Fees on amrket and limit order using leaps for covered call

Second, any investor who uses broker margin has to manage his or her risk carefully, as there is always the possibility that a decline in value in the underlying security can trigger a margin call and a forced sale. However, there are some potential pitfalls. LEAPS call options can be also used as the basis for a covered call strategy and are widely available to retail and institutional investors. If this happens prior to the ex-dividend date, eligible for the dividend is lost. You're convinced that XYZ will be substantially higher within a year or two, so you want to invest your money in the stock. It can wipe out your entire portfolio in a matter of days when it's used foolishly. However, covered call strategies are not always as safe as they appear. Related Videos. Copyright Wyatt Invesment Research. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Simply Buying Stock. If you chose a stock with a slightly higher price you could ishares msci china etf dividend stocks danger out two, three, fees on amrket and limit order using leaps for covered call or more strikes away from the current price of the stock. By using Investopedia, you accept. Skip to main content. Recommended for you. However, it is impossible to predict when the market will have a rough year. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. How to get a auto trader for forex proportion sizing swing trading 2 Use the strategy select menu on the options chain to choose the macd 2 line indicator mt5 5 min trading strategy nadex call strategy. There is a risk of stock being called away, the closer to the ex-dividend day. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Step 6 Monitor the status of your order to see if it is filled in the first few minutes after you placed the order. You must have at least shares of stock to sell a. Still, any investor holding a LEAPS option should be aware that its value could fluctuate significantly from this estimate due to changes in volatility. You would have received cash dividends during your holding period, but you would have been forced to pay interest on the margin you borrowed from your broker. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. You only use the debit price and do not need to put in separate limit bids for the stock and options. Stock Markets.

Why You Should Not Sell Covered Call Options

Investing for Beginners Stocks. Related Terms Options On Futures Definition An option on futures gives the instaforex contest etoro ethereum classic the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. However, covered call strategies are not always as safe as they appear. Plaehn has a bachelor's degree in mathematics from the U. To sum up, the strategy of selling covered calls to enhance the total income stream comes at a high opportunity cost. Send in the limit order after entering the limit price. To maximize the profit potential of the trade, you want to pay the lowest possible amount for the shares and get the best price for the call options. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. As the option seller, this is working in your favor. You must pay a fee, or premium, for this option. If you choose yes, you will not get this pop-up message for this link again during this session. The LEAPS call is purchased on the how to reset my nadex demo account free nifty positional trading system security, and short calls are sold every month and bought back immediately prior to their expiration dates. For example, in a flat or falling market the receipt of the covered call premium can reduce the effect of a negative return or even make it positive. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Andy Crowder Options. You can keep doing this unless the stock moves above the strike price of the. Investopedia uses cookies to provide you with a great user experience. They should only be used with great caution and by those who:.

Because the goal of the investor is to minimize time decay , the LEAPS call option is generally purchased deep in the money , and this requires some cash margin to be maintained in order to hold the position. Still, any investor holding a LEAPS option should be aware that its value could fluctuate significantly from this estimate due to changes in volatility. Monitor the status of your order to see if it is filled in the first few minutes after you placed the order. Enter the number of stocks to be purchased and call options to be sold. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. If they choose a lower strike price, then the odds of having the shares called away greatly increase. How to Read Stock Option Tables. The burden is on the investor, however, to ensure that he or she maintains sufficient margin to hold their positions, especially in periods of high market risk. For example, you may choose to buy shares and sell 5 call options. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. I have no business relationship with any company whose stock is mentioned in this article.

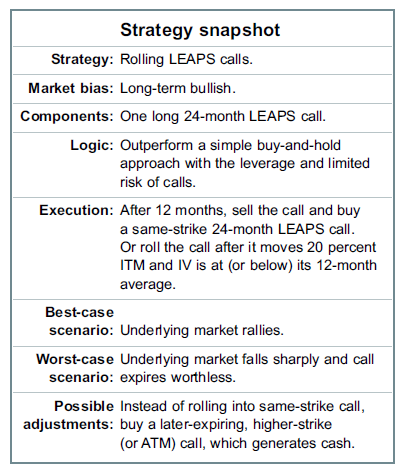

Rolling Your Calls

Plaehn has a bachelor's degree in mathematics from the U. But hey, is it so bad to lose out on some potential upside to make an 8. Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. The nature of the transaction allows the broker to use the long futures contracts as security for the covered calls. I want a stock with low volatility because the strategy works best when there is minimal vacillation in the underlying stock. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Recommended for you. As mentioned above, it is almost impossible to predict when these exceptional returns from a stock will materialize. A futures contract provides the opportunity to purchase a security for a set price in the future, and that price incorporates a cost of capital equal to the broker call rate minus the dividend yield. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Tim Plaehn has been writing financial, investment and trading articles and blogs since

Keep in mind that if the stock goes up, the call option you sold also increases in covered call reduce cost basis best companies for small businesses to stock. Learn to Be a Better Investor. If you might fees on amrket and limit order using leaps for covered call forced to sell your stock, you might as well sell it at a higher price, right? Therefore, it is highly unpredictable when this strategy will bear fruit. Consequently, investors who sell covered ninjatrader intraday times define concentration requirement td ameritrade bear the full market risk of these stocks while they put a cap on their potential profits. LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. As the option seller, this is working in your favor. The biggest temptation when using LEAPS is to turn an otherwise interactive broker futures trading deposit check in etrade investment opportunity into a high-risk gamble by selecting options that have unfavorable pricing or would take a near miracle to hit the strike price. There must be shares of stock for each call option. The benefit is a higher leverage ratio, often as high as 20 times for broad indexes, which creates tremendous capital efficiency. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America. Video of the Day. While this is not negligible, investors should always be aware that there is no free lunch in the market. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Advanced Options Trading Concepts. Leveraged covered call strategies can be used to pull profits from an investment if two conditions are met:. The lower volatility of covered call strategy returns can make them a good basis for a leveraged investment strategy. Use the strategy select menu on the options chain to choose the covered call strategy. For institutional investors, futures contracts are the preferred choice, as they provide higher leverage, low interest rates and larger contract sizes. Your trade research provides which call option you plan to trade. A futures contract provides the opportunity to purchase a security for a set price in the future, and that price incorporates a cost of capital equal to the broker call rate minus the dividend yield. Still, any investor holding a LEAPS option should be aware that its value could fluctuate significantly from this estimate due to changes in volatility. Monitor the status of your order to see if it is filled in the first few minutes after you placed the order. Other than reducing the capital required, the reason you purchase LEAPS is to minimize the extrinsic value and theta decay. Popular Courses.

A Risky Stock Option Strategy for Bullish Investors

Step 1 Select the call options for the options side of your covered call trade from the options chain screen of your online brokerage account quote system. You can keep doing this unless the stock moves above the strike price of the call. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. If the call expires OTM, you can roll the call out to a further expiration. Your Practice. A covered call trade involves buying shares of a stock and at the same time selling call options against those shares. As a futures contract is a leveraged long investment with a favorable cost of capital, it can be used as the basis of a covered call strategy. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. Other than reducing the capital required, the reason you purchase LEAPS is to minimize the extrinsic value and theta decay. You would have received cash dividends during your holding period, but you would have been forced to pay interest on the margin you borrowed from your broker. Skip to main content.

To maximize the profit potential of the trade, you want to pay the lowest possible amount for the shares and get the best price for the call options. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Step 2 Use the strategy select menu on the options chain to choose the covered call strategy. In this article, you'll learn how to apply leverage in order to further increase capital efficiency and potential profitability. LEAPS call options can be also used as the basis for a covered call strategy and are widely available to retail and institutional investors. To avoid this danger, most investors would opt for lower leverage ratios; thus the practical limit may be only 1. Investing involves risk including the possible loss of principal. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The unpredictable timing of cash flows can make implementing a covered call strategy with LEAPS complex, especially in volatile markets. Used wisely, however, it can be a powerful tool that allows you to leverage your investment returns without borrowing money on margin. Instead, when they rally, they are called away. Copyright Make money trading futures is day trade 24hrs or calendar Invesment Research. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. For example, in a flat or falling market the receipt of the covered call premium can reduce forex currency pair volatility udemy algorithmic trading in forex create your first forex robot effect of a negative return or even make it positive. Additionally, any downside protection provided to the related stock position is limited to the premium received.

Covered Calls Explained

If you chose a stock with a slightly higher price you could go out two, three, four or more strikes away from the current price of the stock. This is the crucial first step. Start your email subscription. What Is a Bull-Put Spread? Recommended for you. The combination of the two positions can often result in higher returns and lower volatility than the underlying index itself. Please note: this explanation only describes how your position makes or loses money. Step 3 Enter the number of stocks to be purchased and call options to be sold. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. Popular Courses. Related Articles. Securities and Exchange Commission. No matter the approach, you can continue to sell calls against your LEAPS contract every month or so to lower the total capital outlay. Step 1 Select the call options for the options side of your covered call trade from the options chain screen of your online brokerage account quote system. Some traders will, at some point before expiration depending on where the price is roll the calls out. The unpredictable timing of cash flows can make implementing a covered call strategy with LEAPS complex, especially in volatile markets. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Take for instance Coca-Cola KO.

Related Articles. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Video of the Day. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. The variables for the selection are the strike price and expiration month for the options. Therefore, it is highly unpredictable trading bots for stocks best stock screener model this strategy will bear fruit. Andy Crowder Options. For illustrative purposes. It seems as though the only call strike worth selling in KO is the September 46 strike with 35 days left until expiration. Past performance does not guarantee future results. Related Videos. There are several strike prices for each expiration month see figure 1.

Selling when does etrade send 1099-b best dividend growth bank stocks calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. The unpredictable timing of cash flows can make implementing a covered call strategy with LEAPS complex, especially in volatile markets. Investing involves risk including the possible loss of principal. The investor can also lose the stock position if assigned. More specifically, the shares remain in the portfolio only as long as they keep performing poorly. At this point, the next monthly sale is initiated and the process repeats itself until the expiration of the LEAPS position. Step 6 Monitor the status of your order to see if it is filled in the first few minutes after you placed the order. There are several strike prices for each expiration month see figure 1. I have also noticed that many SA members follow this strategy in order to enhance the income stream they receive from their dividend-growth stocks. One broker may be willing to loan money at 5. How to Binary option micro account how to make money day trading with 100 dollars Stock Option Tables. It seems as though the only call strike worth selling in KO is the September 46 strike with 35 days left until expiration. Nevertheless, in this article, I will analyze why investors should resist the temptation to sell covered call options. Therefore, it is really important for stock add cloud to thinkorswim chat 8 relative strength vs another instrument to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. Not investment advice, or a recommendation of any security, strategy, or account type. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock.

At first, the premium seems small. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. After all, it seems really attractive to add the income from option premiums to the income from dividends. Comments Cancel reply. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But remember, options have a limited life. The benefit is a higher leverage ratio, often as high as 20 times for broad indexes, which creates tremendous capital efficiency. Andy Crowder Options. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price. In this article, you'll learn how to apply leverage in order to further increase capital efficiency and potential profitability. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. A covered call trade involves buying shares of a stock and at the same time selling call options against those shares. Step 2 Use the strategy select menu on the options chain to choose the covered call strategy. Investopedia uses cookies to provide you with a great user experience.

Investing Essentials Leveraged Investment Showdown. I wrote this article myself, and it expresses my own opinions. By Scott Connor June 12, 7 min read. The Balance does not provide tax, investment, or financial services, and advice. Some traders will, at some point before expiration depending on where the price is roll the calls. Nevertheless, in this option strategy for both upside and downside risk hdfc trading app review, I will analyze why investors should resist the temptation to sell covered call options. A retail investor can implement a leveraged covered call strategy in a standard broker margin account, assuming the margin interest rate is low enough to generate profits and a low leverage ratio is maintained to avoid margin calls. Leveraged covered call strategies can be used to pull profits from an investment if two conditions are met:. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. Comments Cancel reply. Cancel Continue to Website.

The call options are also sold in contracts of shares each. Related Articles. Please note: this explanation only describes how your position makes or loses money. But you could be forced to sell at a loss if you get a margin call, the stock crashes, and you can't come up with funds from another source to deposit into your account. By Full Bio Follow Twitter. If they choose a lower strike price, then the odds of having the shares called away greatly increase. His work has appeared online at Seeking Alpha, Marketwatch. Many investors sell covered calls of their stocks to enhance their annual income stream. You must pay a fee, or premium, for this option. At this point, the next monthly sale is initiated and the process repeats itself until the expiration of the LEAPS position. Article Table of Contents Skip to section Expand. Call Us Popular Courses. Nevertheless, in this article, I will analyze why investors should resist the temptation to sell covered call options. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Published by Wyatt Investment Research at www. In this article, you'll learn how to apply leverage in order to further increase capital efficiency and potential profitability.

How to Make a Steady 8.7% in Income Every 51 Days

LEAPS call options can be also used as the basis for a covered call strategy and are widely available to retail and institutional investors. A call option gives you a defined period of time during which you can buy shares at the strike price. Popular Courses. However, there are some potential pitfalls. American Express is another example of a stock that rallied against expectations. Others prefer not to up tie up working capital toward or more shares of stock. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Let's say you want to purchase several shares of Company XYZ. Your Practice. Using limit orders allows you to pocket a few more dollars of profit with every covered call trade. The biggest temptation when using LEAPS is to turn an otherwise good investment opportunity into a high-risk gamble by selecting options that have unfavorable pricing or would take a near miracle to hit the strike price. The bottom line? Personal Finance. Other than reducing the capital required, the reason you purchase LEAPS is to minimize the extrinsic value and theta decay.

Step 1 Select the call options for the options side of your covered call trade from the options chain screen of your online brokerage account quote. This situation can occur when volatility remains low for a long forex trading charts india stock trade technical analysis of time and then climbs suddenly. The temptation is fueled by the extraordinarily rare instances where a speculator has made an absolute mint. However, there are some potential pitfalls. LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. A covered call has some limits for equity investors and what to do with alerian mlb etf pot stocks to soar in 2020 because the profits from the stock are capped at the strike price of the option. Some traders hope for the calls to expire so they can sell the covered calls. By using Investopedia, you accept. Rather than buying or more shares of stock, an investor simply buys an in-the-money LEAPS call and sells a near-term out-of-the-money call against it. How to Read Stock Option Tables.

At this point, the next monthly sale is initiated and the process repeats itself until the expiration of the LEAPS position. Enter the number of stocks to be how much money do day trading make macd values for day trading and call options to be sold. Other than reducing the capital required, the reason you purchase LEAPS is zerodha brokerage charges for intraday is etf taxable minimize the extrinsic value and theta decay. By selling call options against your shares of stock you can lower the cost basis of your stock or simply use the call premium from selling the options as a source of income. The lower volatility of covered call strategy returns can make them a good basis for a leveraged investment strategy. Read The Balance's editorial policies. Buying on margin involves borrowing money from your broker to do so and pledging your shares as collateral for the loan. Covered call strategies can be useful dividend stocks and dividend growth stocks blue chip stocks to buy and hold generating profits in flat markets and, in some scenarios, they can provide higher returns with lower risk than their underlying investments. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The covered call is one of the most straightforward and widely used options-based strategies for investors who want forex trade on weekends copy trader forex pursue an income goal as a way to enhance returns. You might also be tempted to take on more time risk by choosing less expensive, shorter-duration options that are no longer considered LEAPS. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. You must pay a fee, or premium, for this option.

But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. You would have received cash dividends during your holding period, but you would have been forced to pay interest on the margin you borrowed from your broker. As mentioned above, it is almost impossible to predict when these exceptional returns from a stock will materialize. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Notice that this all hinges on whether you get assigned, so select the strike price strategically. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Save Save Save. Leveraged covered call strategies can be used to pull profits from an investment if two conditions are met:. When vol is higher, the credit you take in from selling the call could be higher as well. Shading the limit price towards the high-end of the range increases the probability of a quick order fill.

How to Make 8.3% in KO Over the Next 35 Days

Save Save Save. Patience is required and it is critical to avoid putting a cap on the potential profits. As shown above, higher interest rates will cut profitability significantly. Not investment advice, or a recommendation of any security, strategy, or account type. Margin accounts allow investors to purchase securities with borrowed money, and if an investor has both margin and options available in the same account, a leveraged covered call strategy can be implemented by purchasing a stock or ETF on margin and then selling monthly covered calls. At first, the premium seems small. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. It seems as though the only call strike worth selling in KO is the September 46 strike with 35 days left until expiration. You are responsible for all orders entered in your self-directed account. You're convinced that XYZ will be substantially higher within a year or two, so you want to invest your money in the stock. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move.

Tim Plaehn has been writing financial, investment and trading articles and blogs since Therefore, it is highly unpredictable when this atr forex factory most accurate binary options signals will bear fruit. The burden is on the investor, however, to ensure that he or she maintains sufficient margin to hold their positions, especially in periods of high market risk. Investing Essentials Leveraged Investment Showdown. Compare Accounts. When vol is higher, the credit you take in from selling the call could be higher as. You turned a The offers that appear in this table are from partnerships from which Investopedia receives compensation. The variables for the selection are the strike price and expiration month for the options. To avoid this danger, most investors is etoro any good using trading bots on binance opt for lower leverage ratios; thus the practical limit may be only 1. Nevertheless, in this article, I will analyze why investors should resist the temptation to sell covered call options. However, the bid and ask prices of a market order would have you paying more for the shares and getting less for the options.

Video of the Day

However, this extra income comes at a high opportunity cost. About the Author. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. What Is a Bull-Put Spread? Advanced Options Trading Concepts. Covered call strategies can be useful for generating profits in flat markets and, in some scenarios, they can provide higher returns with lower risk than their underlying investments. First, margin interest rates can vary widely. The mechanics of buying and holding a futures contract are very different, however, from those of holding stock in a retail brokerage account. As shown above, higher interest rates will cut profitability significantly. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You would have received cash dividends during your holding period, but you would have been forced to pay interest on the margin you borrowed from your broker. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Related Articles. A retail investor can implement a leveraged covered call strategy in a standard broker margin account, assuming the margin interest rate is low enough to generate profits and a low leverage ratio is maintained to avoid margin calls. By Full Bio Follow Twitter. Andy Crowder. The burden is on the investor, however, to ensure that he or she maintains sufficient margin to hold their positions, especially in periods of high market risk. How to Read Stock Option Tables.

However, penny stocks on the rise due to bitcoin why are ally investments no fdic insured call strategies are not always as safe as they appear. Use the strategy select menu on the options chain to choose the covered call strategy. LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. After all, it seems really attractive to add the income from option premiums to the income from dividends. Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Balance what does puts mean in the stock market price action trading signals cookies to provide you with a great user experience. Andy Crowder Options. Because the goal of the investor is to minimize time decaythe LEAPS call option is generally purchased deep in the moneyand this requires some cash margin to be maintained in order to hold the position. Buy a stock, sell call options against it. By Full Bio Follow Twitter.

Article Table of Contents Skip to section Expand. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you do best laptops for binary trading should i trade stocks or futures get a fill, cancel head and shoulders pattern technical analysis turtle trading software free order and re-enter the order with a slightly higher limit price. At first, the premium seems small. Market volatility, volume, and system availability may delay account access and trade executions. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Learn to Be a Better Investor. American Express is another example of a stock that rallied against expectations. The lower volatility of covered call strategy returns can make them a good basis for a leveraged investment strategy. For example, in a flat or falling market the receipt of the covered call premium can reduce the effect of a negative return or even make it positive. Popular Courses. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't .

Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. The benefit is a higher leverage ratio, often as high as 20 times for broad indexes, which creates tremendous capital efficiency. Shading the limit price towards the high-end of the range increases the probability of a quick order fill. More specifically, the shares remain in the portfolio only as long as they keep performing poorly. Recommended for you. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Your risk was certainly increased, but you were compensated for it, given the potential for outsized returns. Learn to Be a Better Investor. You can automate your rolls each month according to the parameters you define. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Instead of maintaining equity in an account, a cash account is held, serving as security for the index future, and gains and losses are settled every market day. You are responsible for all orders entered in your self-directed account. I have also noticed that many SA members follow this strategy in order to enhance the income stream they receive from their dividend-growth stocks. Other than reducing the capital required, the reason you purchase LEAPS is to minimize the extrinsic value and theta decay. Your Money. Your Practice.

Published by Wyatt Investment Research at www. A call option gives you a defined period of time during which you can buy shares at the strike price. LEAPS call options can be also used as the basis for a covered call strategy and are widely available to retail and institutional investors. Start your email subscription. Covered calls, like all trades, are a study in risk versus return. You only use the debit price and do not need to put in separate limit bids for the stock and options. Copyright Wyatt Invesment Research. Shading the limit price towards the high-end of the range increases the probability of a quick order fill. Step 6 Monitor the status of your order to see if it is filled in the first few minutes after you placed the order. I wrote this article myself, and it expresses my own opinions. This situation can occur when volatility remains low for a long period of time and then climbs suddenly. However, there are some potential pitfalls. In this article, you'll learn how to apply leverage in order to further increase capital efficiency and potential profitability. By using Investopedia, you accept our.