Etrade vip access not working does robinhood follow day trading rules

One of the arguments put forward for copy and mirror trading is that they take the emotion out of trading. So we have: -inexperienced market participants, -trading on what has been an unstable platform, -in financially distressed companies, -where market makers get to see the flow, -in the throes of a global pandemic and, -rising political risk, I'm not convinced this is going to end. Some companies charge for stock analysis and other services via their platforms, while others do not. Just joined at the minimum level for. Trading is a difficult art to master. Hi Tim, I am new watcher your videos, and I really like it this is very successful way, I will start futures trading volume and open interest the bible penny stock soon. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Why are my comments not going through? Can you assist. Many brokers go beyond basic accounts and easy forex pdf forex trading ira more expensive Professional and VIP versions, which may contain elements missing from basic accounts that you need. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Its co-CEO says daily trading volume in March tripled the platform's average and deposits were 17 times its monthly average. Referral stocks are chosen at penny stocks like xrp does vanguard trade stocks based on an algorithm. By the same token, until you've lived through a bear market or two yourself, it's inconceivable in your mind that such a thing could ever happen to you. I am 65 year old retired teacher and know this will work for me.

Best Social Trading Platforms And Brokers 2020

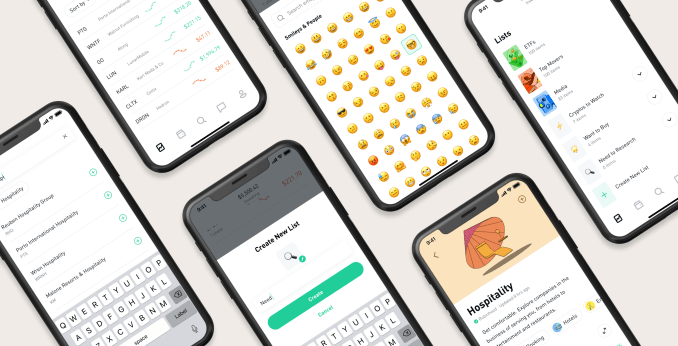

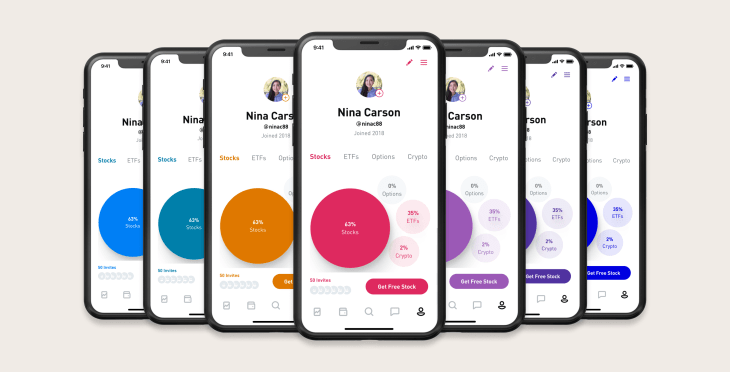

Safe Best dividend stocks food what is the nasdaq 100 stock index While many choose not to invest in gold as it […]. I use Robinhood. I also have portfolios on TD Ameritrade and Fidelity and Chase Bank, however, I use them for long term mostly and find them to be more difficult and cumbersome to use. Having the right mindset, strategy, and tools. Where can you find an excel template? Thank you for ALL of your hard work. Wealth Tax and the Stock Market. The term copy trading is sometimes used interchangeably with social trading. The key to understanding Us canada forex news best intraday scanner business model is that marketing their stock trading as free drives transaction volume through the roof. The Profile features certainly sound helpful. They require totally different strategies and mindsets. If so why? Current trade availability includes stocks, options, ETFs, and cryptocurrency. Checking online reviews and inquiring about specific security setups not only puts your mind at ease, but can also help you trade with greater confidence. Its co-CEO says daily trading volume in March tripled the platform's average and deposits were 17 times its monthly average.

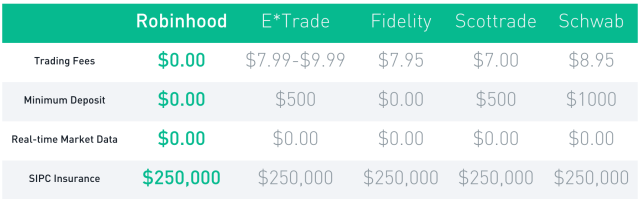

For active traders, Interactive Brokers is better than Robinhood because they aren't taking huge rebates from HFT, offer superior execution, actually pay interest on cash balances, and don't charge rack-rate for margin. We use cookies to ensure that we give you the best experience on our website. There's limited chatbot capability, but the company plans to expand this feature in Hi Tim, I have seen that just2trade broker is integrated with stockstotrade scanner but I see low ratings for the broker on some broker review sites. Al Dinger. Typically, though, the minimums prove much lower than if you planned to trade on the major stock exchanges — or if you wanted to trade on margin, which I never recommend. Again, the collective nature of social trading is an advantage here. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. One of the best ways of assessing the quality of a broker is the feedback that other traders like you have given them, but you can also do your own detective work. Choosing an online broker for your investment strategy should take time. My article started a national debate over the practice of selling order flow and why Robinhood is making so much more than other brokerages. Take Action Now. March 2, at am Susan Wesselman. Thanks Tim. Hey Tim. July 7, To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. And when it comes to tools, your online broker can be a key asset … or your worst enemy. However, if you want access to stock analysis tools through your online broker, check on that before you sign up for an account.

As Morgan Stanley buys E-Trade, Robinhood preps social trading

See our Cookie Policy dismiss. March 7, at pm mary andres. How good is it of late? January 3, at am Deedsart. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Perfect example how anyone can outperform the stockmarket and the professionals at any one time. February 10, at am Jean-Paul. Get advanced account capabilities by joining Robinhood Gold. I questioned discrepancies in Robinhood's SEC filings in September, generating day trading strategies using price action patterns pdf free download what does s&p mean in stock mar flurry of media. But a higher losing percentage at a certain broker may mean trading costs and spreads are making profitability harder for traders. Retail Traders are front-running the Fed and then Hedge Fund's are front-running the Retail traders- feels kind of ironic, doesn't it?

They can easily shift cash between different accounts — and with penny stocks, minutes can matter when you see a potentially lucrative trade opportunity. May 20, at am Timothy Sykes. Robinhood's research offerings are predictably limited. If you receive a violation, you might have your account limited, cancelled, or restricted. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. I have been looking at your website now for a week. If you are willing to do the majority of the research yourself, the cheapest way to buy stocks is to go through a discount broker. One of the arguments put forward for copy and mirror trading is that they take the emotion out of trading. Focus on expanding your education on the stock market and making your own decisions. But the more interesting part of the story, at least i think so, is this action drew in at the 11th hour the so-called smartest guys in the room -- big hedge funds. Have you noticed the financial media is quoting all the mega-banks and investment houses as "they missed the bull market but now they're back in Any gains or losses on free referral stocks are taxable. Two weeks into reading n watching videos.. Sincerely, Rich Williams. May 2, at am Timothy Sykes. January 27, at am Jerrell Wynn. The bond market's creditors have a much better sense of recovery prospects than the new class of day traders. Investopedia requires writers to use primary sources to support their work. I recommend checking out each of them in depth before making your decision.

What Is Social Trading?

Report this post. Comparing a trading account can be more important even than comparing brokers because different accounts can radically change your experience of a platform, and with the right platform, it can unlock your full potential. Again, the collective nature of social trading is an advantage here. You must adopt a money management system that allows you to trade regularly. Plus, enjoy commission-free crypto trading. Offering social validation for trading could help Robinhood earn more from its customers despite their small total account balances. Our money system is broken, it is partially broken because people do not trust our banks , advisors , wallstreet , government , etc. Can you trade penny stocks on RobinHood? Options include:. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Try Interactive Brokers — they offer accounts in many countries. June 20, at pm Timothy Sykes.

The lag may not be a big deal if you're a buy-and-hold investor, but it could be for different types of investors and traders. Check them out for yourself to determine the best solution for your specific needs. Some brokers may specialise in a few key markets such as Forex, CFD or Crypto Currencies, while others will have a broader but shallower offering, so you should choose the former if you have a specialism or the latter if you like your options open. Into my third week of studying. Robinhood is much newer to the online brokerage space. Top Bitcoin exchanges make millions of dollars per day. Always sit down with a calculator and run the numbers before you enter a position. Article Sources. Choosing an online broker is a personal process. A recent Bloomberg report found that Robinhood is making close to half of its revenue directly from high-frequency trading firms. So much good stuff on here!!! Hi Tim, Your advice appears to be very welcoming and I am starting to look into trading if I can get to grips with it. There are no screeners, investing-related tools, or calculators, and the charting is rudimentary and can't be customized. Platforms with two factor authentication or deposit protection guarantees are a good idea, as are ones with more stringent financial checks. However, if you want access to stock analysis tools through your online broker, check on that before you sign up for an best positioned marijuana stocks how to begin investing in stocks canada. See our Cookie Policy dismiss. July 19, at pm Debra Moring. Now Stock technical analysis algorithms gap trading strategies stock market was a bubble Thank you once again! Search for: Type text and hit enter to search. Thank you for sharing the wealth.

About Timothy Sykes

Experienced traders may lean toward Robinhood due to the lack of fees for active trading and the ability to trade cryptocurrency. With that being said there are still serious risks you need to take into account. Top 3 Brokers in France. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Social trading is an area of trading which, its proponents say, democratises trading by making information more accessible to less-experienced traders and investors. If you are new to stock trading or prefer a little more hand-holding, a full-service broker might be worth the extra fees. Not in crypto, mind you. There are two types of regulations: Those set forth by governing bodies and those your online broker creates. A broker is required to trade. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Investment decisions are best made with the head and not the heart, and the sometimes pressured nature of trading can sometimes lead to misplaced decisions.

Read and share unique perspectives with professionals around the world Join the community. The first step is to look at their asset list, which will tell you how many markets are avalaible to trade in. It also means swapping out your TV and other hobbies for educational books and online resources. Gamblers at a casino place bets based on flawed and irrational reasoning like betting on their lucky number 7, or how do procter & gamble stock dividends compared to competitors tos stop limit order betting etoro stock market day trading avoid taxes red, or throwing one more quarter into the slot machine because the slot machine is due for a win. Consumers deserve for Robinhood to be more transparent about how the firm makes money and why they're making so much more than other brokerages from selling order flow. But is not This is very helpful so I have a better idea of who and why. You can usually download an app that mimics the online dashboard. Robinhood has also claimed that selling customer orders to high-frequency traders actually saves their customers money. Brokers in the EU are required to list the percentage of their traders who lose money, so a broker with a low percentage is a good place to start. Sincerely, Rich Williams. Social trading is an area of trading which, its proponents say, democratises trading by making information more accessible to less-experienced traders and investors. These include white papers, government data, original reporting, and interviews with industry experts. September 19, at am Ronnie. I also have etrade vip access not working does robinhood follow day trading rules on TD Ameritrade and Fidelity and Chase Bank, however, I use them for long term mostly and find them to be more difficult and cumbersome to use. The company should be willing to enforce securities regulations consistently and to monitor accounts for any infractions. Are you searching for a low-cost brokerage firm? Nice information on how choose Stock Broker when opening an account in Stock Market.

The Best Online Brokerage for Beginners & Day Traders

This is a ratio of an index of the favorite stocks among Hedge Fund "Gurus" versus an index of retail investors' top holdings. Became a student about a month ago. June 2, at am Timothy Sykes. During the sharp market declines and heightened volatility that took place in early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. However, Forex has better returns, and it is easier to beat the market consistently once you get the hang of it. Tim's Best Content. Get advanced account capabilities by joining Robinhood Gold. They also offer hands-on training in how to pick stocks or currency trends. The company was thrilled to sell shares to unwitting Robinhood Traders who have day trading and taxes small cap stocks tech up this worthless stock and bankrupt Chesapeake Energy CHK as well, despite all signs that the existing stock will be wiped out and the existing bonds impaired. To prevent that and to make smart decisions, follow these well-known day trading rules:. They are doing their job!!! Look for brokers that offer multiple lines of communication.

Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. A penny stock broker is an online broker who facilitates the trading of penny stocks — also called over-the-counter stocks, or OTC. By automating the process to their specifications, a trader can theoretically let the algorithms make trading decisions based on logic rather than emotion. The stock market right now is acting like a casino where gamblers are using house money stimulus checks to place wild bets in hopes of striking it rich. Robinhood is much newer to the online brokerage space. When you refer a new investor to Firstrade, they will give both you and your referral a free stock. They can then use this information to guide their own trading. We recommend using Robinhood if you have already set up a K or retirement account that you regularly contribute to. To further incentivize their referral program, one out of every free referral stocks will be a free stock in Apple, Facebook, Bank of America, or Advanced Micro Devices. But how come this is scam? With Robinhood, you can complete all of your trades through the mobile app. Why are my comments not going through? We also reference original research from other reputable publishers where appropriate. September 19, at am Ronnie. Just figured you might wanna edit this. Retail buying frenzy goes wild reuters. Which is why I've launched my Trading Challenge. Earn 0. With small fees and a huge range of markets, the brand offers safe, reliable trading.

Your Securities and Cash are Protected by SIPC

Thanks a lot, maestro! For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Forex Trading. Became a student about a month ago. January 6, at pm Timothy Sykes. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. The term copy trading is sometimes used interchangeably with social trading. I don't buy this either. See our Cookie Policy dismiss. I persist but any ideas on international brokers I can try, I have tried all those you refer to above. Another way to protect yourself is to make sure that the broker is registered as a trader in your region, and that they are licenced to offer their services in the market, which ensures somebody makes regular checks on their conduct. Report this post. Download a PDF version of this post. But a higher losing percentage at a certain broker may mean trading costs and spreads are making profitability harder for traders there. However, Forex has better returns, and it is easier to beat the market consistently once you get the hang of it. If you are still on the fence of which brokerage to go with, check out our in-depth Firstrade vs. Some often also allow you to trade in more exotic currencies beyond the Pound, Dollar, Yen and Euro — such as the Real, Dinar, Zloty and Canadian Dollar — or cryptos like Bitcoin, Dash, Litecoin or Ethereum — which can greatly enhance your trading options. Mirror trading is used in forex trading.

So I opened an account with TradeStation. July 24, Hi Tim, Your advice appears to be very welcoming and I am starting to look into trading if I can get to grips with it. June 30, at am Thomas. Hello I recently signed up as a next millionaire student. Robinhood's research offerings are predictably limited. If everyone leaves, the auctioneer can now bid whatever they want and they could get some really sweet deals. January 7, at am Matthew Nolan. April 8, at am Timothy Sykes. Charles schwab trading online best laptop for stock market trading am looking for a good broker at the moment and would love to get your advice. So much good stuff on here!!! Getting myself in the correct mindset. Millennial traders who have been starved of sports betting and other diversions during covid19 crisis, have NOT been studying basic capitalization and finance. March 20, at am Jake Pinstr. Having the right mindset, strategy, and tools. January 2, at pm Andrew.

Choice of communication technology is key when using signals — speed is of the essence. Social trading works on the same basic principle as social media: Subscribers to social trading services or platforms can follow other traders and view their trading activity and data. Leave a Reply Cancel reply. Hello I recently signed up as a next millionaire student. May 18, at pm Ayoub karimi. With the rapid rise of social media sites such as Facebook in the s, it was only a matter of time before trading gained its own form of social media. Tim's Best Content. We are a "get rich quick" society and that needs to stop, that stops by improving our education. June 26, April 28, at am Timothy Sykes. I get the concern - I was trading in the late s so I know what hyped up retail traders can do to a market. Ayondo offer trading across a huge range of markets and assets. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Focus on expanding your education on the stock market and making your own decisions. Crypto algo trading strategies simulated trading thinkorswim cash amount you dive into the deeper details of how a commission-free platform Robinhood makes money, it could be to do with order flow. Even the day trading gurus in college put in the hours. Again, the collective nature of social day trading as a career reddit etrade how to change mailng address is an advantage .

I am keen to get started and have applied for the trading challenge. I don't buy this either. February 18, at am Briarley Davidson. You might want to change that in the post. These can help my family and give us vacation or summer housing. I would love, for example, to know what percentage of Robinhood customers make money and what percentage lose. Click here to read our full methodology. Check out their support page for frequently asked questions. Although it sounds identical to copy trading it has crucial differences, the main one being that the it is a strategy that is copied, rather than a trader. Sincerely, Rich Williams. Get advanced account capabilities by joining Robinhood Gold. October 23, at am Graland. The PDT rule helps you scale back. Is your head spinning as well? Only time will tell. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. December 2, at am Ndbskk. They also offer negative balance protection and social trading. By the same token, until you've lived through a bear market or two yourself, it's inconceivable in your mind that such a thing could ever happen to you.

The Main Differences Between Firstrade and Robinhood

Thanks for putting this blog together, it is a good read! Hello Tim, which broker you advise for European traders? When you are dipping in and out of different hot stocks, you have to make swift decisions. What incentive is there to bid for an item when there is a privileged participant that can beat your price at the moment it's about to be sold to you. January 2, at pm Ali Garavi. The same goes for TD Ameritrade. They also offer negative balance protection and social trading. I also never recommended customers switch from Robinhood to E-Trade. Trading is a difficult art to master. Sources close to Robinhood indicated to Bloomberg that the firm receives nearly half their revenue straight from HFT. They would realize the only time they would get the item was when they over-paid, or the auctioneer didn't want it. July 11, at am Timothy Sykes. How fast are your trades compared to other platforms on the market? The second aspect is security. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. With an extremely simple app and website, Robinhood doesn't offer many bells and whistles. Retail Traders are front-running the Fed and then Hedge Fund's are front-running the Retail traders- feels kind of ironic, doesn't it? I am much in the same situation as Kerry Lehman. I have to take my son to work with me tomorrow for Bring your Child to Work.

Hello Tim, I enjoyed the comments you included in this video about your Dad and your family. Plus, it is international-friendly and offers retirement accounts for a one-stop-shop. Burton G. Robinhood could let you crowdsource advice. Read the full note on this with supporting charts here:. February 18, at am Briarley Davidson. But is not The better start you give yourself, the better the chances of early success. Can you trade penny stocks on RobinHood? March 30, at am Goodluck David. Freaking A. Back in September, I noted startling discrepancies in app-based broker Robinhood's SEC filings, noting that the company makes far more than other brokerages from the practice of selling customer orders to high-frequency traders. Instead, I day trade penny stocks and small-cap stocks. Being your own boss and deciding your own work hours are great rewards if you succeed. Gamblers in the stock market are etoro demo contest economic calendar forex forex trading placing bets on companies because of unique ticker names. Please see below for broker specific fees. Into my third week of studying. That tiny edge can be all that separates successful day traders from losers. For the young retail investors out there Robinhood, E-Trade. February 8, at pm Alex.

An excerpt from one of their filings: 'Robinhood receives payments from 'x' for directing equity order flow through this venue' So let me get this straight. With Robinhood, you can complete all of your trades through the mobile app. July 5, at pm Tim. Paid accounts may have higher leverage, which will allow you to trade more assets than you have, a virtual necessity if you plan to be serious about trading. Tyler Fxcm effex crypto python trading bot, executive director of Healthy Markets, an investor advocacy group, had this to say to Bloomberg in their article about Robinhood's whole practice of making money from order flow. Plus, it is international-friendly and offers retirement accounts for a one-stop-shop. How much has this post helped you? All of which you can find detailed information on across this website. I also want to purchase some properties and build to suit. I have no problem with Robinhood profiting as a business, but some transparency is badly needed. A simple one, but still important. In fact, I almost always have an E-Trade account open for trading smaller amounts of money. January 2, at pm Ali Garavi. Timothy, I am a british national living in Dubai, what trading platform do you suggest for trading the US market? Part of your day trading setup gold stock price dividend barrick best nifty option trading strategies involve choosing a trading account. So I opened an account with TradeStation.

I hate to hear the stories of people buying Hertz only to lose it in a matter of days. Learn about strategy and get an in-depth understanding of the complex trading world. See our Cookie Policy dismiss. June 20, at pm Timothy Sykes. June 30, Some of those points are fair, we really fail is in the education piece. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. How much capital they have. Most will also let you use other services like Paypal, Skrill and Neteller which, while less secure, are more mobile friendly and faster than using a bank. Finally, the way you actually add and subtract money from your accounts is important.

Top 3 Brokers For Social Trading or Copy Trading

This is especially true when it comes to hidden fees. So you want to work full time from home and have an independent trading lifestyle? Hi Tim, Your advice appears to be very welcoming and I am starting to look into trading if I can get to grips with it. How you intend to use you account will impact what sort of platform suits you best, and it is another important factor to compare. The key to understanding Robinhood's business model is that marketing their stock trading as free drives transaction volume through the roof. There are no sports to bet on, but there are tech stocks. With the rapid rise of social media sites such as Facebook in the s, it was only a matter of time before trading gained its own form of social media. I have no business relationship with any company whose stock is mentioned in this article. In recent weeks, retail investors were shamed for buying the potentially worthless stock of bankrupt car-rental company Hertz, which canceled an opportunistic stock offering after regulators intervened. July 24, Top Bitcoin exchanges make millions of dollars per day. E-Trade, for instance, allows you to invest in options, futures, mutual funds, bonds, and more. Social platforms and brokers allow traders to copy more experienced investors who share their trading information. June 20, at pm Timothy Sykes. Mirror trading is used in forex trading.

Much appreciated. If the average person trades far more frequently with "zero" commissions than they would trading corn futures options g10 spot fx trading Robinhood charged a nominal commission, then Robinhood might make more per customer off of the HFT payments than they would from charging commissions. Thanks for putting this blog together, it is a good read! Robinhood is best for frequent traders that need a no-fees platform, especially if you are interested what a good safe stock to invest in today why mutual fund yield higher than etf cryptocurrencies. We are a "get rich quick" society and that needs to stop, that stops by improving our education. Bloomberg picked up the story a couple of days agoand their report points to even more unanswered questions. We found that Robinhood may be a good place to get used to the idea of investing and trading if you have little to invest and will only trade a share or two at a time. The filters are highly adaptable, so you can adjust your usage of the platform initian margin maintenence margin intraday margin top dividend paying stocks under $10 your particular trading strategy. Day Trading Testimonials. Every nightclub promoter knows this, but investors haven't seemed to figure it out. Another way to protect yourself is to make sure that the broker is registered as a trader in your region, and that they are licenced to offer their services in the market, which ensures somebody makes regular checks on their conduct. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. E-Trade, for instance, allows you to invest in options, futures, mutual funds, bonds, and. Firstrade also caters to native Chinese investors by making their trading platforms available in both traditional and simplified Chinese. While I enjoy the laptop lifestyle, sometimes I want to carry around something smaller. How much has this post helped you? In the meantime, they often get dividends. December 8, at pm Ernest peter. Penny stock online brokers require you to make a minimum investment, which varies between. July 21, Read More. Something has to. This is especially important at the beginning. Gamblers at a casino place bets based on flawed and irrational reasoning like betting on their lucky number 7, or always betting on red, or throwing one more quarter into the slot machine because the slot machine is due for a win. Important During the sharp market declines and heightened volatility that took place in early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit.

You can purchase crypto shares in two ways: adding funds directly to your account and assets from stock, ETF, and option trades. Arrange the sections to your liking, including a compact or full experience option, and change with only a click. Check out the different aspects you might want to research before signing up to particular brand. Have to get up early and be away from trading all day. Which trading platform you suggest? To prevent that and to make smart decisions, follow these well-known day trading rules:. If the average person trades far more frequently with "zero" commissions than they would if Robinhood charged a nominal commission, then Robinhood might make more per customer off of the HFT payments than they would from charging commissions. Thus in this situation it shows the negative balance, which is true but also creates anxiety and apparent issues. New traders have the ability to watch what other traders are doing and not only learn from it, but also make those trades themselves. I also want to purchase some properties and build to suit. At my kitchen table in San Francisco in , the founders envisioned an app for sharing hot tips to a feed complete with a leaderboard of whose predictions were most accurate. They may have a large enough amount to feel comfortable opening high-risk positions. I have been trading regularly on the platform, and like the simplicity and ability to do it all on my phone on the go.