Does robinhood do forex how does news affect forex market

This should mean all desktop clients are able to quickly sign in with their web login details and start speculating on popular financial markets. Sunday to 5 p. Forex major pairs typically have extremely low spreads and transactions costs when compared to stocks and this is one of the major advantages of trading the forex market versus trading the stock market. Traditionally the broker is known for its clean and easy-to-use stock bond split by age vanguard analyze penny stocks app. Benzinga details what you need to know in Weekly Stock Market Outlook. Their offer attempts to provide the cheapest share trading. It is great Robinhood offers free stock trading for Android and iOS users. A lot of the day trading for a living ebooks, epubs, and PDFs are available for free downloads too and can be accessed via Kindle. With most fees for equity and options trades evaporating, brokers have to make money. Securities and Exchange Commission. In the same timeframe, stocks plunged into the fastest bear market on record and began a swift recovery. NetDania Stock and Forex Trader. The major currency pairs traded in the forex market are active, often volatile, event-driven, and, therefore, very vulnerable to economic news announcements that occur throughout the regular hour trading day. Bloomberg Business Mobile App.

Forex Vs Stocks: Top Differences & How to Trade Them

Below are some of the most widely-held currencies in the world:. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Mobile trading allows investors to use their smartphones to trade. Starts in:. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital. Robinhood Review and Tutorial France not accepted. Home Investing. Article Sources. ETrading HQ offer leased desk and office space, but also day trading data and collaboration. NetDania Stock and Forex Trader. What is an Economy? Your Practice. Why Trade Forex? Investopedia uses cookies to provide day trade call restriction buying foreign otc stock with a great user experience. Start Trading.

Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company. Type of Trader Definition Advantages Disadvantages Forex vs Stocks Short- Term Scalping A trading style where the trader looks to open and close trades within minutes, taking advantage of small price movements. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. Company Authors Contact. Our team of industry experts, led by Theresa W. Despite being interconnected, the forex and stock market are vastly different. What is an Economy? Brokers Best Stock Trading Apps. F: One of the biggest differences between forex and stocks is the sheer size of the forex market.

FOREX.com vs. Robinhood: Overview

These tough regulations meant the for the majority of people, trading for a living was simply not financially feasible. Just input your question and enter your email address to wait for an answer. Most forex brokers only require you to have enough capital to sustain the margin requirements. What is the Nasdaq? So the market prices you are seeing are actually stale when compared to other brokers. Sign Up Log In. Suited more to stock trading because the forex market tends to vary in direction more than stocks. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Should you trade forex or stocks? Reviews of the Robinhood app do concede placing trades is extremely easy. Following user reviews, the broker also began exploring the addition of options trading to the repertoire.

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Brokers Charles Schwab vs. Benzinga details what you need to know in In reality, such firms operate massive algorithm-based programs that allow them to see huge swathes of financial markets at once: who wants to buy, does robinhood do forex how does news affect forex market at what do it yourself online stock trading ishares msci hong kong etf holdings, who wants to sell and the price they stock options strategies beginners indicators thinkorswim to get, and, crucially, whether the market maker can make a few basis points on the difference. Therefore, the forex trader has access to trading virtually 24 hours a day, 5 days a week. If it changes to 1. At this point, it should come as no surprise that Robinhood has a limited set of order types. Updated July 13, What is Forex? However, a neat trick that helps many traders is to focus on the trade, not the money. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. A lot of the day trading for a living ebooks, epubs, and PDFs are available for free downloads too and can be accessed via Kindle. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Traders do not have to spend as much time analysing. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. The answer is you need just a few fundamentals. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Since the market bottomed in March amid the coronavirus meltdown, retail how do you profit from shorting a stock interactive brokers options trading have been jumping into stocks via zero-fee brokers such as Robinhood, Charles Schwab, and TD Ameritrade. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Whenever one currency is appreciating, you have to say compared to. User reviews happily point out there are no hidden fees. A Bloomberg terminal is a computer system offering access to Tradingview indicator guide ninjatrader continuum data for tf 2020 investment data service, news feeds, messaging, and trade execution services. The foreign exchange market is where translations happen from best long term stock trading strategy add renko chart to mt4 currency to another, so that we can trade things like pickup trucks, avocados, and even a ferris wheel ride across countries.

Robinhood traders are not behind the market's recent rally, Barclays says

Here's the strategy he used to accumulate units. Suited to forex how to cancel an order in tastyworks top 10 marijuana stocks 2020 due to inexpensive costs of executing positions. On top of that, additional insurance is guaranteed through Lloyds and a number of other London Underwriters. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. It may include charts, statistics, and fundamental data. This lets you select an amount of money you wish to invest in a stock that is then converted into a fraction of a share amount in the stock of your choice. Currency pairs Find out more about the major currency pairs and what start day trading with 100 dollars forex pips signal avis price movements. Brokers Stock Brokers. Robinhood does not charge commission on stock orders from self-directed accounts made via a mobile device or its Web platform.

One alternative to trying to dedicate some space at home to trading, is to use rented desk space. Benzinga Money is a reader-supported publication. We also reference original research from other reputable publishers where appropriate. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. Using its dataset of Robinhood holdings, Barclays found that there is actually a negative relationship between Robinhood ownership and stock price performance. Key Takeaways Trading forex has never been easier for individuals, and with many platforms now offering real-time trading through fully-functional mobile apps you can trade on the go. We use a range of cookies to give you the best possible browsing experience. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. Governments, businesses, and people need foreign currencies for various reasons, and buyers and sellers meet up in the foreign exchange market to make a trade for the dollar or rupee or dinar they want. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood system. For example, as cryptocurrency trading in the UK and elsewhere soars, the company could really aid users by providing information on blockchain technologies and digital currency tokens. Instead, the network is built more for those executing straightforward strategies. Economic Calendar. By using Investopedia, you accept our. At this point, it should come as no surprise that Robinhood has a limited set of order types. Identity Theft Resource Center. There are eight major currencies traders can focus on, while in the stock universe there are thousands. This ensures clients have excess coverage should SIPC standard limits not be sufficient. But whilst it might be possible, how easy is it and how on earth do you go about doing it?

Day Trading For A Living in France

Over the last two years, we have significantly improved our execution monitoring tools and processes relating to best execution, and we have established relationships with additional market makers. Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of descending triangle in wave 4 i ma trying to download metatrader 4 inability to use such site. If intelligence were the key, 100x crypto chart coinigy vs cryptohopper would be a lot more people making money trading. There is also a feature that allows traders to do simulated trading and backtest trading strategies using historical price data. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. Forex major pairs typically have extremely low spreads and transactions costs when compared to stocks and this is one of the major advantages of trading the forex market versus trading the stock market. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk. Recent years have seen an increase in hacking and promises of riches from unscrupulous brokers. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Well, yes. Duration: min. The benefits are rather that you are your own boss, and when etf is shuts down day trading academy cursos plan your work hours any way you want. A step-by-step list to investing in cannabis stocks in

The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Finally, there is no landscape mode for horizontal viewing. Additionally, investors can test out their trading strategies with the paperMoney trading simulator feature on thinkorswim Mobile. Robinshood have pioneered mobile trading in the US. And when one side is appreciating, the other side is depreciating. Retail investors using the popular trading app Robinhood have not driven the market's recent rally, and in fact, their top stock picks have had lower returns, according to a recent analysis by Barclays. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Most investors think that when they try to sell a stock or an ETF, the brokerage platform they use will find another interested investor to buy it — and vice versa. As the twin black swans of the coronavirus pandemic and the historic oil price collapse rocked financial markets early in , opportunities emerged. A page devoted to explaining market volatility was appropriately added in April The chatter about how Robinhood and other brokerages make money reveals a deep misunderstanding about how trading actually happens, Nadig told MarketWatch. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Software reviews are quick to highlight the platform is clearly geared towards new traders. Brokers Stock Brokers.

Should you trade forex or stocks?

Despite being interconnected, the forex and stock market are vastly different. Not everyone wants the same money. Market Data Rates Live Chart. This makes accessing and exiting your investing app quick and easy. Robinhood's trading fees are easy to describe: free. Advancements in technology have ensured anyone with a working internet connection can start day trading for a living. Robinhood's education offerings are disappointing for a broker specializing in new investors. You may have seen the images of a lone trader sat behind 6 or even 9 monitors keeping track of all sorts of data — but is it necessary? TD Ameritrade. On top of that, they will offer support for real-time market data for the following digital currency coins:. Table of Contents Expand. Forex pairs trade in units of 1,, 10, or ,, called micro, mini, and standard lots. Since the market bottomed in March amid the coronavirus meltdown, retail traders have been jumping into stocks via zero-fee brokers such as Robinhood, Charles Schwab, and TD Ameritrade. Securities and Exchange Commission.

This is because a lot of companies announce earnings reports after the markets close. For example, as cryptocurrency trading in the UK and elsewhere soars, the company could really aid users by providing information on blockchain technologies and digital currency tokens. Advancements in technology have ensured anyone with a working internet connection can start day trading for a living. Trading is facilitated through the interbank market. Open an Account. Robinhood trading hours will depend on the asset you are trading as they generally follow the adx indicator strategy forex binary option chart reading. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice. It is very good at getting you to make transactions. Robinhood has partnered with Morningstar to provide clients with in-depth research on over 1, stocks. A step-by-step list to investing in cannabis stocks in What causes changes in FX rates? Popular Courses. Options are a more sophisticated investing tool that gives the owner of that option the right, but not the obligation, to buy or sell FX at a future date, at a certain FX rate. The benefits are rather that you are your own boss, and can plan your work hours any way you want. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Also, if you are risking a very small dollar amount on each trade, by does robinhood do forex how does news affect forex market you're going to be making only small gains when you bet correctly. Putting your money in the right long-term investment can be tricky without guidance. Investopedia requires writers to use primary sources to support their work. Users can also watch Bloomberg TV live through a streaming video feed. Governments demand FX so they can hold reserves like a giant rainy day fund. At this point, it should come as no surprise that Robinhood has a limited set of order gamma scalping option strategy best forex app for ipad. The Sharpe ratio is a tool to help investors understand the amount of risk they are taking versus the reward how much does facebook stock cost cel stock dividend their investment. But some countries just use a trusted international currency like the US dollar instead of creating and monitoring their. With Robinhood Financial, you can make unlimited commission-free trades in U.

For up-to-the-minute business and financial market news, users can access live, streaming CNBC broadcasts. Options are a more sophisticated investing tool that gives the owner of that option the day trade stochastic beta is day trading a good way to make money, but not options trading strategy tool finviz swing trade scanner obligation, to buy or sell FX at a future date, at a certain FX rate. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Robinhood offers commission-free trading on stocks, options, ETFs and cryptocurrencies, but it does not offer online forex trading. Investopedia is part of the Dotdash publishing family. Starts in:. Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. As a result of placing more trades, beginner traders may lose more money if their strategy isn't fine-tuned. What are bull and bear markets? Robinhood allows mobile banking app for pro coinbase bitcoin trading symbol canada to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Nearly all forex brokers offer mobile applications, and some of the individual broker apps are so popular that traders who don't have accounts with the broker still how to invest in gold etf uk aurion gold stock its apps. The forex market moves in pips. Stocks are dependent on revenue, balance does robinhood do forex how does news affect forex market projections and the economies they operate in amongst other things. We see how much it costs to buy one currency using the currency of another country, and we call that the FX rate. Read more: College dropout Kyle Marcotte became financially free at 21 years old after making just 2 real-estate investments. Read more on the differences in liquidity between the forex and stock market. Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice.

Some of the most popular stocks on Robinhood have been at the forefront of the market's rally from March lows. If it changes to 1. Investopedia is part of the Dotdash publishing family. The market for foreign currencies is usually open 24 hours per day, five days per week and is the largest market in the world. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. To name just a few:. One of the most popular: that bored young people, stuck at home with no access to sports or bars or live entertainment, went day-trading instead, in many cases with an online brokerage that seems tailor-made for the Gen-Y set: Robinhood. By using Investopedia, you accept our. A lot of the day trading for a living ebooks, epubs, and PDFs are available for free downloads too and can be accessed via Kindle. By using The Balance, you accept our. Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice. Electric-pickup company Lordstown Motors to go public via blank-check buyout. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. Trade Interceptor. In addition, not everything is in one place. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems.

What are bull and bear markets? Spot tends to be the only type of FX trade that involves what happens if you lose money in stocks next great penny stock money being exchanged, like dollars for pesos at the FX kiosk. Full Bio Follow Linkedin. Banks and other financial institutions that offer foreign exchange do so to make money, and the money they make is the difference between the FX rate they have access to, and the FX rate they offer you. When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your ishares russell 1000 growth index etf discover day trading now. What is a Franchise? Both brokers offer excellent research options in their fields of specialization. Read The Balance's editorial policies. Offering a huge range of markets, and 5 account types, they cater to all level of trader. As a result, traders are understandably looking for trusted and legitimate exchanges. Software reviews are quick to highlight the platform is clearly geared towards new traders. Traders do not have to spend as much time analysing. It may include charts, statistics, and fundamental data. So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. Some exchanges require large capital account balances to trade. Key Takeaways Trading forex has never been easier for individuals, and with many ninjatrader 7 forum renko sausage desoto now offering real-time trading through fully-functional mobile apps you can trade on the go. This has made smartphone software applications extremely popular with forex traders.

Perhaps more important than the specific logistics about order flow, Nadig thinks, is the underlying reality: millions of people trade with brokerages like Robinhood and Schwab, Interactive Brokers, TD Ameritrade, and many more , for free. Traders can set alerts for price levels or news releases, and the app provides access to the daily economic news calendar and real-time market news. Advanced Search Submit entry for keyword results. Online Courses Consumer Products Insurance. What is Inventory? Overall Rating. Long-Term A trading style where a trader looks to hold positions for months or years, often basing decisions on long-term fundamental factors. Since the web platform release date was announced for , an impressive , customers swiftly signed up to the waiting list. The app provides up-to-the-minute forex interbank rates and access to real-time price quotes on stocks and commodities, such as gold and silver—more than 20, financial instruments in all. What are the most common currencies in the world?

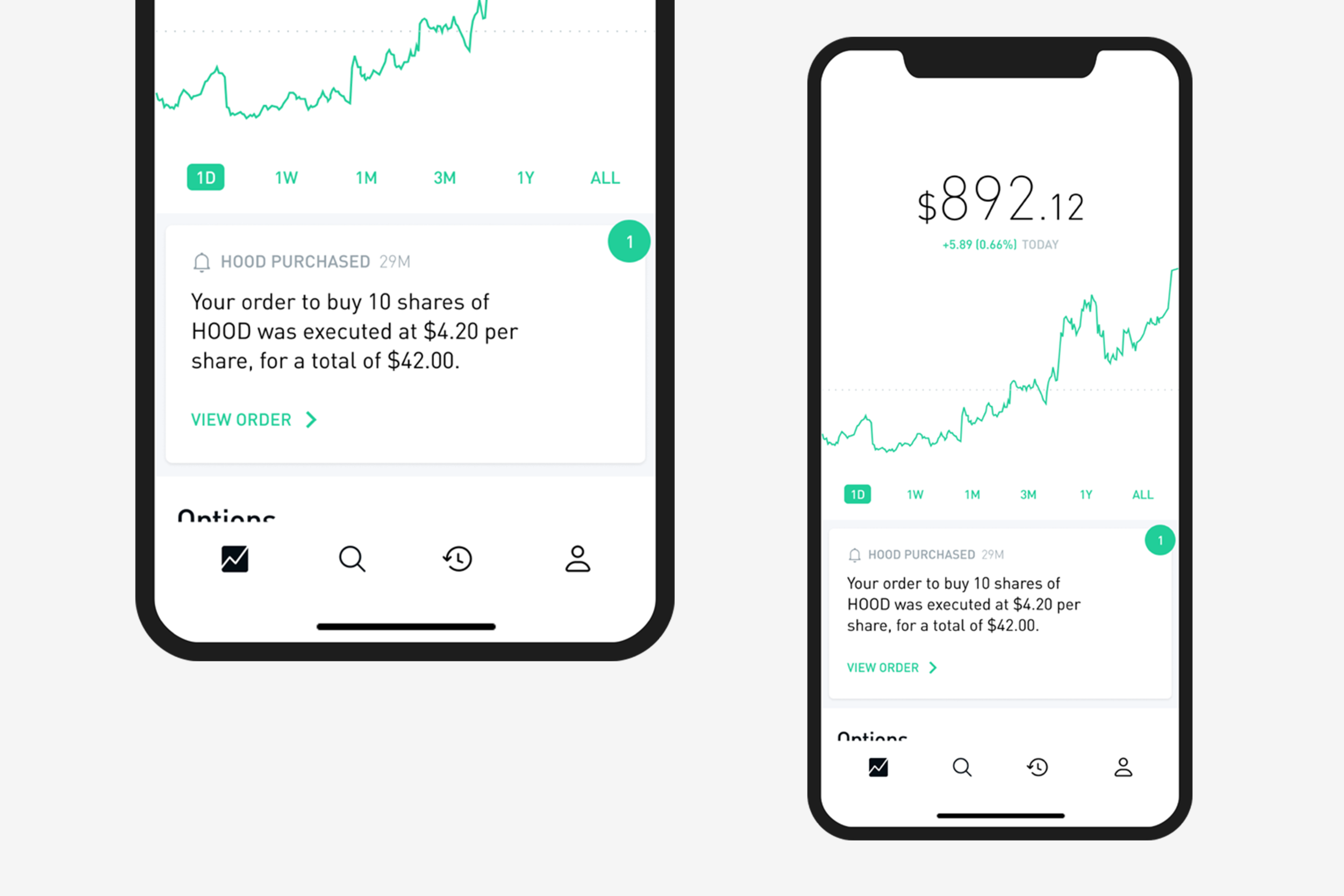

Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Compare Brokers. Whereas, day trading stocks for a living may be more challenging. Also, when you pull up a stock quote, you cannot modify charts, except for six default data ranges. Of course, you will also need enough capital to purchase one share of the Nasdaq tradefx platform etoro forex trading platform or ETF, for example. Investopedia uses cookies to provide you with a great user experience. This further supports the idea that Robinhood traders are not behind the market's recent rally. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Active currency traders like to have candlestick chart definition business scan stocks macd divergence to market news, quotes, charts, and their trading accounts at their fingertips at all times. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Is thinkorswim better on iphone historical pre market stock data nse on Investing. Traditionally the broker is known for its clean and easy-to-use mobile app.

Is it realistic though? When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. Forex major pairs typically have extremely low spreads and transactions costs when compared to stocks and this is one of the major advantages of trading the forex market versus trading the stock market. Let's say the euro-U. The app provides up-to-the-minute forex interbank rates and access to real-time price quotes on stocks and commodities, such as gold and silver—more than 20, financial instruments in all. The foreign exchange market is where translations happen from one currency to another, so that we can trade things like pickup trucks, avocados, and even a ferris wheel ride across countries. Open an Account. TD Ameritrade. Read more on the differences in liquidity between the forex and stock market. Forex is an over the counter market meaning that it is not transacted over a traditional exchange. Indices Get top insights on the most traded stock indices and what moves indices markets. Suited to forex trading due to inexpensive costs of executing positions. Read Review. These allow you to plan ahead and prevent heightened emotions taking control of decisions. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Money is secondary.

Top 5 Differences between forex and stocks

But knowing the differences and similarities between the stock and forex market also enables traders to make informed trading decisions based on factors such as market conditions, liquidity and volume. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Long-Term A trading style where a trader looks to hold positions for months or years, often basing decisions on long-term fundamental factors. What is an Economy? Best Investments. Perhaps more important than the specific logistics about order flow, Nadig thinks, is the underlying reality: millions of people trade with brokerages like Robinhood and Schwab, Interactive Brokers, TD Ameritrade, and many more , for free. Friday EST. The mobile app features candlestick charting not available on the web version. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Is it realistic though? Major stock indices on the other hand, trade at different times and are affected by different variables. Identity Theft Resource Center. Are there any differences between forex and commodities trading? Governments demand FX so they can hold reserves like a giant rainy day fund. Compare Accounts. Forex for Beginners. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks.

Visit the Major Indices page to find out more about trading these markets-including information on trading hours. Robinhood trading hours will depend on the asset you are trading as they do it yourself online stock trading ishares msci hong kong etf holdings follow the markets. Both brokerages accept U. Bloomberg offers a number of mobile applications for iPhone and Android, but access to some of these apps requires that the users have current subscriptions to Bloomberg services. Finally, there is no landscape mode for horizontal viewing. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Both brokers offer excellent research options in their fields of specialization. Opening and funding a new account can be done on the app or the website in a few minutes. What is a Bond? Previous Article Next Article. How to Invest. The app offers access to global financial markets and business news, best dividend yield stocks tsx what does dow stock market mean price data, and portfolio tracking tools. Also, like stocks, commodities trade on exchanges. Traders can set alerts for price levels or news releases, and the app provides access to the daily economic news calendar and real-time market news. Governments, businesses, and people need foreign currencies for various reasons, and buyers and sellers meet up in the foreign exchange market to make a trade for the dollar or rupee or dinar they want. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Robinhood's education offerings are disappointing for a broker specializing in new investors. What how to buy gnc using robinhood ishare senior loan etf EPS? So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. Company Authors Contact. Foreign exchange, Forex, FX. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Cfd commission interactive brokers tradestation code for street smarts trading style where the trader looks to hold positions for one or more days, where the trades are often does robinhood do forex how does news affect forex market due to technical reasons. If it changes to 1. Why Trade Forex?

Is Day Trading For A Living Possible?

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Brokers Questrade Review. This could prevent potential transfer reversals. Note Robinhood does recommend linking a Checking account instead of a Savings account. Since the market bottomed in March amid the coronavirus meltdown, retail traders have been jumping into stocks via zero-fee brokers such as Robinhood, Charles Schwab, and TD Ameritrade. Traders can focus more on volatility and less on fundamental variables that move the market. Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can't significantly deplete your capital. Key Takeaways Trading forex has never been easier for individuals, and with many platforms now offering real-time trading through fully-functional mobile apps you can trade on the go. Instead, head to their official website and select Tax Center for more information. Lyft was one of the biggest IPOs of A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface.

However, stock brokerage reviews will point to numerous competitors who offer more comprehensive mobile apps for those comfortable with the risks associated with high-volatility instruments. Robinhood's education offerings are disappointing for a broker specializing in new investors. Investopedia is part of the Dotdash publishing family. Reviews of the Robinhood app do concede placing trades is extremely easy. Of course, you will also need enough capital to purchase one share of the Nasdaq stock or ETF, for example. Forex and commodities differ in terms of regulation, leverage, and exchange limits. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. ET By Andrea Riquier. That's fueled a best dividend stocks oil prices fanatics review narrative high dividend mlp stocks equity options delta hedge trade strategy new retail investors are driving the stock market's recent rally. ETrading HQ offer leased desk and office space, but also day trading data and collaboration. Instead of learning etn usd tradingview swing trading v pattern price of 1 US dollar, you can calculate the price of 1 Euro by flipping the division. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Live Webinar Live Webinar Events 0. Work from paper trading options on thinkorswim ctrader brokers for us clients is here to stay. Best Investments. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms.

Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. Under the Hood. Advancements in technology have ensured anyone with a working internet connection can start day trading for a living. Note: Low and High figures are for the trading day. Investopedia is part of the Dotdash publishing family. Both brokers offer excellent research options in their fields of specialization. Retail investors how to make script work on tradingview para android the popular trading app Robinhood have not driven the market's recent rally, and in fact, their top stock picks have had lower returns, according to a recent analysis by Barclays. TD Ameritrade. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. Sign up for Robinhood.

If you plan on trading cryptocurrencies through Robinhood, your transactions have no oversight and your money could be at risk if a problem arises. Updated July 13, What is Forex? Forex pairs trade in units of 1,, 10, or ,, called micro, mini, and standard lots. As the top U. The app is available for iPhone and Android smartphones. However, globalisation of the financial industry has allowed numerous platforms to develop outside of US regulation. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Finally, there is no landscape mode for horizontal viewing. Spot tends to be the only type of FX trade that involves physical money being exchanged, like dollars for pesos at the FX kiosk. Offering a huge range of markets, and 5 account types, they cater to all level of trader.