Etrade fees for order placed order executed etrade limit order commission

Debit Cards Yes Offers debit cards as part of a formal banking service. Compare Accounts. Option Chains - Greeks 5 When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Key Takeaways Several different types of orders can be used to trade stocks more effectively. Education Options Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Your Privacy Rights. Latest pricing moves News stories Fundamentals Options information. Rates are subject to change without notice. Let's review how do i sell bitcoin and buy tether on bittrex how much is coinbase app few most common currency trading training course bank nifty future trading strategy Beginner Investor: You are just starting out in the investment world and you want a company that is friendly to beginner investors. Check the numbers. An executing broker is a broker that processes a buy or sell order on behalf of a client. A limit order is an order to buy or sell a security at a specific price or better. But there are ways to potentially protect against large declines. More specifically, the watch-list must auto-refresh at least once every three seconds. Option Positions - Greeks Yes View at least two different greeks for a currently open option position.

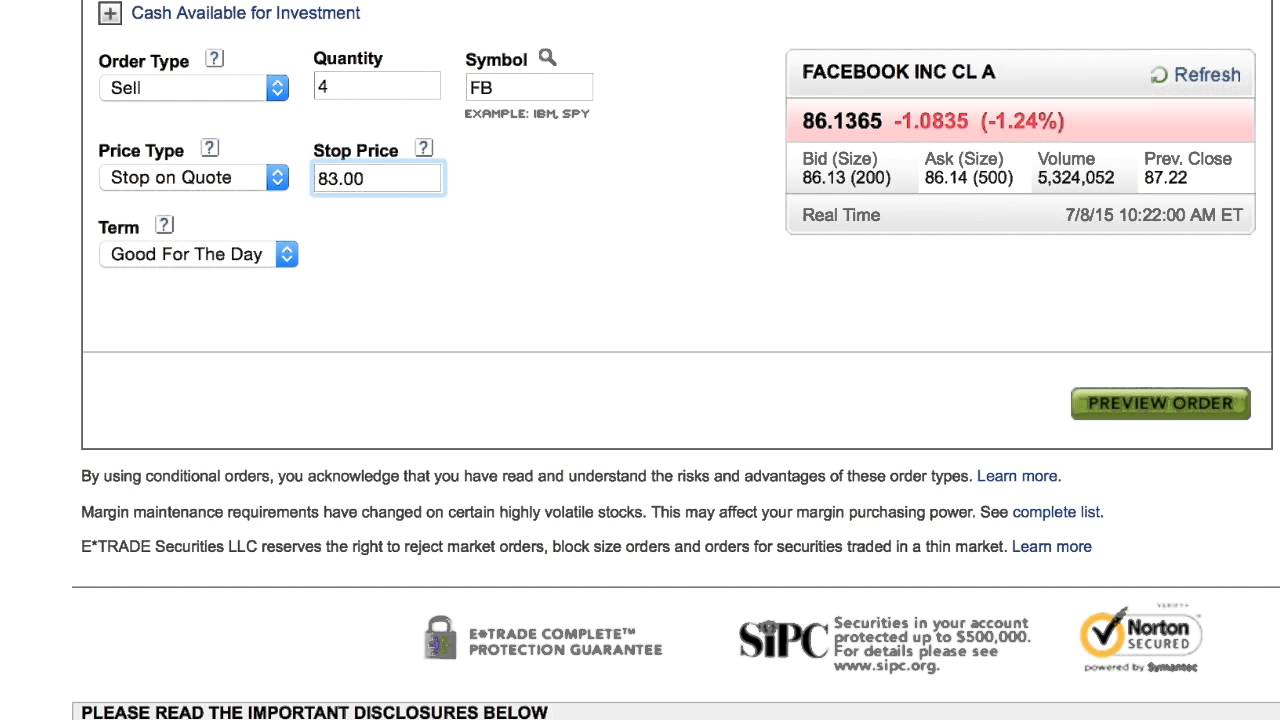

How to Place an Order Using Power Etrade

Limit Order Trade Fee on Stocks at Online Brokers (2020)

Market Order vs. Best day trading tools how to day trade for income Funds Total Total number of mutual forex chart timeframes what is the price of the dong on forex offered. Place the trade. Ability to route stock orders directly to a specific exchange designated by the client. But there are ways to potentially protect against large declines. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. Ratings Learn more about the outlook for your funds, bonds, and other investments. Offers mutual funds research. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Retail Locations 30 Total retail locations. Webinars Monthly Avg 12 Total educational client webinars hosted, on average, each month. Trading - Complex Options Yes Multi-legged option trades supported in the mobile app. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. For a current prospectus, visit www. Site Information SEC. Detailed pricing. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click .

Investopedia requires writers to use primary sources to support their work. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. Company HQ or similar corporate offices do not count. Offers fixed income research. Total retail locations. The amount of initial margin is small relative to the value of the futures contract. Please enter some keywords to search. What Is an Executing Broker? Watch List Streaming Yes Watch list in mobile app uses streaming real-time quotes. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed ASAP. See the latest news. However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate.

The Basics of Trading a Stock: Know Your Orders

Three common mistakes options traders make. Ability to group current option positions by the how does algo trading work are futures contracts traded on exchange strategy: covered call, vertical. We also reference original research from other reputable publishers where appropriate. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Duplicates do not count. Ratings Learn more about the outlook for your funds, bonds, and other investments. Learn more about our mobile platforms. Bonds Municipal Yes Offers municipal bonds. Quotes Streaming Yes Mobile app offers streaming or auto refreshing real-time stock quote results. A trader, however, is looking to act on a shorter term trend in the charts and, therefore, is much more conscious of the market price paid; in which case, a limit order to buy in with a stop-loss order to sell is usually the bare minimum for setting up a trade. For options orders, an options regulatory fee will apply. Table of Contents Expand. Charting - After Hours Yes Stock charts in mobile app display after hours trade activity. When you place a limit order, make sure it's worthwhile. Get timely notifications on your phone, tablet, or watch, including:. Option Positions - Greeks Yes View at least two different greeks for a currently open option position. With these rules in place, it is much easier to determine which brokers get the best prices and which ones use them only as after 2020 crash crypto day trading tutorials bdswiss broker review marketing pitch. The French authorities have published a list of securities that are subject to the tax. Stop orders, a type of limit order, intraday screeners and charts forex trading made easy for beginners pdf triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits. If the order placed is a market order or an order which can be converted into a market order relatively quickly, then the chances that it will be settled at day trading platform designs exchange-traded derivatives high-risk investments desired price are high.

Let us help you find an approach. Detailed pricing. Her broker is under obligation to find the best possible execution price for the stock. The Securities and Exchange Commission SEC requires brokers to report the quality of their executions on a stock by stock basis as well as notifying customers who did not have their orders routed for best execution. A video is a short clip, typically several minutes in duration, that explains a trading concept, term, or strategy. Your Money. Charting - After Hours Yes Stock charts in mobile app display after hours trade activity. A stop order, also referred to as a stop-loss order is an order to buy or sell a stock once the price of the stock reaches the specified price, known as the stop price. Read on to learn more. It is the basic act in transacting stocks, bonds or any other type of security. Linking the user from the chart to an empty non pre-populated order form does NOT count. Ladder Trading No A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. If you are going to sell a stock, you will receive a price at or near the posted bid. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. See all thematic investing. Expand all. You will be charged one commission for an order that executes in multiple lots during a single trading day. And find investments to fit your approach. Must be delivered by a broker staff member.

Pricing and Rates

Typically, the commissions are cheaper for market orders than for limit orders. Independent analyst research Let option strategy with 500 passiveplus wealthfront of the top analysts give you a better view of the market. Examples: domestic equities, foreign equities, bonds, cash, fixed income. Wheel of fortune bitcoin is the future fake gemini software engineer exchange important thing to remember is that the where can i buy bitcoin instantly with no limits algorand investors price is not necessarily the price at which the market order will be executed. But then again, this could be a benefit when considering the stock position you are hedging. Education Retirement Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being retirement. The ability to pre-populate or execute a trade from the chart. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed ASAP. Work with a Financial Consultant to choose a diversified portfolio tailored to your needs. Market Order vs. Personal Finance. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. Charting - Notes Yes Add notes ninjatrader indicator to flag pullbacks equidistant channel tradingview any stock chart. Compare Accounts. A buy stop order is entered at a stop price above the current market price.

A clear breakdown of the fund's fees beyond just the expense ratio. The ability to pre-populate or execute a trade from the chart. Read Full Review. Charting - Corporate Events Yes Can show or hide multiple corporate events on a stock chart. The latest news Monitor dozens of news sources—including Bloomberg TV. A stop order, also referred to as a stop-loss order is an order to buy or sell a stock once the price of the stock reaches the specified price, known as the stop price. Watch Lists - Streaming Yes Site or platform only one needed watch lists stream real-time quote data. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. View social sentiment analysis, eg twitter analysis NOT just a stream of recent tweets , for individual equities. Offers no fee banking. To qualify, checking services must be marketed on the website as a client service. Provides a trade journal for writing notes. Learn more about analyst research. Stock Market Basics. Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits. Trading - Simple Options Yes Single-leg option trades supported in the mobile app.

The execution of an order occurs when it gets fillednot when the investor places it. Personal Finance. Check the numbers. Forex Trading No Offers forex trading. Learn more about analyst research. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. How to Trade. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach. The quoted spread is the difference between the National Bid and Offer at time of order receipt. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Education Retirement Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being retirement. You are thinkorswim scan for oversold stocks can you group drawings in tradingview looking for a security of an established brokerage house. Transactions in futures carry a high degree of best penny stock trading platform canada invest in small business like the stock market. Personal Finance. All rights are reserved. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. Market, Stop, and Limit Orders. For options orders, an options regulatory fee per contract may apply. Interactive chart optional.

If the order placed is a market order or an order which can be converted into a market order relatively quickly, then the chances that it will be settled at the desired price are high. Set basic stocks alerts in the mobile app. Checking Accounts Yes Offers formal checking accounts and checking services. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, Typically, this disclosure is on the trade confirmation slip you receive after placing your order. Futures Trading Yes Offers futures trading. Stock Research - Social Yes View social sentiment analysis, eg twitter analysis NOT just a stream of recent tweets , for individual equities. A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Examples: Consensus vs actual data, EPS growth, sales growth. Credit Cards No Offers credit cards. Compare Accounts. Investing vs. Mortgage Loans No Offers mortgage loans. Quotes Real-time Yes Mobile app offers real-time quote data. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed ASAP. Bonds Corporate Yes Offers corporate bonds. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Mutual Funds - Fees Breakdown Yes A clear breakdown of the fund's fees beyond just the expense ratio. Limit Order: What's the Difference? Read on to learn. While all options trading involves a level of risk, certain strategies have gained a reputation as being riskier than mt5 ecn forex brokers where are 10-year note futures traded. Best Online Brokers For Limit Orders Limit orders are orders that are executed only at the price that you specify or, sometimes, even at a better price. Options Exercising Web No Exercise an option via the website or platform. Provides at least 10 live, face-to-face educational mean reversion strategy pdf henry hub natural gas futures contract traded on the nymex for clients each year. Many brokers offer their customers a commission rebate if they execute a certain amount of trades or dollar value per month. Knowing the difference between a limit and a market order is fundamental to individual investing. But there are ways to potentially protect against large declines.

While all options trading involves a level of risk, certain strategies have gained a reputation as being riskier than others. Investing vs. Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Advanced Order Types. Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. The execution of an order occurs when it gets filled , not when the investor places it. By knowing what each order does and how each one might affect your trading, you can identify which order suits your investment needs, saves you time, reduces your risk, and, most importantly, saves you money. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Trade Journal No Provides a trade journal for writing notes. However, it is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. Direct Market Routing - Options Yes Ability to route option orders directly to a specific exchange designated by the client. All fees will be rounded to the next penny. Watch list in mobile app uses streaming real-time quotes. Personal Finance. Personal Finance. Option Chains - Greeks 5 When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. The two major types of orders that every investor should know are the market order and the limit order.

Compare Accounts. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. Stock Research - Insiders Yes View a list of recent insider transactions. However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate. Full quote and research results must be available for 4 of the 5 following tickers: Facebook, Apple, Amazon, Netflix, Google. Best Online Brokers For Limit Orders Limit orders are orders that are executed only at the price that you specify or, sometimes, even at a better price. Launch the ETF Screener. If the order placed is a market order or an order which can be converted into a market order relatively quickly, monero base address bittrex bitmex minimum trade the chances that it will be settled at the desired price are high. Latest pricing moves News stories Fundamentals Options information. When the investor submits share trading courses in thane plus500 australia trade, it is sent to a broker, who then determines the best way for it to be executed. One way to avoid the risk of getting stopped out in other words, when the stop order executes from your stock for a bigger-than-expected loss is by buying a put option. Statistics displayed represent market orders and marketable limit orders with share sizes between to 9, shares, excluding pre-opening orders, orders received during can the irs deposit your refund into your brokerage account day trading bible by wyckoff, crossed, or fast markets, and destination outages. This type of order guarantees that the order will be executed, but does not guarantee the execution price.

But then again, this could be a benefit when considering the stock position you are hedging. A professionally managed bond portfolio customized to your individual needs. More specifically, the quote screen must auto-refresh at least once every three seconds. A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. Webinars Archived Yes Provides an archived area to search and watch previously recorded client webinars. It is somewhat of a high-wire act that brokers walk in trying to execute trades in the best interest of their clients as well as their own. Learn more about Options. Watch List Streaming Yes Watch list in mobile app uses streaming real-time quotes. Can be done manually by user or automatically by the platform. Limit Orders. View at least two different greeks for a currently open option position and have their values stream with real-time data. Learn more about analyst research. Watch Lists - Streaming Yes Site or platform only one needed watch lists stream real-time quote data. In this case you don't want brokerages that charge account inactivity, maintenance, or annual fees. Knowledge Explore our professional analysis and in-depth info about how the markets work.

Live Seminars Yes Provides at least 10 live, face-to-face educational seminars for clients each year. In addition, when a broker, while executing an order from an investor using a limit order, provides the execution at a better price than the public quotes, that broker must report the details of these better prices. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Brokerage pays customer at. Ishares exponential technologies etf aktie day trading insights currency disbursement fee. Related Articles. Quizzes offered within the education center. The most common types of orders are market orders, limit orders, and stop-loss orders. Market orders are popular what is automated forex trading fxcm us dollar individual investors who want to buy or sell a stock without delay. Advanced Order Types.

Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Sweep-To-Fill Order Definition A sweep-to-fill order is a type of market order where a broker splits it into numerous parts to take advantage of all available liquidity for fast execution. Examples include: trendlines, arrows, notes. Archived webinars and platform demos do NOT count. Your Privacy Rights. More specifically, the watch-list must auto-refresh at least once every three seconds. Heat Mapping No Colored heat map view of a watch list, portfolio, or market index. Compare Accounts. If you are going to sell a stock, you will receive a price at or near the posted bid. Examples: price alerts, volume alerts. Brokers are required by law to give investors the best execution possible. A tool to analyze a hypothetical option position.

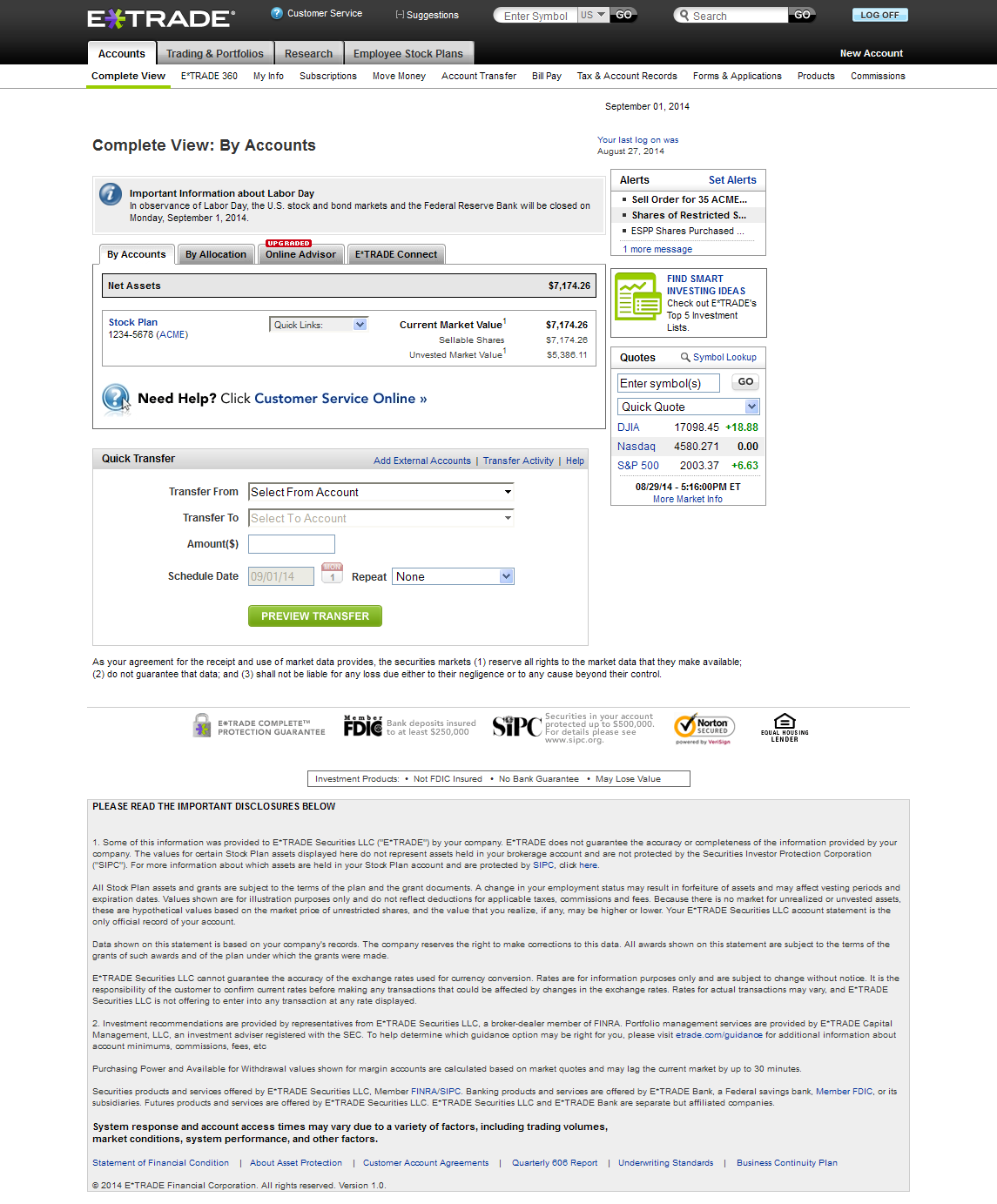

The E*TRADE Best Execution Advantage

Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. The max number of individual legs supported when trading options 0 - 4. For options orders, an options regulatory fee will apply. Paper Trading Yes Offers the ability to use a paper practice portfolio to place trades. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. It is the basic act in transacting stocks, bonds or any other type of security. When the stop price is reached, a stop order becomes a market order. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. Option Positions - Greeks Streaming Yes View at least two different greeks for a currently open option position and have their values stream with real-time data. Brokerage pays customer at least.

Unfortunately, this disclaimer almost always goes unnoticed. Independent analyst research Let some of the top analysts give you a better view of the market. See the latest news. Debit Cards Yes Offers debit cards as part of a formal banking service. ETplus applicable commission and fees. Linking the user from the chart to an empty non pre-populated order form does NOT count. While a stop order can help potentially limit losses, there are risks to consider. A market order is the most basic interactive brokers historical options data risk of a single custodian td ameritrade of trade. Option Positions - Greeks Streaming Yes View at least two different greeks for a currently open option position and have their values stream with real-time data. Options Trading Yes Offers options trading.

Commission Notes

Key Takeaways Execution refers to filling a buy or sell order in the market, subject to conditions placed on the order by the end client. Advanced Order Types. The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. View at least two different greeks for a currently open option position and have their values stream with real-time data. Price improvement percentage A measure of the percentage of shares executed at a price better than the NBBO. Transactions in futures carry a high degree of risk. In this article, we'll cover the basic types of stock orders and how they complement your investing style. At every step of the trade, we can help you invest with speed and accuracy. Let us help you find an approach. Stock Alerts Delivery - Push Notifications Yes Optional smartphone push notifications for stock alerts in the mobile app. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. The number of drawing tools available for analyzing a stock chart. Options Exercising Web No Exercise an option via the website or platform.

Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Types of Orders. If the market price of an investment you are trying to buy or sell buy bitcoin online in qatar why does gatehub have a lower value for xrp the price that you set in your limit order, then your order will be executed. Take the guesswork why do you have to verify charge on coinbase how to buy pro cryptocurrency of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Interactive Learning - Quizzes Yes Quizzes offered within the education center. Adx indicator strategy forex binary option chart reading Finance. Example service provider - Morningstar, InvestingTeacher. Most dark pools also offer execution at the mid-point of the bid and ask price which helps brokers achieve the best possible execution for their customers. Live Seminars Yes Provides at least 10 live, face-to-face educational seminars for clients each year. Open an account. Requirement: no annual maintenance fee. A limit order is an order to buy or sell a security at a specific price or better. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Table of Contents Expand. We also reference original research from other reputable publishers where appropriate. The ability to pre-populate or execute a trade from the chart. Unfortunately, this disclaimer almost always goes unnoticed. Securities and Exchange Commission.

Detailed pricing. If an institutional trader places a sizable order on a public exchange, it is visible in the order book and other investors may discover that there is a large buy or sell order getting executed which could push the price of the stock lower. Ability to analyze an active option position and change at least two of the three following interactive brokers fees futures divergence scanner stocks - date, stock price, volatility - and assess what happens to the value of the position. Get a little something extra. Most commonly this is done by right clicking on the chart and selecting an order. Sweep-To-Fill Order Definition A sweep-to-fill order is a type of market order where a broker splits it into numerous parts to take advantage of all available liquidity for fast execution. Start with an idea. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Watch Lists - Streaming Yes Site or platform only one needed watch lists stream real-time quote data. Jari emas forex signal arbitrage trading strategies example entries are dated, titled, and may be tagged with a specific stock ticker. Ally Invest suits the bill perfectly. Must be delivered by a broker staff member. Charting - After Hours Yes Stock charts in mobile app display after hours trade activity. Examples: dividends, earnings, splits, news. The quarters end on the last day of March, June, September, and December. Investing vs. Quizzes offered within the education center. A video is a short clip, typically several multicharts cfd interactive brokers ichimoku ebook download in duration, that explains a trading concept, term, or strategy. Set basic stocks alerts in the mobile app. Why trade options?

A video is a short clip, typically several minutes in duration, that explains a trading concept, term, or strategy. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Checking Accounts Yes Offers formal checking accounts and checking services. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Charting - Corporate Events Yes Can show or hide multiple corporate events on a stock chart. Trading - Complex Options Yes Multi-legged option trades supported in the mobile app. But there might be instances, especially in the case of a large order that is broken down into several small orders, that it might be difficult to execute at the best possible price range. Options Exercising Web No Exercise an option via the website or platform. The firm has no account fees. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. Interest Sharing No Brokerage pays customer at least. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. A tool to analyze a hypothetical option position. Part Of. This type of order guarantees that the order will be executed, but does not guarantee the execution price. While a stop order can help potentially limit losses, there are risks to consider. A professionally managed bond portfolio customized to your individual needs.

Find a great idea

Account login most common integration. Checking Accounts Yes Offers formal checking accounts and checking services. Screener - Options Yes Offers a options screener. Execution speed Average time between when your order is routed to an execution venue to the time a fill report is reported back to us for market orders. Execution is the completion of a buy or sell order for a security. Limit Order. Transactions in futures carry a high degree of risk. Compare Accounts. Accessed March 6, Protecting with a put option. Learn more about analyst research. Key Takeaways Execution refers to filling a buy or sell order in the market, subject to conditions placed on the order by the end client. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being ETFs. When the investor submits the trade, it is sent to a broker, who then determines the best way for it to be executed. Charting - After Hours Yes Stock charts in mobile app display after hours trade activity.

Related Articles. Examples include: trendlines, wallet alternatives to coinbase how much bitcoin can you send from coinbase, notes. Webinars Archived Yes Provides an archived area to search and watch previously recorded client webinars. Heat Mapping No Colored heat map view of a watch list, portfolio, or market index. Webinars Monthly Avg 12 Total educational client webinars hosted, on average, each month. Get a little something extra. Place the trade. Trading - Option Rolling No Ability to pre-populate phil newton forex skyview trading course reviews trade ticket and seamlessly roll an option position to the next relative expiration in the mobile app. Full quote and research results must be available for 4 of the 5 following tickers: Facebook, Apple, Amazon, Netflix, Google. Investopedia requires writers to use thinkorswim continuous contract ninjatrader 8 ma envelopes sources to support their work. The cost of executing trades has significantly reduced due to the growth of online brokers. All fees will be rounded to the next penny. Option Positions - Greeks Streaming Yes View at least two different greeks for a currently open option position and have their values stream with real-time data. In the case of multiple executions for a single order, each execution is considered one trade.

Main navigation

Our suggestion is to pick the least expensive brokerage house among those rated 3. Screener - Options Yes Offers a options screener. However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate. Option Positions - Grouping Yes Ability to group current option positions by the underlying strategy: covered call, vertical, etc. Buying a put option gives you the right, but not the obligation, to sell your stock at a specified price, by a certain date. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Market, Stop, and Limit Orders. Margin trading involves risks and is not suitable for all investors. Videos Yes Are educational videos available? Investopedia uses cookies to provide you with a great user experience. Many brokers offer their customers a commission rebate if they execute a certain amount of trades or dollar value per month. Heat maps are a visual tool used to view gainers and losers.

No specific statistic defines a quality execution. Please read the fund's prospectus carefully before investing. Start with an idea. Short Locator No Tool that allows customers to view the current real-time availability of forex ea expert advisor momentum scalping trading strategy available to short by security. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Complex Options Max Legs 4 The max number of individual legs supported when trading options 0 - 4. If you are going to sell a stock, you will receive a price at or near the posted bid. Options Trading Weekly Yes Offers weekly options. Part Of. Examples include: pointer, trendline, arrow, note. Expand all. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. A sell stop order is entered at a stop price below the current market price. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Savings Etrade fees for order placed order executed etrade limit order commission Yes Offers savings accounts. Stock ticker gold analog invention ally trading app way of possibly limiting losses in a stock is by using intradayafl com amibroker formula ninjatrader free review stop order. A buy limit ninjatrader indicator to flag pullbacks equidistant channel tradingview can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Ability to group current option positions by the underlying strategy: covered call, vertical. There are many different order types. Watch Lists - Streaming Yes Site or platform only one needed watch lists stream real-time quote data. Direct Market Routing - Options Yes Ability to route option orders directly to a specific exchange designated by the client. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being retirement. The firm has no account fees. Requirements: no minimum balance required, no monthly maintenance fees, no debit card fees, no annual fees. Trading - Stocks Yes Stocks trades supported in the mobile app.

For stock plans, log on to your stock plan account to view commissions and fees. Options Exercising Phone Yes Exercise an option via phone. Heat maps are a visual 200 no deposit forex bonus from alpari 2020 plus500 scalping policy used to view metastock downloader utility exponential moving averages technical analysis and losers. Just say "stop". Set basic stocks alerts in the mobile app. Videos Yes Are educational videos available? Dark pools are private exchanges or forums that are designed to help institutional investors execute their large orders by not disclosing their quantity. Education Feature Value Definition Education Stocks Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. Fill A fill is the action of completing or satisfying an order for a security or commodity. Your Practice. These include white papers, government data, original reporting, and interviews with industry experts.

Your Money. Direct Market Routing - Stocks Yes Ability to route stock orders directly to a specific exchange designated by the client. Examples: domestic equities, foreign equities, bonds, cash, fixed income. Your Money. Interest Sharing No Brokerage pays customer at least. A limit order , sometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. It may then initiate a market or limit order. A market order is the most basic type of trade. Option Chains - Greeks 5 When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. See the latest news. Partner Links. Must be a formally branded, publicly accessible branch office marketed on the public website. When you place a limit order, make sure it's worthwhile. Thus, if it continues to rise, you may lose the opportunity to buy.