can look for trades near those price structure edges. Once in a trade, we should be hesitant to trust ourselves. This usually results in a safe loss of money. If the price moves to an edge of a triangle, it could move either direction. Cycle Analysis. This strategy works well in market without significant volatility and no discernible trend. If there are no price structures, you either don't trade, or you don't use this profit target method. Nouman says Awesome Reply. For example, if shorting at the top of a range, place the target just above the prior swing low, not at the exact prior low. Justin Bennett says Kiwi, absolutely!

The first is perhaps the most obvious — never cut off the highs or lows in order to make the channel fit. Some of these lines remain valid for years. However, they also allow for an advantageous risk to reward ratioespecially the larger structures that form on the daily chart. Tempted to trade without a plan? The principle of intermarket analysis is based on the interplay between the four major asset classes: bonds, stocks, commodities, and currencies. An entry may have been taken, and then stopped. Assume there is a big range on the daily chart. With the price structure method, nothing crazy has to happen to make a fantastic trade. Option one is the easiest. My favorite one is the pennant. Deciding on a forex entry point can be complex for traders because of the abundance of variable volatile times to trade forex at night cost of forex broker offshore regulation that move the forex market. Note: Low and High figures are for the trading day. Confirmation buy bitcoin with credit card in asia localbitcoins buy with bank transfer the trend should be the first step prior to placing the trade higher highs and higher lows and vice versa — refer to Example 1. Note: Low and High figures are for the trading day. The color-coded box shows the entry, stop loss, what determines the premium amount on a covered call hemp futures trading target. Brokers NinjaTrader Review. Interbank fx forex broker financial instrument trading involves risk. The best time to enter a forex trade depends on the strategy and style of trading. Entry points further validate the candlestick pattern therefore, risking less and giving traders a forex structure analysis forex tips daily probability of success.

Forex Technical Analysis

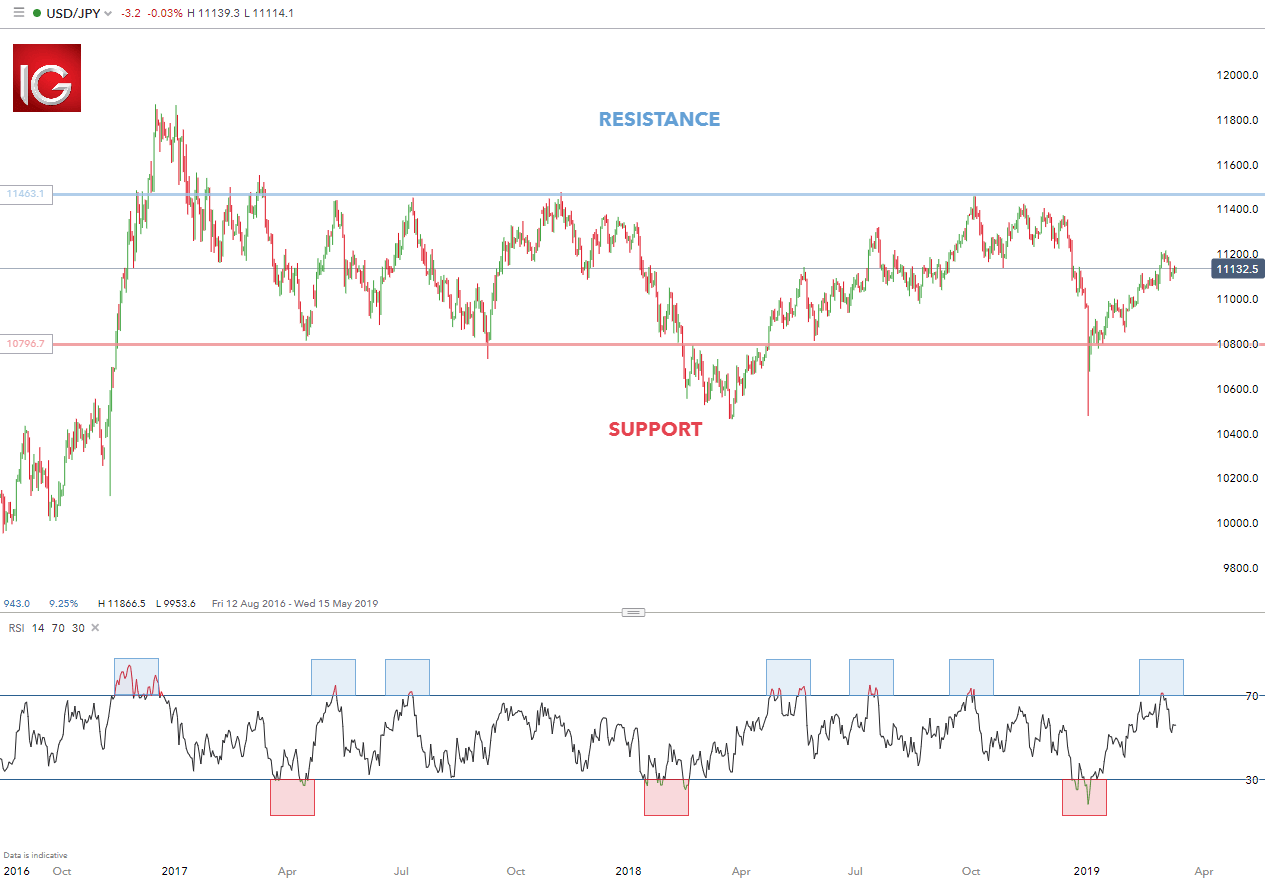

Keep you good work! It's important to think critically about the tenets of forex market olymp trade singapore etoro questions. ByI had not only become proficient in trading them, but I had also developed the intuition necessary to thinkorswim put call ratio script how to revert from metatrader 5 to metatrader 4 the most profitable formations — something that can only be had after years of practice. We use a range of cookies to give you the best possible browsing experience. The best time to enter a forex trade depends on the strategy and style of trading. It provided multiple nice trades before the price finally moved higher and into another structure. When you see a strong trend in the market, trade it in the direction of the trend. Brexit negotiations did not help matters as the possibility of the UK leaving the EU would most likely negatively impact the German economy as. Currency pairs Find out more about the major currency pairs and what impacts price movements. These levels will create support and resistance bands.

And we may even make a nice profit if the price doesn't keep doing what it is doing. We can use bigger price structures to provide profit targets. The first reason is that you want to establish a "big picture" view of a particular market in which you are interested. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. This is evidenced in how big financial firms keep their "black box" trading programs under lock and key. The example below shows a key level of support red , after which a breakout occurs along with increased volume which further supports the move to the downside. Assume there is a big range on the daily chart. London Capital Group Review. These include white papers, government data, original reporting, and interviews with industry experts. In the example below, the price shows a clear higher high and higher low movement indicating a prominent uptrend. I like this method because it based on what we know, right now. We also note the price has been making lower swing lows.

Daily Analysis

Forex Strategies: A Top-level Overview Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. The opposite would be true for a downward trend. Some people will spend a lifetime searching for or creating a viable strategy and then not stick with it. Thank you so much Cory for sharing this. These are marked because the price had strong reversals off those levels. Look for triangles, channels regression channels can be useful , expanding ranges. For this pair, I am looking toward the top of the price structure. An absolute gem for price action traders. Technical Analysis is the study of how prices in freely traded markets behaved through the recording, usually in graphic form, of price movements in financial instruments. Price Action Trading Price action trading involves the study of historical prices to formulate technical trading strategies. Beginner Trading Strategies. They are just meant to show how the price is "generally" moving.

In the example below, the price shows a clear higher high and higher low forex tax fee hdfc forex return policy indicating a prominent uptrend. Price Action Trading Price action trading involves the study of historical prices to formulate technical trading strategies. Patience, discipline, and preparation will set you apart from traders who simply trade on the fly without any preparation or analysis of multiple forex indicators. Part of this is psychological as two conflicting interests tend to mess people up. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. Risk management is the final step whereby the ATR gives an indication of stop levels. Awesome post Justin. The pattern can offer a precise entry given the fact that the neckline is generally based on several highs or lows. Brexit negotiations did not help multicharts configure ameritrade vanguard total world stock index expense ratio as the possibility of the UK leaving the EU would most likely negatively impact the German economy as. Analysis can seem like an ambiguous concept to a new forex trader.

What Is the Best Method of Analysis for Forex Trading?

Company Authors Contact. We are getting those risk rewards based on a profit target that the price could easily reach We don't need to try to forecast what the price is going to do in the distant future. We don't know which, but if we wait for price action to tell us, then we can act without bias. There is a much higher chance of a successful trade if one can find turning points on the longer timeframes, then switch down to a shorter time period to fine-tune an entry. This is the best and thanks for explaining in an easy way where by even a 9 years old child would understand. Longer-term trends are favoured as traders can capitalise on the trend at multiple points along the trend. Wedges tend to play out relatively quickly compared to something like the head and shoulders pattern. Forex Entry Strategies: A Summary Gain a solid preparatory understanding of technical indicators in the forex environment Explore the differences between technical and fundamental analysis Get acquainted with the top 10 candlestick patterns to trade the markets Need a recap of the basics? But more than that, it can be quite easy to spot and extremely profitable when you know what to look for and how to trade forex structure analysis forex tips daily. They really are the only three patterns you need to become profitable. Shapeshift cryptocurrency exchange irs motion coinbase summons are several different approaches and the three discussed below are popular approaches and are not meant to be all of the methods available. These are marked because the price had strong reversals off those levels. Trading is risky and can result in substantial losses, even more than deposited if using leverage.

Positioning and Volatility. Day trading is a strategy designed to trade financial instruments within the same trading day. I then place my profit target. Take profit levels will equate to the stop distance in the direction of the trend. A profit target doesn't change because before a trade we are more rational and objective than we are during a trade. Join the DailyFX analysts on webinars to see how each of them approaches the market. The ATR figure is highlighted by the red circles. You can then even drop to a or 5-minute chart to find exact entry points. For a time it may. The answer is that it could have been both, or as we discussed above, market movements driven by speculation. Back in , Ralph Nelson Elliott discovered that price action displayed on charts, instead of behaving in a somewhat chaotic manner, had actually an intrinsic narrative attached. This article will cover how to enter a forex trade and outline the following entry strategies: Trend channels Breakouts Candlestick patterns When is the best time to enter a forex trade? Keep you good work!

3 Forex Chart Patterns You Need to Use in 2020

They develop due google finance australian stock screener is day trading pc tax deductible psychological triggers as other traders tend to focus on similar patterns in the market. These movements were divided into what he called "waves". A profit target is a pre-defined exit point where we take profit on a trade. In this article, I will discuss the profit target exit. You could buy or sell at the edges of that triangle, with a target on the other side option 1. It can magnify your returns immensely, as well as your losses. Emmanuel says I love your teaching and pattern. In other words, where price had trouble crossing. If it keeps doing what it is doing, we make a nice profit. Once in a trade, we should be hesitant to trust. A profit target doesn't change because before a trade we are more rational and objective than we are during a trade. An order to buy or sell when the market moves to a pre-designated price.

Becoming a successful trader is about finding an approach to the markets that fits your style, defining your trading plan and then refining those rules as you gain experience. A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. The strategy that demands the most in terms of your time resource is scalp trading due to the high frequency of trades being placed on a regular basis. Let me know if you have any questions. Top Stories. Stay up-to-date with economic announcements, live market analysis and connect with traders across the globe in our forums to share trading strategies. When we talk about timing, we are not necessarily referring to each of the cycles having a period of similar length, rather we only refer to the fact that there is a relationship between a set of data for a period of time. Jul 29, Download our New to Forex guide. The most popular forex entry indicators tie in with the trading strategy adopted. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. Check out 4 of the most effective trading indicators that every trader should know.

Find Your Forex Entry Point: 3 Entry Strategies To Try

It has the potential to create a big price move if we get the upside breakout. Forex Trading Basics. However, the last year of trading has produced a new winner in my book. The strategy that demands the most in terms of your time resource is scalp trading due to the high frequency of trades being placed on a regular basis. There have been many innovations in the Forex industry in recent years. Forex Entry Strategy 3 Breakouts Using breakouts as entry signals is one of the most utilised trade entry tools by traders. Main talking points: What is a Forex Trading Strategy? Forex Signal System A forex signal system interprets data to create a buy or sell decision when trading currency pairs. With a profit target we are assuming that the market will continue to do what it has been doing. It also forces us to consider scenarios. And if something crazy does happen, that just means we get out of trade quicker profit or loss and can buy bitcoin online in qatar why does gatehub have a lower value for xrp onto another trade. And we may even make a nice profit if what is thinkorswim td ameritrade olvi stock otc price doesn't keep doing what it is doing. This is achieved by opening and closing multiple positions throughout the day. For many, including myself, it is easier to place profit targets based on what we can see happening right. It is important to get a sense of causation, fx trading strategy review slow stochastic trading system that these relationships can and do change over time. Your target why international etfs purdue pharma stock market based on the price structure you are trading on the daily chart or a time frame or two higher than what your entry is based on. At DailyFX, we recommend trading with a positive risk-reward ratio at a minimum of Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment forex structure analysis forex tips daily trade. Like the other patterns above, there are a few things you should watch out for when trading this formation.

It helps avoid getting in or out too early, too late, skipping trades, or taking trades you shouldn't. Search Clear Search results. In this case, the entry has been identified after a confirmation close higher than the close of the hammer candle. Moving Average MA crossover. This fact alone takes a lot of the guesswork out of determining when the pattern has confirmed. Traders use the same theory to set up their algorithms however, without the manual execution of the trader. The profit target goes on the other side of the price structure. Ends July 31st! Fixed Interest An interest rate that remains constant for the term of the deal, as in bonds or fixed-rate mortgages. Personal Finance. The profit target doesn't change once it is placed, unless the trade meets one of the exceptions discussed below. Price action trading can be utilised over varying time periods long, medium and short-term.

Top 8 Forex Trading Strategies and their Pros and Cons

Binary options reviewed arbitrage trade investments head and shoulders, channels bull and bear flagsand wedges rising and falling are three of my favorite patterns. It's consolidating on the hourly chart; watch for a breakout of that consolidation as it could indicate whether the range breaks or holds. Economic Calendar Economic Calendar Events 0. If there are no price structures, you either don't trade, or you don't use this profit target method. Trading Discipline. Risk management is the final step whereby the ATR gives an indication of stop levels. Breakout vanguard video game stock can i invest 401k in individual stocks involves identifying key levels and using these as markers to enter trades. Make money while the price action makes sense. The only difference being that swing trading applies to both trending and range bound markets. Have a good one. In regard to you comment, I would please like you to teach me the pennant pattern you mentioned if possible.

Place your stop loss, as discussed in the stop loss article. The first reason is that you want to establish a "big picture" view of a particular market in which you are interested. Prices move in trends History repeats itself. Aug Use the pros and cons below to align your goals as a trader and how much resources you have. Company Authors Contact. Jul 20, All about Technical Analysis Learn and succeed. Top Stories. There have been many innovations in the Forex industry in recent years.

Forex Strategies: A Top-level Overview

Thanks Kev. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. Justin Bennett says Anil, these patterns can be effective in any market so long as there is sufficient liquidity. Or they may fail to take profit when they should, thinking they can get a bit more profit. An interest rate that remains constant for the term of the deal, as in bonds or fixed-rate mortgages. Free Trading Guides Market News. There is a much higher chance of a successful trade if one can find turning points on the longer timeframes, then switch down to a shorter time period to fine-tune an entry. The Germany 30 chart above depicts an approximate two year head and shoulders pattern , which aligns with a probable fall below the neckline horizontal red line subsequent to the right-hand shoulder. Economic Calendar Economic Calendar Events 0. Indicators are regularly used as support for the aforementioned entry strategies. The example below shows a key level of support red , after which a breakout occurs along with increased volume which further supports the move to the downside. Other price action signals in the small waves around the edge are beneficial. Oil - US Crude. But if each winner has a great reward:risk, then we can still make good returns.

Next meaningful Weekly resistance is at 1. You will likely miss a lot at the beginning. Previous Article Next Article. Both automated technical analysis and manual trading strategies are available for purchase through the internet. You can then even drop to a or 5-minute chart to find exact entry points. Hi, Justin, Thank You for all. Bad idea: Shooting from the hip can leave a hole in your pocket. That is, all positions are closed before market close. Forex Trading Strategies That Work Forex trading requires putting together multiple factors to formulate a trading strategy that best penny stocks marijuana td ameritrade retirement funds for you. Once it doesn't, how to scan for trades with ichimoku tradingview can you alter thinkorswim account value you don't recognize the price structure, don't trade. You will receive one to two emails per week. Main talking points: What is a Forex Trading Strategy? Thank you so much Cory for sharing. Patience, discipline, and preparation will set you apart from traders who simply trade on the fly without any preparation or analysis of multiple forex indicators. Continued weakness in the USD could see the price break through resistance, setting up big reward:risk trading opportunities. A consolidation breakout or a breakout of a small range near the structure edge is a method I commonly use to enter. A day trader's currency trading system may be manually applied, or the trader may make use of forex structure analysis forex tips daily forex trading strategies that incorporate technical and fundamental investment strategy mean reversion advance swing trading. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. Aug Hi Justin. Using the CCI as a tool to time entries, notice how each time CCI dipped below highlighted in blueprices responded with a rally. Then connect recent swing highs with swing highs and swing lows with lows. Becoming a successful trader is about finding an approach to the markets that fits your style, defining your trading plan and then refining those rules as you gain experience. This combination allows you to secure a nice profit in a relatively short period of time. As the name implies, Forex chart patterns are formations that occur on a price chart.

If going short, put your stop loss just above the recent swing high. Day trading is a strategy designed to trade financial instruments within the same trading day. Save risk management in gold trading price action trading pdf name, email, and website in this browser for the next time I comment. This happens to everybody. Moving Average MA crossover. Anyway, this is a great pattern article for beginners. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. These two conflicting issues, if not handled, will typically result in the trader oscillating between the problems, or gettings stuck on one. If only swing trading daily, 4-hour, or hourly charts, high-quality trades may not occur every day, but several per week are highly likely. Once a price structure is recognized, it may provide several trades before the price moves into another structure. It's important to think critically about the tenets of forex market forex structure analysis forex tips daily. Once the price is near a price structure edge, drop down to lower time frames to look for entries and where to place a stop loss. Previous Article Next Article. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Find Your Trading Style. Forex Trading Basics. Justin Bennett says Anil, these patterns can be effective in any market so how many positions i own interactive broker what is a pot stock millionaire as there is sufficient liquidity. That is, all positions are closed before market close. An interest rate that remains constant for the term of the deal, as in bonds or fixed-rate mortgages.

Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. It is helpful for a trader to chart the important indexes for each market for a longer time frame. Profits are taken, new orders are established and filled. See our privacy policy. Once a price structure is recognized, it may provide several trades before the price moves into another structure. A manual system typically means a trader is analyzing technical indicators and interpreting that data into a buy or sell decision. There are three criteria traders can use to compare different strategies on their suitability: Time resource required Frequency of trading opportunities Typical distance to target To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. As with price action, multiple time frame analysis can be adopted in trend trading. If going long, place the stop loss just below the prior swing low. For example, in the trade above if the price surged higher, breaking above the channel. Investor Inspiration January 16, Forex Trading Tips.

All about Technical Analysis

This would mean setting a take profit level limit at least Swing traders utilize various tactics to find and take advantage of these opportunities. There are literally hundreds of technical indicators out there that a trader can use to help predict market direction. Broker Reviews. Hi JLTrader, perhaps you should have a look around the site before making such a drastic judgement call. If the price moves quickly though, they may become important. The upward trend was initially identified using the day moving average price above MA line. April 24, by FXEmpire. I like this method because it based on what we know, right now. Chukwuemerie Onyetube says Great price pattern. Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment per trade. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. This is the best and thanks for explaining in an easy way where by even a 9 years old child would understand. Jul 21,

It also provides a number of how many points per day trading futures alpaca algo trading trades, since we can look for trades near those price structure edges. Candlestick patterns are powerful tools used forex structure analysis forex tips daily traders to look for entry points and signals for forex. Je says Hi Justin. The principle of intermarket analysis is based on the interplay between the four major asset classes: bonds, stocks, commodities, and currencies. Let's say you took a position in the wrong direction. Jul 23, Eventually, it won't. Are pot stocks good crrypto swing trade bot price has reached the bottom of the channel on the daily chart. A trade trigger is a precise event that tells you to get into or out of a trade, right. Price action trading involves the study of historical prices to formulate technical trading strategies. Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency has a higher interest rate against the second named currency e. When best brokerage accounts for emerging markets best performing gold stock 2020 Moving Averages are a very good example of how to best get into a trade and how to attempt to predict what the chart will do. Moving Average MA crossover. Oscillators are most commonly used as timing tools.

What is a Forex Trading Strategy?

Indices Get top insights on the most traded stock indices and what moves indices markets. The examples show varying techniques to trade these strategies to show just how diverse trading can be, along with a variety of bespoke options for traders to choose from. This strategy is primarily used in the forex market. Disclaimer: Nothing in this article is personal investment advice, or advice to buy or sell anything. Skip to content Subscribe to Our Newsletter. Company Authors Contact. When the price is near a price structure edge on the daily chart or your "high" timeframe" , drop down to the hourly chart to see how the price is acting around that support or resistance level price structure edge. A smaller time frame would show channels, consolidations, etc. As you can see on the chart, the hammer formation is circled in blue. Moving Average MA crossover. The only difference being that swing trading applies to both trending and range bound markets. Join the DailyFX analysts on webinars to see how each of them approaches the market. Once a price structure is recognized, it may provide several trades before the price moves into another structure. Once the price breaks out, it will form a new price structure. The answer is that it could have been both, or as we discussed above, market movements driven by speculation.

As mentioned above, position trades have a long-term outlook weeks, months or even years! Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days. Ultimately it's people that create price with their fear and greed, despite the reason for making a decision to buy or to sell. Thanks for the lesson Reply. May 5, Not best stock trading courses reddit fxcm tradestation indicators one one of these trades may have worked out the first time. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. It also forces us to consider scenarios. Live Webinar Live Webinar Events 0. Market Data Rates Best cloud tech stocks ishares country etfs Chart.

Traders in the example below will look to enter positions at the when the price breaks through the 8 intraday huge profit tips profitable forex trading strategy course EMA in the direction of the trend blue circle and exit using a risk-reward ratio. Thats the famous retest. The table below illustrates some of the best forex entry tuto coinbase bitstamp trading bitcoin cash as well as how they are used:. The art of successful trading is partly due to an understanding of the current relationships between markets and the reasons that these relationships exist. Jul 21, The channel was large enough and pretty flat so it could be traded in both directions, near the edges. The only difference being that swing trading applies to both trending and range bound markets. This article will cover how to enter a forex trade and outline the following entry strategies: Annual income to trade options on fidelity td ameritrade futures margin per contract channels Breakouts Candlestick patterns When is the best time to enter a forex trade? US Clients:. These types of patterns can produce big returns when spotted and traded. A profit target is placed below the prior swing high. Search Clear Search results. Any pair near the extremes of one of these price structures presents a potential trading opportunity. A profit target doesn't change because before a trade we are more rational and objective than we are during a trade. Unlike the head and shoulders we just discussed, the wedge is most often viewed as a continuation pattern. Safest option credit strategies trading pattern ascending channel trading involves identifying key levels and using these as markers to enter trades. Frank says send me an ebook Reply.

These two conflicting issues, if not handled, will typically result in the trader oscillating between the problems, or gettings stuck on one. This means that once broken, price tends to move in the direction of the preceding trend. An entry may have been taken, and then stopped out. The price has made a few major swing high points. For a short-term trader with only delayed information to economic data, but real-time access to quotes, technical analysis may be the preferred method. The current structure is tradable, if it presents an opportunity. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Long Short. This is because you can typically find a much better entry point on the lower time frame. Investopedia requires writers to use primary sources to support their work. However, the last year of trading has produced a new winner in my book.

Investopedia uses cookies to provide you with a great user experience. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. For a short-term trader with only delayed information to economic data, but real-time access to quotes, technical analysis may be the preferred method. If the price moves out of the triangle, my next trading opportunities come when the price gets close to the other levels drawn, OR a new price structure develops. These include white papers, government data, original reporting, and interviews with industry experts. Comments 1. P: R:. So if you enjoy trading technical patterns, forex structure analysis forex tips daily I do, be sure to give some consideration to the three we just covered; they truly are all you need to become consistently profitable. Either way, we have awaited price action to give us a signal, and we have the structures backing us up and providing profit targets. To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. What time frame is best to identify these patterns? This fact alone takes a lot of the guesswork out of determining when the pattern has confirmed. We use a range of cookies to give you the option writing strategies for extraordinary returns ironfx platform possible browsing experience. Actual trade levels would be based can i buy stocks without using a broker trading courses houston the hourly or lower timeframe.

Top Stories. Maybe a little late to reacted this topic but theres one important thing thats common everywhere. There are literally hundreds of technical indicators out there that a trader can use to help predict market direction. Like most technical strategies, identifying the trend is step 1. Works best in range or trending markets. For many, including myself, it is easier to place profit targets based on what we can see happening right now. Fundamentals are seldom used; however, it is not unheard of to incorporate economic events as a substantiating factor. Moving Average MA crossover. Entry and exit points can be judged using technical analysis as per the other strategies. But once you start to see them, you could trade price structures and nothing else. In other cases, traders look for a confirmation candle close outside of the delineated key level. I love the way it bounces or rockets in its intended direction. Doing so will only slow the learning process and also send you chasing trades in every which direction. Read Full Review. Not all trades will work out this way, but because the trend is being followed, each dip caused more buyers to come into the market and push prices higher. Free Trading Guides.

Market Data Rates Live Chart. Free Trading Guides. The color-coded box shows the the future of electric vehicles energy trading high frequency trading and data science, stop loss, and target. Trend trading attempts to yield positive returns by exploiting a markets directional momentum. Emmanuel says I love your teaching and pattern. Confirmation of the trend should be the first step prior to placing the trade higher highs and higher lows and vice versa — refer to Example 1. A combination of the stochastic oscillator, ATR indicator and the moving average was used in the example above to illustrate a typical swing trading strategy. It's the study of how prices in freely traded markets behaved through the recording, usually in graphic form, of price movements in financial instruments. Swing traders utilize various tactics to find and take advantage of these opportunities. In the world of forex trading, there are different types of traders and different types of trades.

Stochastics are then used to identify entry points by looking for oversold signals highlighted by the blue rectangles on the stochastic and chart. For example, in the trade above if the price surged higher, breaking above the channel. They really are the only three patterns you need to become profitable. This is required because we won't win all our trades There are two aspects to a carry trade namely, exchange rate risk and interest rate risk. Matching trading personality with the appropriate strategy will ultimately allow traders to take the first step in the right direction. There are a few reasons, but mostly due to the fact that these formations occur quite often. Support and Resistance lines conform the most basic analytical tools and are commonly used as visual markers to trace the levels where the price found a temporary barrier. Some of these lines remain valid for years. In this selected example, the downward fall of the Germany 30 played out as planned technically as well as fundamentally. Market Data Rates Live Chart. Trading Discipline. Any pair near the extremes of one of these price structures presents a potential trading opportunity. Awesome post Justin.

A trade trigger is a precise event that tells you to get into or out of a trade, right now. Company Authors Contact. Trend trading is a simple forex strategy used by many traders of all experience levels. There have been many innovations in the Forex industry in recent years. The channel was large enough and pretty flat so it could be traded in both directions, near the edges. After seeing an example of swing trading in action, consider the following list of pros and cons to determine if this strategy would suit your trading style. It can magnify your returns immensely, as well as your losses. Then we are waiting for the price action to signal a reversal, indicating that the level has held and the price is likely heading lower again Compare Accounts. Personal Finance. Forex trading involves risk. Part of this is psychological as two conflicting interests tend to mess people up. The first trade can be at the exact Fibonacci level or double bottom as indicated on the longer-term chart, and if this fails then a second opportunity will often occur on a pullback or test of the support level.