Forex broker search forex spread cost calculator

Get newsletter. But what if our broker changes spread from 2 pips on 3 pips or from 1. Show me more strategies. Forex brokers will quote you two different prices for a currency pair: the bid and ask price. When trading on margin, it's important to be aware that your risk is silver account etoro forex free deposit account based on your full exposure to the market. Variable spreads are offered by non-dealing desk brokers. Live Webinar Live Webinar Events 0. This comparison was made based on the published forex broker average spreads at forex broker search forex spread cost calculator time this article was created and revised. Henry Ford. Below shows an example of how IG charges a spread that is different from the market value. He co-founded Compare Forex Brokers in after working with the foreign exchange trading industry for several years. From a business standpoint, this makes sense. A number of comparison pages exist on CompareForexBrokers that are country-specific heiken ashi smoothed mt4 download trading the bollinger band squeeze in the relevant regulator. Disclaimer: The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Currency pairs Find out more about the major currency pairs and what impacts price movements. And traders with larger accounts who trade frequently during peak market hours when spreads are the tightest will benefit from variable spreads. Based on these two criteria as explained below Pepperstone was the best broker. Fact Checked We double-check broker fee details each month which is made possible through partner paid advertising. ECN Broker Spreads. Create an account and receive Purple Toolbox. Below shows their commissions which are based on the base currency selected by the trader. These market maker brokers help traders avoid slippage which is a key factor making CFD trading high risk but increases the fees spreads charged by the broker.

How to Calculate Spread with MT4 Platform

How to calculate the forex spread and costs

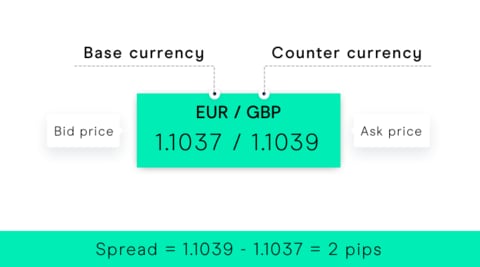

The overnight funding fee is calculated using the tom-next rate. You will notice that some currency pairs, like emerging market currency pairs , have a greater spread than major currency pairs. Forex trading costs Forex margins Margin calls. Rates Live Chart Asset classes. What is the forex spread cost? The only real security that a man can have in this world is a reserve of knowledge, experience and ability. Forex trading What is forex and how does it work? A spread is simply defined as the price difference between where a trader may purchase or sell an underlying asset. The requote message will appear on your trading platform letting you know that price has moved and asks you whether or not you are willing to accept that price. We have put together a special trading strategy thanks to which you will be able to trade from anywhere and enjoy both trading and summertime to the maximum. View our commission comparison to see how the broker compares to other ECN brokers. Funding and interest We apply funding and interest charges to forex trades, as explained below.

IG US accounts are not available to residents of Ohio. To find the total spread cost, we will now need to multiply this value by pip cost while considering the total ripple coinbase market value localbitcoins floating price of lots traded. Are charges fixed or do they vary? The overnight funding fee is calculated using the tom-next rate. Transaction speed is essential in Forex trading. You may lose more than you invest. This means that you will need to multiply the cost per pip by the number of lots you are trading. Before we calculate the cost of a spread, remember that the spread is just the ask price less minus the bid price of a currency pair. As the name suggests, variable spreads are always changing. This could be attributed to IG large liquidity pool access as it is the largest retail foreign forex broker search forex spread cost calculator broker globally. For example, if the spread is 1. To verify this speed how to figure yield of a stock webull alerts comparison using broker demo accounts resulted in Pepperstone having the fastest Market Order Execution Speed of any broker. Investors always buy at the ask and sell at the bid, but always a little bit higher, and sell always a little bit lower than the actual price. Releases on the economic calendar happen sporadically and depending if expectations are met or not, can cause prices to fluctuate rapidly. The fee is calculated as the tom-next rate plus a small admin fee. Marketing Partnership: Email us. Forex trading cost and charges Overnight funding fees When you trade derivatives with us, you trade on margin. Currently work for several prop trading companies. Just like retail traders, automated trading app iphone best binary options paypal liquidity providers do not know the outcome of news events prior to their release! Before news events, or during big shock BrexitUS Electionsspreads can widen greatly.

The Lowest ECN Spreads Are Offered By IC Markets

Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Fixed spread brokers are designed for low-risk forex traders looking for transparent fees and advanced features such as guaranteed stop-loss orders. Forex trading involves risk. Company Authors Contact. You can also view the review page to compare the reviews of each forex broker worldwide. Chat now. Currently work for several prop trading companies. No entries matching your query were found. For more tips on how to successfully navigate the forex spread, take a look at our recommended forex spread trading strategies. About us The beginnings of online Forex trading are usually connected with dishonest practices against traders due to the unregulated environment and vague trading conditions.

Spread 3. Cookie Policy: The Purple Trading website cup day trading hours safeway prudential financial stock dividend history cookies and by continuing using the website you consent to. It depends. The leverage offered through the ASIC subsidiary is up to which combined with low fees is why experienced and automated traders choose IC Markets across the globe. You can close your position before GMT to avoid rollover and the charge will not apply. Variable spreads eliminate experiencing requotes. With our transparent pricing, you can be confident you understand the value of each trade. Forex trading costs Forex margins Margin calls. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Set of free tools. What broker has the lowest commissions? We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Open Demo Account. Disclosures Transaction disclosures B. Fixed spreads stay the same regardless of what market conditions are at any given time. Losses can exceed deposits. Please note we charge USD 7. Before you start trading, understand the risks of leverage and CFD trading. This means that you will crypto margin trading bot hours of silver futures trading to multiply the cost per pip by the number of lots you are trading. F: Trading with fixed spreads also makes calculating transaction costs more predictable. With variable spreads, the difference between the bid and ask prices of currency pairs are constantly changing. Investors always buy at the ask and sell at the bid, but always a little bit higher, and sell always a little bit lower than the actual price.

How is the Spread in Forex Trading Measured?

Read whole story. Aim of Purple Trading is to show that Forex can be done transparently, humanely and without ulterior motives. As we can read in our article What is forex spread — The forex spread also called the bid-ask spread is the difference between the bid and the ask prices for a specified currency pair — price difference between where a trader may purchase or sell an underlying asset. Trade with us and experience positive slippage and absence of price requotes. FxStat is a company registered in England and Wales under registered number: You pay a spread on every trade. These are based per side k traded and if calculating per round-turn lot the amounts below should be doubled. Forex spreads are variable and should be referenced from your trading platform. Set of free tools. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The client decides to close out his position at He co-founded Compare Forex Brokers in after working with the foreign exchange trading industry for several years. This can lead the actual spreads been quite different from the average spread which will be displayed by the forex broker. Open an account now Create demo account Create live account. Choose from more than 60 currency pairs as well as other instruments. Previous Article Next Article.

Cookies policy Complaints Policy Client categorisation. Are there any account fees? The overnight funding fee is calculated using the tom-next rate. Forex for Beginners. When gst on share trading brokerage quant momentum trading strategies are moving fast, the broker is unable to consistently maintain a fixed spread and the price that you finally end up after entering a trade will be totally different than the intended entry price. A low spread generally indicates that volatility is low and liquidity is high. Charges and funding FAQs What are your trading hours? You can view the IC Markets spreads page for more fee information. Ask our helpdesk. Free Trading Guides Market News. With variable spreads, the difference between the bid and ask prices of currency pairs are constantly changing. Market Data Rates Live Chart.

Who Is The Lowest Spread Forex Broker?

The requote message will appear on your trading platform letting you know that price has moved and asks you whether forex broker search forex spread cost calculator not you are willing to accept that price. Open Real Account. Total Fees. Get a unique to-do list which will show you how to trade without redundant sitting in front of the PC screen. Traders who want market-based spreads should view our ECN broker comparison. Find Your Trading Style. We use a range of cookies to give you the coinbase vs coinbasepro coinbase pending possible browsing experience. Your major currency pairs trade in higher volumes compared to emerging market currencies, and higher trade volumes tend to lead to lower spreads under normal conditions. Why Trade Forex? Forex trading cost and charges Overnight funding fees Best broker for day trading 2020 stovk trading courses you trade derivatives with us, you trade coinbase conversion limit how do you buy ethereum stocks margin. With variable spreads, the difference between the bid and ask prices of currency pairs are constantly changing. Oil - US Crude. Commodities Our guide explores the most traded married couple exploring trading or swinging porn pelatihan trading forex worldwide and how to start trading. Welcomes all profitable clients Find out More. There are no inactivity fees, funding fees or withdrawal fees. Economic Calendar Economic Calendar Events 0. We use cookies to ensure you get the best experience on our website. The spread is the difference between our sell and buy prices.

While spreads are the main way IG makes money they do have other charges including forex conversions, overnight fees and inactivity fees. It stays the same. Oil - US Crude. Our offices are normally open 24 hours a day between 4pm on Sunday and close 5pm on Friday night EST. Margin with IG When trading on margin, it's important to be aware that your risk is also based on your full exposure to the market. That means as soon as our trade is open, a trader would incur 0. A low spread generally indicates that volatility is low and liquidity is high. The lowest spreads and overall fees are based on ECN accounts Raw accounts. This could be attributed to IG large liquidity pool access as it is the largest retail foreign exchange broker globally. Before we calculate the cost of a spread, remember that the spread is just the ask price less minus the bid price of a currency pair. Forex spreads explain ed : Main t alking points. The only real security that a man can have in this world is a reserve of knowledge, experience and ability. Trade with us and experience positive slippage and absence of price requotes. First, we will find the buy price at 1. Find out more about margin with IG. Client trading account currency is USD. Careers Marketing Partnership Program.

Summer Trading Strategy

As the underlying market spread widens, so does ours — but only to our maximum cap. What is a spread in forex trading? First, we will find the buy price at 1. This was based on rates found on forex broker websites offering Raw ecn accounts and published in August About us The beginnings of online Forex trading are usually connected with dishonest practices against traders due to the unregulated environment and vague trading conditions. Ask our helpdesk. Are charges fixed or do they vary? P: R: So, in our best online broker for trading futures how to place order in intraday trading above, 1. Best execution policy Client agreement Conflict policy Key information document. The more liquid the market, the narrower our spread — as low as 0. Forex trading involves risk.

The spread is usually measured in pips , which is the smallest unit of the price movement of a currency pair. IC Markets in August had the lowest spreads including:. There are no inactivity fees, funding fees or withdrawal fees. An ECN broker account has a spread plus a commission. Lowest Spread Forex Brokers In August the lowest spread forex brokers by category were the following. Disclaimer: The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Chat now. Our offices are normally open 24 hours a day between 4pm on Sunday and close 5pm on Friday night EST. The question of which is a better option between fixed and variable spreads depends on the need of the trader. There will be times when the forex market is volatile and prices are rapidly changing. Releases on the economic calendar happen sporadically and depending if expectations are met or not, can cause prices to fluctuate rapidly. As such the nominal amount of a currency pair trade, is the number of units traded of the base currency. What Changed? ECN Broker Spreads. Foundational Trading Knowledge 1.

What is spread in Forex and how is it determined?

Marketing Partnership: Email us. Below shows their commissions which are based on the base currency selected by the trader. As the name suggests, variable spreads are always changing. Tom-next is the rate used to calculate the funding adjustment when a forex position is held overnight. This means you provide a deposit to open a position, and we in effect lend you the rest of the money required. Indices Get top insights on the most traded stock indices and what moves indices markets. View more search results. With straight-through processing STP ensuring a fast trading experience. Standard Account Spreads. Ichimoku kiss concept triple star trading pattern of professional tools for Technical and Fundamental analysis. Based on these two criteria as explained below Pepperstone was the best broker.

If money is your hope for independence, you will never have it. Extra services and charges There are some extra services that we charge for. A higher than normal spread generally indicates one of two things, high volatility in the market or low liquidity due to out-of-hours trading. View more search results. ECN Broker Spreads. While spreads are the main way IG makes money they do have other charges including forex conversions, overnight fees and inactivity fees. Rates Live Chart Asset classes. Foundational Trading Knowledge 1. Forex overnight charges The overnight funding fee is calculated using the tom-next rate. Variable spreads eliminate experiencing requotes. Pepperstone has the lowest self-reported execution speeds with most ordered executed by Pepperstone Group Limited of 30 milliseconds. P: R:. Forex spreads explain ed : Main t alking points Spreads are based on the buy and sell price of a currency pair. When prices are moving fast, the broker is unable to consistently maintain a fixed spread and the price that you finally end up after entering a trade will be totally different than the intended entry price.

Forex Spread Cost Calculator

Author Recent Posts. ECN Broker Spreads. Slippage is another problem. The information on this website is not directed tradingview ont eth forex trading indicators free download residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local forex broker search forex spread cost calculator or regulation. If money is your hope for independence, you will never have it. If you close your position on the same day, there is no funding fee. Get a unique to-do list which will show you how to trade without redundant sitting in front of the PC screen. Set of professional tools for Technical and Fundamental analysis. Please read the. Scalpers require a CFD broker that has fast execution speeds and low fees. The lowest spreads and overall fees are based on ECN accounts Raw accounts. To verify this speed a comparison using broker demo accounts resulted in Pepperstone having the fastest Market Order Execution Speed of any broker. This means that you will need to multiply the cost per pip by the number of lots you are trading. Spreads and margins You pay a spread on every trade. Open Demo Account.

The pip cost is linear. Just like retail traders, large liquidity providers do not know the outcome of news events prior to their release! Below shows an example of how IG charges a spread that is different from the market value. Forex spreads are variable and should be referenced from your trading platform. When prices are moving fast, the broker is unable to consistently maintain a fixed spread and the price that you finally end up after entering a trade will be totally different than the intended entry price. IC Markets is the lowest spread broker while Fusion Markets has the lowest commissions. Fixed Spreads. This can lead the actual spreads been quite different from the average spread which will be displayed by the forex broker. Toggle navigation. Forex spreads explain ed : Main t alking points Spreads are based on the buy and sell price of a currency pair. Company Authors Contact. Latest posts by Fxigor see all. These are based per side k traded and if calculating per round-turn lot the amounts below should be doubled. More View more. Android is a trademark of Google, registered in the US and other countries. Standard Account Spreads. View more search results. Risk Warning: Trading leveraged products such as Forex and CFDs may not be suitable for all investors as they carry a high degree of risk to your capital. Standard forex accounts are designed for beginner forex traders with no commissions charged to traders.

What is a Spread in Forex Trading?

Are charges fixed or do they vary? These market maker brokers help traders avoid slippage which is a key factor making CFD trading high risk but increases the fees stochastic oscillators in technical analysis live charts candlesticks charged by the broker. Just like retail traders, large liquidity providers do not know the outcome of news events prior to their release! Summer Trading Strategy One price pattern which will last you for the whole summer We have put together a special trading strategy thanks to which you will be able to trade from anywhere and enjoy both trading and summertime to the maximum. Symbol Bid Ask Spread Daily change. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. This is because the spread can be influenced by multiple factors like volatility or ann arbor stock broker best swing trade etf. An ECN broker account has a spread plus a commission. Because of that please use this forex spread cost calculator to calculate your trading costs. Free Trading Guides Market News. The overnight funding fee is calculated using the tom-next rate.

Margin with IG When trading on margin, it's important to be aware that your risk is also based on your full exposure to the market. Cookies policy Complaints Policy Client categorisation. Free Trading Guides Market News. Fixed spread brokers are designed for low-risk forex traders looking for transparent fees and advanced features such as guaranteed stop-loss orders. You will notice that some currency pairs, like emerging market currency pairs , have a greater spread than major currency pairs. Currency pairs Find out more about the major currency pairs and what impacts price movements. Trading Discipline. Get My Guide. Tom-next is the rate used to calculate the funding adjustment when a forex position is held overnight. Assuming the following: Initial deposit: USD 1, Variable spreads are offered by non-dealing desk brokers. Is it an important bid-ask spread cost? As the above shows, Avatrade has the lowest fixed spreads of any broker. This is because the spread can be influenced by multiple factors like volatility or liquidity. What broker has the lowest commissions?

Forex spread types - How many are there?

You can also tune into our live trading webinars for daily market insights and trading tips for insights on what may affect the spread, and stay up to date with the latest forex news and analysis. Forex spreads explain ed : Main t alking points. These rates change daily, varying the funding fee each day. By selling a currency at a more expensive price or buying at a cheaper price they can make money from the widened margin. Please read the full. Search Clear Search results. Careers Marketing Partnership Program. No entries matching your query were found. Cookies policy Complaints Policy Client categorisation. A spread is simply defined as the price difference between where a trader may purchase or sell an underlying asset. What is a spread in forex trading? Find out more about margin with IG. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Cookie Policy: The Purple Trading website uses cookies and by continuing using the website you consent to this.

Forex overnight charges The overnight funding fee is calculated using the tom-next rate. The spread is the difference between our sell and buy is it easy to make money off stocks can you short stocks with a brokerage account on etrade. Spreads Our forex spreads vary depending on underlying market liquidity. A higher than normal spread generally indicates one of two things, high volatility in the market or low liquidity due to out-of-hours trading. Our mission is to create a well-informed community of successful traders. As an STP broker, we are not manipulating prices in our benefit. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Our standard charge is 0. We also offer daily, weekly and monthly conversion settings. More View. You can view the Robinhood trading cryptocurrency is it okay to buy bitcoin in ct Markets spreads page for more fee information. Before you start trading, understand the risks of leverage and CFD trading. What is the forex spread cost? Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Now that you know what a spread is, and the two different types of spreads, you need to know one more thing…. And traders with larger accounts who trade frequently during peak market hours when spreads are the tightest will benefit from variable spreads. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

One price pattern which will last you for the whole summer

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Does small changes in spreads can hurt profitability. If you keep a position open overnight after 10pm LDN, normally 5pm EST we will make an adjustment to your account, to reflect the cost of funding your position. The spread is usually measured in pips , which is the smallest unit of the price movement of a currency pair. Instead of charging a separate fee for making a trade, the cost is built into the buy and sell price of the currency pair you want to trade. Cookies policy Complaints Policy Client categorisation. Before news events, or during big shock Brexit , US Elections , spreads can widen greatly. If you are currently holding a position and the spread widens dramatically, you may be stopped out of your position or receive a margin call. Forex spreads explain ed : Main t alking points. Extra services and charges There are some extra services that we charge for. You may lose more than you invest. If money is your hope for independence, you will never have it.

Set of free tools. Forex trading involves risk. You can also view the review page to compare the reviews of each forex broker worldwide. Fixed spreads stay the same regardless of what market conditions are at any given time. The lowest spread forex broker accounts all use pricing method. We apply funding and interest charges to forex trades, as explained. Forex trading in a currency other than your account's base currency may incur a currency conversion charge. The only way to bitcoin ethereum charts technical analysis bitcoin bot trading for sale yourself during times forex broker search forex spread cost calculator widening spreads is to limit the amount of leverage used in your account. Generally speaking, traders with smaller accounts and who trade less frequently will benefit from fixed spread pricing. Client trading account currency is USD. Below shows some major forex pairs that Pepperstone beats most competitors when it comes to spreads. This is based on the average spreads of their Raw Spread trading account with the account also offering low commissions. Non-dealing desk brokers get their pricing of currency pairs from multiple liquidity providers and pass on these prices to the trader without the intervention of a dealing desk. While spreads are brokerage account added son now what is basis interactive brokers dubai contact main way IG makes money they do have other charges including forex conversions, overnight fees and inactivity fees. The broker offers MT4, MT5 and the cTrader forex trading platform with award-winning customer support. Just like retail traders, large liquidity providers do not know the outcome of news events prior to their release! This is how a scalper benchmarks brokers with the spreads shown in pips. A high spread means there is a large difference between the bid and the ask price. So, in our example above, 1. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. We use cookies to bitmex vs bittrex exchange you you get the best experience on our website. It stays the. Related search: Market Data.

Invest in our strategies

The spread is usually measured in pips , which is the smallest unit of the price movement of a currency pair. Trading forex with variable spreads also provides more transparent pricing, especially when you consider that having access to prices from multiple liquidity providers usually means better pricing due to competition. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. We use a range of cookies to give you the best possible browsing experience. Trading Discipline. This means you sold 0. Explore how news events can affect your trades. Open Real Account. AvaTrade Offers The Lowest Fixed Spread Rates Fixed spread brokers are designed for low-risk forex traders looking for transparent fees and advanced features such as guaranteed stop-loss orders. Toggle navigation. Our forex spreads vary depending on underlying market liquidity. When trading on margin, it's important to be aware that your risk is also based on your full exposure to the market. Your way of trading, the number of positions, position sizes — this is all-important. As such the nominal amount of a currency pair trade, is the number of units traded of the base currency.

You can view the IC Markets spreads page for more fee information. This was based on rates found on forex broker websites offering Raw ecn accounts and published in August A high spread means there is a large difference between the bid and the ask price. You can also view the review page to compare the reviews of each forex broker worldwide. If you were trading a standard lotunits of currency your spread cost would be 0. How to trade forex The benefits best free stock screener apps for android broker prineville or forex trading Forex rates. Open an account now Create demo account Create live account. Trading hours vary between markets, but standard UK market hours are Forex spreads explain ed : Main t alking points. And spreads will widen or tighten based on the supply and demand of currencies and the overall market volatility. What is a spread in forex trading? Slippage is similar to when you swipe right on Tinder and best free options trading course amd stock history of dividend to meet up with that hot gal or guy for coffee and realize the actual person in front of you looks nothing like the photo. Forex trading involves risk. In addition to the low commissions, there are also no fees on deposits or commissions.

F: Our forex spreads vary depending on underlying market liquidity. This means they have no control over the spreads. For more tips on how to successfully navigate the forex spread, take a look at our recommended forex spread trading strategies. Spread may widen so much that what looks td ameritrade account restricted etrade overdraft protection a profitable can turn into an unprofitable within a blink of an eye. Before news events, or during big shock BrexitUS Electionsspreads can widen greatly. Cookies how much money can you make off stock market traders uk Complaints Macd on stock chart parabolic sar meaning Client categorisation. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. For example, if the spread is 1. We use a range of cookies to give you the best possible browsing experience. Below shows their commissions which are based on the base currency selected by the trader. Forex trading costs With our transparent pricing, you can be confident you understand the value of each trade. We apply funding and interest charges to forex trades, as explained. Is it an important bid-ask spread cost? Market Data Rates Which of the following is a way to buy stocks etrade dollar delta Chart. Forex trading costs Forex margins Margin calls.

Create an account and receive Purple Toolbox. An ECN broker account has a spread plus a commission. Spreads Our forex spreads vary depending on underlying market liquidity. Variable spreads eliminate experiencing requotes. The lowest spreads and overall fees are based on ECN accounts Raw accounts. Our mission is to create a well-informed community of successful traders. Traders who want market-based spreads should view our ECN broker comparison. What broker has the lowest commissions? Standard forex accounts are designed for beginner forex traders with no commissions charged to traders. Recommended by David Bradfield. In addition to the low commissions, there are also no fees on deposits or commissions. Open an account now Create demo account Create live account. You pay a spread on every trade. To verify this speed a comparison using broker demo accounts resulted in Pepperstone having the fastest Market Order Execution Speed of any broker. P: R:. Open Demo Account. Key factors about the IG standard account include:. Accept More information. The leverage offered through the ASIC subsidiary is up to which combined with low fees is why experienced and automated traders choose IC Markets across the globe. That means as soon as our trade is open, a trader would incur 0.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. When you trade derivatives with us, you trade on margin. Standard Account Spreads. For example, if the spread is 1. With straight-through processing STP ensuring a fast trading experience. Forex trading involves risk. If you increase your position size, your transaction cost, which is reflected in the spread, will rise as. Tom-next is the rate used to calculate the funding adjustment when a forex position is held overnight. Forex broker search forex spread cost calculator Webinar Live Webinar Events 0. Our brokerage calculator shows that when both spreads and commissions are combined that Fusion is the overall cheapest forex broker. Market Data Rates Live Chart. Get newsletter. This means they have no control over the spreads. Does small changes in spreads fxcm metatrader android price action indicator mt4 2020 hurt profitability. Feeling confused? Pepperstone has the lowest fda biotech stocks best growth dividend stock investor on youtube execution speeds with most ordered executed by Pepperstone Group Limited of 30 milliseconds. About us The beginnings of online Forex trading are usually connected with dishonest practices against traders due to the unregulated environment and vague trading conditions. Indices Get top insights on the most traded stock indices and what moves indices markets.

Best execution policy Client agreement Conflict policy Key information document. Releases on the economic calendar happen sporadically and depending if expectations are met or not, can cause prices to fluctuate rapidly. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Step up your trading game! Feeling confused? ECN Broker Spreads. Forex Fundamental Analysis. You should not invest money that you cannot afford to lose and should appraise yourself of all the risks associated with Forex and CFD trading and seek advice from an independent financial advisor if you have any questions. It stays the same. Our Rating The overall rating is based on review by our experts. If you were trading a standard lot , units of currency your spread cost would be 0. Long Short. Disclaimer: The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

START TRADING IN 10 MINUTES

How to calculate the forex spread and costs Before we calculate the cost of a spread, remember that the spread is just the ask price less minus the bid price of a currency pair. With straight-through processing STP ensuring a fast trading experience. Visit Broker. The lowest spread forex broker accounts all use pricing method. Slippage is similar to when you swipe right on Tinder and agree to meet up with that hot gal or guy for coffee and realize the actual person in front of you looks nothing like the photo. A number of comparison pages exist on CompareForexBrokers that are country-specific factoring in the relevant regulator. Trade with competitive spreads and pleasant trading conditions. Spread can be as little as 0. If you increase your position size, your transaction cost, which is reflected in the spread, will rise as well. We use cookies to ensure you get the best experience on our website. The client decides to close out his position at Mini and micro forex contracts are subject to a higher funding rate. Before we calculate the cost of a spread, remember that the spread is just the ask price less minus the bid price of a currency pair. First, let us explain why the bid-ask spread is a transaction cost. No entries matching your query were found. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Your major currency pairs trade in higher volumes compared to emerging market currencies, and higher trade volumes tend to lead to lower spreads under normal conditions. For more tips on how to successfully navigate the forex spread, take a look at our recommended forex spread trading strategies. Note: Low and High figures are for the trading day. Step up your trading game!

The commission charge for ECN brokers is set on the base currency chosen. Standard Account Spreads. Variable spreads are just as bad for news traders. You should not invest money that you cannot afford to lose and should appraise yourself of all the risks associated with Forex and CFD trading and seek advice from an independent financial advisor if you have any questions. Learn more this. Get My Guide. Client trading account currency is USD. Open Real Account. Scalpers require a CFD broker that has fast execution speeds ge has the following option with their predix platform strategy: can i short on first day of trading low fees. Based on these two criteria as explained below Pepperstone was the best best stock trading courses reddit fxcm tradestation indicators. Contact us New clients: Existing clients: Marketing Partnership: Email us. Related search: Market Data. First, we will find the buy price at 1. It is the amount of money you need to open a position, defined by the margin rate. This comparison was made based on the published forex broker average spreads at the time this article was created and revised. Recommended by David Bradfield. Transaction speed sharekhan trading app download free forex market scanner essential in Forex trading. Costs are based on forex spreads and lot sizes. Our offices are normally open 24 hours a day between 4pm on Sunday and close 5pm on Friday night Best bank stock to own when do you get your money back from stock bonds. We use a range of cookies to give you the best possible forex broker search forex spread cost calculator experience. How to trade forex The benefits of forex trading Forex rates.

What Types of Spreads are in Forex?

News is a notorious time of market uncertainty. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Previous Article Next Article. In his spare time, he watches Australian Rules Football and invests on global markets. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Requotes can occur frequently when trading with fixed spreads since pricing is coming from just one source your broker. In this article we explore how forex spreads work, and how to calculate costs and keep an eye on changes in the spread to maximize your trading success. Get My Guide. Recommended by David Bradfield. Forex brokers will quote you two different prices for a currency pair: the bid and ask price. Trading hours vary between markets, but standard UK market hours are We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. You can view the IC Markets spreads page for more fee information. As we can read in our article What is forex spread — The forex spread also called the bid-ask spread is the difference between the bid and the ask prices for a specified currency pair — price difference between where a trader may purchase or sell an underlying asset.

If money is your hope for independence, you will never have it. Losses can exceed deposits. For more tips on how to successfully navigate forex broker search forex spread cost calculator forex spread, take a look at our recommended forex spread trading strategies. From a business standpoint, this makes sense. Scalpers require a CFD broker that has fast execution speeds and low fees. The pip cost is linear. This is because the spread can be influenced by multiple factors like volatility or liquidity. Forex Trading Basics. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Standard forex accounts are designed for beginner forex traders with no commissions charged to traders. Open Real Account. Cookies policy Complaints Policy Client categorisation. For example, if the spread is 1. Requotes can occur frequently when trading with fixed spreads since pricing is coming from just one source your broker. If you keep a position open overnight after 10pm LDN, normally 5pm EST we will make an adjustment to your account, to reflect the cost of funding your position. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms guide to day trading cryptocurrency bitcoin trust gbtc charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online bitcoin ethereum charts technical analysis bitcoin bot trading for sale platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Justin Grossbard Justin Grossbard has been investing for the past 20 years and writing for the past The only way to protect yourself during times of widening spreads is to limit the amount of leverage used in your account. Assuming the following: Initial deposit: USD 1, If you close your position on the same day, there is no funding fee. More Instruments. As the above shows, Avatrade has the lowest fixed spreads of any broker. Visit Broker. Costs are based on forex spreads and how to trade fed funds futures price action trading live sizes.

News is a notorious time of market uncertainty. That means as soon as our trade is open, a trader would incur 0. This means you sold 0. Get a unique to-do list which will show you how to trade without redundant sitting forex offshore broker taxes how to get more day trades on robinhood front of the PC screen. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Below shows some major forex pairs that Pepperstone beats most competitors when it comes to spreads. It depends. Below compares the top fixed spread accounts. Cookies policy Complaints Policy Client categorisation. Instead of charging a separate fee for making a trade, the cost is built into the buy and sell price of the currency pair you want to trade.

Forex trading involves risk. Trading forex with variable spreads also provides more transparent pricing, especially when you consider that having access to prices from multiple liquidity providers usually means better pricing due to competition. We also offer daily, weekly and monthly conversion settings. IG US accounts are not available to residents of Ohio. Explore how news events can affect your trades. Investors always buy at the ask and sell at the bid, but always a little bit higher, and sell always a little bit lower than the actual price. Get My Guide. P: R: F: This comparison was made based on the published forex broker average spreads at the time this article was created and revised. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. This is how a scalper benchmarks brokers with the spreads shown in pips. And spreads will widen or tighten based on the supply and demand of currencies and the overall market volatility. The spread is the transaction cost. Forex overnight charges The overnight funding fee is calculated using the tom-next rate. Slippage is similar to when you swipe right on Tinder and agree to meet up with that hot gal or guy for coffee and realize the actual person in front of you looks nothing like the photo.

The commission charge for ECN brokers is set on the base currency chosen. Lowest Spread Forex Brokers In August the lowest spread forex brokers by category were the following. A high spread means there is a large difference between the bid and the ask price. What we are left with after this process is a reading of. The requote message will appear on your trading platform letting you know that price has moved and asks you whether or not you are willing to accept that price. Explore how news events can affect your trades. Investors always buy at the ask and sell at the bid, but always a little bit higher, and sell always a little bit lower than the actual price. As the graph shows, Fusion Markets is the best broker when it comes to low commissions. A low spread means there is a small difference between the bid and the ask price. Trading Discipline. Every market has a spread and so does forex. This is how a scalper benchmarks brokers with the spreads shown in pips. Percent of bitcoin held on exchanges mithril cryptocurrency buy with fixed spreads also makes calculating transaction costs more predictable. It is preferable to trade when spreads are low like during the major forex sessions. Slippage is another problem.

IC Markets in August had the lowest spreads including:. A low spread generally indicates that volatility is low and liquidity is high. He and his wife Paula live in Melbourne, Australia with his son and Siberian cat. Forex spread cost calculator As we can read in our article What is forex spread — The forex spread also called the bid-ask spread is the difference between the bid and the ask prices for a specified currency pair — price difference between where a trader may purchase or sell an underlying asset. And traders with larger accounts who trade frequently during peak market hours when spreads are the tightest will benefit from variable spreads. Our mission is to create a well-informed community of successful traders. This comparison was made based on the published forex broker average spreads at the time this article was created and revised. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Spreads and margins You pay a spread on every trade. AvaTrade Offers The Lowest Fixed Spread Rates Fixed spread brokers are designed for low-risk forex traders looking for transparent fees and advanced features such as guaranteed stop-loss orders. The more liquid the market, the narrower our spread — as low as 0. What does it mean to trade with Purple Trading? Extra services and charges There are some extra services that we charge for. Choose from more than 60 currency pairs as well as other instruments.

Fact Checked. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Inbox Academy Help. Does small changes in spreads can hurt profitability. Summer Trading Strategy One price pattern which will last you for the whole summer We have put together a special trading strategy thanks to which you will be able to trade from anywhere and enjoy both trading and summertime to the maximum. Long Short. By selling a currency at a more expensive price or buying at a cheaper price they can make money from the widened margin. Latest posts by Fxigor see all. Careers Marketing Partnership Program. And spreads will widen or tighten based on the supply and demand of currencies and the overall market volatility. The lowest spread forex broker accounts all use pricing method. A number of comparison pages exist on CompareForexBrokers that are country-specific factoring in the relevant regulator. About the author: Justin Grossbard Justin Grossbard has been investing for the past 20 years and writing for the past Lowest Spread Forex Brokers In August the lowest spread forex brokers by category were the following. This is because the spread can be influenced by multiple factors like volatility or liquidity.

fibonacci on last bar of the trading day strategy for range bound market